We Have $400k In Cash And Stay In A Condo While Renting Out Our HDB: What Options Are There To Avoid ABSD While Upgrading To A Larger Home?

November 11, 2022

Dear Stacked Homes,

My wife and I have been reading your articles and find them to be very insightful. So we decided to seek some advice on the options that are available to us.

Currently, we live in a 2-bedroom condo. We also have a 5-room HDB flat that we rented out. Both properties are located in the north-east area. Our condo is just next to the MRT and full amenities are within walking distance. The estimated market value is about $1.1m for the condo and about $600k for the HDB flat. Both are fully paid, and we do (not) have any outstanding loan for any assets that we own.

I am 56 this year and my wife is 55. We both have FRS in our RA accounts, $100k combined in OA and $400k combined in SA. We have about $400k cash. We are receiving $2.4k monthly rental for our HDB flat. We have an adult daughter, and all 3 of us are still working. My wife and I plan to work for another 5 years before retiring, or when we receive a golden handshake from our employers, whichever comes first.

All 3 of us are wfh more than 50% of the time because of covid. This is causing quite a lot of inconvenience as our 2-bedroom unit is quite small. So we are considering to move to a 3-bedroom condo. However, we understand that we will need to pay a hefty ABSD, which we are trying to avoid.

We have been considering a few options.

If we purchase a 3-bedroom condo, say $1.4 to 1.5m, we will be asked to pay a 25% ABSD immediately? This is almost all the cash that we have on hand.

Next, we will sell our 2-bedroom condo. Will we get a 8% ABSD refund immediately?

We are also considering to sell our HDB flat, which is already 23 years old. Due to its age, more maintenance is needed and also the current rental yield is not high after deducting all the overheads. Also, we have allocated enough funds in our CPF to receive higher returns than our rental income currently. There is still 1-year remaining in the rental contract, so the earliest that we can sell the flat is Sep 2023.

At some point in our retirement, we are considering to move to a HDB flat to free up more cash for retirement. With covid, inflation is very high, so we are planning for contingency.

If we move to a 3-bedroom condo now, what are the chances of capital gain in the next 10 years? As we are used to the north-east area (except Punngol), we are open to buying a unit along the north-east MRT line, preferably within walking distance of an MRT.

Besides the options that we have in mind, we will appreciate if you can share other ideas.

Forgot to mention. We wanted to sell our HDB flat because we want to receive the remaining 17% ABSD refund.

We are also not considering to move back to our 5-room flat because of several reasons.

– the location is not ideal.

– the size >1300sqft is too big for 2 seniors. We expect our daughter to move out at some point in her life.

Also, the 3-bedroom condo that we are considering does not have to be too big. ~900sqft will be enough.

Thank you very much!

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there,

Thanks for writing to us, and happy to hear that you find our content useful!

Like many individuals around your age group, you’ve probably arrived at the point in your life where you’re planning for your retirement years. With two properties on hand that’s fully paid up, that’s definitely a comfortable position to be in. However, this seems to be more of a move to accommodate your lifestyle at this current juncture, and will require more careful planning.

The ABSD refund can be confusing so we will run through that as well as your affordability and the different options that you can possibly take.

Let’s start with the conditions for an ABSD refund!

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Conditions for ABSD refund

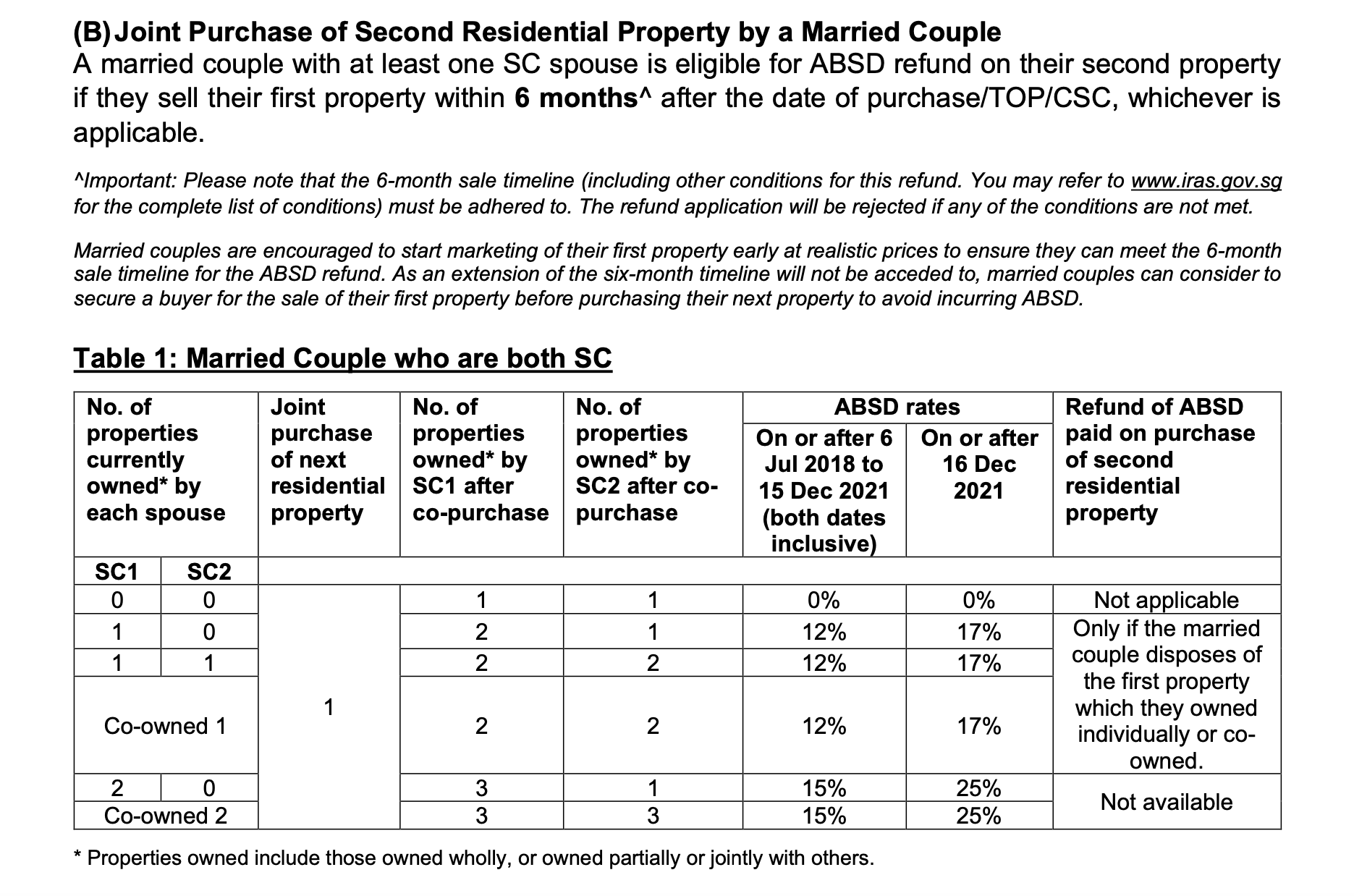

In your case, as both of you already own two properties, if you were to purchase a third one without selling any of the other two beforehand, you’ll incur an ABSD of 25% and this is non-refundable.

So in order to be eligible for the refund, you will need to first sell the existing condominium, purchase the next property and sell off the HDB within 6 months from the purchase of this next property. To entirely avoid paying any ABSD, you will have to sell both existing properties before purchasing the next one.

Essentially the ABSD refund can only be done for matrimonial homes, which means you can only hold on to one property at the end of the day.

The BSD and ABSD are payable within 14 days from the exercise date. As 14 days is insufficient time to withdraw the funds from your CPF accounts, you will have to pay for this in cash first and your solicitor can help to apply to use your CPF funds and you’ll get a refund of your cash afterwards. Do note that is only applicable to the purchase of private properties. For HDBs, you will be able to use your CPF funds to pay for the BSD and ABSD without having to first fork out the cash.

What’s your affordability?

We are assuming that you won’t be taking any loan for the next property given that your plan is to retire in 5 years time and since both of you already have the FRS in your CPF accounts, the rest of the funds can be withdrawn and put towards the purchase.

If you purchase the next property after selling your existing condominium:

| Description | Amount |

| Sales proceeds from the condominium | $1,100,000 |

| Combined CPF funds | $500,000 |

| Cash | $400,000 |

| Total sales proceeds + CPF + cash | $2,000,000 |

| BSD based on $2,000,000 | $64,600 |

| ABSD (17%) based on $2,000,000 (refundable if you sell the HDB within 6 months) | $340,000 |

| Estimated affordability | $1,595,400 |

If your purchase the next property after selling both your existing properties:

| Description | Amount |

| Sales proceeds from the condominium and HDB | $1,700,000 |

| Combined CPF funds | $500,000 |

| Cash | $400,000 |

| Total sales proceeds + CPF + cash | $2,600,000 |

| BSD based on $2,600,000 | $88,600 |

| Estimated affordability | $2,511,400 |

You mentioned that either way, you will be selling the HDB in order to get the ABSD refund, perhaps the latter option of selling both your existing properties before buying the next one may be a better choice given that you totally avoid paying for the ABSD and your affordability will be higher.

That said, this route may also be complicated given that you will need a home to stay in the meantime, and the rental market is also at a current high so that won’t come cheap.

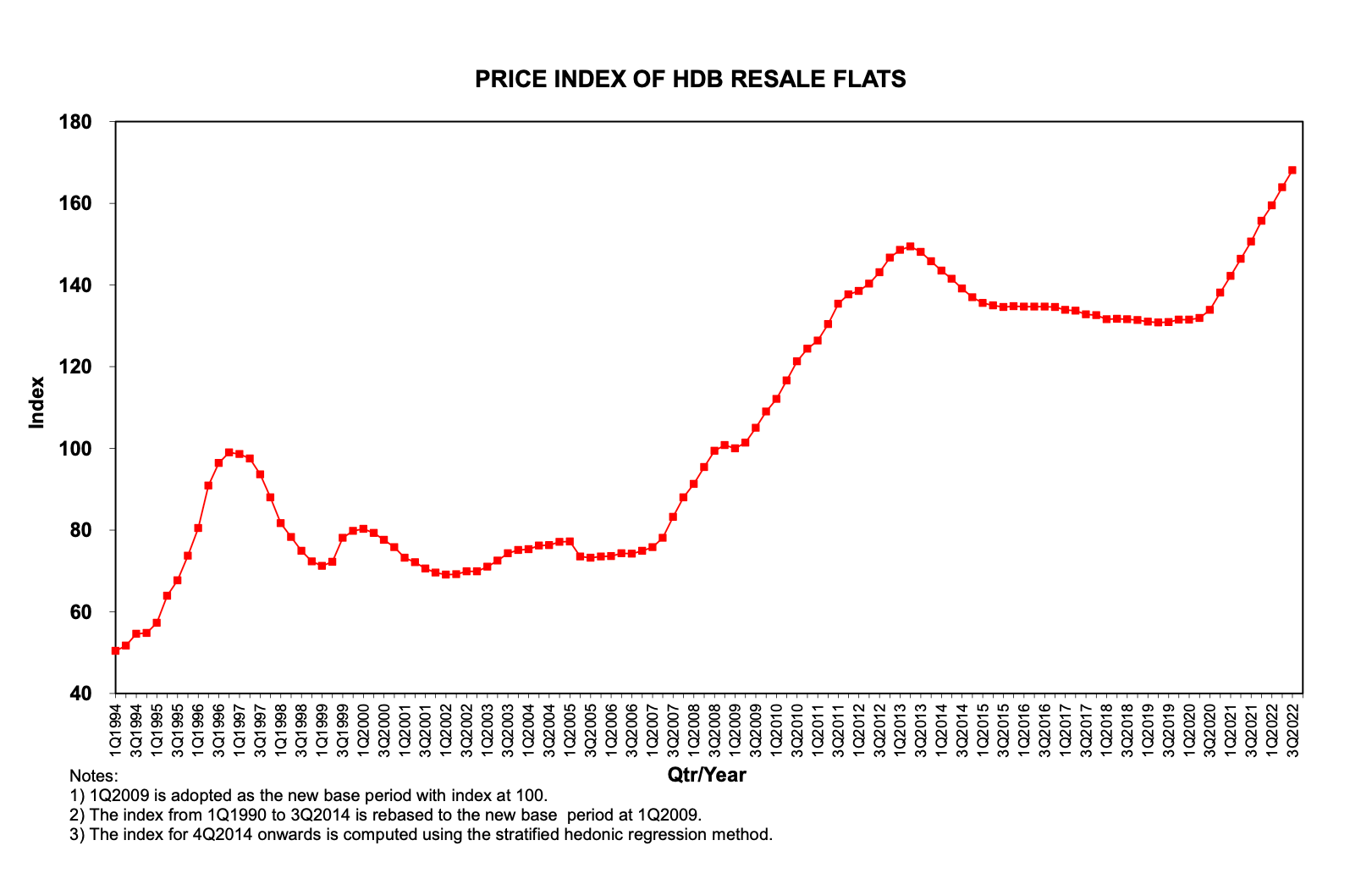

But as you probably already know, HDB prices are at an all-time high now and it would be an opportune time to cash out from it especially since it is now 23 years old. We understand that you have a tenancy that is till Sept 2023, but you can check your Tenancy Agreement if you did have any early termination clause inserted due to the sale of the HDB (you can read more about that here).

Prices of leasehold properties generally start to show signs of stagnation when they hit 21 years but due to the unique market situation the pandemic has put us in, demand for older flats have gone up and in turn, prices have increased.

Now let’s take a look at what are some pathways you can consider!

Option 1: Sell 2 buy 2

To avoid paying any ABSD and still have a second property for investment to fund your retirement, an option you guys can consider is to buy one property each.

In this scenario, you will have to sell off both properties in order to have sufficient funds. Your total sales proceeds + CPF + cash after selling both properties is $2.6M and after deducting the BSD, your estimated budget is $2.5M. We will set aside $1.5M for the own-stay property and $1M for the investment property.

While the BSD is lesser by around $20,000 if it’s two separate purchases of $1.5M and $1M (as opposed to one purchase of $2.6M), we would just round it off at $1.5M and $1M for ease of illustration.

These are some newer 3-bedroom options under $1.5M in the North-East (excluding Punggol) that are available on the market:

| Project | Tenure | Completion Year | Size (sqft) | Asking Price |

| Jewel @ Buangkok | 99 years | 2017 | 936 | $1,500,000 |

| The Vales | 99 years | 2017 | 1044 | $1,480,000 |

| The Luxurie | 99 years | 2015 | 1001 | $1,488,000 |

| Esparina Residences | 99 years | 2014 | 1001 | $1,480,000 |

| The Quartz | 99 years | 2010 | 1066 | $1,350,000 |

These are some newer 2 bedroom options under $1M with decent rental yields that are available on the market. We have also included their average rent and rental yield:

| Project | Tenure | Completion Year | Unit Type | Size (sqft) | Asking Price | Average Rent (Last 3 months) | Rental Yield |

| Parc Riviera | 99 years | 2020 | 2b1b | 603 | $958,888 | $3,400 | 4.25% |

| High Park Residences | 99 years | 2019 | 2b2b | 678 | $990,000 | $3,000 | 3.64% |

| Kingsford Waterbay | 99 years | 2018 | 2b2b | 689 | $980,000 | $3223 | 3.95% |

| The Glades | 99 years | 2017 | 2b1b | 571 | $920,000 | $2,923 | 3.81% |

| Urban Vista | 99 years | 2016 | 2b1b | 624 | $930,000 | $2,670 | 3.45% |

You mentioned the potential capital gains in 10 years time (we will get to that in a bit) so we presume you’re planning to stay for at least another 10 years in this property. For this reason, we picked out younger developments as these generally have more room for appreciation.

For the investment property, it may be safer to go with a 2 bedroom unit instead of a 1 bedder, even though those are more affordable. Typically, they are easier to sell in the future as the buyer pool is larger. Moreover, with 2 bedroom units, you can always choose to rent a room out if you aren’t able to find someone to take on the entire unit which reduces vacancy costs.

Do note that these developments are selected purely based on your surface requirements and it will be best to consult an agent for further analysis.

Let’s now do a simple 10-year projection assuming you guys purchase a 3-bedroom at The Vales and a 2-bedroom at Parc Riviera.

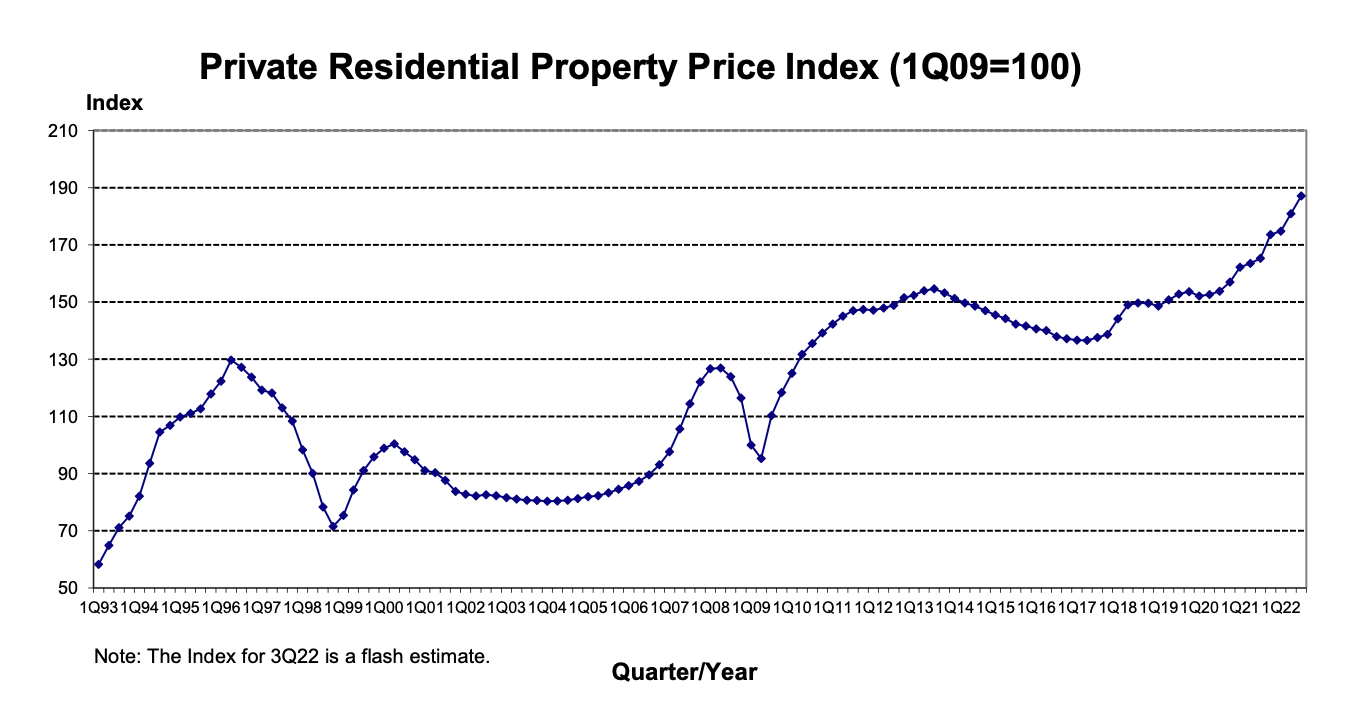

For our growth rate, we’ll look at how the private property index has fared in the past 10 years:

| Year | Property Price Index |

| 2012 | 151.5 |

| 2013 | 153.2 |

| 2014 | 147 |

| 2015 | 141.6 |

| 2016 | 137.2 |

| 2017 | 138.7 |

| 2018 | 149.6 |

| 2019 | 153.6 |

| 2020 | 157 |

| 2021 | 173.6 |

| 2022Q3 | 187.1 |

10 year projection for The Vales – Own stay

| Description | Amount |

| Assuming 23.4% growth over 10 years | $1,826,320 |

| Current valuation | $1,480,000 |

| Interest costs (House will be fully paid) | $0 |

| MCST (Assuming $350/month) | $42,000 |

| Estimated gains | $304,320 |

10 year projection for Parc Riviera – Investment

| Description | Amount |

| Assuming 23.4% growth over 10 years | $1,183,268 |

| Current valuation | $958,888 |

| Interest costs (House will be fully paid) | $0 |

| MCST (Assuming $300/month) | $36,000 |

| Rental income (Assuming $3,400 for 11 months/year) | $374,000 |

| Agency fees should you engage an agent (Based on $1,700/year) | $17,000 |

| Estimated gains | $545,380 |

Estimated gains after 10 years should you decide to sell both properties – $849,700

Do note that these projected gains are merely on paper estimates to act as a guide and will vary depending on future market conditions. In addition, we have decided not to include property tax in here since the Annual Value is not something that we are privy too. However, this should shave of a couple of thousand per year.

Besides avoiding ABSD, other advantages of this option are that it gives you more flexibility in the event you decide to cash out on the investment property. This is because it will not affect your living situation, and also the rental will provide you with a stream of passive income which can help support your retirement.

Option 2: Sell 2 buy 1

With a budget of $2.5M for a 3 bedder, you’ll definitely have more options and can possibly venture out to a more centralised location or get a bigger unit should you wish to.

These are some newer 3-bedroom options under $2.5M which are situated in a more centralised area that is available on the market:

| Project | District | Tenure | Completion Year | Size (sqft) | Asking Price |

| The Panorama | 20 | 99 years | 2019 | 1,141 | $2,180,000 |

| Sky Vue | 20 | 99 years | 2017 | 1,141 | $2,200,000 |

| Pollen & Bleu | 10 | 99 years | 2017 | 1,163 | $2,150,000 |

| Thomson Grand | 20 | 99 years | 2015 | 1,356 | $2,390,000 |

| d’Leedon | 10 | 99 years | 2014 | 1,216 | $2,400,000 |

We’ll also do a 10-year projection to compare with Option 1. Let’s assume you purchase The Panorama at $2.18M:

| Description | Amount |

| Assuming 23.4% growth over 10 years | $2,690,120 |

| Current valuation | $2,180,000 |

| Interest costs (House will be fully paid) | $0 |

| MCST (Assuming $400/month) | $48,000 |

| Estimated gains | $462,120 |

If you were to purchase just 1 property, the estimated gains after 10 years will be $387,580 ($849,700 – $462,120), which will not fare as well as 2 properties from a profit standpoint.

Besides the lower returns, other tradeoffs for a better location would be that you won’t have a stream of passive income from an investment property and should you wish to cash out on the house, you will have to sell and move. This is a huge downside and it may not make sense to tie your funds in a property that cannot generate returns, which could be important in your retirement years.

Although if your lifestyle needs are more important over the next few years, another option would be to look at dual-key units. This allows you and your adult daughter to continue living together with a good amount of privacy since you guys are WFH 50% of the time. Once it’s time for her to move out, you could rent the studio unit out for an additional source of income.

Option 3: Sell 2 buy 1, and invest the remaining funds

Rather than putting all your eggs in one basket, some individuals prefer to diversify their assets portfolio. Let’s say you were to stick with buying a 3-bedroom unit in the North-East, for instance, The Vales at $1.48M and split the remaining $1M equally into high and low-risk investments.

Let’s also do a 10-year projection on this:

| Description | Amount |

| $500,000 in high-risk investments with 7% returns compounded annually | $983,576 |

| $500,000 in low-risk investments with 4% returns compounded annually | $740,122 |

| Initial investment | $1,000,000 |

| Estimated gains | $723,698 |

While 4% returns aren’t considered low-risk in the general sense, your CPF RA does reward you with this level of interest – and so we used 4% as a benchmark for low-risk investments since this is an available option for you.

With this option, your estimated gains after 10 years will be $1,028,018 ($304,320 + $723,698).

Having said that, the performance of your investments also greatly depends on market conditions. This option will give you higher liquidity should you need the funds but it comes with its own set of risks as well.

What are the chances of potential gains in 10 years?

Like any other cycle, the property market has its peaks and troughs. Every peak sets a new benchmark for property prices and it usually takes a while before buyers adjust and accept the new pricing.

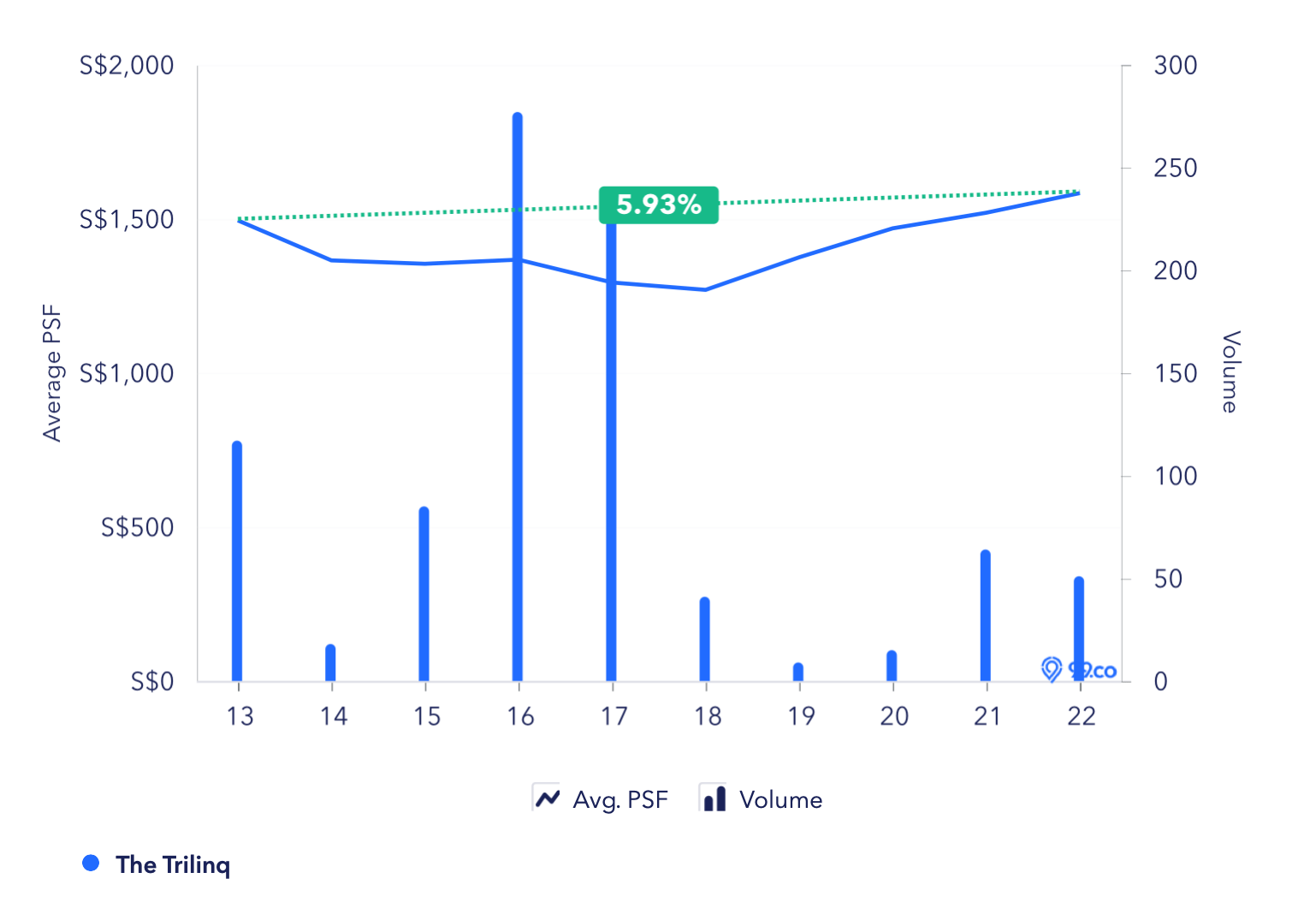

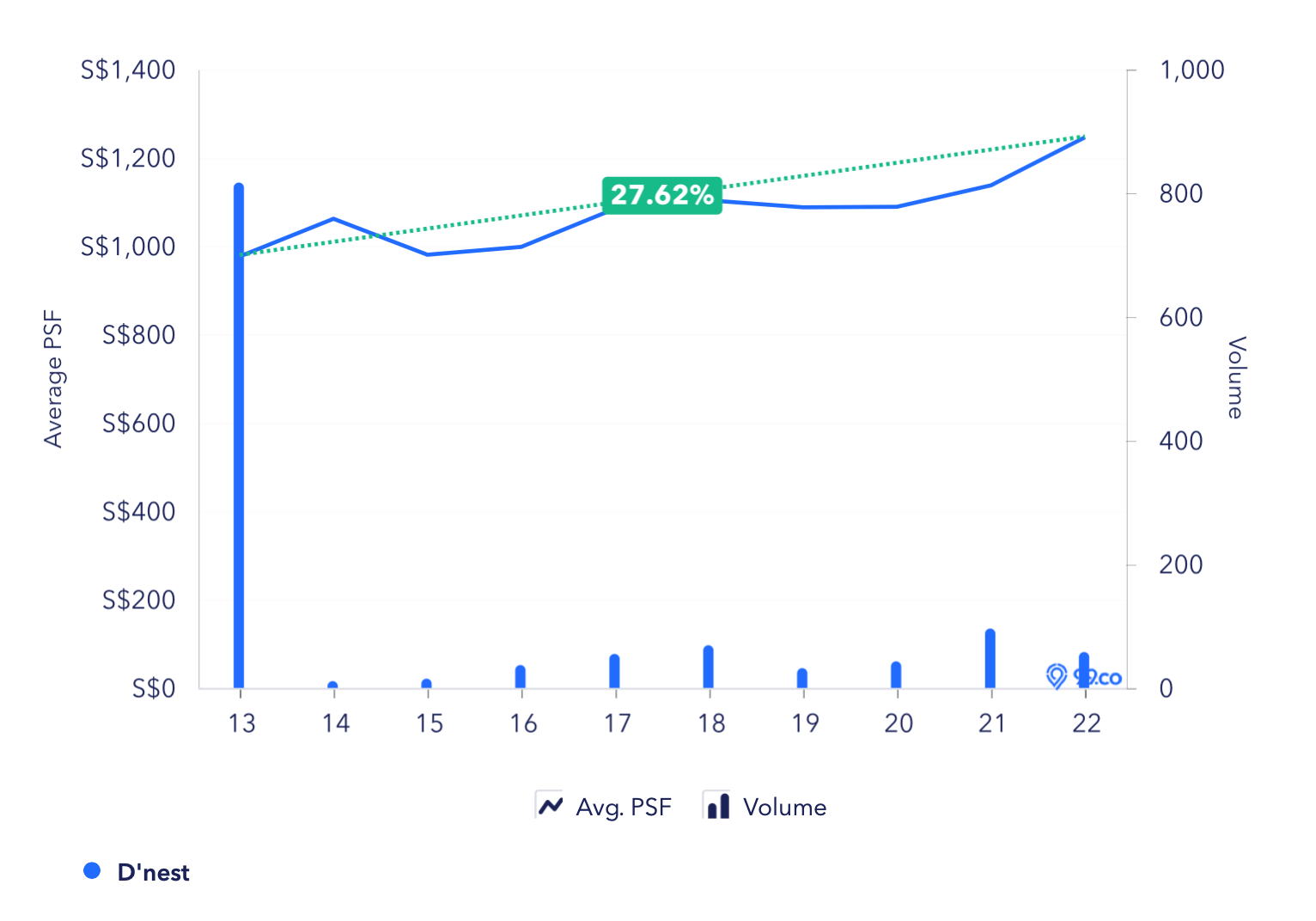

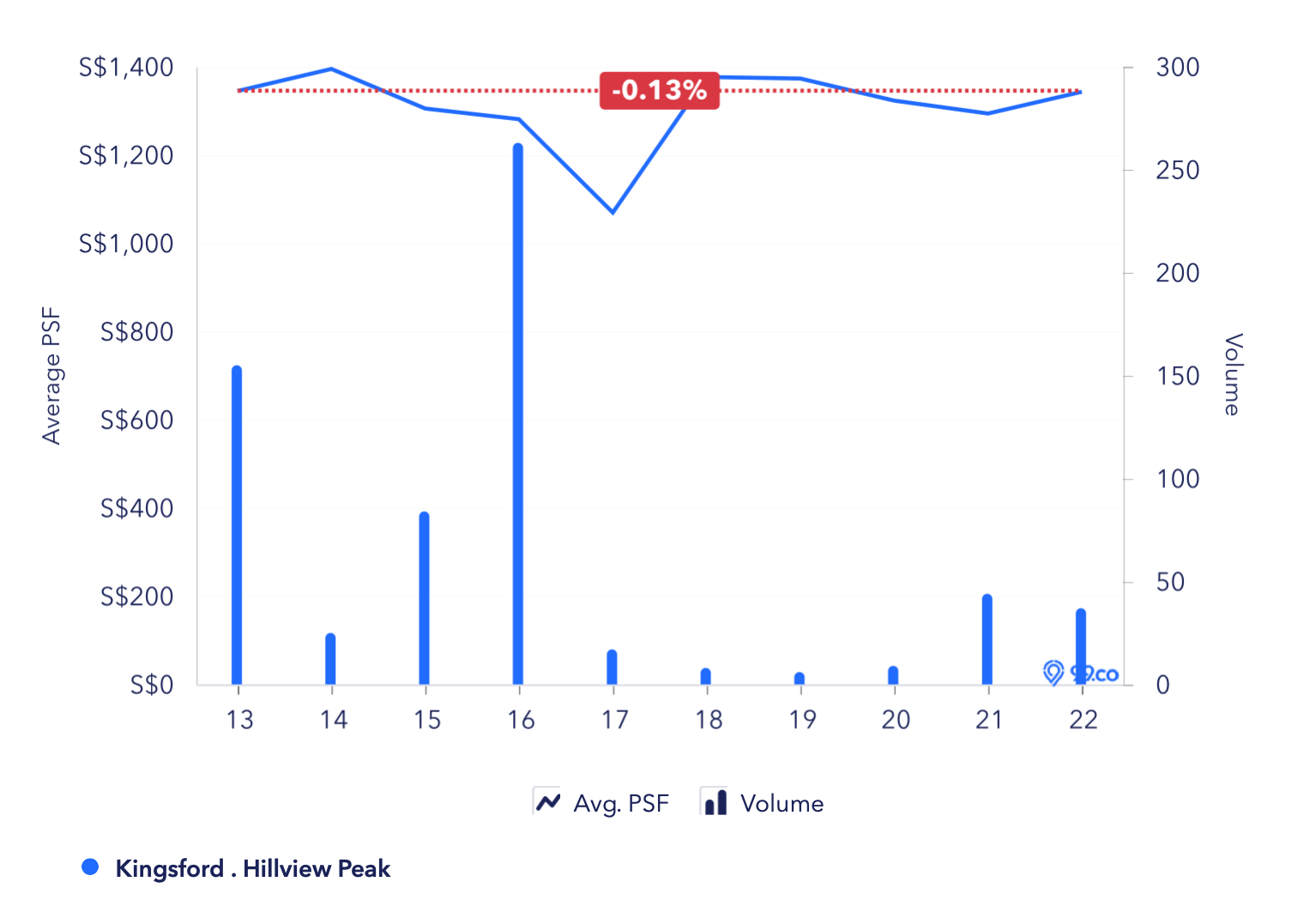

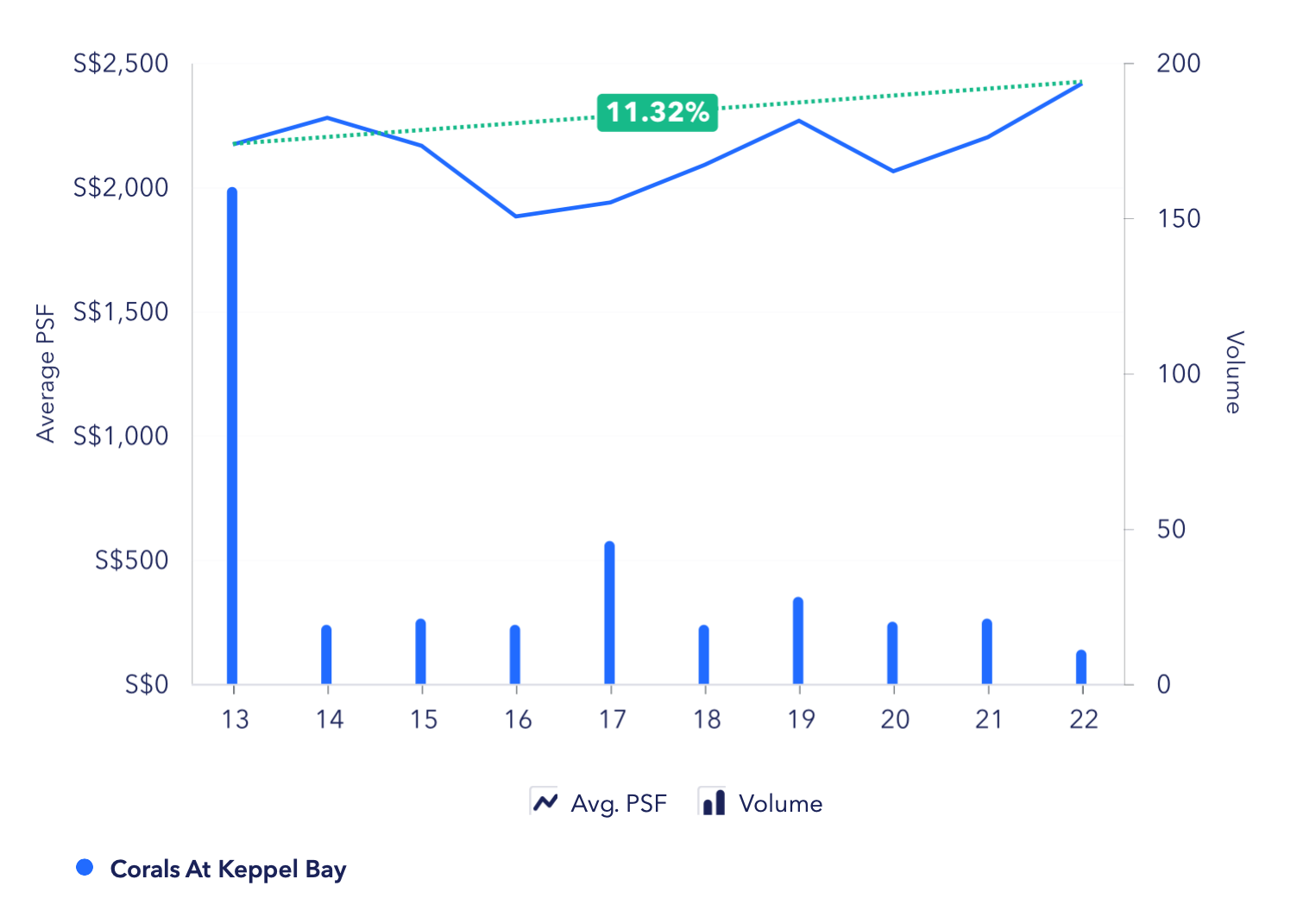

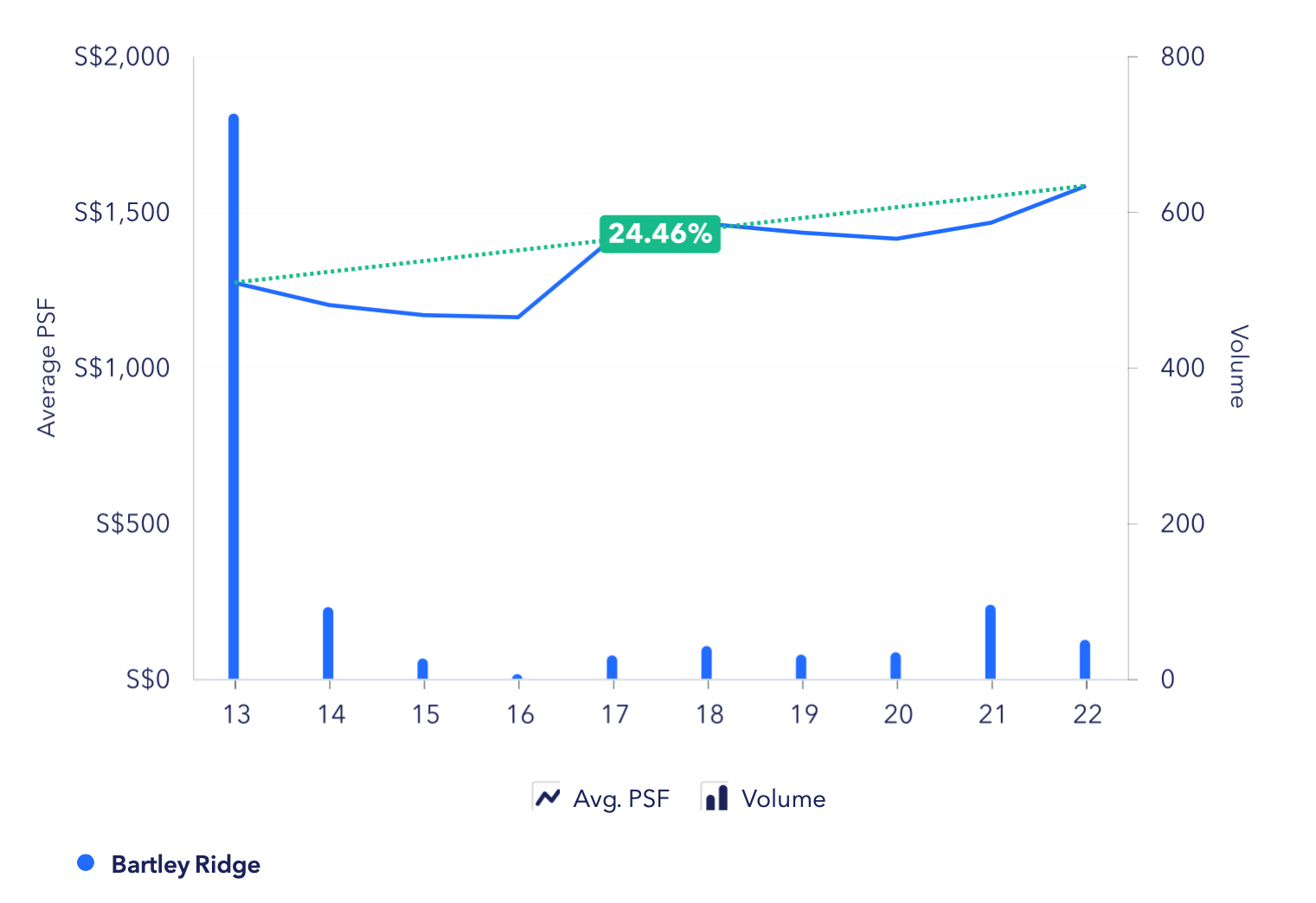

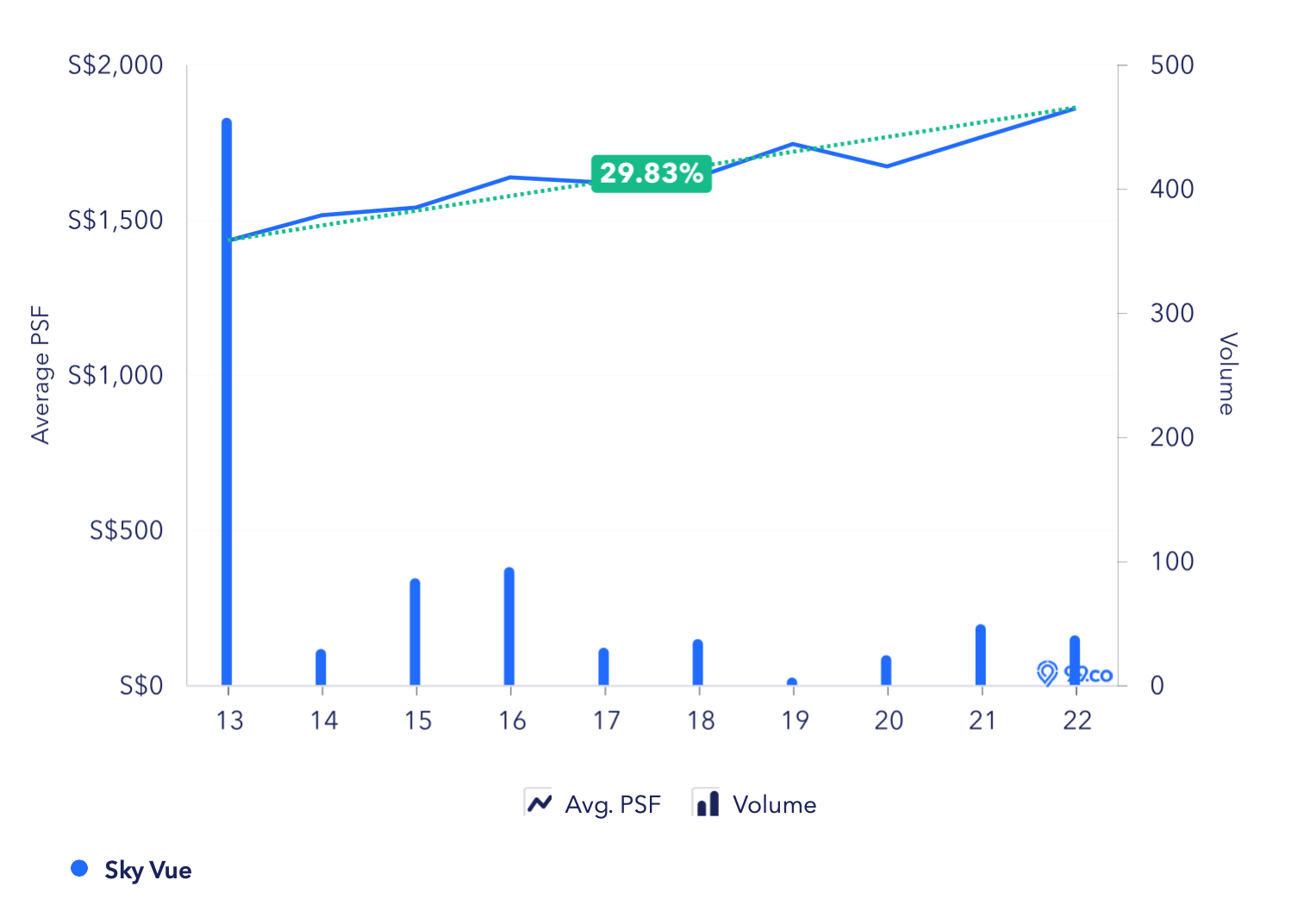

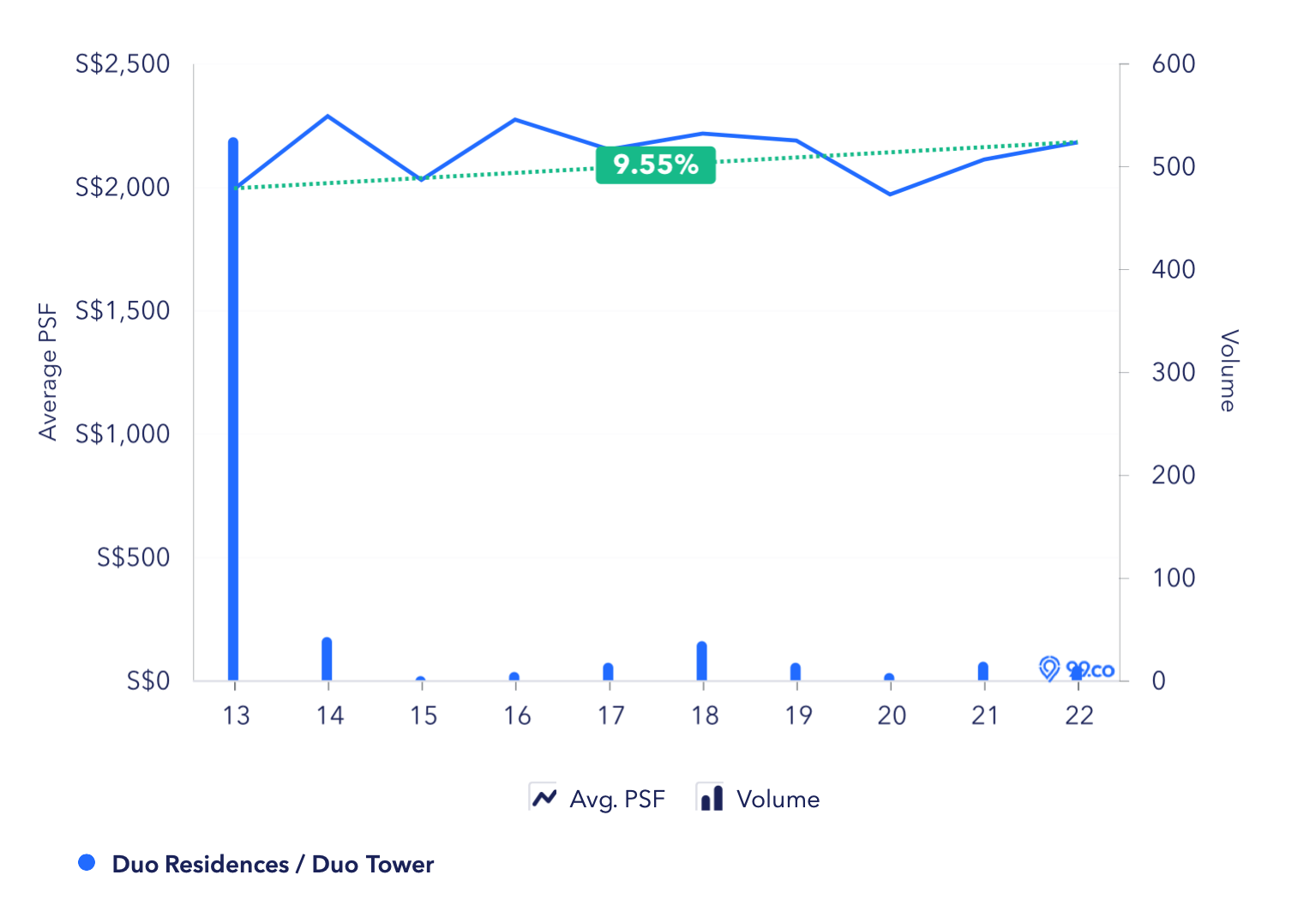

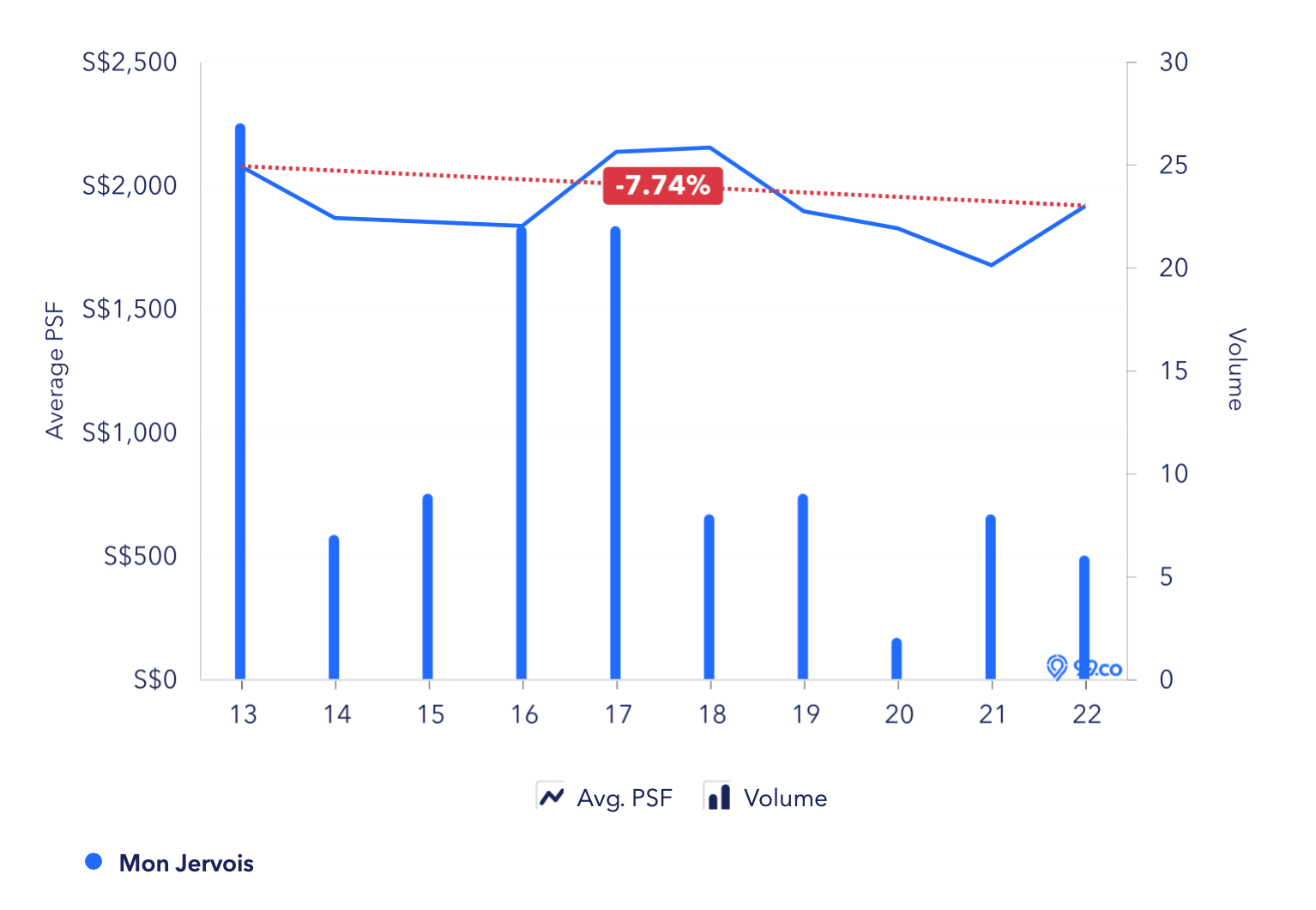

Let’s take a look at how some of the properties that were launched during the last peak in 2013 are performing. For it to be a fair comparison, we will only look at the 99-year leasehold projects.

In the OCR:

In the RCR:

In the CCR:

We can see that the performance of these projects varies and it can be for various reasons such as locality, proximity to amenities, characteristics of the developments, unit attributes, etc. However for most of the projects, even though prices dipped after the three rounds of cooling measures were introduced in 2013, they eventually picked up when the market recovered.

We’ve also done an article before on how buyers who purchased at the peak have fared.

In summary – even if you’re buying at the peak, there is still potential for appreciation if you purchase the right property and have a long enough holding period (10 years or more) – or you have good holding power to withstand any downturns.

Conclusion

To recap, in order to be eligible for the ABSD refund, you will first have to sell your existing condominium before you purchase the next one and you’ll also have to sell the HDB within 6 months of this purchase. You can totally avoid paying any ABSD by selling both existing properties before buying the next property and this will also increase your affordability.

Option 1 to sell 2 buy 2 will give you the most flexibility should there be a need to sell, or if the investment property becomes profitable. You can cash out without affecting your living situation and it’ll also provide you with a stream of passive income that can help to support your retirement.

Option 2 to sell 2 buy 1 in a better location or a bigger sized unit will give you more convenience or a more comfortable living space but should you wish to cash out on the property, you will have to move again. Moving can also be stressful, particularly as age catches up. Also, you will not receive any passive income from this option.

Option 3 to sell 2 buy 1 and invest the remaining funds will give you higher liquidity but depending on where you’re investing the money, the risk levels will vary. We can’t comment too much on this way as it’s hugely variable on how you invest, but we had to bring it up as another option.

We believe for most people in their retirement years, peace of mind is an important factor and you’d rather not be worrying about how your investments are performing.

For this reason we think Option 1 will be ideal in your situation given that you will have 2 fully paid properties so there’s no need to worry about not being able to pay the mortgage in the event there is a lag in the rental and the rental income can also supplement your CPF payouts to fund your retirement.

Should you decide to sell the properties and move to an HDB later down the road, you would have earned a decent amount from the rental and there are also potential capital gains.

Finally, since you do intend to move into an HDB at some point, you should think about what this means when it comes to legacy planning. The easiest consideration is to see the HDB as something that should be sold upon your passing given the restrictions faced when your children have a home of their own.

If you do not prioritise capital appreciation at that point, then purchasing an old resale flat for yourself would make a lot of sense since this frees up more cash that would support you long into your retirement while still being able to afford a bigger and perhaps more desirable location than if you purchased a younger flat.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

5 Comments

Interestingly and coincidentally I am also 55.

I have been lining overseas for 6 years, with past 3 years straight before returning to Spore on 9 October last month for only half a year.

If I would to decide, I would certainly keep the condo if it is a Freehold property and sell the HDB flat.

I also like to suggest to invest in another overseas property to spread the eggs and not just leave in one basket.

With 2 Overseas properties I have now, a penthouse studio unit with seaview and a 4-storey house of 400sqm, they let me embrace and live a more exciting lifestyle, residing 6 months overseas yearly and still receive passive income.

This can be the second option, if they would to decide to get a property in Singapore and not overseas. My advice to them, is to buy another 2-bedroom condo preferably freehold to be able to leave it for future generations like their daughter (in the above case). By the way, I am a single widow with no children.

Holding 2 condos are more beneficial in my opinion because their daughter can move to the new condo and they can lease out one room.

Well, the first option of an overseas property investment is still the most ideal suggestion due to lower costs of living as compared with Singapore’s and lower purchase costs too.

All the best! Thank you. Warm Regards. Angel Julie

Can they not sell the HDB, transfer the existing condo to one person’s name through conveyancing then buy another condo to avoid ABSD?

The answer is very straightforward. DON”T DO ANYTHING. I am serious. At age of almost retirement and considering both are employees , they are already in a good position with one 2room condo and one HDB. only sell off both property if they intend to buy freehold landed terrace, which, at that age, and small family, is not advisable (FH landed is good store of future value, but small and older persons will have trouble with maintenance, climbing stairs etc,). If you buy in today’s market there is no more capital appreciation, prices have run up too high. Do not sell two, it takes a whole life to collect those two properties. I repeat: do not sell. you will regret it! Sometimes in life, just accept what you have, be happy and contented. TO remain still is sometimes the best thing to do.