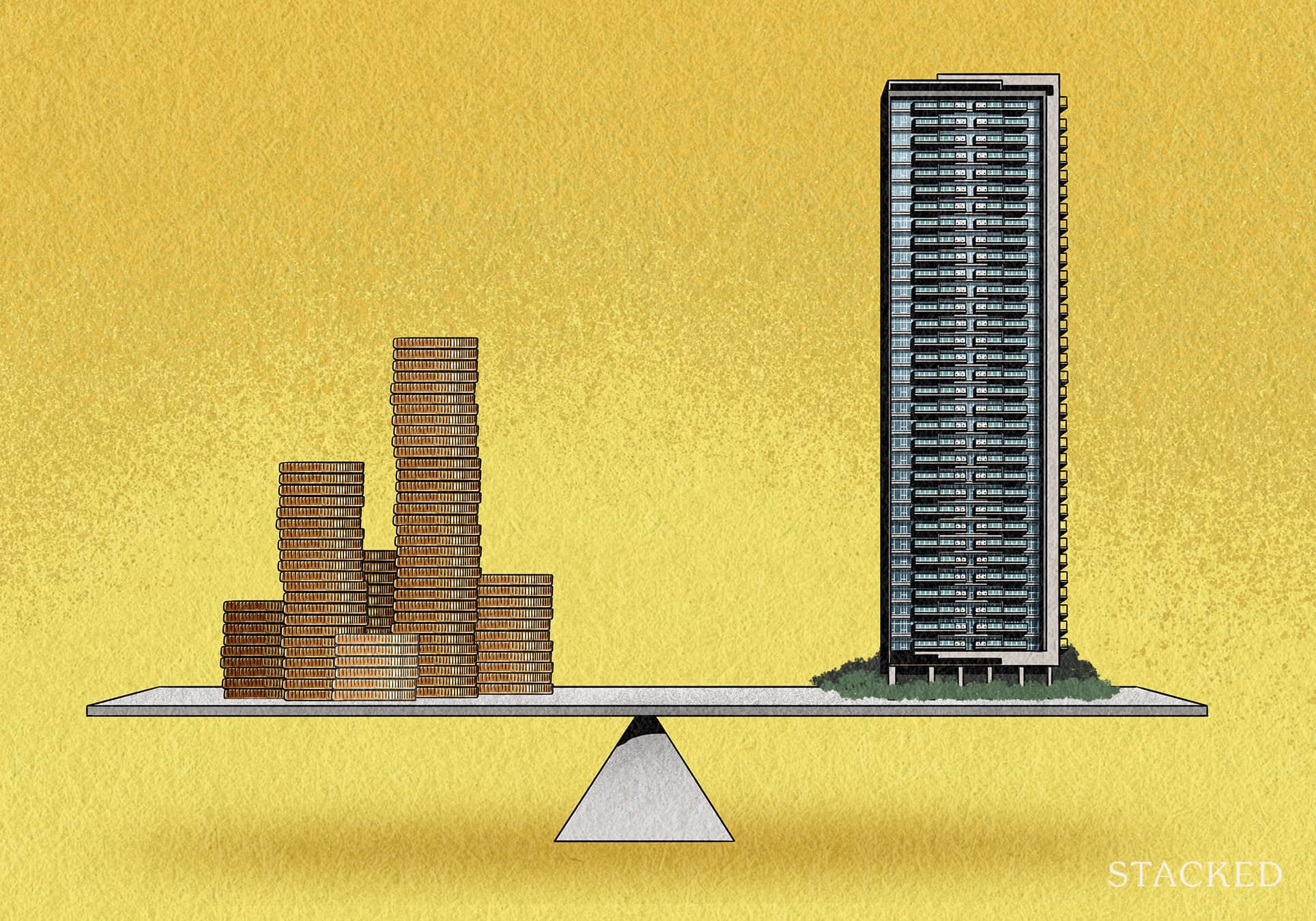

What Is An Affordable Home In Singapore?

September 8, 2024

When it comes to housing affordability, the word “entitled” gets thrown around too much.

There’s a certain kind of judgment that gets levelled on you, when you define affordable housing not just as a roof over your head. If you add that it also has to be fairly near your workplace, near your children’s school, near food outlets, etc. that’s when people raise their eyebrows and start thinking you’re going a bit too far.

Now that’s not totally unfounded; I’ve met people who define “affordable housing” as when they can afford a penthouse near Orchard Road. (Also on the flip side, there are some people who feel you should be content with a cave, a fire, and a hunk of raw meat. Generally, the people who start stories with “In my time ah…”)

But let’s try to find a middle ground here. With the caveat that we shouldn’t be too entitled, consider the many ways housing subtly – or not so subtly – affects your life:

How many people in lower-income brackets, forced to take a home wherever they can, are incapable of optimising their earnings due to distance? A single parent with a toddler gets an offer for a higher paying job in Marine Parade, but they can’t afford to rent or buy there; so they keep their nearby job in Jurong West.

These are actual situations I’ve come across, and it shows how the lack of affordable housing is a chicken-and-egg situation: they could raise their income if they could afford a different location; but they can’t afford that location because they can’t raise their income.

Then there’s the issue of inequality, and slowly being squeezed out of your own neighbourhood. We saw this play out in Tiong Bahru: Perhaps your home was affordable when you bought it, but over time, a wave of gentrification sweeps in. Higher-income people outbid poorer people for homes near you. Expat workers, attracted by the trendy vibe, easily outbid other tenants.

Businesses around you warp to cater to the new, well-heeled residents; and suddenly the closest place to get a cup of coffee is charging you $10 a cup. Through no fault of your own, you suddenly can’t afford to live in the place you’ve stayed for decades. The solution is often a merciless “Well your home would have risen in value too, so sell it and take the profit.” Which is an ice-cold way to tell poorer people they’re being kicked out.

Then consider the impact on family sizes, and the eventual effect of a declining population. Assume the price of a resale flat is about $500 per square foot. An extra room for your children – let’s say about 250 square feet – is an extra $125,000. And we also need to consider that homes near desirable schools tend to be priced higher. It’s made a bit worse by the fact that, when you buy a flat, you’re locked into that location for at least five years – so whether you can afford a given school is also related to whether you can afford a home there.

More from Stacked

HDB vs. SIBOR vs. Fixed Deposit: Which Home Loan is Best Right Now?

You’re at the bank listening to the mortgage banker talk, and you know this is important. But 15 minutes in,…

Wanting a bit more than a plain “roof over our head” isn’t something to be dismissed as entitled

It can feel that way, when someone complains that housing is unaffordable because it’s too far from work and impacts their job; or that their children can’t be near a better school, etc. And again, we do have to draw lines, so sometimes that may be true. But we need to be careful not to degenerate into chest-thumping, “tough it out” mentalities, where we just discount these people as spoiled.

After all, improving education and job prospects – through housing as well as other means – could contribute far more to our economy in the long term than it costs. It’s one reason why we need to look beyond “five times annual income” or wage-to-home cost ratios when deciding what’s affordable.

Meanwhile in other property news:

- We’re gearing up for the biggest ever BTO launch in a long time, coming in October; and the launch sites are some of the most varied we’ve ever seen. Check them out.

- Does buying a unit with a “premium view” really help with your resale gains? We compared High Park Residences and Panorama to see how it worked out for them.

- Resale flats are pricey, so going for older ones can help your wallet. But is that really advisable for a young person in their twenties or thirties? Well…sometimes, but it depends.

- Some of you know I dislike condo units with private pools (what’s the point when you’re already paying for a bigger one?) But I’m not everybody, and I admit it’s sometimes cool in a decadent way. So if you want to find them, here they are.

- Could you afford a property in beautiful; France? Beats me, the closest I’ve been is using a coupon at Paris Baguette. So here’s someone who actually bought a studio apartment there, to explain how.

Weekly Sales Roundup (26 August – 01 September)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 32 GILSTEAD | $14,713,000 | 4198 | $3,505 | FH |

| WATTEN HOUSE | $6,047,000 | 1851 | $3,266 | FH |

| THE CONTINUUM | $5,470,000 | 1905 | $2,871 | FH |

| 19 NASSIM | $5,258,000 | 1475 | $3,566 | 99 yrs (2019) |

| THE RESERVE RESIDENCES | $5,080,000 | 1894 | $2,681 | 99 yrs (2021) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KASSIA | $1,018,000 | 474 | $2,149 | FH |

| HILLHAVEN | $1,469,568 | 721 | $2,038 | 99 yrs (2023) |

| LENTORIA | $1,569,000 | 732 | $2,144 | 99 yrs (2022) |

| SORA | $1,583,000 | 807 | $1,961 | 99 yrs (2023) |

| MIDTOWN BAY | $1,608,000 | 484 | $3,290 | 99 yrs (2018) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| GOODWOOD RESIDENCE | $7,980,000 | 2680 | $2,977 | FH |

| LATITUDE | $7,960,000 | 2788 | $2,855 | FH |

| FOUR SEASONS PARK | $7,800,000 | 2260 | $3,451 | FH |

| THE TRILLIUM | $6,200,000 | 2390 | $2,595 | FH |

| THE DRAYCOTT | $5,450,000 | 2637 | $2,067 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| HAIG 162 | $688,000 | 366 | $1,880 | FH |

| PRESTO@UPPER SERANGOON | $720,000 | 484 | $1,486 | FH |

| RIPPLE BAY | $720,000 | 484 | $1,486 | 99 yrs (2011) |

| FLORAVILLE | $760,000 | 452 | $1,681 | FH |

| SOHO 188 | $770,000 | 431 | $1,788 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| FOUR SEASONS PARK | $7,800,000 | 2260 | $3,451 | $3,800,000 | 4 Years |

| THE DRAYCOTT | $5,450,000 | 2637 | $2,067 | $2,450,000 | 28 Years |

| PEBBLE BAY | $3,589,000 | 1894 | $1,894 | $2,429,000 | 22 Years |

| LATITUDE | $7,960,000 | 2788 | $2,855 | $2,287,900 | 15 Years |

| THE IMPERIAL | $3,400,000 | 1421 | $2,393 | $2,135,550 | 18 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| 6 DERBYSHIRE | $988,000 | 474 | $2,086 | -$200,990 | 7 Years |

| ST REGIS RESIDENCES SINGAPORE | $5,188,000 | 2121 | $2,447 | -$162,000 | 17 Years |

| THE VERV @ RV | $1,950,000 | 1001 | $1,948 | -$150,000 | 13 Years |

| THE CLIFT | $1,055,000 | 506 | $2,085 | -$45,000 | 7 Years |

| THE NAVIAN | $1,088,888 | 657 | $1,658 | $12,776 | 7 Years |

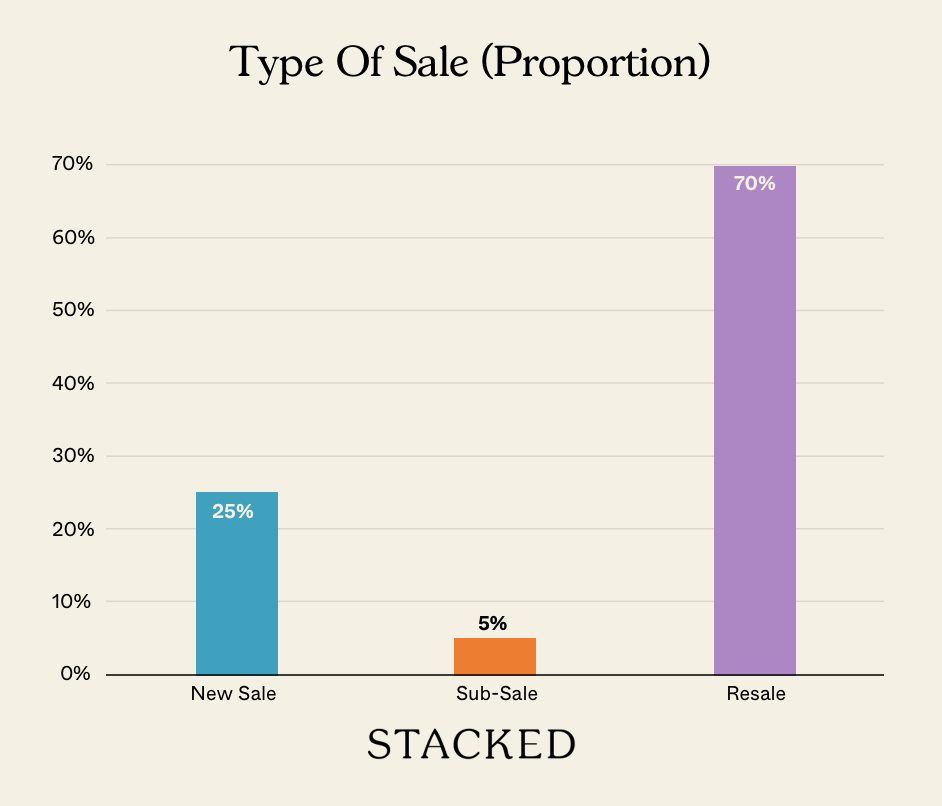

Transaction Breakdown

For more on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is considered affordable housing in Singapore?

How does housing affordability affect people's job opportunities in Singapore?

What impact does gentrification have on affordable housing in Singapore neighborhoods?

Why is housing near desirable schools more expensive in Singapore?

What are some considerations when buying resale flats in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News An Older HDB Executive Maisonette Just Sold For $1.07M — And It Wasn’t In A Mature Estate

Singapore Property News Why The Feb 2026 BTO Launch Saw Muted Demand — Except In One Town

Singapore Property News One Of The Last Riverfront Condos In River Valley Is Launching — From $2,877 PSF

Singapore Property News When A “Common” Property Strategy Becomes A $180K Problem

Latest Posts

Pro We Compared Lease Decay Across HDB Towns — The Differences Are Significant

Editor's Pick We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Pro This Singapore Condo Skipped 1-Bedders And Focused On Space — Here’s What Happened 8 Years Later

0 Comments