Analysing Unprofitable Condos: 6 Reasons Why The Tennery Has Performed Poorly

April 22, 2021

As a continuation from our piece on 13 condos with the most unprofitable transactions, here’s where I (try to) dig deeper into why each particular condo has not done well.

Some may say that these reasons may only be obvious on hindsight, but as the saying goes:

Those who cannot remember the past are condemned to repeat it.

Like I mentioned in my analysis on Stellar RV, there is never just one reason why a property may not do well.

Sure, some reasons may be more important than others, but it is almost always a combination of it all.

In today’s analysis, I will be looking at The Tennery and the possible reasons why it has not fared too well in the resale market today.

For those that might have remembered its launch in 2010, it was one of those hot launches back in the day.

Built by reputable developer Far East Organization, it had a line of cars at the showflat during its launch – they even had to have car valets.

That hype obviously translated to sales, as in its first month of launch, it had sold 261 out of its 388 total units.

Let’s get right to it.

Location: Woodlands Road (District 23)

Developer: Dollar Land Singapore Pte. Ltd.

Lease: 99-years from 2010

Completion: 2014

Number of units: 388 units

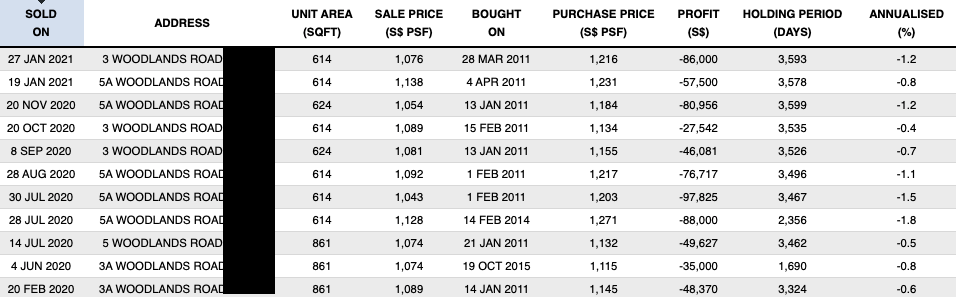

Profitable transactions: 31

Unprofitable transactions: 33

Pricing

While The Tennery has recorded 33 unprofitable transactions so far, it has actually also managed to chalk up 31 profitable transactions.

The average profit so far has been $53,108, while the average loss is -$72,710.

But if you want to be really pessimistic about it, a good number of the profitable transactions would actually be just about breakeven or unprofitable if you were to take into account transaction costs (lawyer fees, agent commissions, interest).

So as of today, prices currently stand at $1,083 psf.

The Tennery definitely did garner lots of talk when it first launched back in 2011.

You might be aware of Far East Organization’s tendency to price at a premium wherever they launch – The Tennery was no different.

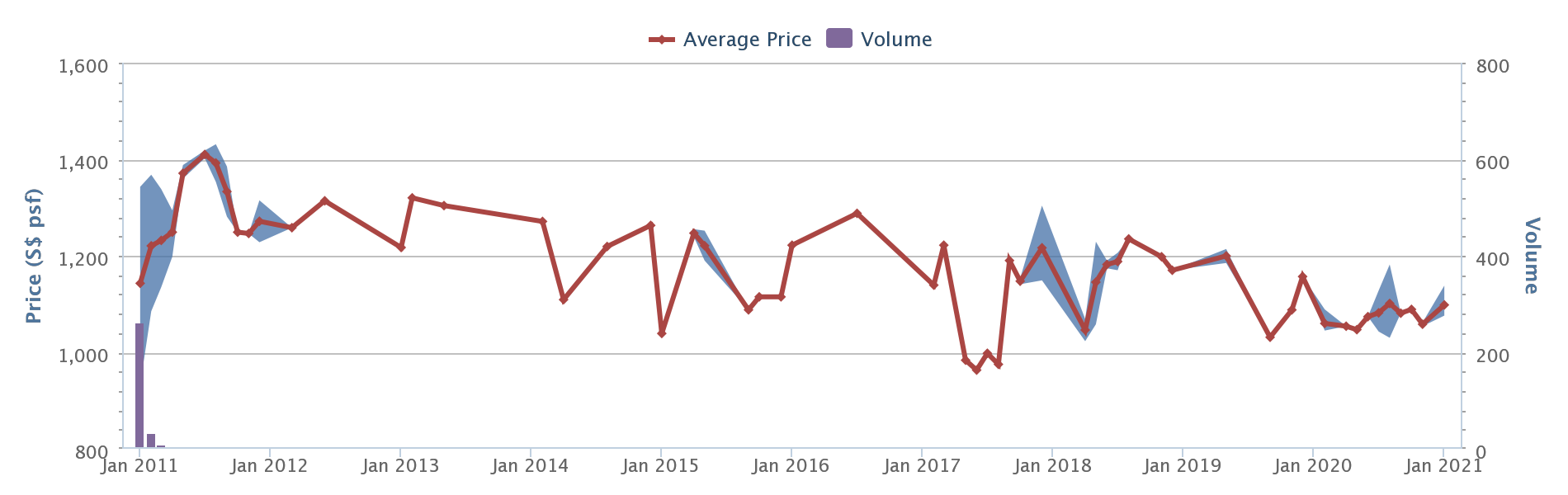

At that time, the average price for new launch condos in District 23 was $1,138 psf. In contrast, The Tennery had an average launch price in January 2011 of $1,143 psf.

Doesn’t sound like much in it, right?

Well, that is until you find out that The Tennery garnered the majority of new launch transactions that month – 98.1% to be exact.

It’s closest comparison, Mi Casa, only had 5 transactions out of 266 total new launch transactions.

At $883 psf, this represented a premium of 29%.

Still, as mentioned earlier, that didn’t stop too many people as it did sell 261 out of its 388 units in the first month.

Now that we’ve gone through the pricing, let’s look at some of the possible reasons for its resale performance so far.

1. Competition In The Area

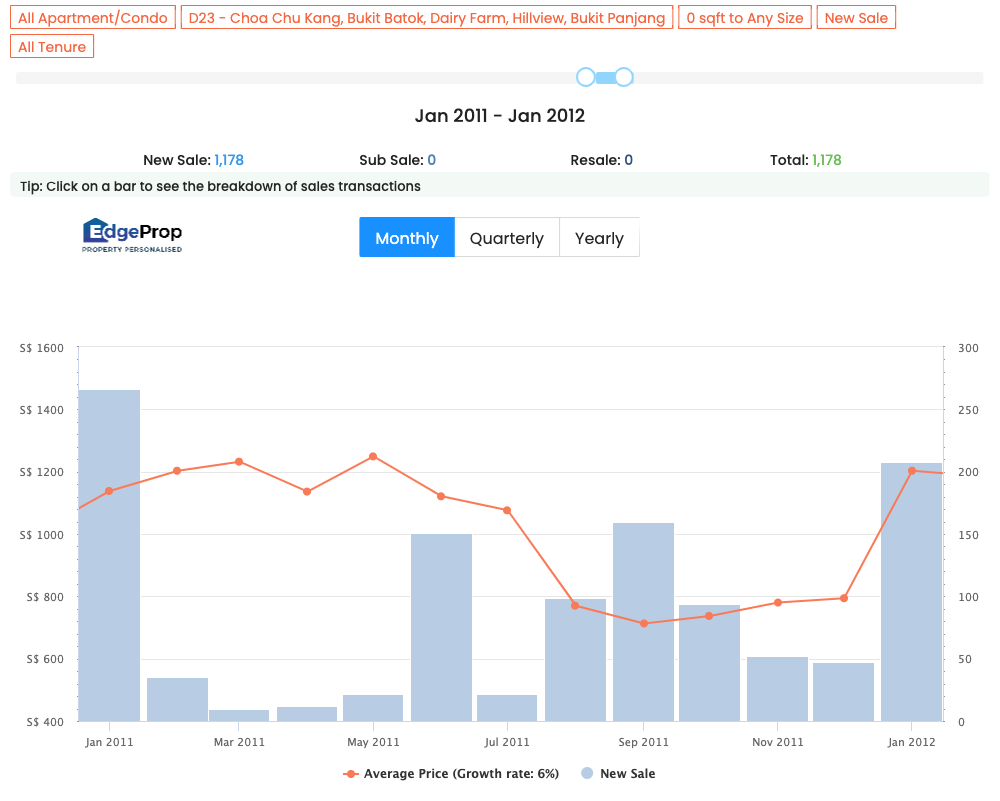

Let’s now look at some of its competition in the area at that time.

Frankly, it actually didn’t have much close comparisons as newer developments like Hillion and Hillsta only came about a couple of years later.

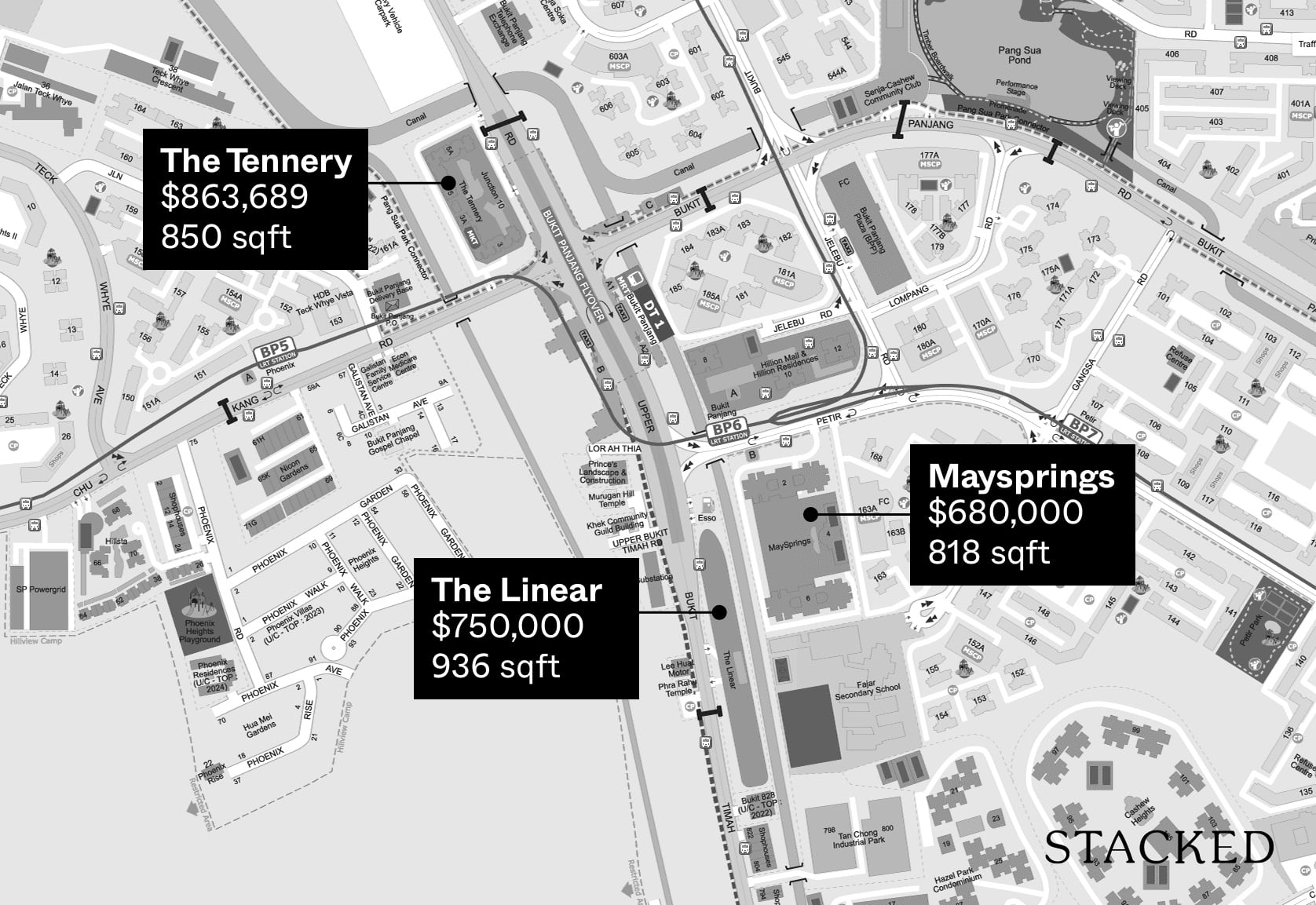

But just to give you an idea, here are its 2 closest resale competitors at the time: Maysprings and The Linear.

Note, these are exact (lowest) prices taken at the time of launch.

| Project | TOP | Tenure | 2 Bedroom Size | Quantum | PSF |

| The Tennery | 2014 | 99 years | 850 sqft | $863,689 | $1,016 |

| Maysprings | 1998 | 99 years | 818 sqft | $680,000 | $831 |

| The Linear | 2006 | 999 years | 936 sqft | $750,000 | $801 |

As you can see from the table above, while there is a significant age gap, the sizes of Maysprings and The Linear are about equivalent to The Tennery.

It doesn’t take a genius to see that the prices at Maysprings and The Linear are definitely more affordable on an overall quantum basis.

And while you can argue that Maysprings is considerably older than The Tennery, that nearly 30% premium will also be a big factor particularly for buyers who will be more sensitive at this price point.

But that’s not to say that Maysprings and The Linear did not come with its own set of complaints.

Many people do single out the small swimming pools of Maysprings and the awkward narrow layout of The Linear as a point of contention.

That said, here’s what would have happened if you had bought a unit at either Maysprings or The Linear instead.

I would have liked to show actual transaction data here, but because of a lack of transactions in this time frame, I took the average psf from the past year of the 2 bedroom units in each development.

| Project | 2 Bedroom Size | Price in 2011 | PSF 2011 | Current Price | Current PSF |

| The Tennery | 850 sqft | $863,689 | $1,016 | $901,000 | $1,060 |

| Maysprings | 818 sqft | $680,000 | $831 | $750,924 | $918 |

| The Linear | 936 sqft | $750,000 | $801 | $992,160 | $1,060 |

While each of the developments have appreciated, you can see that Maysprings and The Linear have both fared better than The Tennery. (Of course, let’s not forget The Linear is essentially a freehold property).

The thing is, many buyers were buying in at that higher price point because of their perceived value of what is supposed to come (Downtown MRT line, spillover rental tenants from the Jurong Lake District).

While some might say that the reaching effects of the JLD has yet to be fully realised, I would say the ceiling for The Tennery has been somewhat hampered by the presence of these 2 comparables in the area.

Which leads me to my next point.

2. Future Competition

In most cases, having a new launch in the area will help to boost the prices because of the new higher price that it is launched at.

That is, unless it is priced competitively (Penrose vs Sims Urban Oasis, for example).

With The Tennery, this was impacted by the launch of Hillion Residences in early 2013.

It boasted a bigger retail mall below, and it was right smack where the Downtown MRT station would be.

In other words, it was the best location in terms of convenience in Bukit Panjang.

Naturally, you would expect it to push the boundaries of pricing in Bukit Panjang – and it did, as the average selling prices in the first 2 months was about $1,363 psf, a good amount higher than The Tennery.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Are Older Three- and Four-Bedders in District 10 Holding Up Against the New Launches? We Break It Down

In our previous piece, we saw how one/two-bedders in District 10 fared. This time, we’ll turn to the larger three-…

But as mentioned by Ryan previously here, new launches are attractive because the overall quantum is actually lower.

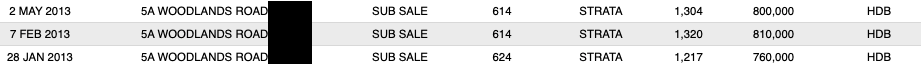

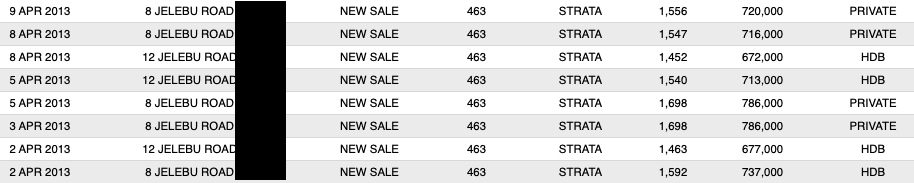

If we were to compare between the prices transacted during 2013, you can see the difference in prices.

So while the unit was much smaller at Hillion Residences on paper, it also translated to a lower overall price.

Which is why despite the difference in size, that price point plus added convenience meant that most people would see Hillion Residences as the more appealing option.

And by it being the newer project, it would mean there would be a cap on the prices that The Tennery could command.

But frankly, the Hillion Residences hasn’t exactly set the world alight either – so the limitations are there for all to see.

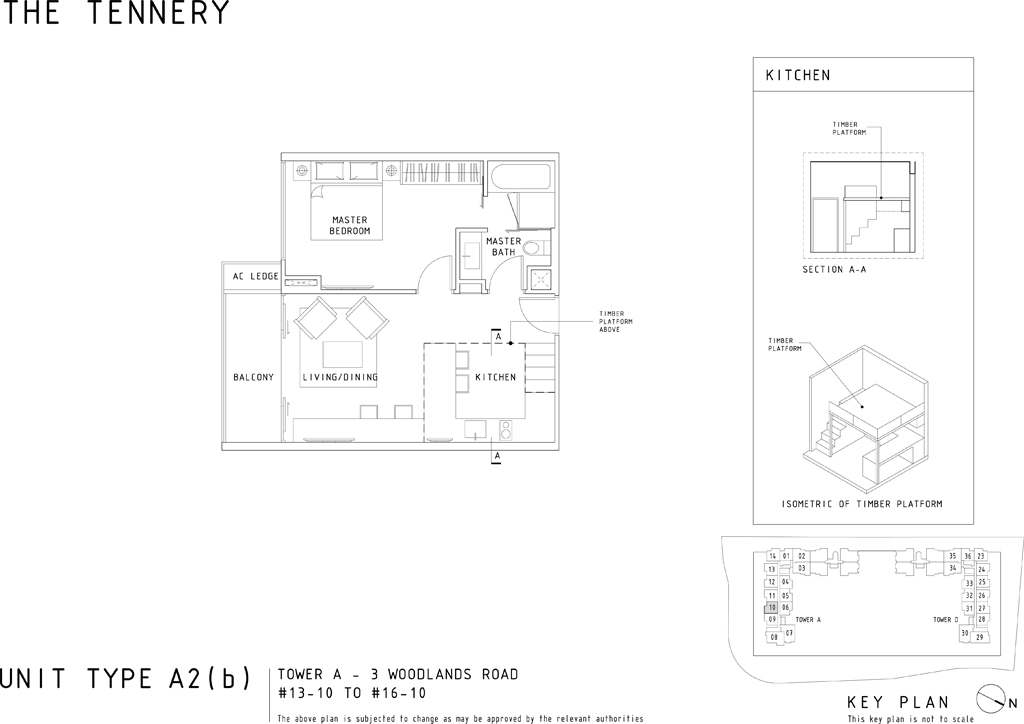

3. SOHO/Loft Units Out Of Vogue

While this was a trend back in 2011, having a loft unit today is more commonly seen as an inefficient use of space.

In today’s market, you are much more likely to see loft units featured in the special units (top floor, bottom floor, penthouse) rather than the entire development like The Tennery.

Bear in mind, that these loft units were at a height of 3.4 metres – which if you think about it, could also be pessimistically classified as just a unit with a high ceiling.

I can’t speak for everyone, but I reckon a proper loft unit would really only be useful at at least 4 metres in height – so you could at least stand on the platform quite comfortably.

At 3.4 metres while you are able to incorporate a platform to have extra space, the height limitations are quite restrictive to what you could actually do to it.

I’m guessing when it came down to a situation of a bigger unit with high ceiling but further away from MRT (The Tennery) versus smaller unit but directly above a better mall plus MRT (Hillion Residences), the choice was quite straightforward for many.

4. Shopping Mall Selection

As much as mixed-developments are being flaunted as a must have, it really only becomes a draw when the curation of its tenants are well-rounded.

Case in point: places like North Point Residences or Watertown Condo.

Condo ReviewsWatertown Condo Review: Waterfront Views And Unparalleled Convenience

by Reuben DhanarajI would go so far to say that Far East malls aren’t as competent as their competitors like Frasers when it comes to shopping malls.

I’m not going to go through their entire list of malls here, but a few that pop to mind like Pacific Plaza, West Coast Plaza or Clarke Quay Central aren’t known to be the most attractive spots.

When first launched, Junction 10 (the mall at The Tennery) was definitely meant to be a draw for residents. And to a certain extent, it was.

Initial tenants included shops like Giant, Watsons, Guardian, BreadTalk, ToastBox, BBQ Chicken and Kumon.

Today, most of them have been replaced with new tenants like Sheng Siong (which undoubtedly is great for residents).

But the resulting current unit mix isn’t good enough that footfall to the shopping mall is satisfactory.

The tenant mix reads something like a small neighbourhood mall than it does a proper retail destination.

And well, you can’t really be expecting much when the retail space consists of only 2 small floors.

The biggest kicker was when they actually closed the Ten Mile Junction LRT station at The Tennery in 2019 – the reason being low ridership numbers.

This was also the first ever MRT/LRT station to be removed from operations.

Clearly, this signified that even with an LRT station for residents in Bukit Panjang to easily access the mall, it wasn’t enough to draw people in.

5. It’s A Rental Project

338 units. 227 1 bedroom, 111 2 bedroom.

It’s plain to see that investors were the main target audience for such a project.

More commonly than not, you’ll find that projects geared towards rental will have investors that have lesser staying power.

If they’ve made their money from rent, they are more inclined to let go of their property – even at a loss if they have identified better opportunities elsewhere.

Contrast this to an own stay project where the homeowner would need to sell at a palatable price in order to upgrade or fund for retirement – the mindset there is very different.

And so, that leads me to the final point.

6. Rental Prices

Of course, if the rental numbers that you’d get from The Tennery were good, it would be a different story.

| HILLION RESIDENCES | MAYSPRINGS | THE TENNERY | |

| Year | 700 – 800 sqft | 700 – 800 sqft | 800 – 900 sqft |

| 2014 | – | – | $2,450 |

| 2015 | – | – | $2,445 |

| 2016 | – | $2,167 | $2,440 |

| 2017 | $2,450 | $2,073 | $2,312 |

| 2018 | $2,360 | $2,069 | $2,292 |

| 2019 | $2,428 | $2,099 | $2,353 |

| 2020 | $2,439 | – | $2,348 |

| 2021 | $2,600 | – | $2,275 |

I’m only showing the 2 bedroom units here, as the Maysprings has no 1 bedroom units to compare with.

But you can see that while The Tennery used to be able to command above $2.4k a month in rent, this dropped once Hillion Residences was introduced to the scene.

And again, it’s not difficult to see why.

It is the newer development of the 2, the shopping mall is a proper one, and the MRT station is right there.

| Project | Size | Rent | Quantum | Rental Yield |

| The Tennery | 861 | $2,275 | $930,000 | 2.9% |

| Hillion Residences | 710 | $2,600 | $1,020,000 | 3.05% |

It isn’t a stark difference here, but it is a higher rental yield nonetheless.

Final Words

To be honest, there could be even more factors.

Heavy vehicles heading to and from JB and Kranji plying the flyover, possibly even not enough support from HDB prices in the area (I will need to study this further).

As always there is never just one reason, but a mix of different reasons.

Things could change in the future, when the vision of the JLD is fully realised. But for now, these are the current issues that this development is facing.

For more on issues affecting property investment, or in-depth reviews of new and resale properties, follow us on Stacked. If you’re pondering the future gains of your property purchase, do reach out to us for a proper consultation.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why has The Tennery performed poorly in resale transactions?

How does the location of The Tennery affect its resale value?

What impact did future nearby developments have on The Tennery's market performance?

Why are loft units at The Tennery considered less desirable today?

How does the shopping mall at The Tennery influence its resale prospects?

In what way does The Tennery being a rental project impact its resale performance?

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

3 Comments

Thanks for the insightful article, as you mentioned Tennery exit price is hampered by cheaper projects within the vicinity. Would you say the same will happen to Provence Residence EC at Canberra years later?

The launch price will be out on 10th May but expected to be around 11xx – 12xx PSF, however, just across the road, there is Visionaire and Brownstone, also around the vicinity we have Canberra Residence, 1 Canberra, etc. all of these had an entry price of around 7XX – 8XX PSF.

Using the same logic as your example, it would be hard for Provence to exit with a gain in the future, since it has to sell at least 13XX – 14XX to gain, whereas older ECs/Condos (in fact not THAT old) in the vicinity with the same (or even bigger) size can sell at a comparably cheaper price (10XX – 11XX, etc.) and still gain due to much lower entry price? Thus Provence will not survive the competition (and Parc Canberra too since their entry price also quite high compared to others in the vicinity, but could be slightly cheaper than Provence due to land price. )

Wonder if you could share more on your thoughts on Hillion Residences (“hasn’t exactly set the world alight either”)? I thought it is in a great location and decently priced

You know what – I think one of the main reasons why the Tennery is not doing well is DUE TO THIS ARTICLE. Naturally people Google while considering pro and cons – and your article is on the first page with a startling eye catching title.

This whole super biased write-up gives any reader the creeps about The Tennery while ignoring all the true practical advantages of living there.

More than 90% of the Tennery are single-bedders – so it competes with single-bedders of Hillion and Linear. But this article chose to compare unit areas/pricing of 2-bedders instead.

Strange.

Could it be because Hillion has super small single-bedders?

Or could it be Linear’s single-bedders all suffer tremendous noise and sun?

So why not compare all of their single-bedders?

Tennery vs Hillion:

Tennery has 3.4m high ceiling, not only does it give an airy atmosphere, it allows building of additional storage cabinets and shelves. Tennery has a loft for extra bed/storage but article condemns it as not being a true loft. Hillion can’t even have one, even if you have the money to build one. It has a true-sized living room that’s 3.7m wide. Hillion has hotel style narrow corridors serving as both living room and kitchen. This article totally ignores the high practical value of additional space/storage, but instead chose to point out Tennery’s slightly further distance to MRT/Hillion mall. Come on, Tennery is just a stone’s throw away from Hillion. Is Hillion’s small distance advantage greater than Tennery’s much larger space, larger bathroom, higher ceiling and a full-sized loft that can fit a king size bed?

Tennery vs Linear

All single-bedders at The Linear directly faces west, suffering the full wrath of Singapore’s melting afternoon sun. Most of Tennery units faces north-south. All the Linear single-bedders suffer extreme traffic noise due to its very close proximity to the main road as they’re all low-floor units. Linear residents have to walk across to Hillion in order to reach any amenity or supermarket (enough to make you dripping wet during a storm). Tennery has a huge supermarket right inside Junction10 itself. Many units at The Tennery have superb unblocked view of the railway corridor. But all single bedders at The Linear face a high-traffic main road. Does this article mention any of these? No.

The title of this article is “Why The Tennery has performed poorly”.

I think the main reason could be this article itself.