How ABSD Deadlines Can Negate Your New Launch Discounts

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

It’s practically a guaranteed profit. That’s what you’ll often hear at a VIP preview or the first phase of a new launch. Buy the unit now at a seven to 10 per cent discount, and when the “normal” price is applied, you’ve made your returns.

These early bird new launch discounts are a big part of Singapore’s private property scene, and draw much of the initial crowd. It’s a normal scheme that you’ll probably have seen utilised everywhere else. From concerts to exhibition tickets, early bird discounts are used to attract more adventurous buyers – and slowly increasing prices by using social proof and FOMO (fear of missing out) marketing to push the rest of the sales.

In essence, almost everybody wins – developers are happy, early buyers are happy they managed to get in at a discount, and later buyers are happy they secured their units.

However, incidents such as the fire sale at 38 Jervois have made buyers more cautious.

Many are now wising up to the risk of last-minute new launch discounts due to the ABSD deadline; or some have started seeing these as potential opportunities. Here’s a rundown on how they work, and on recent developments near the deadline:

A summary of the ABSD deadline and how it matters

Developers pay an Additional Buyers Stamp Duty (ABSD) of 30 per cent on the land price, such as when buying in an en-bloc purchase. This applies to all developments consisting of five or more units.

Developers can later apply for ABSD remission of 25 per cent, if they complete the entire development and sell every unit within five years.

The purpose of this policy is to prevent land hoarding – a practice where developers, or a cartel of developers, purposely buy and hold the land to create scarcity and drive up prices.

However, the ABSD deadline has a side-effect: it can also prompt developers to slash prices to clear out a handful or remaining units, as it makes no sense to pay the 30 per cent tax over them.

Note that as of 6th May 2020, an exception has been made. Existing ABSD deadlines have been extended by six months for all developers, to account for the Circuit Breaker period (construction was forced to stop during the CB).

When might ABSD-related discounts happen?

This tends to happen when there are a small number of units unsold (e.g. around the last 10 units), and the ABSD deadline is close.

A developer that has a large number of outstanding units is actually less likely to slash prices. For example, if the development has over 200 units still unsold, and the ABSD deadline is a month away, there may be no point in last minute discounts. They’d likely still miss the deadline, given the number of units to move.

A discount due to the ABSD deadline can negatively impact earlier buyers

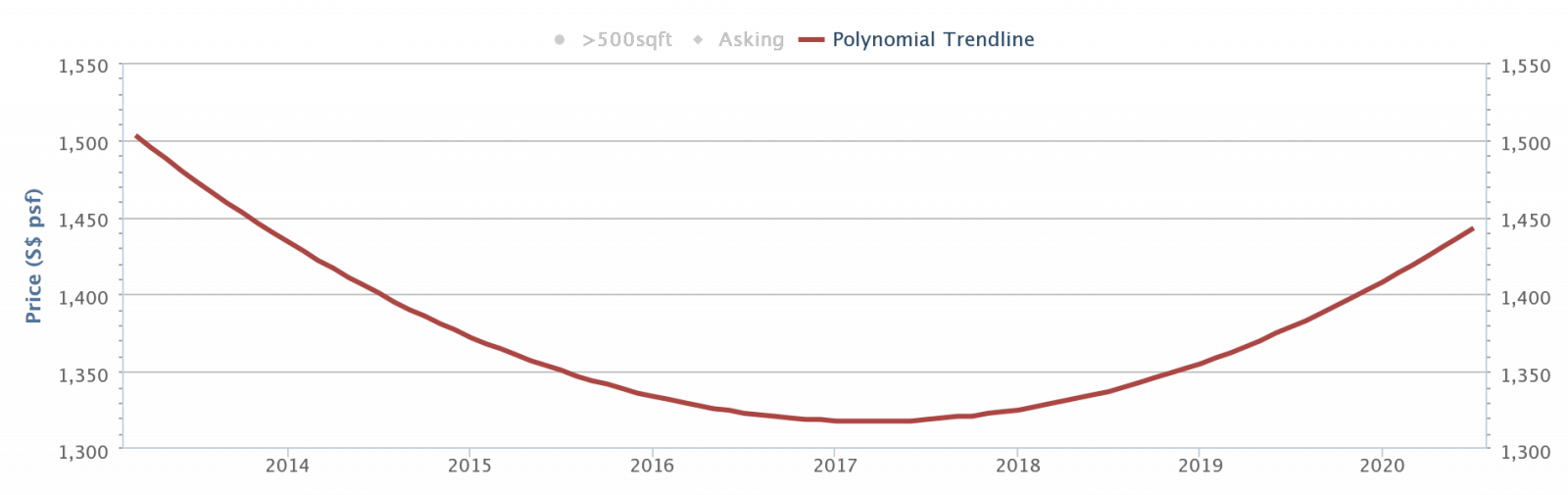

One example of this would be the Trilinq. The median developer’s selling price was around $1,380 psf in 2016 (launch was around $1,545). But by January 2017 – around the time of Trilinq’s ABSD deadline – some prices were down to $1,139 psf – a decrease of 14.46 per cent.

If you were one of the early buyers of the Trilinq, I can’t imagine that you’d be a happy camper at all.

More from Stacked

Top 5 Hottest HDB Towns By Resale Volume (Q1 2021)

Resale flat prices are at an eight-year high; but market watchers saw it coming as early as October 2020. At…

In these cases, there can be 3 possible scenarios that might follow:

- Market moves up and prices increase across the board such that everyone is happy

- Price adjusts to the initial selling price – early buyers stay status quo while later entrants make that upside

- Price adjusts to the new normal – if a big enough number have bought in at the slashed prices and market conditions does not improve – your “cheaper” entry price becomes the new valuation

In the more recent case of 38 Jervois, a total of 16 units were sold on discount. The Straits Times (see the above link) reported that discounts on the various units ranged from 13 to 24 per cent.

As with the Trilinq, I’m sure earlier buyers will not be happy at all.

Thankfully, cases like this didn’t result in unrest in Singapore – just look at what happened in a similar situation in China.

So from cases such as this, you can understand why it is important to look at a developers track record – it’s certainly not ideal to be stuck in a similar situation.

For comparison, check out our previously compiled list of discounts at new launches. If you look through these, you’ll see that the bigger discounts are around seven to eight per cent only.

Property PicksNew Condo Launch Price list 2020 + Discounts/Price Drops (Updated)

by StackedSo you can see how these early buyers would be frustrated, when they realise the extent of the later ABSD-related discounts.

You can try waiting for an ABSD-deadline discount yourself of course; but don’t get your hopes too high

Most developers are reluctant to slash prices this way, for the aforementioned reasons. Also, the developer needs to ensure every unit is sold; if they give a discount and then units are still left over, the situation is even worse for them.

As such, the discounted units are often sold en-bloc to an entity, such as a holding company, investment firm, etc, rather than to the public.

But you can keep a close eye on properties nearing the ABSD deadline, if you’re feeling lucky:

| Development | Remaining units at present | Approx. ABSD deadline |

| Forest Woods | 2 of 519 | 2020 |

| Cayman Residences | 1 of 19 | 2020 |

| Seaside Residences | 38 of 841 | 2021 |

| Kandis Residences | 24 of 130 | 2021 |

| Le Quest | 24 of 516 | 2021 |

| Grandeur Park Residence | 10 of 720 | 2021 |

| The Tapestry | 60 of 861 | 2021 |

| 120 Grange | 10 of 56 | 2021 |

| Martin Modern | 50 of 450 | 2021 |

| 38 Carpmael | 1 of 16 | 2021 |

| 8 Hullet | 7 of 44 | 2021 |

How can you avoid being “conned” by later discounts like this?

There are some warning signs to note.

One example would be developments hit by a “No Sale License”. This means the developer cannot sell any units, until after the development is completed (the new Normanton Park is currently facing this issue). This means the developer has a much shorter time to sell, so there’s a greater risk of missing the ABSD deadline.

Also, be cautious with regard to high-quantum, boutique developments. Examples are developments with 50 or fewer units, where each unit has a quantum in the range of $2.5 million or above. High quantum units are usually harder to move; and if the ABSD deadline encroaches with just three or four unsold units, the developer may be more inclined to bundle them off at a discount.

If you’re in doubt about any new launch discounts, drop us a message before buying; we can help you get an expert opinion before you put down the cheque. You can also check out our latest in-depth reviews on new developments.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Market Commentary

Property Market Commentary The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Property Market Commentary 2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden

Thanks for the great article Ryan, very useful in educating buyers like me as well as informing us of the options in securing the best deal possible. I am actually torn between buying an older resale HDB unit with little to none loan taken or a new launch with a longer loan repayment but possibility of growing capital investment. I am 46 years old and I have a steady income ($10K a month). I recently sold my condo at a negative sales and while all the proceedings were returned to my CPF, i actually bled cash due to the 2% commission paid to the property agent which was all paid in cash. So now, I have a choice of buying a resale HDB fully paid with CPF and cash (the good ones come with a hefty COV) or buy a new launch with again a big loan to my name. While my inclination is to go with the former, I am also not closed to the option of exploring newer launches or even resale condo (as mentioned above) with good potential or discounted due to the ABSD deadline. I am just worried about carrying a big loan as I am planning to take it easy and slow down with work.

Do you have any advice for me? I have about $500K in CPF and about $50K in cash that I can use for home right now.

Rani