Our Resale HDB Buying Journey: $700k+ Home At SkyTerrace@Dawson (Ethnic Quota Helped)

May 10, 2021

From the long wait for Permanent Resident (PR) status, to the process of house hunting, finding an HDB flat can be a challenge. But this week we spoke to A, who recently managed to find a new home with a foreign (now PR) wife. Here’s the process of shortlisting properties and wide-scale house-hunting, and how they eventually ended up with a new flat at the famed SkyTerrace@Dawson:

An urgent need for their own home

A and his wife had lived with their parents a significant length of time, and his wife was eager to find a place of their own:

“As my spouse is a foreigner and her family isn’t in Singapore, she stayed with my family for about five to six years. Based on where she grew up, people there generally move out of their parents’ home once they start working, so staying with me and my family was not something she was used to,” he says. “Therefore, she has been wanting to move out and have her own space.“

But as many might ask, why opt for an HDB flat when trying to move out fast?

If it’s an option, many Singaporeans with a foreign spouse will start their search in the private market. Only citizens and PRs can buy HDB flats. But A and his wife had reasons for the wait:

“Based on our available finances and monthly income, we were able to purchase a leasehold resale Executive Condominium (EC), at a range of about $900,000. But this meant that most of our savings would be depleted entirely, and this was not something we were prepared to do. We wanted to at least have our savings invested elsewhere and not entirely put into our home.

New ECs were out of the question as our savings weren’t enough to bring down the monthly mortgage since the MSR would apply, not TDSR. It’s rather unfortunate because 2016 saw EC prices that were really affordable (e.g. Treasure Crest) whereas Ola is around 30 per cent more!”

The Mortgage Servicing Ratio (MSR) applies to the purchase of all HDB properties. This restricts your monthly home loan repayments to 30 per cent of your monthly income.

This shouldn’t be mistaken for the Total Debt Servicing Ratio (TDSR). The TDSR restricts your monthly home loan repayments – inclusive of all other debts such as car loans and personal loans – to 60 per cent of your monthly income.

Getting a home loan for an EC requires you to meet the MSR and the TDSR.

“We looked at other condos developments, but those that were within our budget would either be one or two bedroom projects, “ A says, “We felt these were not suitable, since we wanted to buy with long-term planning ahead (having a child), so we wanted at least three bedrooms. To us, having facilities like a pool and tennis courts were not important at all. The choice was clear that HDBs were our best bet.”

These considerations made the couple decide it was worth the wait, for A’s wife to get PR status:

“As such, we actually waited for the outcome of our PR application because we intended to apply for a BTO. But this process took really long, and by the time it was approved, COVID-19 hit and there were construction delays.”

The other important reason was the availability of grants

Because A’s wife is a PR, they can get the usual range of grants, like the Family Grant, for buying a resale flat. If A had bought under the Non-Citizen Spouse Scheme, the grant amount would have been halved (as his spouse wouldn’t qualify for them, A would have gotten the Singles Grant instead).

Waiting for a BTO flat, after such a long time spent getting PR status, wasn’t too palatable

A says that: “At 30, we weren’t motivated to wait several years, plus endure construction delays, before moving in. Plus the fact that my wife already stayed with my family for five to six year and was looking forward to starting her own household.”

At present, multiple HDB estates are facing construction delays of six to nine months. It’s also worth noting that, if Covid-19 sees a relapse in other parts of the world, the flow of construction material and foreign labour could be jeopardised; so there’s still a chance for delays beyond this.

As such, the couple started to look in the resale market instead. This was quite an involved process, thanks in part to the pandemic:

“When we started searching for resale flats, circuit breaker just started so physical viewings weren’t possible. My spouse searched for listings, and we shortlisted several we thought were good in terms of layout and price.

But these good- priced listings turned out to have huge downsides like being on the low floor or facing the carpark, so we left them out.”

A and his wife already had a negative experience in a ground floor home, where “there were lots of lizards creeping in and leaving droppings everywhere”. Ground floor units tend to be more prone to vermin, especially if there’s dense vegetation or a bin centre nearby.

The couple initially considered a resale flat in Sengkang

“At first, I only wanted to spend about $600,000 or less on a flat,” A says. “We considered Sengkang because my brother stays there and so do some of our friends.”

We saw a recently-MOP flat that had a really amazing view in Sengkang. It was completely unblocked and faced the greenery. It was also just one to two minutes walk from the LRT station and it was also renovated very nicely.

The seller asked for $650,000 which was just slightly above the budget, but still manageable.

The problem was it was directly west facing, and we couldn’t be there to feel how hot it really was and we’ve never stayed in a west-facing unit before. So we decided against it, especially since we could only view through virtual meetings.”

North-South facing units are the coolest for most units; you can read more about the west sun and related issues in this earlier article. And while you can blast the air-conditioner, a unit exposed to full sun glare will drive up the electricity bills.

After discounting some other flats in Tiong Bahru (the couple disliked the urban density of the area), they set their sights on Queenstown instead:

“One day, in my wife’s eagerness to move out, she searched online again and found some 4-room flats along Queenstown for $700,000+. It’s more than our budget allowed, but we really, really love the location.

We’ve cycled through the park connector, and fell in love with the area around Dawson before; but we thought that the houses here would be way off budget and didn’t give it serious consideration.

We also realised that there were many flats that could not be sold to Chinese buyers, but we were eligible given my spouse is under the “other” race category – unsurprisingly these flats were also cheaper.”

HDB flats are subject to an ethnic quota. Non-Malaysian PRs cannot make up more than five per cent of the households in a neighbourhood, and not more than eight per cent in a block.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

6 Final Upcoming GLS Sites In 2025: Which Sites Hold The Most Promise For Buyers?

With the government furiously churning out GLS sites, there may be some hope for at least moderating property prices, and…

You can check your particular block’s status on the HDB website. It’s tough on sellers, unfortunately, since any buyer is likely to lower their offer if they learn you’ve maxed-out your quota.

Moreover, A realised that there was an added bonus to staying in this estate:

“My parents stay in quite a central area where there were hardly any HDBs around, so I never thought I’d qualify for the proximity grant in my life. It turned out that the block was actually within the 4km radius, allowing us to unlock the $20,000 Proximity Housing Grant.”

The Proximity Housing Grant is given to families buying a resale flat within 4 KM of their parents or child. This was previously just 2 KM. Home buyers can check if they qualify via HDB’s distance enquiry tool.

Searching for alternatives in Queenstown

“We also shortlisted several units in SkyVille@Dawson and one at Strathmore Green, but as these were newer, the only ones within our budget had ethnic quota issues,” A says.

Our first visit was to the Forfar Heights unit. It was renovated well, but we didn’t like the odd renovation done by the owner: the bathroom was exposed in the master bedroom. The costs to change this would be heavy, since the owner hacked down the walls already.

Next was the Strathmore Green unit. But it was just outside the lift lobby, and we didn’t like that the neighbour stared at us when we entered and left the flat.

Moreover, we didn’t quite like facing the school opposite given noise issues.”

While most buyers like properties near schools, there is such a thing as being too close. The (unproven) saying is that it’s best to be within one kilometre of a school, but at least 300 metres away to minimise the noise.

We don’t think this can ever be proven though, as it depends on the size of the school, how rowdy the students are, and the school activities (warning: some have marching bands that will wake you on Saturday morning). So it’s best to visit and check first hand.

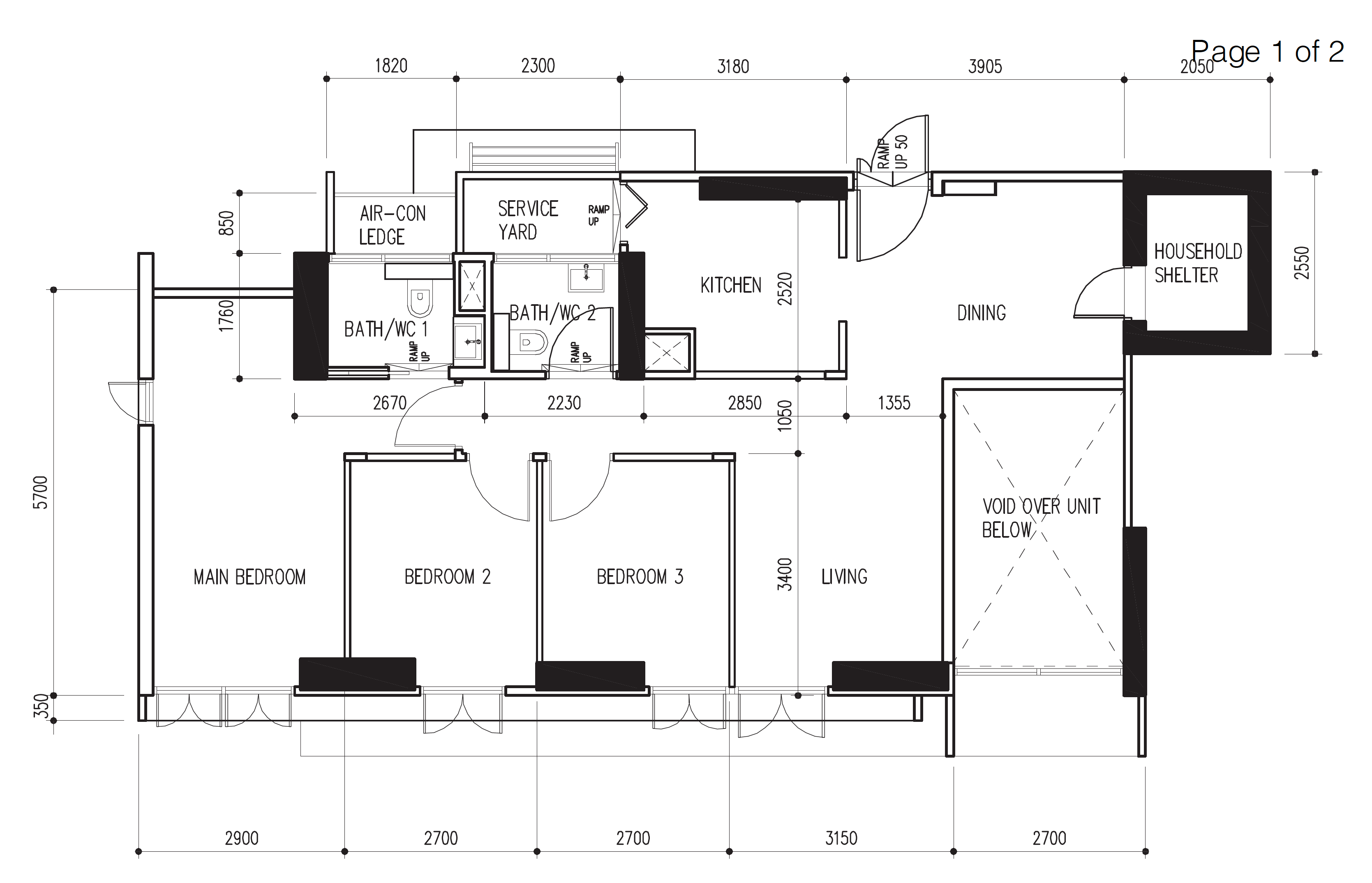

“Next were the SkyVille units. Many of those within our budget were low floor and faced the carpark. What we didn’t like was the layout. Upon entering, the dining area was immediately at the entrance and it felt really cramped. This was consistent in all the units we saw, and we didn’t like the idea of being restricted to such a small space when having guests over.

The service yard also faced inwards, which was really dark and unpleasant. Moreover, while the architecture and sky garden were nice, we felt that a lot of the public would come here to use the sky garden which could result in longer wait times at the lifts.

There were also eight units per floor; and while all units were corner units, the amount of common space outside the door was paltry. During heavy rain, we could see the water almost reaching quite far in too.”

At this point, viewings were again possible. A and his wife made nine different viewings of the development, and found this to be a consistent occurrence.

As we’re fond of pointing out, you should view the same development at multiple times of day, and under different conditions. Sometimes negative effects, like noise pollution, are one-off events; like a neighbour having a party that day. Other times, you’ll be able to see if effects like noise, rainwater in the corridor, or heat are a constant.

“So when we visited a unit at SkyTerrace@Dawson which met our criteria, we were left with a good impression. You can say SkyVille units became a point of comparison.

There were only four units per floor, served by three lifts. There was a large amount of common space outside – the seller could even put a big table there. It had a separate, large dining space, and a service yard that faced the outside.

We liked that the owners didn’t do much carpentry or hacking work, so renovation would be more straightforward.”

Property Market CommentaryDo Resale Properties Really Cost More To Renovate?

by Ryan J. OngThis is one of the reasons sellers should think twice, before “renovating to improve sale chances”. Even if your renovations are new and top notch, buyers may not value them more. Most home buyers will want to customise their space, and will even tear up one or two-year old renovations to do it.

“The owners were also really nice,” A says, “and even repainted the home which gave me a very good impression. That was when we decided to make an offer.”

This unit was a roughly 936 sq. ft., 4-room flat. The couple’s unit at SkyTerrace@Dawson is close to the Queenstown MRT station (about 8 minutes walk away), with a mid-floor placing that allows for unimpeded views.

Ultimately, the biggest surprise came from the renovation costs

At first, A and his wife estimated the cost to fall between $20,000 and $30,000. The idea was to do basic work on the bathrooms, and maybe the kitchen, and that was it.

“However, once we got the flat and started putting in ideas for the home, the cost went up to $50,000 to $60,000 from multiple quotes,” A says. “We did not anticipate carpentry to be so expensive. For example, we wanted slatted wood along the bomb shelter to hide it, as well as at the master bedroom wardrobe – but these costs added up to about $5,000 so we decided against it.

There were also a lot of hidden costs that we didn’t know about, for example, running a hot water pipe as my wife wanted to have hot water in the kitchen. But HDBs flats do not come with these. In the end, we figured a complete makeover of the kitchen was better than a half-measure.”

Repainting the home and engaging in anti-mould treatment racked up another $5,000-$6,000, and during the bathroom makeover there was a leak. This raised renovation costs as more hacking works and re-doing waterproofing was needed, and it also set the renovations back another week.

Sanitary wares, lighting and electrical works added between $8,000 to $9,000 to the costs.

So for others looking for their dream resale flat, A offers this bit of advice:

“Do not underestimate the renovation aspect, especially if you intend to make this home a long-term one (as in you’re not selling right after MOP). We paid about $50,000 in total in renovation, including lighting and sanitary wares – up from the initial plan of $20,000 to $30,000. Adding in appliances and furniture would make it about $70,000.”

While resale units provide the opportunity to move in immediately, their “second-hand” nature means there’s existing work to clear out or change. As such, you should expect that renovation costs could be higher for resale properties, be they condos or HDB flats.

As an aside, note that the maximum possible renovation loan – from any bank – is capped at $30,000 or six months of your income, whichever is lower.

For more on finding your own dream property, follow us on Stacked. We’ll also provide you with the latest reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Homeowner Stories

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

0 Comments