How Much Better Are Rental Yields For Compact Units?

September 13, 2020

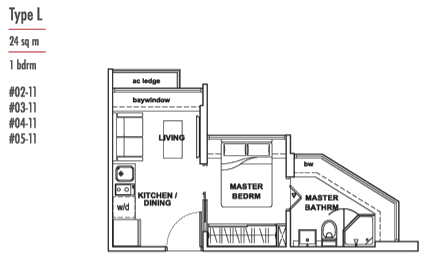

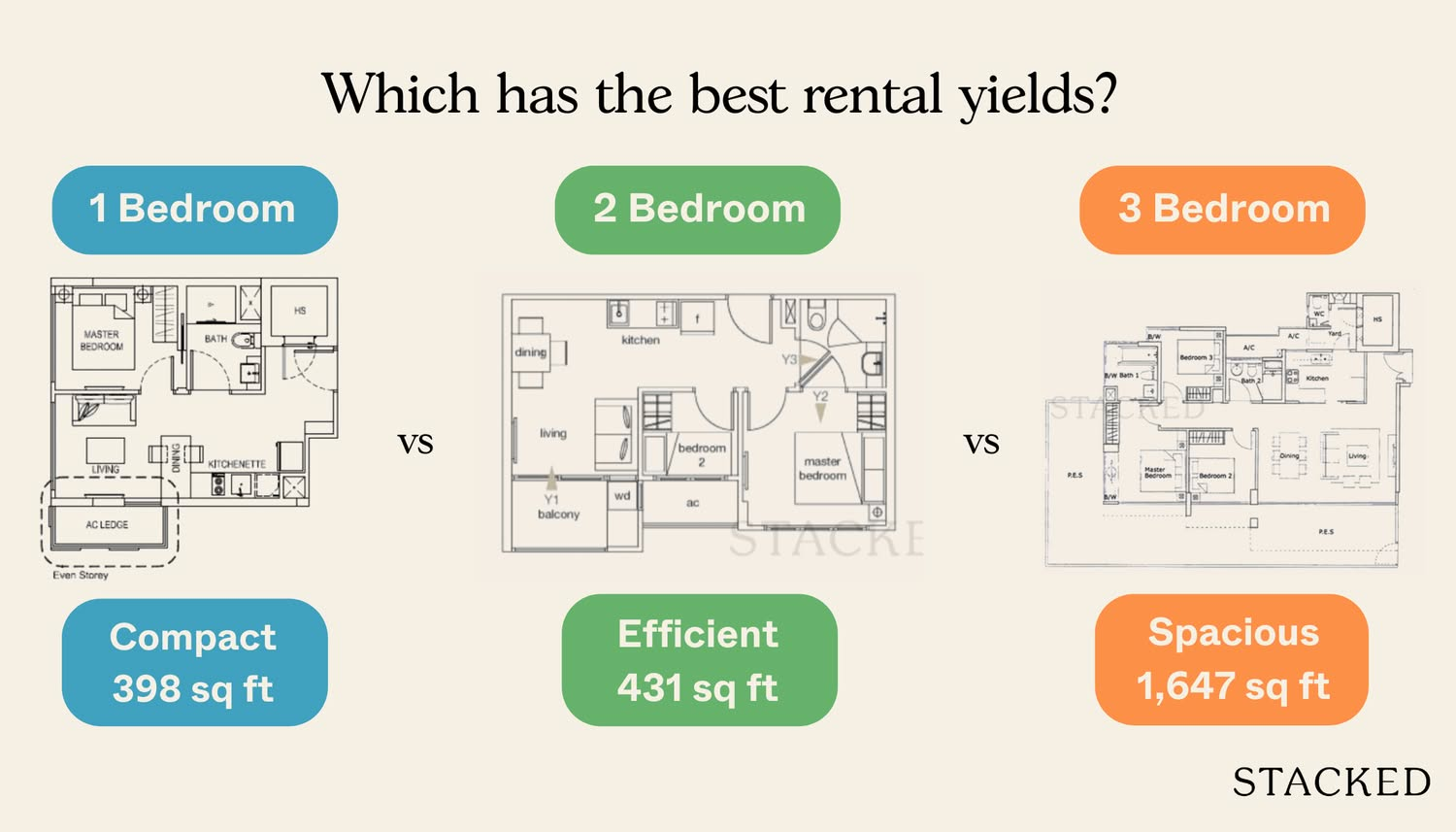

Like many property buyers, you’ve probably had a chance to squint at a tiny floor plan of a compact unit (510 sq.ft. or under). Some of them are so small, you may have stayed in motel rooms that offer more legroom.

(Fun fact: the smallest condo unit in Singapore is at Suites @ Guillemard, at about 258 sq. ft. For comparison, the average two-room flat is 387 sq.ft.)

Despite this, you’ll often be told that compact units are great for rental yields. An oft-used guideline in the Singapore private property market is that the average condo rental yield is two to three per cent, whereas compact units tend to yield three to four per cent.

In this article, we try to see if that’s accurate, and whether it changes based on the property’s location:

A quick summary of rental yield

The gross rental yield is the annual rental income generated by the property, divided by the total cost of the property. This is expressed as a percentage. E.g. if the annual rental income of a property is $30,000, and the total cost is $1.2 million, then the yield is 2.5 per cent.

(Finding the net rental yield is more complex, and involves deducting costs like maintenance fees, property taxes, etc. To work out the net rental yield, contact us on Facebook, and we can take a closer look at the specific property in question).

How we’ll gauge the rental yields of compact units

We’ll start by looking at the approximate rental yield of compact units (510 sq.ft. or below), and measuring them against the expected yield for the region.

Based on Square Foot Research, the average condo rental yield (all sizes and across the board) currently averages 3.1 per cent in the city or city fringe, and 3.4 per cent in fringe regions.

We’ll be looking at developments that are within roughly one kilometre of an MRT station (as these are the ones typically bought to be let out). We will also restrict our search to developments no older than 10 years, to minimise the age factor.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

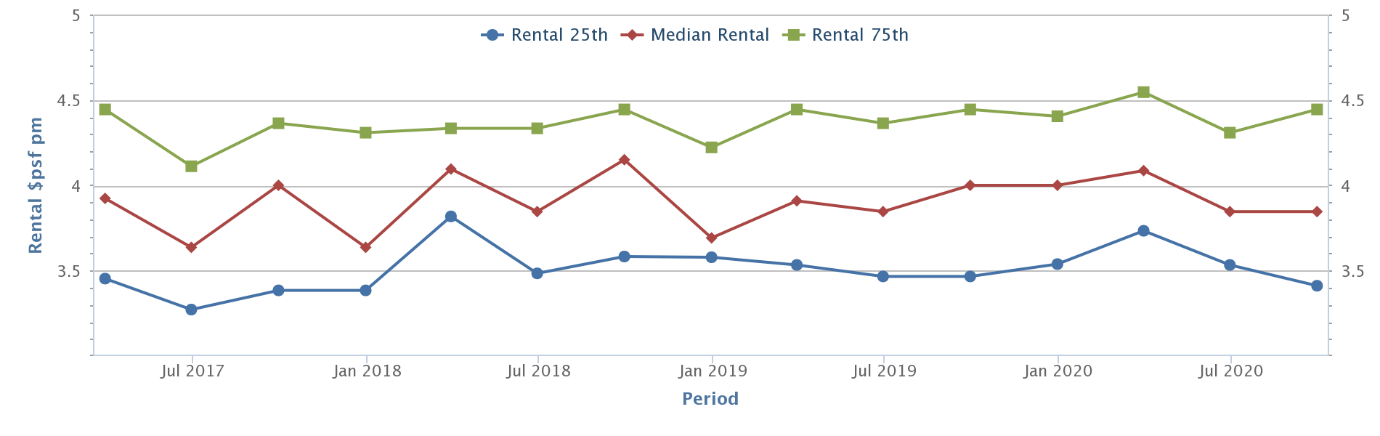

Compact Units in the Core Central Region (CCR)

- Illuminaire on Devonshire

- Robinson Suites

- The Clift

Illuminaire on Devonshire (Orchard)

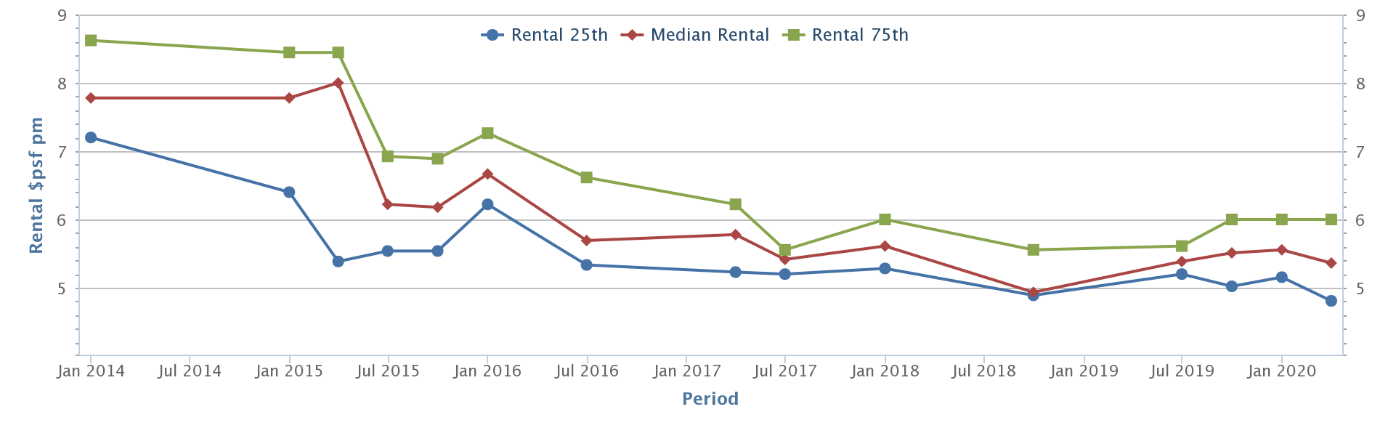

Rental rates at Illuminaire on Devonshire range between $4.81 to $6 psf, with a median rental rate of $5.36 psf.

These are the five most recent recorded rental transactions, for units of 500 sq.ft. or under only:

| Date | Rental rate | Est. rental yield based on average quantum of $940,000* |

| Jul 2020 | $2,500 | 3.1% |

| May 2020 | $2,600 | 3.3% |

| Apr 2020 | $3,000 | 3.8% |

| Apr 2020 | $2,650 | 3.3% |

| Apr 2020 | $2,600 | 3.3% |

*Average quantum based on caveats lodged with URA in the past six months

Conclusion:

Compact units at Illuminaire on Devonshire average $5.96 psf, which is higher than the median rental rate of $5.36 psf.

In terms of rental yield, the compact units here average 3.36 per cent of late, which is 0.26 per cent higher than the average yield for city / city fringe properties.

Robinson Suites (Raffles Place / Downtown)

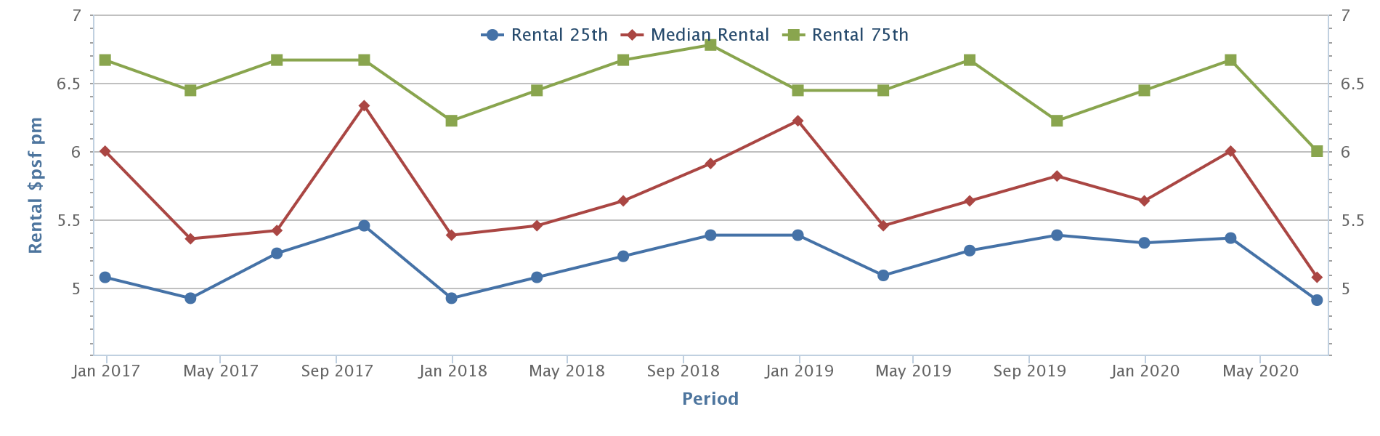

Rental rates at Robinson Suites range from $4.91 psf to $6 psf. The median rental rate is $5.08 psf.

These are the five most recent recorded rental transactions, for units of 500 sq.ft. or under only:

| Date | Rental rate | Est. rental yield based on average quantum of $1.21 million |

| Jul 2020 | $2,800 | 2.7% |

| May 2020 | $2,800 | 2.7% |

| Apr 2020 | $2,700 | 2.6% |

| Apr 2020 | $2,700 | 2.6% |

| Apr 2020 | $3,200 | 3.1% |

*Average total prices were not available for this property. As such, we estimated the overall price using the current price per square foot (average of $2,500 psf for the compact units), and estimated the total price of a unit size of 484 sq. ft. (typical for compact units in this development.

Conclusion:

In terms of rental yield, the compact units here average 2.74 per cent of late, which is 0.36 per cent lower than the average yield for city / city fringe properties.

The Clift (Downtown)

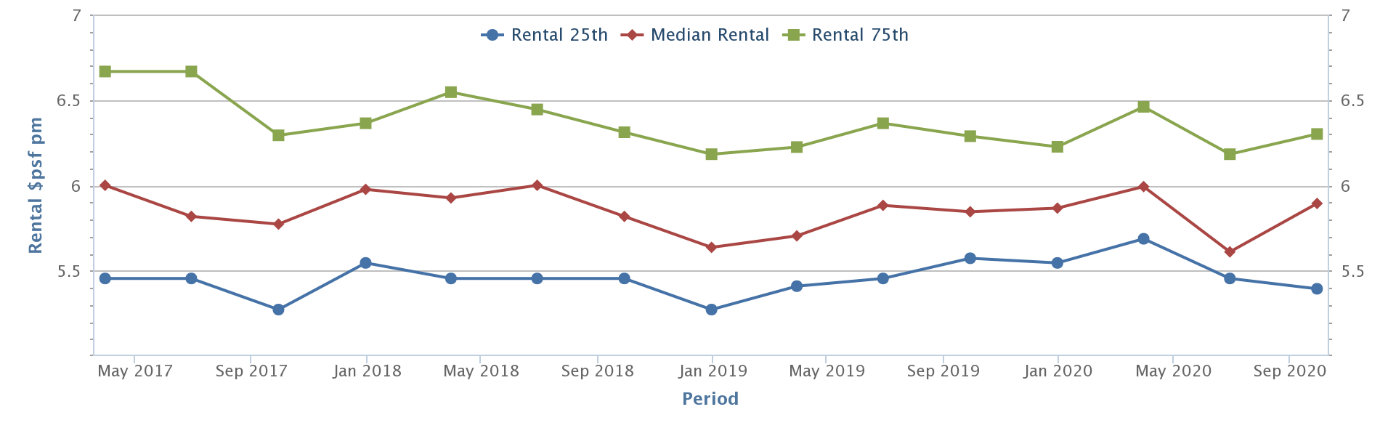

Rental rates at The Clift range from $5.39 psf to $6.30 psf. The median rental rate is $5.89 psf.

These are the five most recent recorded rental transactions, for units of 500 sq.ft. or under only:

| Date | Rental rate | Est. rental yield based on average quantum of $950,000* |

| Jul 2020 | $3,000 | 3.7% |

| Jul 2020 | $3,000 | 3.7% |

| Jul 2020 | $2,900 | 3.6% |

| Jun 2020 | $2,900 | 3.6% |

| May 2020 | $3,000 | 3.7% |

* Average quantum based on caveats lodged with URA in the past six months

Conclusion:

In terms of rental yield, the compact units here average 3.66 per cent of late, which is 0.56 per cent higher than the average yield for city / city fringe properties.

Compact units in the Rest of Central Region (RCR)

- Loft @ Holland

- The Poiz Residences

- Sky Vue

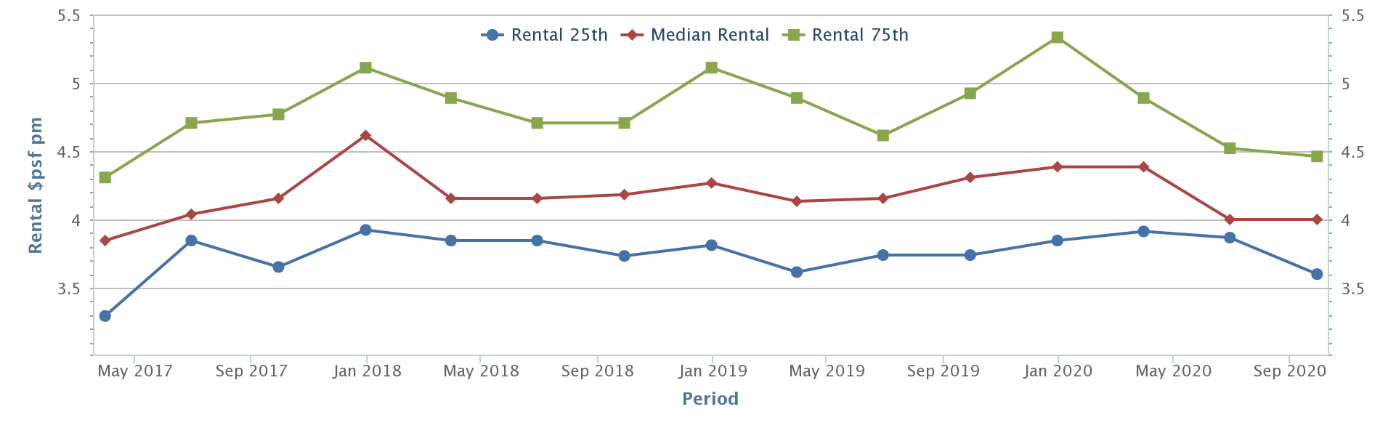

Loft @ Holland (Holland Village)

More from Stacked

The Growing Number Of $2 Million Condos In Singapore: Is This The New Norm In 2024?

While many buyers still like to compare properties by the price per square foot, ultimately it is the quantum that…

Rental rates at The Loft @ Holland range from $6.14 psf to $6.86 psf. The median rental rate is $6.57 psf.

These are the five most recent recorded rental transactions, for units of 500 sq.ft. or under only:

| Date | Rental rate | Est. rental yield based on average quantum of $808,591* |

| Jul 2020 | $2,252 | 3.3% |

| Jul 2020 | $2,300 | 3.4% |

| Jul 2020 | $2,300 | 3.4% |

| Jul 2020 | $2,300 | 3.4% |

| Jul 2020 | $2,400 | 3.5% |

*Average quantum based on caveats lodged with URA in the past six months

Conclusion:

In terms of rental yield, the compact units here average 3.4 per cent of late, which is 0.3 per cent higher than the average yield for city / city fringe properties.

The Poiz Residences (Potong Pasir)

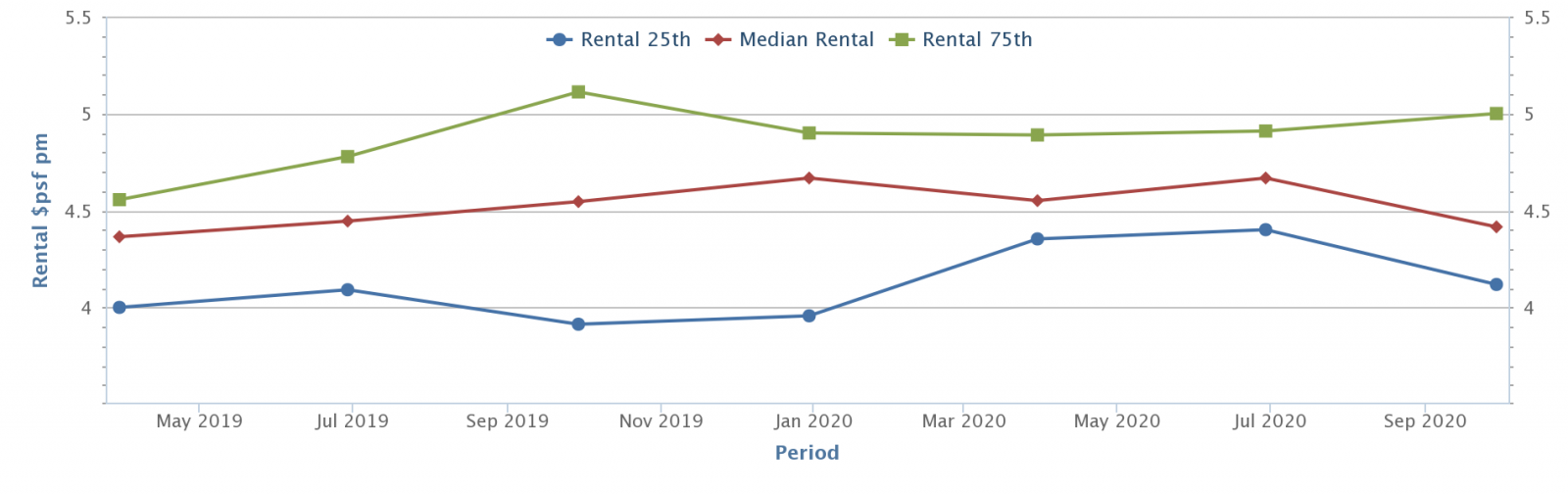

Rental rates at The Poiz Residences range from $4.12 psf to $5 psf. The median rental rate is $4.42 psf.

These are the five most recent recorded rental transactions, for units of 500 sq.ft. or under only:

| Date | Rental rate | Est. rental yield based on average quantum of $724,000* |

| Jul 2020 | $2,500 | 4.1% |

| Jul 2020 | $1,900 | 3.1% |

| Jul 2020 | $2,500 | 4.1% |

| Jul 2020 | $2,100 | 3.4% |

| Jul 2020 | $2,400 | 3.9% |

*Average quantum based on caveats lodged with URA in the past six months

Conclusion:

In terms of rental yield, the compact units here average 3.72 per cent of late, which is 0.62 per cent higher than the average yield for city / city fringe properties.

Sky Vue (Bishan)

Rental rates at Sky Vue range from $3.60 psf to $4.46 psf. The median rental rate is $4 psf.

These are the five most recent recorded rental transactions, for units of 500 sq.ft. or under only:

| Date | Rental rate | Est. rental yield based on average quantum of $810,000* |

| Jul 2020 | $2,400 | 3.5% |

| Jul 2020 | $2,200 | 3.2% |

| Jun 2020 | $2,250 | 3.3% |

| Jun 2020 | $2,200 | 3.2% |

| Jun 2020 | $2,300 | 3.4% |

*Average quantum based on caveats lodged with URA in the past six months

Conclusion:

In terms of rental yield, the compact units here average 3.32 per cent of late, which is 0.22 per cent higher than the average yield for city / city fringe properties.

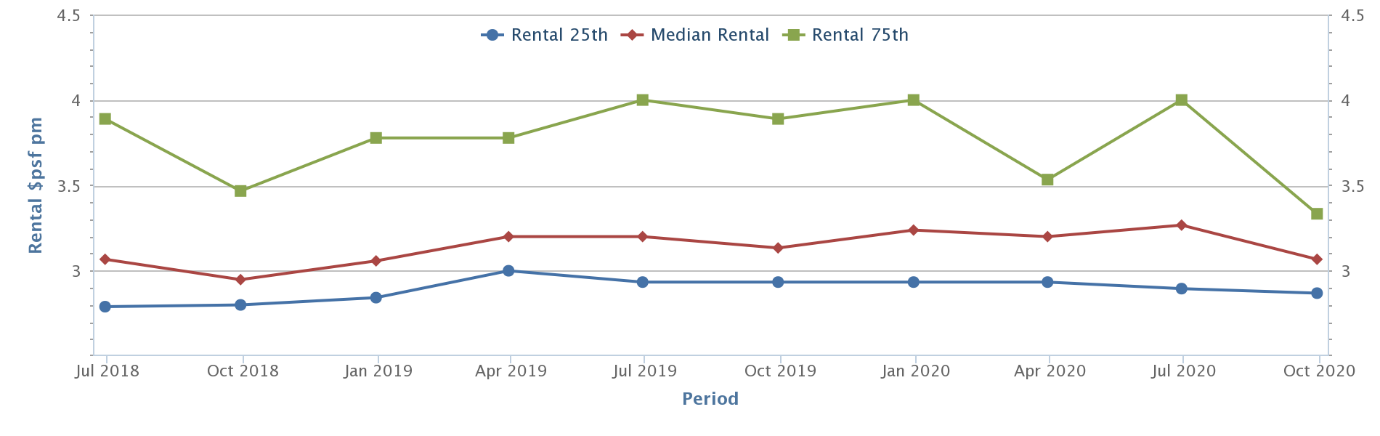

Compact units in the Outside of Central Region (OCR)

- J Gateway

- The Glades

- Coco Palms

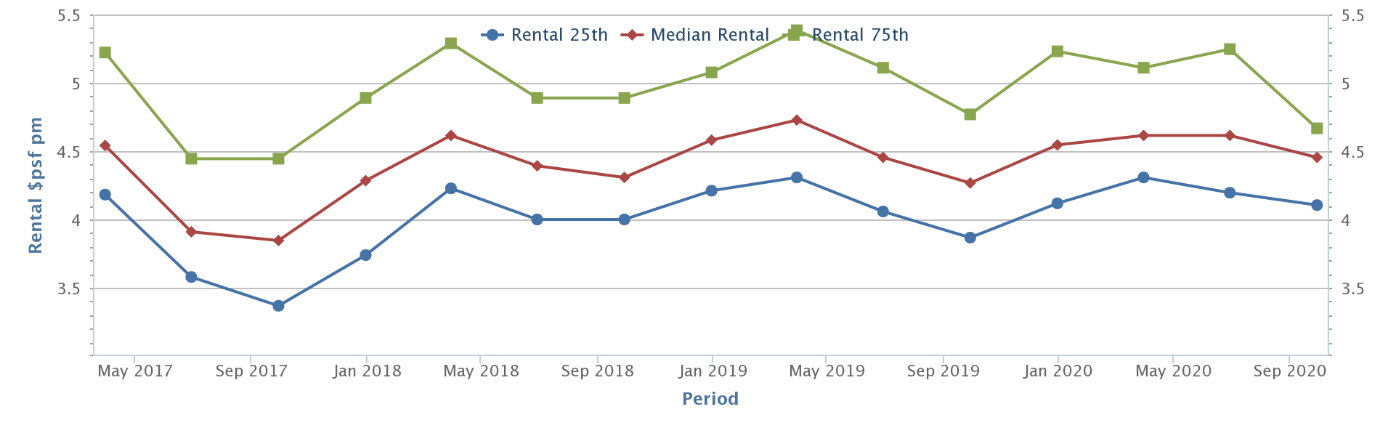

J Gateway (Jurong East)

Rental rates at J Gateway range from $4.11 psf to $4.67 psf. The median rental rate is $4.45 psf.

These are the five most recent recorded rental transactions, for units of 500 sq.ft. or under only:

| Date | Rental rate | Est. rental yield based on average quantum of $677,500* |

| Jul 2020 | $2,400 | 3.1% |

| Jul 2020 | $2,300 | 3.5% |

| Jul 2020 | $2,600 | 3.4% |

| Jul 2020 | $2,350 | 3.7% |

| Jul 2020 | $2,300 | 3.8% |

In terms of rental yield, the compact units here average 3.62 per cent of late, which is 0.22 per cent higher than the average for fringe region properties.

The Glades (Tana Merah)

Rental rates at The Glades range from $3.41 psf to $4.44 psf. The median rental rate is $3.85 psf.

These are the five most recent recorded rental transactions, for units of 500 sq.ft. or under only:

| Date | Rental rate | Est. rental yield based on average quantum of $868,842* |

| Jul 2020 | $1,800 | 2.5% |

| Jul 2020 | $2,000 | 2.7% |

| Jul 2020 | $1,950 | 2.7% |

| Jul 2020 | $2,100 | 2.9% |

| Jul 2020 | $2,150 | 2.9% |

*Average total prices were not available for this property. As such, we estimated the overall price using the current price per square foot (average of $1,833 psf for the compact units), and estimated the total price of assuming a unit size of about 474 sq.ft (typical for compact units in this development).

Conclusion:

In terms of rental yield, the compact units here average 2.74 per cent of late, which is 0.66 per cent lower than the average for fringe region properties.

Coco Palms

Rental rates at The Coco Palms range from $2.87 psf to $3.35 psf. The median rental rate is $3.07 psf.

These are the five most recent recorded rental transactions, for units of 500 sq.ft. or under only:

| Date | Rental rate | Est. rental yield based on average quantum of $644,000* |

| Jul 2020 | $1,900 | 3.5% |

| Jul 2020 | $1,800 | 3.3% |

| Jul 2020 | $1,900 | 3.5% |

| Jul 2020 | $1,700 | 3.2% |

| Jul 2020 | $1,800 | 3.3% |

*Average quantum based on caveats lodged with URA in the past six months

Conclusion:

In terms of rental yield, the compact units here average 3.36 per cent of late, which is 0.04 per cent lower than the average for fringe region properties.

Overall, rental yields for compact units (unsurprisingly) continue to beat their bigger and more expensive counterparts. However, the numbers no longer seem as optimistic as before.

From the above examples, we can see compact units – on average – no longer beat their bigger counterparts by huge margins, such as a whole percentage point.

We can also see that some compact units fall below the average rental yield, despite their smaller quantum. This is a good reminder that cheaper doesn’t always translate to better yields.

The market for compact units bears watching, and the rental market is set for some turbulence in light of Covid-19. It remains to be seen if compact units will again outperform their bigger counterparts, when the full weight of the downturn sinks its teeth in.

In the meantime, you can check out in-depth reviews of the latest property offerings, including an analysis of the smaller units; follow us on Stacked for more details.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are rental yields higher for small condo units compared to larger ones in Singapore?

What factors influence the rental yield of compact units in different regions of Singapore?

How does the age of a property affect the rental yield of compact units?

Do all compact units outperform larger units in rental yield?

Has the rental yield advantage of compact units changed over time?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Rental Market

Rental Market Is Singapore’s Rental Market Really Softening? We Break Down The 2024 Numbers By Unit Size

Editor's Pick The Cheapest Condos For Rent In 2024: Where To Find 1/2 Bedders For Rent From $1,700 Per Month

Rental Market Where To Find The Cheapest Landed Homes To Rent In 2024 (From $3,000 Per Month)

Rental Market Where To Find High Rental Yield Condos From 5.3% (In Actual Condos And Not Apartments)

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

3 Comments

Hi Ryan, thank you with your article with good factual analysis. Much appreciate it.

compact units are definitely better rental yield wise. but you would need to be careful of stuff like capital appreciation (hardly any if rental is soft), and overall maintenance of the apartment block (since many units are rented out, maintenance isn’t top on the agenda). Furthermore, these days, tying up one person name to a compact property may be seen as a waste given the govt’s ABSD regime. But as far as rental yield is concerned, it’s optimised for it.