Prime Resale Freehold Condos Cheaper Than New 99-Year Suburban Condos: Too Good To be True?

August 27, 2022

The year is 2017, the market is on a bit of a slowdown and you decide this is the right time to buy an investment property.

You have always been a bit of a traditionalist, and you subscribe to the theory that freehold properties will perform better.

You found an ideal property – a new condo that was just completed in 2016 in District 10. It’s freehold and just opposite good schools like SCGS and SJI. It’s 5-minutes walk away from an MRT station that has 2 lines, and you even have a Cold Storage just next door.

Plus, for a small development of just 100 over units, it even has a rooftop tennis court.

What’s not to like? It ticks all the boxes on paper.

At the same time, your friend tells you about this other property in the equally premium District 9.

It’s a 99-year leasehold condo though, and will only be completed in 2021. There is 4x the number of units (you do have a tennis court too), and about the same distance away from a yet to be completed MRT station.

Both are around the same size, price per square foot, and thus, at a similar price point.

If given a choice between the two which would you choose?

For most casual observers, the first property would likely be their first pick.

Why?

It seems like a no brainer. You get a freehold lease, an equally premium location. It’s near better schools, has fewer units, and it even offers the equivalent major facilities (like a tennis court).

Plus at the same price point, even though the leasehold property may be a little newer, who would opt for the leasehold property?

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How picking the first property would’ve panned out

If you haven’t guessed by now, let me show you just which developments these are, and how they have performed since then.

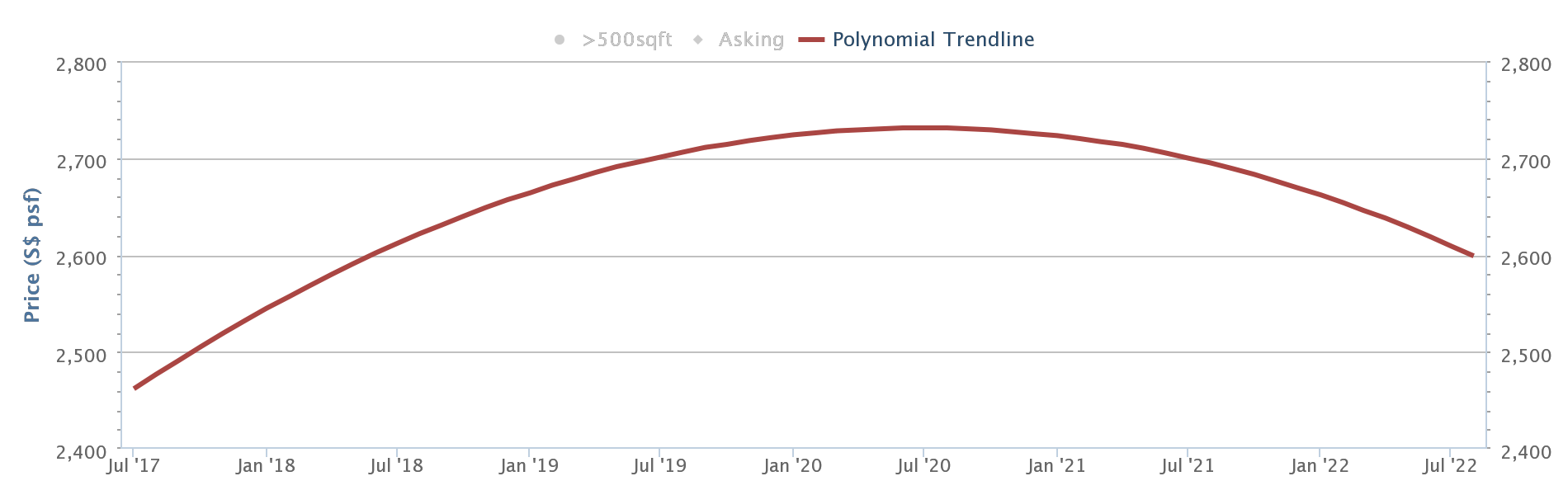

The second property is Martin Modern. Here’s how it has performed in terms of $PSF.

Prices for a 2 bedroom 850 sq ft unit at Martin Modern were sold at an average of $2,321 psf in July/Aug 2017.

| Date | Size (sq ft) | Price ($PSF) | Price (Total) |

| 18 Aug 2017 | 850 | 2,340 | $1,989,680 |

| 22 Jul 2017 | 850 | 2,320 | $1,972,722 |

| 21 Jul 2017 | 850 | 2,413 | $2,051,857 |

| 21 Jul 2017 | 850 | 2,358 | $2,005,022 |

| 21 Jul 2017 | 850 | 2,259 | $1,921,042 |

| 21 Jul 2017 | 850 | 2,269 | $1,929,117 |

| 21 Jul 2017 | 850 | 2,293 | $1,950,112 |

| 21 Jul 2017 | 850 | 2,308 | $1,963,032 |

| 21 Jul 2017 | 850 | 2,332 | $1,983,220 |

| 21 Jul 2017 | 850 | 2,287 | $1,944,460 |

| 21 Jul 2017 | 850 | 2,363 | $2,009,060 |

| 21 Jul 2017 | 850 | 2,306 | $1,960,610 |

And most recently in 2022, given the average prices at Martin Modern are at $2,652 psf over the last 6 months, we can reasonably assume that you could be sitting on a paper profit of $281,350.

Contrast this to the Robin Residences performance, the first property pick.

Prices for a 2 bedroom 850 sq ft unit at Robin Residences were sold at an average of $2,397 psf in July/Aug 2017.

| Date | Size (sq ft) | Price ($PSF) | Price (Total) |

| 11 AUG 2017 | 850 | 2,367 | $2,012,670 |

| 28 JUN 2017 | 850 | 2,426 | $2,063,000 |

Today, the average prices at Robin Residences over the last 6 months are recorded at $2,338 psf. Given that, we can assume that if you had bought a unit here, you’d be likely looking at a small loss or at best, a breakeven price over the past 5 years.

(Of course, if we were to account for rental too, then Robin Residences will reflect better results. But we are just doing an absolute price comparison here).

Talking about rental, it is perhaps even starker when we look at the rental numbers. Here’s how much a Robin Residences equivalent 2 bedroom unit rents for today.

| Date | Size (sq qft) | Size Range | Bedrooms | Monthly Rent ($) | Monthly $PSM |

| MAY 2022 | ROBIN DRIVE | 800 TO 900 | 2 | 4,200 | 4.9 |

| MAR 2022 | ROBIN DRIVE | 800 TO 900 | 2 | 4,300 | 5.1 |

And here’s what an equivalent Martin Modern unit has achieved in the rental market.

| Date | Size (sq qft) | Size Range | Bedrooms | Monthly Rent ($) | Monthly $PSM |

| JUL 2022 | MARTIN PLACE | 800 TO 900 | 2 | 7,200 | 8.5 |

| JUL 2022 | MARTIN PLACE | 800 TO 900 | 2 | 6,900 | 8.1 |

| JUN 2022 | MARTIN PLACE | 800 TO 900 | 2 | 6,500 | 7.6 |

| APR 2022 | MARTIN PLACE | 800 TO 900 | 2 | 5,800 | 6.8 |

| MAR 2022 | MARTIN PLACE | 800 TO 900 | 2 | 6,600 | 7.8 |

| MAR 2022 | MARTIN PLACE | 800 TO 900 | 2 | 6,000 | 7.1 |

| MAR 2022 | MARTIN PLACE | 800 TO 900 | 2 | 6,000 | 7.1 |

| MAR 2022 | MARTIN PLACE | 800 TO 900 | 2 | 6,000 | 7.1 |

| MAR 2022 | MARTIN PLACE | 800 TO 900 | 2 | 6,000 | 7.1 |

| MAR 2022 | MARTIN PLACE | 800 TO 900 | 2 | 6,700 | 7.9 |

| MAR 2022 | MARTIN PLACE | 800 TO 900 | 2 | 6,000 | 7.1 |

| MAR 2022 | MARTIN PLACE | 800 TO 900 | 2 | 6,500 | 7.6 |

Bear in mind too, that because Robin Residences has much fewer units, the monthly maintenance is likely to be higher.

As a result, your net rental returns are even better with Martin Modern.

There’s a big misconception that buyers still hold onto today

One of the biggest misconceptions buyers have today is to use the psf pricing from other districts to directly compare against whichever property they are trying to make a case against.

You may have heard other utter sentences such as:

“For this PSF price, I can buy XXX in District 10”

or…

“For this price, I can buy this freehold apartment in a more premium district, how is this worth the price?”

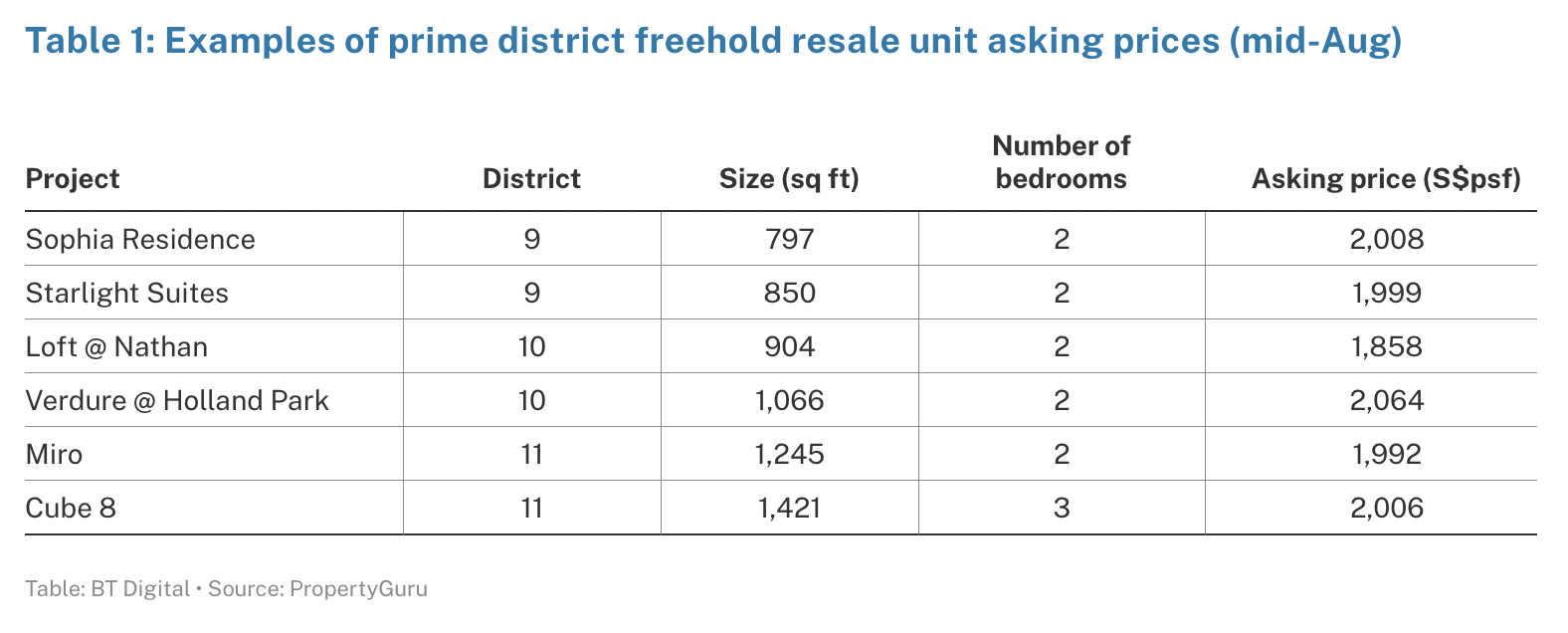

In fact, in Business Times there was an article just published yesterday titled: “Prime freehold resale homes now available at new leasehold suburban prices.”

In the article, they compared the prices of some prime district freehold resale condos asking prices.

This was compared to the recent successful new launch over in Ang Mo Kio, where AMO Residence sold over 98% of its 372 units on launch.

New Launch Condo ReviewsAmo Residence Review: Rare Ang Mo Kio New Launch With Landed/Park Views And Full Facilities For 372 Units

by Matthew KwanThe median selling price of AMO Residence was $2,110 psf, and many were questioning why people were willing to pay over $2,000 psf for a leasehold condo in the OCR, when you could buy a freehold option in the CCR for less than $2,000 psf.

There are 2 reasons which were not mentioned in the article, that I’d like to go through.

The first is because of the total final quantum.

Let’s take the cheapest psf in the table to compare, which is Loft @ Nathan at an asking price of $1,858 psf.

More from Stacked

Are Older One- and Two-Bedders in District 10 Holding Up Against the New Launches? We Break It Down

Because of areas like Tanglin, Holland V, Grange Road, and parts of Bukit Timah, District 10 (D10) has long been…

Again, taken out of context, this looks to be an absurd decision.

Who would pay $2,110 psf for a leasehold condo in the OCR, when you can buy a freehold condo in the CCR for $1,858 psf?

But let’s dig deeper.

First, at $1,858 psf for a 904 sq ft unit, this means a quantum of $1.68 million.

To opt for the same 2 bedroom 2 bathroom unit at AMO Residence, you’d need to choose the bigger 743 sq ft unit.

Applying an average of $2,110 psf, would mean a price of $1.57 million.

It’s not a massive difference, but $110,000 is still a nice chunk of change that can go towards a more than decent renovation.

As such, the AMO Residence unit is still cheaper in terms of the cash out of pocket for the buyer.

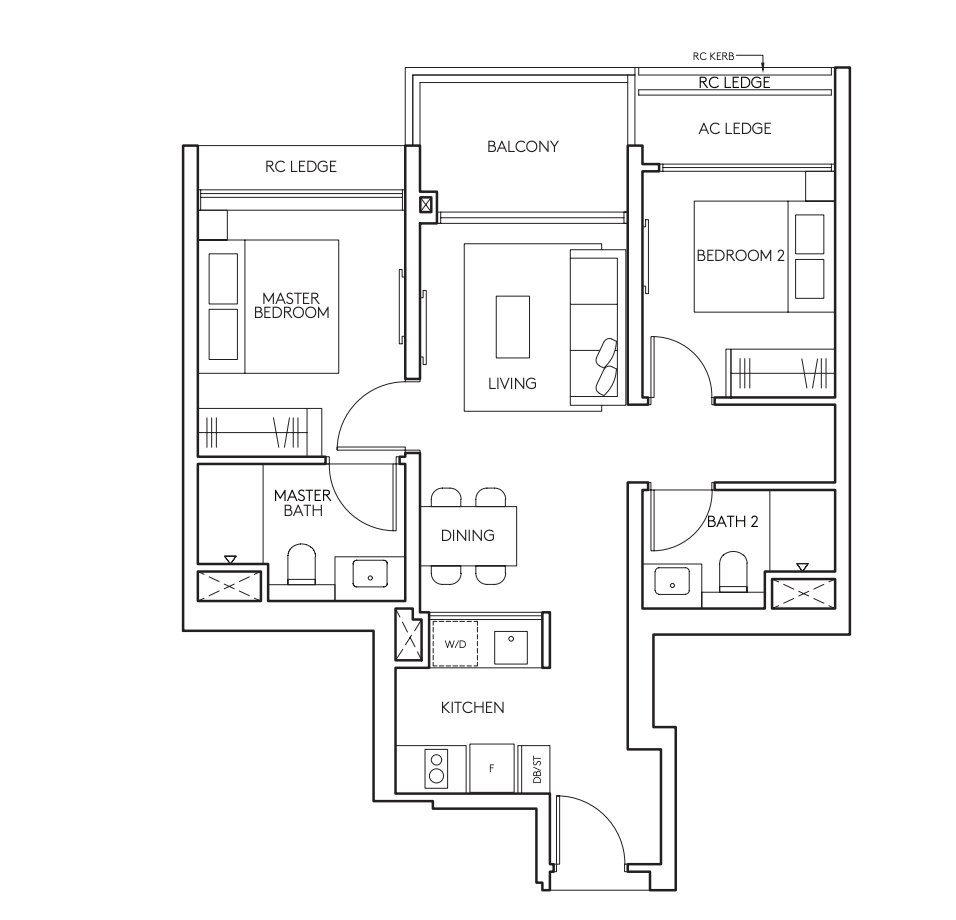

Secondly, it’s even more apparent when you look closer at the floor plan of the unit:

That’s when you’d discover that the Loft @ Nathan unit isn’t a true 2 bedroom unit, it’s more like a good-sized 1 + 1 bedroom unit.

But let’s give it the benefit of doubt here. After all, you could fashion that study into a small bedroom too.

Also, it sounds big on paper, but in reality, it may not look quite as big as you might expect.

The kitchen is tiny (so much so that the washer/dryer has to be placed on the balcony), and there’s quite a lot of planter space. And because it’s set over 2 levels, you do have additional wasted space that has to go to the staircase.

It must be said, you do get better privacy for the occupants because it is set over 2 levels. That’s an advantage that the unit at AMO Residence can’t provide.

Still, look at the layout at AMO Residence and the differences are like night and day.

You have an efficient dumbbell layout, where the occupants of both rooms get better privacy. There’s a decent-sized living, and the kitchen is able to be enclosed.

You even have a small nook in which you can create a study area.

Let me show you one more comparison that I remember hearing about.

The friend with a $1.3 million budget

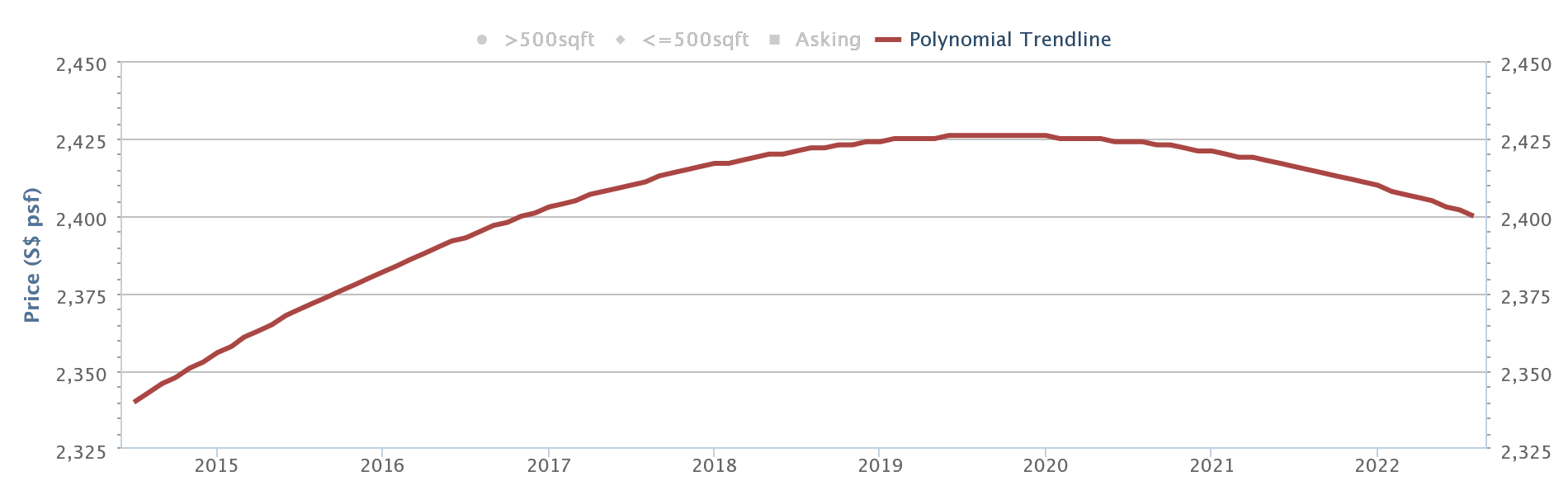

I had a friend who was looking to invest in a small unit in 2018, and had a budget of about $1.3 million.

At that time, there were quite a number of new launches to choose from.

There were 99-year leasehold developments in the Queenstown area like Stirling Residences, and Margaret Ville, to freehold ones like Amber 45 in the more prestigious District 15.

As he was quite a detailed person, he had compiled all the prices of new launch condos with units that fit his budget.

But, like many people, he questioned the value of paying such high $ per square foot for these new developments.

He just couldn’t quite comprehend why people anyone would be willing to pay $1,800+ psf for a 99-year leasehold unit in District 3, when you could get a freehold one in a more premium district like District 15 – and for an even lower psf!

This was one of his comparisons at that point.

For his budget, he could buy a new 624 square foot 2 bedroom unit at Stirling Residences.

| Date | Size (sq ft) | Price ($PSF) | Price (Total) |

| 30 JUL 2018 | 624 | $1,762 | $1,100,000 |

| 29 JUL 2018 | 624 | $1,813 | $1,132,000 |

| 28 JUL 2018 | 624 | $1,820 | $1,136,000 |

| 22 JUL 2018 | 624 | $1,800 | $1,124,000 |

| 14 JUL 2018 | 624 | $1,743 | $1,088,000 |

| 14 JUL 2018 | 624 | $1,693 | $1,057,000 |

| 11 JUL 2018 | 624 | $1,826 | $1,140,000 |

| 5 JUL 2018 | 624 | $1,725 | $1,077,000 |

| 5 JUL 2018 | 624 | $1,719 | $1,073,000 |

| 5 JUL 2018 | 624 | $1,831 | $1,143,000 |

| 5 JUL 2018 | 624 | $1,712 | $1,069,000 |

| 5 JUL 2018 | 624 | $1,699 | $1,061,000 |

| 5 JUL 2018 | 624 | $1,788 | $1,116,000 |

| 5 JUL 2018 | 624 | $1,736 | $1,084,000 |

| 5 JUL 2018 | 624 | $1,730 | $1,080,000 |

| 5 JUL 2018 | 624 | $1,749 | $1,092,000 |

This was priced at just above $1,800 psf for one on the higher floors, although you could even get one for just under $1,700 psf for the lowest floor.

At that same time, he came across resale listings online for freehold developments in the East.

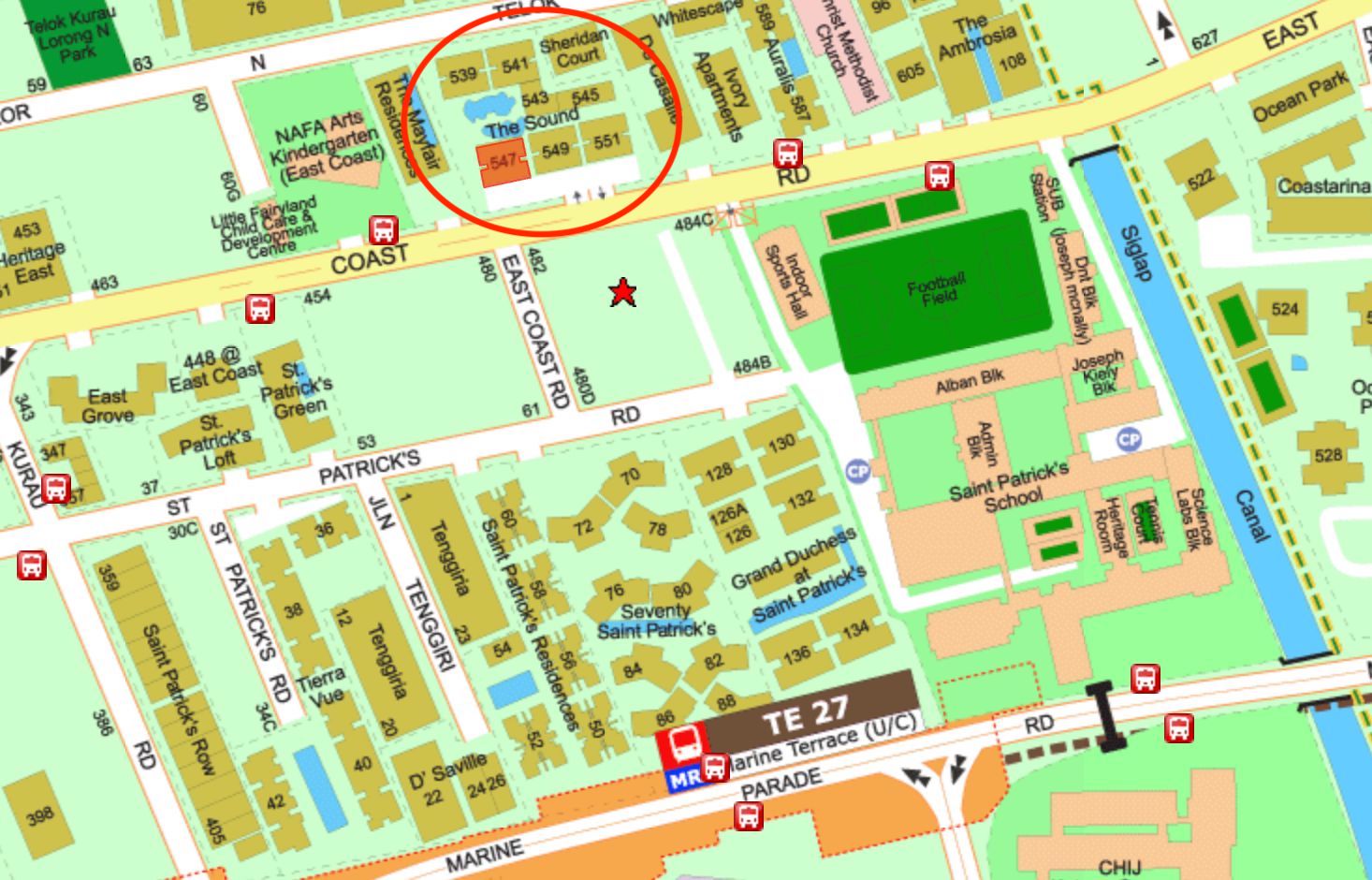

One of which was The Sound, a freehold condo with 104 units in District 15.

While yes, it’s older, it was just built in 2013 (so it was about 5 years old at that time). It also wasn’t close to an MRT station, as Kembangan MRT was quite a distance away if you had to walk.

But, there was some future upside for when Marine Terrace on the Thomson East Coast line would finally be launched. Although it must be said, this was in 2018 so this was still quite some time away (it isn’t even completed yet right now).

So with that in mind, he felt that The Sound would be a better purchase.

First, it was asking for a lower psf ($1,700+), and at a smaller size, it would be even more affordable.

Second, there could be a future appreciation when the Thomson East Coast line was completed.

And finally, he just couldn’t fathom the thought of paying more for a leasehold property.

Ultimately, he really couldn’t decide and analysis paralysis took over – and he opted to do nothing.

But here’s what could have happened based on recent transactions:

The Sound

Stirling Residences

While on paper The Sound was at least profitable, it would actually register as a loss if you account for the usual selling costs.

On the other hand, the supposedly more expensive Stirling Residences did well, registering a $231,000 gross profit.

Final Words

I would like to have some caveats here on these comparisons.

Sometimes, it may not be ideal to pick such resale comparisons as you can’t tell the actual unit conditions from the transaction.

So if the unit had some leakage issues, or was in a poorer condition than usual, these will definitely have a detrimental effect on the eventual price.

Also, you won’t be able to tell if the owner had difficult circumstances and had to let go at a lower than usual price.

Ideally, you’d want to look out to see if it’s an outlier before you use it as a basis for comparison. So look for units of the same size that sold recently, and if they’re sold for much lower or higher, then you’d want to be careful about using it to compare.

To end, I’m not saying that a leasehold is better than a freehold, or that a new launch is better than buying a resale.

Just as there are examples above that show that’s the case, there are also many other examples that you can find that prove otherwise.

The main takeaway is that you can’t just compare two different psf prices in different locations, and use that as a deciding factor whether to invest or not invest in a property.

Ultimately, it’s about investing in what would have value in the future.

Just like how when investing in stock, you should not confuse a “cheap” stock with a value stock – it could be the case that a $100 stock is undervalued, while a $5 stock is overpriced.

You’d always want to know what are the future factors that could contribute to a property’s appreciation, rather than what seems to be of “value” at the current juncture.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why might freehold resale condos be cheaper than new leasehold condos in the suburbs?

How did the performance of Martin Modern compare to Robin Residences since 2017?

What misconceptions do buyers have about comparing property prices across districts?

Why is it important to consider the total quantum and unit layout when comparing properties?

What should investors focus on instead of just price per square foot when choosing a property?

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Latest Posts

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

2 Comments

Very nice article sean, insights and comparisons are too good.