Sell HDB buy Condo: Can you actually upgrade to a CONDO and have a SECOND PROPERTY?

December 12, 2017

NEWSFLASH!!! You can upgrade to a CONDO and have a SECOND PROPERTY with additional CASH IN THE BANK!

Sound familiar?

Perhaps it rings a bell to you because you’ve been scrolling through your Facebook feeds. Well, recently we have been seeing many of these cookie-cutter ads with this REALLY big hook for a tagline. Not surprisingly, these posts have been shared multiple times on Facebook, with many people commenting and asking the agent to reach out to them.

Here are just a few of these sell HDB buy Condo ads:

From the sound of it, it seems that any typical household in Singapore can own a condo if they know how to unlock the secret. Sell HDB buy Condo, doesn’t it sound so simple? Well, if it sounds too good to be true, it probably is. So let’s work out some calculations to see how this can be achieved.

Let’s use an example atypical of a household found in some of these ads: A couple, Mr. and Mrs. Lee, both 35 years of age, now plans to sell their flat.

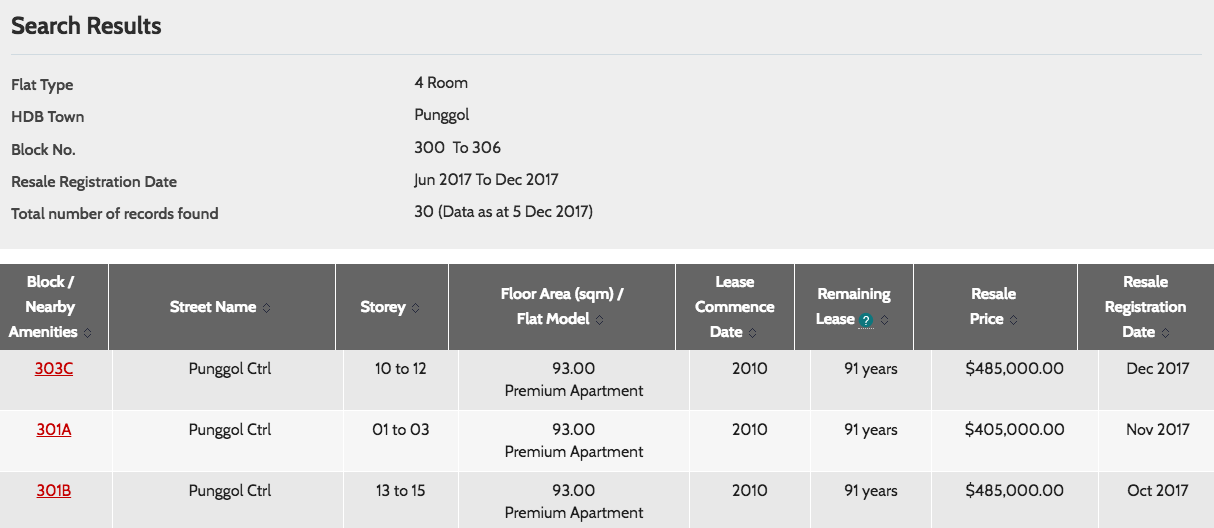

We assume that they managed to obtain their BTO flat at a reasonable age of 25. Counting back 10 years ago to 2007, plus a 3 year wait for a BTO flat, we now look for one that was completed in 2010. A quick search which concludes to Coralinus 2 in Punggol. This development was built in Feb 2010 and back then it commanded a price of about $220,000 for a 4 room HDB flat.

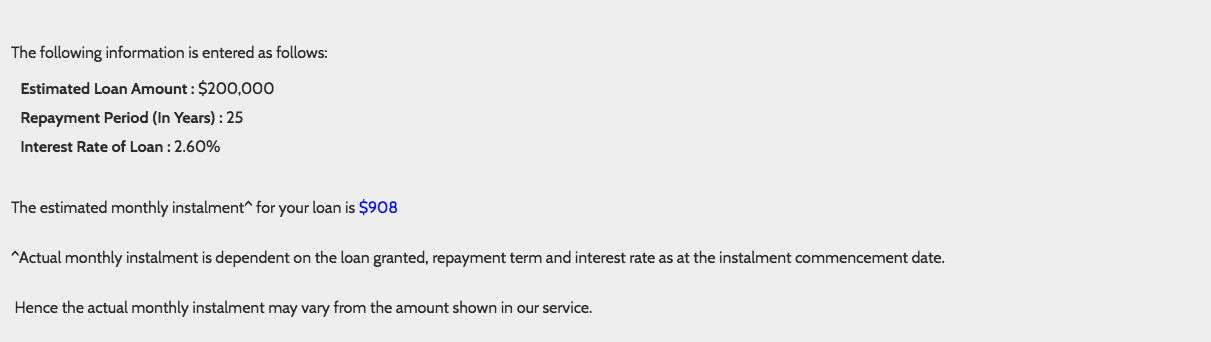

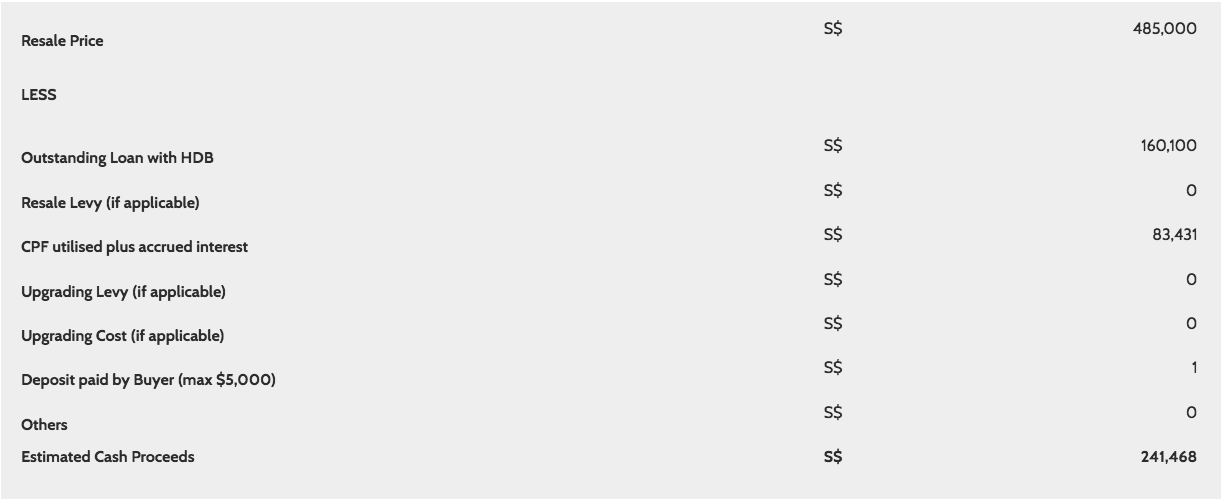

In 2017, a 4 room HDB flat was sold for $485,000. To simplify, let’s assume that this couple took an HDB loan and paid off the standard down payment of 10% for the flat. This means that they would have taken a loan of $198,000 which we will keep at $200,000 to make things easy to compare.

From here we can see that the monthly repayment for the loan is at $908, of which $475 goes to the principal and $433 is the monthly interest. This means that after 7 years they would have paid a total of $76,272, and $39,900 of the principal amount. Based on the $76,272 that was paid out of their CPF, they would have to pay back $7,159 cash on accrued interest upon any sale. If you would like to read up more about using your CPF to purchase your home you can do so here.

So based on a sale of $485,000, they would have garnered cash proceeds of $241,468. A pretty tidy sum all right. Way to go Mr. and Mrs. Lee!

Finally, we need to work out how much an average couple would have saved up to see the final cash balance at hand. According to Singsaver, the average savings rate is about 20%. So to keep things simple, our assumptions here is that the couple has earned a combined salary of $6,000 (taking home $4,800 after CPF) since the beginning.

Based on this, after 10 years, they would have saved $115,200. After adding the CPF left in account ($190,128) + cash savings ($115,200) + cash proceeds from sale ($241,468) you would get a grand total of $546,797.

Now you might be thinking, more than half a million dollars? That seems enough!

But hold on.

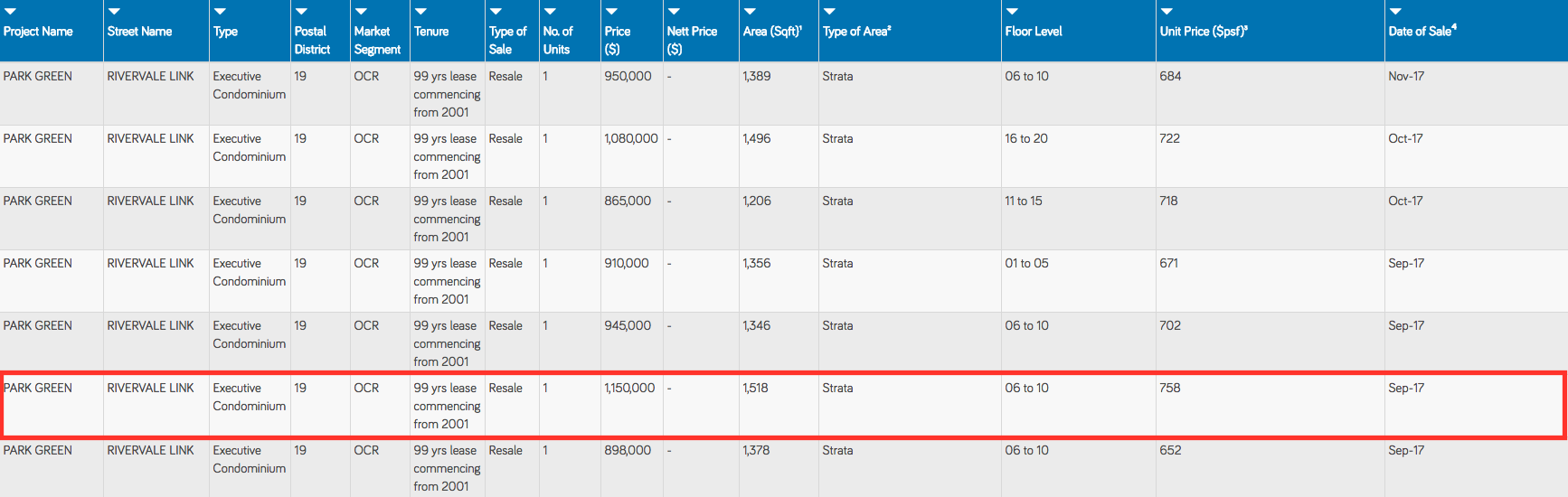

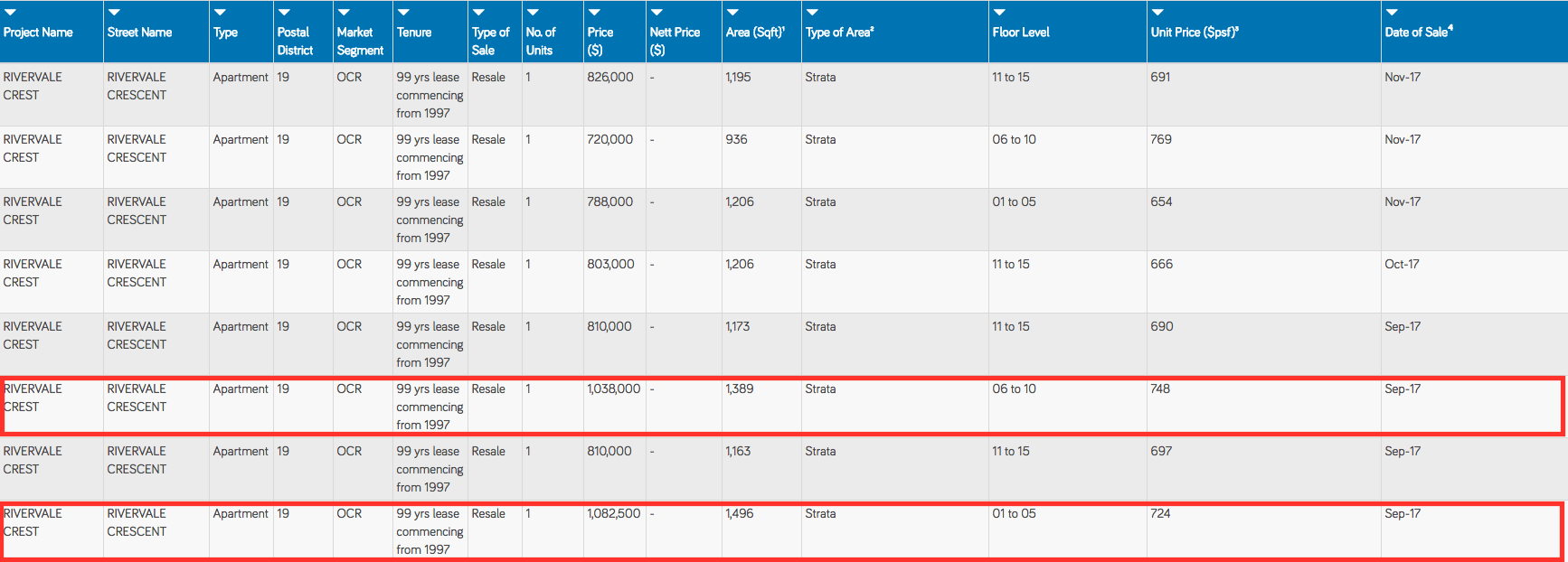

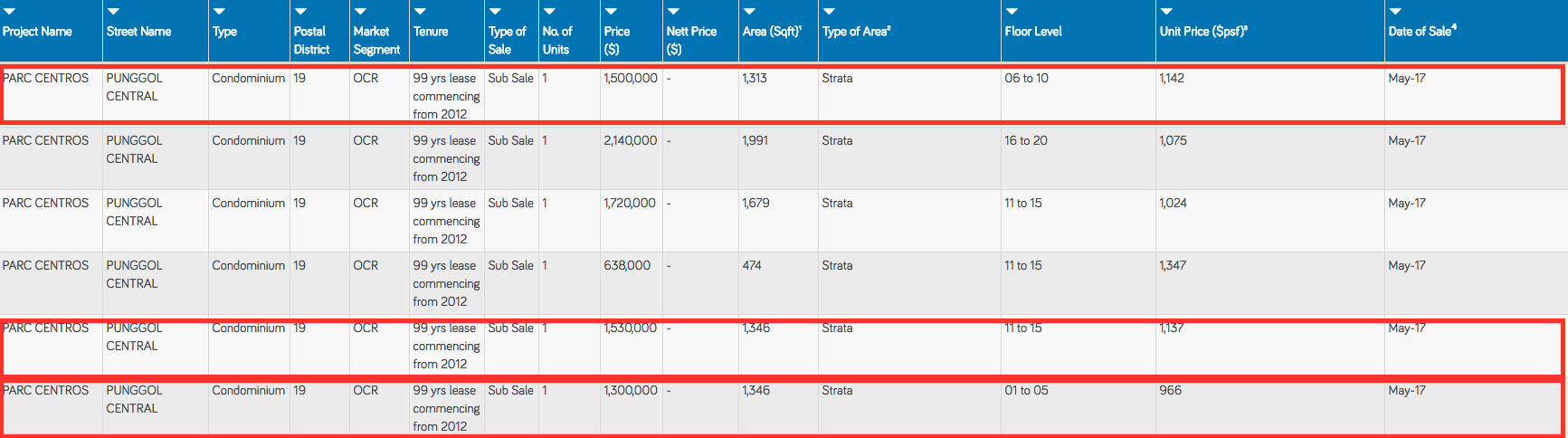

First let’s look at how much it would cost them to upgrade to a condo. As all these ads do not specify what type of 4-bedroom condominium, we will just have to showcase both, so either an executive condominium (EC) or a private condominium. A 4 bedroom EC in the Punggol or Sengkang area like Park Green today would cost about $1.1million. An older 4-bedroom condominium like Rivervale Crest would cost about the same, while a newer development like Parc Centros at Punggol would be out of reach at about $1.3 million.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Park Green – EC in Sengkang

Rivervale Crest – 99-years leasehold from 1997

Property AdviceSell your home: 5 actionable tips to take for a first-time home seller

by Druce TeoPark Centros – Condo in Punggol

To make things easier, let us go through a few of these sell HDB buy Condo scenarios

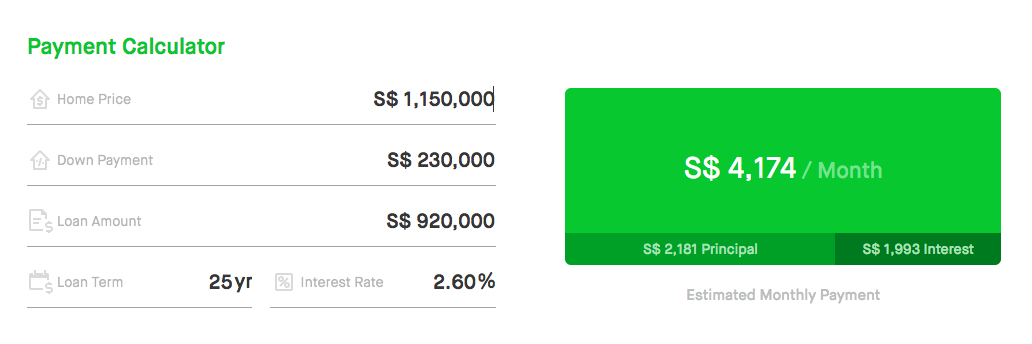

Scenario A – Upgrade to EC with minimum downpayment

If we take an EC like Park Green as an example and put the minimum down payment, the monthly payment is definitely out of the question as it exceeds the couple’s total debt servicing ratio (TDSR) of $3,600.

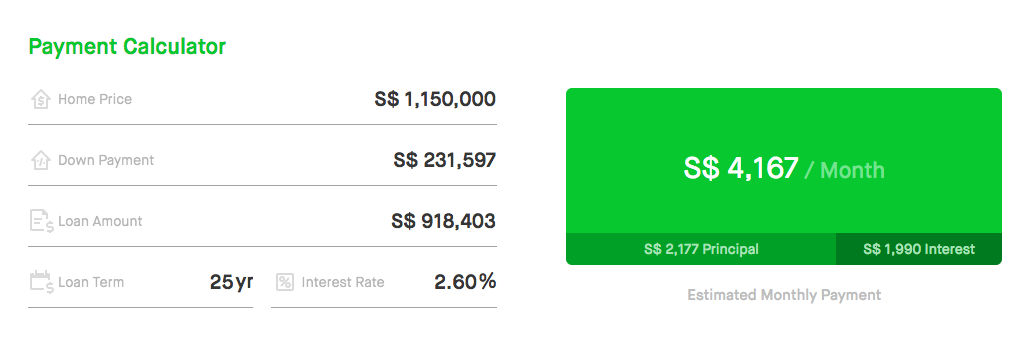

Scenario B – Upgrade to EC savings not touched and minimum cash balance of $200,000

Now because the advertisement said that the couple was able to not use any of their savings and managed to retain a balance of $200,000 cash as a reserve fund, let us plug that in to see what we get. So CPF left in account ($190,128) + cash proceeds from sale ($241,469) is $431,597. After taking away the $200,000 cash that we need to retain we are left with $231,597.

Clearly, this scenario does not work out for the couple.

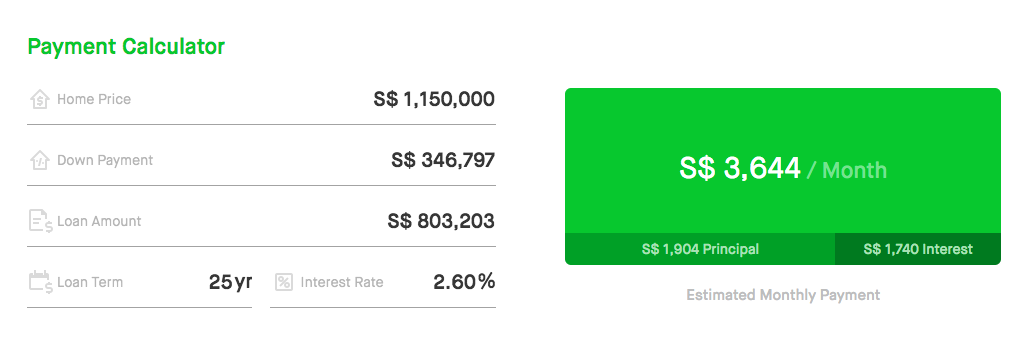

Scenario C – Upgrade to EC saving only $200,000 cash reserve

What if we were to add in the cash savings and just save the $200,000 cash reserves? Even at a $346,797 down payment, the monthly repayments still slightly exceed the TDSR requirements of the couple.

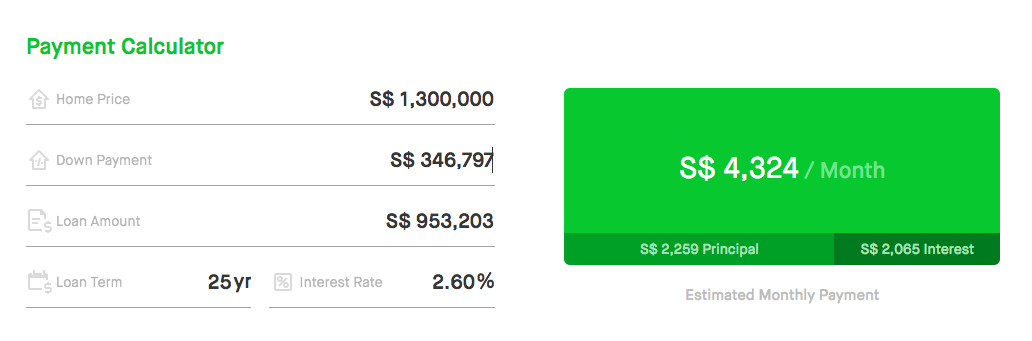

Scenario D – Upgrade to 4-bedroom condominium

As these calculations are just for an EC, it is obvious that affordability for a newer 4-bedroom condominium in Punggol would even harder, but we can show you the numbers anyway.

So to make sure that all bases are covered we have taken a look at a couple of other locations that were completed in 2010, namely Fernvale Vista, Sembawang Green, Sri Geylang Serai and Pinnacle @ Duxton.

| Punggol – Coralinus 2 | Sengkang – Fernvale Vista 1 | Sembawang – Semabawang Green | Geylang – Sri Geylang Serai | Central – Pinnacle @ Duxton | |

|---|---|---|---|---|---|

| Purchase Price | $220,000 | $180,000 | $172,000 | $292,000 | $343,100 |

| Selling Price | $485,000 | $420,000 | $350,000 | $660,000 | $900,000 |

| HDB Loan | $200,000 | $162,000 | $154,800 | $262,800 | $308,790 |

| Monthly Repayment | $908 | $735 | $703 | $1,193 | $1,401 |

| Total payment + interest | $76,272 | $61,740 | $59,052 | $100,212 | $117,684 |

| Total principal paid | $39,900 | $32,356 | $30,828 | $52,332 | $61,488 |

| Oustanding loan | $160,100 | $129,644 | $123,972 | $210,468 | $247,302 |

| Accrued interest from CPF | $7,159 | $5,795 | $5,543 | $9,406 | $11,047 |

| CPF utilised plus accrued interest | $83,431 | $67,535 | $64,595 | $109,618 | $128,731 |

| CPF left in account | $190,128 | $204,660 | $207,348 | $166,188 | $148,716 |

| Cash Savings (20%) | $115,200 | $115,200 | $115,200 | $115,200 | $115,200 |

| Cash proceeds from sale | $241,469 | $222,821 | $161,433 | $339,914 | $523,967 |

| Total cash + CPF | $546,797 | $542,681 | $483,981 | $621,302 | $787,883 |

| Monthly Mortgage for EC | $3,644 | $3,663 | $3,929 | $3,306 | $2,550 |

| Monthly Mortgage for Condo | $4,324 | $4,343 | $4,609 | $3,986 | $3,321 |

Comparing the different locations, we can easily see that if you managed to secure a Geylang BTO, it is possible to sell it 7 years on and upgrade to a 4 bedroom EC. However, it must be said that at $3,306, the monthly repayments are rather close to the TDSR limits. This can be risky in the event one half of the couple loses their job.

Of course you might have noticed that with the Pinnacle @ Duxton, both options of the EC and the condo are within reach. However, to some people it might even be considered a downgrade in lifestyle, as staying in the City and a further away area like Punggol cannot exactly be compared. Judging that purchasing a unit here was almost compared to striking the lottery, it is safe to say that this cannot be considered as an option that most Singaporeans would be able to follow.

Finally, at the end of most of these sell HDB buy Condo advertisements they would add a sentence such as “With a clear asset progression road map planned for them they are even thinking of investing in a second property next year”. On the surface, it sounds like a natural progression, but let’s take a second to stop and think about it.

Buying a second property in Singapore entails:

– a 25% down payment.

– ABSD tax for second property

With the cash reserve that many of them are throwing about, this is only sufficient for buying a $800,000 second property. Firstly, based on our calculations from the first part, it does not look likely that they can have much of a cash reserve if they do upgrade to a private property. Second, the ABSD tax on the second property is nothing to sniff at.

Some of you may say, but the guy could have bought the first property under his name and the wife can buy the second under her name so no ABSD. While that is very true, with a combined income of $6k, it is pretty much unlikely that she would be able to obtain a loan for the second property solely under her name.

As you can see, there are exceptional cases in which these scenarios can happen. But for most people (that did not get Pinnacle @Duxton), this is going to be quite a hard sell for them. There are just too many risk factors that could happen. What if you lose your job? What if the interest rates go up? Thus, it is always important to stay informed to ensure that you are making the best decision for you and your family.

If you like to know more about how much it would cost to upgrade to a Condo you can do so here. Also, if you are open to older freehold condos, we have done up a comprehensive list of older freehold condos that you might want to know about.

And if you’re still unsure if this strategy is suitable for you, feel free to reach out to us at stories@stackedhomes.com!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan Ong

Ryan is part property consultant, part wordsmith, and a true numbers aficionado. Ryan's balanced approach to every transaction is as diverse as it is effective. Since starting his real estate journey in 2016, he has personally brokered over $250 million of properties. Beyond the professional sphere, you'll often find him cherishing moments with his beloved cats: Mia, Holly, Percy and Toto.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice Should I Pay $500K More For A New Launch — Or Buy A Resale Condo Instead?

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Latest Posts

Singapore Property News A Rare Freehold CBD Office Unit Is Up For Sale At $20.5M — And Foreigners Can Buy It

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

2 Comments

Hi my HDB is reaching MOP soon, am looking to upgrade. Do you provide consultation ?