We Own An Ang Mo Kio BTO And Have $150k In Cash: Can We Afford To Buy 2 Condos Or Should We Upgrade To An EC?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Hi Ryan,

I would like to take this opportunity to thank you and StackHome for providing Singaporeans with in-depth analyses of the Singapore property market. I really appreciate the content you guys are producing.

I am currently facing a dilemma in choosing one of four options for my property journey and would like to hear your opinion. Below are my details and the four options. How would you rank them, and which option do you think would be most suitable for my situation?

| Item | Amount |

| HDB Estimated Sale Price | $900,000 |

| Cash Savings + CPF : | $150,000 |

| Outstanding House Loan: | $300,000 |

| Total remaining Cash +CPF Available: | $750,000 |

| Item | Amount |

| Husband + Wife Salary [Annual], mid-30s | $177,000 |

| Insurance costs [Annual] | $19,200 |

| Option 1: Two Condos | Down Payment | Estd Property Price |

| 1st Condo [Own-Stay] 2BR | $347,100.00 | $1,250,000.00 |

| 2nd Condo [Rental] | $303,600.00 | $1,100,000.00 |

| Total Cash+CPF | $650,700.00 | |

| Remaining Cash for investment | $99,300.00 |

| Option 2: One Condo + Investment | Down Payment | Max Price |

| Condo [Own-Stay] 3BR | $509,600.00 | $1,800,000.00 |

| Total Cash+CPF | $509,600.00 | |

| Remaining Cash for investment | $141,100.00 |

| Option 3: Continue to stay in HDB |

| Option 4: Try for EC as Second timer |

Hello there,

We’re happy to hear that you’ve found our content helpful and appreciate the detailed information you’ve provided.

From the calculations you’ve shared, all four options could be viable paths, and we’ll be diving deeper into each one in the article to assess them more thoroughly.

Let’s begin by evaluating your affordability.

Affordability

Selling

| Estimated Sale Price | $900,000 |

| Outstanding loan | $300,000 |

| Sales proceeds (CPF + cash) | $600,000 |

Buying

Combined affordability

| Maximum loan based on ages of 33 and 35 with a combined monthly income of $14,750, at 4.8% interest | $1,546,224 (30-year tenure) |

| CPF + cash | $750,000 |

| Total loan + CPF + cash | $2,296,224 |

| BSD based on $2,296,224 | $84,411 |

| Estimated affordability | $2,211,813 |

Husband’s individual affordability

| Maximum loan based on the age of 35 with a monthly income of $8,250, at 4.8% interest | $864,837 (30-year tenure) |

| CPF + cash* | $375,000 |

| Total loan + CPF + cash | $1,239,837 |

| BSD based on $1,239,837 | $34,193 |

| Estimated affordability | $1,205,644 |

*As we do not know the exact amount of CPF both of you have individually, we are assuming an even split of the funds

Wife’s individual affordability

| Maximum loan based on the age of 33 with a monthly income of $6,500, at 4.8% interest | $681,387 (30-year tenure) |

| CPF + cash* | $375,000 |

| Total loan + CPF + cash | $1,056,387 |

| BSD based on $1,056,387 | $26,855 |

| Estimated affordability | $1,029,532 |

*As we do not know the exact amount of CPF both of you have individually, we are assuming an even split of the funds

Depending on how much cash you have, you can adjust your individual affordability by moving the cash around.

Now that we better understand your financials, let’s run through the options you’re considering.

Potential pathways

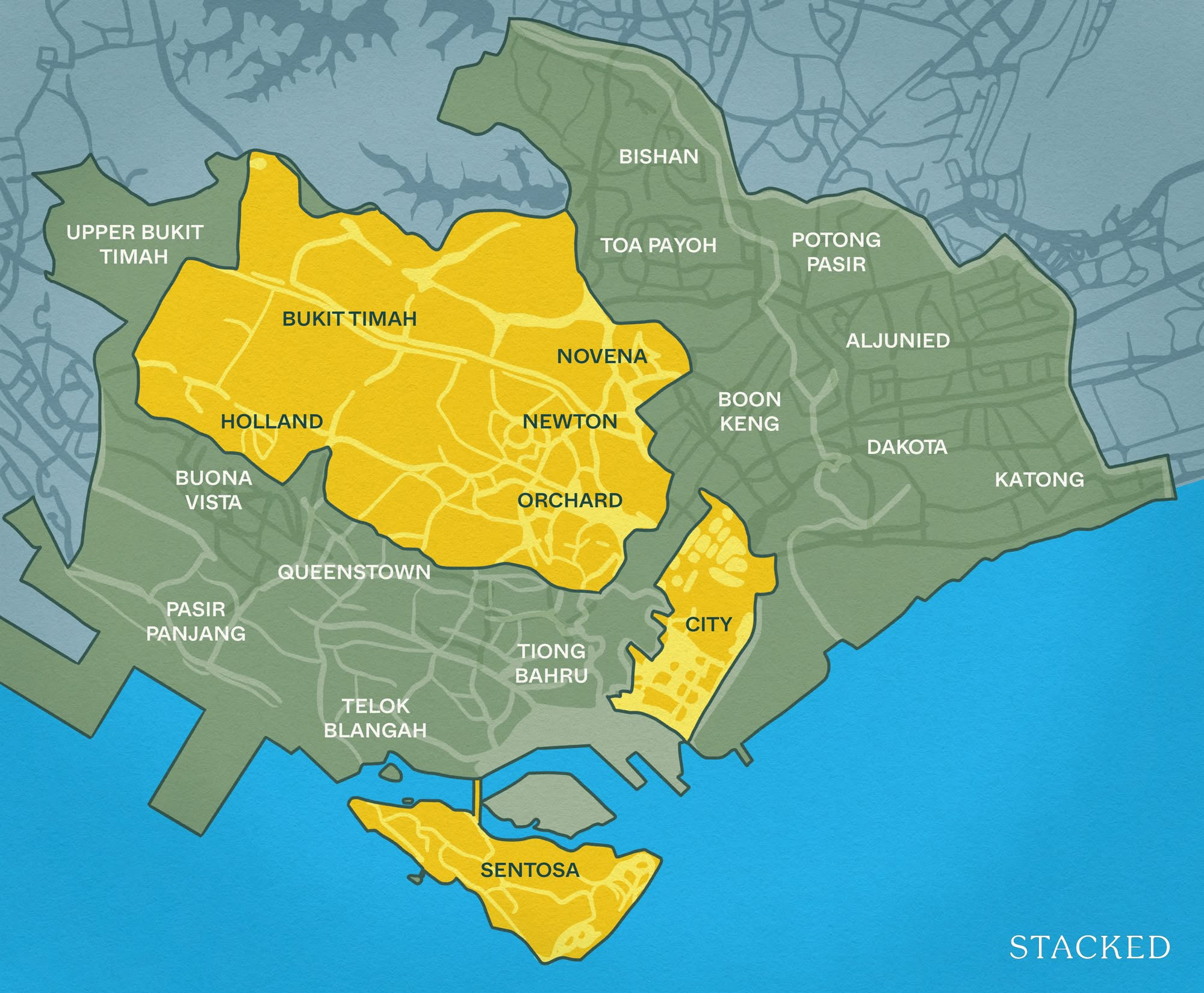

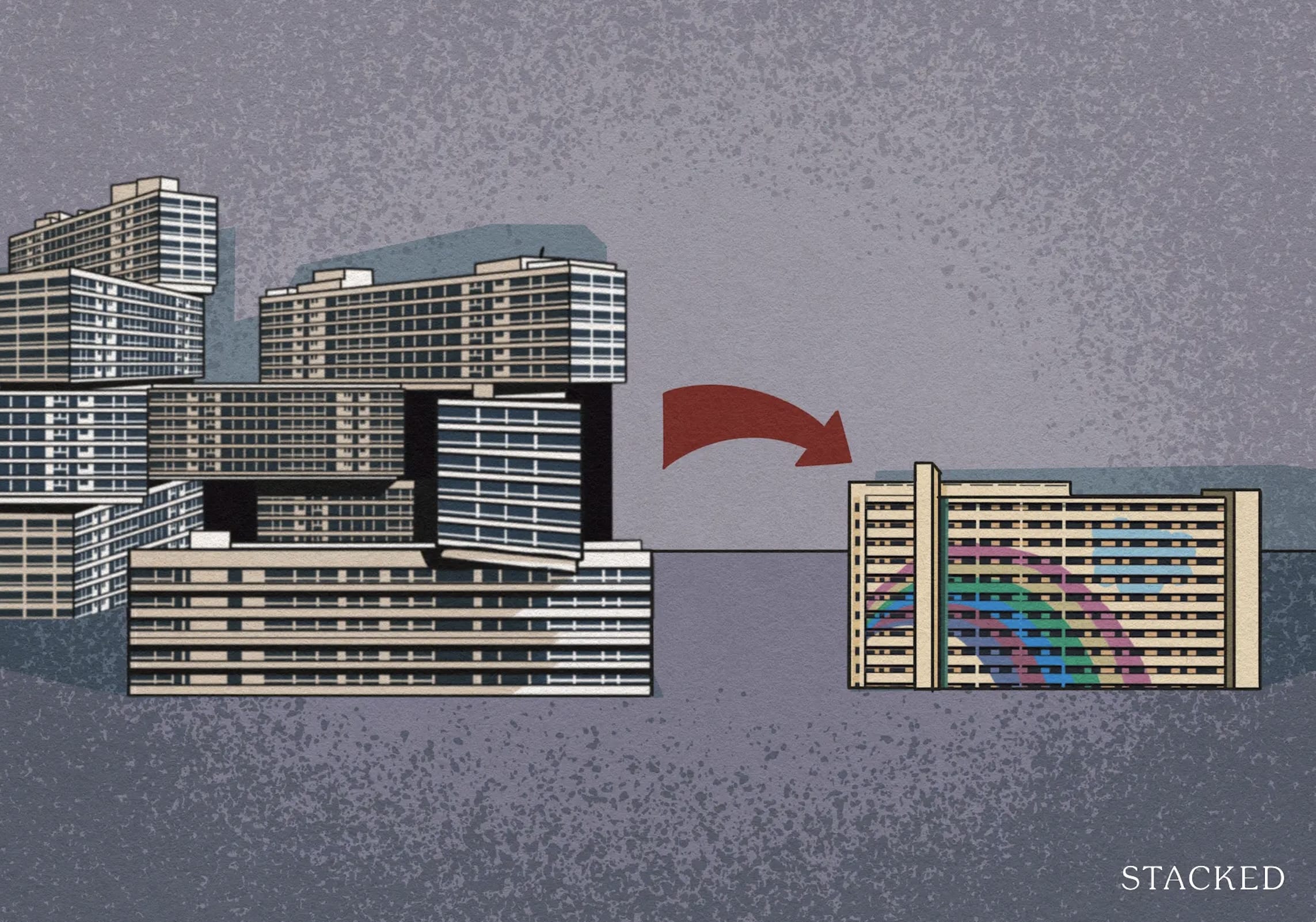

Sell the HDB and buy two condos

Purchasing two condos can offer several advantages, particularly in terms of diversification. By owning multiple properties, you reduce your investment risk—if one property underperforms, the other may balance it out, resulting in a more stable portfolio.

In addition to the potential rental income, owning two condos provides significant flexibility. You could choose to live in one and rent out the other or even rent out both while living in a development that better suits your preferences. This flexibility allows you to adapt your strategy over time, aligning with your personal and financial goals.

However, there are challenges to consider with owning multiple properties. One obvious key drawback is the increased financial commitment. Purchasing two condos doubles your financial obligations, including mortgage payments, property taxes, maintenance fees, and other costs. This can strain your finances, especially if one or both properties don’t perform as expected in terms of rental income or appreciation.

There’s also the risk of vacancy. If both units are rented out, you may face periods when one or both properties are unoccupied. This can disrupt your cash flow and make it difficult to meet your financial commitments.

Liquidity is another concern. Real estate is generally a less liquid investment, meaning it can take time to sell a property and access funds. If you need to sell one of your condos quickly, you may have to accept a lower price, especially in a sluggish market.

Let’s take a look at the potential costs involved.

We will assume that both of you fully utilise your budgets of $1.2M and $1M respectively, with the $1M property intended for investment and generating a 3% rental yield. For calculation purposes, we will use a 10-year timeline. Since your calculations only accounted for the 25% down payment and you’ve allocated the remaining funds for other investments, we will assume that you plan to take out the maximum loan possible.

Own stay property

| Purchase price | $1,200,000 |

| BSD | $32,600 |

| Maximum loan | $864,837 |

| Funds required | $367,763 |

| Funds remaining | $7,237 |

| Interest expense (Assuming a 30-year tenure and 4% interest) | $311,980 |

| BSD | $32,600 |

| Property tax | $12,400 |

| Maintenance fee (Assuming $300/month) | $36,000 |

| Total cost | $392,980 |

Investment property

| Purchase price | $1,000,000 |

| BSD | $24,600 |

| Maximum loan | $681,387 |

| Funds required | $343,213 |

| Funds remaining | $31,787 |

| Interest expense (Assuming a 30-year tenure and 4% interest) | $245,802 |

| BSD | $24,600 |

| Property tax | $36,000 |

| Maintenance fee (Assuming $250/month) | $30,000 |

| Rental income | $300,000 |

| Agency fee (Assuming it’s paid once every 2 years) | $13,625 |

| Total cost | $50,027 |

Total cost if you were to take this pathway: $392,980 + $50,027 = $443,007

Total funds remaining: $7,237 + $31,787 = $39,024

Potential gains from other investment avenues based on varying Return-On-Investment (ROI) if you were to invest the remaining funds:

| ROI | Potential gains in 10 years | Total cost after deducting gains |

| 4% | $18,741 | $424,266 |

| 5% | $24,542 | $418,465 |

| 6% | $30,862 | $412,145 |

| 7% | $37,742 | $405,265 |

Sell the HDB and buy a bigger condo

Even though your maximum affordability is up to $2.2M, you’ve based your calculations on a purchase price of $1.8M, so we’ll proceed with that figure.

| Purchase price | $1,800,000 |

| BSD | $59,600 |

| Maximum loan | $1,546,224 |

| Funds required | $313,376 |

| Funds remaining | $436,624 |

| Interest expense (Assuming a 30-year tenure and 4% interest) | $557,782 |

| BSD | $59,600 |

| Property tax | $28,800 |

| Maintenance fee (Assuming $350/month) | $42,000 |

| Total cost | $688,182 |

Potential gains from other investment avenues based on varying Return-On-Investment (ROI) if you were to invest the remaining funds:

| ROI | Potential gains in 10 years | Total cost after deducting gains |

| 4% | $209,686 | $478,496 |

| 5% | $274,590 | $413,592 |

| 6% | $345,303 | $342,879 |

| 7% | $422,281 | $265,901 |

Remain status quo

Given the recent growth rate of HDBs and the prime location of your flat, it’s reasonable to expect that prices will remain stable in the short to mid-term. Compared to the first two options, this pathway is certainly the most affordable and keeps you in an ideal location.

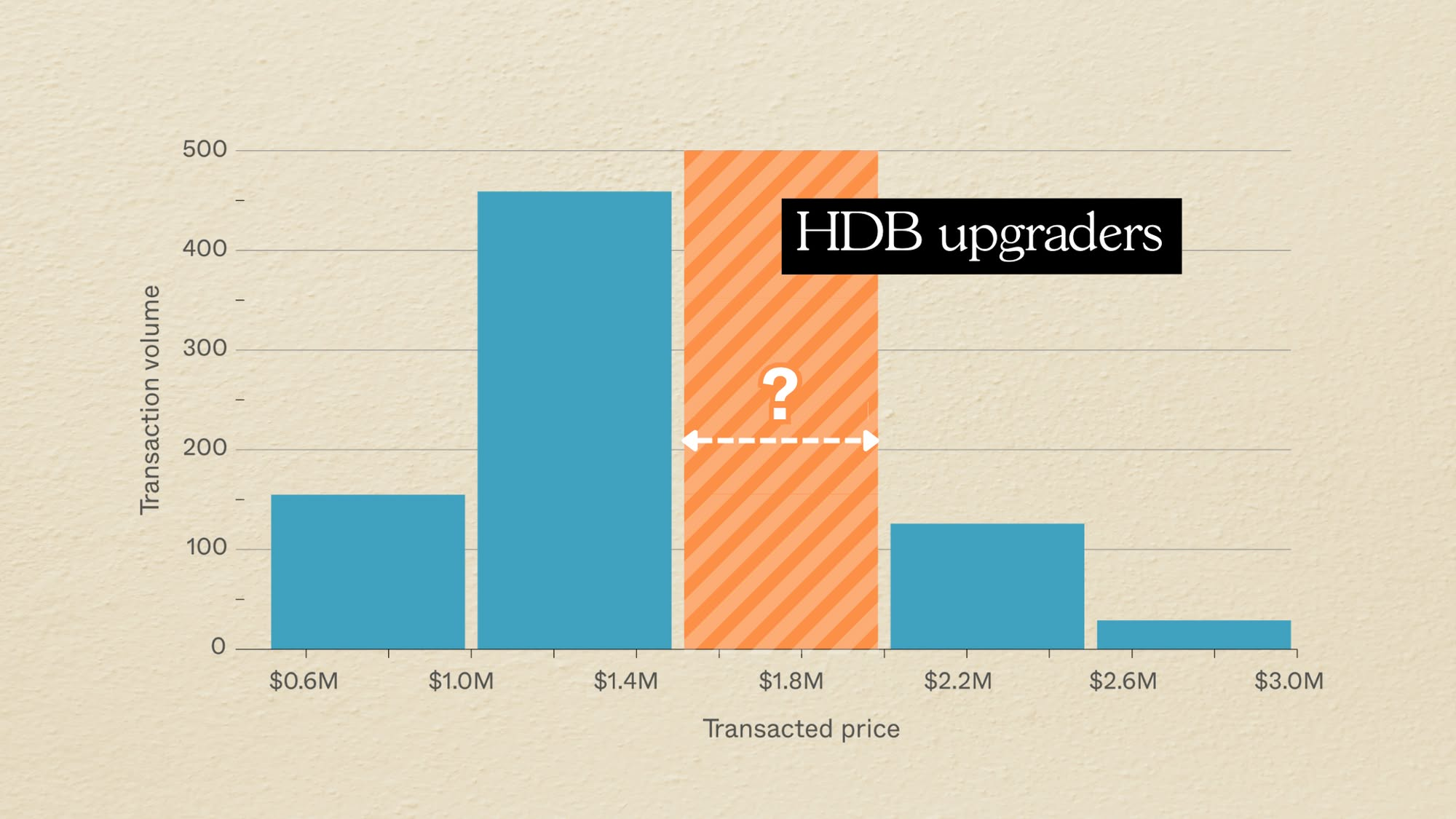

However, it does limit your ability to unlock profits that could be used for other investments to generate additional funds. Additionally, if you plan to eventually upgrade to a private property, it may become more challenging due to the increasing price gap between HDBs and private properties, as shown in the graph and table below.

| Year | HDB (resale) | Non-landed private property (resale) | Price gap |

| 2013 | $469 | $1,245 | 165.46% |

| 2014 | $441 | $1,190 | 169.84% |

| 2015 | $423 | $1,191 | 181.56% |

| 2016 | $424 | $1,248 | 194.34% |

| 2017 | $425 | $1,292 | 204.00% |

| 2018 | $419 | $1,325 | 216.23% |

| 2019 | $416 | $1,344 | 223.08% |

| 2020 | $431 | $1,294 | 200.23% |

| 2021 | $488 | $1,345 | 175.61% |

| 2022 | $532 | $1,455 | 173.50% |

| 2023 | $564 | $1,562 | 176.95% |

Another observation from the table is the decline in HDB prices following the 2013 cooling measures and their subsequent stagnation until the pandemic, while private property prices rebounded more quickly. This isn’t to suggest that private properties are unaffected by cooling measures, but rather that, as government-owned assets, HDBs are more regulated and intended primarily for personal residence rather than investment purposes.

Let’s take a look at the costs involved to keep your HDB. We will assume that you took a bank loan and that the loan tenure remaining is 20 years.

| Interest expense (Assuming a 20-year tenure and 4% interest) | $97,711 |

| Property tax | $7,600 |

| Town council service and conservancy fee (Assuming $71/month) | $8,520 |

| Total cost | $113,831 |

Since we don’t have details on how much of your $150,000 in available funds is in cash versus CPF, we’ll assume that $100,000 is in cash, which you will allocate towards other investments.

Potential gains from other investment avenues based on varying Return-On-Investment (ROI) if you were to invest your cash savings:

| ROI | Potential gains in 10 years | Total cost after deducting gains |

| 4% | $48,024 | $67,967 |

| 5% | $62,889 | $53,102 |

| 6% | $79,085 | $36,906 |

| 7% | $96,715 | $19,276 |

Try for an EC as a second timer

We understand the appeal of purchasing an EC, especially given its strong track record of profitability. Historical data shows that most EC transactions tend to be profitable, even when sold in less favourable market conditions.

Previously, we discussed how timing was the main factor contributing to losses between 1996 and 1999, which you can read about here.

Buying an EC, much like a BTO, is often considered a “Singaporean Privilege.” The exclusivity is heightened by the fact that the income ceiling for ECs is only $2,000 higher than for BTOs, and the mortgage is assessed based on the Mortgage Servicing Ratio (MSR), similar to HDBs, rather than the Total Debt Servicing Ratio (TDSR) used for private properties. This often results in a higher initial payment due to the reduced loan amount available.

Since you’ve already purchased a subsidised flat, buying a new EC will require you to pay a resale levy.

Furthermore, as a second-time applicant, your likelihood of securing a unit may be reduced, as only 30% of the units in an EC new launch are allocated to second-time buyers.

This will be your revised affordability for the purchase of an EC, presuming that your current HDB is a 4-room flat:

| Maximum loan based on ages of 33 and 35 with a combined monthly income of $14,750, at 4.8% interest | $843,395 (30-year tenure) |

| CPF + cash | $750,000 |

| Total loan + CPF + cash | $1,593,395 |

| BSD based on $1,593,395 | $49,269 |

| Resale levy | $40,000 |

| Estimated affordability | $1,504,126 |

Looking at the recent EC launches, with a budget of $1.5M, you should be able to get a 3-bedroom unit. Let’s take a look at the costs involved assuming you max out your budget.

| Purchase price | $1,500,000 |

| BSD | $44,600 |

| Resale levy | $40,000 |

| Maximum loan | $843,395 |

| Funds required | $741,205 |

| Funds remaining | $8,795 |

| Interest expense (Assuming a 30-year tenure and 4% interest) | $304,245 |

| BSD | $44,600 |

| Resale levy | $40,000 |

| Property tax | $19,800 |

| Maintenance fee (Assuming $300/month) | $36,000 |

| Total cost | $444,645 |

Potential gains from other investment avenues based on varying Return-On-Investment (ROI) if you were to invest the remaining funds:

| ROI | Potential gains in 10 years | Total cost after deducting gains |

| 4% | $4,224 | $440,421 |

| 5% | $5,531 | $439,114 |

| 6% | $6,956 | $437,689 |

| 7% | $8,506 | $436,139 |

What should you do?

Let’s do a quick summary of the 4 pathways:

| Potential pathways | Cost incurred | Funds remaining | Potential gains at 7% ROI |

| Sell the HDB and buy two condos | $443,007 | $39,024 | $37,742 |

| Sell the HDB and buy a bigger condo | $688,182 | $436,624 | $422,281 |

| Remain status quo | $113,831 | $150,000 | $96,715 |

| Try for an EC as a second timer | $444,645 | $8,795 | $8,506 |

Among the four options, maintaining the current status quo incurs the least cost but also forgoes the potential opportunity to cash out and reinvest your funds in higher-yield investments. Given you are still relatively young, you have the advantage of leveraging a more substantial loan, making this the least favourable option.

While purchasing an EC presents a good opportunity for profit, the lower loan quantum means you will need to use most of your CPF and cash savings for the purchase. This approach will significantly deplete your funds available for other investments or emergencies, which might not be as suitable.

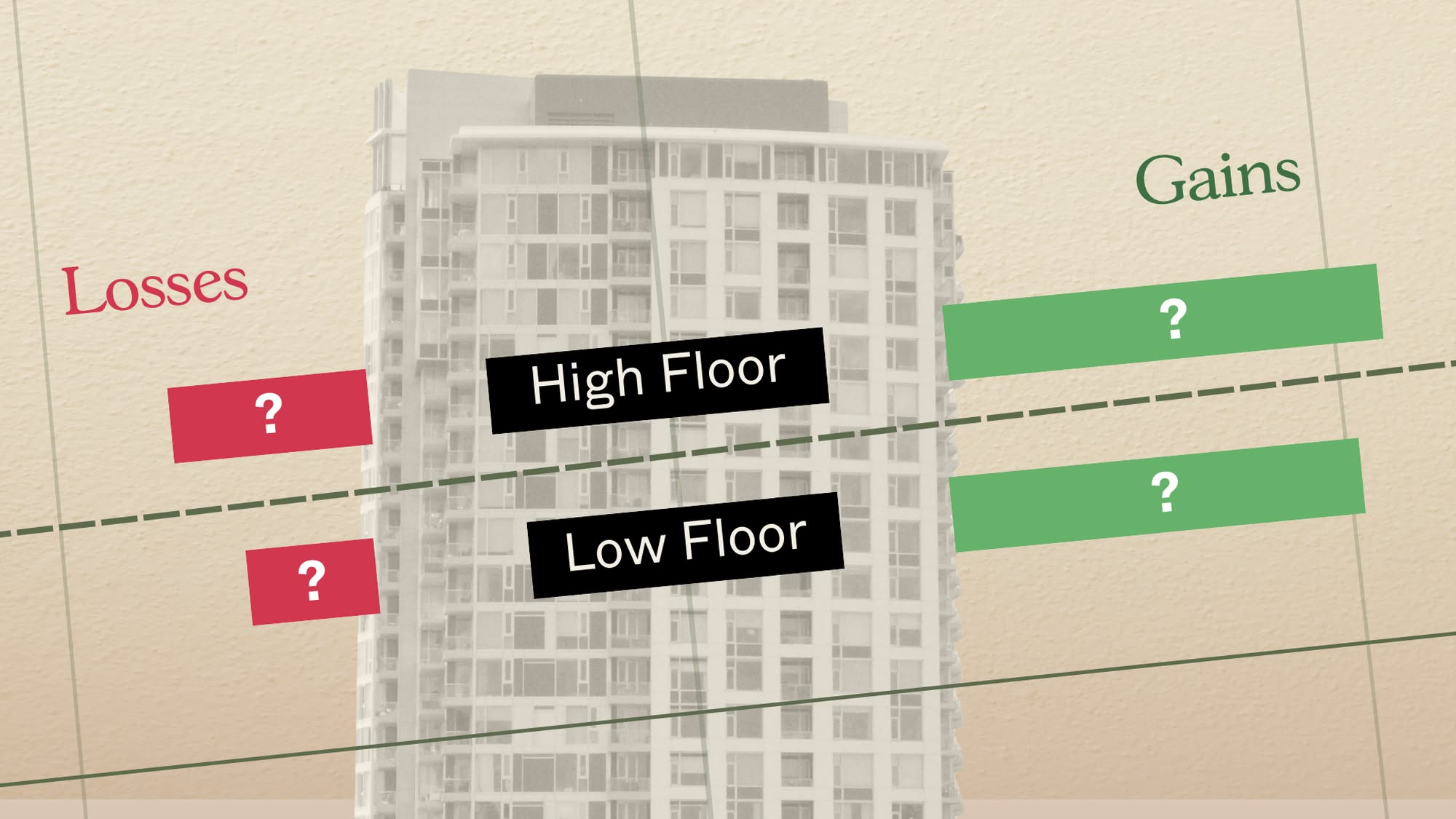

Between the first two pathways, it ultimately depends on your personal preference and risk tolerance. Do you prefer to make your profits through rental income and potential capital appreciation of a property, or through other financial investments?

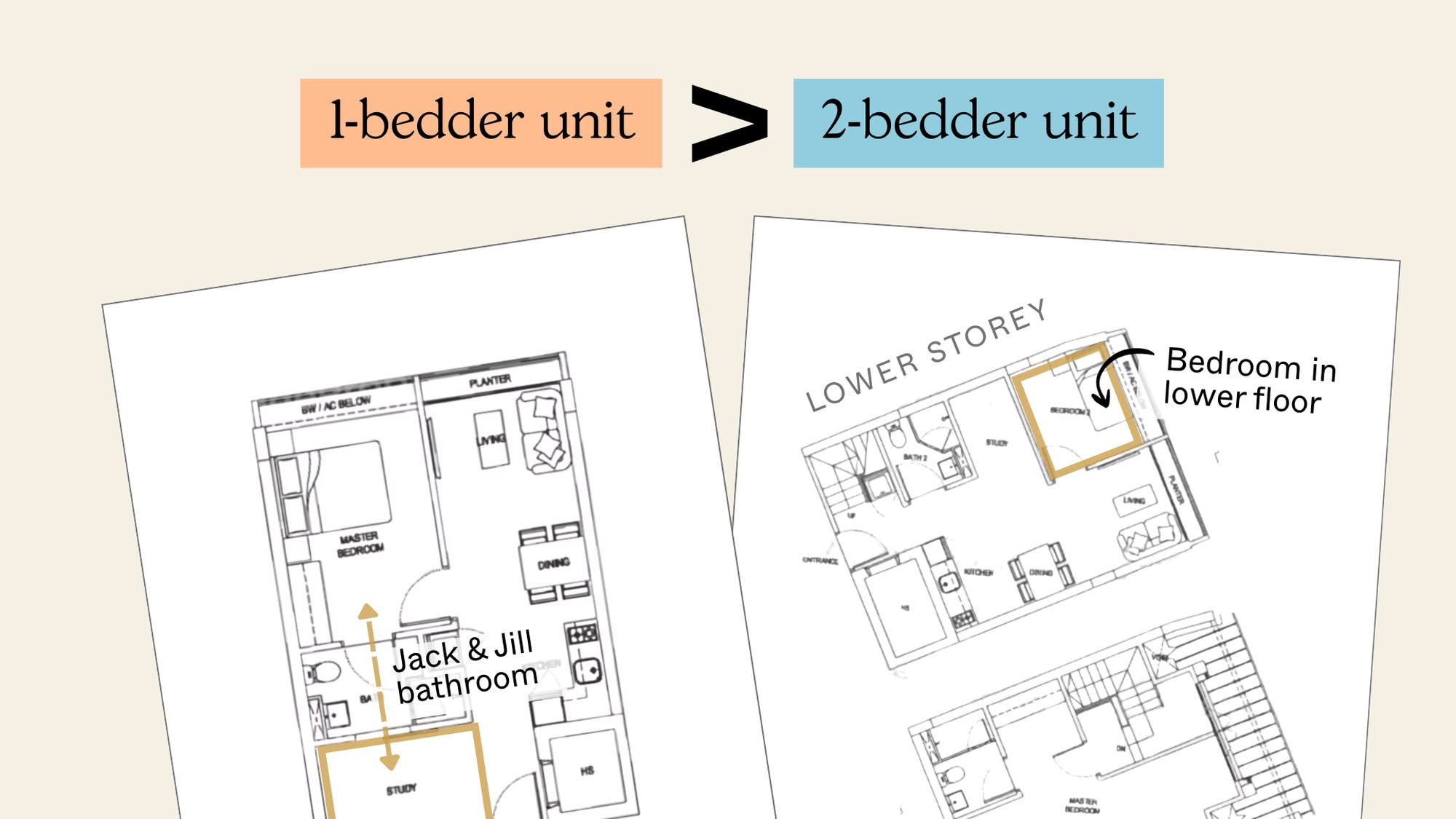

Option 1 will leave you with fewer funds for further investment, but the rental income could help offset some of your expenses. This approach could leave you in a tight cash position. However, if you choose not to act right away, you’ll have the opportunity to save up first. Since the leftover funds are limited, be mindful of the smaller transaction costs, like conveyancing and agency fees, which haven’t been factored into our calculations. Moreover, the limited funds could limit your investment options. We wouldn’t jump into investing in a second property for the sake of it if you are unable to find one that meets your goals – we recommend consulting an agent on this.

On the other hand, Option 2, while preserving more capital for other uses, involves a higher overall cost. The significant cost difference between Option 1 and Option 2 only becomes notable with a 6% ROI or higher.

| ROI | Sell the HDB and buy two condos | Sell the HDB and buy a bigger condo | ||

| Potential gains in 10 years | Total cost after deducting gains | Potential gains in 10 years | Total cost after deducting gains | |

| 4% | $18,741 | $424,266 | $209,686 | $478,496 |

| 5% | $24,542 | $418,465 | $274,590 | $413,592 |

| 6% | $30,862 | $412,145 | $345,303 | $342,879 |

| 7% | $37,742 | $405,265 | $422,281 | $265,901 |

For Option 2 to be advantageous, your investments would need to yield more than 6%, which is feasible. Since you’re unlikely to manage the investments yourself, this option may be simpler compared to Option 1, which involves tenant management. Additionally, the only extra cost would likely be the broker’s fee, whereas owning a property requires ongoing maintenance and management between tenancies.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Read next from Editor's Pick

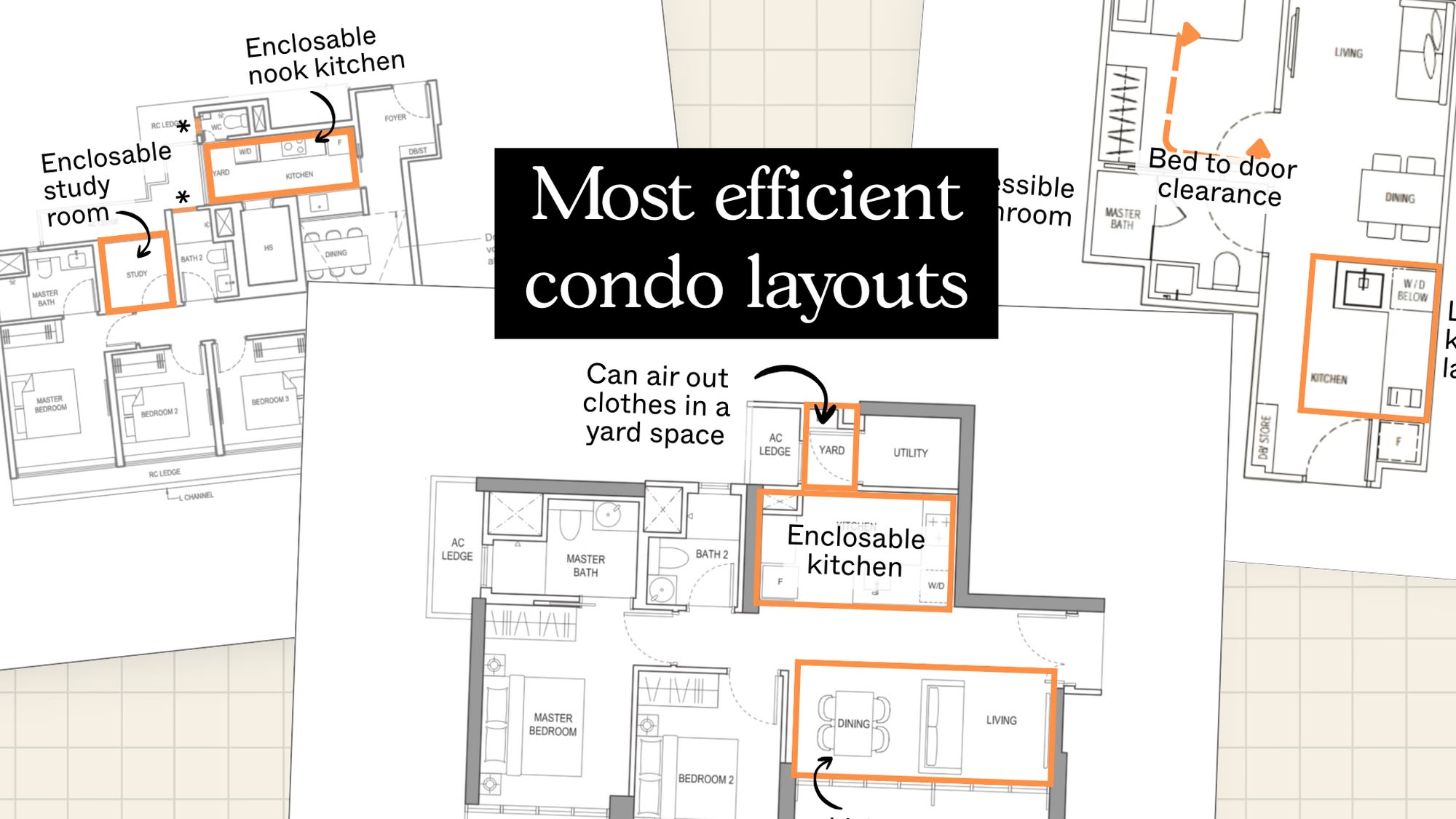

Property Advice The New Condos In Singapore With The Most Efficient Layouts In 2025 Revealed – And What To Look Out For

Property Advice The Hidden Costs of Hiring a “Cheaper” Agent In Singapore

Property Investment Insights Treasure at Tampines Pricing Review: How Its Prices Compare to D18, OCR, and the Wider Market

Landed Home Tours We Toured A Freehold Landed Estate Next To Mount Faber – With Semi-Detached Units From $5.2million

Latest Posts

On The Market The Cheapest 4-Bedroom Condos Under $1.7M You Can Buy Today

Homeowner Stories We Could’ve Sold Our Home for More, But We Didn’t — Here’s Why We Let It Go in Just 24 Hours

Pro Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

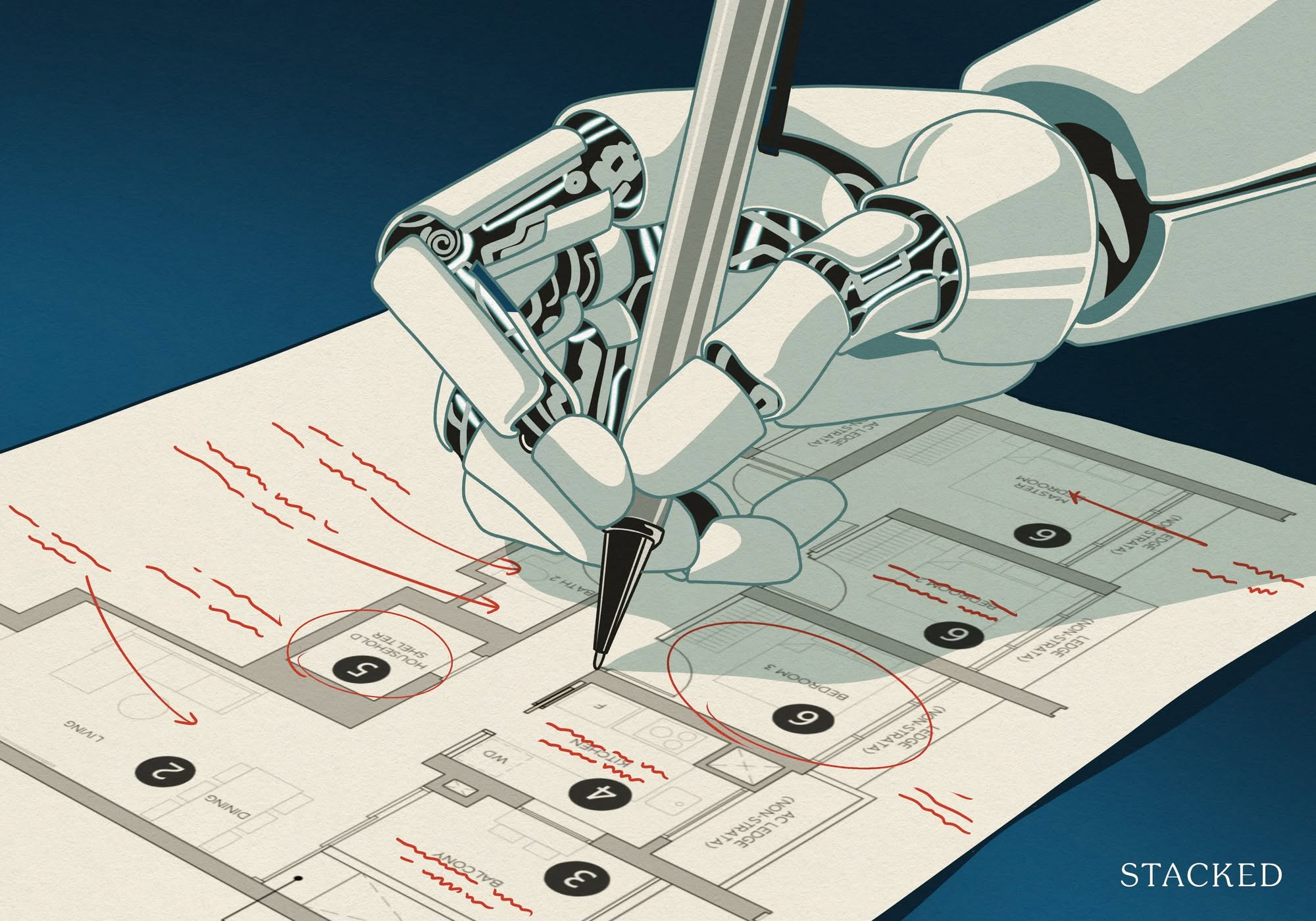

Property Market Commentary I Tested ChatGPT Against Claude on Singapore Condo Floor Plans — And There Was a Clear Winner

Property Investment Insights Which Resale Two-Bedroom Condos Quietly Made Buyers Six-Figure Profits In Singapore?

Property Market Commentary Why Developers Are Now Building for Families in Singapore’s Most Expensive Districts

Singapore Property News Why More Singaporeans May Soon Trade Condos For Resale HDBs

Singapore Property News This 5-Room HDB in Clementi Just Sold For $1.458M: Here’s What The Seller Could Have Made

On The Market We Found The Cheapest And Biggest 5-room Flats Over 1,400 Sq ft You Can Buy Right Now

Pro Low Floor vs. High Floor: What Transaction Data Reveals About the Premium

Singapore Property News 14,000 Homes In Kranji And A Transformed Woodlands — Will The North Become Singapore’s Next Hotspot?

Pro Can a One-Bedder Outperform a Two-Bedder? We Analysed 5 Years of Data

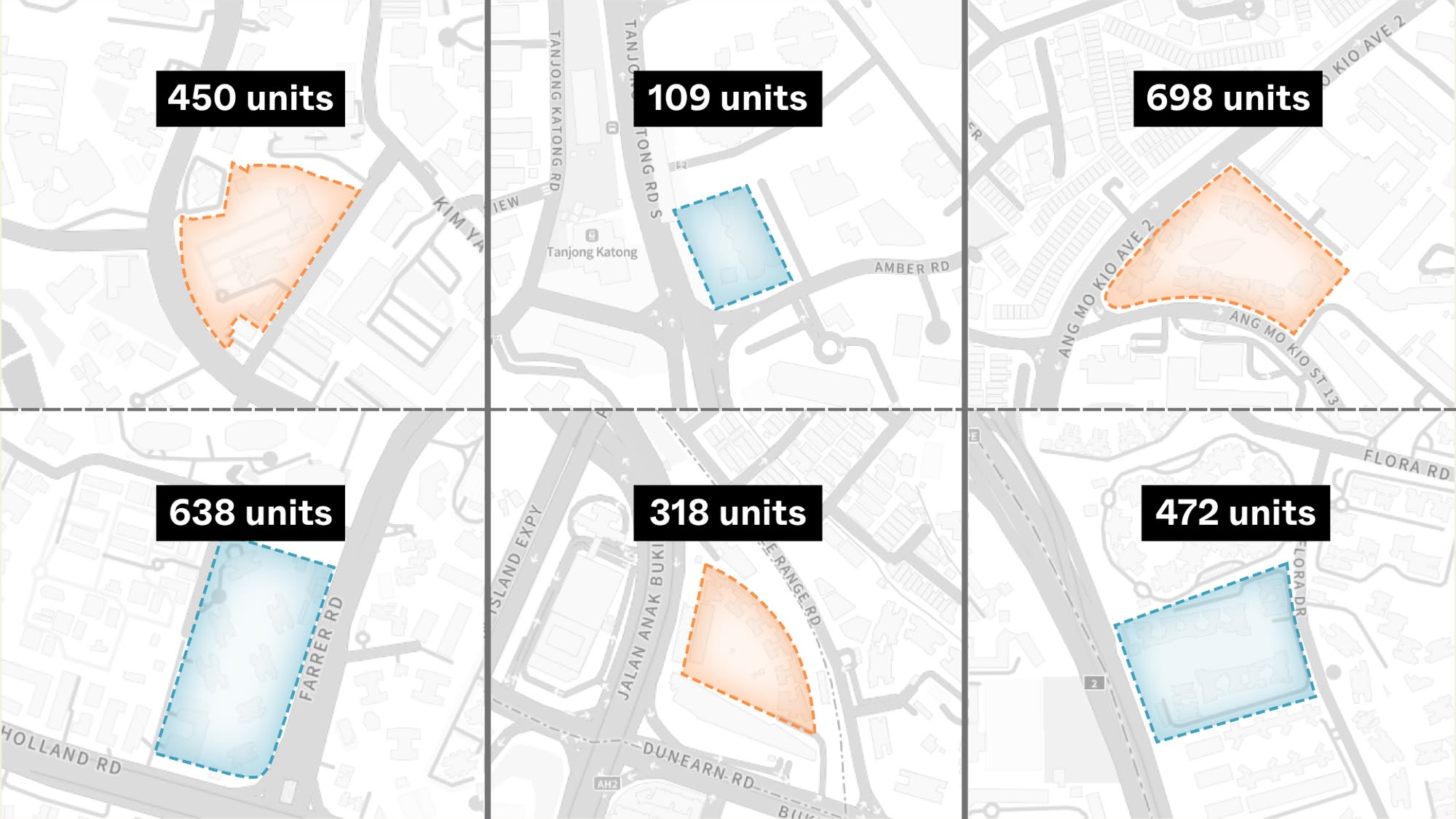

Singapore Property News Springleaf Residence Sells 870 of 941 Units (92%) At Launch — What’s Driving Demand?

Singapore Property News Could Your East-Side Condo Be Worth More Now? Singapore Just Raised Height Limits Near Changi

Singapore Property News From SERS to VERS: What Every HDB Owner Needs to Know About the Big Shift