How Much Would It Take To Pay Off Your Flat By 30, 40, 50 or 55?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

For many Singaporeans – heck, for many people across the world – paying off the mortgage early is a common aspiration. We get it too: most of us don’t like the thought of owing money, especially on something as major as our home. The good news for Singaporeans is that, unlike the Singapore private property market, HDB flats are affordable to most. But if you want to take it further and go for early retirement, FIRE, etc., here’s how much you’d need to do it:

How are the following figures derived?

In all of the following, we assumed full financing from available loans. This is 90 per cent of your flat price if using an HDB loan, and 75 per cent if using a bank loan.

We have also assumed the flat is a new 4-room flat, which is the most common first-home choice among Singaporeans. We will use an assumed cost of $320,000 for this flat (this is a typical amount after subsidies).

We have excluded stamp duties, renovations, and furnishing, as these are not covered by the home loan.

For the purposes of bank loans, we have used an interest rate of 1.3 per cent, which is the present-day average. However, for the purposes of determining the minimum income only, we have used an interest rate of 3.5 per cent. This is the rate that banks will use when factoring your MSR (even if the real interest rate is a lot lower).

The HDB loan rate is 2.6 per cent, and seldom changes.

In each of the following, we have assumed that the buyers’ obtained their flat at age 25. We have also assumed a loan tenure of 25 years.

How did we derive the minimum income required?

Under the Mortgage Servicing Ratio (MSR), your monthly home loan repayment cannot exceed 30 per cent of your combined monthly income (among all borrowers). We’ve used the MSR to determine the minimum income level, for a loan of the given tenure.

How much do you need to pay off your flat in just five years?

Using an HDB loan

| Details | Amount |

| Downpayment (10% of $320,000) | $32,000 |

| Loan quantum | $288,000 |

| Monthly repayment on 5-year loan tenure | $5,123.95 |

| Total interest paid on 5-year loan tenure | $19,436.93 |

| Minimum combined income required | $17,079.83 (exceeds income ceiling for BTO flats) |

The income ceiling for buying a BTO flat is currently $14,000 per month. This means such a loan wouldn’t usually be possible, and you’d need to either (1) buy a resale flat (for which there’s no income ceiling), or (2) make a much bigger down payment, to reduce the monthly loan repayment.

Using a bank loan

| Details | Amount |

| Downpayment (25% of $320,000) | $80,000 |

| Loan quantum | $240,000 |

| Monthly repayment on usual 25-year loan tenure | $4,133.57 |

| Total interest paid on 25-year loan tenure | $8,014.42 |

| Minimum combined income required | $14,553.40 (exceeds income ceiling for BTO flats, see above) |

How much do you need to pay off your flat in 15 years?

Using an HDB loan

| Details | Amount |

| Downpayment (10% of $320,000) | $32,000 |

| Loan quantum | $288,000 |

| Monthly repayment on 15-year loan tenure | $1,933.94 |

| Total interest paid on 15-year loan tenure | $60,109.15 |

| Minimum combined income required | $6,446.46 |

Using a bank loan

| Details | Amount |

| Downpayment (25% of $320,000) | $80,000 |

| Loan quantum | $240,000 |

| Monthly repayment on 15-year loan tenure | $1,468.28 |

| Total interest paid on 15-year loan tenure | $24,289.48 |

| Minimum combined income required | $5,719 |

How much do you need to pay off your flat in 25 years?

Using an HDB loan

| Details | Amount |

| Downpayment (10% of $320,000) | $32,000 |

| Loan quantum | $288,000 |

| Monthly repayment on 25-year loan tenure | $1,306.57 |

| Total interest paid on 25-year loan tenure | $103,970.45 |

| Minimum combined income required | $4,355.23 |

More from Stacked

An Old 1986 Executive Maisonette In Hougang Gets A Cosy Transformation Into A Modern Farmhouse Look

An executive maisonette is all the rage these past few Covid-19 years. The two-storey feature and unique layout are perhaps…

Using a bank loan

| Details | Amount |

| Downpayment (25% of $320,000) | $80,000 |

| Loan quantum | $240,000 |

| Monthly repayment on 25-year loan tenure | $937.46 |

| Total interest paid on 25-year loan tenure | $41,237.63 |

| Minimum combined income required | $4,005.00 |

To pay off the home loan only after 30 years:

HDB loans are capped at 25 years. If you start servicing the loan at 25, it’s not possible to stretch the loan tenure past the age of 50.

It is possible for bank loans though. The catch is that if the loan tenure exceeds 25 years, the maximum financing falls to 55 per cent. So you will need a bigger down payment, if you want to stretch the loan this far.

Do also note that the maximum loan tenure for bank loans financing HDB purchases is 30 years.

| Details | Amount |

| Downpayment (45% of $320,000) | $144,000 |

| Loan quantum | $176,000 |

| Monthly repayment on 30-year loan tenure | $590.66 |

| Total interest paid on 30-year loan tenure | $36,639.28 |

| Minimum combined income required | $2,634.40 |

In a bid to make things easier, we have also broken down how much it would cost to pay off a BTO in both a mature and non-mature estate. For this example, we’ve used prices from the recent BTO sales launch in November 2020 – Tengah (non-mature) and Toa Payoh (mature).

Minimum Combined Income for HDB Loan

| Min. Income (HDB LOAN) | 3-Room | 4-Room | 5-Room |

| Mature BTO Price | $324,000 | $466,000 | $627,000 |

| By 30 Years Of Age | $17,293* | $24,873* | $33,466* |

| By 40 Years Of Age | $6,527 | $9,388 | $12,631 |

| By 50 Years Of Age | $4,410 | $6,342 | $8,534 |

| Non-Mature BTO Price | $194,000 | $288,000 | $394,000 |

| By 30 Years Of Age | $10,355 | $15,372* | $21,030* |

| By 40 Years Of Age | $3,908 | $5,802 | $7,937 |

| By 50 Years Of Age | $2,640 | $3,920 | $5,362 |

Do note that at 25, the maximum tenure is just 25 years for HDB loans.

Minimum Combined Income for Bank Loan

| Min. Income (BANK LOAN) | 3-Room | 4-Room | 5-Room |

| Mature Estate BTO Price | $324,000 | $466,000 | $627,000 |

| By 30 Years Of Age | $14,735* | $21,193* | $28,516* |

| By 40 Years Of Age | $5,791 | $8,328 | $11,206 |

| By 50 Years Of Age | $4,055 | $5,832 | $7,847 |

| By 55 Years Of Age | $2,667 | $3,836 | $5,162 |

| Non-Mature Estate BTO Price | $194,000 | $288,000 | $394,000 |

| By 30 Years Of Age | $8,823 | $13,098 | $17,919* |

| By 40 Years Of Age | $3,467 | $5,147 | $7,042 |

| By 50 Years Of Age | $2,428 | $3,604 | $4,931 |

| By 55 Years Of Age | $1,597 | $2,371 | $3,244 |

*Not possible to do so given these income exceeds the ceiling for BTOs.

Do note that for bank loans exceeding 25 years in tenure for HDBs, the financing changes from an LTV of 75% to 55%.

What about paying off the entire loan with a windfall?

Sometimes, occurrences like winning the lottery, getting an inheritance, etc., provides an opportunity to pay off the outstanding home loan.

For HDB loans, you can do this anytime you want, without any penalty. For bank loans, you need to check for prepayment penalties. There is usually a period just after you take the loan (around three to five years is the norm), when you pay a penalty for trying to pay off the loan early.

With most banks, this comes to 1.5 per cent of the amount redeemed (e.g., if you try to pay off $100,000 at one go, you would pay $1,500 in penalty). This isn’t true of every loan package, so do check before you pay.

Finally, an important note on paying off your home loan early

Please keep in mind that it’s not prudent for everyone to pay off their flat loan by 30 or 40, even if they could.

A fully paid-up flat can’t pay for needs like meals or healthcare (unless you’re willing to sell the flat, which defeats the purpose). It’s a mistake to empty one’s savings on early home loan repayments, and end up needing personal loans in emergencies.

The typical unsecured loan has an interest rate of six to nine per cent, whereas HDB loans are only 2.6 per cent. In most such cases, the borrowers would be better off keeping cash for emergencies, paying their home loan slowly, and avoiding the use of other loans.

If you’re uncertain about how home loans work, or you need help with the numbers, drop us a message on Facebook. You can also follow us on Stacked, to know more about the Singapore property market, and for reviews on new and resale properties alike.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Market Commentary

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Property Market Commentary 2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

Latest Posts

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Overseas Property Investing Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden

Homeowner Stories Does The “Sell One, Buy Two” Strategy Still Work In 2025? 3 Real Stories From Singapore Homeowners

Editor's Pick Where $4 Million Semi-Ds Sit Next To $40 Million GCBs: Touring First Avenue In Bukit Timah

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

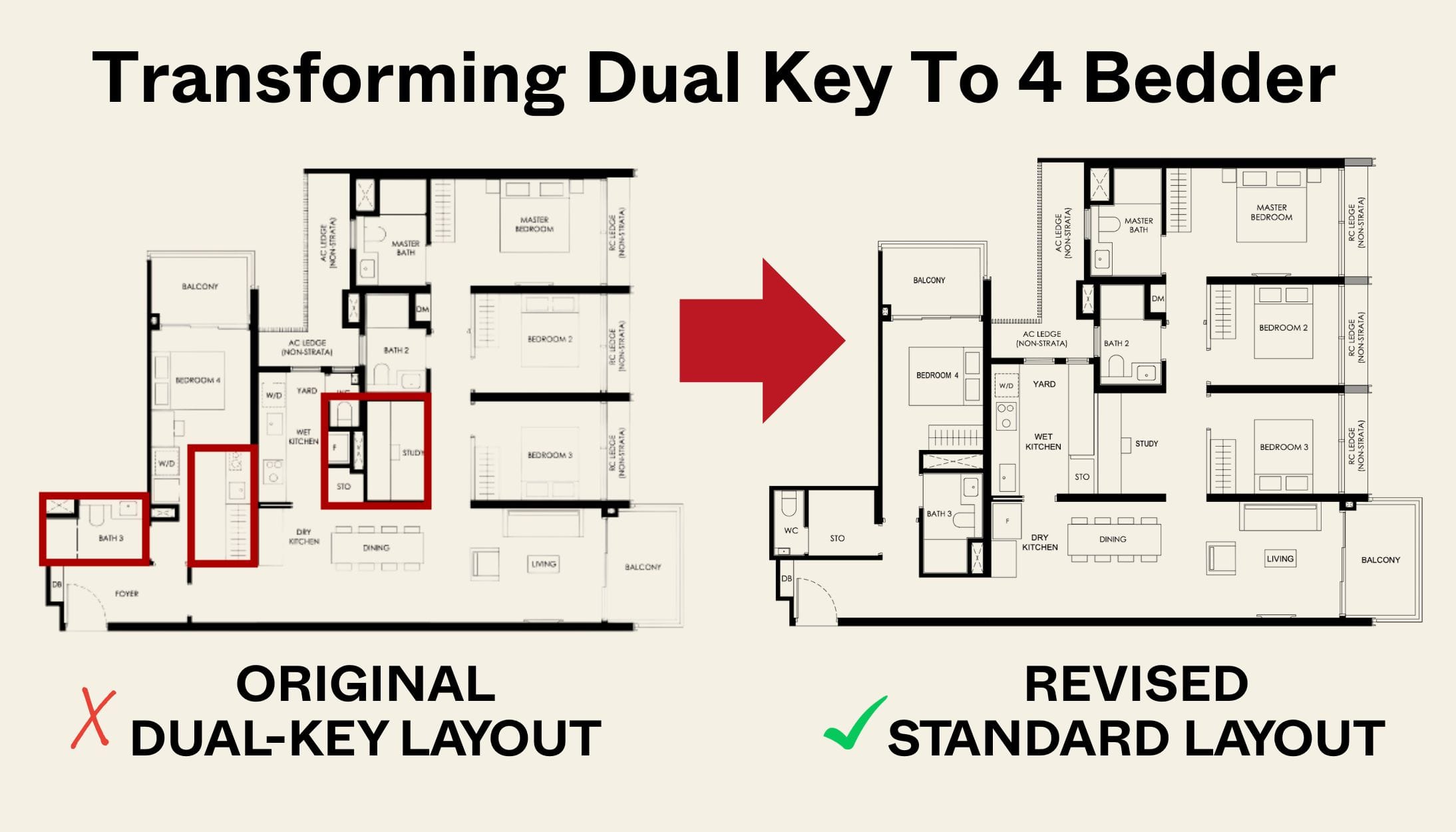

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

Editor's Pick The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Editor's Pick Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7