Complete Guide To Getting Your Home Loan Approved This Month

April 23, 2020

So you’ve reset your SingPass, you’ve handed over three months of your payslip, you’ve filled in all the forms after an hour at the bank – the second time over. And now, as you open the letter, you see the familiar “we regret to inform you…” beginning. You’re about to end up in home loan limbo for the third time.

Well, you’re not alone.

Along with people who can’t seem to get their HDB Loan Eligibility (HLE) letter, some home buyers have a much harder time than others. This guide is for them – and also for those of you who don’t want the wall-punching frustration of lining up at banks over your lunch hour, only to get denied applications.

Here’s what you need to know to get your loan approved:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Factors that determine if your home loan is approved

- Acceptable credit score

- Loan tenure and age limits

- Mortgage Servicing Ratio

- Total Debt Servicing Ratio

- Eligibility of the intended property purchase

- Legal complications involving the property

1. Acceptable credit score

One of the first things a bank or financial institution will look up is your credit score. This is derived from the Credit Bureau of Singapore (CBS), which logs your various loans and repayment history.

Your credit report score is a four-digit number, ranging from 1000 to 2000 (the higher the number, the more likely it is that the bank will approve your loan).

The credit score is accompanied by a credit grade, ranging from AA to HH, AA is the best possible score.

You can buy a copy of your credit report from CBS for $6.42, just visit their website (although if you get a rejection letter, it often comes with a way to check your credit report for free– the method to do this will be described in the rejection letter). Note that banks of Financial Institutions do not charge you anything for looking up your credit score.

What to look for in your credit score

In general, any grade below AA is sufficient to affect your loan application. Most lenders require, at minimum, a grade of no worse than CC. Even then, your loan quantum (the maximum amount you can borrow) is likely to be reduced if your grade is BB or below.

In general, you should expect maximum financing of no more than 55 per cent of your property price or valuation (whichever is lower), if your grade is CC. This can make it hard to buy a property until you improve your credit score, or can afford the sizeable down payment.

As such, it’s important to repay all your loans on time, and avoid having too many lines of credit.

Your credit score will eventually repair itself if you continue to make loan repayments on time – but it can take up to 12 months for your consistent performance to start showing up in the credit report. As such, you should start working to improve your score as early as a year before making your home loan application.

Two other important credit grades to note are Cx, and Hx.

Hx denoted bankruptcy, either current or in the past. If you were bankrupt before, note that you typically need to wait for around five years after your official letter of discharge from bankruptcy, to be eligible for a home loan.

Some non-banking Financial Institutions may still choose to give you a home loan, as long as you have been discharged from bankruptcy. However, the interest rate is usually higher than what a bank would charge.

The grade Cx will only appear if you have no credit history in Singapore. That is, you’ve never used a credit card, taken a personal loan, education loan, etc.

When your grade is Cx, there’s no way to evaluate your creditworthiness. This can affect the decision to lend to you, as you’re an unknown factor (different lenders respond to this in different ways).

The usual way to avoid a grade of Cx is to use a credit card purely as a mode of payment (i.e. you charge things to the credit card, but always pay the bill in full each month, so there’s never any actual debt or interest).

Another way is to take a small loan of at least $1,000 and make consistent loan repayments over a short time.

This can transform your Cx into a perfect AA score if you do it around 12 months prior to your loan application.

2. Loan tenure and age limits

It’s commonly said that the maximum loan tenure for private property is 30 years, and the maximum for HDB properties is 25 years. That’s not exactly right; here’s a more precise explanation:

The maximum loan tenure for private property is actually 35 years. However, your Loan To Value (LTV) ratio is reduced to 55 per cent, if your loan tenure exceeds 30 years, or if your loan tenure plus your existing age would exceed the retirement age of 65.

(The LTV ratio is the maximum amount you can borrow. So an LTV of 55 per cent means you can only borrow up to 55 per cent of your property price or valuation, whichever is lower).

For example, say you are 38 years old, and you want a loan tenure of 30 years. This would exceed the retirement age of 65 (38 + 30 = 68), so your loan tenure will drop to 55 per cent.

Likewise, if you are 25 years old, but want a loan tenure of 35 years, your loan tenure will also drop to 55 per cent (while you don’t breach the age limit, your loan tenure is longer than 30 years).

For HDB flats, the maximum loan tenure is 30 years. But the LTV ratio is reduced to 55 per cent if your loan tenure is 25 years, or if the loan tenure plus your age would exceed the retirement age of 65.

But what if there’s more than one borrower, and their ages are different?

Their Income Weighted Average Age (IWAA) will be used to determine their collective age for the purpose of the home loan. The formula is as follows:

(Monthly income of borrower A x the age of A) + (Monthly income of borrower B x the age of B) / total monthly income of A and B

For example, say you have a monthly income of $5,000 per month and are 42 years old. Your co-borrower will be your spouse, who earns $6,000 per month and is 39 years old. Your IWAA would be:

($5000 x 42) + ($6,000 x 39) / $11,000 = 40 years old

Note that the IWAA will be reduced if the younger borrower is the higher earner, or increased if the older borrower is the higher earner.

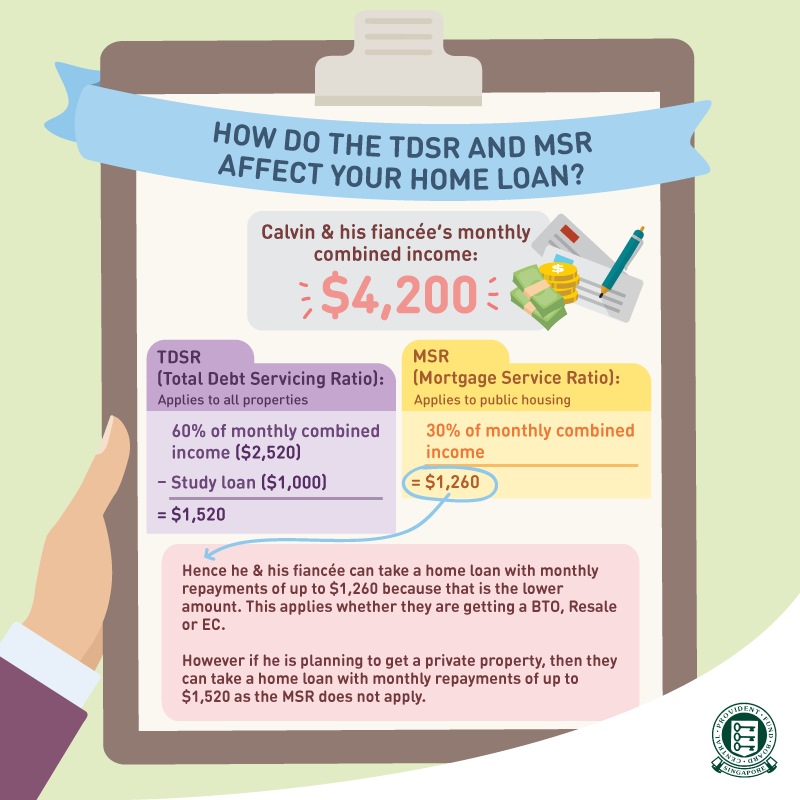

3. Mortgage Servicing Ratio

For HDB properties, you must meet a Mortgage Servicing Ratio (MSR). This restricts your monthly home loan repayment to 30 per cent of your monthly income.

For example, say you earn $3,500 per month, and your spouse earns $2,500 per month (a total of $6,000 per month). Your maximum monthly home loan repayment cannot exceed $1,800 per month.

(Note: Your monthly income, for these calculations, excludes your employer’s contribution to your CPF.)

If you have variable income (e.g. you are self-employed), your income counts as being 30 per cent lower. So if you have a declared income of $3,500 but work on commissions, for example, you count as earning $2,450 for the purposes of the MSR.

Property Market CommentaryHDB vs. SIBOR vs. Fixed Deposit: Which Home Loan is Best Right Now?

by Ryan J. Ong4. Total Debt Servicing Ratio (TDSR)

The TDSR applies to all property loans, for public or private housing (i.e. for HDB properties, you need to meet both the MSR and the TDSR).

The TDSR restricts your monthly debt obligations to 60 per cent of your monthly income. This is inclusive of all your debts, including credit card debts, car loans, education loans, etc.

For example, say you and your co-borrower have a combined monthly income of $15,000.

Nominally, your TDSR ceiling would be $9,000 per month.

But you also have car loan repayments of $1,500 per month, your child’s education loan at $2,000 per month, and various personal loan repayments amounting to $1,000 per month. These would reduce your maximum allowable home loan to ($9,000 – $1,500 – $2,000 – $1,000 = $4,500 per month.

As such, you should try to pay down as much of your outstanding loans as possible, before applying for a home loan.

As with the MSR, variable income (such as from commissions, rental income, portfolio dividends, etc.) count as 30 per cent lower, when calculating your TDSR.

5. Eligibility of the intended property purchase

To date, there is no bank that gives out home loans for properties with 30 years or less on the lease.

The LTV may also be lower for properties with only 40 years on the lease. Depending on the condition, size, and location of the property, some banks may also refuse the loan. Non-banking Financial Institutions may be more open to the idea, although they tend to charge higher interest rates to account for the risk – you’ll need the help of a good mortgage broker here, as they know how to negotiate with the lenders.

The location of the property also matters, but in Singapore, the only real “problem location” is some parts of Geylang. Banks generally won’t give out loans for properties in the red-light area, which is broadly considered to be anything below Lorong 30.

Again, non-banking Financial Institutions may be more flexible, but possibly at the cost of a higher interest rate.

If you’re seeking a Singapore home loan for an overseas property, there are limited areas that will be approved. These are almost always within capital cities only – for example, you may get a loan approved for a home in West London, but it’s unlikely for a property in Bristol.

6. Legal complications involving the property

Some banks may put a stay on home loans, for properties with legal issues. The most typical involve lawsuits with developers, such as we saw The Seaview back in 2016.

This doesn’t make it impossible to get your loan approved, but some banks may want to wait for the situation to be resolved, before granting loans.

Banks may also refuse loans if they see there’s a potential legal dispute involving the property (e.g. the seller’s ownership is being contested).

To minimise any disappointment, always get Approval In Principle (AIP) before you go home shopping

If all the math is giving you a headache, here’s a simple solution: go to the bank and get AIP before you start looking for a home. The AIP will clearly state how much the bank will lend you if you buy within a given period (often around two weeks).

That way, you won’t end up in a situation where you put down the deposit, but later can’t get the loan.

After you get the AIP, you can visit Stacked Homes for the most in-depth reviews of Singapore properties. You can also follow us on Facebook and drop us a message if you have any questions about the home buying / loans process.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

0 Comments