We Make $500k Per Year: Should We Buy A New Launch 4-Bedder Or A Freehold Landed Property With Legacy Planning In Mind?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Hi! Needless to say, I have really enjoyed the articles and content on Stacked Homes, particularly the home tours of houses with great design and review of new launch condos. The production quality far exceeds the other cookie cutter videos that are available on the internet.

I’m writing to seek some advice on our next home purchase. My family of four is currently living in a 4 bedroom condo unit in Pasir Ris (Coco Palms). We have enjoyed our stay so far, great facilities, proximity to MRT station and other amenities. Nothing really to complain about, except that it is a leasehold property. With that in mind, coupled with the wish to leave a better legacy for our kids, my wife and I have been contemplating buying a freehold property for our next home. The house is meant for our stay and not for investment, but hopefully is able to increase in value over time.

Our family yearly household income is about $500k, and we do still have an outstanding loan of $600k on the current house. Other than our car, we do not have any major loans on hand. We have also set aside about $400k in cash if there is a good opportunity not to be missed. We have been looking out for new launch condos in the east with 4 or more bedrooms (we have been easterners all my life and very much like to remain so). The thought of getting a landed terrace house has also crossed our mind, but we think that may be stretching our finances somewhat, especially with the higher maintenance cost. Furthermore, we don’t get to enjoy the same facilities offered in a condo. On the other hand, we do get the flexibility of designing our house to our liking.

On this note, can I seek your quick advice and thoughts on this? What do you think would be a viable option for our family?

Thank you!

Editor’s Note: Some financial information was left out of the question for privacy reasons

Hey!

Thank you for your kind words and for reaching out to us with your query. It’s great to hear that you have enjoyed the content on Stacked and found value in our home tours and condo reviews.

Considering your family’s desire for a freehold property and the goal of leaving a better legacy for your children, it’s understandable that you are exploring your options for your next home. Your current situation in Coco Palms sounds pleasant, but as you rightly mentioned, the leasehold aspect may be a concern in the long term.

Given your family’s yearly household income and the outstanding loan on your current property, it’s important to evaluate your financial capabilities and the potential affordability of different housing options. While a landed terrace house may offer the flexibility of customising your space, it’s essential to carefully consider the higher maintenance costs associated with such properties. On the other hand, new launch condos in the east could provide the amenities and convenience that your family has been accustomed to.

And just like many parents, we understand the desire to leave a lasting legacy for your children, particularly in light of the increasing property prices. Considering that you will be residing in this home for a significant period, it is essential to ensure that the property is not only a valuable asset but also fulfills your family’s living requirements.

To begin, we will assess your affordability before delving into the advantages and disadvantages of the two options you are contemplating.

Affordability

Sale of Coco Palms

As there were no 4 bedder transactions made this year, this may not accurately reflect the current prices. These were the two latest 4 bedroom units that changed hands last year.

| Date | Size (sq ft) | PSF | Price | Level |

| Nov 2022 | 1,389 | $1,332 | $1,850,000 | #05 |

| Aug 2022 | 1,389 | $1,304 | $1,810,000 | #12 |

We will use the latest transacted price of $1.85M for calculation purposes.

| Description | Amount |

| Sale price | $1,850,000 |

| Outstanding loan | $600,000 |

| CPF used plus accrued interest | $660,000 |

| Cash proceeds | $590,000 |

Purchase affordability

| Description | Amount |

| Maximum loan based on ages of 44 and fixed combined annual income of $500K with a 4.5% interest | $3,731,585 (21 year tenure) |

| CPF funds ($660,000 refunded after selling + $300,000 in OA) | $960,000 |

| Cash ($590,000 sale proceeds + $400,000 on hand) | $990,000 |

| Total loan + CPF + Cash | $5,681,585 |

| BSD based on $5,681,585 | $280,495 |

| Estimated affordability | $5,401,090 |

Now that we have a better understanding of your financial capacity, let’s take a look at the performance of both the options you’re looking at, freehold/999-year leasehold landed and condominiums.

Performance of freehold/999-year leasehold landed and non-landed

Since you have mentioned that you’d like to continue staying in the eastern region, we are looking only at data that is specifically in the East which includes properties from Districts 14 to 18.

| Year | Freehold/999-year leasehold landed (resale) | YoY | Freehold/999-year leasehold non-landed (resale) | YoY | 99-year leasehold landed (resale) | YoY | 99-year leasehold non-landed (resale) | YoY |

| 2014 | $1,290 | -2.12% | $1,121 | -3.94% | $806 | -2.42% | $976 | -2.11% |

| 2015 | $1,226 | -4.96% | $1,137 | 1.43% | $814 | 0.99% | $980 | 0.41% |

| 2016 | $1,167 | -4.81% | $1,151 | 1.23% | $744 | -8.60% | $936 | -4.49% |

| 2017 | $1,230 | 5.40% | $1,220 | 5.99% | $813 | 9.27% | $945 | 0.96% |

| 2018 | $1,327 | 7.89% | $1,215 | -0.41% | $802 | -1.35% | $1,036 | 9.63% |

| 2019 | $1,355 | 2.11% | $1,245 | 2.47% | $814 | 1.50% | $1,043 | 0.68% |

| 2020 | $1,383 | 2.07% | $1,209 | -2.89% | $788 | -3.19% | $1,025 | -1.73% |

| 2021 | $1,494 | 8.03% | $1,331 | 10.09% | $842 | 6.85% | $1,100 | 7.32% |

| 2022 | $1,716 | 14.86% | $1,441 | 8.26% | $1,018 | 20.90% | $1,249 | 13.55% |

| Annualised | – | 3.63% | – | 3.19% | – | 2.96% | – | 3.13% |

From the table above, we can deduce several things:

- Freehold/999-year leasehold landed properties have the best growth rate

- This does not come as a surprise given the scarcity of land (especially freehold land) in Singapore. The limited supply and rising demand inevitably lead to an upward trajectory in prices over time.

- 99-year leasehold landed properties have the lowest growth rate

- As with most 99-year leasehold properties, the lease decay issue may deter buyers from purchasing properties that are older in age. Also, the higher construction and renovation costs needed for older landed properties could be another deterrent, even if they come with a lower price tag.

- The price disparity between a freehold/999-year leasehold landed and a 99-year leasehold landed is gradually increasing

- The performance of freehold/999-year leasehold non-landed and 99-year leasehold non-landed is fairly similar

- This may be the case when looking at the general overview but it eventually boils down to the projects which will have varying performances. For instance, a unit in a freehold boutique development may not grow at the same rate as a unit in a mid-sized 99-year leasehold development.

- Having said that, it is well known that freehold projects do tend to have better value retention potential in the long run.

Considering your intention of leaving a better legacy for your children, we assume that your plan is to retain the property for an extended period and eventually pass it down to them. In that case, opting for a freehold property is undoubtedly a more suitable choice.

Let’s now discuss the pros and cons of living in a landed property and a condominium.

Pros and cons

While some of these pros and cons can be fairly obvious, we wanted to make sure we got all grounds covered so that you can make your decision with confidence.

Living in a landed property

| Pros | Cons |

| Larger living space – Landed properties typically offer more spacious living areas which allow for larger rooms, more storage options, and the potential for creating separate areas for different activities. | Higher cost – Landed properties typically come with a higher price tag compared to non-landed properties depending on the land size and location. Additionally, ongoing expenses related to maintenance, repairs, and property taxes can also be higher. |

| Customisation and personalisation – As you’ve highlighted, one significant benefit of owning a landed property is the ability to customise and personalise the living space according to individual preferences. Homeowners have greater flexibility in modifying both the interior and exterior of the home to fit their needs and liking. | May be less accessible – While not necessarily true for all landed homes, the privacy and serene environment that landed estates offer could also cause some inconvenience in terms of commuting for homeowners who do not drive. |

| Exclusive use of facilities – Landed properties usually come with private gardens, yards, or outdoor spaces which are great for recreational activities, such as gardening, hosting gatherings, or creating play areas for children or pets. Having exclusive control over these outdoor spaces allows for a greater degree of privacy and convenience, as there is no need to share or reserve communal spaces with other residents. | Limited facilities – Unlike in condominiums (and unless you stay in a cluster home), landed properties generally lack facilities such as swimming pools, gyms, or tennis courts, unless homeowners choose to construct them on their own, which would require a significant amount of land and money. As a result, residents of landed properties may need to depend on public facilities or explore alternative options for recreational activities. |

Living in a condominium

| Pros | Cons |

| Rules and regulations – The condo management often establishes rules to ensure a harmonious living environment and maintain a high quality of life within the community. These rules may impose restrictions on various activities such as hosting gatherings, limiting the number or size of pets allowed, or provide guidelines for renovations or the use of common areas. As a result, residents have less freedom to act according to their individual preferences and must comply with the established regulations. There are plenty of negative Google reviews on condominiums citing draconian management and security rules. | Limited privacy – Condominium living means sharing walls and common spaces with neighbours, which can result in a reduced sense of privacy compared to landed properties. During peak hours or weekends, shared facilities may become crowded and noise levels can also be a concern, affecting tranquility within the living environment. Neighbours next door and above/below could make noise and affect your quality of life. This is less likely with landed homes due to the lower density. |

| Security and safety – Condominiums typically have security measures in place, such as 24/7 security guards, CCTV surveillance, and restricted access systems such as key cards or intercoms. This can enhance residents’ sense of safety and provide peace of mind. | Restricted control – The condo management typically makes decisions on matters such as maintenance schedules, renovations, or changes to rules and regulations. While residents may have a voice through participating in meetings or voting, ultimate control lies with these governing bodies. This lack of direct control over decision-making processes can sometimes be seen as a disadvantage by residents seeking more autonomy in managing their living environment. |

| Ease of maintenance and convenience – Condo living typically includes maintenance services for common areas. The condo management does the managing and maintenance of shared spaces such as gardens, corridors, or swimming pools. Although this comes at a cost, it saves time and effort for the residents. | Restricted control – The condo management typically make decisions on matters such as maintenance schedules, renovations, or changes to rules and regulations. While residents may have a voice through participating in meetings or voting, ultimate control lies with these governing bodies. This lack of direct control over decision-making processes can sometimes be seen as a disadvantage by residents seeking more autonomy in managing their living environment. |

Ultimately, the decision to live in a landed property or condominium is highly subjective and primarily depends on personal preferences. There is definitely no right or wrong choice in this matter.

Let’s now take a look at the options you’re considering.

Your options

Purchase a freehold/999-year leasehold landed property

You mentioned that residing in a landed property offers the flexibility to customise your home according to your preferences. This includes the option to plan the interior layout to accommodate your living needs or tear down and rebuild the house entirely.

However, if you are referring to the latter option, it’s important to note that it can affect your affordability as you would need to secure a construction loan to finance the project.

Here are a few things to take note of if you’re intending to rebuild the house:

- Both the construction and mortgage loan will have to be within the Total Debt Servicing Ratio (TDSR) limit which is currently at 55% of your monthly income

- Downpayment and monthly repayment of the construction loan are only payable in cash

- After purchasing the property, the homeowner will need to get an architect to furnish a contract stating the construction cost, new built-in area and the number of storeys, and also approvals from the governing bodies for the said works. The maximum construction loan is up to 75% of the construction cost or 70% of the Gross Development Value (GDV) which is the value of the property once construction has been completed, whichever is lower. This is subject to the bank’s approval.

- Once the construction is complete and the property has obtained its Temporary Occupation Permit (TOP), the homeowner can request for the construction loan to be tagged with the mortgage loan. The bank will re-evaluate the property and the new valuation will reflect the construction cost. Once the construction loan has been converted, the monthly repayment can be paid using CPF.

Affordability IF you decide to rebuild

The cost of rebuilding really depends on the size and scope of the new house. For the purpose of this calculation, we will assume an estimated cost of $450 psf for a 3,000 sq ft built-in area which will amount to $1.35M. Based on this, let’s do a breakdown.

| Description | Amount |

| Loan amount (assuming you are eligible for the full 75% loan) | $1,012,500 |

| 25% downpayment (payable in cash) | $337,500 |

| Monthly repayment based on an interest rate of 5.674% (3M Sora + 2.05%) and a 21 year tenure | $6,885 |

Affordability after taking the construction loan into consideration

| Description | Amount |

| Maximum loan based on ages of 44 and fixed combined annual income of $500K with a 4.5% interest and monthly construction loan repayment of $6,885 | Monthly mortgage repayment based on an interest rate of 4.5% and a 21-year tenure |

| Monthly mortgage repayment based on an interest rate of 4.5% and a 21 year tenure | $16,032 |

| CPF funds | $960,000 |

| Cash ($990,000 – $337,500) | $652,500 |

| Total loan + CPF + Cash | $4,222,964 |

| BSD based on $4,222,964 | $192,977 |

| Estimated affordability | $4,029,987 |

Total monthly repayment: $6,885 + $16,032 = $22,917

Within a budget of $4M, there are available options for freehold/ 999-year leasehold landed properties in the East. However, it’s important to note that most of these land plots are generally smaller, under 2,000 sq ft, and would require major renovations, which we have factored into our calculations.

Considering an average monthly household income of approximately $42,000 (based on an annual income of $500,000), the monthly repayment of $22,917 would utilise slightly over 50% of your income. While this falls within the Total Debt Servicing Ratio (TSDR) limits, it could be financially challenging depending on your lifestyle.

Another factor to consider is the duration of construction. Since you would need to sell your current property before purchasing the new one, there would be a period where you would need to rent if you don’t have alternative accommodation. Depending on the extent of construction required, this process could take between 1 to 1.5 years.

Let’s assume you were to rent a 4 bedder at Coco Palms for the time being.

| Date | Size (sqft) | Price |

| Apr 2023 | 1,200 to 1,300 | $5,500 |

| Feb 2023 | 1,300 to 1,400 | $6,300 |

Considering the average rent of $5,900 per month, renting for a year would amount to $70,800. Adding this to your monthly expenses, including the mortgage and construction loan, would raise your monthly outgoings to $28,817.

While this option is still feasible, it’s important to recognise that committing to such a substantial monthly payment for the next 21 years can induce financial stress. It’s crucial to carefully evaluate your financial situation and stress tolerance before making a decision.

Purchase a freehold/999-year leasehold 4-bedroom condominium

If your intention is to acquire a freehold/999-year leasehold property, it may not be necessary to specifically target a new launch condominium. This is because the primary concern of lease decay, which affects leasehold properties, is eliminated when opting for freehold/999-year leasehold properties.

These are some freehold/999-year leasehold 4-bedders in the East within your budget that are currently available on the resale market:

| Project | District | Completion year | Size (sqft) | Price |

| Meier Suites | 15 | 2011 | 2,207 | $4,500,000 |

| One Amber | 15 | 2010 | 1,701 | $3,800,000 |

| Waterina | 15 | 2005 | 2,142 | $3,780,000 |

| The Waterside | 15 | 1993 | 2,400 | $4,180,000 |

And these are some new launch freehold/ 999-year leasehold 4-bedders in the East within your budget that is currently available:

| Project | District | Completion year | Size (sqft) | Level | Price |

| The Continuum | 15 | 2027 | 1,227 | #10 | $3,376,000 |

| Atlassia | 15 | 2025 | 1,281 | #05 | $2,866,878 |

| Zyanya | 14 | 2025 | 1,195 | #07 | $2,288,900 |

| K Suites | 15 | 2024 | 1,130 | #04 | $2,800,000 |

Apart from The Continuum, the other new launches primarily consist of boutique developments, which do have their usual limitations.

Also, it’s important to note that the mentioned developments were chosen based solely on their alignment based on our limited knowledge of your budget and requirements. We strongly recommend consulting a (good) agent for a more detailed analysis and guidance.

By referring to the two tables, you can observe that the sizes of 4-bedroom units in the new launches are notably smaller compared to those available on the resale market. Although older developments may have less modern facilities, they tend to offer larger floor areas, resulting in a more comfortable living environment.

Despite their age, older developments with freehold/999-year leasehold tenures continue to exhibit strong performance.

| Year | Freehold/999-year leasehold non-landed (resale – age 11 – 20) | YoY | Freehold/999-year leasehold non-landed (resale – age 21 – 30) | YoY | Freehold/999-year leasehold non-landed (resale – age 31 – 40) | YoY |

| 2014 | $1,196 | – | $996 | – | $1,064 | – |

| 2015 | $1,193 | -0.25% | $980 | -1.61% | $1,064 | 0.00% |

| 2016 | $1,172 | -1.76% | $967 | -1.33% | $1,028 | -3.38% |

| 2017 | $1,183 | 0.94% | $973 | 0.62% | $1,081 | 5.16% |

| 2018 | $1,225 | 3.55% | $1,003 | 3.08% | $1,160 | 7.31% |

| 2019 | $1,245 | 1.63% | $1,097 | 9.37% | $1,232 | 6.21% |

| 2020 | $1,210 | -2.81% | $1,058 | -3.56% | $1,204 | -2.27% |

| 2021 | $1,346 | 11.24% | $1,137 | 7.47% | $1,375 | 14.20% |

| 2022 | $1,446 | 7.43% | $1,236 | 8.71% | $1,481 | 7.71% |

| Annualised | – | 2.40% | – | 2.74% | – | 4.22% |

We can see from the above table that over the past 8 years, non-landed properties in the East (Districts 14 – 18) aged 31 to 40 have actually outperformed their younger counterparts. Many of these older projects feature generously sized units with efficient layouts and are situated on larger land plots, which creates a less dense and more desirable living environment. This factor likely contributes to the sustained demand for these projects despite their age.

Let’s say you were to purchase a unit at The Waterside for $4.18M.

| Description | Amount |

| BSD | $190,400 |

| Loan after deducting CPF + cash of $1,759,600 (after deducting BSD) | $2,420,400 |

| Monthly repayment based on an interest rate of 4.5% and a 21 year tenure | $14,864 |

It goes without saying that the monthly repayment of $14,864 for a condominium is likely to be more manageable and comfortable compared to that of a landed property.

To conclude

In general, freehold/999-year leasehold landed properties tend to exhibit slightly better performance compared to non-landed properties, although the difference is not very significant. Over the past 8 years, the prices of freehold/999-year leasehold landed properties in the East have experienced an annual growth rate of 3.63%, while non-landed properties grew at a rate of 3.19% per year.

Both options, either a freehold/999-year leasehold landed property or a 4-bedroom condominium, are viable based on your household income. Although a landed property may offer slightly higher returns in the long term due to its higher growth rate, it could strain your finances with the higher monthly repayment. Since you mentioned that this property is primarily for your own stay rather than investment purposes, considering a 4-bedroom condominium might be a more comfortable and prudent choice at this point in time. It would still serve as an asset that retains its value while ensuring a lighter financial burden.

Ultimately, the decision rests with you regarding whether you are willing to compromise certain aspects of your current lifestyle for a landed property, or if you prefer to maintain your current lifestyle while holding a valuable asset. Since your family will be residing in this property for the foreseeable future, it is crucial that the property aligns with your living needs as well.

Have a question to ask? Shoot us an email at hello@stackedhomes.com – and don’t worry, we will keep your details anonymous.

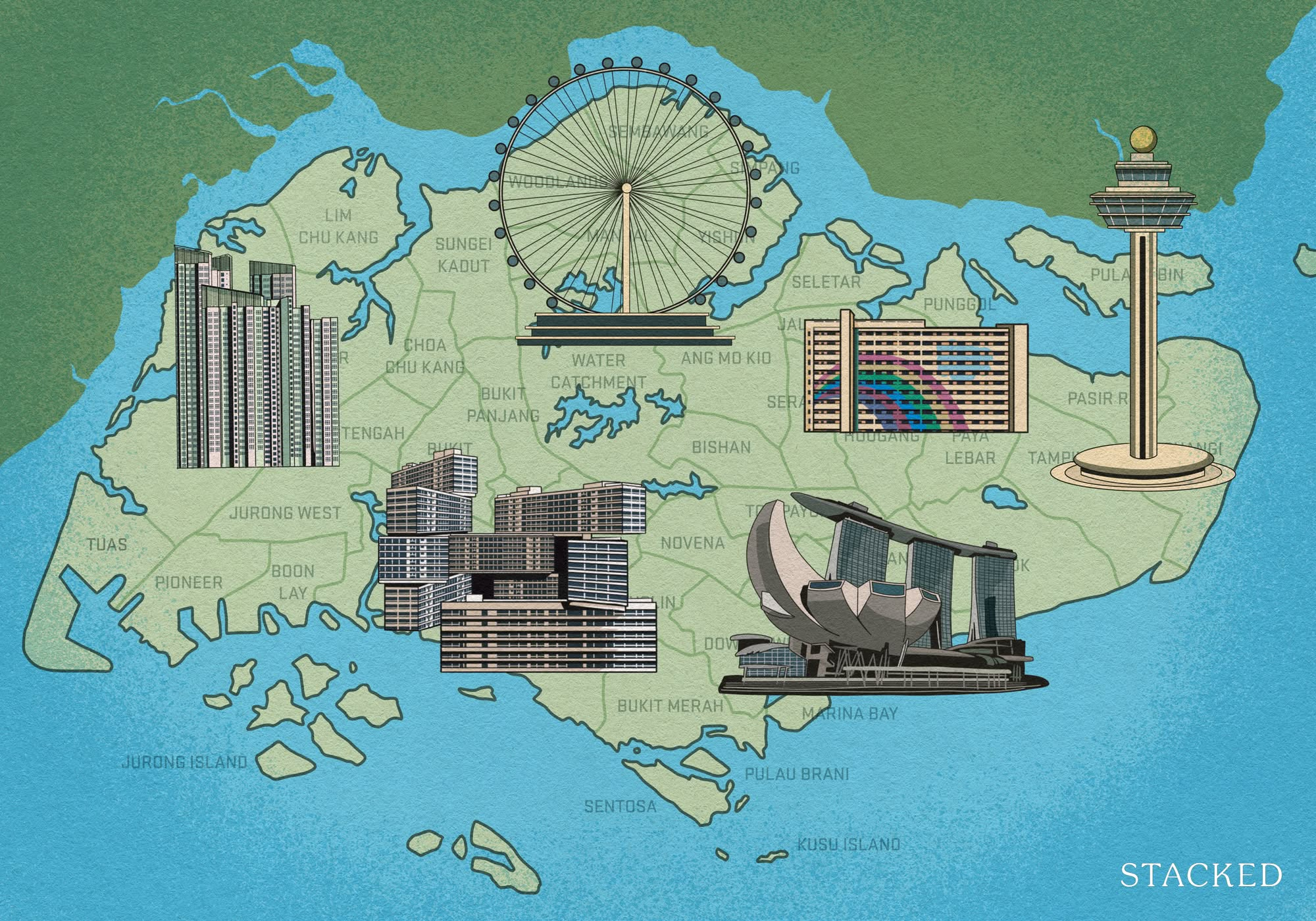

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Read next from Property Advice

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

Latest Posts

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

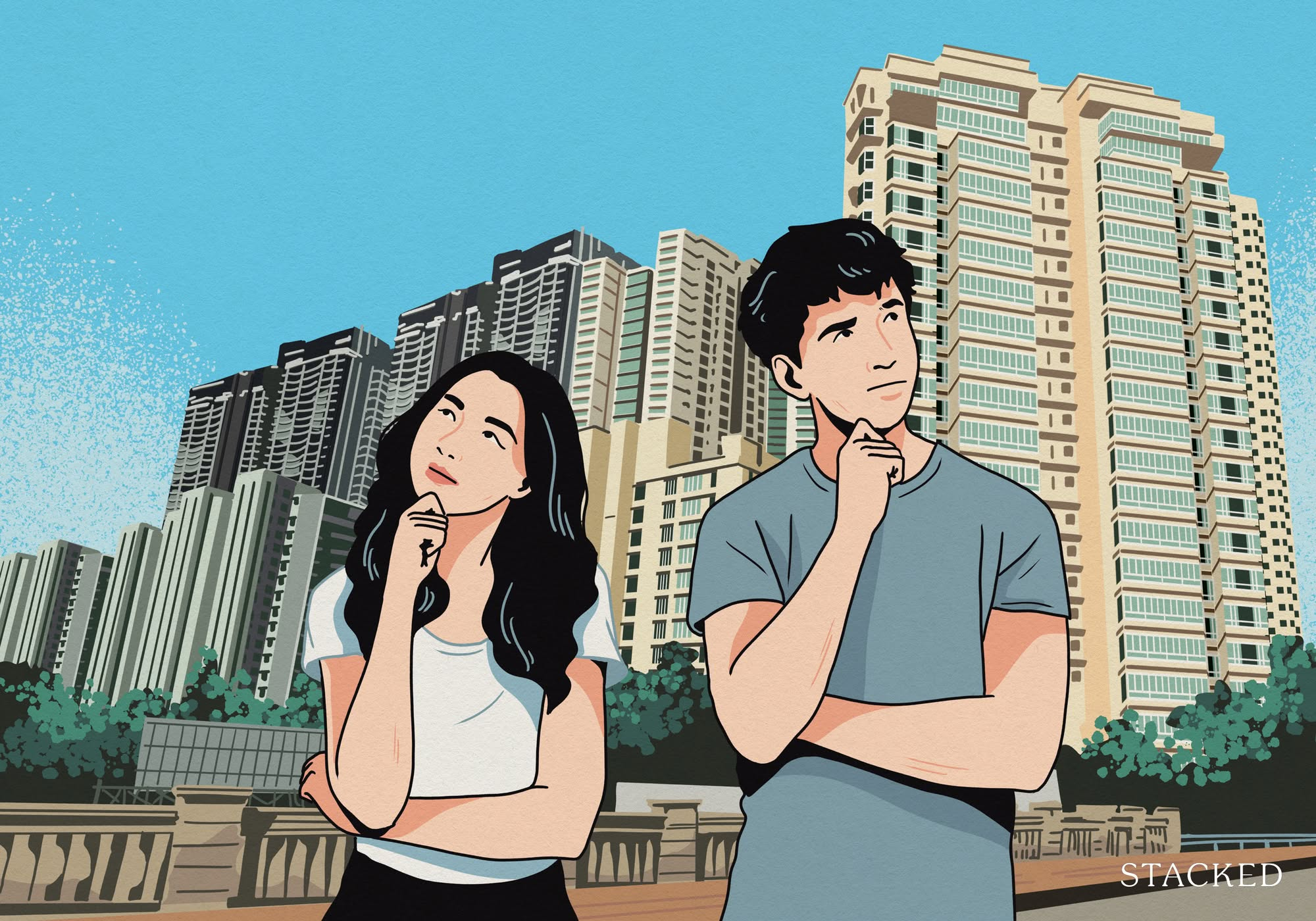

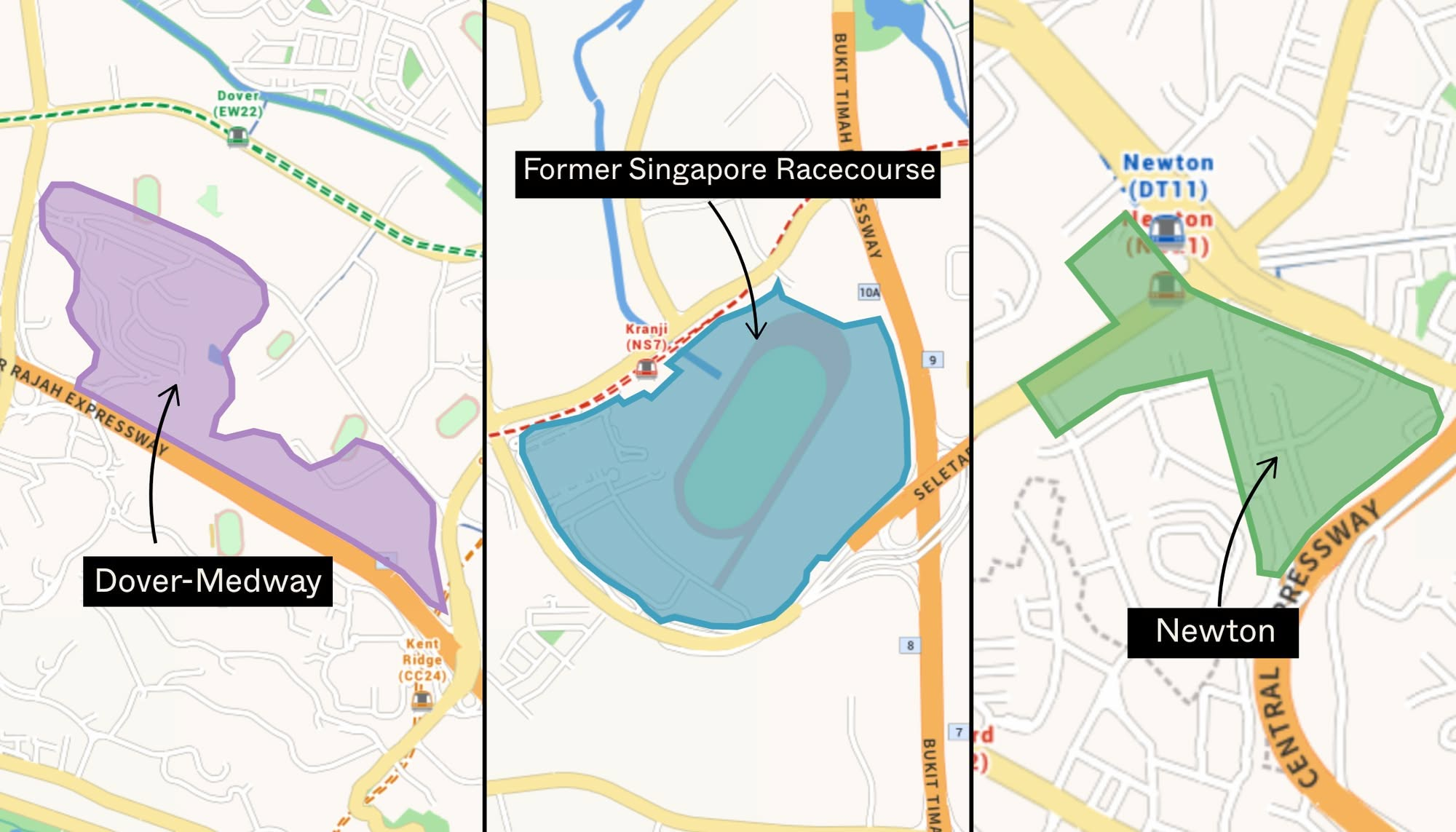

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

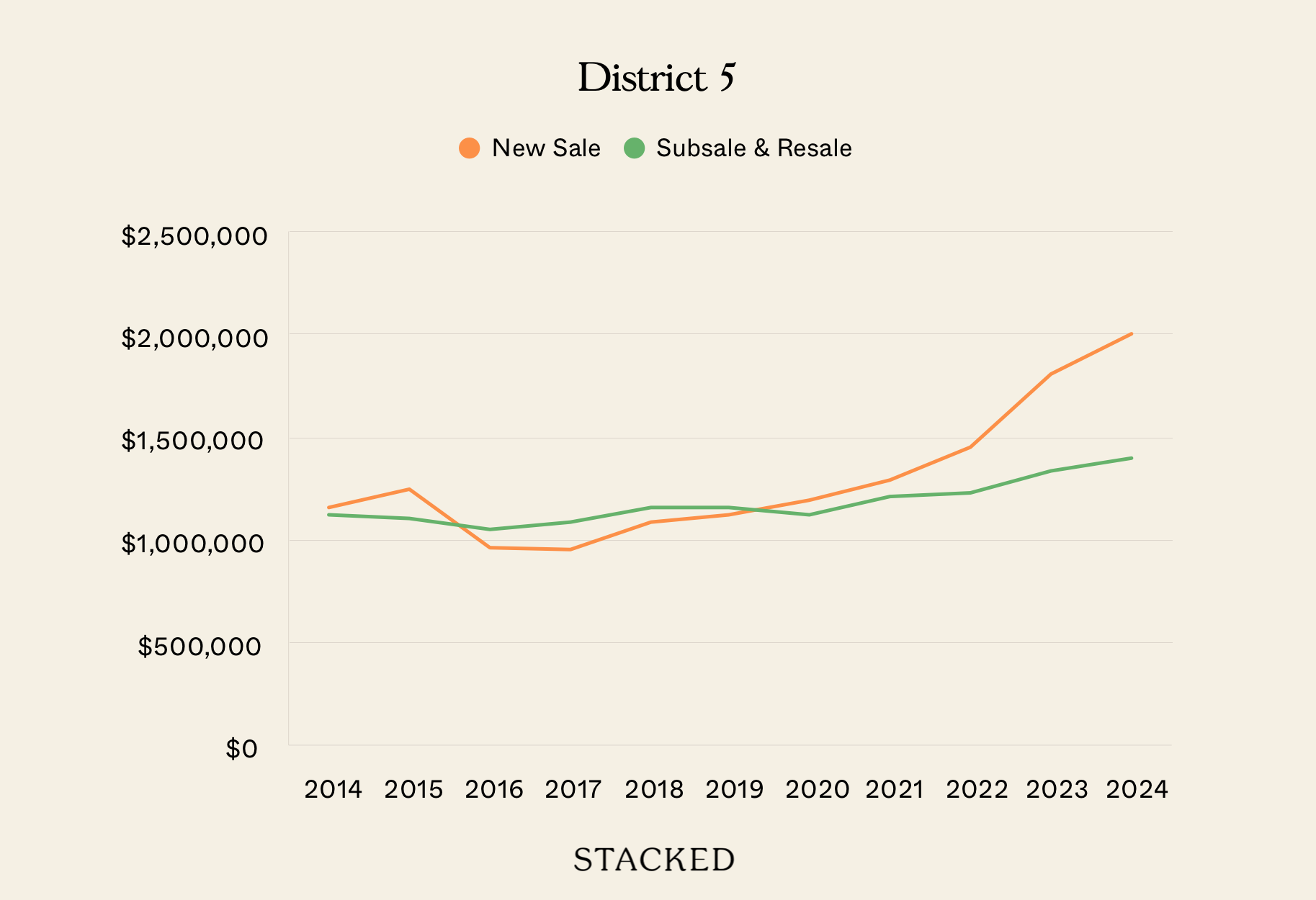

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest

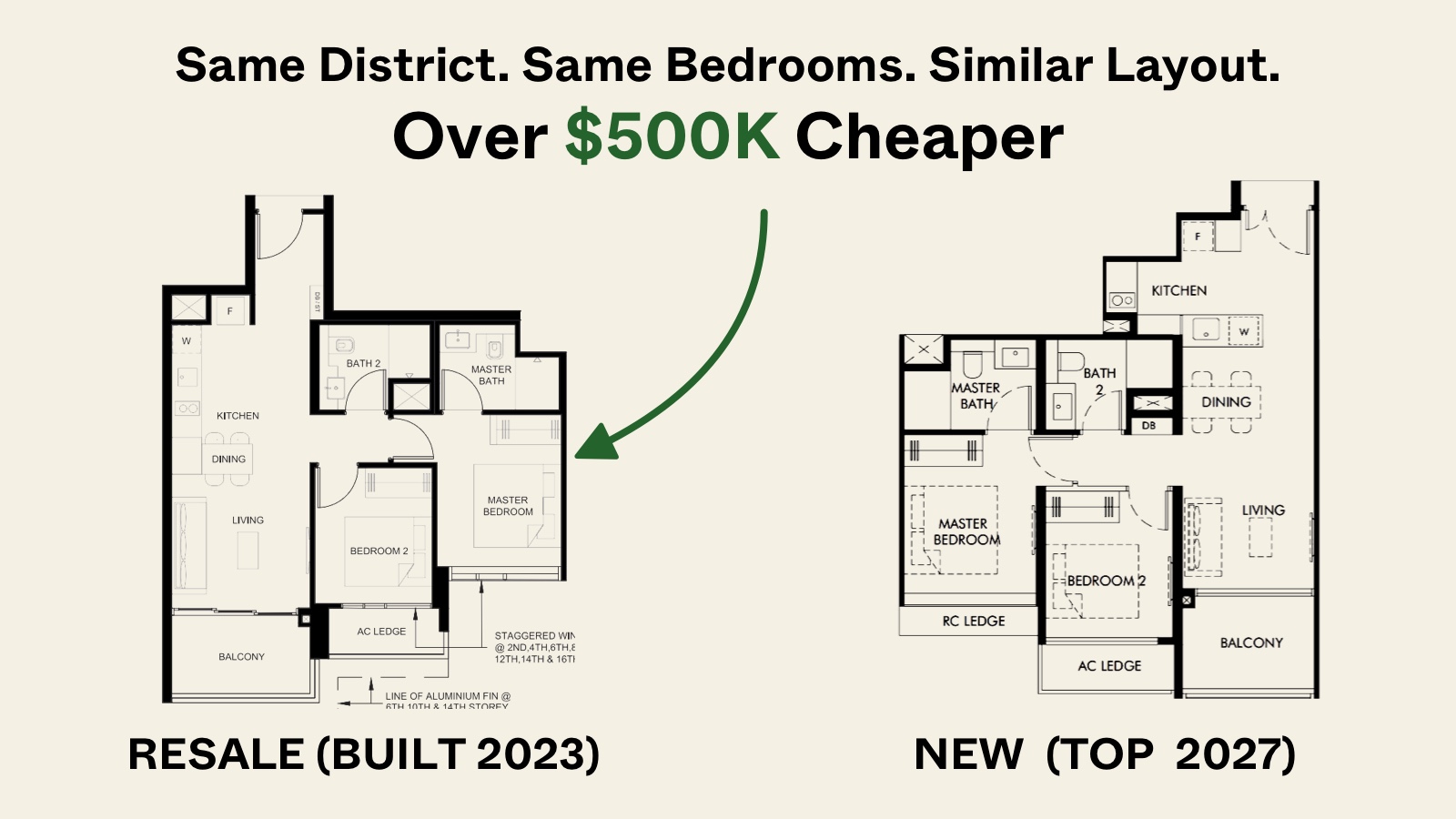

Pro Similar Layout, Same District—But Over $500K Cheaper? We Compare New Launch Vs Resale Condos In District 5

New Launch Condo Analysis The First New Condo In Science Park After 40 Years: Is LyndenWoods Worth A Look? (Priced From $2,173 Psf)

Editor's Pick Why The Johor-Singapore Economic Zone Isn’t Just “Iskandar 2.0”

Editor's Pick URA’s 2025 Draft Master Plan: 80,000 New Homes Across 10 Estates — Here’s What To Look Out For

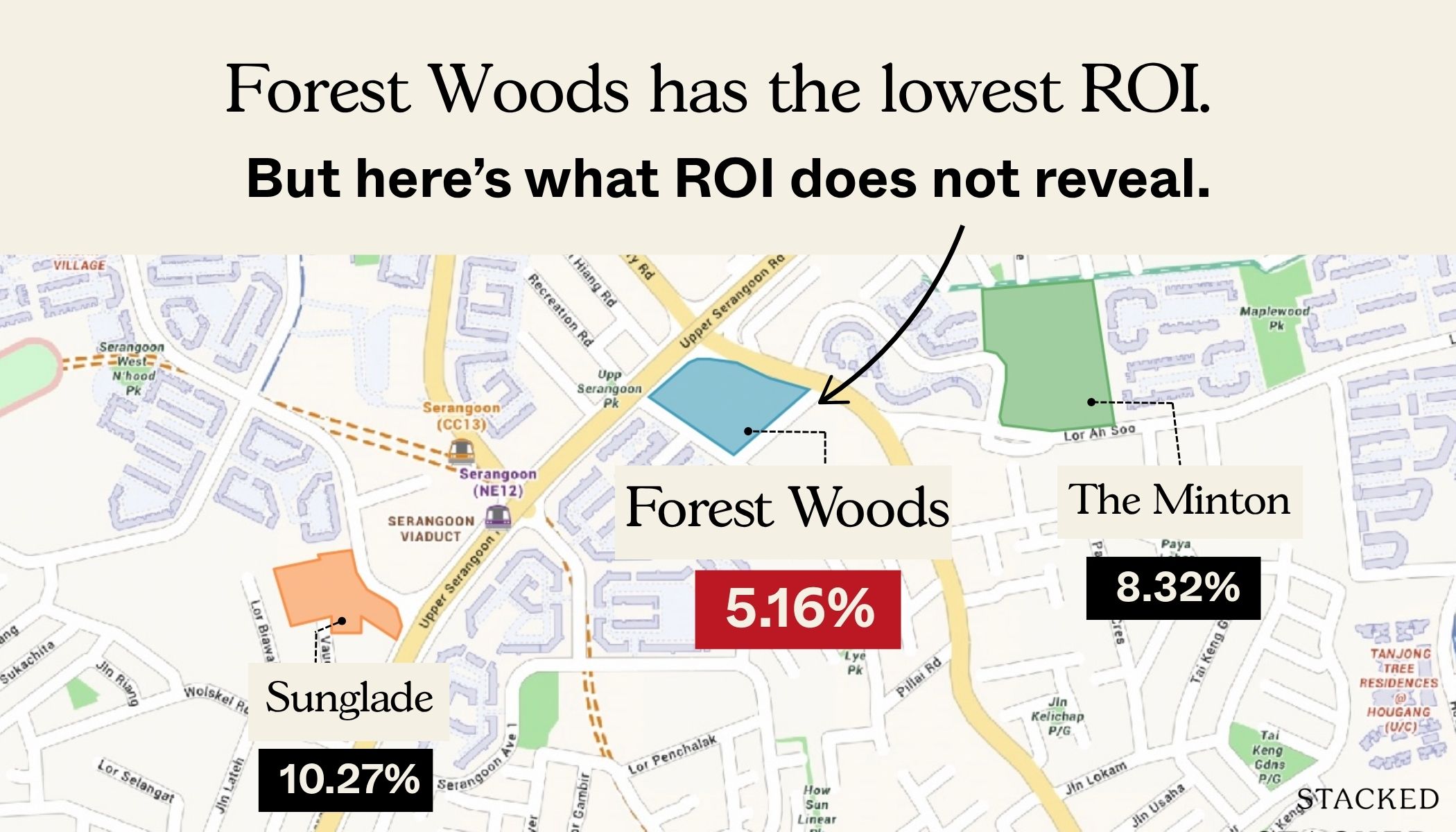

Pro Analysing Forest Woods Condo at Serangoon: Did This 2016 Project Hold Up Over Time?

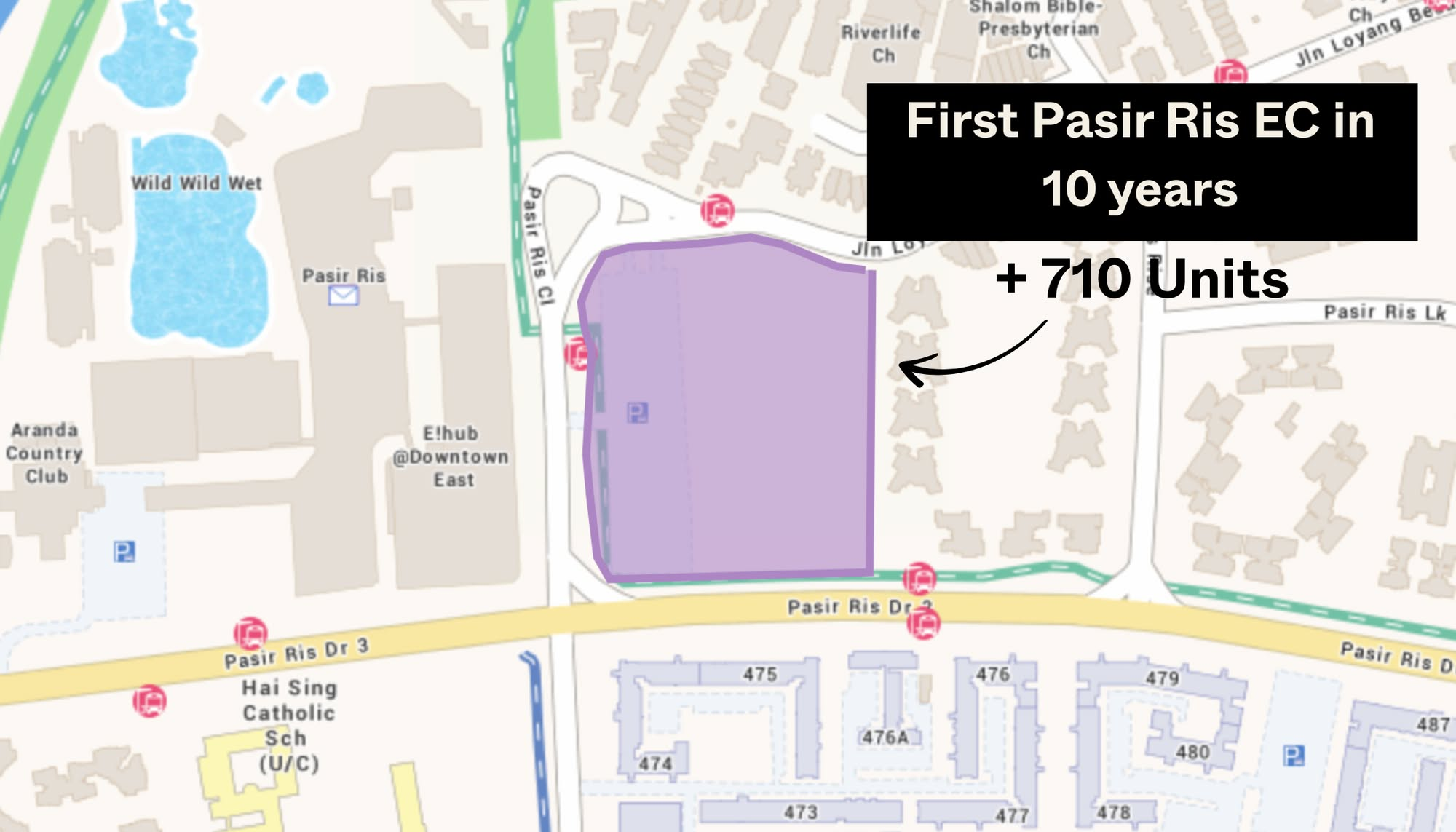

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families

Editor's Pick Where To Find Freehold Terrace & Semi-D Landed Homes From $4.85 million In The East

Singapore Property News She Lost $590,000 On A Shop Space That Didn’t Exist: The Problem With Floor Plans In Singapore

For that monthly outlay, I would suggest buying a smaller freehold condo as an investment asset (both for rental and future use when downsizing as empty nesters), and staying on/renting at Coco Palms. It would be more affordable and not overstretching budgets. It doesn’t need to be either/or but having both the lifestyle they already enjoy plus a nest egg. My thoughts.

Given their budget, I would suggest getting a smaller freehold condo for investment (rental now, to downsize later as empty nesters) while staying put (or renting if they choose to sell) at Coco Palms. That way there’s no degradation of lifestyle as they enjoy living there while easing financial burdens. They’ll have a smaller retirement home and still able to sell their current condo (if staying put) to help the children finance their home purchases when the time comes. That’s my way of thinking.