Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

June 29, 2025

Because lately it feels like if you want a child, you need to sacrifice the square footage where it would learn to walk. That’s the first problem that comes to mind – price – when I look at a 25-year loan tenure and long BTO queues. But price may be adjacent to a wider range of factors, such as:

- Space (or rather, the lack thereof)

- Time to household formation

- Normalisation of dual income

- Policy-induced anxiety in some folks

Let’s start with space, and the gradual shrinking of flat sizes. Back in the 1970s and ’80s, 5-room flats could go up to 1,300+ sq ft. We also had executive apartments. Maisonettes. Balcony spaces big enough to launch the next Mars rocket. Some of these layouts were experimental enough to be weird, sure, but at least they gave you room to be weird.

Today, a “spacious” four-room BTO might clock in at 950 sq ft, and that includes things like the household shelter, which isn’t particularly liveable unless your child is an otter.

Bedrooms have reached the point where, when my neighbour managed to place a queen bed, a full desk, and a wardrobe in the same room, we all gathered to applaud and declare him District Space Planning Wizard.

It’s also a bit annoying that our newest housing types – Prime and Plus flats – the crown jewels of BTOs, launched to anchor great locations and long-term value… don’t come in 5-room sizes. Why? It’s already clear, with the 10-year MOP, that these buyers are far less interested in flipping.

And this bleeds into the time-to-household-formation problem.

You can’t just shack up early and sort it out later: getting the housing here is the sorting out. Couples queue for BTOs like they’re buying season passes to their own future. By the time they get their keys, some have graduated, married, paid off a wedding loan, and decided it’s way too expensive/exhausting to have a second or third child after all. And that’s assuming they even get the flat, since failed balloting attempts could stretch out the time even further.

While the obvious solution to this is resale flats, the price kind of gets in the way of this. It’s one thing to wait for a BTO, and it’s another to drop $900,000 on a four-room flat in Queenstown that’s older than your father-in-law’s NS stories. Yes, moving in is finally immediate; but now you’re staring at the Cash Over Valuation, the 54 years left on the lease, and wondering if your child will inherit the flat or the mortgage.

And it’s not just about money. Buying resale often means a different kind of compromise: older plumbing, odd layouts, tile choices that were cool in the ‘70s but feel like a stab in the eyeballs today, etc. So what do many couples do?

They delay. Delay the flat. Delay the marriage. Delay the kid. Delay the life they want to start until housing permits.

Back in the 1990s or earlier, it was also more possible for one partner to not work, without the whole household collapsing into perpetual cup noodle dinners.

Today? Unless one of you is a high-flyer in the income category, you probably both need to work to afford a 5-room flat (maybe even a 4-room). But when both parents are working full-time – and sometimes beyond full-time – there’s simply less bandwidth to raise a kid, much less multiple kids. And while some families get help from grandparents or a helper, those options come with their own trade-offs: space, privacy, cost, logistics, and, let’s be honest, the delicate politics of who’s “doing it right.”

So yes, we can have children and work. But the way our homes and economy are structured, it can feel like you’re trying to raise children while juggling chainsaws on a tightrope. And we do need to question if we’re getting enough family time with the children, at this particular rate.

More from Stacked

Why Singapore Homes Feel So Unaffordable (Even If Incomes Have Risen)

When discussing housing affordability, the standard yardsticks often include wage growth versus home prices, or sometimes debt-to-income ratios. But there’s…

And looming over it all is the final boss of housing-related fertility: policy-induced anxiety.

Because even if you clear the affordability hurdle, win the BTO ballot, and feng-shui your bomb shelter into a fortune-maker, there’s still the underlying stress of navigating the system itself. For every couple that feels empowered by grants and MOP timelines, there’s another having a mild existential crisis over whether they accidentally violated some kind of essential occupier rule by listing mum when she only stays over “now and then.”

Want to upgrade later? That’s a whole new maze of ABSD, MSR, and MOP acronyms that you need to navigate. Want to decouple for a second property? Better hope your CPF accounts and the stars are in alignment.

And for those eyeing Prime and Plus flats? You’d better be really sure you’re not going to outgrow that four-room unit, because with the 10-year MOP, you’re not moving to a bigger unit for quite a while.

Is any of this intentional? We doubt so.

These policies came about with the best interests in mind, like fairness. But when you stack it all together – the shrinking flat sizes, the long queues, the pricing, the resale trade-offs, the two-income grind, and the administrative acrobatics – it starts to look an awful lot like accidental family planning by design.

My point is, the conditions under which we’re supposed to want more children – smaller flats, tight budgets, long waits, and complex policies – don’t exactly scream “start a family now.”

If we’re serious about boosting fertility, maybe it’s time to rethink more than just baby bonuses and leave policies.

Meanwhile in other property news

- Before you cynically brush aside Johor as an investment zone, take note that it’s not just Iskandar 2.0

- URA’s new draft master plan is putting up some 80,000 new homes; here’s what to look out for.

- What are the most important factors to consider among the hundreds of factors, when shortlisting a property? Here’s some expert advice.

- Join our Stacked Pro readers, as they explore Forest Woods, which may be one of Serangoon’s secret top-performing condos (whatever its ROI may try to suggest.)

Weekly Sales Roundup (16 June – 22 June)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SKYWATERS RESIDENCES | $30,870,000 | 5285 | $5,841 | 99 years |

| CANNINGHILL PIERS | $7,505,000 | 2788 | $2,692 | 99 yrs (2021) |

| THE CONTINUUM | $4,150,000 | 1464 | $2,835 | FH |

| TEMBUSU GRAND | $4,148,000 | 1711 | $2,424 | 99 yrs (2022) |

| THE ORIE | $3,850,000 | 1453 | $2,649 | 99 yrs (2024) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ONE MARINA GARDENS | $1,230,389 | 420 | $2,931 | 99 yrs (2023) |

| LUMINA GRAND | $1,378,000 | 936 | $1,471 | 99 yrs (2022) |

| NOVO PLACE | $1,383,000 | 872 | $1,586 | 99 yrs (2023) |

| HILL HOUSE | $1,388,025 | 431 | $3,224 | 999 yrs (1841) |

| KASSIA | $1,548,000 | 753 | $2,054 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CITYVISTA RESIDENCES | $5,380,000 | 2626 | $2,048 | FH |

| THE ARCADIA | $4,650,000 | 3735 | $1,245 | 99 yrs (1979) |

| THE INTERLACE | $4,200,000 | 3423 | $1,227 | 99 yrs (2009) |

| WATTEN HILL | $4,200,000 | 2669 | $1,573 | FH |

| MARTIN MODERN | $4,000,000 | 1421 | $2,815 | 99 yrs (2016) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| TREASURES @ G20 | $605,000 | 420 | $1,441 | FH |

| THE INFLORA | $686,868 | 474 | $1,450 | 99 yrs (2012) |

| CENTRA SUITES | $737,000 | 463 | $1,592 | FH |

| HIGH PARK RESIDENCES | $760,000 | 452 | $1,681 | 99 yrs (2014) |

| LAKE GRANDE | $775,000 | 409 | $1,895 | 99 yrs (2015) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| SOMMERVILLE GRANDEUR | $3,870,000 | 1830 | $2,115 | $2,020,000 | 29 Years |

| WATTEN HILL | $4,200,000 | 2669 | $1,573 | $2,000,000 | 17 Years |

| THE TRESOR | $3,738,000 | 1399 | $2,671 | $1,908,000 | 16 Years |

| MAPLE WOODS | $2,850,000 | 1141 | $2,498 | $1,750,000 | 28 Years |

| THE ELEGANCE @ CHANGI | $2,388,000 | 2013 | $1,186 | $1,648,000 | 20 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE BERTH BY THE COVE | $3,250,000 | 2992 | $1,086 | -$639,600 | 17 Years |

| BELLE VUE RESIDENCES | $3,088,000 | 1378 | $2,241 | -$592,000 | 14 Years |

| THE SAIL @ MARINA BAY | $2,370,000 | 1033 | $2,294 | -$160,850 | 16 Years |

| MARINA ONE RESIDENCES | $2,000,000 | 1055 | $1,896 | -$147,310 | 10 Years |

| ESPADA | $900,000 | 377 | $2,389 | -$85,000 | 7 Years |

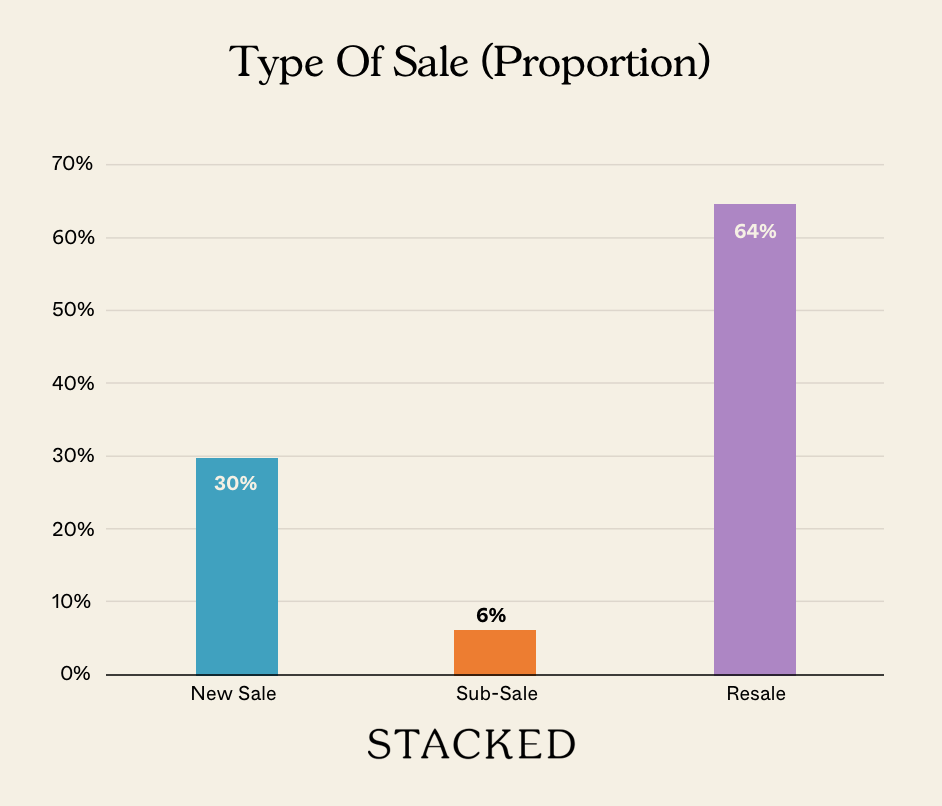

Transaction Breakdown

Follow us on Stacked for more property news and updates in Singapore.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How has the size of public housing flats changed over the years in Singapore?

Why do many couples delay having children in Singapore?

What are some challenges of buying resale flats in Singapore?

How does Singapore’s housing policy affect family formation and fertility?

Are there any recent developments in Singapore’s property market mentioned in the article?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

2 Comments

Reference your “Top 5 Cheapest New Sales (By Project)”

Taking example from ONE MARINA GARDENS, TENURE 99 yrs (2023), does it means that the 99 starts from 2023 instead of TOP (around 2029)?

Hi there! Yes, the 99-year lease starts from 2023 and not when the project obtains its TOP.