Property Prices May Get Even More Expensive In 2023: Why New Land Betterment Charge Rates Will Affect Prices

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

When it comes to new launch prices, most Singaporeans are quick to pick up on the most obvious factors like land scarcity, agent commissions, or developer stamp duties. However, one factor that often slips under the radar – and that many Singaporeans have never even heard of – is the development charge, or DC, but now newly known as Land Betterment Charge (LBC) rates. Here’s why we should be paying attention to them:

What are LBC rates?

The LBC rates came into effect on 1st August 2022.

The LBC is a tax on the increase in land value, resulting from a development. The rate imposed is a percentage of the increase in land value; this is determined by SLA, working with the Chief Valuer (CV), and will also take into account recent land sales.

Simply put, it’s another tax that developers will have to pay to the Singapore Land Authority (SLA) for the right to enhance the use of a land site, or to build a bigger property on the land.

For veterans in the property market, all of this may sound quite familiar. That’s because while the LBC is new, the concept is not: it is similar to past taxes like the Development Charge (DC), Temporary Development Levy (TDL), and Differential Premium (DP).

LBC essentially combines all of those previous taxes into a single tax bill; and one that is collected by SLA. This simplifies the paperwork, as previously developers would have to apply to multiple agencies regarding the DC, TDL, and DP.

For the purposes of LBC rates, Singapore is divided into 118 sectors. Note that these do not correlate to the postal district codes of the locations.

And just like the previous DC system, the LBC rates for each sector will be revised twice every year.

LBC rates have seen significant increases in 2022

As of September, LBC rates were raised by an average of 12.9 per cent for non-landed residential development, and 10.2 per cent for landed residential.

For non-landed residential development, this is the sharpest increase since March 2018. For landed residential, this is the biggest increase we’ve seen since 2011.

LBC rates were raised in all but two sectors (so a total of 116 geographical sectors), by amounts ranging from six per cent to 20 per cent.

The biggest jump in LBC rates was for the following sectors:

Non-Landed Residential Use

| GEOGRAPHICAL SECTORS | DESCRIPTION | % CHANGE |

| 113 | Bt Batok/Jurong Rd | 20.00% |

| 54 | Kallang Bahru/Boon Keng | 18.50% |

| 55 | Upp Boon Keng | 18.50% |

| 56 | Geylang Bahru | 18.50% |

| 57 | Bendemeer/Whampoa/St Michael’s | 18.40% |

| 73 | Ganges Ave/Havelock/Alexander North | 18.40% |

| 75 | SGH/College Rd | 18.40% |

| 79 | Jln Bt Merah/Kampong Bahru | 18.40% |

| 81 | Bukit Merah View | 18.40% |

| 84 | Henderson | 18.40% |

| 86 | Telok Blangah Drive | 18.40% |

| 87 | AYE/Telok Blangah Crescent | 18.40% |

Landed Residential Use

| GEOGRAPHICAL SECTORS | DESCRIPTION | % CHANGE |

| 67 | Nassim/Orange Grove/Ladyhill/Fernhill | 13.60% |

| 25 | Selegie | 11.10% |

| 26 | Prinsep St, Bencoolen St | 11.10% |

| 27 | Waterloo St, Queen St, Victoria St | 11.10% |

| 28 | Kampong Glam/Sultan Gate | 11.10% |

| 29 | Rochor Canal | 11.10% |

| 30 | Kelantan | 11.10% |

| 31 | Little India | 11.10% |

| 32 | Race Course Rd | 11.10% |

| 33 | Mackenzie/Mayne Rd | 11.10% |

| 41 | Orchard/Somerset | 11.10% |

| 49 | Tanjong Rhu | 11.10% |

| 50 | Marina East | 11.10% |

| 68 | Botanic Gardens/Gallop Rd/Tyersall | 11.10% |

| 69 | Ridout/Peirce Hill/Swettenham Rd | 11.10% |

| 89 | East Coast Park | 11.10% |

| 90 | Marina East | 11.10% |

| 96 | East Coast Park/Bayshore | 11.10% |

| 97 | Bedok South | 11.10% |

| 103 | Braddell/Potong Pasir/Bartley/Upp Aljunied/Woodleigh | 11.10% |

| 104 | Bishan/Ang Mo Kio | 11.10% |

| 106 | Seletar | 11.10% |

| 114 | Tuas/Choa Chu Kang/Kranji | 11.10% |

| 115 | Sembawang/Mandai/Woodlands | 11.10% |

Commercial Use

| GEOGRAPHICAL SECTORS | DESCRIPTION | % CHANGE |

| 43 | Tanglin/Cuscaden | 8.40% |

| 41 | Orchard/Somerset | 8.10% |

| 1 | Raffles Place/Golden Shoe | 7.90% |

| 2 | Philip St/Pickering St/South Bridge Rd | 7.90% |

| 3 | High St, Coleman St, St Andrew’s Rd | 7.90% |

| 4 | Bugis (part Rochor Rd, part Beach Rd, part Victoria St) | 7.90% |

| 5 | Marina Centre | 7.90% |

| 6 | Fullerton Rd | 7.90% |

| 7 | Cecil St, Robinson Rd | 7.80% |

| 11 | Marina Bay | 7.70% |

| 12 | Bayfront | 7.70% |

| 42 | Orchard | 7.70% |

Industrial Use

| GEOGRAPHICAL SECTORS | DESCRIPTION | % CHANGE |

| 114 | Tuas/Choa Chu Kang/Kranji | 5.50% |

| 98 | Tampines/Bedok Reservoir/Bedok North/Kembangan | 5.30% |

| 108 | Holland/Dunearn Rd/Sixth Ave | 5.30% |

| 112 | West Coast Rd/Jurong East | 4.30% |

| 111 | AYE/Pasir Panjang/Science Park | 4.20% |

The explanation for the jump in sector 113 has been linked to the en-bloc sale of Lakeside Apartments. In May this year, Lakeside Apartment saw a successful collective sale for $273.89 million, which was 14 per cent above its reserve price of $240 million.

More from Stacked

The Changing Attitudes Toward Chinese Property Developers In Singapore

When Chinese developers first entered the Singapore market, there was some skepticism involved. It didn’t help that, during the en-bloc…

This price of Lakeside Apartments was 48 per cent above the land value estimated by the CV, based on the March 2022 charge rates.

Even without the en-bloc sale, however, realtors opined that charges in this area were due to rise anyway. Envisioned as a major commercial hub, and Singapore’s “second CBD”, Jurong Lake District has continually pushed up property prices and demand in the area.

It’s also from sector 113 that saw the EC GLS site at Bukit Batok West Avenue 8 sold for a new record for EC land at $662 psr ppr after 9 bids. This was awarded to a joint venture between Qingjian Realty and Santarli Construction.

Likewise for sector 57 with an increase of 18.4 per cent in LBC rates. This could have been attributed to the collective sale of Euro-Asia Apartments, which went en bloc for $221.8 million.

The next was sector 104 which had an increase of 17.4 per cent in LBC rates. This was likely due to the collective sale of Chuan Park, which was sold for $890 million or $1,254 psf ppr.

Property Market CommentaryChuan Park En Bloc Saga: 4 Key Lessons To Learn For Future En Bloc Hopefuls

by Ryan JThere is a correspondence between LBC rates and overall property prices

One analyst, who declined to be named, pointed out that way back in 2018, the huge spike in charge rates coincided with the en-bloc fever. While the government has never specifically said charge rates are used to cool the market in any form, it’s plain that charge rates can dissuade aggressive land bids, which can go some way toward cooling of demand.

Note that all of the properties that went en-bloc in the 2017/18 en-bloc fever have been completed and sold, leaving developers again hungry for land. And just in time for this, the LBC rates spike again.

Besides this, we can see the steep rise in LBC rates for landed homes matches ongoing demand. URA’s price index for landed residential properties saw a sharp 6.6 per cent rise in 2H 2021, and we also explained the surge in demand for Good Class Bungalows (GCBs) in this article.

Today, the LBC charge rate for landed residential is the highest in around 11 years.

Why should we be concerned about LBC rates?

First off, higher LBC rates will worsen en-bloc potential. As of December 2021, Developers already face a higher ABSD rate of 35 per cent (of which five per cent is non-remissible).

The higher taxes are coupled with rising risks from the war in Ukraine, as any increase in fuel costs is likely to hit developers hard (there are significant transportation costs in real estate development). This is without considering any price hikes in construction materials, from disrupted supply chains.

Developers already face a significant amount of risk in 2022; and raising LBC rates just compounds the issue. This is a move that could make developers shy away from en-bloc deals, and this isn’t just speculation: bear in mind that, when charges spiked in 2018, the en-bloc fever died in the same year.

(We’d admit there were other contributing factors, such as new cooling measures, but higher taxes can’t be excluded as part of the issue).

Despite soaring prices, word on the ground is that developers are concerned; and less enthusiastic bidding for GLS sites reflects this.

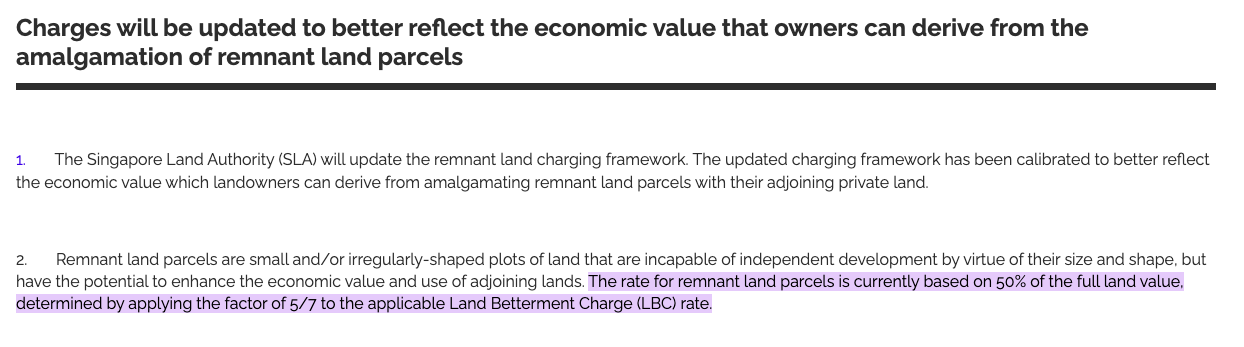

There is also the small issue of SLA’s recently updated charging framework for remnant land.

Previously, this was based on 50 per cent of the full land value, but from the first of September 2022, this will be doubled to 100 per cent. As such this will affect collective sale sites which are proposing the acquisition of remnant land to increase the gross floor area. Remember, there are also changes to how GFA will be computed in the future (this will come into play on 1st June 2023), which will further affect the costs for developers.

The second problem is that developers may transfer the costs to buyers.

If we combine the above issues with already thin developer margins (around 14 per cent), it’s hard to see how developers can further take on higher LBC rates. Something has to give, and it’s most probable that developers will end up transferring the costs to buyers.

Consider that HDB upgraders are already being priced out of new launches, and that recent launches have 1,000+ sq. ft., family-sized units reaching a quantum of about $2 million. How much less affordable will new launches be, if developers also need to pass on the cost of higher LBC rates?

2022 is one of the worst times for developers to push for higher prices, given the steep home loan rate hikes.

As such, higher LBC rates, coupled with existing high prices, are likely to push upgraders to the private resale market in the year ahead.

All we can do is keep our fingers crossed, and hope that higher LBC rates don’t contribute to an even further shortage of private housing supply. For more on the situation as it unfolds, visit us on Stacked. We’ll also provide you with in-depth reviews of new and resale properties alike.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

Singapore Property News URA’s 2025 Draft Master Plan: 80,000 New Homes Across 10 Estates — Here’s What To Look Out For

Latest Posts

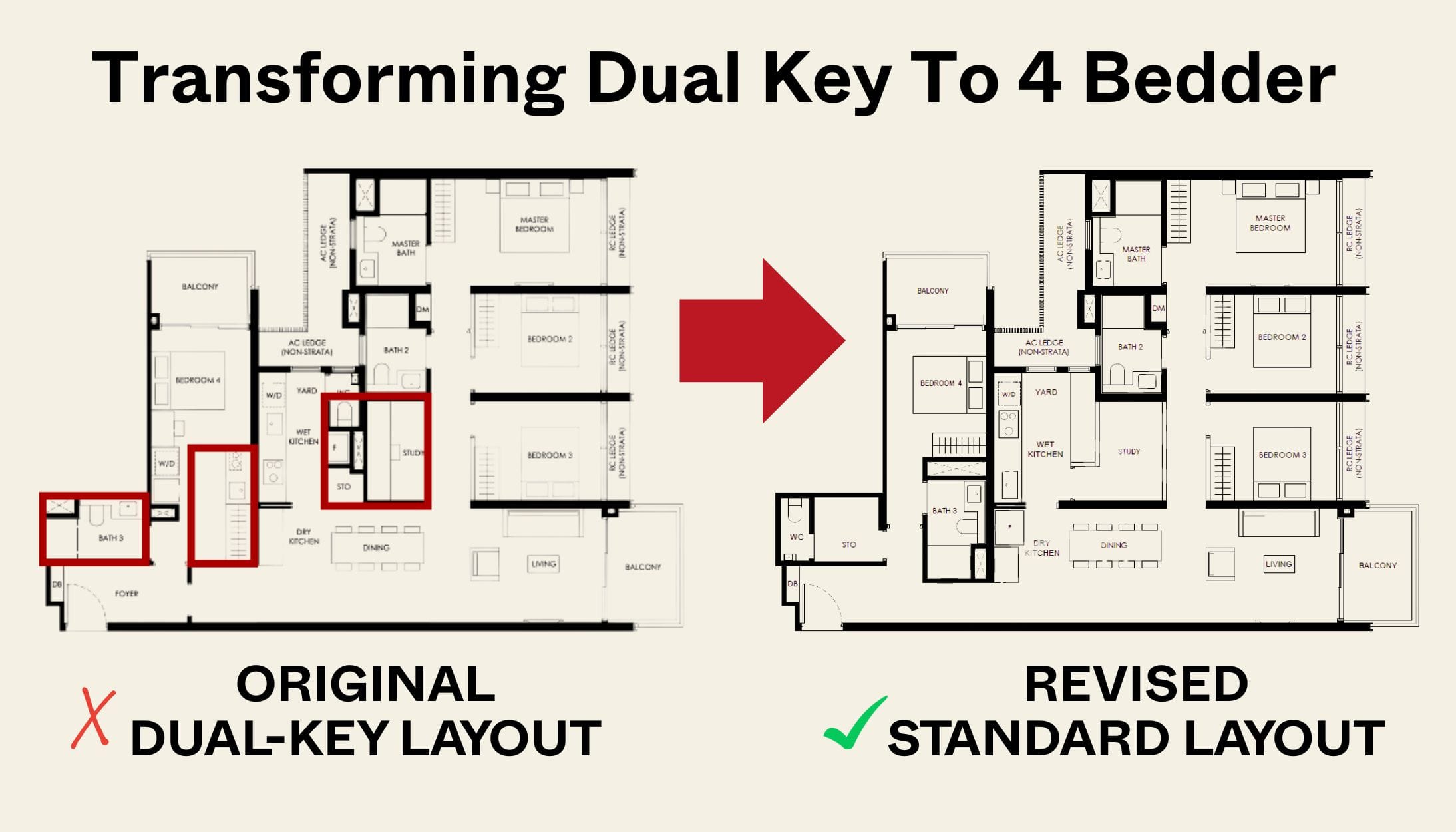

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

New Launch Condo Reviews The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Pro Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest

Pro Similar Layout, Same District—But Over $500K Cheaper? We Compare New Launch Vs Resale Condos In District 5

What is your take on the reasons behind the spike in LBC for the Boon Keng and Whampoa areas?