We Reveal How Much Property Agents In Singapore Are Really Making: Here’s A Detailed Breakdown

September 11, 2022

With commission rates of around 2 per cent (it can even be 3 to 4 per cent for new launches), there’s an impression that property agents are rolling in dough. Many clients certainly feel that way, with the average commission from a resale condo being upward of $30,000 (before being split with any buyer’s agent). However, the reality is quite different, which we’ve written before quite comprehensively here.

But while we delved into the realities of being an agent, there’s something that’s worth expanding more on – and that’s a breakdown of how much an agent can really make in Singapore.

But why is that important?

One, to help buyers and sellers out there to understand the inner workings of being a property agent, that it’s not such an easy life.

Two (this is for those who are deciding on embarking on being an agent as a career, as shown above), that the money doesn’t come in as easily as you think. Here’s a rundown on what it’s really like being an agent, and how much they can make:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A few basic numbers to consider

Back in 2012, there were around 30,577 property agents. Fast forward 10 years till today, and the number of agents is… still just around 32,414. That’s a mere six per cent increase over a decade.

These numbers are suggestive of a very high turnover rate, with as many agents leaving as they are joining on any given year.

But what about during a boom market, such as in the past two years? There should be a huge surge of agents, right?

Well in 2020, there were 30,073 registered agents; so over two years in a “hot property market”, there were only about 2,341 new agents. Furthermore, over half of this number is accounted for by ERA alone, which took on board 1,096 new agents.

That’s not what you would call an impressive surge, especially in a period when the property market has been booming.

The simple explanation is that being a property agent is hard. It is less like a job, and more like trying to run a business on your own (how many other salespeople also need to source for their own inventory?)

Quite a number of people dive into the property market thinking it’s easy money, and leave within the year when they realise how difficult this job is.

How often does it take to close a deal, and get paid?

Some of the top agents can sell a unit every month; but these are outliers. You may be able to find a willing buyer in a day, or you may still be looking for one after close to a year – there’s no way to predict this. The majority of realtors, however, tell us they close a deal roughly once every four months.

And of course, while new launches are the real revenue driver for property agents, the majority of sales are still in the HDB and resale arena.

Consider an agent who sells a $1.6 million condo, for which the typical commission is around $32,000. If there is co-broking, this is split with the buyers’ agent, so the sellers’ agent walks away with $16,000. (This split can be higher or lower, depending on who has the upper hand in the sale, the seller or the buyer).

Spread out over four months, this is equivalent to $4,000 a month – and this is gross, not net, earnings. We haven’t yet deducted other costs, such as the property agency’s cut, transport, buying leads, and so forth.

On top of that, a property agent doesn’t receive their commission immediately. These are the typical wait times, based on the property type:

- Rental – Usually within one month

- Resale flats – Three to four months

- Resale private properties – Six months

- New launches – Nine to 15 months

Many property agents in Singapore use commission advance services, to tide things over. These are sometimes provided by the property agencies themselves, and sometimes by companies (e.g., LytePay). These services allow realtors to get their commission amounts within a single business day, though it comes with a small fee.

However, an agent still has constant pressure on them – during dry months, there’s no commission to withdraw in advance. This is why it’s common practice for agents to build bigger emergency funds than the average person. E.g., while the average employee is often told to save up for six months of expenses, a property agent may have to be sufficiently capitalised for up to a year.

Remember: the agent needs to pay out of pocket first, for services like putting up a listing on a portal. The money comes later, if the deal is closed.

One of the common hazards is that an agent may have already spent time and money on bringing a deal to the closing stage, only for a buyer or seller to back out at the last minute.

The myth of resale flats being “easier money”

Resale HDB flats bring a lot of volume to the table. These are the most commonly transacted properties, and they should – in theory – be a consistent, easy source of income.

Let’s put aside the fact that these days, even HDB provides tools for sellers to perform DIY transactions, via the HDB resale portal. Instead, consider how much an agent might make from helping to sell a flat:

As of Q1 2022, the median price of a 4-room flat was $550,118.

The typical commission for a property agent is two per cent of the price, so this comes to $11,003. However, an agent has other costs that eat into that amount.

More from Stacked

Should You Buy An Older Resale HDB Flat If You Are In Your 20s/30s?

Older resale flats may be spacious, but lease decay and age are major concerns. Whilst the most crucial issue is…

For starters, the property agency itself gets a cut from the agent, which can range between 10 to 20 per cent. This is ostensibly to compensate the agency for its training, legal support, help with marketing materials, etc.

Assuming a 20 per cent deduction, the agent now makes $8,803, before factoring in the cost of marketing (see below).

| 4-room HDB Flat | |

| Median Resale Price | $550,118 |

| Commission (2%) | $11,003 |

| Agency Cut (20%) | $2,200 |

| Take-home Commission | $8,803 |

Incidentally, it doesn’t help that HDB flats have a whole slew of restrictions over who can buy them, such as the ethnic quota, which can make HDB flats a more challenging market than expected.

Property agents spend a lot of their earnings on marketing

These days, property portals are the main source of listings; and the market is more or less cornered by two big players.

There’s PropertyGuru:

Annual subscription: $2,974.60

Monthly subscription: $247.90

And there’s 99.co:

Annual subscription: $843.16

Monthly subscription: $70.30

(The price difference may be due to PropertyGuru still having a much bigger reach)

Besides these base costs, property agents need to pay to “bump up” or refresh their listings. This is done through credits purchased from the portal.

For 99.co, the basic package comes with 4,000 free credits, and each listing uses up 400 credits per week. If an agent has three listings each week, about 800 to 1,000 credits get used each week; and the agent has to buy more. These are at a rate of:

400 credits: $99

2,500 credits: $488

6,500 credits: $888

For PropertyGuru, realtors have mentioned they spend about $1,000 every few months.

Listings on portals are often – but not always – complemented by other marketing tools, such as flyers, the use of newspaper ads, or social media.

For our agent who makes $8,803 from selling a 4-room flat, this is what the take-home commission looks like after marketing:

| Take-home Commission | $8,803 |

| MINUS MARKETING MONTHLY EXPENSES | |

| PropertyGuru Subscription + extra credits every quarter | $580.9 |

| 99.co Subscription + 2,500 credits | $558.3 |

| Traditional Flyers | $400 |

| Newspaper Ads (3 days/month) | $153 |

| Social Media Marketing | $1,500 |

| Home Tour Video (1/month) | $500 |

| Remaining Amount: | $5,110 |

There are also other miscellaneous costs, such as transport and data

Transport costs will vary between agents; but those who opt to use a car can expect to tack on between $1,300 to $1,600 to their monthly costs; and we’re told that, with Grab and GoJek prices rising, ride-share alternatives are almost on par these days.

Let’s use a second-hand 2019 Hyundai Avante as a gauge. At the time of writing:

| Average Monthly Cost | Average Annual Cost | |

| Car Price | – | $84,800 |

| Road Tax | $61.5 | $738 |

| Car Loan Repayment | $844 (based on maximum 70% loan amount of purchase price, and loan tenure of 7 years) | |

| Petrol | $170 | $2,040 |

| Parking | $110 | $1,320 |

| Insurance | $133 | $1,600 |

| ERP | $30 | $360 |

This brings us to an average monthly cost of $1,348.

Next, most property agents will also need to subscribe to:

| Remaining Amount After Marketing Expenses: | $5,110 |

| MINUS BUSINESS MONTHLY EXPENSES | |

| Car | $1,348 |

| SRX | $58.25 |

| EdgeProp | $32.58 |

| Straits Times | $9.9 |

| Remaining Amount: | $3,661 |

The news and data provided by these sources may be required to help clients. However, these days property agencies are getting better at providing news and data of similar quality, so at least their cut is going to good use. Some property portals, like 99.co, also provide data tools for agents.

Property Advice7 Little-Known Secrets Property Agents Don’t Want You To Know

by Sean GohThis isn’t very impressive compared to the income of the average Singaporean

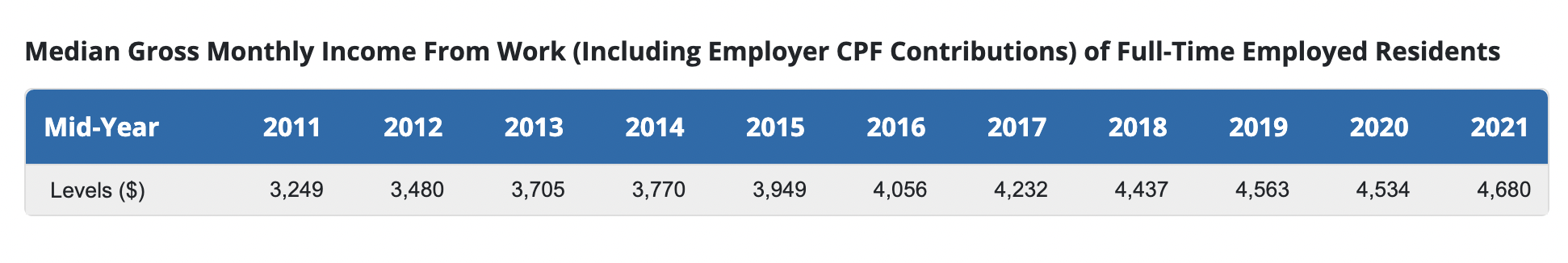

According to the Ministry of Manpower, the average employed Singaporean earns $4,680 per month (as of 2021).

In the above example, our property agent who sold a resale flat earns $5,110 before miscellaneous costs like transport. If a car is involved, his/her earnings drop to around $3,600. Also, bear in mind an employee is assured the same pay every month, whereas an agent may not be able to transact one flat every month.

On top of this, a property agent doesn’t have the 17 per cent employer top-up to their CPF; and many are saddled with providing their own insurance (although we understand that more agencies are now starting to provide group insurance).

The property market can be unforgiving to anyone not at the top

Going by the old Pareto Principle, it’s the top 20 per cent in a field that can reap 80 per cent of the rewards; and this is definitely true in the property market.

The most successful agents also end up being the ones selected to transact higher-end deals, and who can – in turn – afford more marketing.

Property agents who fall somewhere in the middle have a truly tough job. Not only are they likely to earn less than the average employee, they also tend to work longer hours.

“Flexible hours” mean a lot less when you’re on call to help clients almost 24/7, and when you need to deal with administrative complexities that – if not handled exactly right – can cause massive financial damage.

If you’re considering joining the property market, don’t conflate the potential with the probable. You might potentially make six figures in your first year; but plan around the probability that it won’t be that easy.

Try it as a side-hustle before quitting your day job, to get a feel for it first; and try to build up sufficient capital to last at least a year, if you’re going to do it full-time.

The above data has been kindly provided by LytePay. They work with Singapore’s top property agencies to help agents receive their commissions in advance – all for only a small fee of 3.5%. To learn more, visit www.lytepay.co/property-agents.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How much do property agents in Singapore typically earn from selling a resale flat?

What are the main costs property agents in Singapore face when selling properties?

How long does it usually take for a property agent in Singapore to receive their commission after a deal closes?

Is selling HDB resale flats considered a reliable way for property agents to make money?

How does the income of property agents compare to the average Singaporean salary?

What challenges do middle-tier property agents face in Singapore's market?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

8 Comments

Disagree on the cost of car ownership being totally positioned as an expense for property agent.

Being a fair comparison to an average worker from other industry, the only difference on car ownership is only the use of the car for house visits, etc. Therefore only the cost of petrol should be considered when comparing against the average earnings of workers. Unless you are telling me you need to spend $1300 on petrol alone (purely for trips to support the agents work), then the comparison is fair.

Anyways, if you managed to sell more than 1 unit per month, or supplement with rentals, good property agents generally net 10-20k a month. At least that is what my friends are getting.

Totally agree. The calculation is more applicable to a newbie in the market for the 1st month who has only 1 property to market. Working with a team to share costs and marketing multiple properties at the same will drastically bring the per unit cost.

That also means income is shared and significantly goes down per closing

Minus social media costs which can go much higher than the portal costs; can easily range from $1000 to 5 figures a month.

Imagine having to commute from east to West then rush to North then to south and back again to west and east back to back vs daily community to and from work at specific location

Note: agents need to travel not only for viewings; need to meet for discussion; presentations; paperwork; handover; inspections; project briefings; trainings etc

Some listings view 100 times still not closed; some over a yr; imagine the time, effort, marketing costs

Yes if managed to close more than a deal in a month…. What about the marketing time before closing that deal…. What about the other months that have zero closing but all these marketing costs and time still are ongoing and out of pocket.

Everything is visual and high tech too. Invest in video equipments and software… invest in courses to learn … these take time; or pay to outsource to professionals to do … costs against time again

Those who earn higher have to invest in getting a PA to handle otherwise there is totally no time

New tactic of listing by property guru. Before a potential client can reach the agent advertising a home on property guru, a questionnaire pop up when one click on the agent’s contact. It’s asking personal particulars of potential client. With the current privacy law, it is not right for property guru to make such a move. To make matter worse, it’s questionnaire may not go beyond the form filling & therefore no contact is possible for the interested potential buyer. Agents, be aware that this is happening. Your advertisement is dead with this measure of property guru.

Just curious – after getting their license and training, is it possible for the agent to simply go ‘solo’ without being attached to an agency, thus saving the agency cut?

Is there a basic pay for agents if they don’t close for that month?

Property agents earn via commission—typically ~2% on sales and up to a month’s rent for leases—with no fixed salary and substantial upfront costs. Yearly income varies sharply: S$30–60 k for newcomers, S$80–150 k mid‑career, and S$200 k+ at the top. However, expenses (marketing, portal fees, agency splits) and irregular deals mean net take-home is lower than gross figures imply .