How Bad Is The Price Gap Between New Launch And Resale Condos? An Analysis Of 13 OCR Districts (Part 2)

February 23, 2021

Last week we looked at the price gap between new and resale condos in various districts (Click here for Part 1). This week we’re continuing on from that, as well as examining why the gap between absolute prices (the quantum) may not match the gap on a price per square foot basis. Here’s what you need to know:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

More districts with notable price gaps since 2020:

- District 20 (Bishan, Thomson)

- District 21 (Upper Bukit Timah, Clementi Park, Ulu Pandan)

- District 23 (Hillview, Dairy Farm, Bukit Panjang, Choa Chu Kang)

- District 26 (Mandai, Upper Thomson)

- District 27 (Sembawang)

- District 28 (Seletar)

Some notes on the unit sizes:

Methodology to determine bedroom sizes (resale)

Resale – Using rental data from URA, we first filtered those with no ambiguity in sizes – that is, based on rental transactions over the last 5 years, a particular unit size had a consistent number of bedrooms recorded.

For those with the same unit sizes and differing bedroom counts, most were x bedrooms + study, as such, some were counted as 2 or 3 bedrooms if it were a 2-bedroom study unit. To improve efficiency, we determined the proportion of bedrooms-to-size and sorted it from the highest proportion first and used that figure to determine the number of bedrooms for that unit size in the development.

Units without any information in bedroom sizes were excluded.

Methodology to determine bedroom sizes (new launch)

We referred to the floor plans and unit size distribution for each new launch unit to determine the number of bedrooms. Those with +study are treated without the study, so a 2-bedroom + study unit falls under 2-bedroom. Penthouses were excluded from the study.

Transaction data used: January 2019 – December 2020. Sub sale transactions were excluded.

As only OCR is considered here, all transactions within “Central Region” were also excluded.

1. District 20 (Bishan, Thomson)

| # Bedrooms | New Sale Price (Quantum) | Resale Price (Quantum) | New Sale Size (sqft) | Resale Size (sqft) | New Sale ($PSF) | Resale ($PSF) | Resale Age (Average) | % Quantum Gap | % $PSF Gap |

| 2 | $1,064,366 | $1,081,103 | 596 | 863 | $1,787 | $1,304 | 12 Years | -2% | 37% |

| 3 | $1,537,740 | $1,449,197 | 865 | 1190 | $1,777 | $1,253 | 13 Years | 6% | 42% |

| 4 | $1,761,615 | $1,520,805 | 1070 | 1487 | $1,647 | $1,036 | 15 Years | 16% | 59% |

Notable factor:

For District 20, we can attribute the price gap to the emergence of Lattice One. This development is in the posh Upper Thomson area, just next to Lower Pierce Reservoir.

Lattice One is priced notably higher relative to existing developments. One reason is that it’s within a six-minute drive to Sin Ming Plaza, and about eight-minutes’ drive to Junction 8 mall; two of the key amenities in this district. In addition, there are three schools within the important one-kilometre radius: CHIJ St. Nicholas Girls School and Peirce Secondary School are within 680 to 750 metres respectively; Mayflower Secondary is 930 metres away.

Finally, this is a boutique development with only 40 units, so we wouldn’t expect mass-market pricing.

Like a few of the other districts here, you can see that judging the price gap on a psf basis alone does not tell the full story until you dig deeper. As you can see, the 2 bedroom shows a 37% psf price gap but when you compare it on an overall quantum basis it actually is very similarly priced. Again, that’s down to the resale 2 bedroom average size being significantly bigger at 863 square feet, as compared to the 596 square feet average new launch size.

You could also say the same for the 4 bedroom units here, as the psf price gap is at a massive 59% but the overall quantum price gap between the new launch and resale is only at 16%.

2. District 21 (Upper Bukit Timah, Clementi Park, Ulu Pandan)

| # Bedrooms | New Sale Price (Quantum) | Resale Price (Quantum) | New Sale Size (sqft) | Resale Size (sqft) | New Sale ($PSF) | Resale ($PSF) | Resale Age (Average) | % Quantum Gap | % $PSF Gap |

| 2 | $1,319,237 | $1,158,724 | 751 | 991 | $1,757 | $1,174 | 24 Years | 14% | 50% |

| 3 | $1,728,049 | $1,553,451 | 978 | 1381 | $1,766 | $1,126 | 23 Years | 11% | 57% |

| 4 | $2,539,275 | $1,913,652 | 1394 | 1626 | $1,822 | $1,177 | 21 Years | 33% | 55% |

Notable factors:

The price gap here was inevitable and expected. It’s because District 21 saw no less than eight new launches in 2020:

- Ki Residences

- Daintree Residence

- The Verdale

- The Linq @ Beauty World

- View at Kismis

- Mayfair Modern

- Mayfair Gardens

We could say with certainty that District 21 was the hotspot of 2020, with so many new projects. This alone would be enough to create a price gap; but another notable factor about District 21 is the age of its existing condos.

A lot of the resale condos in this district, such as Maplewoods, Clementi Park, and Signature Park, were completed in the 1980’s or 1990’s. In fact one of Singapore’s oldest condos, Pandan Valley, is located in this district.

This age of these resale condos further emphasises the price disparity between new and resale units here. We see future launches here surging ahead in price as well, since Clementi is much in demand: not only is it a mature area, it’s located between the tech-hub of One-North and the lifestyle hub of Holland Village.

That said, at first glance it is surprising to see that the quantum gap isn’t smaller here, given that the average resale age is higher at District 21 than most other districts (22.6 years). So while the average size for the 2, 3, and 4 bedroom units are about what you might expect for resale units of that age, the new launch units are correspondingly higher in price too because of the higher than average unit size too.

3. District 23 (Bukit Batok, Choa Chu Kang)

| # Bedrooms | New Sale Price (Quantum) | Resale Price (Quantum) | New Sale Size (sqft) | Resale Size (sqft) | New Sale ($PSF) | Resale ($PSF) | Resale Age (Average) | % Quantum Gap | % $PSF Gap |

| 1 | $829,017 | $694,550 | 513 | 565 | $1,616 | $1,250 | 8 Years | 19% | 29% |

| 2 | $1,162,267 | $936,954 | 713 | 909 | $1,629 | $1,050 | 15 Years | 24% | 55% |

| 3 | $1,437,666 | $1,219,349 | 972 | 1279 | $1,480 | $951 | 18 Years | 18% | 56% |

| 4 | $1,862,092 | $1,436,764 | 1314 | 1468 | $1,416 | $981 | 17 Years | 30% | 44% |

Notable factors:

The price disparity stems from the Mont Botanik, which started sales in 2019. Sales have been ongoing and by December 2020, the development had reached a take-up rate of about 71 per cent. If you’re familiar with Bukit Timah, you may know Mont Botanik better as the former Hillview House.

Mont Botanik is a small 108-unit development, and the marketing emphasised the low-density nature of its surroundings. Where Mont Botanik can justify a higher price tag, however, is the emergence of the recent Rail Mall. At 1.8 kilometres, the mall’s a mere four-minute drive from Mont Botanik; that mitigates the lack of amenities that often comes with low-density enclaves like Bukit Timah.

As an aside, a 563-unit development, Midwood Condo, also just launched here in January of this year; so do expect the price gap to stay.

Taking a closer look at the price gap, the variance between the quantum and psf price gap for the 1 bedroom isn’t too far off as the average sizes for both are quite similar. This isn’t too surprising given that the average resale unit age is relatively new at 8 years.

Moving down to the 2 and 3 bedroom units is where you’d see that the quantum price gap is quite different from the psf price gap. This is down again to the usual suspects like the smaller average new launch size. But given the high psf and bigger than average new launch unit sizes here that quantum difference can still be considered to be big by some buyers. That is most evident in the 4 bedroom unit range, as the size difference between both new launch and resale isn’t too far off.

4. District 26 (Yishun)

| # Bedrooms | New Sale Price (Quantum) | Resale Price (Quantum) | New Sale Size (sqft) | Resale Size (sqft) | New Sale ($PSF) | Resale ($PSF) | Resale Age (Average) | % Quantum Gap | % $PSF Gap |

| 1 | $756,017 | $703,100 | 537 | 551 | $1,405 | $1,276 | 6 Years | 8% | 10% |

| 2 | $1,034,881 | $950,393 | 783 | 1002 | $1,332 | $962 | 23 Years | 9% | 38% |

| 3 | $1,563,673 | $1,406,665 | 1215 | 1316 | $1,289 | $1,075 | 19 Years | 11% | 20% |

There’s not much to explain here, save to say there haven’t been many new condos in District 26 for some time. Many of the resale condos here – such as Forest Hills and The Calrose – date back to the early 2000’s.

As such, there’s bound to be a price disparity when – after such a long time – newcomers like The Essence enter the area. The Essence is a boutique development with 84 units, which was about 81 per cent sold by 2020; the last remaining units will probably have been sold by the time you’re reading this.

Besides issues of age, The Essence is likely priced higher than its resale counterparts because of its proximity to ORTO – this is a new lifestyle park that features activities from paintball to fishing to dining. The Essence is about a six-minute drive away, making it one of the most closely located private residences to ORTO.

Quite curiously, the psf price gap and the quantum price gap for District 26 is very similar for 1 bedroom units. This is mainly because average unit sizes are similar (average age for resale units is only at 6 years), and the psf price gap is actually small.

The same can be said for 2 bedroom units, where the psf price gap here is bigger but the quantum price gap is quite comparable because of the smaller unit size. Note that the resale units here are on average quite old at 23 years.

The 3 bedroom units in District 26 follow the same trend as 1 bedroom units as the average unit sizes are quite close with the psf price gap not differing by too much either.

5. District 27 (Sembawang)

| # Bedrooms | New Sale Price (Quantum) | Resale Price (Quantum) | New Sale Size (sqft) | Resale Size (sqft) | New Sale ($PSF) | Resale ($PSF) | Resale Age (Average) | % Quantum Gap | % $PSF Gap |

| 2 | $978,602 | $814,677 | 779 | 909 | $1,257 | $905 | 11 Years | 20% | 39% |

| 3 | $1,237,083 | $1,029,733 | 963 | 1194 | $1,285 | $872 | 12 Years | 20% | 47% |

District 27, and in particular Sembawang, is quite subdued in terms of private housing. The area is still developing, but there’s been a significant upgrade in the form of Bukit Canberra. This is both a sports hub and a centre for retail and dining, and it’s a much needed improvement to the otherwise sparse neighbourhood.

The new launch that’s causing the price gap is Parc Canberra. This is one of the few ECs that’s actually close to an MRT station; it’s about 300 metres, or a three-minute walk, to Canberra MRT. Parc Canberra is also just two kilometres from Bukit Canberra by car (about a four-minute drive), or a more direct 1.6 kilometres if you care to cycle. As an alternative to Bukit Canberra, there’s also Sembawang Shopping Centre, which is just 1.3 kilometres away.

Like the developer, most buyers recognise that Parc Canberra has fewer of the drawbacks associated with being in a non-mature area; despite the fact that District 27 as a whole is still a bit “ulu”.

The psf price gap for District 27 is quite large for the 2 and 3 bedroom units at 39% and 47% respectively. That said, the quantum price gap is only at 20% because of the difference in sizes between the new launch and resale units.

6. District 28

| # Bedrooms | New Sale Price (Quantum) | Resale Price (Quantum) | New Sale Size (sqft) | Resale Size (sqft) | New Sale ($PSF) | Resale ($PSF) | Resale Age (Average) | % Quantum Gap | % $PSF Gap |

| 1 | $709,661 | $625,109 | 506 | 498 | $1,403 | $1,266 | 3 Years | 14% | 11% |

| 2 | $974,717 | $855,464 | 718 | 805 | $1,360 | $1,090 | 6 Years | 14% | 25% |

| 3 | $1,231,496 | $1,160,586 | 930 | 1192 | $1,324 | $996 | 12 Years | 6% | 33% |

| 4 | $1,635,671 | $1,513,046 | 1304 | 1594 | $1,254 | $981 | 14 Years | 8% | 28% |

| 5 | $1,759,580 | $1,626,667 | 1588 | 1432 | $1,110 | $1,136 | 2 Years | 8% | -2% |

Seletar is one of the four planned regional centres, although our experience suggests this has gone under-the-radar for most of the public. Nonetheless, the development of the area has improved prospects for District 28 as a whole, which encompasses Seletar as well as parts of Yio Chu Kang.

Property Market CommentaryHow Well Do Regional Centre Properties Compare Against The CBD?

by Ryan J. OngParc Botannia is the new development here that’s pushed a price gap. The Fernvale area is not very developed, so by comparison older resale properties here, such as Riverbank, were priced lower. Apart from age, Parc Botannia can justify its higher price point because it’s right next to Seletar Mall; this removes much of the inconvenience in living in a non-mature area. While there’s no MRT near Parc Botannia, the Thanggam LRT station is right next door, so it’s not too inconvenient to get connected to the wider network.

Given that Fernvale isn’t the most convenient place to live right now though, the price gap could be a bit hard to swallow for some buyers; but those looking at the long term may be able to accept the discrepancy.

District 28 shows quite a surprising price gap for 1 bedroom units given the really new resale unit age of 3 years. The quantum price gap tapers down quite a bit too as the unit type by bedroom gets bigger. In fact, the new launch unit is averagely even bigger than the average resale (1,587 sqft vs 1,431 sqft).

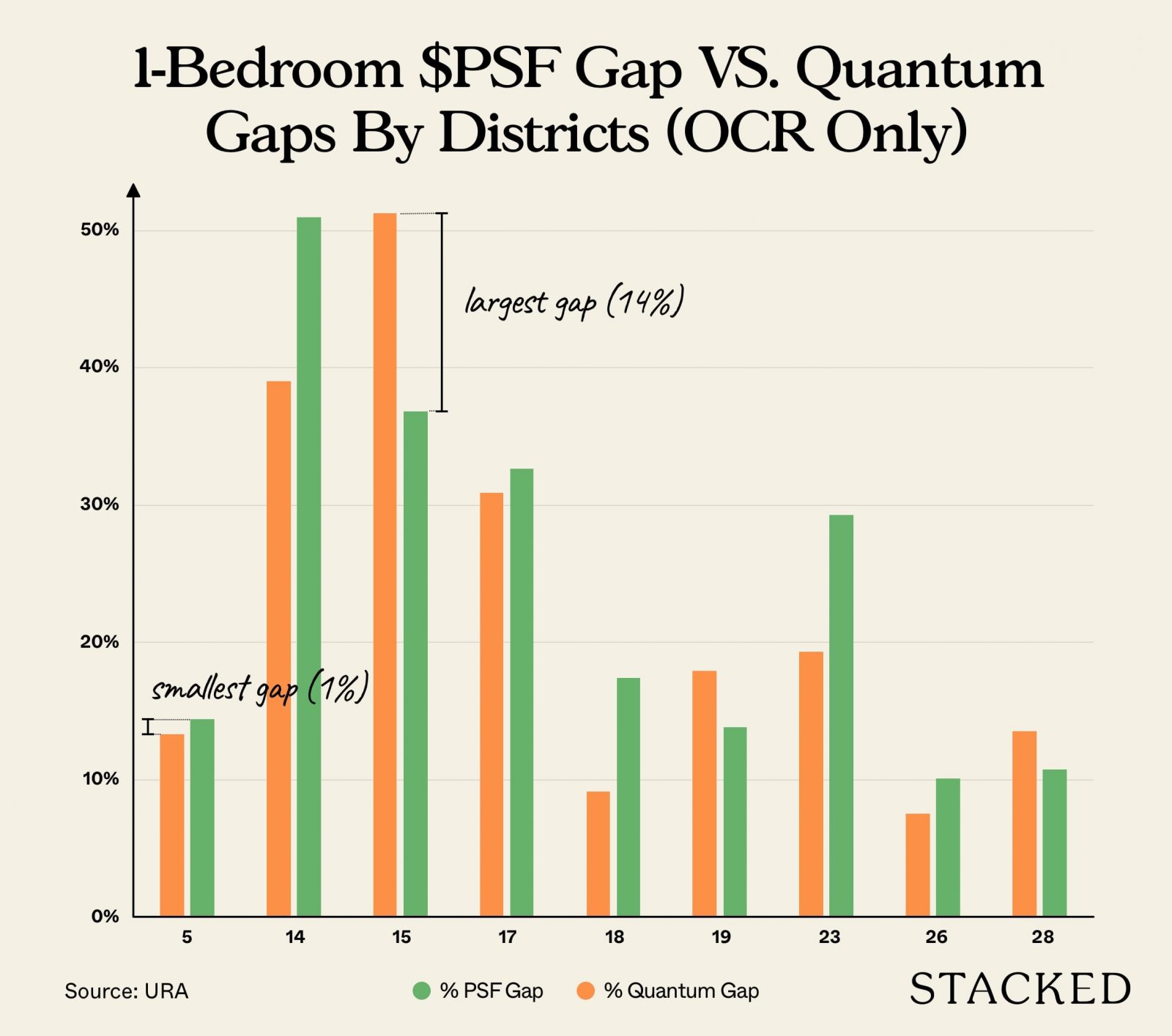

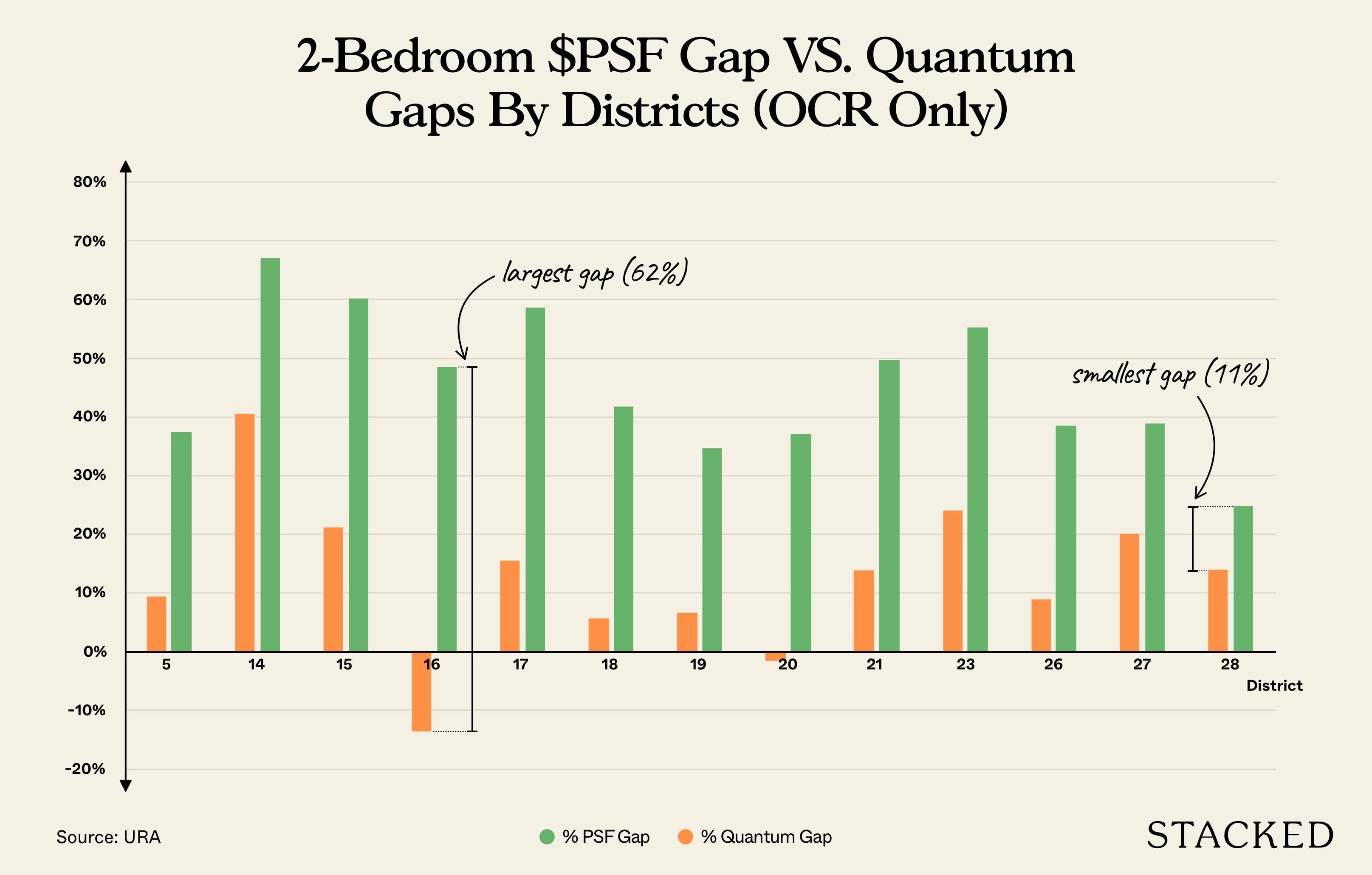

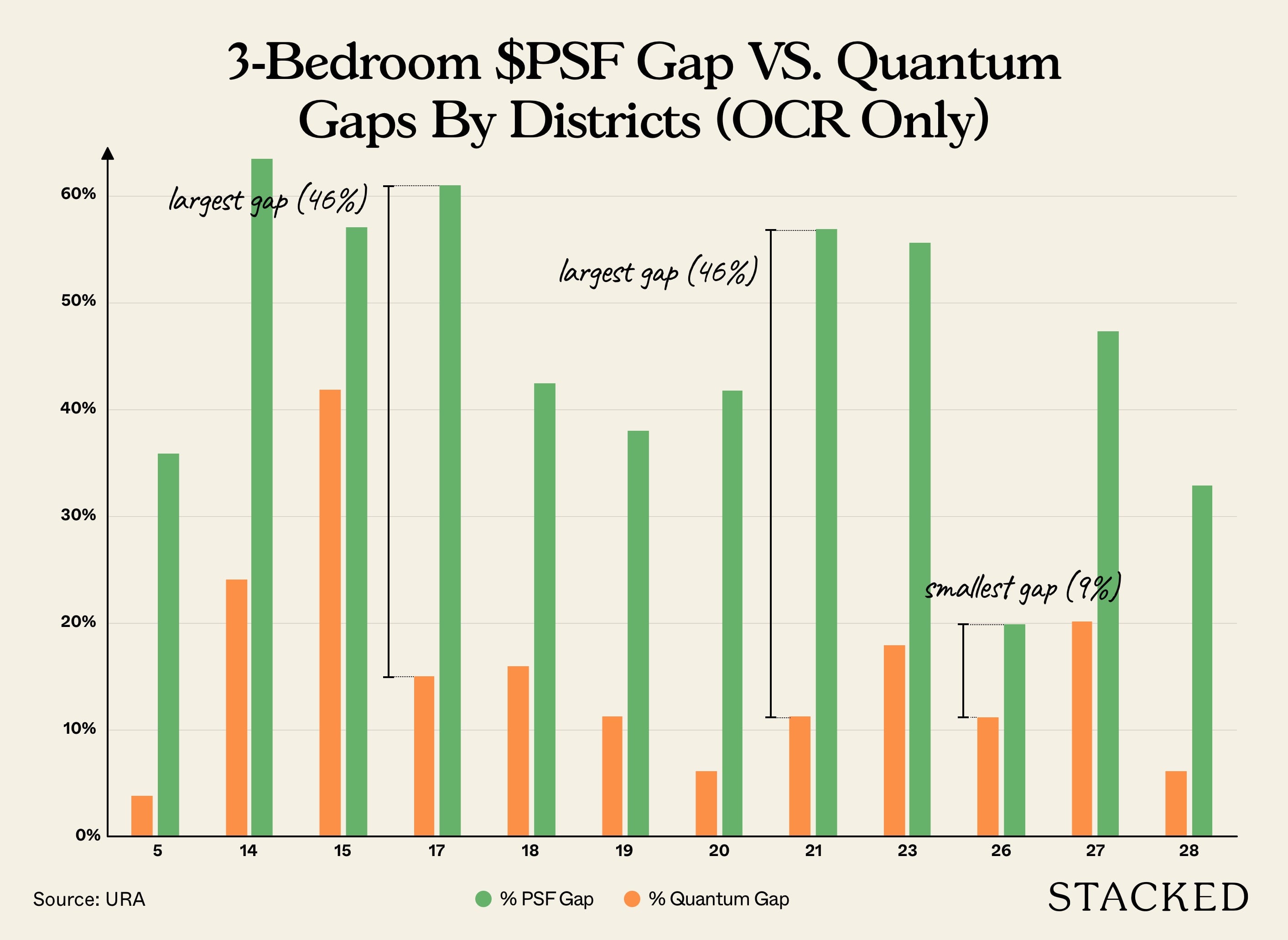

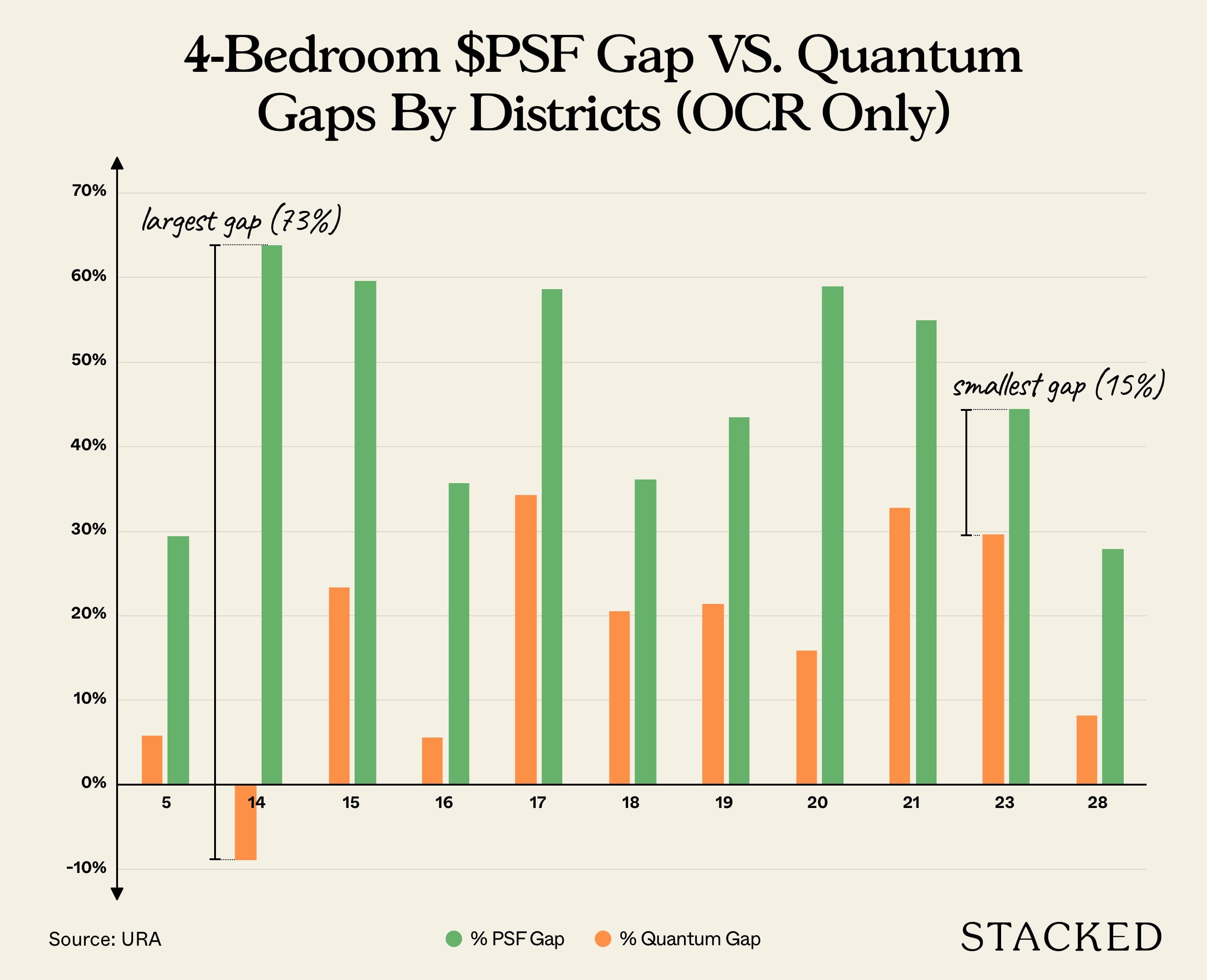

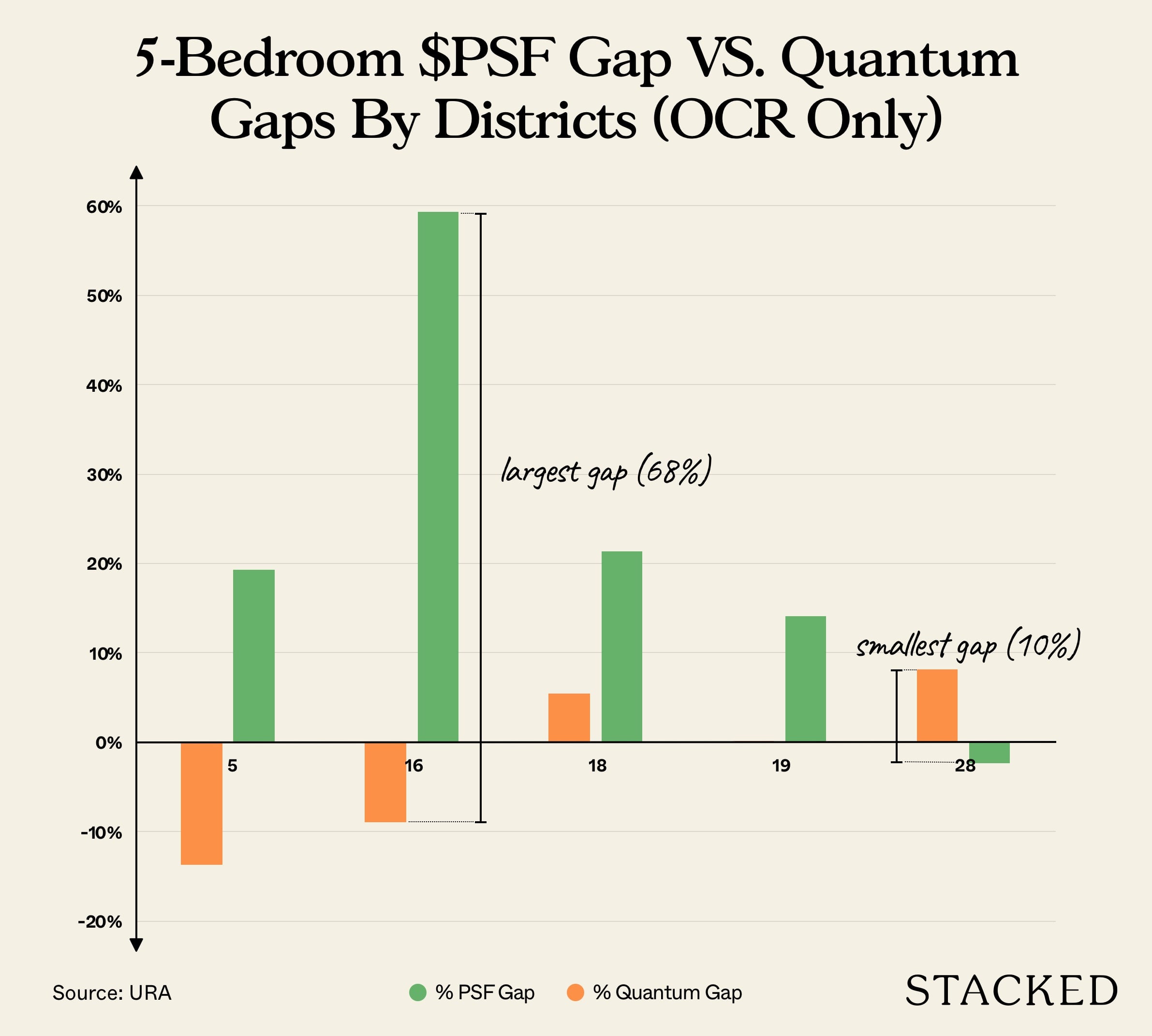

Finally, for those looking to segregate it by bedroom instead, we’ve compiled it into a graph for you.

1 Bedroom

2 Bedroom

3 Bedroom

4 Bedroom

5 Bedroom

Across the list of districts, you may notice that – while the price gap on a PSF basis is widening – the gap between the quantum is not as significant.

For example, consider District 16 (see part 1). The quantum for new one-bedders and three-bedders in Bedok were respectively 14 per cent and nine per cent cheaper than resale counterparts; although there was a large price gap on a psf basis.

Likewise in District 14, new four-bedders were 64 per cent higher than resale counterparts on a psf basis; but in terms of overall costs, the same units were about nine per cent cheaper.

This may come as a relief to buyers, since the key factors – such as financing, stamp duties, and overall affordability – come down to the quantum more than the price per square foot. For some homeowners, this could mean better affordability, not worse.

For those considering shoebox units though, it may be time to ponder if it’s worth splurging for a bigger unit. Some of the most affordably priced shoebox units in 2020 were breaking levels of $3,000 psf.

We’ll keep you informed as the situation changes. For more in-depth reviews of these properties, and updates on the unfolding Singapore private property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the main districts with notable price gaps between new and resale condos since 2020?

How is the size of resale units determined in the analysis?

Why is there a significant price gap between new launch and resale condos in District 21?

What factors contribute to the price gap in District 23?

How does the price gap between new and resale condos compare on a quantum versus price per square foot basis?

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

2 Comments

Can u do a comparison between quantum gap and size gap? I feel it is more meaningful