Should We Sell Our Old HDB Flat In CCK And Buy Another Resale Or Keep For Passive Income?

August 16, 2024

Hello Stacked Homes

I am in my early 50s and my husband is in early 60s. We have a HDB under my name. I am currently unemployed and my husband is still working. He plans to retire in 2 or 3 years time. I hope to retire as soon as possible.

The current 4 room flat was built in 1988 and the resale value is about 400k, in cck. We do not like the current place and will like to move to a more convenient location.

We are planning for retirement and have the following options in mind:

1. Sell the current flat and buy a resale 4 room HDB under joint name. The location that we are looking at will cost about 800K to over 900K.

2. Buy a BTO but we estimate it will take about 8 or 9 years (due to income requirement, ballots, construction) before we can get it.

3. Keep the HDB to earn passive income for living expenses. My husband will get a 2 bedroom condo. Looking at the current property prices, we are thinking of getting a resale EC. Eventually in 6 to 8 years time, we will want to cash out the condo when there is a decent profit of 20%. However, the lease decay of the current HDB maybe higher than the rental income collected.

My main concern is whether is it feasible to keep the current HDB or not.

We hope you can give us some perspectives on our options and offer us advice which is the best option to maximise our returns.

Thank you very much for shedding some light on this.

Please email me should you need further clarifications.

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there,

It is good that you are planning for your retirement now, and while most people tend to downsize and cash out rather than upgrade, there isn’t a one-size-fits-all approach. Your retirement strategy should align with your personal goals.

Let’s begin by assessing the potential costs associated with the options you’re considering.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Potential pathways

Since we don’t have your exact financial details, we’ll assume you have the necessary funds to purchase the properties you’re considering. Additionally, given that you’re both planning to retire soon, we’ll presume the properties will be fully paid for without taking out any loans.

Sell your current flat and buy another flat under both names in a location of your choice

We’ll use the $900K estimate that you’ve given us for this scenario. For calculation purposes, we will use a 10-year horizon which we’ll use to compare across the other scenarios.

| Purchase price | $900,000 |

| BSD | $21,600 |

| Sales proceeds from the sale of the current flat | $400,000 |

| CPF + cash top up required | $521,600 |

Costs incurred

| BSD | $21,600 |

| Town council service & conservancy fees (assuming $72/month) | $8,640 |

| Property tax | $7,600 |

| Renovation cost | $20,000 |

| Total cost | $57,840 |

This option is straightforward as it just involves upgrading to a flat in a location you prefer. Since your husband’s financial capacity allows him to purchase a 2-bedroom resale EC in his name alone, you’ll likely have some funds remaining after the purchase which can be allocated towards your retirement or other investment avenues.

Buy a BTO

There are several factors to consider with this option. Since BTOs (Build-To-Order flats) use a ballot system, there’s an element of luck involved in securing a unit of your choice, as it depends on receiving a favourable queue number.

Additionally, you have no control over the launch locations, which may or may not align with a location that you want to retire in. Moreover, if you’ve previously purchased a subsidised flat, your chances of securing a unit decrease, and a resale levy will be payable. Compared to purchasing a resale flat, there are more uncertainties in securing a unit in your desired estate.

For the sake of calculation, let’s assume your husband retires in 3 years, you secure a BTO unit on your first attempt, and it takes 4 years to be completed. During this period, you will remain in your current property. Considering the cost of the resale flat you’re looking to purchase, we assume it’s in a central location. Since most 4-room flats in the PLH model start at nearly $600K, we’ll use $650K as a hypothetical purchase price.

| Purchase price | $650,000 |

| BSD | $14,100 |

| Sales proceeds from the sale of current flat (assuming that price remains the same) | $400,000 |

| CPF + cash top up required | $264,100 |

Costs incurred

Staying in the current flat for 7 years

| Town council service & conservancy fees (assuming $67/month) | $5,628 |

| Property tax | $1,120 |

| Total cost | $6,748 |

Staying in the BTO for 3 years

| BSD | $14,100 |

| Town council service & conservancy fees (assuming $72/month) | $2,592 |

| Property tax | $1,380 |

| Renovation cost | $20,000 |

| Total cost | $38,072 |

Total cost if you were to take this pathway: $6,748 + $38,072 = $44,820

Keep the HDB to rent out, purchase a 2-bedroom condo under your husband’s name and cash out 6 – 8 years later

Owning two properties is a suitable retirement strategy, as it provides a steady stream of passive income and gives you the option to eventually sell one of them for a lump sum, as you’ve mentioned.

In 2023, the average price per square foot for a resale Executive Condominium (EC) between 650 and 850 square feet was $1,325. If your husband purchases a 750-square-foot unit, it would cost around on average $993,750.

According to the Q1 2024 HDB rental statistics, the average rent for a 4-room flat in Choa Chu Kang is $3,000. For calculation purposes, let’s assume a 10-year horizon where you rent out your flat for 8 years while living in the condo, then sell the condo in the eighth year and move back into the HDB for the remaining 2 years. While we understand that you’re not fond of your current flat’s location and you might prefer to sell both properties and buy one in an area you like instead of moving back, for a simple comparison, we’ll use the former scenario for the calculations.

| Purchase price | $993,750 |

| BSD | $24,412 |

| CPF + cash top up required | $1,018,162 |

Cost incurred

Renting out the HDB for 8 years and moving in for 2 years

| Town council service & conservancy fees (assuming $67/month) | $8,040 |

| Property tax | $38,720 |

| Rental income | $288,000 |

| Agency fee (payable once every 2 years) | $13,080 |

| Total gains | $228,160 |

Staying in the condo for 8 years

| BSD | $24,412 |

| Maintenance fees (assuming $250/month) | $24,000 |

| Property tax | $6,984 |

| Renovation cost | $20,000 |

| Total cost | $75,396 |

Total gains if you were to take this pathway (excluding capital appreciation if any): $228,160 – $75,396 = $152,764

Since you will only be purchasing an investment property in option 3, it is the most profit-generating pathway. In the first two options, while living in the property, you won’t generate profits directly. However, due to the lower funds needed for the top-up, you will likely have leftover funds that can be invested elsewhere.

With a clearer understanding of the required costs, let’s now examine the performance of HDB flats and ECs.

Performance of HDB flats

It’s often assumed that older flats will lose value more quickly than newer ones due to lease decay. However, a recent Business Times article talked about how older, and particularly larger, units have been performing better than their newer counterparts.

This trend became especially noticeable during and after the pandemic, as more people began working from home and realised they needed or preferred larger living spaces. Older flats, which typically offer more generous square footage, have likely outperformed newer, smaller, and more expensive flats for this reason.

The article also highlighted another factor driving the demand for larger flats: private property owners who have cashed out and are now entering the market after fulfilling the 15-month waiting period.

However, we cannot expect all old flats to outperform, especially if they lack any distinct selling points, such as the sea views offered by older Marine Terrace flats. This could make price growth more challenging during market upswings and may cause prices to remain stagnant during downturns.

While growth rates have slowed post-pandemic, HDB prices have continued to rise. Although we can’t predict exactly how long this trend will continue, it’s unlikely that prices will see a significant drop in the short to medium term.

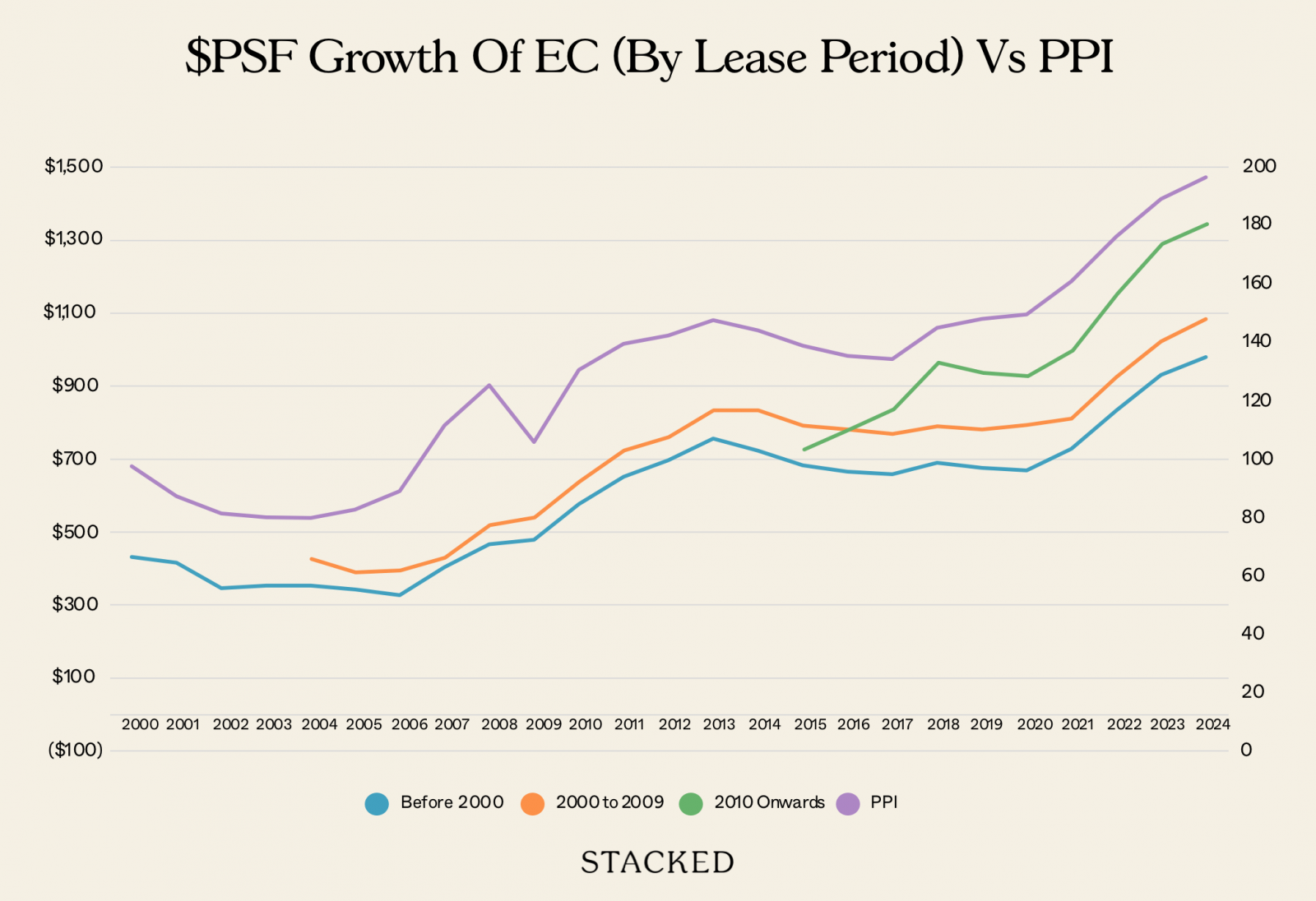

Performance of ECs

| Year | Completed before 2000 | Completed between 2000 to 2009 | Completed 2010 onwards | PPI |

| 2000 | $430 | 97.7 | ||

| 2001 | $413 | 87.5 | ||

| 2002 | $343 | 81.6 | ||

| 2003 | $350 | 80.1 | ||

| 2004 | $351 | $425 | 79.9 | |

| 2005 | $340 | $389 | 82.7 | |

| 2006 | $325 | $394 | 89.2 | |

| 2007 | $402 | $429 | 111.6 | |

| 2008 | $464 | $518 | 125.4 | |

| 2009 | $476 | $539 | 106.0 | |

| 2010 | $574 | $638 | 130.6 | |

| 2011 | $650 | $723 | 139.6 | |

| 2012 | $695 | $760 | 142.4 | |

| 2013 | $754 | $834 | 147.6 | |

| 2014 | $722 | $833 | 144.2 | |

| 2015 | $682 | $792 | $726 | 138.9 |

| 2016 | $664 | $780 | $780 | 135.5 |

| 2017 | $656 | $768 | $836 | 134.4 |

| 2018 | $689 | $789 | $964 | 145.2 |

| 2019 | $675 | $781 | $937 | 148.2 |

| 2020 | $668 | $793 | $928 | 149.7 |

| 2021 | $727 | $810 | $998 | 161.1 |

| 2022 | $832 | $925 | $1,154 | 176.4 |

| 2023 | $930 | $1,022 | $1,290 | 189.1 |

| 2024 | $978 | $1,083 | $1,343 | 196.7 |

| ROI from 2017 | 5.9% | 5.0% | 7.0% | 5.6% |

*PPI data was averaged across the quarters in the year and is used to show the general market movement.

The table shows that in general, ECs across all age groups have performed as well as or better than the PPI. Even older leasehold ECs have achieved annualised gains of 5.9% since 2017, indicating that age has not been a barrier to price growth. This suggests that the leasehold nature of newer resale ECs is unlikely to hinder capital appreciation. Resale ECs are also popular among HDB upgraders due to their relative affordability, mass market appeal, larger size, and family-oriented facilities.

A study conducted by OrangeTee & Tie in 2022 analysed new sale caveats from 2007 to August 21, 2022, and matched them with the resale caveats (if any) of the same units during the same period. The study found that 99.9% of these transactions were profitable. Since ECs tend to be slightly more affordable than private condominiums of a similar age and in the same area, they generally offer higher rental yields. This makes ECs a potentially more attractive investment, especially when considering the overall profitability and rental returns.

What should you do?

The answer to “maximising your returns” depends on what you mean by that and how you plan to use any excess funds if they are not invested in property.

You raised a concern about the potential lease decay of your current flat outweighing the rental income. If we consider straight-line depreciation for a resale flat valued at $400K with 63 years remaining on the lease, this would amount to $6,349 per year. However, since depreciation isn’t linear and is likely to accelerate as the lease term shortens (in theory, according to the Bala’s Curve), this $6,349 figure is a conservative estimate.

Based on the average rent of $3,000 per month for a 4-room flat in Choa Chu Kang, your rental income should surpass the potential depreciation for now. Additionally, since HDB flats with over 50 years remaining on their lease are still appreciating, it’s unlikely that your current flat will depreciate considerably in the near future.

Option 3, which involves purchasing a second property, could potentially maximise your returns by generating passive income and capital gains. However, this option requires a higher financial outlay due to the purchase of an additional property. Given the performance of HDB flats, it is reasonable to expect that prices will not drop significantly in the short to medium term. Therefore, holding onto your flat for a few more years should not pose a significant risk.

Now the other question is – what would the situation look like if you had invested the excess funds elsewhere?

In this case, option 2 looks to be more suitable. You’ll be faced with reduced holding costs and spare you the effort of managing another property.

Let’s take a quick look at the potential gains in Options 1 and 2 if you were to invest your remaining funds over a 10 year period.

| Options | Funds left over | Potential gains (assuming a 5% ROI if you were to invest your leftover funds) |

| 1. Sell your current flat and buy another flat under both names in a location of your choice | $93,750 | $51,687 |

| 2. Buy a BTO | $343,750 | $189,519 |

| 3. Keep the HDB to rent out, purchase a 2-bedroom condo under your husband’s name and cash out 6 – 8 years later | $0 | $152,764 (from rental income) |

In this example, we’ll use 5% as a return on investment, assuming it’s a mix of bonds and equities.

While Option 2 leaves you with more funds for alternative investments, which could yield returns that exceed those in Option 3 at a 5% ROI, Option 1 is still perhaps the most suitable.

Option 1 offers greater flexibility, allowing you to purchase at your own convenience and choice given it’s a resale flat, and giving you more control over the transaction compared to a BTO flat, where timing and availability are less predictable. This is because you’re already looking to retire, so we can’t just purely look at the forecasted financial performance – we have to take into consideration the non-financial benefits of purchasing a resale flat.

The potential gains will then depend on the purchase price and the funds you have left over for other investments. If you’d like to increase the passive income from your investments, you could look at older resale flats in the central area – one that’s lower than the $800-$900k+ budget you’ve highlighted. Alternatively, you could keep an open mind and explore city fringe locations that are older.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

0 Comments