Collective sales: SG property marketSingapore property market watch: Is there an en bloc fever? http://str.sg/4zWe

Posted by The Straits Times on Wednesday, August 2, 2017

If 2017 and the first half of the year of 2018 was any indication of how things would play out, the en bloc market was prepped for big things further down the road. Every older property in Singapore seemed to be going en bloc, but since the cooling measures in July, it has been failed en bloc after failed en bloc.

En bloc fever no more? As many as 30 sites have failed to secure a buyer since January.

Posted by The Straits Times on Sunday, August 12, 2018

With as much as 50 en bloc projects whose tenders have closed without finding a buyer, most people are not as hopeful anymore as before for their property to go en bloc.

There are 50 en bloc projects whose tenders closed without a sale this year up to Sept 12.

Posted by The Straits Times on Saturday, September 15, 2018

Some sites that have a failed en bloc attempt like Thomson View Condominium are already 42 years old, and the older it grows, the less value the units will obviously hold. Not to mention, the upkeep and maintenance cost to keep the development in a liveable condition gets more and more expensive.

More from Stacked

I’ve Stayed In 40+ Airbnb Homes: 9 Design Pitfalls I’ve Learned To Avoid

One of the wonders of Airbnb is that, instead of seeing generic hotel rooms, you get to see the inside…

So for the remaining en bloc hopefuls, what measures can they take at this point to repeat another failed en bloc scenario?

Condo ReviewsMandarin Gardens Review: Entry Level Priced Sea Views In District 15

by ReubenSome developments that have tried to lower their asking prices in hope of ensuring bids from developers. For example, at Park View Mansions in Jurong, they have lowered their asking price to $250 million. Which is 22 per cent lower than what they were asking for early on in 2018. Other developments like Gilstead Mansion and Windy Heights have also lowered their prices or are currently in the midst of a re-signing process to lower their asking prices.

However, strangely enough, a few sites that have decided the right strategy at this point is to raise their asking prices. For example, Mandarin Gardens in the East has raised its asking price to a staggering $2.79 billion, up from $2.5 billion earlier, as they have found out that the land was undervalued. Pine Grove, which is one of the few remaining ex HUDC’s left has also raised its asking price to $1.86 billion in order to secure the 80% majority. Lastly, Dairy Farm estate has also increased its reserve price to $1.84 billion in a bid to try and secure the remaining signatures needed.

As always, feel free to leave a message below or you can always reach out to us at hello@stackedhomes.com!

Druce Teo

Druce is the Chief Editor at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.Read next from Property Market Commentary

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Property Market Commentary 2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

Latest Posts

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden

Homeowner Stories Does The “Sell One, Buy Two” Strategy Still Work In 2025? 3 Real Stories From Singapore Homeowners

Editor's Pick Where $4 Million Semi-Ds Sit Next To $40 Million GCBs: Touring First Avenue In Bukit Timah

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

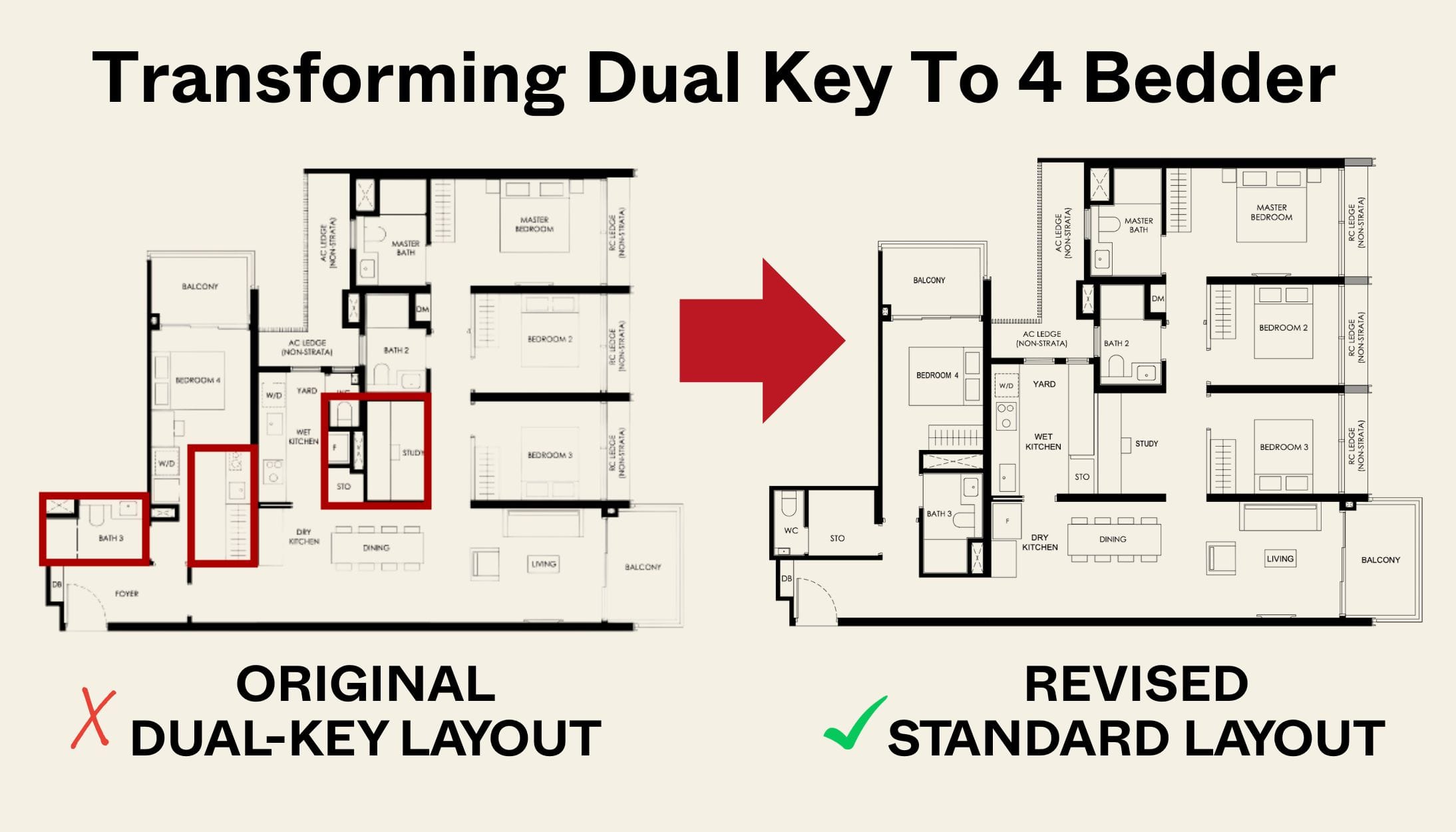

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

Editor's Pick The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Editor's Pick Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?