Buying At A Property Auction During Covid-19: Here’s All You Need To Know

July 15, 2020

Fire sales. Mortgagee sales. Urgent sales. From as early as January this year, reports warning of more properties going “under the hammer” have been flung at you; and you had one more round of it in May. So it was probably a matter of time before you tapped the “a-u-c-t-i-o-n” word in the search bar, and started wondering if maybe there’s a discount private property available.

While not many transactions do go through the property auction route – there are definitely potential gems out there. As a kind reader pointed out, a $2.2 million house on Dido Street was sold during the circuit breaker period (without viewing, of course).

After all, there’s opportunity in crisis. And if there are more property auction sales during this Covid-19 period, well, those looking for discounts will definitely have their interest piqued. Still though, there are a couple of things you need to know, before you decide to go ahead with anything:

First, take note that not all property auctions are mortgagee sales

A property auction can be initiated by a bank, because the owner can’t service the loan – that’s a mortgagee auction, or a distressed sale. This sort of auction can also happen if the property’s been seized due to some form of legal action, and is ordered to be auctioned off by the Court.

The above are different from owner-initiated auctions (or owner auctions). There are when sellers choose to use an auction method, such as to quickly gauge the market reaction to their price. Owner auctions can be urgent sales as well though, such as if the sellers are racing to dispose of the property within the six-month Additional Buyers Stamp Duty (ABSD) deadline.

Second, temper your expectation, because most auctions don’t end in a transaction…or big discount

Most property auctions end up with no one buying. The success rate of auction listings in 2019 was 1.4 per cent, and that was even during a surge in auctions.

There’s a reserve price that has to be met for auctioned properties; and if the price isn’t met, the property won’t be sold. Very often, that’s exactly what happens.

Many of the actual transactions happen after the auction, when people approach the sellers in private to work out another deal.

Another thing to note is that discounts are far from guaranteed, even if a transaction occurs.

To be clear, the reserve price is usually below what the current owner paid for it. But after the bidding, most mortgagee sale properties ultimately transact at close to their market value (or even above the market value).

There have been occasions when a mortgagee sale ended in giant discounts, but it’s not common. The most famous example was back in 2017, when a unit at The Marina Collection was bought at $5.24 million, but sold at around $3 million in the mortgagee sale; a 42.8 per cent discount. Count on these events like you would count on winning Toto though.

We won’t go into the actual bidding process here, although we’ll explain it in a future article

Follow us on Facebook for an update, on how to bid and buy at auctions. For now, let’s focus more on whether the immediate, post-Covid 19 situation is a good time to dive into mortgagee sales:

- The urgency exerts undue pressure, which you don’t want to buy under right now

- Consider if the discounts at new launches aren’t as good, or a better deal

- Most of the properties will be luxury, high quantum units

- The rental market is rocky for the aforementioned units

1. The urgency exerts undue pressure, which you don’t want to buy under right now

We’re in the middle of a recession right now, and major purchases – such as your home – should be made with care. We haven’t even felt the full sting of Covid-19, which could come later in the year. You need to process all kinds of “what-if” scenarios, such as if your income is reduced, or your savings need to be tapped for support for your business / other dependents.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Is It Still Worth Investing In A Condo Given The High PSF?

I was looking at some regrets on getting a condo on a Reddit thread lately, about whether a condo is…

Property Market CommentaryAn RHB Analyst View Of The Singapore Property Market (Post Covid-19): A Recap

by Druce TeoAn auction environment is antithetical to this kind of caution. Sure, you can “go in with a budget in mind”, but ultimately, you’re putting yourself in a position where you have seconds to decide on your bid. And did we mention you’ll need to fork out a non-refundable, 10 per cent deposit on the property on the day itself, no turning back?

(And no, you can’t change your mind and refuse to put down the deposit later! You can be sued for breach of contract if you win the auction, but later refuse to follow through).

Even in better times, we’d caution against buying properties under high pressure scenarios. But in a post-Covid 19 recession, it’s even more important to avoid buying property under stress.

2. Consider if the discounts at new launches aren’t as good, or a better deal

As we’ve mentioned above, the discounts at mortgagee sales are far from guaranteed; and there may effectively be no discount if you end up buying at market value. In which case, what’s the point of the bigger 10 per cent cash outlay, and putting yourself under such stress?

Private property developers are also aware of the Covid-19 situation, and will adapt their prices accordingly. We’ve also compiled a list of new launches and discounts that are in the market; there’s a chance that a new launch discount could be even bigger than what you’d get at a mortgagee sale.

3. Most of the properties will be luxury, high quantum units

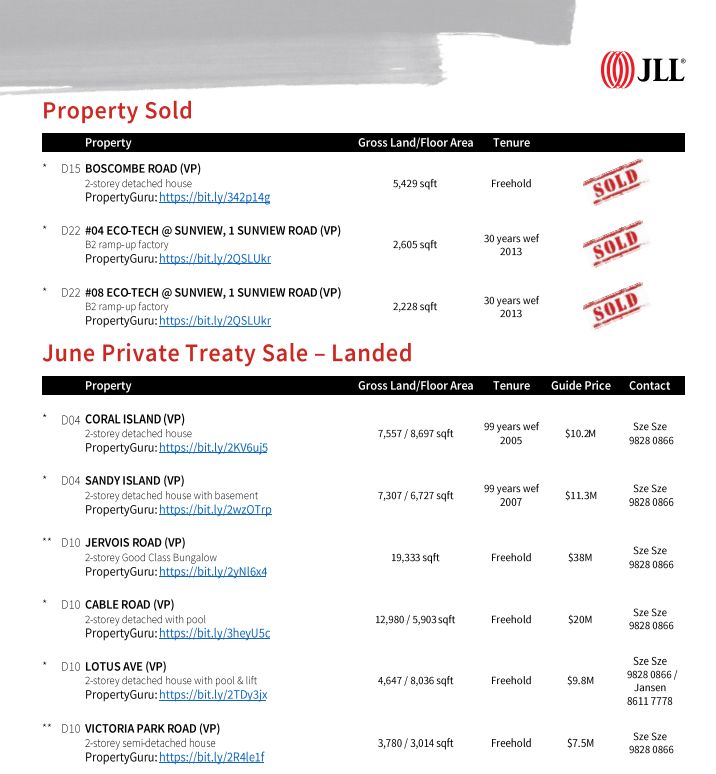

Mortgagee sales since about 2017 to the present have mainly been larger, luxury units. Most are prime district condos, over 1,000 sq.ft., and have a quantum of $3 million or higher.

It’s usually these units that go under the hammer first, during a major crisis (there’s a reasonably sixed pool of people who might buy a $1.3 million condo before the bank forecloses; but how many can afford a $3 million District 9 condo?)

So don’t be surprised if most of the “fire sale” properties are staggeringly expensive, even if the offering price is below their original selling price. A recession is a bad time to overcommit, even if the transaction price ends up a bit below valuation.

Property investment in Singapore relies on holding power, which you won’t have if you can’t comfortably service the payments.

4. The rental market is rocky for the aforementioned units

Rental volumes are down by over a third in the wake of Covid-19, for private properties as well as HDB. This could get even worse if, during the downturn, companies recall their expatriate workers, and cut costs by reducing housing allowances.

Above, we already said that many of these mortgagee sales are luxury, prime region properties. Well when housing allowances shrink, one of the first things foreign tenants might do is downgrade from more premium properties, into mass market rentals. That could see in a migration from luxury condos into cheaper fringe region counterparts; bad news if your intent is property investment in Singapore.

So if you’re counting on rental (i.e. you assume a mortgagee sale will be cheaper, and hence have a higher rental yield), you may be disappointed. Have a quick conversation with us, and we can provide some clarity on the property you have your eye on.

Compare other options to the property auction listings that you’re seeing on Stacked Homes. Our in-depth condo reviews will help you to decide if that property auction is the best choice, or if there are other, better alternatives in the market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are all property auctions during Covid-19 mortgagee sales?

What are the chances of getting a good discount at a property auction during Covid-19?

Is now a good time to buy property at auction during Covid-19?

What types of properties are usually sold at mortgagee sales during Covid-19?

How has the rental market been affected during Covid-19 for properties involved in mortgagee sales?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

0 Comments