Why En-Bloc Sales Will Continue To Be Slow In 2024

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

If it’s been a while since your last en-bloc sale, you may be surprised at how much can change in a single decade. 2014 to 2024 has been an interesting time; not just because of Covid, but because of the roller-coaster of cooling measures, a wild swing from a supply overhang to a housing shortage, and new launch prices that buyers are struggling to process. Here are some of the differences in en-bloc sales today, versus the 2017 or earlier market:

The main issue with the en-bloc market in 2024

Developers have a five-year period to complete and sell any project, lest they end up paying ABSD based on the land price (although this has now been relaxed a little). This led to prior expectations of a five-year cycle, where developers would finish their projects, and then rush to replenish their depleted land banks. But the last cycle, which should have started again in 2022, never came to pass.

(We covered this in an article a while back)

In our earlier article, we mentioned competition from more Government Land Sales (GLS) sites. As of 2024, we see the situation hasn’t changed. One example of this was Pine Grove, where two GLS land parcels (next to Pine Grove) were bought before the condo’s attempted en-bloc.

Pine Grove owners had hoped for a $1.95 billion collective sale (their fifth attempt since 2008). This was later dropped to $1.78 billion. The Pine Grove en-bloc sale would have priced the development at roughly $1,430+ psf (around $1,335 psf at the lower price). Meanwhile, the two GLS parcels next door received top bids of $1,318+ psf, and $1,223+ psf.

We’ve likewise seen GLS plots come up in places like Lentor Central, Orchard Boulevard, Zion Road, etc. The government is following through on its plans to ramp up housing supply, and this will provide stiff competition for en-bloc sales. We’re expecting 5,450 new homes from these land sales in 2024, up from the already high 5,160 new homes in 2H 2023.

Between a GLS plot and an en-bloc sale, most big developers will prefer to just buy government land. There are fewer complications from owners (see the Chuan Park saga), and even less cost for developers to level out the land. Another issue here is the high cost of properties (see below). For the current owners to justify moving and purchasing a new home, the eventual price tag of the redevelopment may be too high for the market to accept. It’s rather different from GLS land where developers just bid against each other.

As such, hopes for an en-bloc sale are muted right now, given that the competition seems to be the government itself.

Other factors that have changed, recently or in the past few years, include:

1. Greater resistance due to the cost of replacement properties

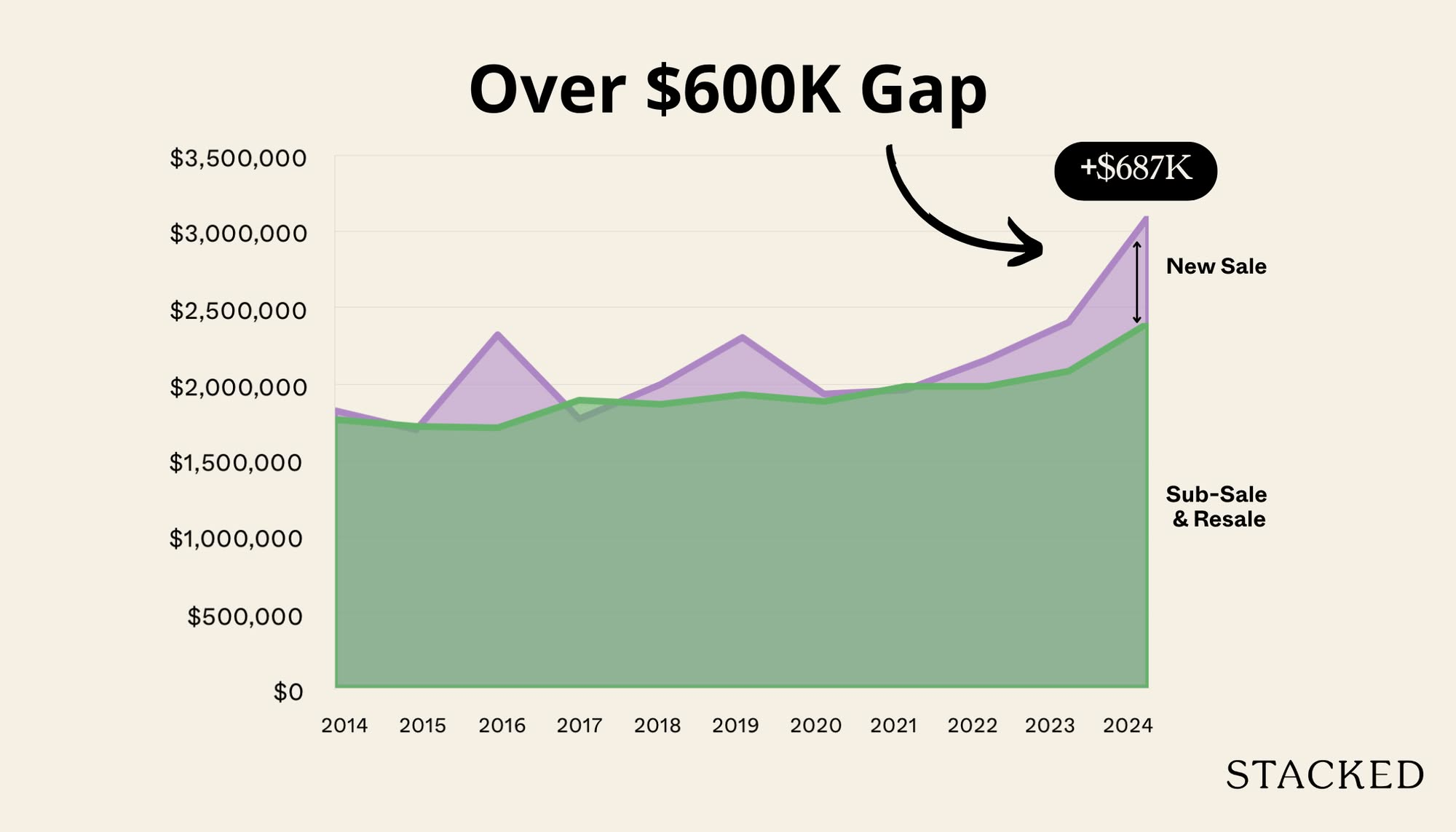

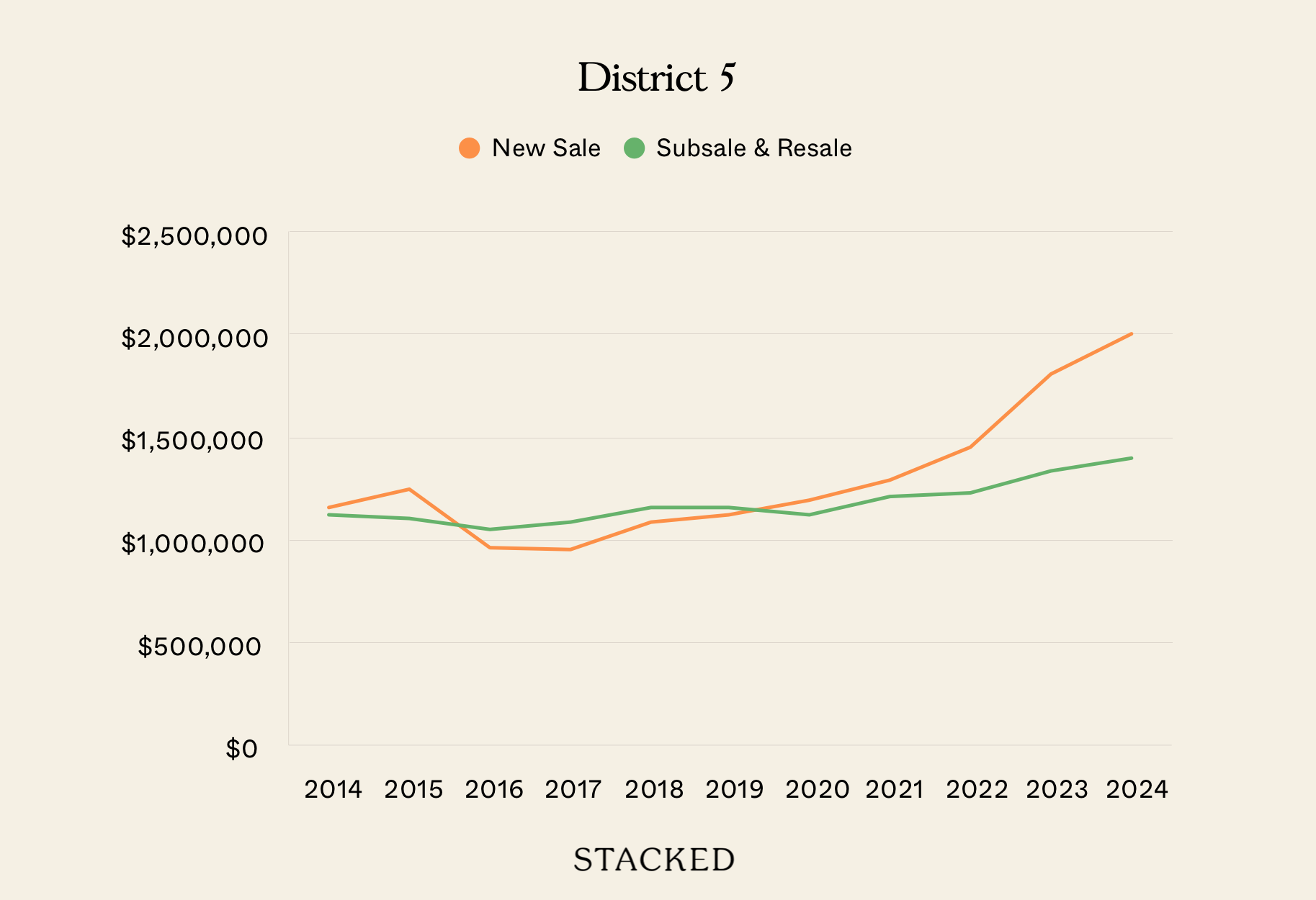

The most obvious factor here is the cost of homes today. As the old saying goes, when you sell high, you buy high. New launch prices averaged $2,250 psf in May 2024, whilst resale prices averaged $1,634 psf.

Consider this in the context of Pine Grove above, where the sellers failed to get even $1,434 psf. Other en-bloc sale attempts this year, such as Thomson View, are pushing for as low as around $1,282 psf.

Simply put, an en-bloc sale today is less of a windfall than it used to be, unless you don’t need a replacement property.

Another factor here is the raised ABSD rates. Foreigners who own properties here are likely to fight hardest against en-bloc sales, as they face a 60 per cent ABSD on any replacement property. Meanwhile, Singaporeans and PRs face the realisation that – if they surrender their second property to an en-bloc, future purchases will come with 20 and 30 per cent ABSD rates respectively. This could make it much tougher to replace their rental income.

2. Right-sizing to HDB after an en-bloc is tougher for some

Unless you’re 55 years old and right-sizing to a 4-room or smaller flat, recent rule changes can make collective sales a headache. There’s now a 15-month waiting period after selling a private property, before you can buy a resale flat.

More from Stacked

I’m Under 35 And Single With A $900k Budget: Which Of These 5 Condos Is Suitable For Future Rental and Resale Potential?

Hi Stacked Home Team,

(A BTO flat is even further out of the question, requiring a waiting time of 30 months).

This is a conundrum for, say, a homeowner in their 30s or 40s who’d need a replacement home. Their options are either to find a private property, thus running into the high prices described in point 1, or to end up needing temporary accommodation for a prolonged period.

This adds an extra difficulty to collective sales that we didn’t have to deal with, prior to the waiting period imposed in September 2022. We have been told that appeals can be made to HDB about this, but these are likely reviewed on a case-by-case basis.

3. GFA harmonisation might result in less generous offers

Recent rule changes to the way Gross Floor Area (GFA) is measured may also account for less generous developer offers. We explain it in more detail here; but to summarise, developers can no longer squeeze more out of features like big air-con ledges, planter boxes, bay windows, etc.

Whilst this is probably a big relief to buyers, it does impact developers’ bottom lines; and given the higher ABSD rate, as well as Land Betterment Charges (LBC), developers may be conservative with their offers.

As an interesting aside to this though, strata void space (i.e., the space between ground and ceiling) did factor into Share Valuation (SV) calculations, prior to the rule change. This could be problematic if sale proceeds are based on SV, as the empty void space is clearly less useful than real “liveable space” in the unit. We don’t know if steps will be taken to standardise things, but it doesn’t seem practical to try and retroactively apply this to every property that came before.

4. More flexibility in Methods Of Apportionment (MOA)

The MOA refers to how sale proceeds are divided. Conventionally, the ways to do this are by Share Value (SV), by strata area, by market valuation, or by some mix of all three.

The MOA is still one of the most contentious parts of a collective sale; this hasn’t changed over the years. However, there is greater flexibility and innovation in how this is done, compared to the earlier years of en-bloc sales. In fact, it’s now the norm for some kind of compromise to be used, as opposed to adhering strictly to SV, strata area, etc.

Consider the case of the Albracca in 2018, for example, which was a boutique condo with 11 units of significantly varying sizes. The MOA that was eventually accepted (see the link) was based on one-third SV, one-third strata area, and one-third valuation. With The Realty Centre, the MOA was 70 per cent based on SV, 220 per cent strata area, and 10 per cent valuation.

In essence, attempts are made to find the lowest difference between the premiums (i.e., en-bloc sale proceeds minus the market value) of the largest and smallest units.

This sort of flexibility is good news for two types of properties: first, projects with units of greatly differing sizes, as strata area is better taken into account, along with SV and valuations. The second is for mixed-use projects, where some commercial units exist alongside residential. This is due to having some weightage toward market value.

Prior to this, mixed-use units were sometimes considered more challenging to sell during an en-bloc sale, which was in turn interpreted as a disadvantage (e.g., a shop space can have a similar strata area to a residential unit, but have a greatly different valuation based on work done to the shop, the foot traffic it’s able to bring, and so forth).

The methods are fairer now than they were in the past, which is one of the factors that may help with en-bloc sales.

The final consideration is the wider economy

This ranges from a higher interest rate environment, to the effect of the war in Europe. Both of these are beyond our scope – but we can say that, with so much uncertainty in the air, developers are likely to continue to be cautious with collective sales right now in 2024.

For more on the Singapore private property market, and its key factors today, follow us on Stacked. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Market Commentary

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

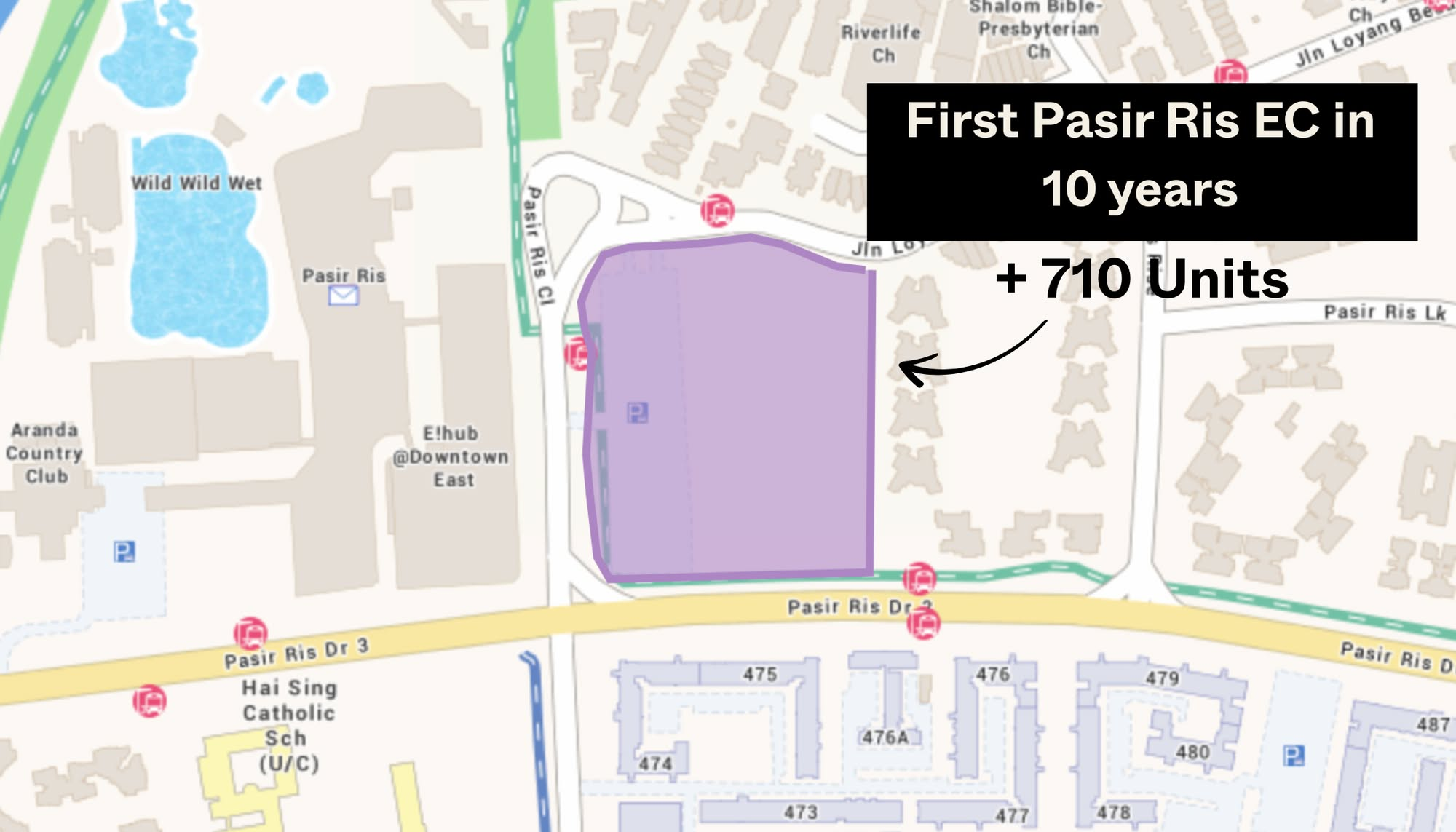

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families

Property Market Commentary Which Central Singapore Condos Still Offer Long-Term Value? Here Are My Picks

Latest Posts

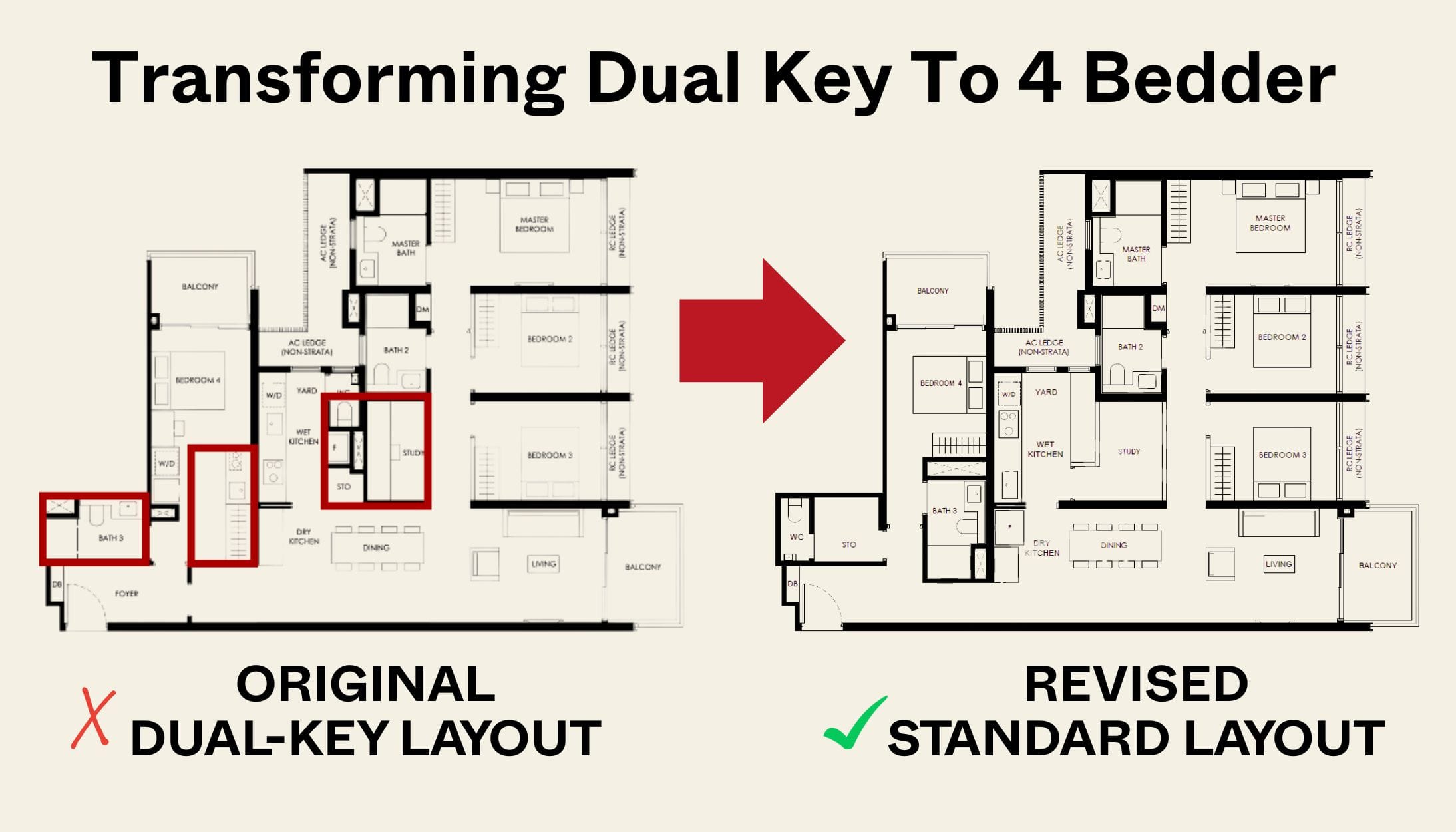

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

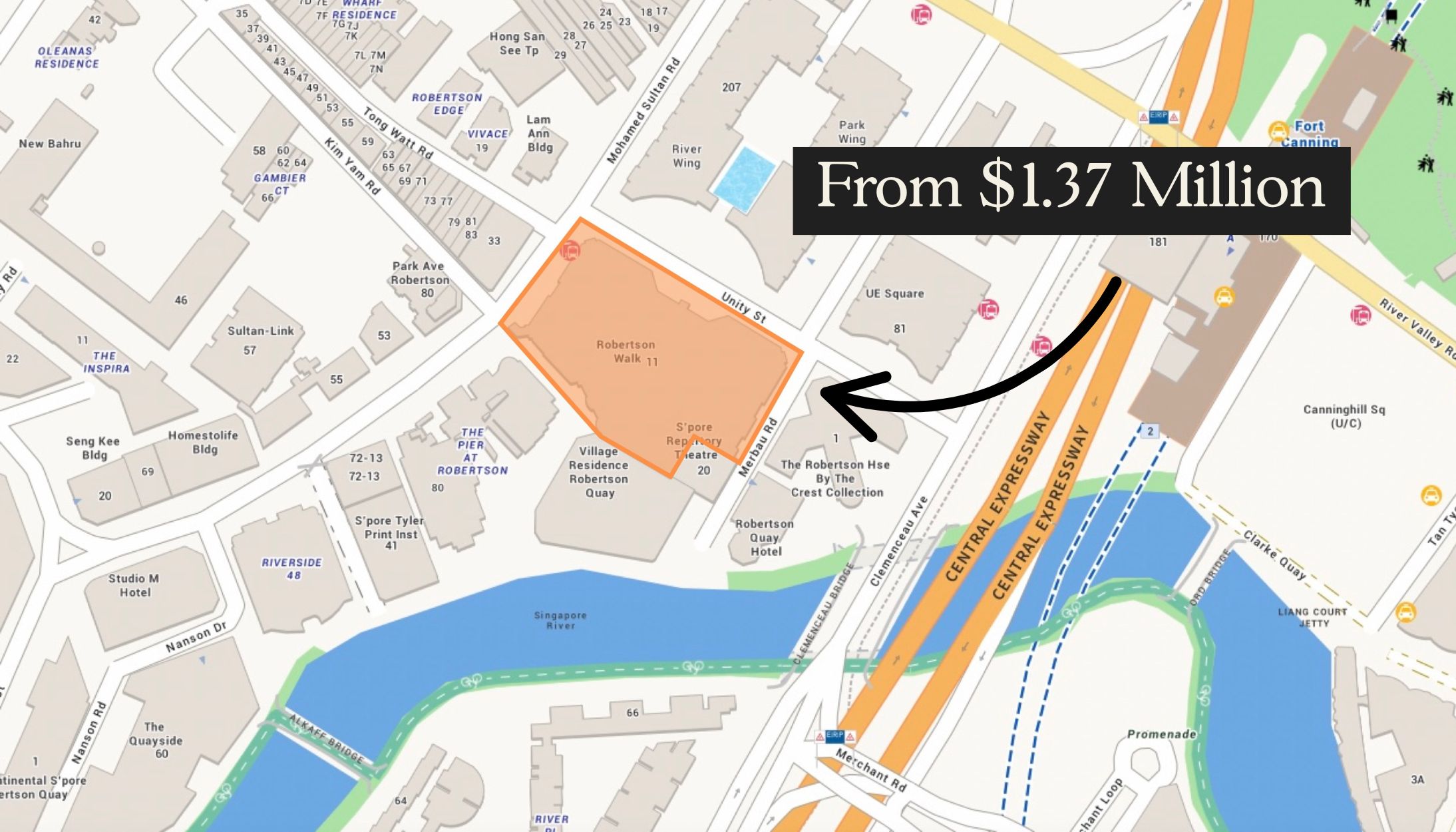

New Launch Condo Reviews The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

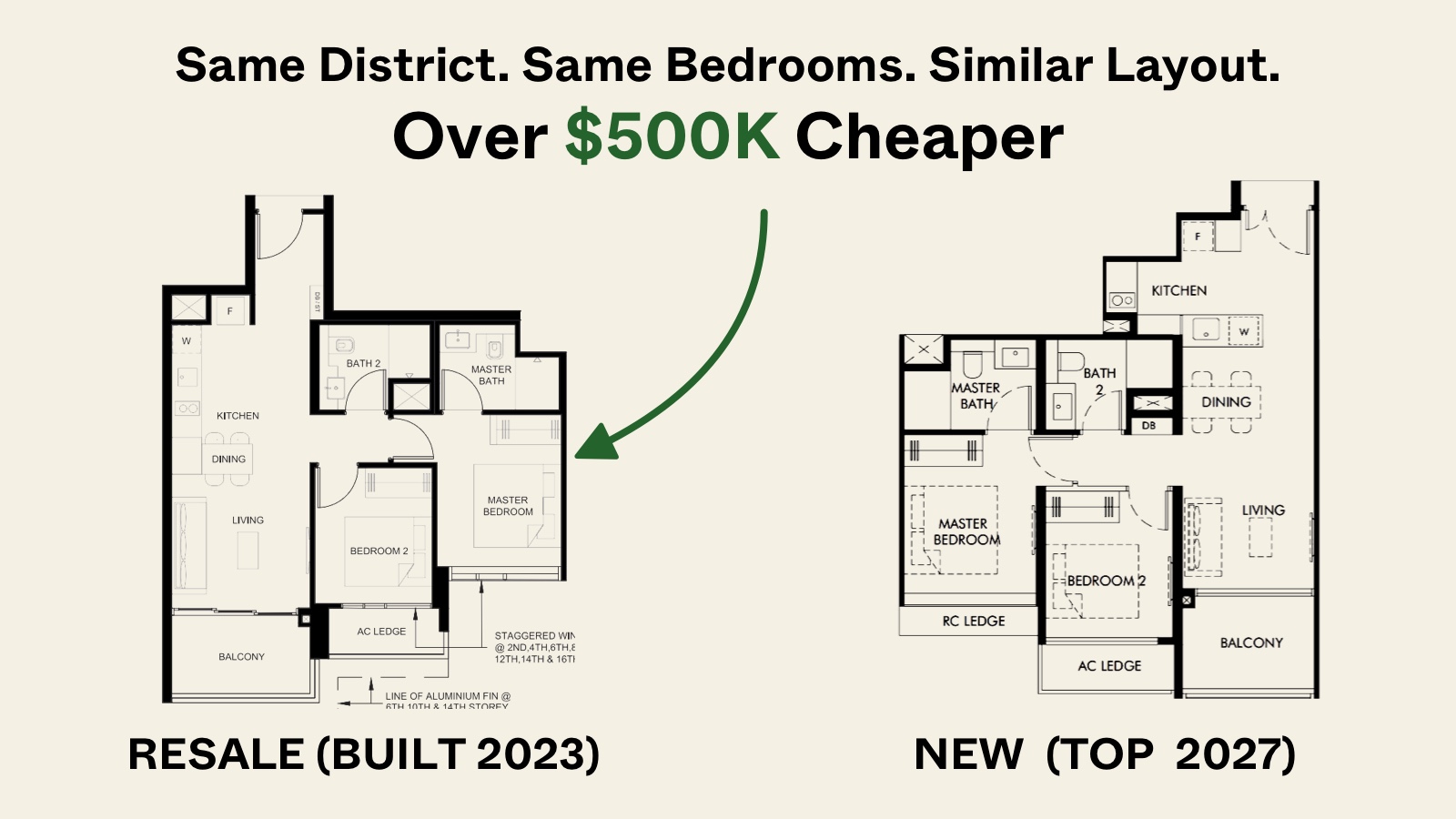

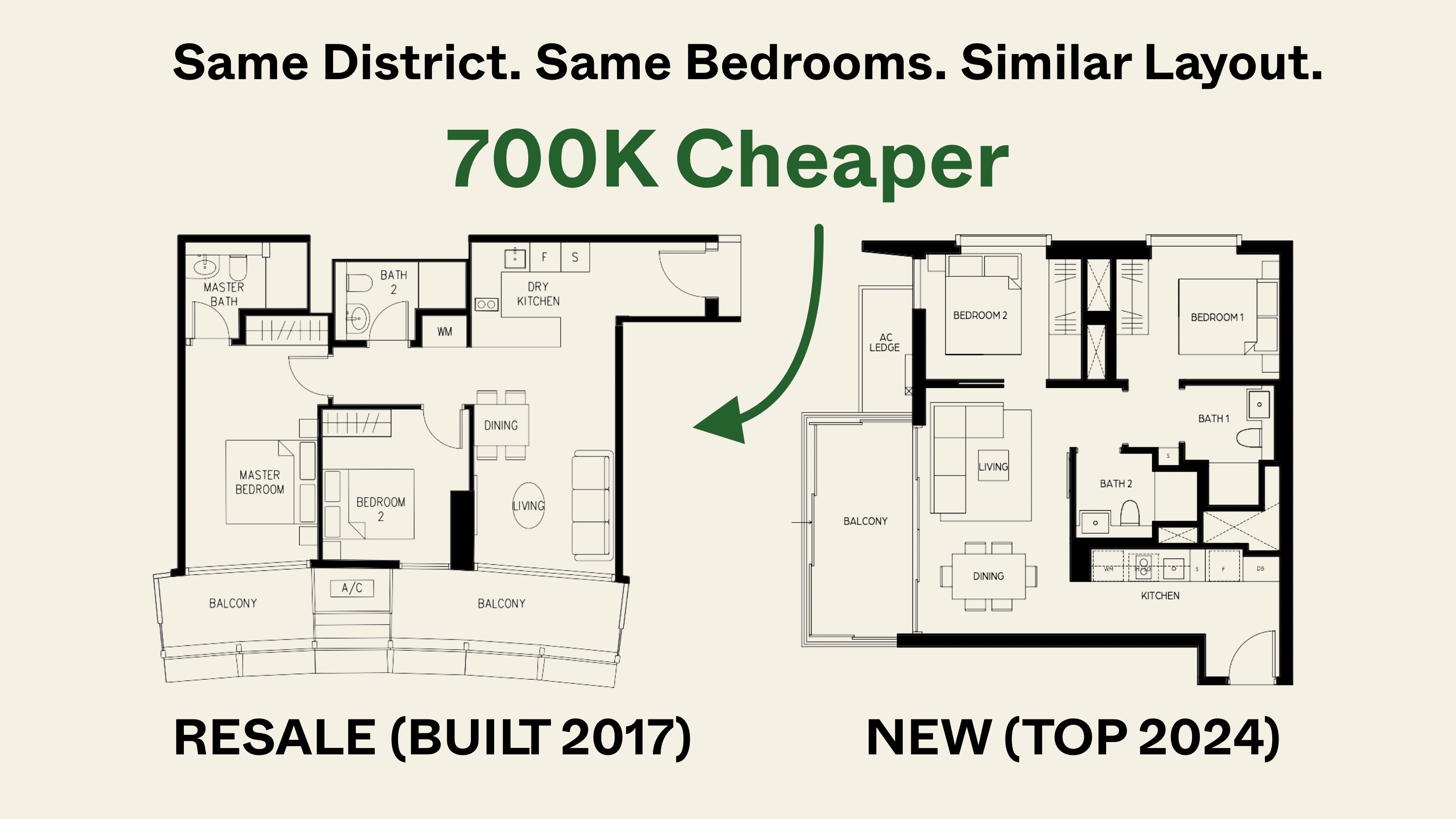

Pro Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest