We Make $500k Per Year And Own 2 Condos: Should We Sell Both To Buy A Landed Or Cluster Home?

October 11, 2024

Hello Stacked Homes

My wife and I are avid readers of your articles – big thanks again for the insightful articles which are very refreshing for the local real estate scene. Grateful if we could get your thoughts on our current situation as we have been debating what our next steps should look like.

Current situation

- I am 40, wife is 39

- I own a 3-Bedder 99y condo (recently TOP-ed) whilst wife owns a 2-Bedder FH (~16yrs old) condo

- Both are currently rented out (we were based overseas for a couple of years and returned late last year)

- The 2-Bedder is currently rented out at a very good rate (completely covers mortgage, mcst and agent fees combined). The tenancy expires Mar’25 and the tenant is keen to renew.

- Less so for the 3-Bedder, in a deficit of ~$700 between rental income and monthly mortgage alone. We don’t intend to stay in the 3-Bedder as we don’t fancy the location (purchased only for investment)

- The tenancy for the 3-Bedder expires Jan’26

- Based on current txn, conservatively estimate an approx 350k profit on the 2-Bedder if we sell it

- And approx 300k profit for the 3-Bedder if we sell it

- We are currently renting a 2-Bedder in the east at 3.8k per month

- Our combined annual income is ~500k

- Our avail cash is ~500k

Options we are debating on

A. Sell both and get a reasonable condition resale FH landed terrace under 5M

B. Sell the 3-Bedder and get a resale 3-Bedder in our preferred location under 2.5M

C. same as option(B) but instead, get a resale FH cluster under 3.6M

Our preferred location is D13 / 14 / 15 / 16 (except geylang)

Option (A) is aggressive as it means saddling ourselves with a 4M loan together and frankly the space is a luxury as we have no kids. However we are rather bullish on the landed scene as an appreciative asset given the limited supply. Our niggling worry though is you never know when the next retrenchment will come along and hit you.

Option (B) is the conservative approach as we get to retain one property for income whilst another to stay in without taking on too big a debt. And in the event we decide to slow things down in our career, we can sell the 2-Bedder and recalibrate the proceeds into say a fixed income fund that can provide 4-5% annual dividends or approx 50k a year.

Option (C) is the in-between option. Whilst less of a priority for the spouse, I personally have grown to value space a lot more post-Covid and really liked the idea of decent built up space for both work from home and personal hobbies. However worried that cluster is a niche segment and may not fare as well longer term vs condo or a regular landed.

We are also acutely aware the market is a bit slow currently and it may take time to sell. Therefore, we are also considering if we have to extend our current lease to buy time.

Grateful for your valuable insights re our current situation. Thanks in advance.

Regards,

Hi there,

Thank you for your kind words and for reaching out with your questions.

To be frank, your current setup is aleady quite ideal. Renting out two properties while living in a location you enjoy offers a great balance between investment and lifestyle. Separating your investment properties from your personal residence is a smart strategy, as the property that suits your lifestyle might not always deliver the best returns.

That said, we understand that your needs may change as you get older. To be sure, renting in the long term may not offer the stability and assuredness that you’d get when it’s your own house. And from that perspective (as well as the desire to live in a bigger home), it could make sense to think about a change.

Let’s begin by evaluating your affordability, and then we can dive into the performance of the various property types and options you’re considering.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

Since we don’t have details on the specific developments you own or a complete financial picture, we are unable to provide precise affordability calculations. However, we’ll assume that you have the necessary funds for the pathways you’re considering.

Based on the ages of 39 and 40, a combined annual income of $500,000 (presuming both of you are earning equally), at an interest rate of 4.8%, your estimated loan amount for a private property would be approximately $3,999,375 with a 25-year tenure.

If you were to take out a loan individually, based on an annual income of $250,000 and an age of 40, the estimated loan amount at a 4.8% interest rate would be around $1,999,688 with a 25-year tenure.

With this and the information you have provided, let’s go over the potential funds required based on the property price you mentioned for each of the three pathways.

- Sell both and get a freehold landed terrace under $5M

| Property price | $5,000,000 |

| BSD | $239,000 |

| Maximum loan | $3,999,375 |

| Cash savings + profits from both properties | $1,150,000 |

| Funds required | $89,625 |

- Sell the 3-bedder and get a 3-bedder in your preferred location under $2.5M

| Property price | $2,500,000 |

| BSD | $94,600 |

| Cash savings + profits from both properties | $800,000 |

| Loan required | $1,794,600 |

- Sell the 3-Bedder and get a freehold cluster house under $3.6M

| Property price | $3,600,000 |

| BSD | $155,600 |

| Maximum loan | $1,999,688 |

| Cash savings + profits from both properties | $800,000 |

| Funds required | $955,912 |

Next, let’s look at how the various property types have been performing in general.

Performance of the different property types

| Year | Strata landed property (resale) | Landed property (resale) | Non-landed property (resale) |

| 2013 | $798 | $1,272 | $1,247 |

| 2014 | $780 | $1,215 | $1,199 |

| 2015 | $690 | $1,170 | $1,185 |

| 2016 | $641 | $1,119 | $1,158 |

| 2017 | $694 | $1,142 | $1,188 |

| 2018 | $711 | $1,188 | $1,248 |

| 2019 | $713 | $1,233 | $1,262 |

| 2020 | $681 | $1,212 | $1,224 |

| 2021 | $766 | $1,344 | $1,330 |

| 2022 | $852 | $1,550 | $1,437 |

| 2023 | $947 | $1,692 | $1,526 |

| Average growth rate | 2.04% | 3.10% | 2.14% |

*We are only looking at resale transactions for properties completed in 2013 and earlier

Among the three categories, strata landed properties recorded the lowest average growth rate over the past decade. The disparity in growth compared to traditional landed properties is particularly significant.

Strata landed properties combine elements of both landed and condominium living. These properties are landed homes (such as terrace houses, semi-detached, or bungalows) within a gated development that shares common facilities and amenities, similar to a condominium.

However, homeowners do not own the land their unit is built on in the same way that owners of traditional landed properties do. Instead, they own the strata title to their individual unit, which gives them ownership of the interior space of the home. The land and common areas within the development are collectively owned by all the residents through the Management Corporation Strata Title (MCST).

As such, the data confirms why you suggested option 1 as the landed segment has seen a higher growth rate over the past decade. There’s no question that the scarcity of freehold landed homes in Singapore would see future appreciation as well as being priced out the longer you wait.

Since you’re considering all three property categories, let’s explore each of them in more detail. We will be looking at data for the four districts (13,14,15,16) which you have pointed out.

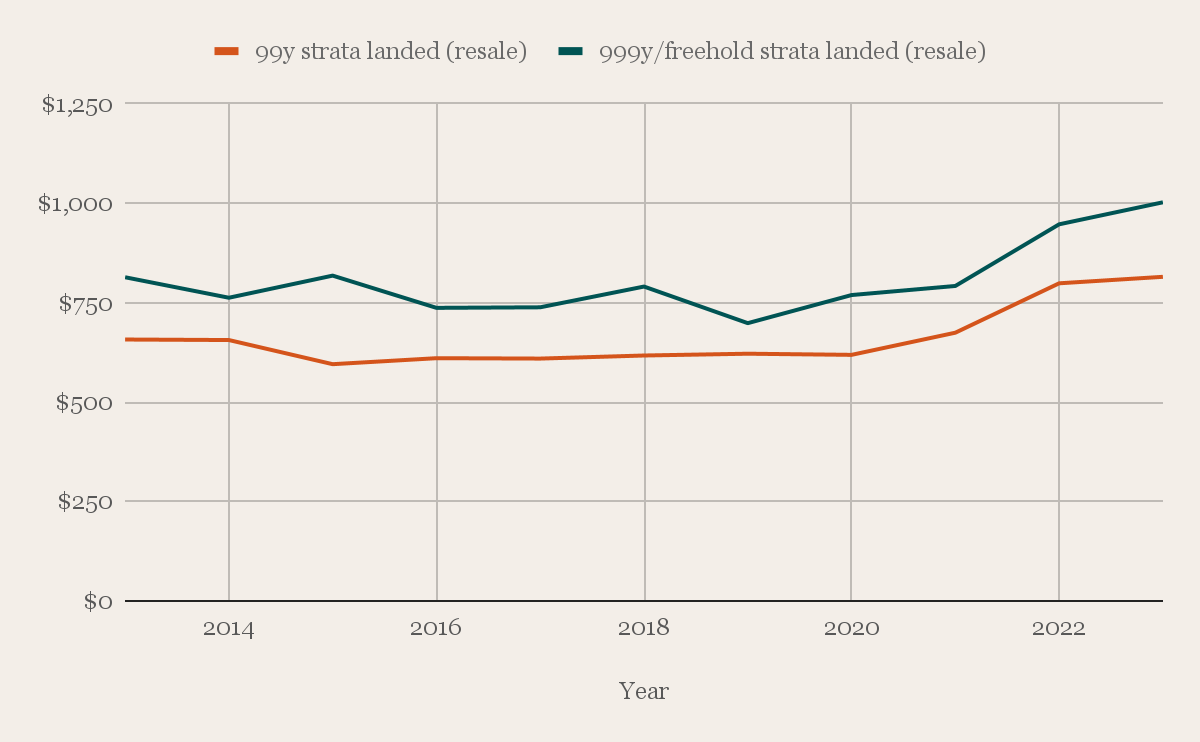

Strata landed property

These include cluster houses, town houses, and strata bungalows.

| Year | 99-year strata landed (resale) | Number of transactions | 999-year/freehold strata landed (resale) | Number of transactions |

| 2013 | $657 | 16 | $814 | 21 |

| 2014 | $656 | 8 | $762 | 8 |

| 2015 | $595 | 11 | $818 | 16 |

| 2016 | $610 | 14 | $737 | 15 |

| 2017 | $609 | 11 | $738 | 12 |

| 2018 | $617 | 26 | $791 | 18 |

| 2019 | $622 | 10 | $698 | 11 |

| 2020 | $619 | 15 | $769 | 21 |

| 2021 | $674 | 54 | $792 | 56 |

| 2022 | $799 | 23 | $947 | 12 |

| 2023 | $815 | 14 | $1,002 | 8 |

| Average growth rate & total units sold | 2.39% | 202 | 2.52% | 198 |

*We are only looking at resale transactions for properties completed in 2013 and earlier in districts 13, 14, 15, and 16

Over the past decade, 999-year or freehold strata landed properties in the four districts have shown a slightly stronger price appreciation compared to their 99-year leasehold counterparts. However, due to the limited supply of these units, the overall transaction volume remains relatively low.

As you’ve rightly noted, strata landed properties cater to a niche group of buyers who value the space and privacy of landed homes but also seek the convenience and facilities typically found in condominiums. One of the main draws of strata landed homes is their relative affordability compared to traditional landed properties, offering an accessible way to experience landed living. For space-conscious buyers like yourself, these homes provide significantly more living area than a typical condominium unit.

However, despite this appealing mix, many buyers looking for landed homes still tend to prefer traditional landed houses when possible, as reflected in stronger demand and price growth for these properties. The relatively low supply of strata landed homes over the years further underscores the fact that the market demand for such properties remains limited.

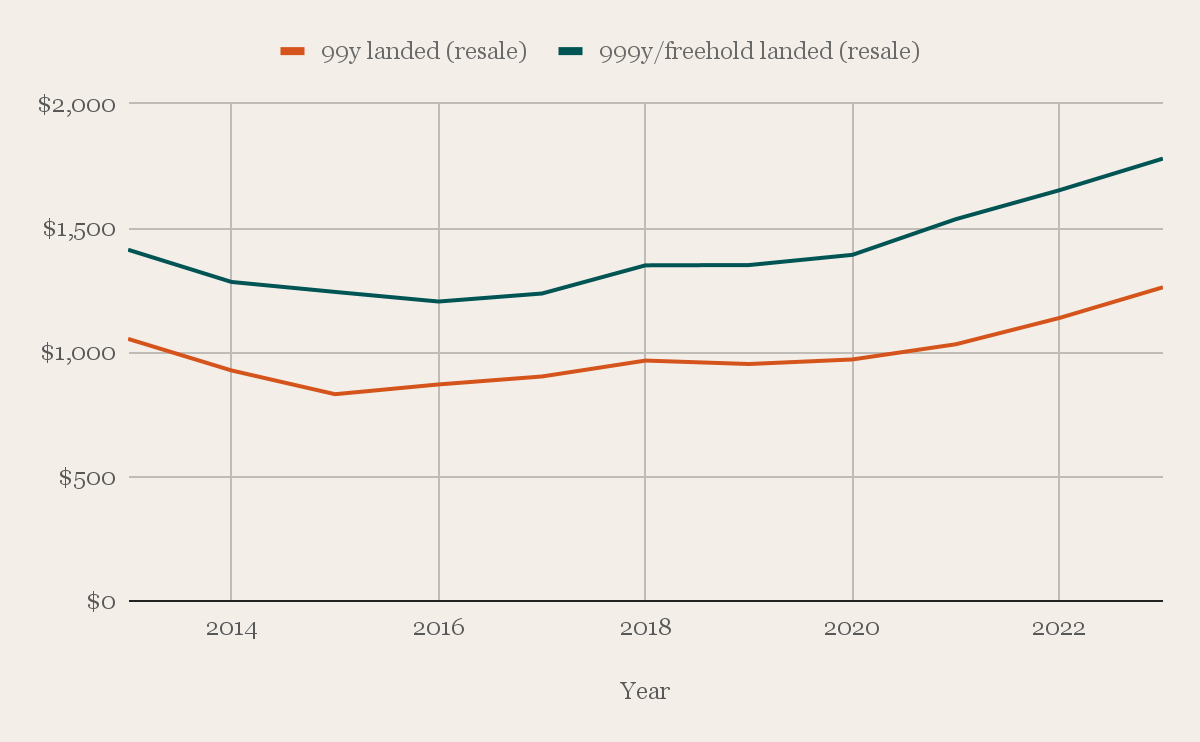

Landed property

| Year | 99-year landed (resale) | 999-year/freehold landed (resale) |

| 2013 | $1,054 | $1,413 |

| 2014 | $927 | $1,283 |

| 2015 | $832 | $1,243 |

| 2016 | $871 | $1,205 |

| 2017 | $903 | $1,237 |

| 2018 | $967 | $1,350 |

| 2019 | $953 | $1,351 |

| 2020 | $972 | $1,392 |

| 2021 | $1,033 | $1,536 |

| 2022 | $1,138 | $1,652 |

| 2023 | $1,262 | $1,780 |

| Average growth rate | 2.10% | 2.52% |

*We are only looking at resale transactions for properties completed in 2013 and earlier in districts 13, 14, 15, and 16

It’s no surprise that 999-year/freehold landed properties have seen a higher growth rate compared to their 99-year leasehold counterparts. Freehold properties are not subject to the issue of lease decay, making them more appealing to buyers seeking long-term investment security. Furthermore, as the supply of such homes will never be increased, the scarcity of such properties continues to drive up demand and, consequently, prices.

This combination of long-term stability and limited supply makes freehold landed homes especially desirable for both investors and homeowners.

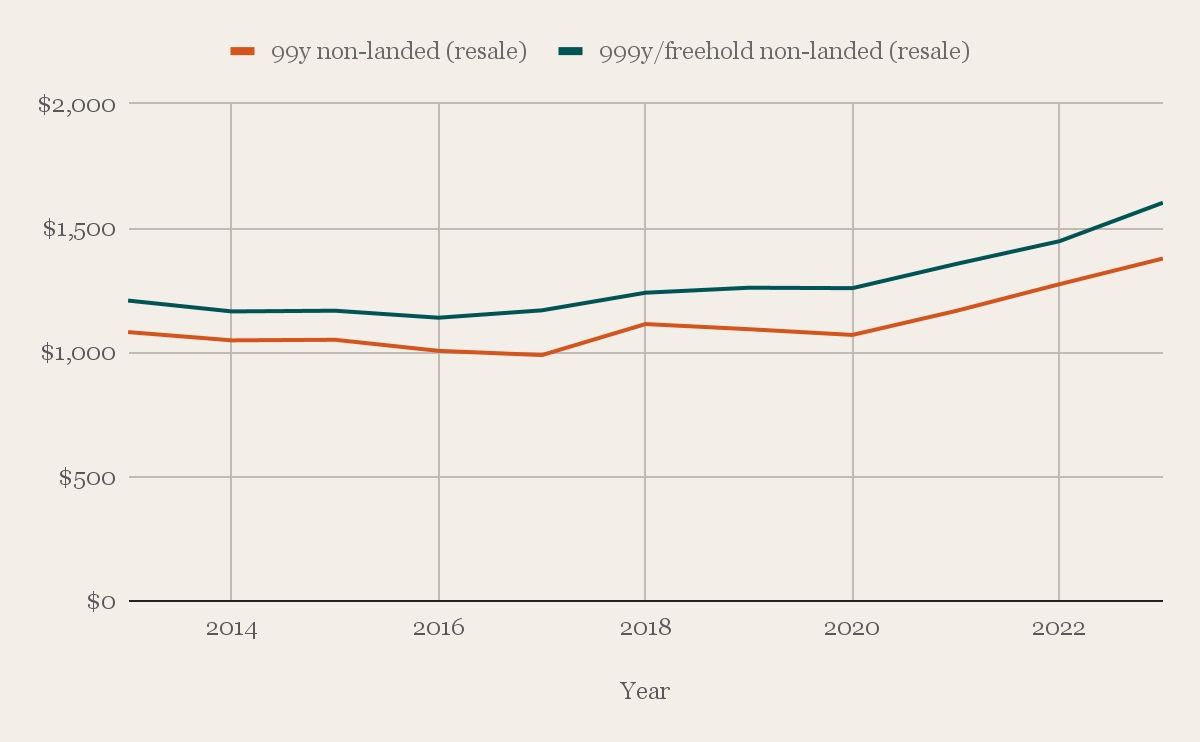

Non-landed property

| Year | 99-year non-landed (resale) | 999-year/freehold non-landed (resale) |

| 2013 | $1,082 | $1,208 |

| 2014 | $1,048 | $1,165 |

| 2015 | $1,051 | $1,168 |

| 2016 | $1,006 | $1,139 |

| 2017 | $989 | $1,169 |

| 2018 | $1,114 | $1,240 |

| 2019 | $1,093 | $1,260 |

| 2020 | $1,070 | $1,258 |

| 2021 | $1,167 | $1,356 |

| 2022 | $1,274 | $1,447 |

| 2023 | $1,378 | $1,602 |

| Average growth rate | 2.62% | 2.96% |

*We are only looking at resale transactions for properties completed in 2013 and earlier in districts 13,14,15, and 16

In general, 99-year leasehold non-landed properties tend to see a higher appreciation in the short to medium term but it appears in these four districts that 999-year or freehold non-landed properties have a slight upper hand.

Leasehold condominiums are generally more affordable than their freehold counterparts, making them accessible to a wider range of buyers from homeowners to investors. Investors typically focus on capital appreciation over the short to medium term, rather than holding properties indefinitely. In this context, 99-year leasehold condominiums tend to perform well, as they are often launched at more accessible prices that facilitate quicker price growth in the initial years. Furthermore, investors looking for rental income may favour leasehold properties, which typically offer higher rental yields relative to their purchase prices.

In contrast, freehold properties usually exhibit slower price appreciation. This is largely due to the fact that owners tend to hold onto these properties for extended periods, resulting in reduced market liquidity and lower transaction volumes.

Although leasehold properties have a finite lease period, concerns about lease decay generally arise only as the lease approaches its final decades. For 99-year leasehold properties, the first 30 to 40 years are perceived as a secure investment window. Most buyers and investors focus on appreciation potential during these early years, rather than the long-term implications of lease expiry.

Now that we have a better idea of the performance of the various property types, let’s take a look at the potential costs involved for the pathways you’re considering.

Potential pathways

Based on the information that you’ve provided, your current property expense per month is around $4,500 ($700 for the 3-bedder and $3,800 for rent).

Sell both and get a freehold landed terrace under $5M

For calculation purposes, we will use a 10-year timeframe and assume that you take up the maximum loan. Although, it is unlikely that you will need to do so after selling both your properties.

| Interest expense (Assuming 4% interest and 25-year tenure) | $1,387,776 |

| BSD | $239,000 |

| Property tax | $279,800 |

| Maintenance cost (Assuming $5K/year)* | $50,000 |

| Renovation cost** | $500,000 |

| Total costs | $2,456,576 |

*Given that maintenance for landed properties are on an adhoc basis, this is just an estimate

**Will be dependent on extent of works done

Based on a loan of $3,999,375, with a 4% interest and 25-year tenure, the monthly mortgage repayment will be $21,110.

Sell the 3-bedder and get a 3-bedder in your preferred location under $2.5M

| Pros | Cons |

| The least costly option of the 3 | Smaller living space |

| Will be in your chosen location | |

| Get to enjoy condo facilities |

Similarly, it is unlikely that you will have to take up a loan of $1,794,600 after selling the 3-bedder but we will use this figure for calculation purposes.

| Interest expense (Assuming 4% interest and 25-year tenure) | $622,723 |

| BSD | $94,600 |

| Property tax | $60,800 |

| Maintenance fee (Assuming $350/month) | $42,000 |

| Renovation cost* | $50,000 |

| Total costs | $870,123 |

*Will be dependent on extent of works done

Based on a loan of $1,794,600, with a 4% interest and 25-year tenure, the monthly mortgage repayment will be $9,473.

Sell the 3-Bedder and get a freehold cluster house under $3.6M

| Pros | Cons |

| More affordable than a conventional landed property | Property type appeals to a niche market |

| More space | Low growth rate |

| Get to enjoy condo facilities |

Given that you are buying this property under your name alone, depending on the sale price of the 3-bedder, you may have to take up the maximum loan.

| Interest expense (Assuming 4% interest and 25-year tenure) | $693,888 |

| BSD | $155,600 |

| Property tax | $145,400 |

| Maintenance fee (Assuming $800/month) | $96,000 |

| Renovation cost* | $200,000 |

| Total costs | $1,290,888 |

*Will be dependent on extent of works done

Based on a loan of $1,999,688, with a 4% interest and 25-year tenure, the monthly mortgage repayment will be $10,555.

What should you do?

From an investment standpoint, based on the growth rate and smaller buyer pool for cluster houses, option 3 would be the least preferred choice.

Choosing between the first two options ultimately depends on your comfort level and long-term goals. Option 1 offers the benefit of a larger home, which aligns with your preference and could be a solid long-term investment. However, it would incur significant costs and require selling both of your current properties, thereby eliminating your passive income stream.

Option 2 is less financially taxing and allows you to retain both properties. As you mentioned, you could rent out the second property for passive income or eventually sell it and reinvest the proceeds. This option offers more flexibility, though the tradeoff would be settling for a smaller living space compared to a landed home.

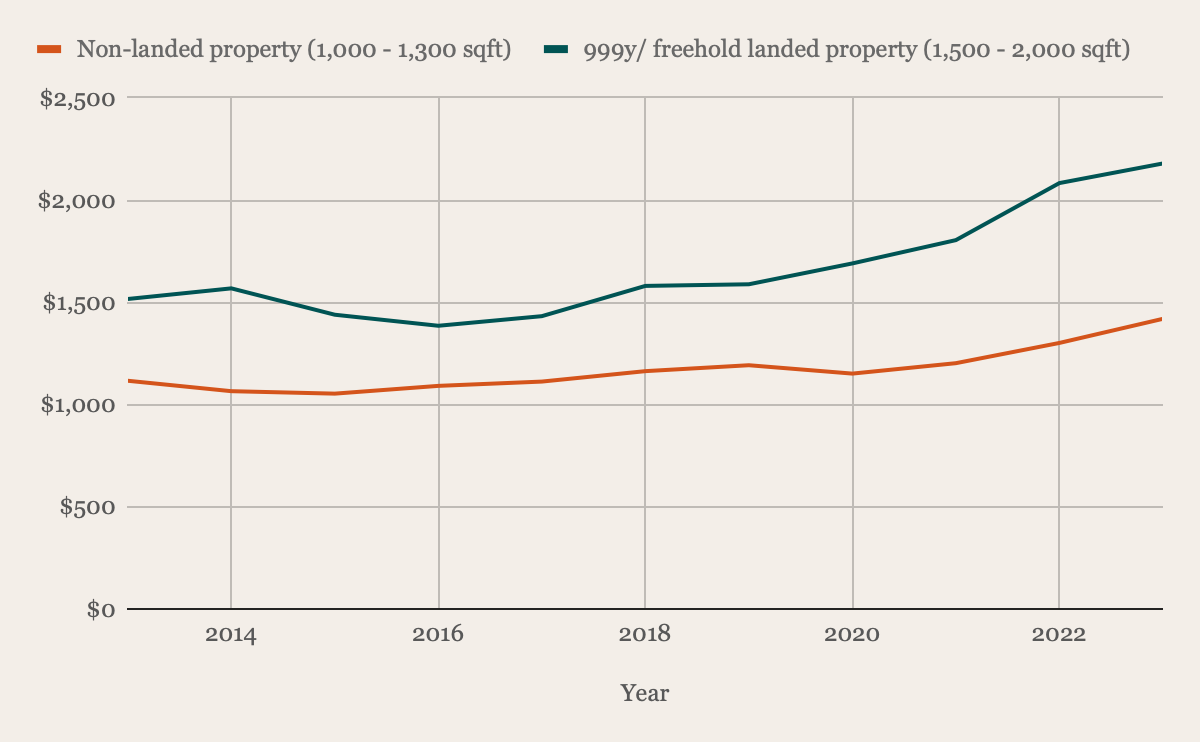

In making the decision between options 1 and 2, you should also consider the possibility of being priced out if you choose not to buy the landed home now. To do this, we’ll take a look at the price trends of a 3-bedroom condo (1,000 – 1,300 sq ft) as compared to a 999-year or freehold landed property (1,500 – 2,000 sq ft).

| Year | Non-landed property (1,000 – 1,300 sqft) | 999y/ freehold landed property (1,500 – 2,000 sqft) | % difference |

| 2013 | $1,116 | $1,516 | 35.84% |

| 2014 | $1,065 | $1,568 | 47.23% |

| 2015 | $1,053 | $1,439 | 36.66% |

| 2016 | $1,091 | $1,385 | 26.95% |

| 2017 | $1,112 | $1,432 | 28.78% |

| 2018 | $1,163 | $1,580 | 35.86% |

| 2019 | $1,192 | $1,588 | 33.22% |

| 2020 | $1,151 | $1,690 | 46.83% |

| 2021 | $1,202 | $1,804 | 50.08% |

| 2022 | $1,301 | $2,083 | 60.11% |

| 2023 | $1,419 | $2,179 | 53.56% |

| Average | 2.52% | 3.89% | – |

While both non-landed and 999-year/freehold landed properties have experienced growth over the past decade, the price gap between them has steadily widened.

From 2016 onwards, 999-year and freehold homes have consistently outpaced non-landed properties in terms of price appreciation. This could be driven by their inherent scarcity, long-term appeal, and higher investment potential, as they are not subject to concerns over lease decay.

A 999-year or freehold landed property is undoubtedly a strong investment, but the real question is whether to make the leap now or wait in the hopes that the price gap between landed and non-landed properties might narrow in the future (if it ever does). Do remember too, that owning one landed property means that a major part of your wealth will be tied down to one place. And because you stay in it, you can never realise the profit till you sell. This means you effectively would have to sell and right size to a smaller property at some point – unless you are intending on keeping it as a legacy if you have children.

Alternatively, while we cannot provide specific advice on whether to hold or sell your current properties without knowing their locations, another option could be to maintain your current strategy and evaluate the performance of your 3-bedder. If it is not performing well, you could sell it and reinvest in a better-performing property with a stronger appreciation or rental potential while renting a place that suits your needs.

Given that it’s just the two of you, you could even consider renting a small landed or cluster house. This approach would offer even greater flexibility, as you’d retain two investment properties while not being tied to your residence, allowing you more freedom in choosing a place to stay without concerns over its appreciation or value retention potential.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

0 Comments