Your Monthly Interest Payments Are Set To Spike In 2022: Here’s What You Need To Know

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Since around 2008/9, bank home loans have been significantly cheaper than HDB Concessionary Loans. Homebuyers have been warned repeatedly that bank loans could one day be pricier than HDB loans again – but that concern has been diminished, after being repeated for more than a decade. This year, however, a surprisingly sharp interest rate hike, over a short period, has made the warning tangible again:

Table Of Contents

- What’s happening with US interest rates?

- The rise in interest rates is sharper than expected

- How does this matter to Singapore homeowners?

- 1. Higher-income buyers of BTO flats may still be affected

- 2. Reconsider refinancing your HDB loan to a bank loan

- 3. EC buyers will have to deal with the rising rates

- 4. Tighter TDSR limits, plus rising home loan rates, may make borrowing tougher

- 5. Internal board rates are not necessarily proof against rising rates

- 6. If you have just a little left to go, you may want to consider prepayment

- How will this affect rental?

What’s happening with US interest rates?

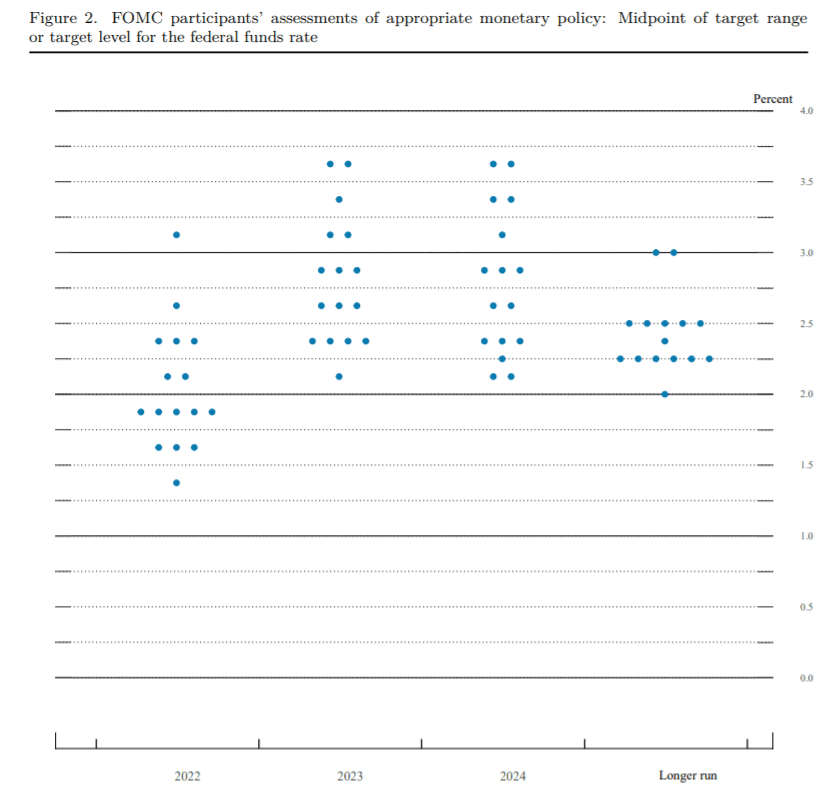

The US Federal Reserve may raise interest rates to about 2.25 to 2.5 per cent this year, much higher than the predicted 1.9 per cent we heard about in 2021. This is to combat rising inflation in the US, which has continued despite the pandemic and the war in Ukraine.

This has an indirect effect on interest rates in Singapore as well. When the Fed raises interest rates, many loans – in particular home loans – tend to rise in tandem (although not necessarily at the same pace).

Some mortgage brokers have said that interest rates of 2.5 per cent in the US could mean home loan rates of above three per cent in Singapore, depending on how banks respond.

This would once again raise private bank rates above the HDB loan rate, which is set at 0.1 per cent above the prevailing CPF rate (2.6 per cent).

The US previously dropped to zero or near-zero during the Global Financial Crisis in 2008/9, to stimulate the economy. Efforts were then made to normalise over the next decade, but the Covid-19 pandemic saw rates plummet to near zero again.

As such, we saw an unusually long period in which Singapore home loans were able to stay below two per cent on average.

The rise in interest rates is sharper than expected

Back in 2020, mortgage brokers pointed out that, even if interest rates rise, it would be in small increments of about 0.25 per cent, over a long period.

So it’s a surprise that the Fed has planned no less than six rate hikes in the span of just this year. Current Fed Chair Jerome Powell also said he was willing to consider increments of larger than 0.25 per cent, if they felt it necessary.

The move also ran contrary to expectations, given rising geopolitical tensions. Some mortgage brokers told us that they previously expected rate hikes to be delayed, to cope with rising fuel costs in the event of Russian sanctions.

The reasons may go beyond economics. Interest rate hikes are a factor in increasingly divisive US politics: former US President Donald Trump often criticised the Fed for trying to implement rate hikes, whilst current US President Joe Biden is supportive of them.

How does this matter to Singapore homeowners?

This isn’t a concern to those using HDB loans, which are likely to remain at the current 2.6 per cent.

Other homeowners, however, need to know the following:

- Higher-income buyers of BTO flats may still be affected

- Reconsider refinancing your HDB loan to a bank loan

- EC buyers will have to deal with the rising rates

- Tighter TDSR limits, plus rising home loan rates, may make borrowing tougher

- Internal board rates are not necessarily proof against rising rates

- If you have just a little left to go, you may want to consider prepayment

Besides this, there may be some impact on the rental market, as landlords face rising costs.

1. Higher-income buyers of BTO flats may still be affected

Under some circumstances, such as if your income is on the high-end, HDB may tell you to use a private bank loan, instead of an HDB loan. This means you’re at the mercy of rising interest rates, even if you’re just trying to buy a regular BTO flat at a launch.

You may want to try and appeal this, but if HDB is insistent you go to a bank, we suggest you quickly find a mortgage broker and try to lock in a good rate – before they start climbing later in the year.

2. Reconsider refinancing your HDB loan to a bank loan

Over the past few years, many homeowners with HDB loans have refinanced into bank loans – this lowered their interest rate from 2.6 per cent to an average of just 1.3 per cent.

But while you can refinance from an HDB loan to a bank loan, you cannot reverse the process. Once you do it, you’re stuck with using bank loans in the open market. Given that home loan rates could go past HDB’s 2.6 per cent, possibly in as little as a year, now is probably not the best time to switch.

More from Stacked

The Trivelis DBSS Vs Clementi Ridges Issue 10 Years On: Did Trivelis Owners Really Lose Out?

Several years ago, the DBSS project Trivelis made the news, but not in a good way. Besides some quality complaints,…

3. EC buyers will have to deal with the rising rates

Lest you forget, there are no HDB loans for Executive Condominiums (ECs). This is regardless of whether or not they’ve been privatised.

As such, buyers looking to upgrade or purchase an EC have no choice but to use bank loans. If you’re an owner-investor or concerned about the bottom line, talk to a mortgage broker about the likely interest rates you’ll be paying.

A $1 million loan at 1.3 per cent, for 25 years, would cost total interest repayments of about $171,800+. Raising this by a single percentage point would raise total interest repayments to over $315,800, over the same loan tenure.

4. Tighter TDSR limits, plus rising home loan rates, may make borrowing tougher

During the December 2021 cooling measures, the Total Debt Servicing Ratio (TDSR) was tightened from 60 to 55 per cent. This means your monthly home loan rate, coupled with other debt obligations, cannot exceed 55 per cent of your monthly income.

Singapore Property News16 Dec 2021 New Property Cooling Measures Kick In: Here’s How It May Affect You

by Ryan J| Cooling Measure | Old Measure | 16 December 2021 New Measure |

|---|---|---|

| Loan To Value Ratio | 90% for HDB loans 75% for bank loans | 85% for HDB loans 75% for bank loans |

| Total Debt Servicing Ratio | 60% of monthly income | 55% of monthly income |

| Additional Buyers Stamp Duty | Singapore Citizens None for first property 12% on second property 15% on subsequent property Permanent Residents 5% on first property 15% on subsequent property Foreigners 20% Entities 25% +5% non-remissible for property developers | Singapore Citizens None for first property 17% on second property 25% on subsequent property Permanent Residents 5% on first property 25% on second property 30% on subsequent property Foreigners 30% Entities 35% +5% non-remissible for property developers |

For HDB properties (regardless of whether you use bank or HDB loans), the monthly loan repayment cannot exceed 30 per cent of your monthly income; this is called the Mortgage Servicing Ratio (MSR).

Depending on how much your interest rate pushes up your monthly repayments, you may find you now bust the TDSR, despite qualifying before. This will mean you either need to drag out the loan tenure (if possible) or make a bigger down payment.

5. Internal board rates are not necessarily proof against rising rates

When interest rates threaten to rise, many loan packages will start to boast of a board rate (i.e., an interest rate set by the bank) that hasn’t changed in a long time.

One variant of an internal board rate is a fixed deposit rate, in which the home loan interest rate is pegged to a particular tranche of fixed deposits.

While this might help to keep rates low, mortgage brokers have warned us not to oversimplify the issue. Some bank loans specify that the lender can raise rates at any time, without having to justify it to borrowers. Likewise, rising interest rates could mean later fixed deposit-pegged loan packages are pricey, as interest rates on fixed deposits are likely to rise as well.

6. If you have just a little left to go, you may want to consider prepayment

If you have just a little bit left of your home loan outstanding, this may be the year to consider prepayment (i.e., pay off the whole remainder, instead of continuing to pay monthly).

This could spare you future losses from a rising interest rate.

However, consult a qualified financial planner, or other experts of your choice, to review your finances before doing this. It is imprudent to accelerate loan repayments if it would leave you without savings, as you cannot easily liquidate your home in an emergency (and doing so may cause losses).

A mortgage broker can help go over the terms of your loan, to check if you would face penalties for doing this. It’s usually best to wait out the lock-in period of home loans, and make your lump-sum payment only when you’re past the lock-in.

Otherwise, you may be charged around 1.5 per cent of the undisbursed loan amount, when prepaying the loan.

How will this affect rental?

Realtors we spoke to said that, if interest rates rise substantially, landlords might also raise rental rates to match. This is especially true for higher-end properties, where realtors noted that rental rates are rising anyway (initially due to higher property taxes announced this year, but rising interest provides yet another justification).

However, not all landlords will be worried. Apart from those who have already paid off their property, realtors reminded us that landlords can claim mortgage interest rates as tax deductions (but only the interest portion). As such, the impact on landlords should stay manageable.

For more on the situation as it unfolds, follow us on Stacked. We also provide in-depth reviews of new and resale properties to alike, to help you make an informed decision.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

Editor's Pick The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden