Why You Should Rethink Any Expensive Property Investment Seminars

November 21, 2020

By now, you’ve probably seen the YouTube ads warning you about declining HDB flat values; or the older ads claiming you can own multiple properties with no money down. Most recently, a certain education company has come under fire for these marketing tactics.

This isn’t a new trend; ask property market veterans, and most will recall similar seminars even back in 2010. At the time, the property market was in a strong recovery after the Global Financial Crisis, and numerous courses teaching loopholes and high-risk methods were common. The difference is that back then, the social media marketing was less slick, and didn’t invade your YouTube videos all the time.

Just in case some of our readers are thinking about paying for the seminar, or are just curious, here’s why you probably shouldn’t:

A general overview of how to “own multiple properties” without putting down cash:

- Purchase industrial properties

- Use financing other than home loans

- Invest with someone else’s money

- Use rental income to cover costs, and potentially qualify for more loans

1. Purchase industrial properties

Owning multiple residential properties is out of the question. For Singapore Citizens, there’s an Additional Buyers Stamp Duty (ABSD) of 12 per cent on the property price or valuation (whichever is higher) for your second property. This increases to 15 per cent on your third and subsequent residential properties.

However, there’s no ABSD on commercial or industrial properties (although you do have to pay seven per cent GST).

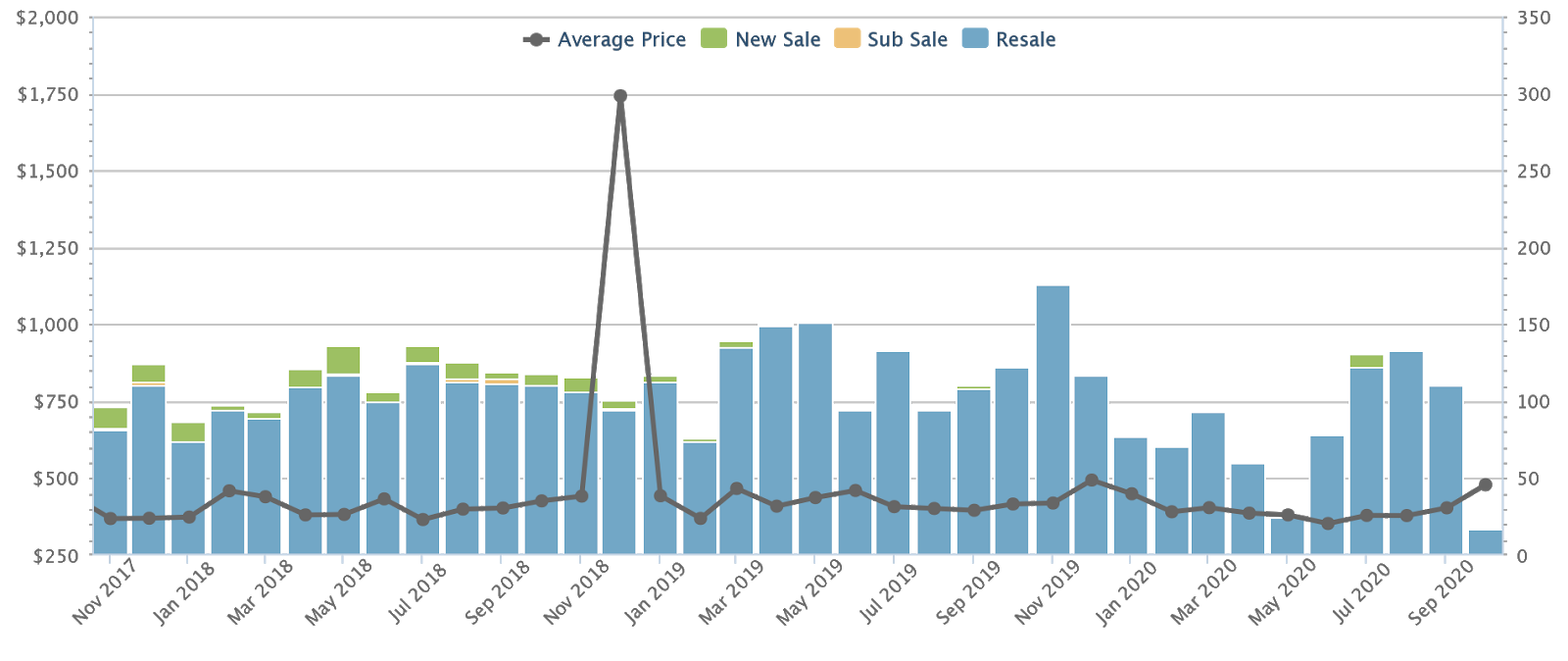

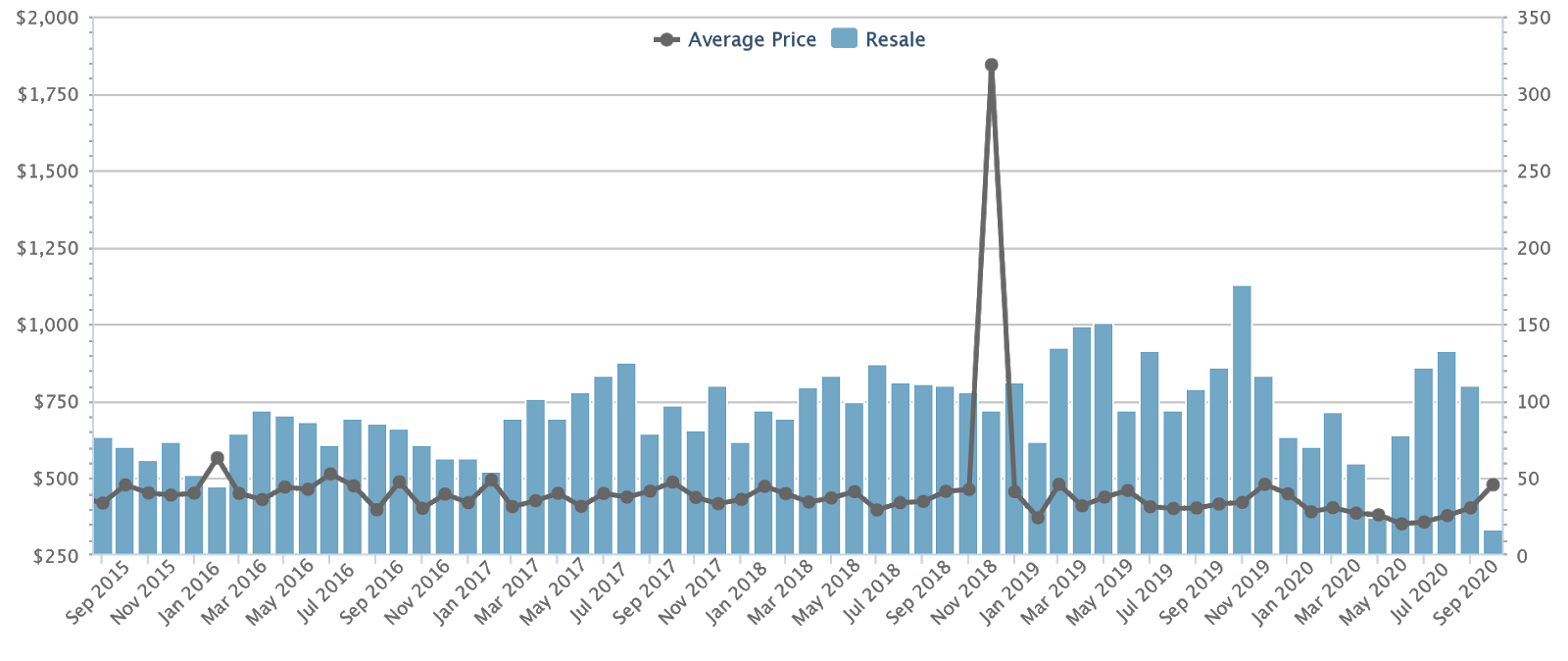

In addition, there’s the issue of cost. According to Square Foot Research, as of September 2020, the average price of industrial properties in Singapore is just $404 psf.

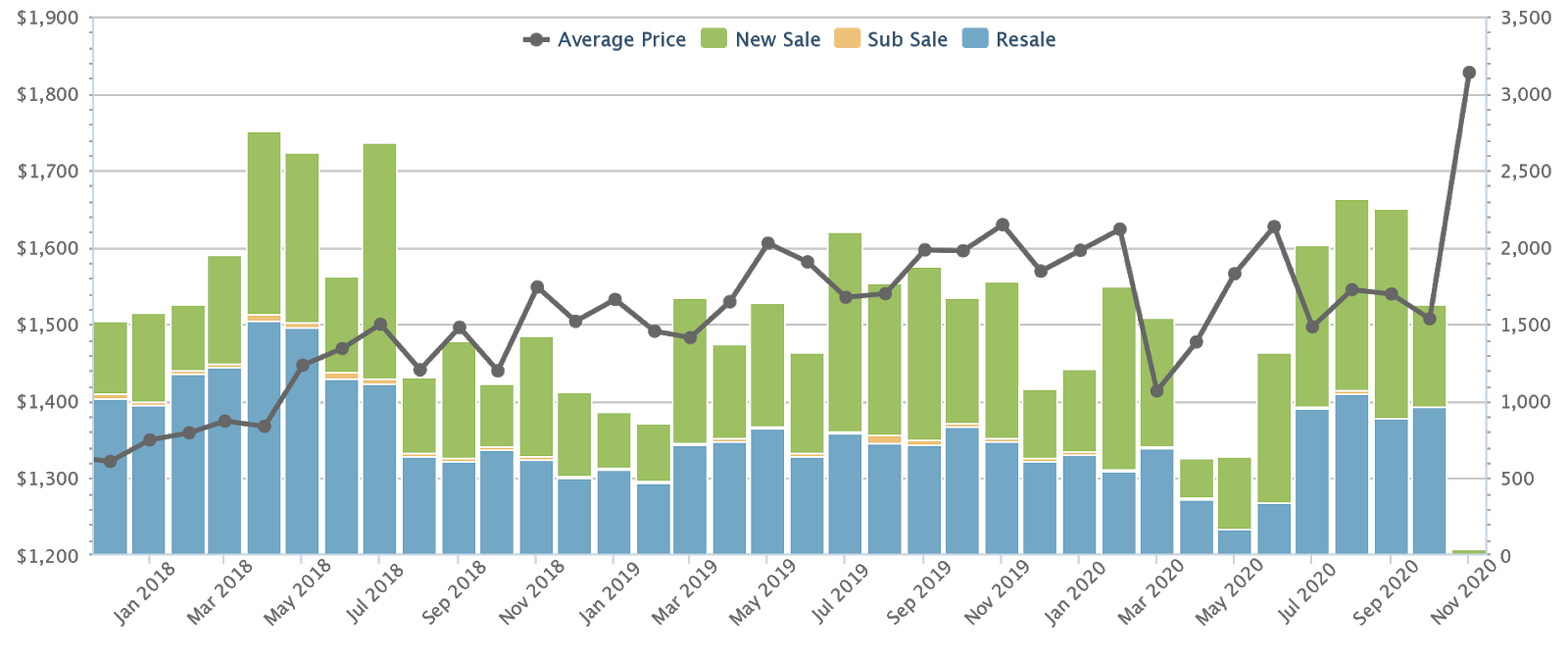

By contrast, residential properties averaged $1,539 psf in September 2020.

As such, most of your “multiple properties” are likely to be warehouses, packing and assembly plants, etc.

2. Use financing other than home loans

As the name implies, home loans are only for residential properties. For commercial and industrial properties, you can use business loans.

(This requires you to set up a company)

Business loans offer a higher amount of financing than home loans – often as high as 90 per cent of the industrial property price or value (whichever is lower). You may also notice some banks advertising 120 per cent loans; these typically mean stacking a working capital loan on top of the commercial property loan.

As you own more properties and generate more rental income, your business entity can potentially use the income stream to justify further property purchases.

Assuming you’re able to secure these business loans, commercial / industrial properties allow you greater leverage compared to the residential market.

Property AdviceAll You Need To Know: The Income Requirements For Getting A Home Loan

by Ryan J. Ong3. Invest with someone else’s money

There’s no way to get any property with zero down payment (not even with the aforementioned ‘120 per cent’ loan scheme). As such, many seminars may advocate alternatives such as:

- Pooling your money with other investors

- Selling “equity” in your property-owning entity to other investment partners

- Borrowing from family and friends

You would then split the returns with your fellow investors. If you can pull sufficient investors on board, you may be able to make the initial property purchase using none of your own money (hence “no money down”).

You can see the general idea at this point: if the property is financed with a combination of other investors’ money, plus the bank’s money, you can essentially own multiple property assets without touching your own cash.

4. Use rental income to cover costs, and potentially qualify for more loans

This is possible for industrial properties due to their lower costs; for residential properties, you can barely cover the mortgage interest in most cases in the current climate.

If you can generate a positive cash flow from rental income, this could potentially be used to justify getting another business loan, for yet another property. That property can then lead to another, etc.

How to (theoretically) cover the full cost of an industrial property with just the rental income

Let’s say you purchase a 1,500 sq. ft. industrial property, somewhere (District 22). Average prices as of September 2020 were just $252 psf:

The cost of this property would be roughly $378,000. You secure a loan of $302,400 for the property, at a rate of 3.7 per cent per annum (a typical business loan rate*varies from bank to bank). At a loan tenure of 30 years, the monthly loan repayment is about $1,392.

Besides this, let’s assume maintenance fees of about $200 per month. For convenience, we’ll assume your tenant pays all utilities as part of the Tenancy Agreement (TA).

How much of the costs will the rental cover?

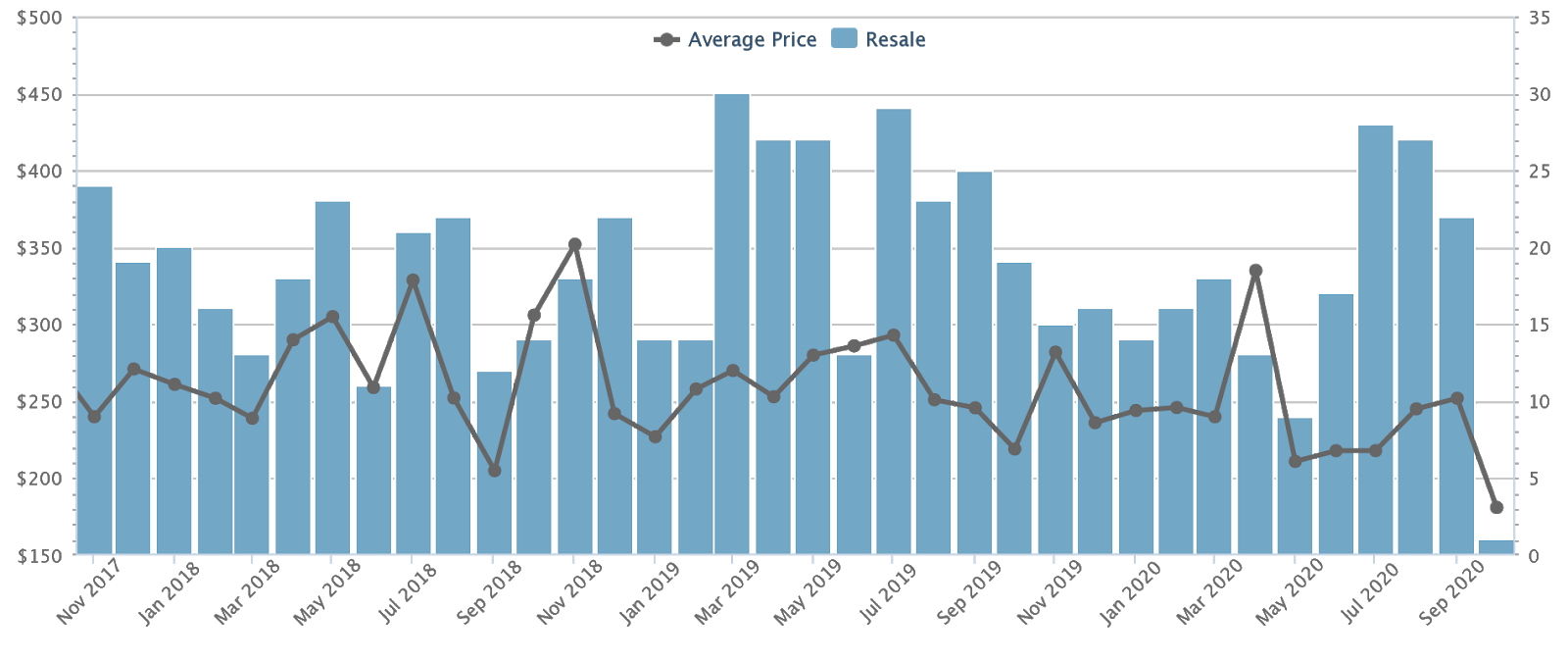

As of September 2020, the rental rate was $1.42 psf. Do note the volatility of the rental rate, by the way. At 1,500 sq. ft., this generates about $2,130 per month.

Your mortgage repayment and maintenance fees come up to $1,592 per month. This generates a positive cash flow of $538 a month…assuming everything goes smoothly.

However, don’t forget these other costs:

- The initial down payment for this property was $75,600.

- If you borrowed money from anyone else for the down payment, you need to pay them back

- Total interest paid at the end of the loan tenure is $198,682.

- The Buyers Stamp Duty (BSD) is $5,940

- The GST payable is $26,460

We also haven’t factored in variables like the cost of renovations, the cost of marketing the property to tenants (e.g. agent commissions), and the property tax, which is 10 per cent of the Annual Value*.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

7 Useful Tips For Soon-To-Be Retirees To Find The Ideal Forever Home

Finding a home for the rest of your life can be an emotional event. For many, it’s seen as being…

Ideally, all these costs will be more than covered by appreciation and accumulated rental income, when you eventually sell the property.

*The Annual Value of the property is set by IRAS. It’s an estimate of the probable annual rental income.

Can an industrial property appreciate well enough to cover those costs?

There’s no crystal ball, but let’s use past performance as a guideline:

In September 2015, the average price of an industrial property was $419 psf. In September 2020, the average price was $404 psf (3.5 per cent decrease).

But let’s not forget about depreciation. There’s a reason why leasehold properties are always trading at a discount than freehold ones in general – the land is returned to the state once the lease is up.

It’s the same reason why many are afraid of what would happen when their HDB lease runs to $0. And ironically, some of these investment trainers actually use this to push you towards these property investment courses.

Now, most industrial properties have leases that start between 30-60 years remaining.

As the years go by, the inherent worth of the land would continue to fall (see Bala’s Curve). Sure, if the economy somehow booms and industrial property is in demand, prices could rise – but that’s a bet one has to be willing to take.

Moreover, no matter how “in-demand” your industrial properties are, you can’t escape the fact that it has, say, 10-20 years left if you hold it long enough. No investor in the right mind would pay more than your purchase price when it had 50-60 years of lease.

And what if a shock event like an economic collapse occurs? Your bank may, at their discretion, re-evaluate your property’s value again to determine if their position is still safe. If they determine that the value falls below the required margin, then they’d require a top-up. And if the economic situation is dire, there’s no income – what do you think would happen next?

So when you sell, you may actually realise a capital loss, or worst still, have your property repossessed.

Besides gains, there are plenty of other variables that need to be accounted for:

- Rental vacancies

- Bad tenants

- State of the economy

- Difficulty in exiting the investment

1. Rental vacancies

Our example provides an idealised scenario, where there are no vacancies. This is never a good assumption to make. You need to ensure you have sufficient funds to cover any periods of vacancy, even without the rental income.

In case it needs to be said, long or multiple vacancies drastically lower the potential return on the property.

2. Bad tenants

Tenants may fail to pay on time, default on payments, or simply go bust. Problem tenants may also cause damage to the property.

Landlords also need to keep an eye on tenants to prevent abuses; such as when tenants make illegal modifications (e.g. turning an entire B2 industrial space into offices, when predominant use requirements don’t allow this).

3. State of the economy

Industrial properties are more closely tied to the fate of the tenant’s respective industries. If Singapore’s manufacturing sector is in decline, tenants will start hunting for cheaper alternatives; or even worse, be unable to pay rent.

Given the current Covid-19 situation, we’d be extra cautious about industrial property investment.

4. Difficulty in exiting the investment

Note that industrial properties are subject to the Sellers Stamp Duty (SSD). This is 15 per cent for selling on the first year, 10 per cent on the second year, and five per cent on the third year.

If you buy an industrial property that isn’t doing well, you could incur worse losses than expected when trying to offload it.

(Other commercial properties, like shops, are not subject to SSD).

Besides this, do consider what happens if you borrowed money, or teamed up with other investors. What happens if you – or one of your fellow investors – decides they want to pull out of the scheme?

Also, who is calling the shots? If you roped in your siblings as fellow investors, for instance, do they have any say in which properties you buy or sell?

These issues can get messy, and may lead to lawsuits and broken relations.

The people teaching you these methods have no skin in the game

There’s a reason why many such companies brand themselves as “educators”. They only teach you the methods. If you use those methods and things go wrong, it’s entirely your problem. The instructors already took your money, and don’t have to give back a single cent.

As with anything, you’d do well to fully educate yourself before deciding to plunge ahead with your hard earned money. We wouldn’t go to the extent of saying that the method doesn’t work, but that you should be aware of the risks that follow along with it as well.

If you’d like another take on these courses, here’s a great one to find out more.

Illustrations by: Xiu Ying

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are expensive property seminars worth attending for investment tips?

Can I buy multiple properties without using my own money?

Is investing in industrial properties a good way to own multiple properties?

How do property seminars suggest financing multiple properties?

What are the risks of investing in industrial properties based on the article?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

6 Comments

Thank you Ryan for the unbiased editorial. Really so much more valuable than all the fluff and rahrah by those ‘gurus’/educators.

Thank you so much for your sharing. I attended a webinar on property investment and what you shared is exactly what the trainer was pushing ie. industrial properties, loans, rent to cover mortgage!

I’m guessing they also push you to “upgrade” or sell one’s HDB (since it made money already, so cash out) and then ask you to plough it into riskier properties – right?

Good article! Someone has to say something about all these “scaminars”. We all know which one you’re talking about. Funny how in the ads you mentioned, they keep mentioning Bala’s curve and lease decay for 99 year HDB properties, but didn’t mention that industrial properties have even shorter leases! Keep up the good work.