Singapore Rental Market Challenges: Can Landed Homes Outperform The Slowdown?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

The condo rental market recently saw record highs, but the momentum finally appears to be slowing. Many tenants have now found cheaper alternatives, even if it means moving to more fringe locations. However, one property segment that remains untouched – at least regarding rental rates – is the landed housing segment. We spoke to some realtors on why landed homes haven’t lost their momentum, and whether it’s likely to continue:

A rough snapshot of landed vs. condo rental rates

The following is only a rough look at how landed homes have performed vs. condo counterparts, over the past four quarters. This isn’t a particularly in-depth look (e.g., we haven’t differentiated between types of landed housing, unit sizes, and so forth, plus the number of rental landed homes will invariably be low), but it does suffice to show a general market trend:

Landed vs. condo rental rates in the CCR:

As of Q2 this year, the average rental rate for landed homes was around $4.22 psf, up 33.8 per cent from Q3 in 2022. At the same time, condo rental rates averaged $6.29 psf, up 18.8 per cent from Q3 last year.

Some realtors have commented that, as CCR condo rental rates climbed, tenants have gradually shifted to the RCR. Areas such as District 11 (Newton and Novena) and District 15 (Marine Parade) also have strong expatriate appeal, and lower rents here could have prompted a small exodus.

At the same time, the absolute wealthiest tenants – the ones who can afford to rent prime region landed housing – would be undeterred and continue to rent there. This would explain the landed segment in the CCR maintaining its momentum, whilst condo counterparts start to slow down.

Landed vs. condo rental rates in the RCR:

This was the only region where condo rental rates climbed faster than landed counterparts. Landed rental rates here averaged $3.12 psf, up around 11.7 per cent from Q3 2022. Condo rental rates averaged $5.53 psf, up around 16.4 per cent from Q3 last year.

This may be consistent with the theory broached by realtors, of CCR condo tenants relocating to the cheaper but equally convenient RCR districts.

Landed vs. condo rental rates in the OCR:

Landed rental rates in the OCR averaged $2.95 psf in Q2 this year, up around 21.8 per cent from Q3 2022. Condo rental rates averaged $4.59 psf, up 16.5 per cent from Q3 last year.

Why are landed rental rates still going strong?

Several realtors offered opinions along the following lines:

- The higher ABSD rate on foreigners discourages buying

- Constant barrage of advice against buying leasehold landed

- Completion of more homes doesn’t affect the landed market as much

- Affluent tenants have higher privacy demands

1. The higher ABSD rate on foreigners discourages buying

ABSD for foreigners buying Singapore properties was doubled recently, from 30 per cent to 60 per cent. Barring a few specific nationalities (e.g., US Citizens, who pay the same tax rates as Singaporeans), the doubled ABSD may have caused prospective home buyers to back off.

However, some of these foreigners have already made the move to Singapore, and have business ventures or other interests here. The wealthier among them may also be unused to living in apartments or other shared spaces. This leaves only one alternative: that’s to rent landed properties.

More from Stacked

5 Surprising Reasons Why Some New Launch Condos Sell Better Than Others

In a real estate market where HDB upgraders and first-time buyers are grappling with affordability issues, it's interesting to witness…

Two of the realtors we spoke to saw this turnaround in clients. Both had prospective buyers from China; but after the new ABSD hike, their clients instructed them to find a rental option instead.

One of the realtors noted her client had opted to buy in Hong Kong instead, while renting a unit in Singapore.

2. Constant barrage of advice against buying leasehold landed

One realtor chalked up the rental demand to sales pitches. Buyers are often led to believe that leasehold landed aren’t “real” landed properties, and belong to lesser categories such as cluster housing, or strata-titled landed units in condo projects.

(We have covered this in some detail, in this previous article).

However, foreigners can’t buy freehold landed homes without special permission from the Singapore Land Authority (SLA). Most are restricted to the leasehold landed homes in areas like Sentosa Cove.

Now coupled with weaker expected appreciation with rising interest rates, higher ABSD (see point 1), and psychological dislike of lease decay: it’s easy to see why a foreigner, who is denied a freehold landed property, would rather rent than buy a leasehold “liability”.

3. Completion of more homes doesn’t affect the landed market as much

Due to the major housing shortage following Covid, we saw locals rushing for condo and HDB rentals. In a rare confluence, both Singaporeans and foreigners found themselves in need of temporary accommodation.

As more new homes are completed, however, more Singaporeans can finally stop renting. This frees up some tenanted units, and we’ll consequently see condo rental rates fall.

But while hundreds of new condo units are being completed, the same isn’t true for landed housing. As such, the fundamentals of demand and supply haven’t changed in the landed rental market; and it’s unlikely that landed will see the same slowdown as its condo counterparts.

4. Affluent tenants have higher privacy demands

One realtor pointed out that, among the ultra-high net worth foreigners, there’s simply never a question of renting a condo. Even with 24/7 security, some of these tenants – who have celebrity status in business or media – would find themselves scrutinised by gawkers, the press, or other forms of privacy intrusion.

As such, these tenants are forced to rent more exclusive forms of housing, even if they know landlords charge them exorbitant rates (which they can luckily afford).

The same realtor also said that property ownership has tax implications that differ from renting. Some nationalities, for example, could end up paying property taxes in both Singapore and their home country, and hence would rather rent instead. Also, some countries impose capital controls and restrict how their citizens can invest; this applies even abroad.

As long as Singapore continues to draw these affluent individuals, rental rates for high-end landed properties will continue to rise.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Rental Market

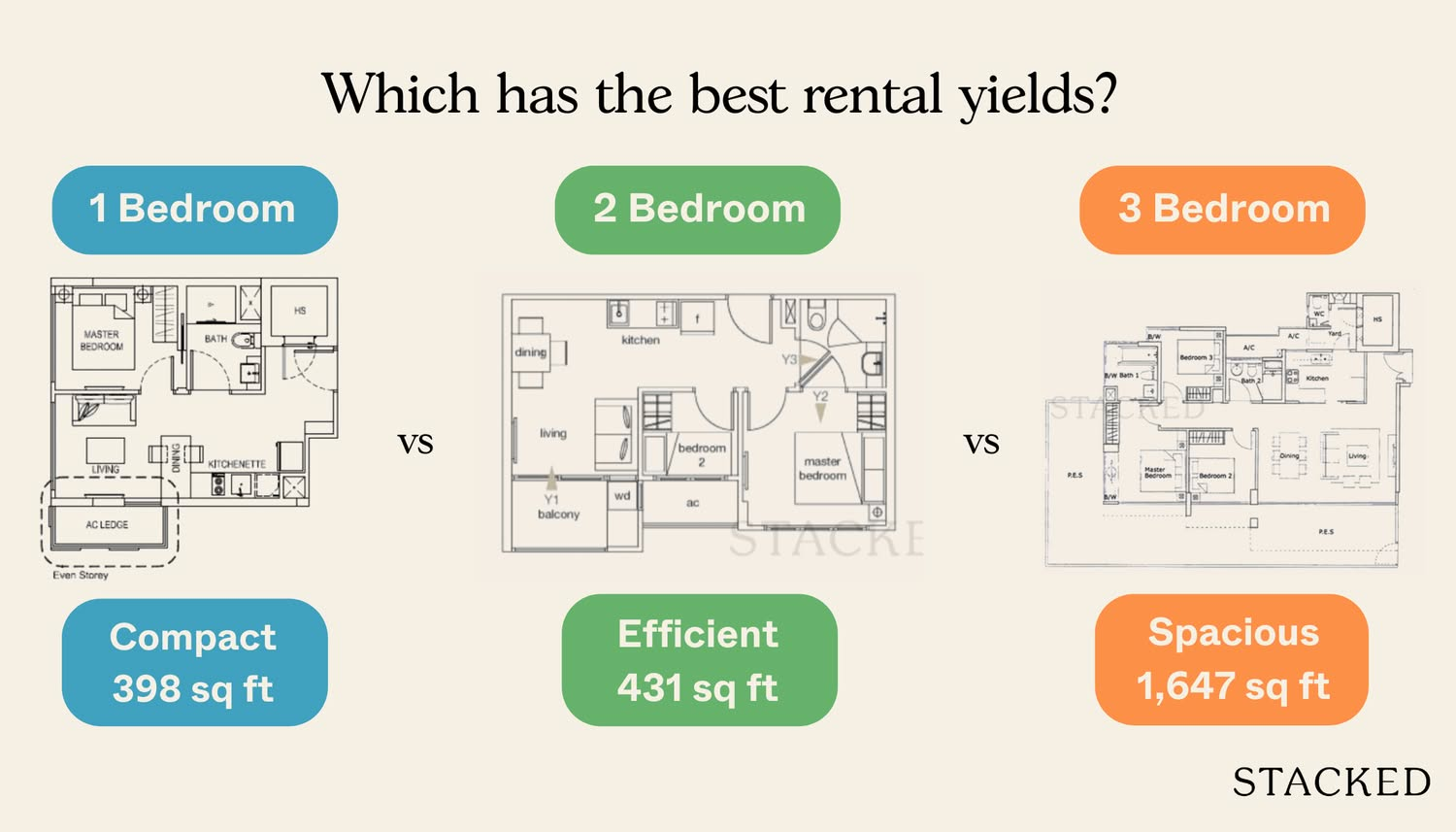

Rental Market Is Singapore’s Rental Market Really Softening? We Break Down The 2024 Numbers By Unit Size

Editor's Pick The Cheapest Condos For Rent In 2024: Where To Find 1/2 Bedders For Rent From $1,700 Per Month

Rental Market Where To Find The Cheapest Landed Homes To Rent In 2024 (From $3,000 Per Month)

Rental Market Where To Find High Rental Yield Condos From 5.3% (In Actual Condos And Not Apartments)

Latest Posts

Property Market Commentary Why 2026 May Be a Good Year to Buy an EC — With an Important Caveat

Overseas Property Investing What $940,000 Buys You in Penang Today — Inside a New Freehold Landed Estate

Singapore Property News One of Singapore’s Biggest Property Agencies Just Got Censured

New Launch Condo Analysis This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

Singapore Property News Over 3,500 People Visit Narra Residences During First Preview Weekend

Singapore Property News 66% of Units at Coastal Cabana Sold at End of First Sales Day, Prices Average $1,734 psf

New Launch Condo Reviews Newport Residences Review: Rare Freehold Development in the CBD with Panoramic Sea Views from $3,012 psf

Property Advice I Regret My First HDB Purchase. What Should I Do Next?

On The Market Here Are The Rarest HDB Flats With Unblocked Views Yet Still Near An MRT Station

Singapore Property News New Condo Sales Hit a Four-Year High in 2025 — But Here’s Why 2026 Will Be Different For Buyers

Pro How a 1,715-Unit Mega Development Outperformed Its Freehold Neighbours

Overseas Property Investing Why ‘Cheap’ Johor Property Can Get Expensive Very Quickly For Singaporeans

Pro Why This Old 99-Year Leasehold Condo Outperformed Newer Projects in Bukit Timah

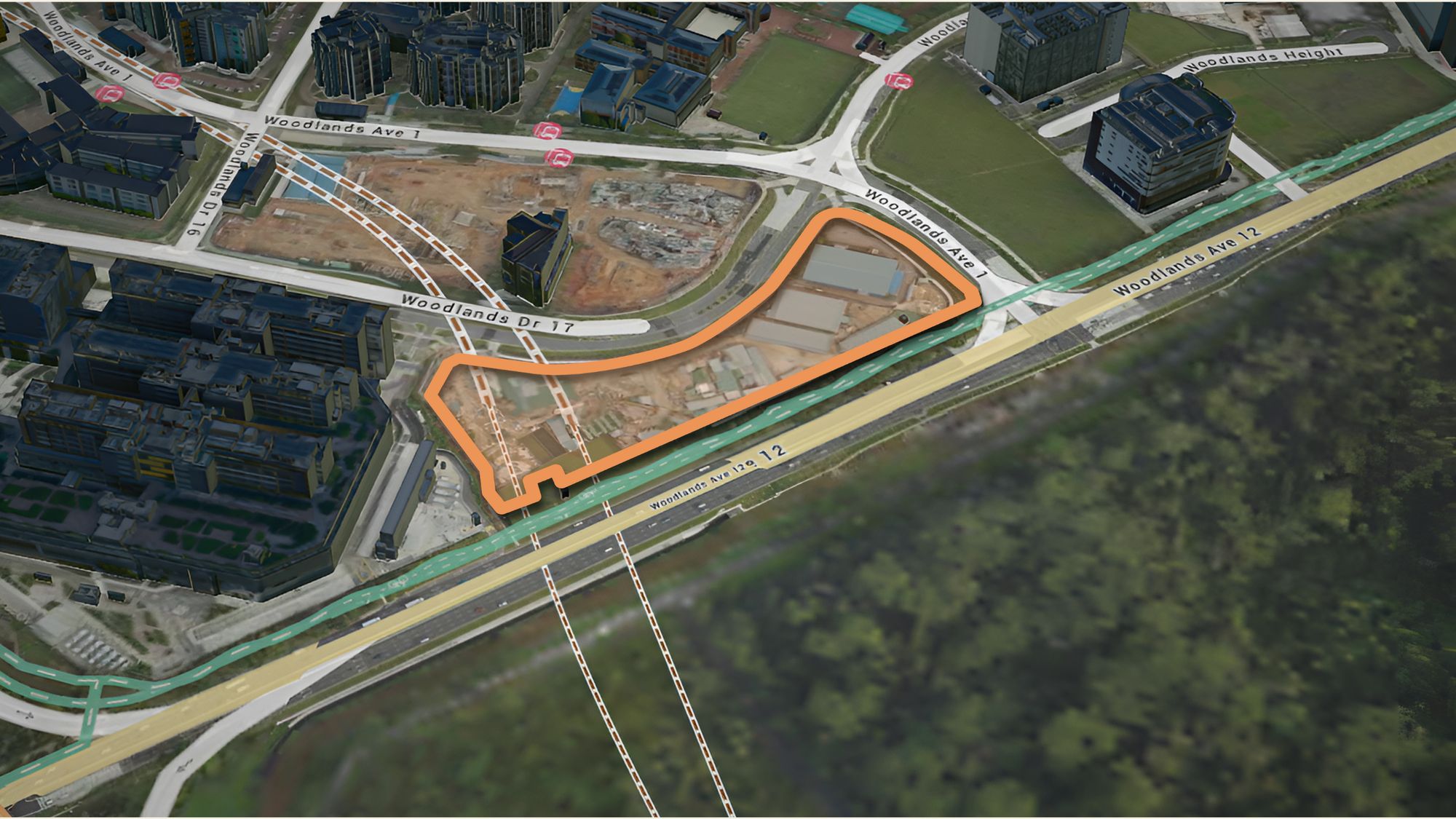

Singapore Property News This New Woodlands EC May Launch at $1,850 PSF: Here’s Why

New Launch Condo Analysis This Freehold New Launch Condo In The CBD Is Launching From Just $1.29M