Is It Time To Refinance From An HDB Loan To A Bank Loan?

November 5, 2020

After almost seven years of consecutive decline, the HDB resale market seems to have turned a corner. They hit a 10-year high as of Q3 2020; and there’s a good chance the momentum will continue.

Perhaps you’ve been tempted into a resale flat yourself, given the slew of new (five-year old) flats that just entered the market. Or maybe you’re one of the lucky Singaporeans who won out at the giant August 2020 BTO exercise. In either case, you’ll quickly realise something that seems downright unfair:

Private bank loan rates average around 1.3 per cent per annum right now, whereas the HDB Concessionary Loan is at 2.6 per cent. How can condo owners pay half the interest rate of HDB owners?

Well, you can refinance from an HDB loan to a bank loan if you want to – but it’s important to get the full picture first:

How HDB loan rates are determined, versus bank loan rates

The HDB loan rate is pegged at 0.1 per cent above the prevailing CPF rate, which has stayed at 2.5 per cent since around 1999. As such, the HDB loan rate has also been at 2.6 per cent over the past two decades.

Since the interest rate hasn’t changed in 21 years, it’s common for most home owners to regard HDB loans as being a “fixed rate”. But note this is not technically correct: CPF rates are revised on a quarterly basis. If the CPF rates do rise one day, your HDB loan rate will go up with it.

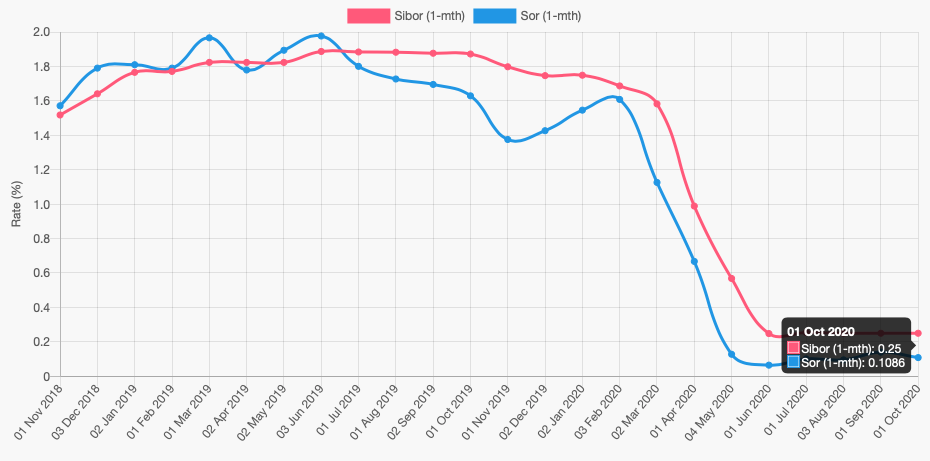

Bank loans are more complex. We have a more detailed explanation in a previous article. But to summarise, bank home loans are either based on the Singapore Interbank Offered Rate (SIBOR), or are set by the bank itself (e.g. pegged to the bank’s fixed deposit rates, or some other board rate).

Bank loans rate fluctuate more often; the interest rate often changes every month, or every three months, for most loan packages.

Bank loan rates are currently at record lows due to the United States Federal Reserve keeping rates near zero. This is expected to last till 2022 at least. At present, that means it’s possible to find home loans at just around 1.3 per cent.

How much money are we talking about exactly?

Let’s say you have an outstanding loan of $350,000 for your flat. This is with a loan tenure of 25 years.

Using an HDB loan at 2.6 per cent per annum, your approximate monthly repayments are about $1,588. About $758 of this goes toward servicing the interest only; so you’d pay around $126,353 in interest by the end of the loan.

On the other hand, let’s say you’re on a bank loan instead, and owe the same amount, with the same loan tenure. At 1.3 per cent per annum, you’d pay around $1,367 per month, of which $379 goes toward interest. By the end of 25 years, you’d pay about $60,138 in interest.

That’s a difference of about $66,215.

However, there’s an important caveat to add

The interest you’ll pay on the HDB loan is higher, but it’s also more predictable. The HDB loan rate, as we mentioned above, seldom changes.

With bank loan rates, it’s hard to foresee what they will be in 10- or 15-years’ time, let alone when your loan tenure ends.

We can tell you that bank loans have been at two per cent or below since around 2009; but this was caused by a black swan event – the Global Financial Crisis. At the time, the US Federal Reserve also cut interest rates to stimulate the economy.

Covid-19 is also a black swan event; one that occurred after interest rates were starting to normalise. As such, interest rates have been kept low by two unusual circumstances.

Before the current low-interest environment, bank loans were sometimes more expensive than HDB loans. In the 1990’s, for instance, it was typical for bank loans to be at around four per cent per annum.

So on the one hand, we can definitively say bank loans could have saved you more money, from around 2009 to the present. However, there’s no guarantee that will hold true at the end of 25 years.

With that in mind, should you refinance from your HDB loan into a bank loan?

Key factors to consider are:

- Justifying the costs to refinance

- Whether you’re paying the home loan in cash

- There’s no way to undo this action

- Your future plans for the flat

- Prepayment penalties

- Leniency if anything goes wrong

1. Justifying the costs to refinance

Refinancing may mean paying conveyancing fees. This ranges between $2,500 to $3,000, which can sometimes be paid with your CPF (it depends on the law firm you use). In addition, there may be other charges such as bank processing fees, or valuation costs.

You need to work out whether the eventual savings justify this expense. In the above example, switching to a bank loan lowers the monthly repayment from $1,588 to $1,367; this is a savings of $221 a month.

Assuming you pay $2,500 to refinance, it will take around a year just to cover the cost of refinancing. In some cases it may not be worth going ahead; such as if you’re planning to upgrade and sell your flat next year anyway.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

10 Key Factors To Help You Pick The Ideal New Launch Condo Unit

The hard (or fun?) part is over. You've found your ideal condo development - it's near to the MRT, there's…

2. Whether you’re paying the home loan in cash

Regardless of whether you use a bank or HDB loan, you can service the home loan repayments from your CPF.

However, some home owners use cash instead of CPF (e.g. because they want to accrue more CPF for retirement, or want to avoid negative cash sales when they upgrade).

You may feel more of a pinch if you are paying a couple of hundred a month out of pocket. A difference of a few hundred dollars a month can mean more to these owners as it directly affects their wallet. On the other hand, home owners who fully service their loan with CPF may not feel the difference.

3. There’s no way to undo this action

You can refinance from an HDB loan to a bank loan, but the reverse isn’t possible. Once you decide to go with a bank, you’re stuck with the decision to the end.

This means you’re at the mercy of more volatile interest rates, and have to be more proactive: you’ll have to actively compare home loan rates every few years, and take steps to refinance to keep your loan rates down.

Property Market CommentaryHDB vs. SIBOR vs. Fixed Deposit: Which Home Loan is Best Right Now?

by Ryan J. Ong4. Your future plans for the flat

Are you intending to stay in the flat for good, or are you going to upgrade after the Minimum Occupation Period (MOP)? This impacts your decision to refinance.

Homeowners who use their flat as a “stepping stone” to a private property are often inclined toward bank loans. They’re less worried about the interest rates 10 or 15 years from now, as they intend to sell at around the five-year mark or soon after.

In the meantime they want interest repayments rates low, as that ultimately means better gains.

Some home owners who rent out their flats are also inclined toward cheaper bank loans, as it helps to push up their net rental yield.

If you’re thinking of your flat in terms of asset progression or rental, drop us a message on Facebook; we can give you better advice for your specific situation.

4. Prepayment penalties

Most banks impose penalties if you try to pay off your home loan early; the typical penalty is 1.5 per cent of the amount you’re prepaying. This can be an added cost when you want to sell.

For example, say you want to sell the flat, while you still owe $200,000. If your home loan imposes a prepayment penalty, you’d have to pay an added $3,000 to redeem the loan.

Different loan packages have varied terms and conditions. Some home loans don’t charge a prepayment penalty if you’re selling your house; some will only charge the penalty for a given portion of the prepayment (e.g. 1.5 per cent on the first $100,000 only). Many banks won’t charge the prepayment penalty after a given time period, such as three to five years.

HDB loans, on the other hand, have no such penalties. You can pay off the entirety of your HDB loan at one go if you like (if you strike 4D or something). That means no more interest repayments at all.

5. Leniency if anything goes wrong

HDB’s mission is to keep a roof over our head, so they’re less inclined to seize your flat if you can’t pay. HDB might be lenient in events such as medical emergencies, job loss, and so forth (on a case-by-case basis).

Banks can’t give you as much leeway, as they’re businesses that must be operated in a certain way. If you can’t pay your mortgage for some reason, the bank is quicker to foreclose.

For those who are just purchasing their flats now, note that you can choose to start with a bank loan if you want.

The chief difference is that, if you use an HDB loan, the minimum down payment is 10 per cent, which can be fully paid with CPF.

If you use a bank loan, the minimum down payment is 25 per cent (five per cent in cash, and 20 per cent from any combination of cash or CPF).

In conclusion, it could be a good idea to switch to a bank loan right now, especially if you’re not holding on to the flat in the long term

Interest rates are at a historic low, and will be for the foreseeable future as the world recovers from Covid-19. If your plan is to upgrade after the next five years, it’s worth considering a bank loan to save money over the period of your MOP.

If you’re staying in your flat indefinitely however, there’s a greater risk – the situation may not be the same a decade down the road.

Do remember not to go with just any bank though! Some may not give you the lowest rate on the market. We can connect you with the cheapest current home loans if you need.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Should I refinance my HDB loan to a bank loan now?

What are the main differences between HDB and bank home loans?

What should I consider before refinancing from an HDB loan to a bank loan?

Are there any penalties for paying off a bank home loan early?

How does the interest rate environment affect the decision to refinance?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

0 Comments