Hi Stacked (Ryan),

My housing situation is going to change in 2024- I am about to sell my 3BR BTO in Jan and upgrade to a bigger flat (open to either HDB 5rm/mansionette or condo) in the Beauty world area.

Here’s the information pertaining to my housing journey:

- Husband + Wife with 2 young children in the process of selling 3BR BTO that just reached MOP (target to complete by 1Q24)

- Looking to purchase a house in Beauty World/King Albert Park by Aug 2024 and the renovation completed by Dec 2024

- No extension of stay required as I am staying in a relative’s house after the sale of the BTO

- An agent who is my friend is assisting with my housing journey but I would like to have a second opinion in case I miss out some blind spots.

| Demographics | Husband | Wife |

| Age | 36 | 34 |

| Annual Income | $200,000 (employee) | $100,000 (self-employed) |

| Approval in Principle for Pte Property from a local bank(as at Jan 2024) | $1,260,000 | $680,000 |

| CPF OA (existing balance) | $110,000 | $0 |

| CPF OA (used for housing including deferred interest) | $80,000 | $70,000 |

| Cash available for housing, buyer stamp duty, renovation | $600,000 | $300,000 |

Current Flat in Kallang/Whampoa region

| Selling Price | $800,000 (based on comparables in the vicinity) |

| Existing Loan | $235,000 |

Future housing options

Important criteria

- <5 mins walk to MRT (we don’t own a car)

- Minimum size of 1,200 sqft

- Preferably in Beauty World or King Albert Park to be near child’s primary school

| Housing Options | HDB | Private Walk-up Apartment | Full Condo |

| Project | Blk 2, 3 Toh Yi Drive | Kilat 19, Chun Tin Court, Sun Court | Sterling, Blossomvale, Maplewoods |

| Tenure | 99- year starting from 1988 | Freehold | Freehold |

| Price | ~1.3mil ($850 psf) | ~2.3mil ($1,200 psf) | $2.6mil ($2,000 psf) |

| Size | 1600sqft (Executive maisonette) | 2000 sqft | 1300 sqft |

| Pros | · Highest affordability· Spacious | · Very Spacious | · Condo facilities (our family uses the gym + pool regularly)· Possible capital appreciation in the future (especially when Cross Island Line is operational + Turf City Masterplan finalized) |

| Cons | · Lease decay | · Low liquidity as each project has less than 20 units· Walk-up apartment with no lift (inconvenient for strollers, groceries runs, injuries)· Limited pool of buyers in the future· Low en-bloc probability due to height limit (faces landed housing)· Not senior-friendly so it will never be our forever home | · Smallest in size due to budget constraints· MCST fees are the highest of the 3 options· Financial stress |

| Other notes/questions | If I purchase the resale HDB, I may purchase another private apartment (own stay or investment) after MOP, if private property prices are right | · I am unsure about the capital appreciation of the walk-up apartments under consideration given their low liquidity?· Is my assessment of the en-bloc potential of the walk-up apartments accurate? | · Gardenvista, Le Jardin, Mayfair Modern, Mayfair Garden, KAP Residences, Sherwood Towers have all been ruled out owing to proximity to MRT or the design of the layout· Other condos as a secondary consideration are Casa Esperanza (part of carpark to be given up for construction of CRL- how does this affect its capital value) and Meadowlodge (99yr) |

General Questions

1. On the pros and cons of each housing option, is there anything that we might have missed out?

2. What is the maximum affordability for Option 3 based on our financial situation?

3. Any other housing option that we might have missed out?

4. Of the 3 housing options, which is most preferred in terms of

- Financial prudence

- Best risk-reward ratio

Thanks and looking forward to hearing your advice.

Hi there,

Thank you for reaching out and compliments to you for how thorough you’ve been in your research!

It’s great that you’ve already narrowed down your focus to one specific area so let’s just right in to review the numbers you’ve provided before we explore the three options you’re considering in more detail.

Affordability

Selling your existing property

We will assume the selling price of $800,000 as you’ve mentioned.

| Description | Amount |

| Selling price | $800,000 |

| Outstanding loan | $235,000 |

| CPF funds to be refunded into OA | $150,000 |

| Cash proceeds | $415,000 |

Combined affordability (Buying a private property)

| Description | Amount |

| Maximum loan | $1,940,000 (30-year tenure) |

| CPF funds | $260,000 |

| Cash | $1,315,000 |

| Total loan + CPF + cash | $3,515,000 |

| BSD based on $3,515,000 | $150,500 |

| Estimated affordability | $3,364,500 |

*Includes all CPF and cash proceeds from the sale of your existing flat

Let’s also look at your individual affordability just to explore the possibility of buying your desired property under one name, keeping the option of purchasing a second property open.

Husband’s affordability (Buying a private property)

| Description | Amount |

| Maximum loan | $1,260,000 |

| CPF funds | $190,000 |

| Cash | $1,015,000 |

| Total loan + CPF + cash | $2,465,000 |

| BSD based on $2,465,000 | $92,850 |

| Estimated affordability | $2,372,150 |

Wife’s affordability (Buying a private property)

| Description | Amount |

| Maximum loan | $680,000 |

| CPF funds | $70,000 |

| Cash | $300,000 |

| Total loan + CPF + cash | $1,050,000 |

| BSD based on $1,050,000 | $26,600 |

| Estimated affordability | $1,023,400 |

In the above calculations, we allocated all the cash proceeds from your current flat to enhance the husband’s budget. Given the substantial cash reserves available, you’ve more flexibility in adjusting your individual affordability by moving the cash around. Considering that one of the options you are exploring requires a budget of $2.6M, utilising all available cash funds (including the cash proceeds and both your and your husband’s available cash) would improve his individual affordability to $2.6M. However, this would also imply that there might not be enough funds remaining for a significant renovation.

Now, let’s examine your affordability in the scenario where you choose to purchase an HDB flat. Considering you are thinking about acquiring a second property in the event of an HDB purchase, we will assume that the HDB will be procured under the wife’s name, as the husband qualifies for a higher loan quantum.

Wife’s affordability (Buying an HDB)

| Description | Amount |

| Maximum loan based on age of 34 and an annual income of $100K with a 4.8% interest | $305,394 (25-year tenure) |

| CPF funds | $70,000 |

| Cash | $1,000,000 |

| Total loan + CPF + cash | $1,375,394 |

| BSD based on $1,375,394 | $39,615 |

| Estimated affordability | $1,335,779 |

*Given that your household income exceeds the $14k ceiling for an HDB loan, you will have to take up a bank loan for the HDB purchase

As the eligible loan quantum for an HDB is considerably lower, buying a $1.3M property would need $1,000,000 of cash to be put towards the purchase.

Now that we have a clearer idea of your affordability, let’s run through the options you’re considering.

Potential options

Option 1. Buy an HDB

Let’s take a look at how the Executive HDBs along Toh Yi Drive have been performing over the last 10 years.

| Year | Bukit Timah Executive HDB | YoY | All Executive HDB | YoY |

| 2013 | $591 | – | $426 | – |

| 2014 | $574 | -2.88% | $413 | -3.05% |

| 2015 | $597 | 4.01% | $401 | -2.91% |

| 2016 | $606 | 1.51% | $402 | 0.25% |

| 2017 | $590 | -2.64% | $405 | 0.75% |

| 2018 | $601 | 1.86% | $406 | 0.25% |

| 2019 | $604 | 0.50% | $397 | -2.22% |

| 2020 | $597 | -1.16% | $403 | 1.51% |

| 2021 | $671 | 12.40% | $453 | 12.41% |

| 2022 | $761 | 13.41% | $499 | 10.15% |

| 2023 | $792 | 4.07% | $529 | 6.01% |

| Average | – | 3.11% | – | 2.32% |

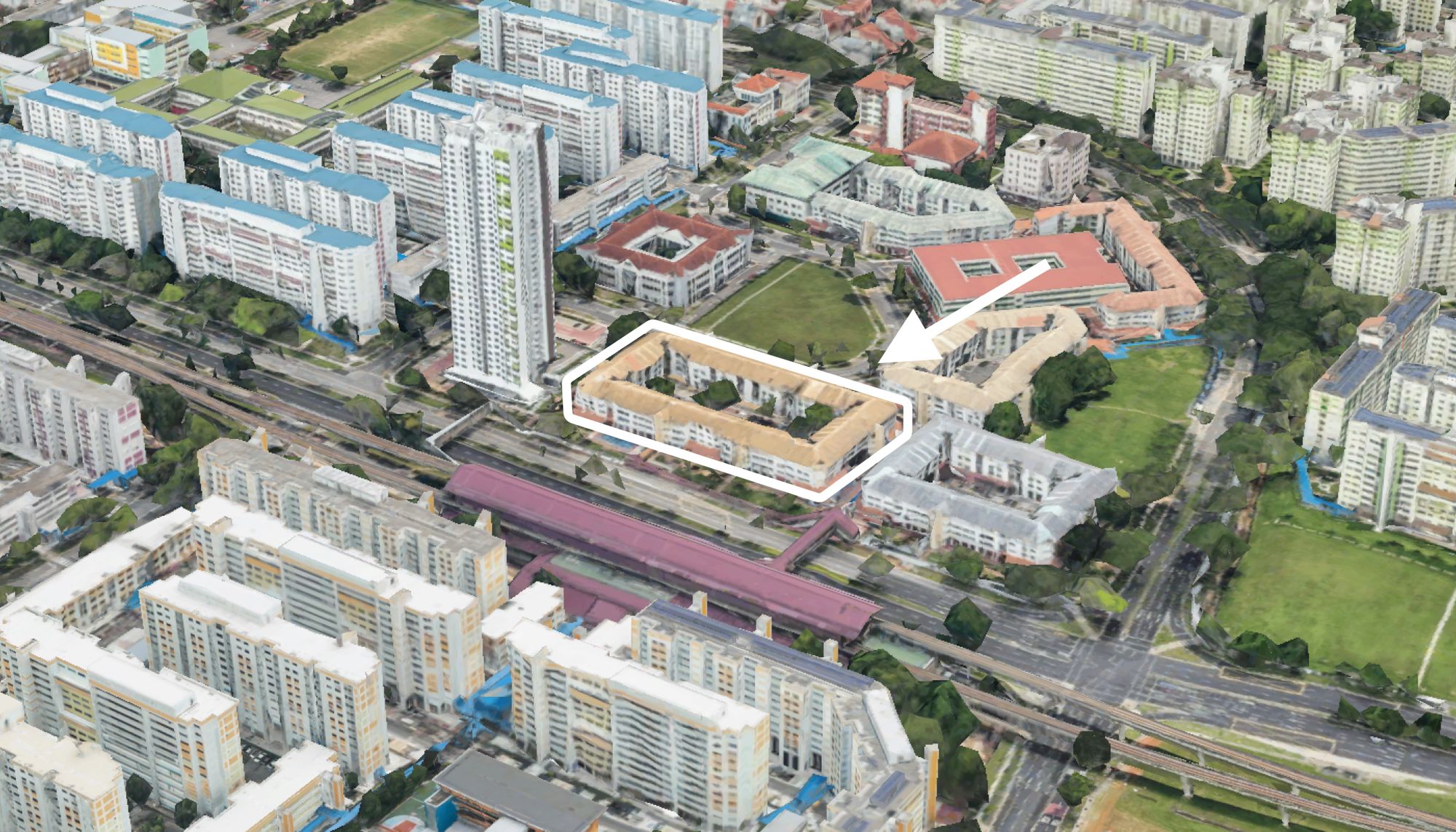

Analysing the table above, it is evident that the Executive units in Bukit Timah, on average, exhibit superior performance compared to other Executive flats across the island. This observation is unsurprising, given that Upper Bukit Timah is a highly desirable location. Toh Yi Gardens, being the sole HDB estate in the area, may also contribute to this trend. Additionally, its proximity within 1 km of the renowned Pei Hwa Presbyterian Primary School serves as an added draw for families with children.

The appeal of Toh Yi Gardens, given its pricing and prime location, remains strong despite its age. This is understandable, as comparable options within the same price bracket would only allow you to purchase smaller 1-bedroom condominiums nearby. Moreover, the expected revitalisation of Beauty World is poised to further enhance the property’s value retention prospects.

Nonetheless, it is essential to consider the implications of its 99-year leasehold status, particularly the impact of lease decay on long-term value. The market has witnessed a rapid price surge in the past three years, driven by unique conditions. However, as the market returns to stability, a return to the slower, more steady growth rates observed before the pandemic is likely.

Since you are looking to purchase an investment property next if you go down this route, let’s take a look at the costs involved.

These are some of the recent transactions for Executive units along Toh Yi Drive:

| Date | Block | Level | Size (sqm) & type | Price |

| Jan 2024 | 2 | 04 to 06 | 154.00Maisonette | $1,360,000 |

| Jan 2024 | 6 | 07 to 09 | 146.00Maisonette | $1,300,000 |

| Jan 2024 | 7 | 04 to 06 | 150.00Maisonette | $1,208,000 |

| Dec 2023 | 2 | 10 to 12 | 146.00Maisonette | $1,350,000 |

For calculation purposes, we will assume the purchase price to be the average of $1,304,500.

| Description | Amount |

| Purchase price | $1,304,500 |

| BSD | $36,780 |

| Maximum loan | $305,394 |

| CPF and cash needed | $1,035,886 |

Seeing as your child is still in primary school, we presume that you plan to stay in this property for a considerable amount of time. For our calculations, we will look at a 10-year horizon.

Cost incurred

| Description | Amount |

| BSD | $36,780 |

| Interest expense (Assuming 25-year tenure at 4% interest) | $105,971 |

| Property tax | $14,280 |

| Town Council service & conservancy fees | $12,840 |

| Total cost | $169,871 |

Now let’s look at the husband’s affordability for the second property.

| Description | Amount |

| Maximum loan | $1,149,704 (24-year tenure) |

| CPF funds | $190,000 |

| Cash* | $342,000 |

| Total loan + CPF + cash | $1,681,704 |

| BSD based on $1,681,704 | $53,685 |

| Estimated affordability | $1,628,019 |

*Total cash after deducting cash needed for the HDB purchase

Given that the husband can only purchase the second property 5 years later, the loan quantum and tenure will be reduced. It is most likely that during the 5 year Minimum Occupation Period (MOP), you would have saved up more funds to put towards the purchase, but for calculation purposes, we will only use the remaining cash on hand after deducting the cash used for the purchase of the HDB.

Let’s assume a purchase price of $1.6M, with a 3% rental yield. Looking at the same 10-year horizon, the holding period for the investment property will be 5 years.

| Description | Amount |

| Purchase price | $1,600,000 |

| BSD | $49,600 |

| CPF + cash | $532,000 |

| Loan required | $1,117,600 |

Cost incurred

| Description | Amount |

| BSD | $49,600 |

| Interest expense (Assuming 24-year tenure at 4% interest) | $208,923 |

| Property tax | $37,200 |

| Maintenance fees (Assuming $300/month) | $18,000 |

| Rental income | $240,000 |

| Agency fees (Payable once every 2 years) | $12,960 |

| Total cost | $86,683 |

Total cost for both properties over 10 years: $169,871 + $86,683 = $256,554

Option 2. Buy a freehold walk-up apartment

Let’s take a look at how the 3 walk-ups you’ve picked out have been performing.

| Year | Kilat 19 | Chun Tin Court | Sun Court | All non-landed FH/999y (resale) |

| 1995 | $441 | $403 | $651 | |

| 1996 | $399 | $422 | $815 | |

| 1997 | $444 | $365 | $774 | |

| 1998 | $566 | |||

| 1999 | $656 | |||

| 2000 | $397 | $321 | $745 | |

| 2001 | $352 | $616 | ||

| 2002 | $580 | $604 | ||

| 2003 | $203 | $564 | ||

| 2004 | $572 | |||

| 2005 | $601 | |||

| 2006 | $288 | $750 | ||

| 2007 | $321 | $920 | ||

| 2008 | $371 | $862 | ||

| 2009 | $513 | $861 | ||

| 2010 | $500 | $1,048 | ||

| 2011 | $684 | $1,196 | ||

| 2012 | $1,289 | |||

| 2013 | $1,427 | |||

| 2014 | $823 | $910 | $1,366 | |

| 2015 | $1,365 | |||

| 2016 | $1,396 | |||

| 2017 | $826 | $1,466 | ||

| 2018 | $1,239 | $1,544 | ||

| 2019 | $846 | $1,575 | ||

| 2020 | $1,504 | |||

| 2021 | $1,032 | $1,592 | ||

| 2022 | $1,146 | $1,714 | ||

| Overall % growth | 159.86% | 210.53% | 109.93% | 163.29% |

Due to the scarcity of units and limited transactions in these projects, we looked at data over a longer time to see the price trends. From 1995 to 2022, you can see notable growth in the projects, particularly with Kilat 19 and Chun Tin Court displaying growth rates comparable to or even exceeding those of the overall freehold and 999-year leasehold non-landed property market. However, it’s important to acknowledge that the still limited transaction data may not offer the most precise representation.

Nevertheless, over the past 15 years, there has been evident and steady price appreciation, indicating sustained demand for these projects. Nevertheless, as rightly highlighted in your list of drawbacks, walk-up apartments come with inherent challenges such as a restricted buyer pool and the inconvenience of the lack of a lift.

Conversely, as walk-up apartments are typically older, they boast more spacious interiors, providing a comfortable living environment. Some also feature unique characteristics that enhance the property’s charm.

Being freehold, there’s no concern about lease decay. However, as you correctly noted, these properties might not be suitable for long-term residence, especially for seniors. We have previously discussed various factors to consider when purchasing a walk-up in an article, most of which align with your observations.

You also raised the point of en-bloc potential and the height restrictions around it. This is generally true, as the low-density housing surrounding these walk-ups would likely be maintained to keep the characteristics of the neighbourhood. Since accurately predicting this en bloc is challenging, we do not recommend basing a property purchase solely on this factor.

Let’s now look at the costs involved.

We will use the latest transaction at Kilat 19 which was done in January 2022 at $2,110,000 for a 1,146 sq ft 3-bedroom unit, as the purchase price.

As we have seen with the affordability calculations earlier, it is possible to purchase a $2.3M solely under the husband’s name so you can keep the option of purchasing a second property open.

| Description | Amount |

| Purchase price | $2,110,000 |

| BSD | $75,100 |

| CPF + cash | $1,205,000 |

| Loan required | $980,100 |

As before, we will assume a 10-year holding period.

Cost incurred

| Description | Amount |

| BSD | $75,100 |

| Interest expense (Assuming 29-year tenure at 4% interest) | $351,273 |

| Property tax | $41,420 |

| Maintenance fees (Assuming $350/month) | $42,000 |

| Total cost | $509,793 |

Let’s say you were to purchase a second property for investment under the wife’s name for $1M, with a 3% rental yield.

| Description | Amount |

| Purchase price | $1,000,000 |

| BSD | $24,600 |

| CPF + cash | $370,000 |

| Loan required | $654,600 |

Since there is no waiting period required, we will assume a similar 10-year holding period.

Cost incurred

| Description | Amount |

| BSD | $24,600 |

| Interest expense (Assuming 30-year tenure at 4% interest) | $236,139 |

| Property tax | $36,000 |

| Maintenance fees (Assuming $250/month) | $30,000 |

| Rental income | $300,000 |

| Agency fees (Payable once every 2 years) | $13,500 |

| Total cost | $40,239 |

Total cost for both properties over 10 years: $509,793 + $40,239 = $550,032

Option 3. Buy a freehold condo

We will take a look at how the 3 projects you’ve picked out have been performing.

| Year | The Sterling | YoY | The Blossomvale | YoY | Maplewoods | YoY | All non-landed FH/999y (resale) | YoY |

| 2013 | $1,456 | – | $1,322 | – | $1,441 | – | $1,427 | – |

| 2014 | $1,579 | 8.45% | $1,390 | 5.14% | $1,389 | -3.61% | $1,366 | -4.27% |

| 2015 | $1,352 | -14.38% | $1,363 | -1.94% | $1,348 | -2.95% | $1,365 | -0.07% |

| 2016 | $1,371 | 1.41% | $1,283 | -5.87% | $1,342 | -0.45% | $1,396 | 2.27% |

| 2017 | $1,413 | 3.06% | $1,321 | 2.96% | $1,383 | 3.06% | $1,466 | 5.01% |

| 2018 | $1,662 | 17.62% | $1,552 | 17.49% | $1,551 | 12.15% | $1,544 | 5.32% |

| 2019 | $1,560 | -6.14% | $1,492 | -3.87% | $1,554 | 0.19% | $1,575 | 2.01% |

| 2020 | $1,607 | 3.01% | $1,506 | 0.94% | $1,728 | 11.20% | $1,504 | -4.51% |

| 2021 | $1,810 | 12.63% | $1,681 | 11.62% | $1,779 | 2.95% | $1,592 | 5.85% |

| 2022 | $1,919 | 6.02% | $1,868 | 11.12% | $1,938 | 8.94% | $1,714 | 7.66% |

| 2023 | $2,082 | 8.49% | $2,074 | 11.03% | $2,099 | 8.31% | $1,790 | 4.43% |

| Average | – | 4.02% | – | 4.86% | – | 3.98% | – | 2.37% |

The table clearly illustrates that in the past decade, the three developments have surpassed the performance of the broader freehold and 999-year leasehold non-landed private property market. Notably, during the market recovery period from 2017 to 2018, these three projects demonstrated substantial growth. This might be attributed to the introduction of Mayfair Gardens and Mayfair Modern, which are 99-year leasehold developments that were launched at significantly higher price PSF compared to the freehold projects in the surrounding area.

Let’s also look at your secondary considerations, Casa Esperanza and Meadowlodge

| Year | Casa Esperanza | YoY | All non-landed FH/999y (resale) | YoY |

| 2013 | – | – | $1,427 | – |

| 2014 | $1,315 | – | $1,366 | -4.27% |

| 2015 | $1,433 | 8.97% | $1,365 | -0.07% |

| 2016 | – | – | $1,396 | 2.27% |

| 2017 | $1,359 | – | $1,466 | 5.01% |

| 2018 | $1,466 | 7.87% | $1,544 | 5.32% |

| 2019 | $1,481 | 1.02% | $1,575 | 2.01% |

| 2020 | $1,631 | 10.13% | $1,504 | -4.51% |

| 2021 | $1,658 | 1.66% | $1,592 | 5.85% |

| 2022 | – | – | $1,714 | 7.66% |

| 2023 | $1,836 | – | $1,790 | 4.43% |

| Average | – | 5.93% | – | 2.37% |

Despite the consistent growth in prices at Casa Esperanza, this is a small development comprising only 90 units. The chart reveals multiple years with no transactions which poses a limitation to accurately capture its true appreciation through the average growth rate. In years with recorded unit sales, the transaction volumes remained low, typically not exceeding 4 per year.

Nevertheless, the development boasts a well-balanced mix of units, primarily featuring 3-bedroom units. This suggests a higher likelihood of homeownership compared to investor interest (likely due to the proximity to Methodist Girls Primary School).

| Year | Meadowlodge | YoY | All 99y non-landed (resale) | YoY |

| 2013 | $1,145 | – | $1,057 | – |

| 2014 | – | – | $1,029 | -2.65% |

| 2015 | $944 | – | $1,033 | 0.39% |

| 2016 | $1,089 | 15.36% | $1,129 | 9.29% |

| 2017 | $1,046 | -3.95% | $1,115 | -1.24% |

| 2018 | $1,147 | 9.66% | $1,153 | 3.41% |

| 2019 | $1,174 | 2.35% | $1,178 | 2.17% |

| 2020 | $1,148 | -2.21% | $1,173 | -0.42% |

| 2021 | $1,187 | 3.40% | $1,207 | 2.90% |

| 2022 | $1,352 | 13.90% | $1,337 | 10.77% |

| 2023 | $1,394 | 3.11% | $1,464 | 9.50% |

| Average | – | 5.20% | – | 3.41% |

Similarly, in the case of Meadowlodge, the absence of YoY data for 2014 and 2015 could cause discrepancy in accurately reflecting its appreciation. Nevertheless, a discernible upward trend in prices is evident.

The project which consists of just 64 units with a mix of 3 and 4-bedroom types, also leads us to assume that the majority of occupants are homeowners rather than investors. Another aspect to consider is the development’s age, with its 99-year lease commencing in 1997, it is 27 years old this year. If your plan is to hold the property for the long term, lease decay will be a concern.

In the analysis of 3-bedroom transactions for The Sterling, The Blossomvale, and Maplewoods in 2023, the units are minimally priced at $2.8M for 3-bedders sized between 1,300 – 1,400 sq ft. As such, acquiring the property jointly under both your names becomes necessary.

However, this is limiting if you decide to purchase a second property, which would require either decoupling or payment of Additional Buyer Stamp Duty (ABSD). Regardless, your combined affordability extends up to $3.3M, so the three projects you’ve shortlisted are financially feasible.

Let’s look at the costs incurred assuming a purchase price of $2.8M.

| Description | Amount |

| Purchase price | $2,800,000 |

| BSD | $109,600 |

| CPF + cash | $1,575,000 |

| Loan required | $1,334,600 |

Cost incurred

| Description | Amount |

| BSD | $109,600 |

| Interest expense (Assuming 30-year tenure at 4% interest) | $481,441 |

| Property tax | $78,800 |

| Maintenance fees (Assuming $420/month) | $50,400 |

| Total cost | $720,241 |

What should you do?

Let’s do a quick summary of all 3 options:

| Number of properties | Total costs over 10 years | |

| Option 1. Buy an HDB | 2 | $256,554 |

| Option 2. Buy a freehold walk-up apartment | 2 | $550,032 |

| Option 3. Buy a freehold condo | 1 | $720,241 |

From the options above, you can see that Options 1 and 2 offer the opportunity to own two properties at a lower overall cost compared to Option 3, where ownership is limited to one property but with higher associated expenses.

In Option 1, the combination of the lower cost of an HDB, coupled with rental income from the investment property, serves to offset expenses. As highlighted earlier, it’s advisable to segregate personal residence and investment properties if possible. Despite the HDBs along Toh Yi Drive being 35 – 36 years old, a combination of factors such as their sought-after location, and being the exclusive HDB cluster in the area may sustain demand and prices in the short to medium term. While lease decay may still emerge down the road, this is a location that is better off than most other areas. And given the current market conditions where prices and interest rates are still high, this might be an ideal route since it will also give you time to save up for the next place.

For Option 2, despite the freehold status of walk-up apartments eliminating concerns over lease decay, they possess drawbacks, as you mentioned. While they may be suitable for long-term hold, as evidenced by price appreciation from 1995 to 2022, they may not be the most practical choice as you age. Although there is demand for walk-up apartments, the potential buyer pool is narrower compared to conventional properties so their liquidity is lower. Nevertheless, this option provides the opportunity to acquire a second property for investment, offering an alternative avenue for profit generation.

Regarding Option 3, the higher price point of the projects necessitates joint ownership. Analysing their growth rates over the past decade reveals that all three developments have consistently outperformed the market. Considering their strategic location, tenure, proximity to amenities, and renowned schools, prices are likely to remain resilient in the long run. Although the costs associated with this option are higher, they are primarily driven by elevated interest rates.

From a risk-reward perspective, Option 1 seems to achieve the right balance of both market timing and prudence, while allowing you to purchase a second property later on for investment. Option 3 is also viable if considering long-term hold, however, you’ve mentioned the possible financial strain so this may not be the most optimal choice.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Read next from Editor's Pick

Homeowner Stories I Transformed My Two-Bedroom Unit Into A Dual-Key Layout – Here’s Why I Would Not Do It Again

Landed Home Tours We Toured An ‘Exclusive’ Freehold Landed Enclave In Singapore That Feels Close To Nature – And Even Has A Canal Running Through It

Overseas Property Investing I Left Singapore for New York and Ended Up Launching a $450M Manhattan Project. Here’s What I Learned About Buying Property Here

On The Market Rare Detached Freehold Home On Singapore’s ‘Millionaire’s Row’ Up For Sale At $14m

Latest Posts

Singapore Property News How A Waterfront Development With 4,000 Homes Is Going To Reshape Singapore’s Property Market

On The Market 5 Rare HDB Flats Above 1,700 Sq Ft You Can Buy Right Now – From $850K

Pro District 15 Resale vs New Launch Condos – Analysing Price Gaps for Larger Family Units

Property Investment Insights Are Singapore’s Suburban Condos Still Affordable? The Surprising Truth

On The Market Rare 16,000 Sq ft Freehold Plot In D15 Hits The Market For $39M

Pro New Launch vs Resale One and Two Bedders in D15: Here’s Where The Price Gaps Are The Biggest

Property Market Commentary Why More Families Are Choosing Two-Bedders Over Bigger Properties in 2025

Property Market Commentary What The URA Master Plan Reveals About Marina Bay’s Future (And How It Could Impact Property Values)

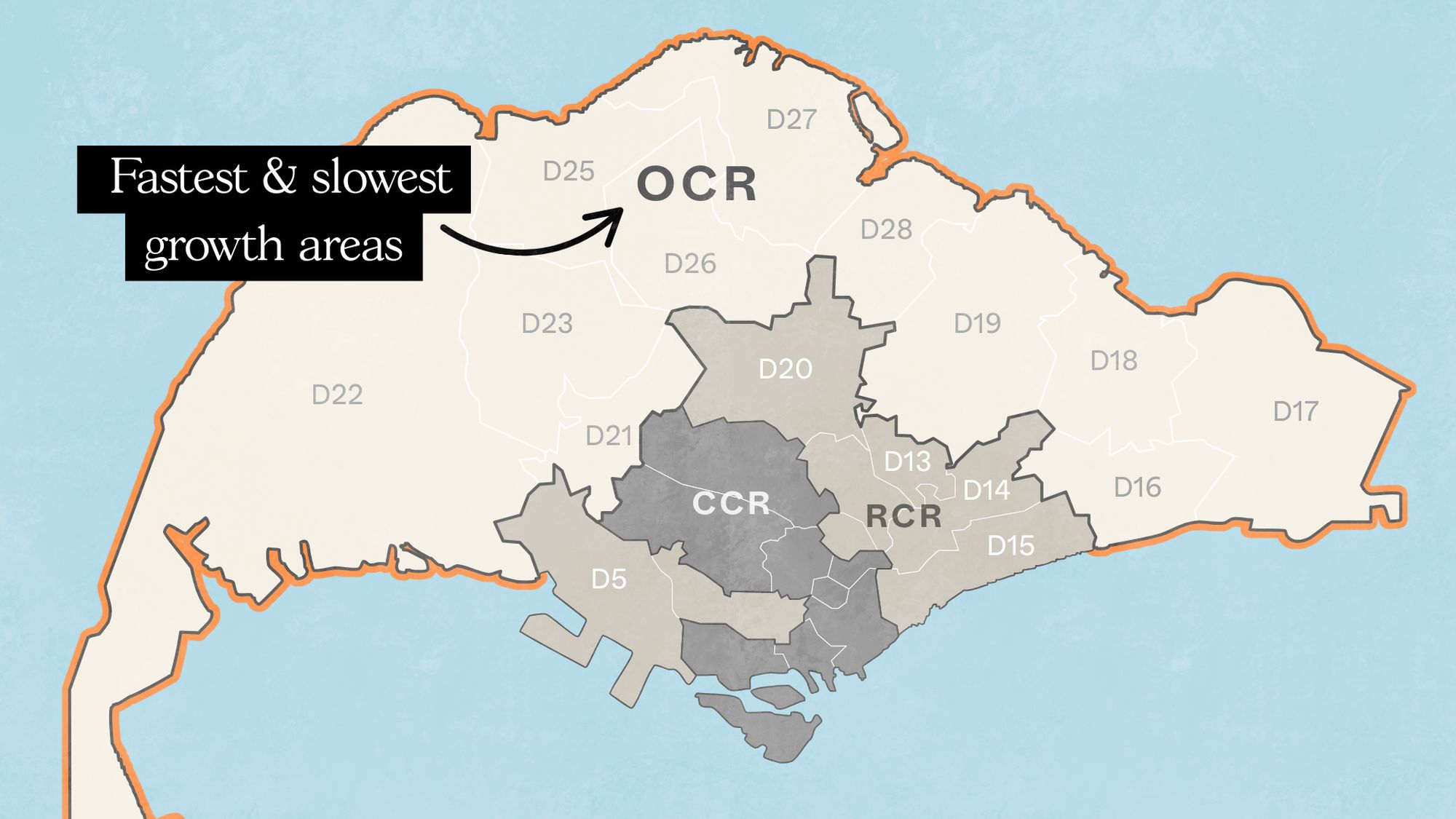

Singapore Property News Where Condo Prices Rose Fastest (and Slowest) in Singapore’s Outside Central Regions

On The Market 5 Cheapest Freehold 3-Bedroom Condo Units In Singapore You Can Buy This Week – Including Quiet Spot in Floraville

Pro Analysing 10 Years of District 12 Boutique Condo Transactions: Insights Into What Drives Profitability

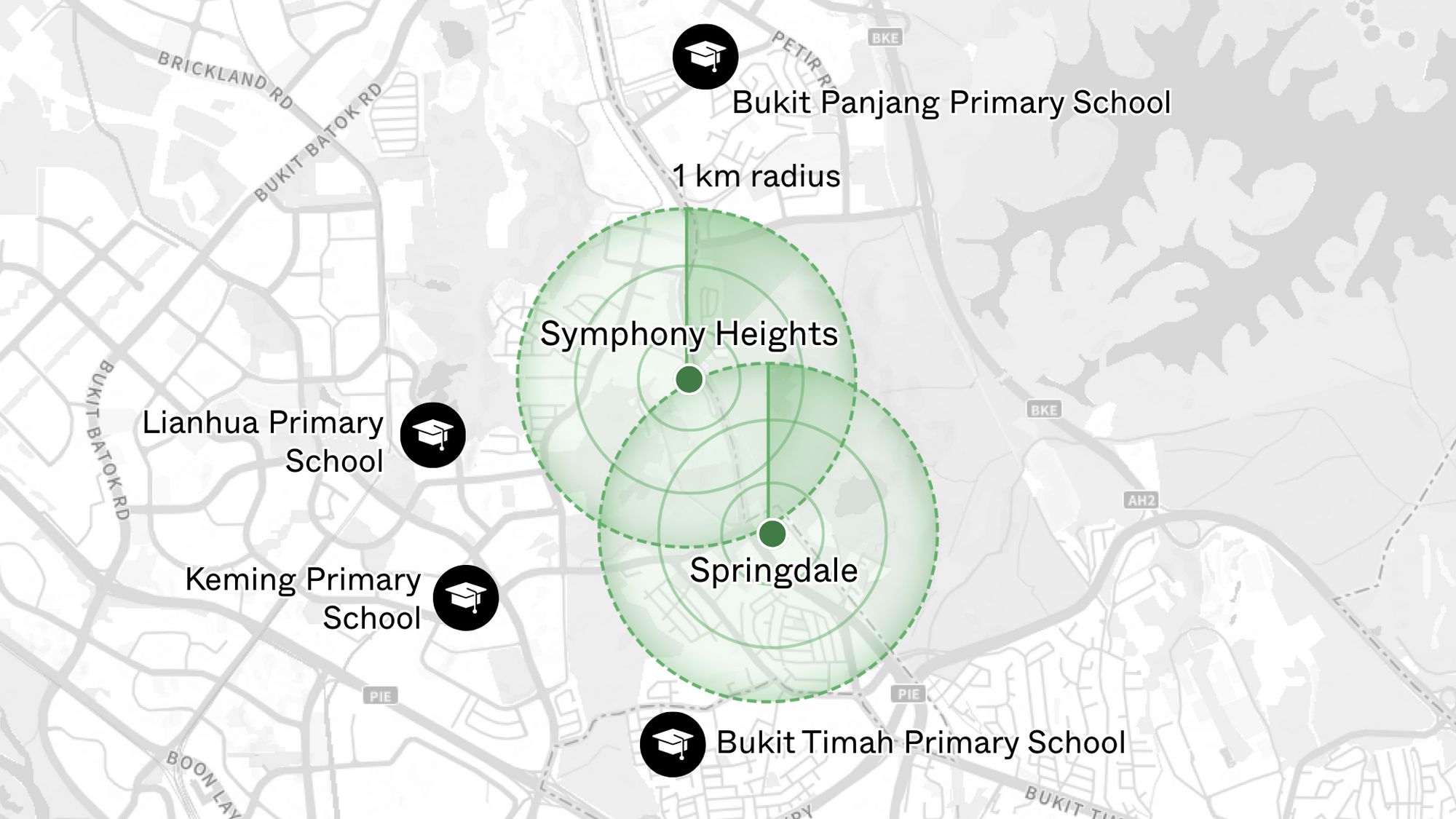

Property Investment Insights Do Primary Schools Really Matter For Property Prices In Singapore? These 6 Condos Suggest Otherwise

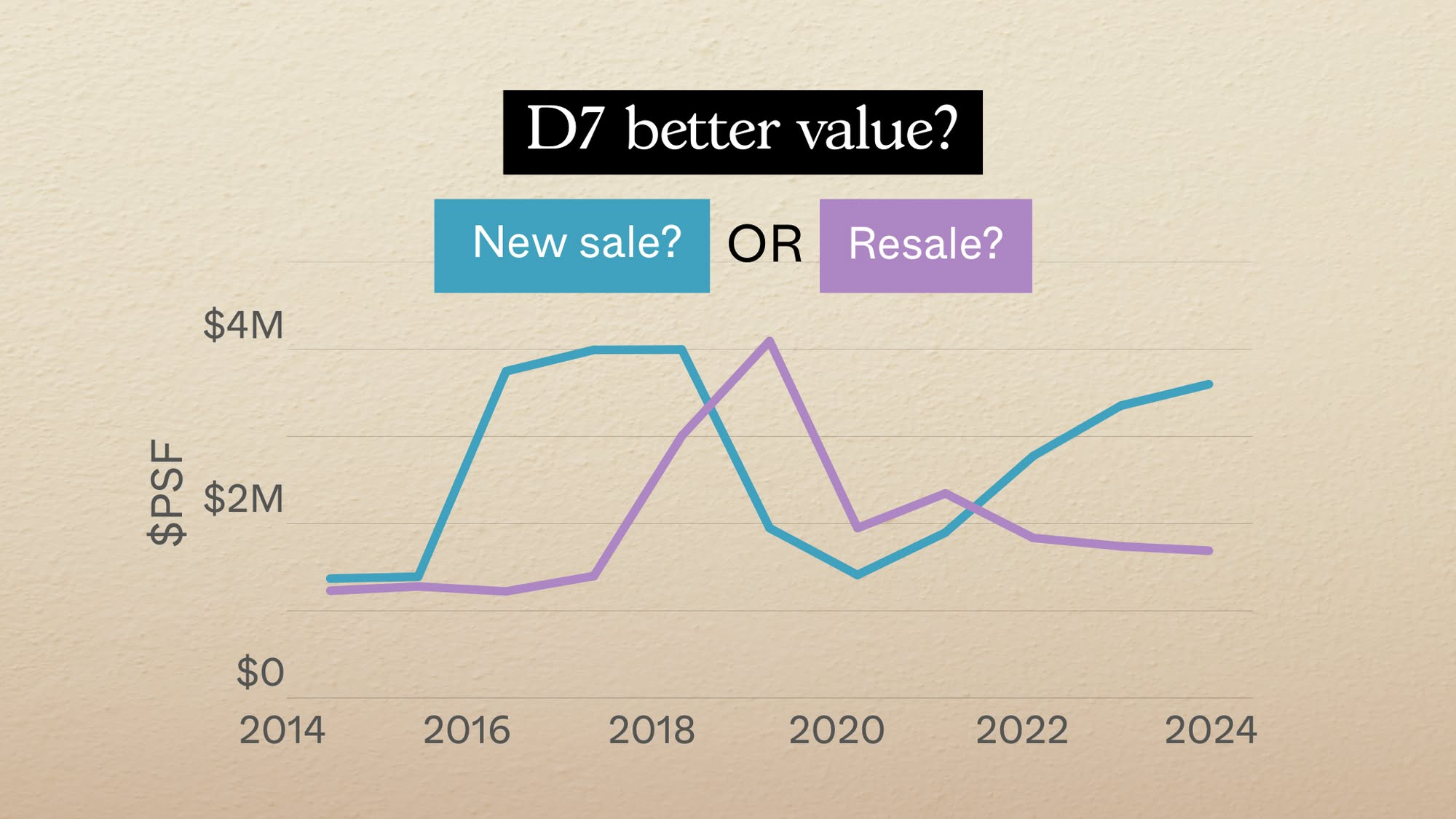

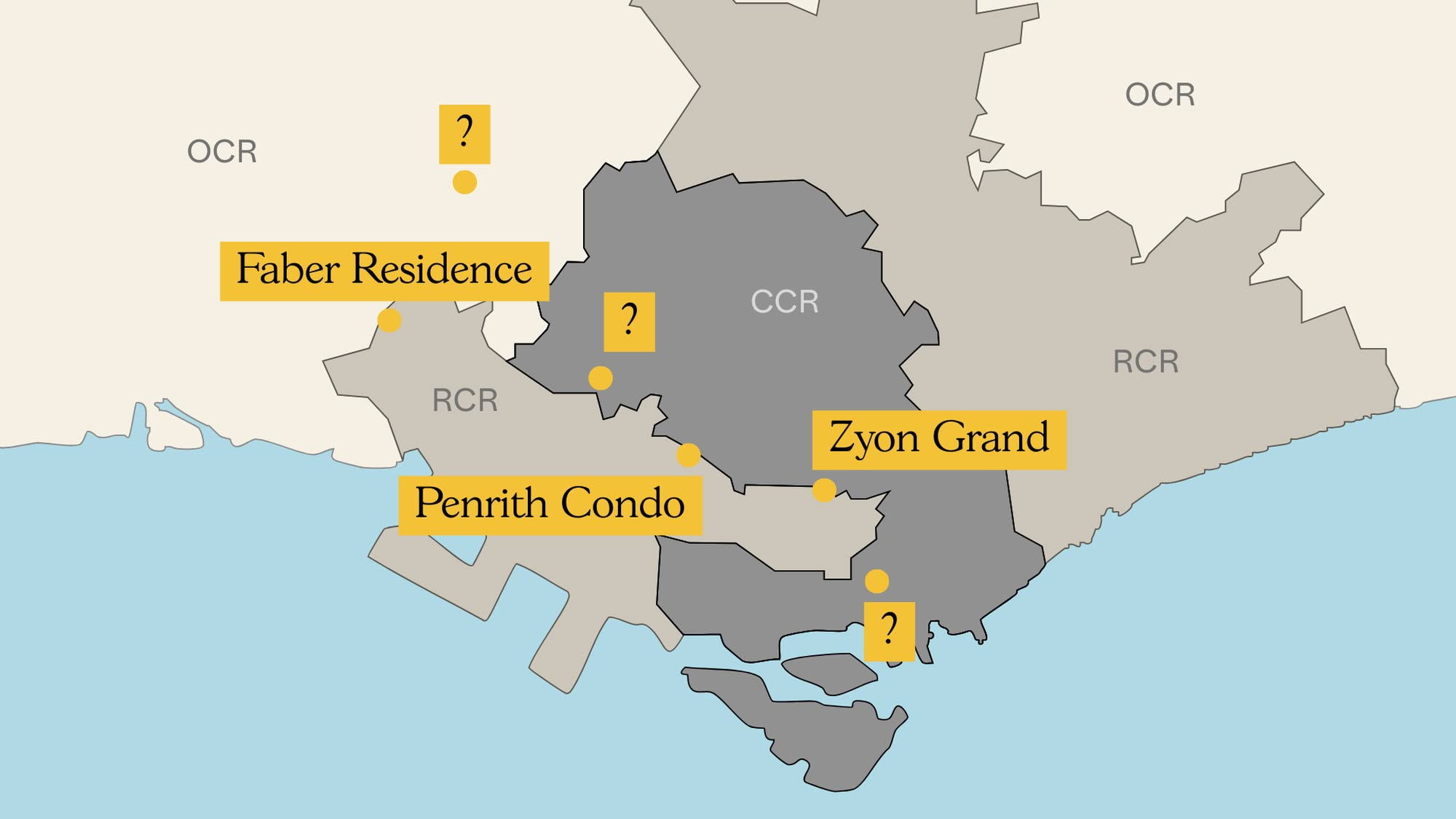

Pro New Launch vs Resale Condos in District 7: Which Bedroom Types Offer Better Value Today?

Property Market Commentary 6 Upcoming New Condo Launches To Keep On Your Radar For The Rest Of 2025

Singapore Property News Decoupling Is No Longer a Property Hack: What the Courts and IRAS Have Made Clear