Should “Sandwiched Singaporeans” Rent First, Or Buy The Cheapest Condo They Can Afford?

July 7, 2020

Should you rent or buy?

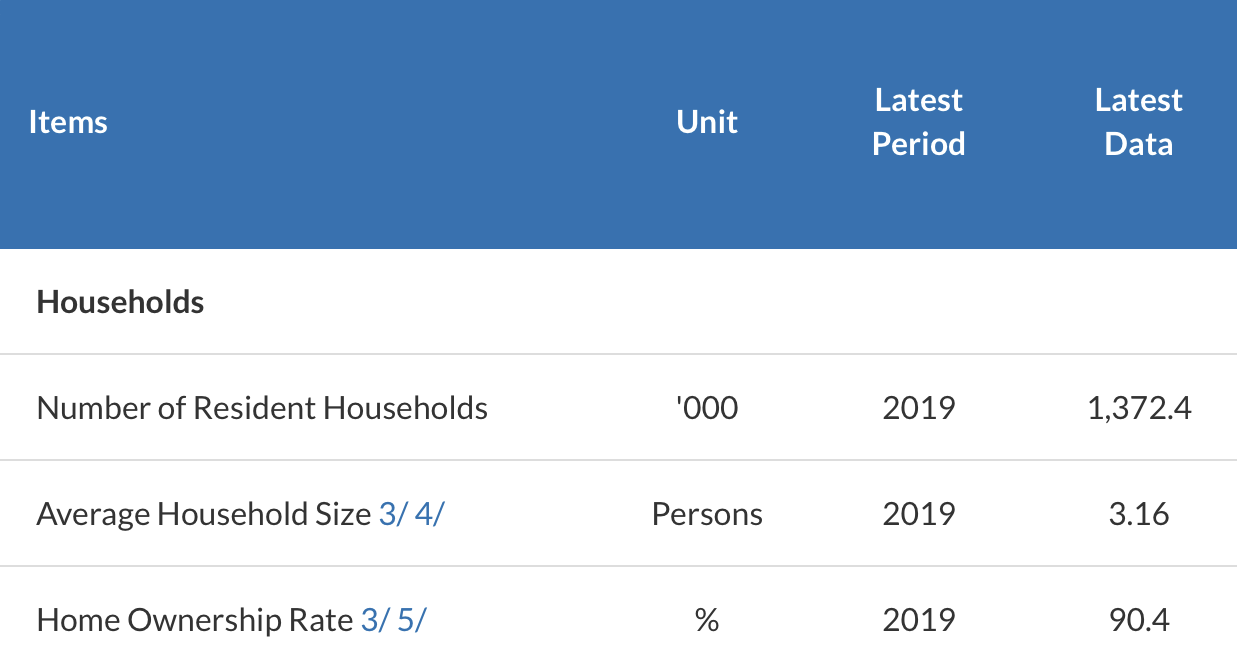

With homeownership rates in Singapore at a staggering 90.4%, you might think that this scenario isn’t something that many people would experience.

After all, for many young couples they don’t actually have to face this dilemma – especially when many would just get a BTO (Build-To-Order) HDB.

But what about those “fortunate” few couples that earn way more than the income ceiling for a flat ($14,000 per month) or an Executive Condominium ($16,000 per month)?

Let’s not forget singles below the age of 35 too. There’s no way you’re getting an HDB property and the trouble is, you’re not exactly rich either.

So admittedly while this is still a niche crowd, we have been seeing an increasing number of people reaching out. Hence, it’s time to address the question of rent vs buy – from a financial perspective.

Key financial considerations

- How much cash in hand you require, for renting versus buying

- Recurring costs of renting versus buying

- Capital appreciation

1. How much cash in hand you require for renting versus buying

First, let’s look at the initial cost of renting a flat, and then a condo.

For this example, we will draw up comparisons in the Outside of Central Region (OCR). It comprises the following districts: 16, 17, 18, 19, 21, 22, 23, 24, 25, 26, 27, 28.

We use the OCR because, as a sandwiched Singaporean, it’s more realistic that you’d consider buying a condo here than in, say, Bugis or Orchard.

The initial costs that you’ll pay in renting a flat or condo are as follows:

- Security deposit (usually one month of rent for each year of lease, or half a month’s rent for a six-month lease)

- If you use a property agent to represent you as a tenant, you may have to pay their service fees (commission). This fee is typically 50 per cent of one month’s rent, if the lease is for one year. For a lease of two years, your agent will usually split the commission paid by the landlord with their own agent. None of this is set in stone, so do be prepared to negotiate it. You can, of course, choose to rent without an agent.

- Initial furnishings (we will assume this to be around $1,500 for additional study desks, chairs, lamps, etc. as most units are rented out inclusive of basic appliances and furniture).

For our following examples, we will assume you get a property agent to represent you, and that you sign one year of lease.

The initial cost you’ll face when buying a condo unit are:

- 5 per cent down payment in cash

- 20 per cent down payment in CPF

- Buyers Stamp Duty (BSD)

- Conveyancing fees

- Valuation and stamping fees

- Initial renovations and furnishing (we will set this at $30,000, as this is the typical renovation loan cap)

Note that we haven’t included agent fees for buying a condo; that’s because such fees are typically paid by the seller, although there are exceptions.

We’ll also assume this is your first condo and that you’re a Singapore Citizen, thus excluding Additional Buyers Stamp Duty (ABSD). For details on BSD charges or the down payment, check our ultimate guide to buying a condo.

Initial cost of renting a flat in the OCR:

For all of the following, remember you can deduct your property agent’s service fee (half a month’s rent) if you have no agent, or the landlord’s agent is paying (e.g. you sign two years lease).

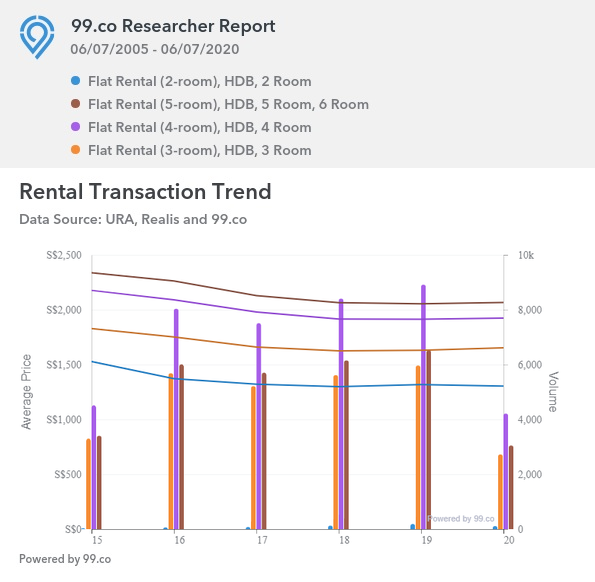

The average rental cost of a 2-room flat in the OCR averages $1,304 per month. This is an initial cost of around $3,456 (security deposit + agent fees + furnishing).

For a 3-room flat, the average rental rate is $1,653 per month. This comes to an initial cost of about $4,249.50.

For a 4-room flat, the average rental rate is $1,909 per month. That’s an initial cost of about $4,363.50.

For a 5-room flat, the average rental rate is $2,020 per month. That’s an initial cost of about $4,530 per month.

For all of the above, you must be prepared to pay in cash.

Initial cost of renting a condo in the OCR:

(Districts 16, 17, 18, 19, 21, 22, 23, 24, 25, 26, 27, 28)

(Again, remember to deduct your agent’s service fee if you’re not using a tenant’s agent, signing a two-year lease, etc.)

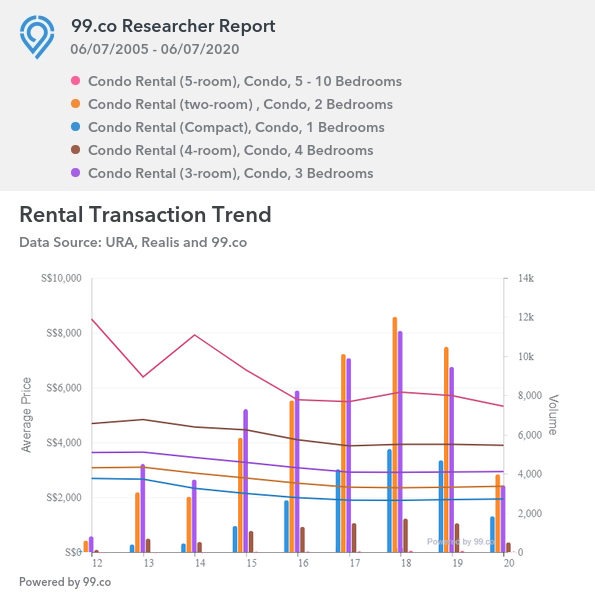

The rental cost of compact units in the OCR averages $1,935 per month, for a likely initial cost of around $4,402.50 (security deposit + agent fees + furnishing).

Two-room condos average $2,401, with a likely initial cost of $5,101.

Three-room condos average $2,938 per month, with a likely initial cost of $5,907.

Four-room condos average $3,899 per month, with a likely initial cost of $7,348.

Five-room condos average $5,317 per month, with a likely initial cost of $9,475.50.

As with all rental costs, these must be paid in cash.

Initial cost of buying a condo in the OCR:

| Costs | Compact Unit | 2-Room Condo | 3-Room Condo | 4-Room Condo | 5-Room Condo |

| Average Price | $748,282 | $960,759 | $1,260,185 | $1,678,573 | $2,066,168 |

| Cash Downpayment | $37,414 | $48,038 | $63,009 | $83,928 | $103,308 |

| CPF Downpayment | $149,656 | $191,152 | $252,037 | $335,715 | $413,234 |

| Total Downpayment | $187,070 | $240,190 | $315,046 | $419,643 | $516,542 |

| Buyer Stamp Duty (Payable with CPF) | $17,048 | $23,423 | $35,007 | $51,743 | $67,247 |

| Renovation | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 |

| Legal Fees | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 |

| Total Initial Payment | $229,618 | $296,112 | $391,553 | $503,886 | $616,289 |

4-room and 5-room condos are quite a stretch for sandwiched Singaporeans, even in the OCR. But we added it for completeness sake.

While it’s unsurprising that buying costs more, being able to use your CPF can make it seem like less of a stretch. For example, the minimum down payment on a condo is 25 per cent, which sounds staggering – but the actual cash in hand that you require is just five per cent.

Likewise, the stamp duties and even the conveyancing fees can be covered by CPF.

So if you’re buying a compact unit with the help of your CPF, for instance, the initial amount of cash in hand that you need is potentially just $37,414, plus whatever you want to spend on renovations.

If this is an amount that you can easily manage, you might give more consideration to buying now instead of renting.

On the flip side, if the initial cash outlay would clear out all of your savings including your emergency fund, then it’s wiser to rent for a while and save up.

2. Recurring costs of renting versus buying

- Loan repayment if buying, or monthly rent

- Maintenance fees

- Property taxes

- Utility bills

- Repairs

Loan repayment if buying, or monthly rent

We have already given you the average monthly rentals a landlord will charge (see above).

If you buy a condo, you’ll instead make loan repayments to the bank. Unlike rental, these loan repayments can be taken from your CPF.

The following is the likely monthly repayment, based on a loan of 25 years, at 1.3 per cent per annum (a realistic interest rate at the time of writing).

We will use the same average condo prices as given above.

| Type of Unit | Approximate Cost | Max Loan Quantum | Monthly Mortgage | Monthly Rent |

| Compact Units | $748,282 | $561,212 | $2,192 | $1,935 |

| 2-room Condo | $960,759 | $720,569 | $2,815 | $2,401 |

| 3-room Condo | $1,260,185 | $945,139 | $3,692 | $2,938 |

| 4-room Condo | $1,678,573 | $1,258,930 | $4,917 | $3,899 |

| 5-room Condo | $2,066,168 | $1,549,626 | $6,053 | $5,317 |

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

My Home Renovation Journey: How I Transformed An Old Resale Condo With Odd Corners + Pet Friendly

Renovations are a common headache for first-time home buyers. If you’ve talked to a contractor or interior designer, you probably…

Notice that, excluding maintenance, the difference in monthly costs between renting and buying is not as big as you may expect. For instance, the current average rental rate for a 2-room condo (see above) is $2,401. The monthly loan repayment were you to buy, is $2,815, or a difference of about $414.

Maintenance fees

This is where the monthly costs between ownership and renting seriously begin to deepen. Condo owners have to pay into the maintenance fund, and the amount varies between different developments (it depends on everything from the unit’s share value, to the nature of facilities, to the number of units in the development).

For most condo units in the OCR, maintenance fees range from $900 to $1,400 per quarter. For larger 4-room and 5-room units, the fees are often higher; around $1,400 to $1,600 per quarter.

This varies between condos, so do ask before you buy.

Tenants, of course, don’t pay maintenance fees of this sort.

Property taxes

Your property tax rate is based on the Annual Valuation (AV) of your home, as determined by IRAS. This, in turn, determines the property tax rate. The median AV of a private non-landed home, as of 2018, was $24,000; this is quite common for two to three-room condo units.

Based on Owner Occupied tax rates (see the IRAS site for more details), this is just $640. But note that if you let-out the property, it will increase to $2,400.

Four and five-room condo units tend to have an AV closer to $32,000, which comes to about $960. You’ll need to contact IRAS to find the exact AV of a given address.

Tenants don’t pay property tax.

Utility bills

This doesn’t just apply to home buyers. Most landlords will also want tenants to cover the utility bills. As such, you should factor these into your costs when renting; and you need to consider how the bill is split if you live with other, unrelated tenants.

Less frequently, landlords may agree to absorb utility bills or to cover the bills to a certain amount (it’s tax-deductible for them if they pay for it).

According to SP Group, typical monthly bills as of May 2020 are as follows:

| 2-room flat | $57.02 |

| 3-room flat | $97.09 |

| 4-room flat | $114.13 |

| 5-room flat | $118.70 |

| Condo | $137.13 |

Repairs

There’s no way to predict how much you’ll spend on repairs; but it’s a good idea to budget roughly $500, to cover one major incident per year.

For tenants, take note of this line in the Tenancy Agreement (TA):

MINOR REPAIR: The Tenant is responsible to pay for all minor repairs so long as the cost per item per incident does not exceed S$______________.Where cost exceeds this amount, Tenant shall pay this amount of S$______________and the balance shall be paid by the Landlord

In other words, you pay an initial sum (e.g. the first $150) of any repair bill, before the landlord covers the rest. These amounts are negotiable. In any case, it’s still cheaper than being a homeowner and having to bear the full cost of everything.

3. Capital appreciation

This is where it gets tricky, as it requires a lot more research and analysis. Based on the above, you can tell that condo owners definitely pay more than renters – in both the upfront costs and recurring costs.

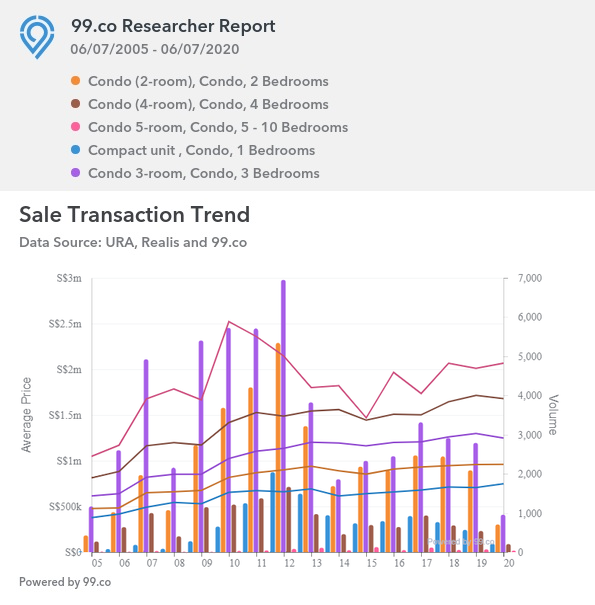

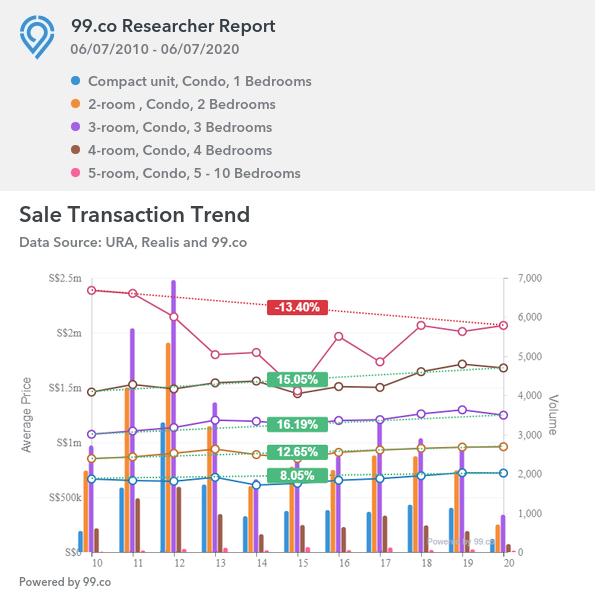

The difference is that homeowners have already started building equity, and acquired an appreciating asset. Here’s a look at price appreciation of condos in the OCR, over the past 10 years:

| Type of Unit | Prices (2010) | Prices (2020) | Annual Gain |

| Compact Units | $666,722 | $720,361 | 0.78% |

| 2-room Condo | $852,908 | $960,759 | 1.2% |

| 3-room Condo | $1,074,363 | $1,248,311 | 1.5% |

| 4-room Condo | $1,458,957 | $1,678,573 | 1.41% |

| 5-room Condo | $2,385,749 | $2,066,168 | -1.43% |

(This assumes there is no rental income from the properties)

Resale vs New Launch capital appreciation for compact units

To give you a better idea of the potential capital appreciation, let’s take a look at the average cheapest condo price of a compact unit in the OCR – $748,282.

But to make this a more accurate portrayal, we should look at actual transactions to see how compact units have really done over the years.

Ideally, we want something more than 5 years back (a reasonable number for most young couples that would outgrow a compact unit), but not too far back that factors like BSD or SSD would have been drastically different.

Let’s go with 2014.

$748,282 back in 2014 was quite a decent sum to start off with, so we’ll take that down a notch, to a more realistic range of $600,000 to $700,000.

First up, new launch compact units.

A good example we’ve found is the Panorama, a new launch back in 2014.

| Date | Size | PSF sold | Purchase date | PSF bought | Profit/loss |

| 23 Mar 2020 | 431 | 1,579 | 30 Jun 2014 | 1,431 | $64,000 |

| 14 Nov 2019 | 431 | 1,714 | 19 Jun 2014 | 1,411 | $130,536 |

| 3 Oct 2019 | 431 | 1,568 | 8 Jul 2014 | 1,423 | $62,432 |

If you had bought the 431 square feet unit, you would have made a tidy gross profit of $64,000 – with an earlier transaction going as high as $130,536.

| Date | Size | PSF sold | Purchase date | PSF bought | Profit/loss |

| 23 Jan 2020 | 452 | 1,500 | 3 Feb 2014 | 1,563 | -$28,700 |

That’s not to say it’s all a bed of roses for new launches, if you had gone for the Glades in a similar time frame, you would have made a loss of $28,700.

Now let’s look at resale condos – of which there weren’t too many resale transactions in 2014 of units that sold between $600,000 to $700,000.

| Date | Size | PSF sold | Purchase date | PSF bought | Profit/loss |

| 5 Mar 2020 | 463 | 1,296 | 7 May 2014 | 1,404 | -$50,000 |

This one at the Caspian made a loss of $50,000, having sold in March 2020.

Finally, resale condominium transactions that made money – there were only 14 projects that had transactions that fit our criteria.

Of which – only one featured a profit making transaction – Parc Rosewood.

| Date | Size | PSF sold | Purchase date | PSF bought | Profit/loss |

| 29 Jan 2019 | 506 | 1,285 | 16 Jul 2014 | 1,162 | $62,000 |

If you had purchased a compact unit back in 2014, you would have made a gross profit of $62,000.

So do you lose out on this appreciation by delaying, and renting for a number of years?

The answer is maybe – it will also come down to what you’re doing with the money you save by renting instead (e.g. where it’s invested); and on whether you would have holding power if you were to buy (e.g. if you were to buy, and then find you can’t afford it, you might have to sell at a loss; and so much for any capital gains).

The question of where you can put your money to get better returns is the job of a wealth manager; we can’t give you that sort of investment advice. But we can help if you want to know which properties you can afford, or which ones are likely to appreciate better. Contact us on Facebook, for help on the property you’re considering.

Based on the above, crunch the numbers to work out if you should be buying or renting

If the initial costs would wipe out your savings (you have no holding power), or you need liquidity because you’re self-employed / a business owner, it might be better for you to wait.

Otherwise, you may be better off using the money that’s just sitting in your CPF. The sooner you buy and pay off your home loan, the quicker you cross a major hurdle toward financial freedom.

Ultimately, even if capital appreciation is your main factor between the two, you can clearly see how important it is to choose the right project and unit – make the wrong choice and you could be setback for the foreseeable future.

If you’re still unsure of the next step, contact us at Stacked. You can also follow us for the latest news and property reviews in Singapore’s real estate scene.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Should I rent or buy a home as a Singaporean earning above the income ceiling?

What are the main costs involved in renting a flat or condo in Singapore?

How do the monthly costs of owning a condo compare to renting in Singapore?

Can I benefit from property appreciation if I buy a condo in Singapore?

What should I consider before deciding to buy a condo in Singapore as a sandwiched Singaporean?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

4 Comments

Hi Ryan, I am in the same scenario and purely based on numbers crunching, renting makes more sense. However, the utility gained from renovating, doing up my space and satisfaction gained by owning my own property outweighs the cost. Another reason (maybe a Singaporean one) is that it will be easier to convince your parents that you’re moving out.

Hi Ryan, must said good job and the insightful article. It’ll be interesting to do a 360 view comparison as the buyer stamp and seller stamp duties plus interest paid are not part of your profit and loss examples. If you factor all these in, i have a feelings that in the present market, it may tip in favor of renting. Would be insight if you do an example of the a 5 years renting vs a private condo ownership of 5 years with some real life examples. Keep up the good work!