We Make $15k Per Month And Own An Executive Apartment In Queenstown: Should We Keep It Or Sell To Upgrade To A Condo?

October 14, 2022

Hi Stacked Homes!

You guys are an amazing trove of information for all things related to home buying/selling, with articles that are clear and easy to understand/digest. I appreciate the amazing work the team has put in to make this site an integral resource for anyone who hopes to learn more.

Speaking of learning more, I would like to seek your opinion on the following;

We are a family with children already in primary school. My wife & I are in our early 40s with a combined income of S$15K.

We do not have any outstanding liabilities, save for our HDB loan (serviced via CPF, with less than $200K remaining. Total CPF used is about $400K and accrued interest from CPF is less than $150K) and a car loan which cost us about $1.1K monthly. Our current property is an EA in Queenstown which is almost 30 years old.

An agent knocked on my door recently and painted a rosy picture of how we stand to benefit if we were to sell off our EA and upgrade to a condominium.

The reality is that my wife and I are very comfortable where we are and have never considered upgrading to a condominium until we spoke to this agent (which led us to browsing online portals and looking for resources to find out more and discovering Stacked Homes in the process!).

ABSD is pretty much a no go (not considering buying 2nd property) so selling the EA is probably the way to go should we choose to upgrade.

Should we decide to upgrade, what we hope to get out of this exercise is asset/capital appreciation without any degradation in our current lifestyle (i.e. pay for the bank loan for new property entirely via CPF), with the aim of downgrading in the future when we’re ready to retire.

Is that feasible/possible or is it a pipe dream?

We are also hoping to learn more about how these new restrictions in place will affect us (i.e. smaller pool of buyers from condo downgraders) as potential seller who are considering if we should list our EA after this round of cooling measures.

Hopefully to hear back from you awesome folks on what are the options available to us.

Thank you!

Hi there!

Thank you for your kind words, we really appreciate the support and it’s always nice to hear how our content has helped.

You are not the first homeowner to have these thoughts and questions after having spoken to an agent and will surely not be the last. Many homeowners are comfortable where they are and unless someone or something comes along to trigger them, they probably will not think of moving either. In fact, some HDB owners may have never thought they could be able to afford a private property until the sums are actually done for them.

That being said, while it doesn’t mean you can afford it on paper, that means that upgrading to a private property is a sensible choice either. There have been home owners that have been urged to upgrade, only to be stuck later on paying for a house that they don’t actually need either.

As such, let us first take a look at your affordability to see if this is a feasible option!

To start, let’s see the recent Executive Apartment transactions in the area.

Recent Executive Apartment (EA) transactions in Queenstown:

| Date | Block | Street | Level | Size (sqm) | Completion Year | Resale Price |

| Sep 2022 | 148 | Mei Ling Street | 22 to 24 | 156 | 1995 | $1,250,000 |

| Aug 2022 | 148 | Mei Ling Street | 01 to 03 | 145 | 1995 | $1,130,000 |

| Aug 2022 | 150 | Mei Ling Street | 01 to 03 | 142 | 1995 | $1,100,000 |

| Mar 2022 | 150 | Mei Ling Street | 04 to 06 | 142 | 1995 | $1,046,000 |

| Feb 2022 | 148 | Mei Ling Street | 01 to 03 | 149 | 1995 | $1,080,000 |

Based on these transactions, the average price of an EA in Queenstown is estimated to be $1,121,000.

| Description | Amount |

| Sale price | $1,121,000 |

| Outstanding loan | $200,000 |

| CPF used plus accrued interest | $550,000 |

| Cash proceeds | $371,200 |

Assuming you were to sell at the average price of $1,121,000, your cash proceeds will be approximately $371,200.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

| Description | Amount |

| Maximum loan based on $15K combined income, assumed ages of 42 and a car loan of $1100/month | $1,288,868 (23 years tenure) |

| Monthly repayment based on 4% interest rate | $7,150 |

| CPF funds (refunded after sale of EA) | $550,000 |

| Cash (using $200,000 from the cash proceeds and saving the rest as emergency funds) | $200,000 |

| Total loan + CPF + cash | $2,038,868 |

| BSD based on $2,038,868 | $66,155 |

| Estimated affordability | $1,972,713 |

As we do not know if you have more CPF funds or cash on hand that you would like to put into the new property, this calculation only includes the CPF refund and cash proceeds received from the sale of the EA. Naturally, this could be more should you be able to put more cash up, but just based on this, your estimated affordability is $1.97M.

| Age of employee | CPF allocation for Ordinary Account | CPF allocation for Special Account | CPF allocation for Medisave |

| Up to 35 years old | 23.0% | 6.0% | 8.0% |

| 35 to 45 years old | 21.0% | 7.0% | 9.0% |

| 45 to 50 years old | 19.0% | 8.0% | 10.0% |

| 50 to 55 years old | 15.0% | 11.5% | 10.5% |

| 55 to 60 years old | 12.0% | 5.5% | 10.5% |

| 60 to 65 years old | 3.5% | 4.5% | 10.5% |

| 65 to 70 years old | 1.0% | 2.5% | 10.5% |

| Above 70 years old | 1.0% | 1.0% | 10.5% |

From what you’ve mentioned, your current age of early 40s will put you in the 35 – 45 years old range. And based on a combined income of $15K a month, 21% of that would be $3,150, which goes into your Ordinary Account (OA) every month. Assuming you each make $7500 a month, with CPF’s cap on ordinary wages at $6000 and including employer’s contributions at 17%, $2220 goes into your CPF accounts monthly. Of this $2220, $1260.29 goes into your OA. So combined, $2520.58 goes in both your CPF OAs each month.

Buying a $1.97M property would mean that you’ll have to top up an extra $4,000 $4629.42 in cash every month for the repayment of the loan which is a rather substantial amount. So as you mentioned, if having to top up additional cash each month to repay the loan is a deal breaker for you guys, then this may not be a viable option.

Be that as it may, let’s take a more in-depth look at whether it is a worthwhile sacrifice to make!

Executive HDB in Queenstown

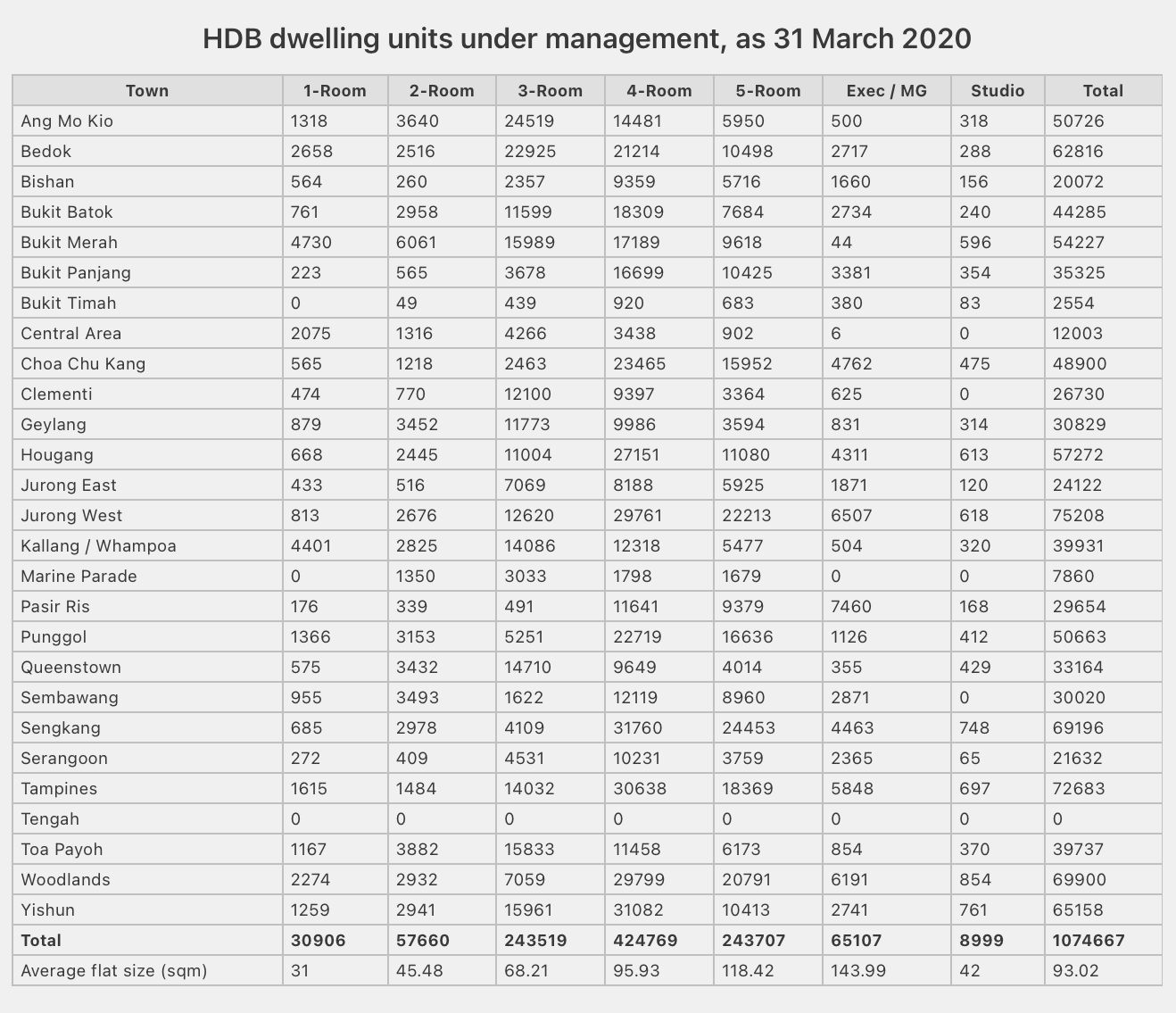

We can see from the table above that Queenstown has one of the lowest numbers of executive flats after Bukit Merah, the Central Area and Marine Parade (which does not have any). Given its strategic location and limited supply, it is inevitable that prices will be higher than other estates.

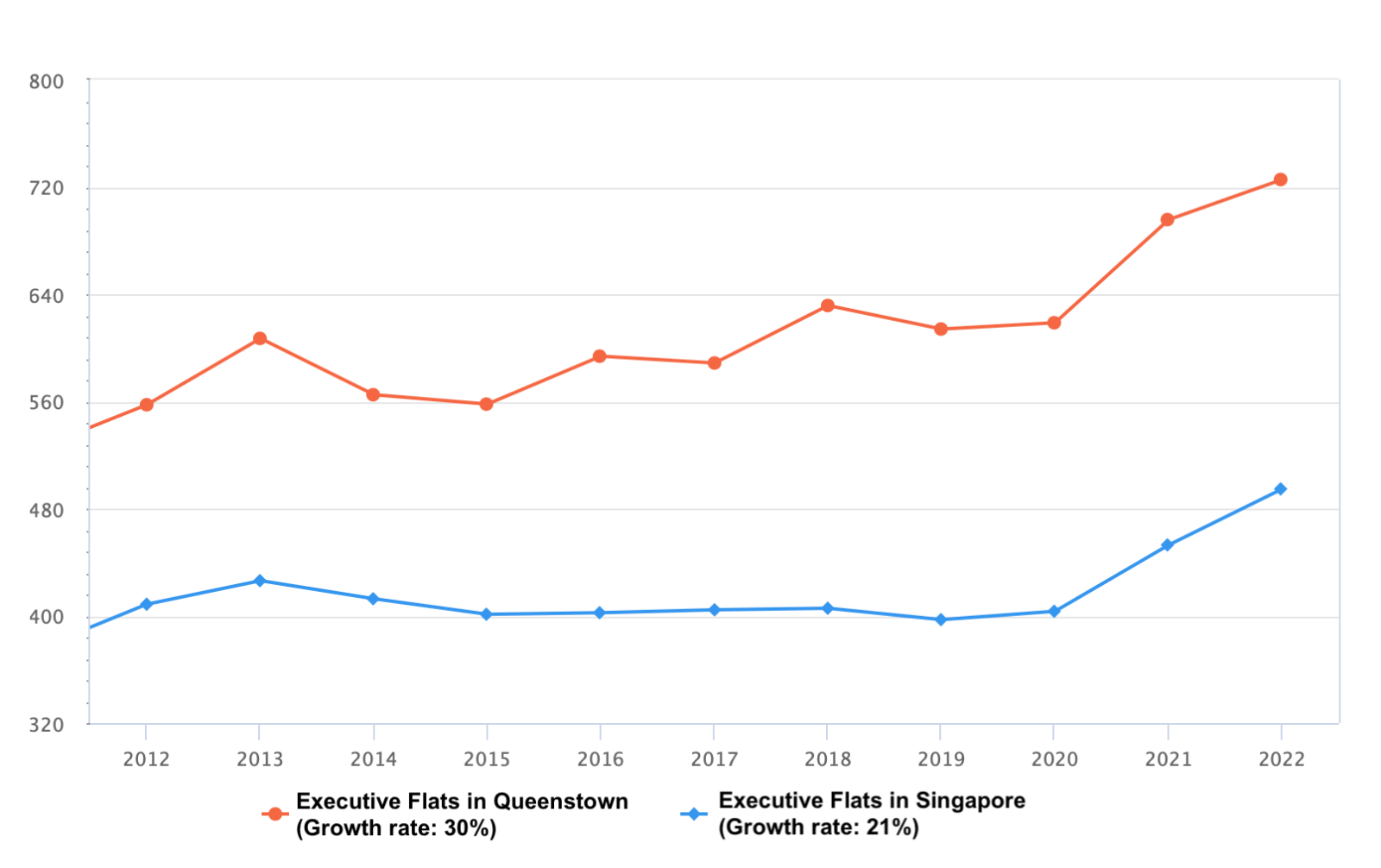

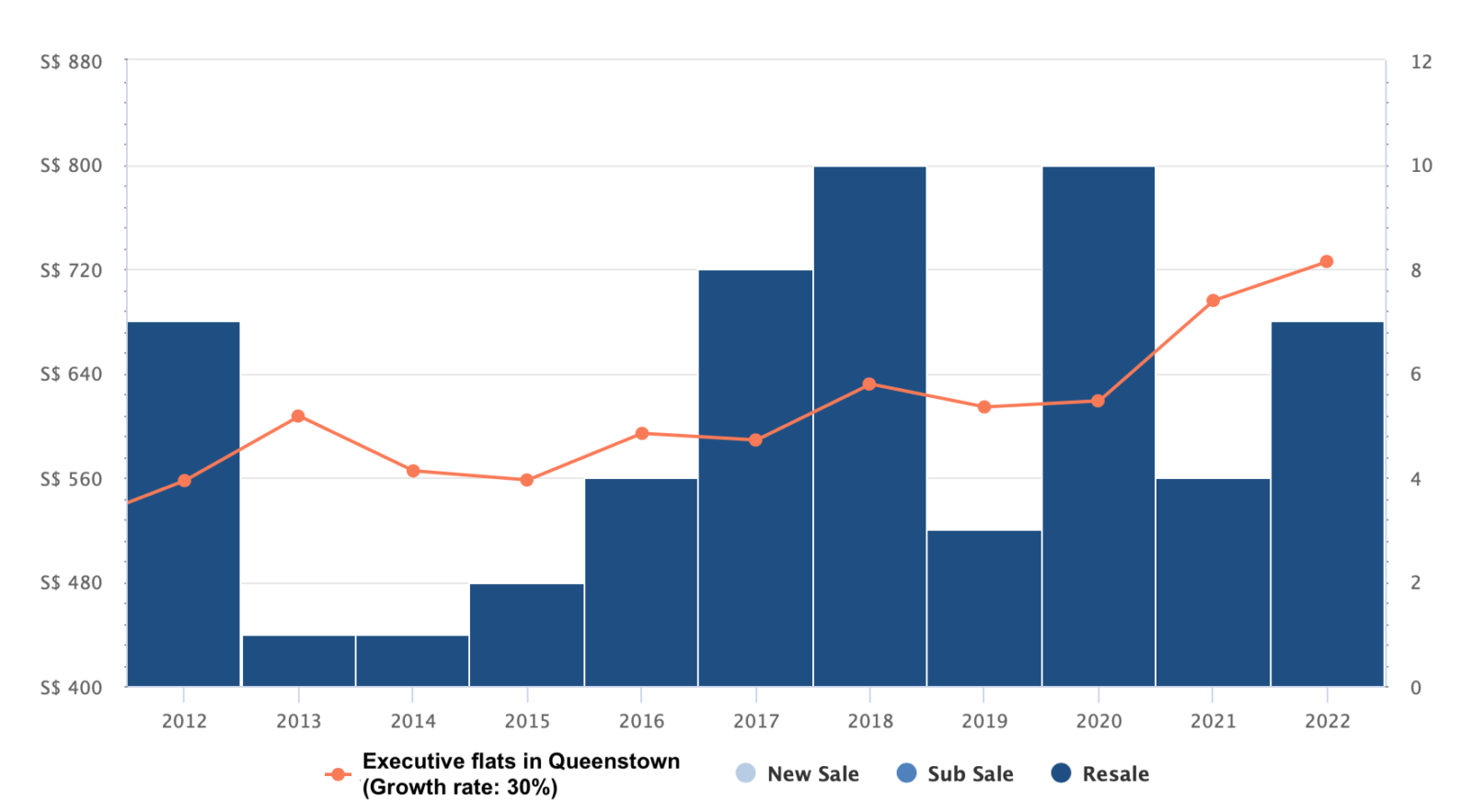

Most of the executive units in Queenstown were completed in 1993 – 1995 which makes them 27 – 29 years old at this point in time. In spite of their age, prices have been keeping up with the overall market and its growth over the last 10 years has exceeded that of the overall price growth for executive units in Singapore.

The first executive flat in Queenstown that hit the $1M mark was a unit at 149 Mei Ling Street located on #16-18 in July 2012 when the block was 17 years old. Since 2018, the majority of the executive flats being transacted in Queenstown were sold above $1M.

Given its rosy outlook so far, should you still hold onto your flat? Let’s take a look at the depreciation effects by taking a look at the next biggest flat type in Queenstown – 5-room flats.

| Completion Year | Average Size (sqm) | Average Price | % Difference |

| 1975 – 1980 | 118.64 | $797,679 | – |

| 1990 – 1999 | 127.33 | $945,608 | 18.54 |

| 2000 – 2010 | 110.47 | $891,172 | -5.76 |

| 2011 – 2016 | 111.7 | $1,077,297 | 20.89 |

For now, the current market is unique with old flats still transacting at high prices so it may not be the best representation of how a property moves in a regular market. Nonetheless, we can still see from the table above that flat prices generally decline as they age, even in a centralised location like Queenstown. The reason for the 5 room units completed between 1990 – 1999 being higher than those completed in 2000 – 2010 could be due to their much bigger sizes.

Lease decay is a real issue with leasehold properties so holding onto the HDB for the long term may not be the wisest thing to do.

Editor’s Note (03 Nov 2022): We’ve adopted the use of the Resale Price Index (10-year horizon) in our calculations to project prices into the future. This figure is a moving target over the quarters and will be reflected in our advice article at the point of writing. As of 2022Q3, the RPI stands at 168.1. Compared to 2012Q4 (146.7), this is a 14.58% jump in 10 years.

Let’s do a 10-year projection if you were to stay put in the EA:

| Description | Amount |

| Assuming | $1,284,666 |

| Current valuation | $1,121,000 |

| Interest costs (based on outstanding loan of $200K at 2.6% interest and assuming 10 years of lease tenure remaining) | $27,341 |

| Property tax (assuming $27,600 annual value – (avg rental at $3300 minus $1000 for furniture & maintenance fees) | $7840 |

| Town council service & conservancy fees (at $108.50/month) | $13,202 |

| Estimated gains | $115,283 |

Private options

Seeing that you are currently living in an EA in Queenstown, we presume that space and location are both important factors for you. Based on $1.97M, these are some resale options that are decently sized in the central region that are available on the market:

| Project | District | Tenure | Completion Year | Unit Type | Size (sqft) | Asking Price |

| Bishan 8 | 20 | 99 years | 2000 | 4 bedroom | 1173 | $1,900,000 |

| The Aberdeen | 12 | Freehold | 1998 | 3 bedroom | 1302 | $1,848,000 |

| D’Leedon | 10 | 99 years | 2014 | 3 bedroom | 1216 | $1,950,000 |

| Water Place | 15 | 99 years | 2004 | 3 bedroom | 1216 | $1,950,000 |

These developments may or may not be suitable for you, and it is best to consult with an agent for further analysis. But for the sake of comparison with a budget of $1.97M, options in central locations are pretty limited but if you are open to looking at projects outside the central region, there will certainly be more choices.

Let’s assume you were to buy the D’Leedon unit at $1.95M:

| Description | Amount |

| Purchase price | $1,950,000 |

| CPF funds | $550,000 |

| Cash | $200,000 |

| BSD | $62,600 |

| Loan | $1,262,600 |

| Monthly repayment (4% interest with 23 year tenure) | $7,001 |

Editor’s Note (03 Nov 2022): We’ve adopted the use of the Property Price Index (10-year horizon) in our calculations to project prices into the future. This figure is a moving target over the quarters and will be reflected in our advice article at the point of writing. As of 2022Q3, the PPI stands at 187.1. Compared to 2012Q4 (151.5), this is a 23.5% jump in 10 years.

10-year projection:

| Description | Amount |

| Assuming | $2,408,250 |

| Current valuation | $1,950,000 |

| Interest costs (based on loan of $1,262,600 at 4% interest with a 23 year tenure) | $428,860 |

| Property tax (assuming $44,796 annual value – (avg rental at $5733 minus $2000 for furniture & maintenance fees) | $14,718 |

| MCST (assuming $350/month) | $42,000 |

| Estimated gains | -$27,328 |

Do note that these projections are merely an estimate on paper and are meant to simply serve as a guide. There are, of course, many things that can change which can alter the trajectory of a property, like the revising of plot ratio in the next Master Plan or the addition of an MRT line which cannot be accounted for here. Comparing the two 10-year projections, holding a private property will net you $100,962 more $142,611 less than if you were to hold on to the HDB for the next 10 years.

However, with a monthly repayment of $7,001 for the private property, you will have to top up $3,851 $4480.42 in cash as your CPF OA contributions a month are $3,150 $2520.58 based on a monthly combined income of $15K (assuming $7,500 each). This will without a doubt have an impact on your lifestyle and for an additional $10K of profits each year, it may not be the most worthy tradeoff.

If we were to only utilise your monthly CPF OA contributions to pay off the mortgage, based on a 4% interest rate over 23 years, the maximum loan quantum will be $560,000 $454,000.

| Description | Amount |

| Loan | |

| CPF funds | $550,000 |

| Cash | $200,000 |

| Total loan + CPF funds + cash | |

| BSD based on $1,310,000 | |

| Estimated affordability |

Editor’s notes 18 Oct 2022 1430: We previously highlighted condos within the $1.2+ million range – Westwood Residences, The Terrace, Signature at Yishun and Bellewoods as a result of an inaccurate CPF OA contribution amount. We apologise for the error and have updated the figures.

The previous options are not applicable since the new budget is $100K lower than before, so these are some options that are within your budget of $1.17M:

| Project | District | Tenure | Completion Year | Unit Type | Size (sqft) | Asking Price |

| Westwood Residences | 22 | 99 years | 2018 | 3 bedroom | 1034 | $1,150,000 |

| The Terrace | 19 | 99 years | 2018 | 3 bedroom | 1001 | $1,146,888 |

| Signature at Yishun | 27 | 99 years | 2017 | 3 bedroom | 947 | $1,150,000 |

| Blossom Residences | 23 | 99 years | 2014 | 3 bedroom | 969 | $1,168,888 |

Let’s assume you were to purchase a unit at Westwood Residences at $1.15M:

| Description | Amount |

| Purchase price | $1,150,000 |

| CPF funds | $550,000 |

| Cash | $200,000 |

| BSD | $30,600 |

| Loan | $430,600 |

| Monthly repayment (4% interest with 23-year tenure) | $2,389 |

10-year projection:

| Description | Amount |

| Assuming | $1,420,250 |

| Current valuation | $1,150,000 |

| Interest costs (based on a loan of $430,600 at 4% interest with a 23-year tenure) | $146,259 |

| Property tax (assuming $19,800 annual value – (avg rental at $3650 minus $2000 for furniture & maintenance fees) | $4720 |

| MCST (assuming $350/month) | $42,000 |

| Estimated gains | $77,271 |

In this case, you will not have to top up any cash for the monthly mortgage and at the end of 10 years, the projected return is $79,734 $51,024 more $38,012 less than if you were to hold on to the HDB.

Should you move to a private property?

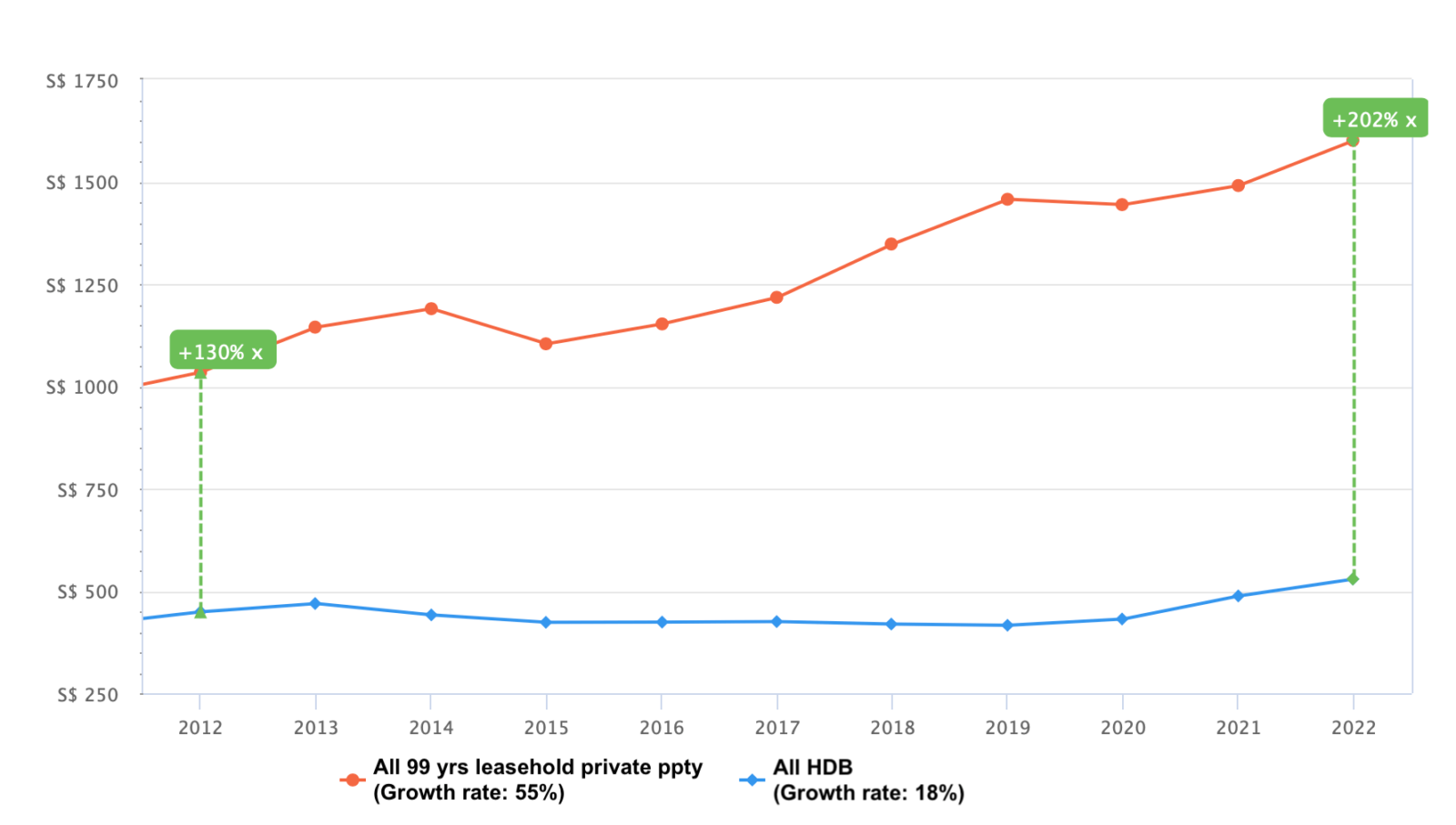

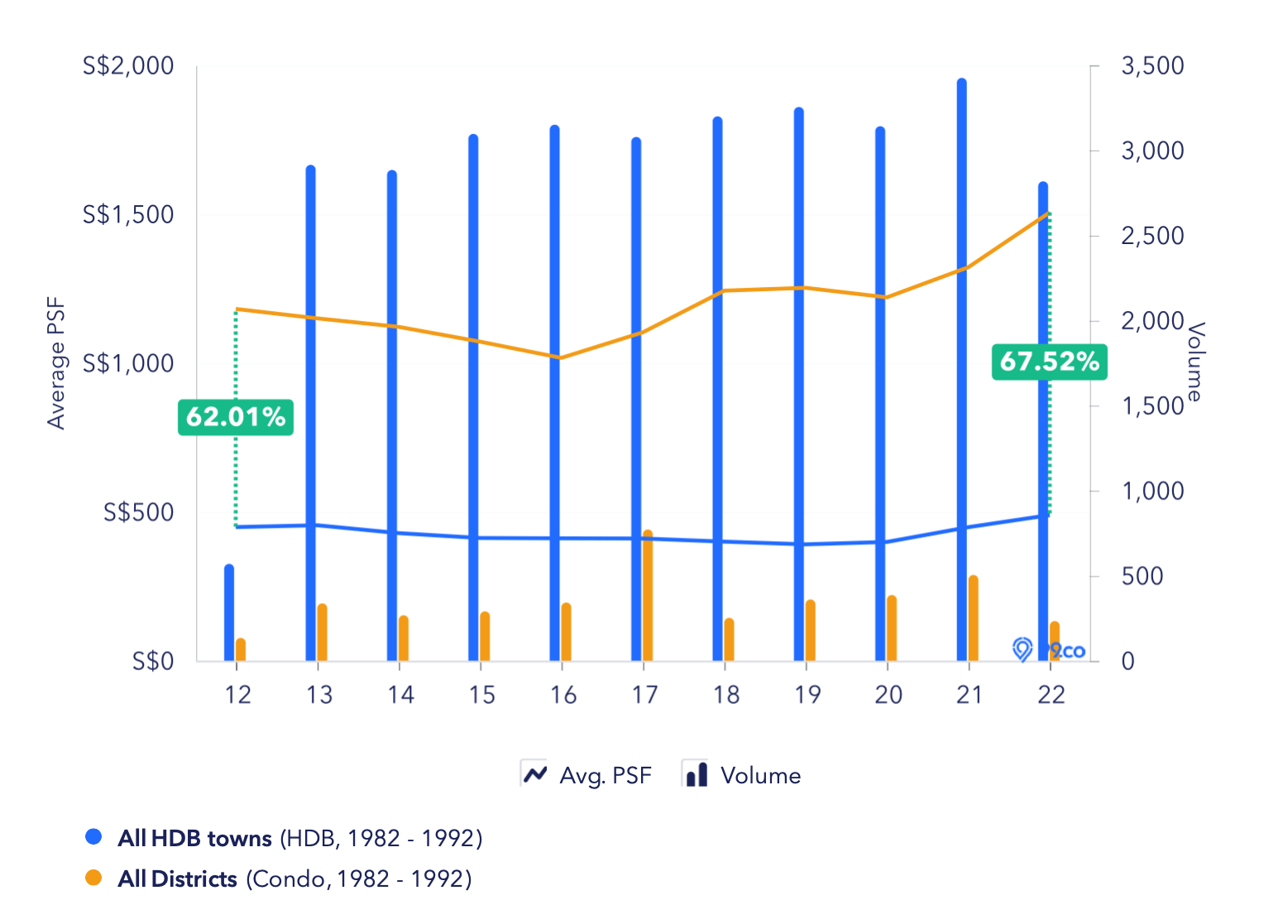

From the graph above we can see that the price disparity between an HDB and a private property is widening over the years and making it increasingly challenging for HDB owners to upgrade to private property.

This graph shows the price trends of HDBs and private condominiums that were completed between the years 1982 – 1992, making them 30 – 40 years old now. Even at this age, the price gap is still significant at over 60%.

Pros of owning a private property:

- Private property owners have more control

- Unlike a HDB, private property owners have a choice of collectively putting up their project for sale to potential developers. This option helps to resolve the issue of lease decay as owners may still stand to profit even when the development is old.

- Forced savings for retirement

- Let’s say you were to purchase a $1.2M private property at 40 years old and take up a loan with 25 years of tenure. At the end of the loan tenure, you have a fully paid-up property. If the price remains stagnant at $1.2M, you’ve managed to accumulate $1.2M of forced savings which will allow you to easily downgrade to an HDB and still have funds left over as additional support for your retirement.

Cons of moving to a private property:

- Change in lifestyle

- With the monthly repayment for a private property more than doubling your current mortgage for the HDB (if you were to take the maximum loan possible), it will definitely have an impact on your way of life.

- Monthly expenses go up

- Monthly maintenance fees eat into your available cash.

- Compromise in terms of location or size

- Due to budget constraints, you will probably have to choose between either a smaller unit in a more favourable location or a spacious unit in a less ideal location.

You’ve mentioned that should you guys decide to upgrade, besides the asset/capital appreciation, it is also with the aim of downgrading in the future when you’re ready to retire so we assume your plan is to stay in this next property for the long term.

If that is the case, it is a logical move to take advantage of the current market to switch up the HDB for a private property with a higher growth potential seeing that the HDB will be 45 – 50 years old in 15 – 20 years time. Besides the lease decay, the buyer pool will also be reduced given that younger buyers will not be able to fully utilise their CPF funds or be eligible for the full CPF Housing Grants or HDB loan.

We’d just caution against buying old leasehold private properties since the lease decay can eat into the future value of your home.

How will the latest cooling measure affect you?

The latest round of cooling measures will likely affect HDB owners like yourself who are looking to sell highly valued flats as a portion of potential buyers are made up of private property owners looking to cash out.

From the HDB website, you’re able to check on the transacted prices but not the Cash Over Valuation (COV) amounts that were paid, if any. A buyer that purchased an executive unit at 150 Mei Ling Street in February last year actually paid a hefty COV of $179K! It’s not impossible, but it’s more challenging for a first-time home buyer to be willing to fork out such a huge amount of cash for an HDB flat. Private property downgraders on the other hand who’ve managed to cash out a tidy profit on their homes would be more open to paying to secure a unit they deem worthy of its asking price even if it’s above market rate.

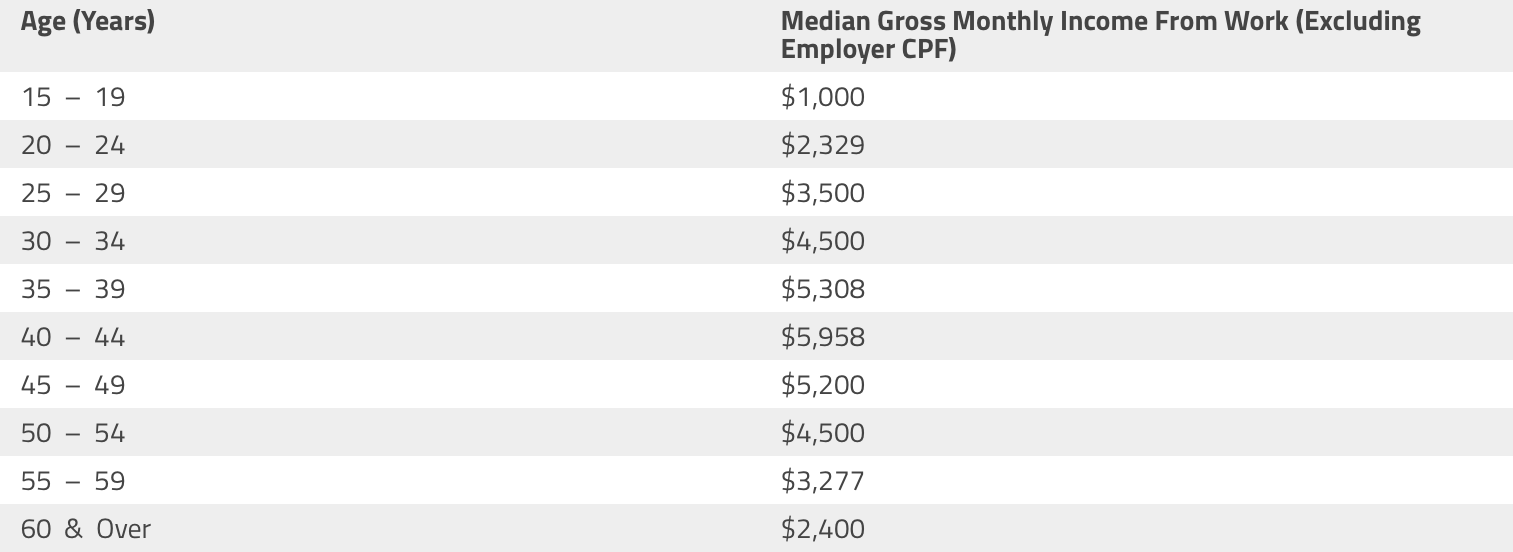

In order for a buyer under 40 years old to purchase a $1.1M flat and take the maximum loan, they’d have to be drawing an individual/combined income of at least $15K per month. For older buyers, they’d have to be drawing a higher salary as the loan tenure will be shorter. As this group of buyers will not be eligible for an HDB loan due to their incomes, they’ll have to take a bank loan which means they’ll need minimally $275K of cash and CPF funds to pay for the downpayment.

Looking at the median Singaporean income in 2021, an average Singaporean is unlikely able to afford to purchase a million-dollar property so the buyer pool is already limited despite what the headlines may say.

With the latest 15-month wait-out period for private property owners looking to switch to an HDB, the buyer pool will be further reduced. This especially affects those holding on to larger units since even cash-rich households aged 55 and above are affected by this ruling.

Conclusion

Like you’ve said, your current situation is very comfortable being in a centralised location and having a generous living space. Even though supply in the area is limited and demand is high at the moment, the lease decay can still be a cause for concern especially if you plan to hold it for a long term, say 15 – 20 years.

Switching to a private property that has better value retention potential does make sense in this scenario even though the difference in projected returns isn’t the most fantastic. Again, we must be aware that these were just based on an average return for a private property. If you do pick the right one, the returns could also be substantially more. However, one thing you’ll need to consider is if you wish only to utilise your CPF funds for the monthly mortgage, you likely will have to compromise on the size and location of the next property.

In this regard, we’d say that if you’re not prepared to cough up the extra cash each month to service a higher-priced property, then we’d recommend staying where you are at the moment. The quality of life you can get from your existing flat is a very important consideration too.

It’s likely that if you’d want to keep the amount you pay for a private property without any cash adjustment, you’d have to settle for a place that wouldn’t be in as convenient a location as your current place.

If you think about it, it’s like the situation that we’ve written about for the person that chose to buy the $1.4 million Henderson HDB flat. When you actually look at comparable resale private alternatives, you’d find that you can’t get anything equivalent for that same price. So as much as people say “$1.4 million can buy private”, the truth is that you really can’t make that comparison.

It’s the same reason why someone would be willing to pay $1.1 – $1.2 million for your current home right now because that same price would not be able to get them a home of that size in the location in the private condo arena.

To wrap up, if you have identified a really solid resale alternative, and if your priority was to leave an asset for your children that can retain its value, then perhaps the sacrifice could be worth it. But seeing that you seem to value your lifestyle and are very comfortable where you are at, upgrading at this point doesn’t seem to make much sense for you.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

0 Comments