“Surprise” New Property Cooling Measures Aug 2024: How New Loan Curbs And Grants Will Affect HDB Homebuyers

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Following the NDP rally speech, MND has rather quickly followed up with the numbers. In our last piece on whether the Cash Over Valuation (COV) is still relevant in today’s context, we mentioned that the situation with the high resale HDB prices is also a matter of optics – something had to be done soon.

So if you’re buying a flat anytime soon, you may want to learn about the following which kicks in today (20th August). This move is directed at cooling the HDB resale market, even as higher housing grants are given to help with rising costs. But how would this affect you as a homebuyer, and would it really help to cool the market? Here’s what you need to know:

Tighter loan curbs for HDB loans

Prior to today, HDB loans had a Loan To Value (LTV) ratio of 80 per cent. The LTV has now been reduced to 75 per cent.

The LTV refers to the maximum amount of the flat’s price or value* (whichever is lower) that can be covered by the loan. E.g., for a flat priced at $500,000, the maximum loan quantum would now be $375,000. The remainder of this can be covered in any combination of cash and/or CPF.

For private bank loans, the LTV was already 75 per cent before this, so there’s no impact on bank loans.

*For BTO flats, the valuation is always the same as the price. It’s only for resale flats that the price may be higher or lower than the actual valuation.

What are the possible consequences of the loan curb?

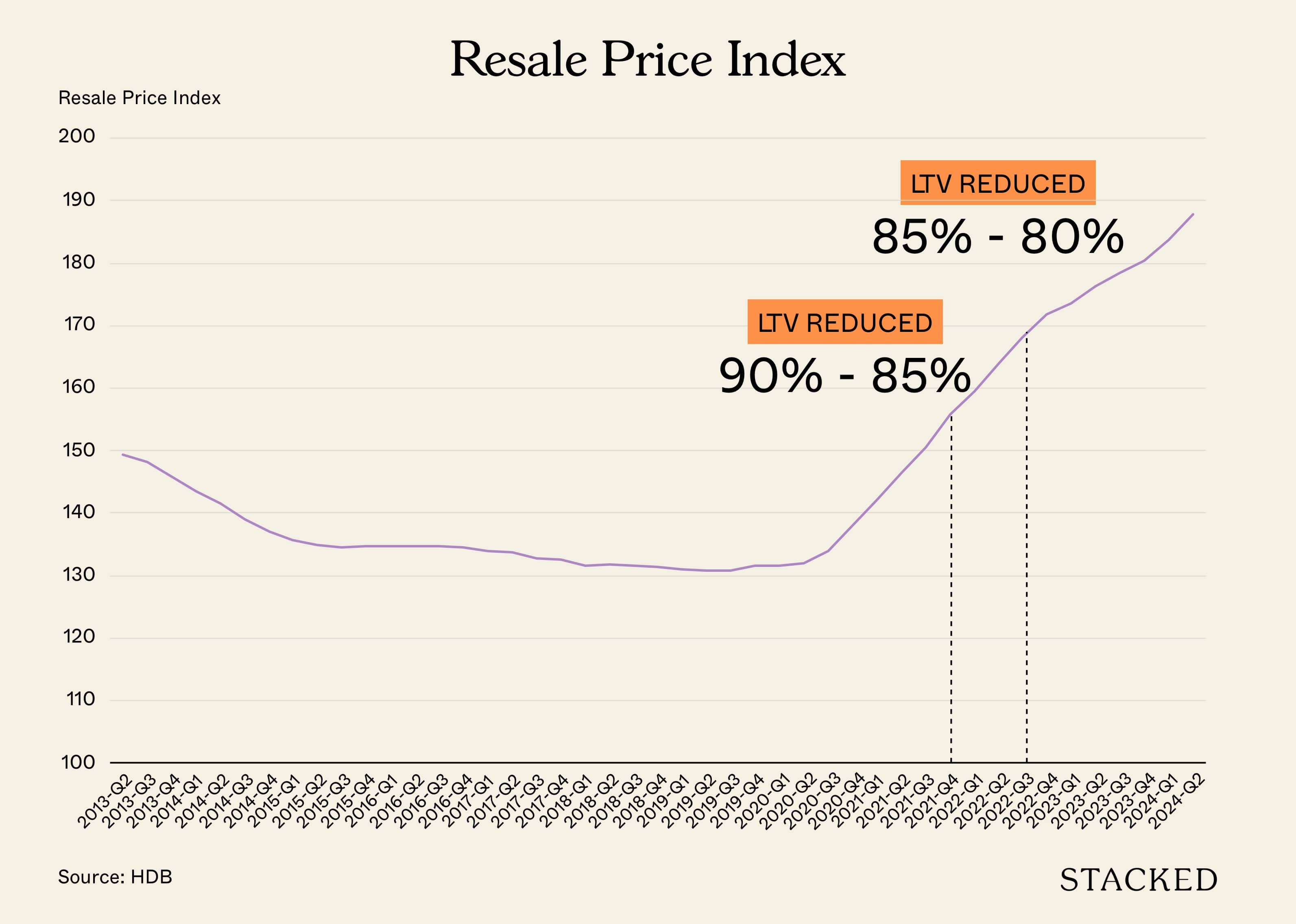

The last time there were cooling measures based on the LTV ratio, here’s what happened:

In essence, there wasn’t the intended effect. Perhaps prices may have increased faster? But that’s hard to conclude. So this time, for the majority of people buying BTO flats, the answer is nothing. The fact is, most Singaporeans already pay more than the minimum required down payment. For example:

Consider a 4-room BTO flat, priced at $300,000 (this is a common amount before grants). With an LTV of 75 per cent, the minimum down payment would be $75,000. Most individual Singaporeans, between the ages of 25 to 30, would already have between $40,000 to just below $60,000 in their CPF.

(As to how the CPF number is derived, you can see the details here).

So if you combine the CPF savings of both spouses, it would likely be in the range of $80,000 to $120,000 for a young couple. Even assuming they opt to keep $20,000 in their CPF, you can see they would already be paying more than the minimum down payment of 25 per cent. Also, remember that the $75,000 minimum ignores any grants, otherwise it would likely be even lower.

As such, for many young couples buying BTO flats, they likely won’t even notice the difference. But the loan curb can make a difference for higher-priced resale flats.

Resale flats cost significantly more than their BTO counterparts. A 4-room resale flat in some parts of Yishun, for example, can reach up to $700,000 (this would be a minimum down payment of $175,000). Based on this, you can see how the loan curb incentivises buyers to bear with a longer wait and stick to BTO options. Or at the very least, to be far less generous when making an offer.

But will it deter million-dollar flats? We doubt so.

Most buyers of million-dollar flats are not young first-time buyers. For this particular segment, buyers tend to be older, with higher income or more accrued wealth. These buyers tend not to use HDB loans, or aren’t even eligible, and wouldn’t flinch at a five per cent reduction in LTV limits. If you are using a private bank loan, the LTV is already at 75 per cent.

More from Stacked

I Regret Buying A DBSS: 5 Homeowners Share Their Biggest Regrets

Introduced in 2005 but discontinued in 2011, Singapore's Design, Build & Sell Scheme (DBSS) remains a topic of conversation, even…

On top of that, typically many million-dollar flat transactions come from older Singaporeans, who sold their private properties to right-size. The sale proceeds of their condo (or in some cases even a landed property) provide more than enough for a replacement flat, so they may not even care about financing options.

For these reasons, we don’t see much impact, if any, on the most expensive end of the HDB resale market. But it’s likely this isn’t about them at all: million-dollar flats are still outliers, and HDB probably wants to focus more on bringing down the prices of $600,000 to $700,000 flats.

As of 2024, many of the resale flats in this price range really have no business being so expensive; some are just 4-room flats in pretty average locations. These are the homes that need to be more affordable, especially for middle-class Singaporeans.

For those curious to know, here’s a look at the cash/CPF needed at the various LTV levels we’ve seen (the last column shows the difference due to the latest policy):

| Flat Price | At LTV 90% | At LTV 85% | At LTV 80% | At LTV 75% | Before/After Difference |

| $300,000 | $30,000 | $45,000 | $60,000 | $75,000 | $15,000 |

| $350,000 | $35,000 | $52,500 | $70,000 | $87,500 | $17,500 |

| $400,000 | $40,000 | $60,000 | $80,000 | $100,000 | $20,000 |

| $450,000 | $45,000 | $67,500 | $90,000 | $112,500 | $22,500 |

| $500,000 | $50,000 | $75,000 | $100,000 | $125,000 | $25,000 |

| $550,000 | $55,000 | $82,500 | $110,000 | $137,500 | $27,500 |

| $600,000 | $60,000 | $90,000 | $120,000 | $150,000 | $30,000 |

| $650,000 | $65,000 | $97,500 | $130,000 | $162,500 | $32,500 |

| $700,000 | $70,000 | $105,000 | $140,000 | $175,000 | $35,000 |

| $750,000 | $75,000 | $112,500 | $150,000 | $187,500 | $37,500 |

| $800,000 | $80,000 | $120,000 | $160,000 | $200,000 | $40,000 |

| $850,000 | $85,000 | $127,500 | $170,000 | $212,500 | $42,500 |

| $900,000 | $90,000 | $135,000 | $180,000 | $225,000 | $45,000 |

| $950,000 | $95,000 | $142,500 | $190,000 | $237,500 | $47,500 |

| $1,000,000 | $100,000 | $150,000 | $200,000 | $250,000 | $50,000 |

| $1,050,000 | $105,000 | $157,500 | $210,000 | $262,500 | $52,500 |

| $1,100,000 | $110,000 | $165,000 | $220,000 | $275,000 | $55,000 |

| $1,150,000 | $115,000 | $172,500 | $230,000 | $287,500 | $57,500 |

| $1,200,000 | $120,000 | $180,000 | $240,000 | $300,000 | $60,000 |

| $1,250,000 | $125,000 | $187,500 | $250,000 | $312,500 | $62,500 |

| $1,300,000 | $130,000 | $195,000 | $260,000 | $325,000 | $65,000 |

| $1,350,000 | $135,000 | $202,500 | $270,000 | $337,500 | $67,500 |

| $1,400,000 | $140,000 | $210,000 | $280,000 | $350,000 | $70,000 |

| $1,450,000 | $145,000 | $217,500 | $290,000 | $362,500 | $72,500 |

| $1,500,000 | $150,000 | $225,000 | $300,000 | $375,000 | $75,000 |

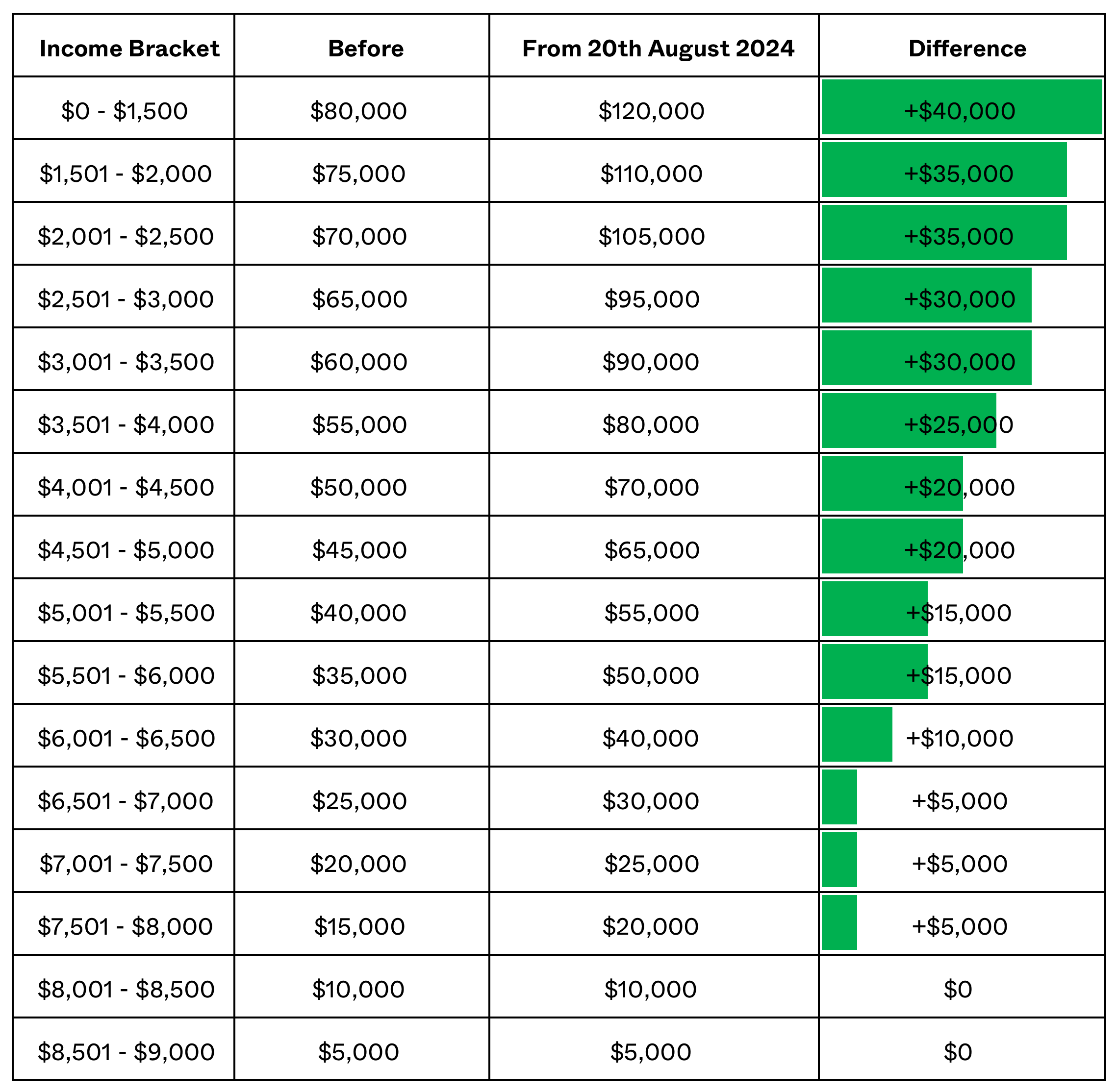

There will also be more generous housing grants, for lower and middle-income Singaporeans

The maximum Enhanced Housing Grant (EHG) was previously $80,000, but the ceiling has been raised to $120,000. Singles get half the grant (as there’s just one recipient of the grant), so for singles, this rises accordingly: from a former cap of $40,000 to a new cap of $60,000.

This is not to be confused with the CPF Housing Grant which remains unchanged.

(Note that the Proximity Housing Grant remains unchanged by the new rules; it’s still $30,000/$20,000 for families and $15,000/$10,000 for singles.)

The amount of the grant is based on household income (flat type and location don’t matter). Check the HDB website to see how much you qualify for.

Do note that the EHG is tiered – the lower the income bracket, the greater the impact of the subsidy. Here’s a look at the difference based on the most recent policy:

Those earning above $8,000 will not benefit from this new rule. The benefits become greater the lower the income bracket.

Besides helping to offset the tighter loan curbs for lower and middle-income families, this ensures generally cheaper housing for lower-income Singaporeans. Spending less on the home loan or down payment means more money elsewhere; a rather important consideration, since the post-Covid inflation is affecting everyone (an issue not unique to Singapore right now).

Here’s an example of a First Timer earning $2,000 as a household income looking to purchase a 3-room as a family:

| Item | Amount |

| Max Loan | $126,526 |

| Enhanced Housing Grants | $75,000 |

| CPF Housing Grants | $80,000 |

| Total | $281,526 |

Here’s what it looks like after the change:

| Item | Amount |

| Max Loan | $126,526 |

| Enhanced Housing Grants | $110,000 |

| CPF Housing Grants | $80,000 |

| Total | $316,526 |

In this case, someone with a household income is assisted with an additional $35,000 which makes flats in the low $300k range reachable when it previously wasn’t.

There could be further ripple effects here: we could see the lower-priced flats now rise in price (and demand) corresponding to the additional grants.

Ultimately, these moves will have the biggest effect on the lower-income group (which was probably the main intention), while making things more difficult for the lower to middle-income earners. For the higher-end HDB market, well, watch out for more million-dollar HDB price headlines in the coming months.

For more changes as they happen, follow us on Stacked; we’ll update you on price movements and on-the-ground observations going forward.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Editor's Pick

Property Market Commentary What “Lucky” Singaporean Homebuyers Used To Get Away With — That You Can’t Today

Landed Home Tours We Toured A Quiet Freehold Landed Area Near Reputable Schools — Where Owners Rarely Sell

Overseas Property Investing The Biggest Mistake Singaporeans Make When Analysing Overseas Property

Property Market Commentary 7 Close To TOP New Launch Condos In 2026/27 For Those Looking To Move In Quick

Latest Posts

Property Investment Insights These Resale Condos In Singapore Were The Top Performers In 2025 — And Not All Were Obvious Winners

Singapore Property News CapitaLand–UOL’s $1.5 Billion Hougang Central Bid May Put Future Prices Above $2,500 PSF

Singapore Property News Why New Condo Sales Fell 87% In November (And Why It’s Not a Red Flag)

Pro How A 944-Unit Mega-Condo In Pasir Ris Ended Up Beating The Market

Property Investment Insights What Changed In Singapore’s Property Market In 2025 — And Why It Matters

Singapore Property News How Much Smaller Can Singapore Homes Get?

Pro How Much More Should You Really Pay for a Higher Floor or Sea View Condo?

On The Market 5 Spacious 5-Room HDB Flats Under $600K You Can Still Buy Today

Property Advice I Own A 55-Year-Old HDB Flat, But May Have To Sell — Can I Realistically Buy A Freehold Condo With $700K?

New Launch Condo Reviews Coastal Cabana EC Review: A Unique EC With Sea Views Priced From $1.438M

Landed Home Tours We Toured a Freehold Landed Area Buyers Overlook — It’s Cheaper (and Surprisingly Convenient) From $3.2M

Singapore Property News The Hidden Costs of Smaller Homes in Singapore

Property Advice We Own A 2-Bedder Condo In Clementi: Should We Decouple To Buy A Resale 3 Bedder Or Sell?

On The Market We Found the Cheapest Yet Biggest 4-Room HDBs You Can Buy From $480K

Pro Why This Freehold Mixed-Use Condo in the East Is Underperforming the Market