The Singapore residential rental market has been on the downtrend since 2013.

Despite the rising property prices earlier this year (before the cooling measures in July), the Singapore residential rental market has not been in good shape.

So why is the residential market doing well in terms of sales at one point but the rental market is still flailing behind?

A big reason could be because of the rush of en bloc deals that started in 2017.

Before the cooling measures, the influx of cash from the en bloc deals could have been the main driver for pushing the prices further up, thereby forcing the Government to act to soften the market.

Another factor could be the increase in foreigners purchasing property in Singapore as well, as the tax on foreigners buying property in countries like Hong Kong and Australia were increased.

With that being said, on the Singapore residential rental market side the immigration policy has still not been relaxed.

So with less expats and foreigners coming in, naturally the rental market would be as weak as it is.

Could the Singapore Residential Rental Market rise in prices in 2019?

If you have been keeping track of the rental market in Singapore, in November there was actually a slight pick up in private condo rental rates.

Before you get your hopes up (if you are a landlord), this was actually only a measly 0.6%.

However, the core central region (CCR) did rise up by 1.8%.

But if you were compare it the year before in November 2017, the number of transactions actually fell by 11.8% from 4,297 units rented out.

So based on all these figures, is it possible that the rental market prices might rise in 2019?

More from Stacked

2024 Year-End Review Of The Singapore Property Market: Key Numbers And Trends You Need To Know

2024 was a year that came with several surprises toward its end. Besides the first post-GFA harmonisation condos, we also…

Rental MarketMinimum rental period in Singapore – how long can you actually rent?

by SeanFor the Singapore rental market, probably the most important factor is always about the number of foreigners and expats coming into Singapore.

So if you were to look at the number of Singapore non-residents coming in, this actually dropped 0.1% to 1.64 million in June.

Not to mention that it is widely known that expat salaries in Singapore has been dropping.

According to findings of the latest MyExpatriate Market Pay survey by ECA International, the expat salary has shrunk by over SGD$15,986 as compared to the year before.

This means that expats will be feeling the pressure because of the lower salary package, and the higher living costs in Singapore might also cause them to look elsewhere.

Not just that, because of the en bloc deals in 2017/2018, there will definitely be more new condo units coming onto the market in the next few years, which further adds to the already rising vacancy rates.

All this news seemingly points to little let off for an already soft rental market.

But there could yet be a slight glimmer of hope next year in 2019.

Because of the en bloc deals that have taken place, there could also be more local demand as these people look to rent to tide them over before moving into their new home.

Also, the cooling measures have prompted many would be buyers to adopt a wait and see stance, so this group of buyers could also choose to rent in the short term.

How do you think the Singapore residential rental market will perform in 2019? Let us know by leaving a comment below or by reaching out to us at hello@stackedhomes.com

Sean

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Read next from Rental Market

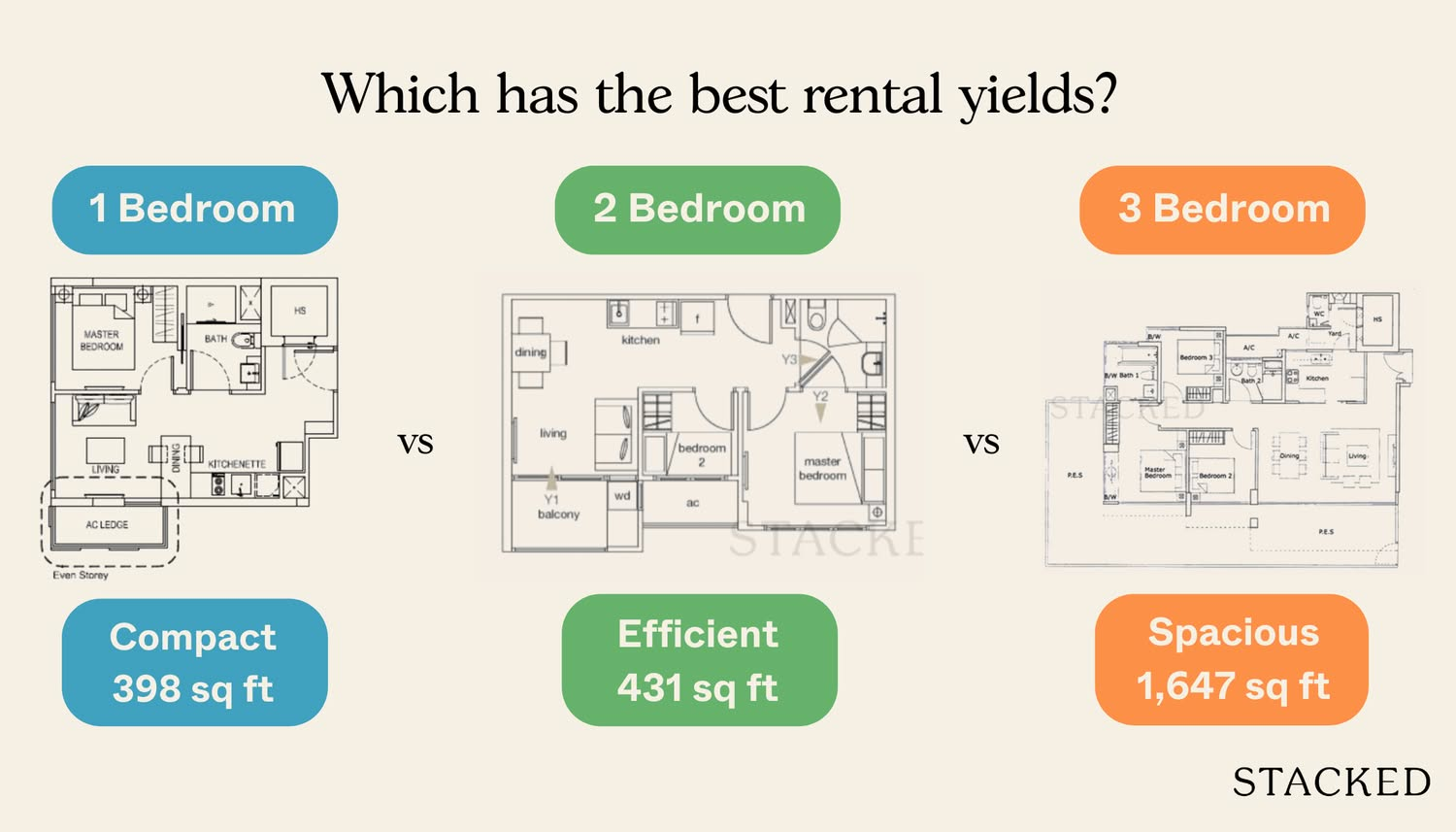

Rental Market Is Singapore’s Rental Market Really Softening? We Break Down The 2024 Numbers By Unit Size

Editor's Pick The Cheapest Condos For Rent In 2024: Where To Find 1/2 Bedders For Rent From $1,700 Per Month

Rental Market Where To Find The Cheapest Landed Homes To Rent In 2024 (From $3,000 Per Month)

Rental Market Where To Find High Rental Yield Condos From 5.3% (In Actual Condos And Not Apartments)

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

Editor's Pick The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?