Property Investment Insights Ultimate New Launch Cheat Sheet 2020 (Land Price, PSF PPR, Take Up Rate)

-

Sean

Sean

- February 2, 2020

- 25 min read

What we like

What we don't like

If you are in the market for a new launch condo in Singapore you really could not have chosen a better time. After the crazed en bloc frenzy in 17/18, it is almost like a new launch buffet from the plethora of new launches stemming from 2019.

And 2020 is no different by any means.

In order to help you on your home buying journey, we have gathered all the new launches that are available (and coming up) into one ultimate new launch cheat sheet.

Here at Stacked, we like to value-add as much as possible. And so after painstakingly sourcing for all the important info and penning it down, we sincerely hope that it will help you make a better buyer’s choice.

The buyer’s path isn’t the easiest by far, so if you feel like you need some advice along the way, feel free to drop us a message at hello@stackedhomes anytime!

Cue the Cheat Sheet.

Ultimate New Launch Cheat Sheet

For 2020

| Project Name | Take up rate | GFA (Sqft) | Est Breakeven |

|---|---|---|---|

| The Line @ Tanjong Rhu | 43% | 134,753 | $1,635 |

| Kallang Riverside | 94% | 250,975 | – |

| The Crest | 94% | 575,293 | $1,397 |

| Marina One Residences | 60% | 80,450,172 | – |

| Queens Peak | 96% | 593,479 | $1,336 |

| Grandeur Park Residences | 98% | 590,013 | $1,210 |

| Seaside Residences | 92% | 778,391 | $1,321 |

| Artra | 92% | 473,975 | $1,313 |

| Martin Modern | 84% | 513,929 | $1,757 |

| Le Quest | 87% | 507,813 | $1,066 |

| Kandis Residence | 69% | 113,607 | $890 |

| Parc Botannia | 95% | 594,182 | $931 |

| ParkSuites | 19% | 149,622 | $1,750 |

| 8 Hullet | 84% | 212,231 | $2,711 |

| The Tapestry | 82% | 700,372 | $987 |

| Twin Vew | 89% | 528,187 | $1,016 |

| Amber 45 | 82% | 156,970 | $1,556 |

| Margaret Ville | 91% | 255,628 | $1,481 |

| The Garden Residences | 39% | 494,937 | $1,443 |

| 120 Grange | 80% | 35,462 | $2,014 |

| Affinity at Serangoon | 63% | 831,361 | $1,325 |

| Park Colonial | 88% | 675,391 | $1,609 |

| Stirling Residences | 73% | 1,021,131 | $1,542 |

| Daintree Residence | 24% | 301,491 | $1,414 |

| Riverfront Residences | 83% | 1,187,108 | $1,147 |

| Mont Botanik Residence | 45% | 89,409 | $1,021 |

| The Tre Ver | 89% | 2,224,191 | $1,250 |

| Casa Al Mare | 29% | 39,424 | – |

| The Jovell | 26% | 363,673 | – |

| Jadescape | 47% | 1,292,331 | $1,027 |

| Bukit 828 | 50% | 27,446 | $1,098 |

| Jui Residences | 64% | 94,984 | $1,237 |

| 3 Cuscaden | 84% | 64,589 | $2,428 |

| The Woodleigh Residences | 28% | 1,026,280 | $1,691 |

| Kent Ridge Hill Residences | 50% | 478,536 | $1,594 |

| Whistler Grand | 64% | 631,809 | $1,255 |

| Parc Esta | 73% | 1,638,912 | $1,381 |

| Petit Jervois | 4% | 49,813 | $1,911 |

| Fourth Avenue Residences | 24% | 425,878 | $2,101 |

| RV Altitude | 26% | 80,852 | $2,253 |

| Fyve Derbyshire | 27% | 56,044 | $1,930 |

| One Meyer | 29% | 52,554 | $1,952 |

| 35 Gilstead | 41% | 56,965 | $2,214 |

| Treasure @ Tampines | 40% | 4,207,231 | $1,113 |

| The Essence | 27% | 69,058 | $1,076 |

| Rezi 24 | 40% | 78,456 | $1,276 |

| Florence Residences | 40% | 3,293,718 | $1,303 |

| Nyon | 23% | 67,814 | $1,738 |

| Boulevard 88 | 58% | 565,147 | – |

| 1953 | 53% | 57,564 | $1,436 |

| Mayfair Gardens | 75% | 146,639 | $1,762 |

| Mayfair Modern | 29% | 135,249 | $1,762 |

| Coastline Residences | 19% | 116,809 | $2,100 |

| Wilshire Residences | 12% | 66,985 | $2,004 |

| The Lilium | 3% | 81,439 | $1,589 |

| The Gazania | 10% | 218,876 | $1,856 |

| Jervois Prive | 0% | 39,988 | $2,171 |

| Juniper Hill | 10% | 103,541 | $2,444 |

| Amber Park | 32% | 619,981 | $2,073 |

| Parc Komo | 41% | 302,896 | $1,356 |

| Riviere | 11% | 584,277 | $2,321 |

| Meyerhouse | 9% | 164,226 | $1,974 |

| Olloi | 29% | 39,654 | $1,466 |

| The Hyde | 12% | 62,770 | $2,600 |

| Lattice One | 58% | 36,049 | $1,173 |

| Sky Everton | 72% | 213,233 | $2,130 |

| Sloane Residences | 8% | 52,830 | $2,188 |

| View at Kismis | 28% | 136,101 | $1,319 |

| One Pearl Bank | 33% | 634,953 | $2,191 |

| Dunearn 386 | 11% | 28,770 | $1,907 |

| Haus on Handy | 17% | 154,667 | $2,310 |

| Jervois Treasures | 3% | 29,680 | $2,265 |

| Parc Clematis | 36% | 1,450,753 | $1,312 |

| Uptown @ Farrer | 19% | 155,404 | $1,484 |

| Cuscaden Reserve | 2% | 122,580 | $3,059 |

| Avenue South Residence | 42% | 1,056,190 | $1,641 |

| Meyer Mansion | 13% | 255,410 | $1,873 |

| The Antares | 10% | 234,022 | $1,608 |

| RoyalGreen | 17% | 260,938 | $2,581 |

| Midwood | 4% | 467,088 | $1,561 |

| Midtown Bay | 18% | 1,036,968 | $2,291 |

| Neu @ Novena | 75% | 66,663 | $2,024 |

| Parkwood Collection | 6% | 128,672 | $1,017 |

| Urban Treasures | 8% | 191,304 | $1,619 |

| The Iveria | 26% | 43,662 | $2,011 |

| One Holland Village Residences | 40% | 691,619 | $2,498 |

| Sengkang Grand Residences | 35% | 1,309,423 | $1,396 |

| Dairy Farm Residences | 8% | 490,019 | $1,355 |

| Pullman Residences | 2% | 285,470 | $2,445 |

| Van Holland | 20% | 35,715 | $2,216 |

| Leedon Green | 5% | 507,940 | $2,387 |

| The Avenir | 6% | 384,208 | $2,406 |

| One Normanton Park | 0% | 1,904,112 | $1,448 |

| Former Cairnhill Mansions | 0% | 129,121 | $3,165 |

| The Atelier | 0% | 129,064 | $2,199 |

| Former Chancery Court | 0% | 388,182 | $2,181 |

| Former Phoenix Heights | 0% | 63,979 | $1,019 |

| Belgravia Green | 0% | 204,572 | – |

| Nim Collection | 0% | 0 | – |

Why You Need To Know (Land Price, PSF PPR, Take Up Rate)

I’m sure many of you would have seen these terms (land price, PSF PPR, take up rate) in the news before. With terms like these bandied about constantly, it’s important to know these figures so that you can have a better understanding of the market. Here are a couple of reasons why:

- Find out the breakeven price

It’s important to find out the breakeven price so that you know how much leeway a developer has to play around with.

Let’s take the Queens Peak for example.

First, you’ll need the land price, site area, and plot ratio. Next, you have to multiply the site area with the plot ratio which gives you your gross floor area (GFA).

From this, you can add in a bonus GFA cap for balconies which has been reduced to 7%. It’s still possible to achieve the 10% bonus GFA beyond the Master Plan-allowable Gross Plot Ratio by qualifying for other incentive schemes like the Green Mark Bonus GFA Scheme or the new Indoor Recreation Space Bonus GFA Scheme. In this case, however, we have incorporated a 7% figure.

| Item | Amount |

| Land Price | $483.18 million |

| Site Area (Sqm) | 10,516 |

| Plot Ratio | 4.9 |

| GFA + Bonus Area | 593,479 |

Thereafter, you’ll need to work out all the other costs.

- Construction costs: Design/material/construction

- Admin expenses: Staff/office

- Marketing: Showflat construction/commission for agencies/advertisements/lawyer fees

- Finance: Interest expenses for borrowings

| Item | Amount |

| Construction | $166.7m |

| Land Financing | $42.35m |

| Legal/Taxes | $69.92m |

| Marketing | $8.35m |

| Est Total | $770.55m |

| Est Breakeven | $1,298.36 |

It’s worth noting here that construction costs can vary a lot, especially when it comes to luxury developments. For the sake of simplicity, we took an average construction cost of $300 PSF and applied it to all. But for most luxury developments, you can expect construction costs of $450 PSF and above.

- Estimate the price of the new launch

Leading on from the breakeven price, you can very easily find out the estimated price of the new launch by adding in a profit margin from the breakeven price earlier. Most developers will be looking for a return of investment of about 25 to 35 per cent in today’s market – this has dwindled down from the 40 to 50 per cent in earlier years.

In this example, the Queens Peak has an estimated breakeven of $1,298.36 PSF. From here we are able to guesstimate how much the new development would be launched at. (Of course, Queens Peak is already launched). Don’t expect it to be 100% accurate, it’s really just to give you an idea of the rough price.

So at a launch price of $1,800 PSF commands a very decent 38.64% margin for the developers.

- Decipher from the take up rate

The take up rate is an important figure to know so that you can judge the demand of the property. If a new launch sells 75% of its units in 3 months naturally you can derive that it is very popular, and price increases can be expected. Whereas if a new launch is at less than a 10% take up rate even after a year, you can bank on some carrots to be dangled to attract buyers to the property.

Now that you know some of the importance of these figures, let’s get right into our new launch cheat sheet!

New Launch Cheat Sheet 2020

1. The Line @ Tanjong Rhu

The Line @ Tanjong Rhu is a freehold condo that was launched in August 2012. At a land cost of $146 million, the estimated break-even price will be around $1,635 PSF. It currently has a take up rate of 43.1% in the 7 years and 6 months since launch.

2. Kallang Riverside

The Kallang Riverside is a freehold condo that was launched in June 2014. It currently has a take up rate of 94.3% in the 5 years 8 months since launch.

3. The Crest

The Crest is a 99-year leasehold condo that was launched in July 2014. At a land cost of $516.3 million, the estimated break-even price will be around $1,397 PSF. It currently has a take up rate of 41.6% in the 5 years and 7 months since launch.

4. Marina One Residences

Marina One Residences is a 99-year leasehold condo that was launched in October 2014. It currently has a take up rate of 60.3% in the 5 years and 4 months since launch.

View Marina One Residences review

5. Queens Peak

Queens Peak is a 99-year leasehold condo that was launched in November 2016. At a land cost of $483.18 million, the estimated break-even price will be around $1,336 PSF. It currently has a take up rate of 96.3% in the 3 years and 3 months since launch.

6. Grandeur Park Residences

Grandeur Park Residences is a 99-year leasehold condo that was launched in March 2017. At a land cost of $483.18 million, the estimated break-even price will be around $1,210 PSF. It currently has a take up rate of 96.3% in the 3 years and 3 months since launch.

7. Seaside Residences

Seaside Residences is a 99-year leasehold condo that was launched in April 2017. At a land cost of $624.18 million, the estimated break-even price will be around $1,321 PSF. It currently has a take up rate of 92.2% in the 2 years and 10 months since launch.

8. Artra

Artra is a 99-year leasehold condo that was launched in April 2017. At a land cost of $376.88 million, the estimated break-even price will be around $1,313 PSF. It currently has a take up rate of 92% in the 2 years and 10 months since launch.

9. Martin Modern

Martin Modern is a 99-year leasehold condo that was launched in July 2017. At a land cost of $595.1 million, the estimated break-even price will be around $1,757 PSF. It currently has a take up rate of 84.2% in the 2 years and 7 months since launch.

10. Le Quest

Le Quest is a 99-year leasehold condo that was launched in August 2017. At a land cost of $301 million, the estimated break-even price will be around $1,066 PSF. It currently has a take up rate of 87.2% in the 2 years and 6 months since launch.

11. Kandis Residence

Kandis Residence is a 99-year leasehold condo that was launched in September 2017. At a land cost of $51.1 million, the estimated break-even price will be around $890 PSF. It currently has a take up rate of 69.2% in the 2 years and 5 months since launch.

12. Parc Botannia

Parc Botannia is a 99-year leasehold condo that was launched in November 2017. At a land cost of $287.1 million, the estimated break-even price will be around $931 PSF. It currently has a take up rate of 94.7% in the 2 years and 3 months since launch.

13. Parksuites

Parksuites is a 99-year leasehold condo that was launched in February 2018. At a land cost of $175.9 million, the estimated break-even price will be around $1,750 PSF. It currently has a take up rate of 18.5% in the 2 years since launch.

14. 8 Hullet

8 Hullet is a freehold condo that was launched in March 2018. At a land cost of $38.2 million, the estimated break-even price will be around $2,711 PSF. It currently has a take up rate of 84.1% in the 1 year and 11 months since launch.

15. The Tapestry

The Tapestry is a 99-year leasehold condo that was launched in March 2018. At a land cost of $370.1 million, the estimated break-even price will be around $987 PSF. It currently has a take up rate of 81.5% in the 1 year and 11 months since launch.

16. Twin Vew

Twin Vew is a 99-year leasehold condo that was launched in May 2018. At a land cost of $291.99 million, the estimated break-even price will be around $1,016 PSF. It currently has a take up rate of 88.5% in the 1 year and 9 months since launch.

17. Amber 45

Amber 45 is a freehold condo that was launched in May 2018. At a land cost of $156 million, the estimated break-even price will be around $1,556 PSF. It currently has a take up rate of 82% in the 1 year and 9 months since launch.

18. Margaret Ville

Margaret Ville is a 99-year leasehold condo that was launched in June 2018. At a land cost of $238.39 million, the estimated break-even price will be around $1,481 PSF. It currently has a take up rate of 90.9% in the 1 year and 8 months since launch.

19. The Garden Residences

The Garden Residences is a 99-year leasehold condo that was launched in June 2018. At a land cost of $446.28 million, the estimated break-even price will be around $1,443 PSF. It currently has a take up rate of 38.8% in the 1 year and 8 months since launch.

20. 120 Grange

120 Grange is a freehold condo that was launched in June 2018. At a land cost of $48.5 million, the estimated break-even price will be around $2,014 PSF. It currently has a take up rate of 80.4% in the 1 year and 8 months since launch.

21. Affinity at Serangoon

Affinity at Serangoon is a 99-year leasehold condo that was launched in June 2018. At a land cost of $499 million, the estimated break-even price will be around $1,295 PSF. It currently has a take up rate of 62.6% in the 1 year and 8 months since launch.

22. Park Colonial

Park Colonial is a 99-year leasehold condo that was launched in July 2018. At a land cost of $700.7 million, the estimated break-even price will be around $1,609 PSF. It currently has a take up rate of 87.7% in the 1 year and 7 months since launch.

23. Stirling Residences

Stirling Residences is a 99-year leasehold condo that was launched in July 2018. At a land cost of $1.003 billion, the estimated break-even price will be around $1,542 PSF. It currently has a take up rate of 72.5% in the 1 year and 7 months since launch.

24. Daintree Residence

Daintree Residences is a 99-year leasehold condo that was launched in July 2018. At a land cost of $265 million, the estimated break-even price will be around $1,414 PSF. It currently has a take up rate of 23.5% in the 1 year and 7 months since launch.

25. Riverfront Residences

Riverfront Residences is a 99-year leasehold condo that was launched in July 2018. At a land cost of $575 million, the estimated break-even price will be around $1,147 PSF. It currently has a take up rate of 82.5% in the 1 year and 7 months since launch.

26. Mont Botanik Residence

Mont Botanik Residence is a freehold condo that was launched in August 2018. At a land cost of $47.8 million, the estimated break-even price will be around $1,021 PSF. It currently has a take up rate of 45.4% in the 1 year and 6 months since launch.

27. The Tre Ver

The Tre Ver is a 99-year leasehold condo that was launched in August 2018. At a land cost of $334.2 million, the estimated break-even price will be around $1,250 PSF. It currently has a take up rate of 89% in the 1 year and 6 months since launch.

28. Casa Al Mare

Casa Al Mare is a freehold condo that was launched in August 2018. It currently has a take up rate of 28.6% in the 1 years and 6 months since launch.

29. The Jovell

The Jovell is a 99-year leasehold condo that was launched in September 2018. It currently has a take-up rate of 25.7% in the 1 year and 5 months since launch.

30. Jadescape

Jadescape is a 99-year leasehold condo that was launched in September 2018. At a land cost of $638 million, the estimated break-even price will be around $1,027 PSF. It currently has a take up rate of 47.3% in the 1 year and 5 months since launch.

31. Bukit 828

Bukit 828 is a freehold condo that was launched in September 2018. At a land cost of $17 million, the estimated break-even price will be around $1,098 PSF. It currently has a take up rate of 50% in the 1 year and 5 months since launch.

32. Jui Residences

Jui Residences is a freehold condo that was launched in September 2018. At a land cost of $47 million, the estimated break-even price will be around $1,237 PSF. It currently has a take up rate of 64.1% in the 1 years and 5 months since launch.

33. 3 Cuscaden

3 Cuscaden is a freehold condo that was launched in November 2018. At a land cost of $110.23 million, the estimated break-even price will be around $2,428 PSF. It currently has a take up rate of 84.4% in the 1 year and 3 months since launch.

34. The Woodleigh Residences

The Woodleigh Residences is a 99-year leasehold condo that was launched in November 2018. At a land cost of $1.13 billion, the estimated break-even price will be around $1,691 PSF. It currently has a take up rate of 27.6% in the 1 year and 3 months since launch.

35. Kent Ridge Hill Residences

Kent Ridge Hill Residences is a 99-year leasehold condo that was launched in November 2018. At a land cost of $490 million, the estimated break-even price will be around $1,594 PSF. It currently has a take up rate of 50.2% in the 1 year and 3 months since launch.

36. Whistler Grand

Whistler Grand is a 99-year leasehold condo that was launched in November 2018. At a land cost of $472.4 million, the estimated break-even price will be around $1,255 PSF. It currently has a take up rate of 63.7% in the 1 year and 3 months since launch.

37. Parc Esta

Parc Esta is a 99-year leasehold condo that was launched in November 2018. At a land cost of $959 million, the estimated break-even price will be around $1,381 PSF. It currently has a take up rate of 72.6% in the 1 year and 3 months since launch.

38. Petit Jervois

Petit Jervois is a freehold condo that was launched in November 2018. At a land cost of $72 million, the estimated break-even price will be around $1,911 PSF. It currently has a take up rate of 3.6% in the 1 year and 3 months since launch.

39. Fourth Avenue Residences

Fourth Avenue Residences is a 99-year leasehold condo that was launched in January 2019. At a land cost of $553 million, the estimated break-even price will be around $2,101 PSF. It currently has a take up rate of 23.7% in the 1 year and 1 month since launch.

View the Fourth Avenue Residences review

40. RV Altitude

RV Altitude is a freehold condo that was launched in January 2019. At a land cost of $127.6 million, the estimated break-even price will be around $2,253 PSF. It currently has a take up rate of 25.7% in the 1 year and 1 month since launch.

41. Fyve Derbyshire

Fyve Derbyshire is a freehold condo that was launched in January 2019. At a land cost of $73.88 million, the estimated break-even price will be around $1,930 PSF. It currently has a take up rate of 26.8% in the 1 year and 1 month since launch.

42. One Meyer

One Meyer is a freehold condo that was launched in March 2019. At a land cost of $69.1 million, the estimated break-even price will be around $1,952 PSF. It currently has a take up rate of 28.8% in the 11 months since launch.

43. 35 Gilstead

35 Gilstead is a freehold condo that was launched in March 2019. At a land cost of $72 million, the estimated break-even price will be around $2,214 PSF. It currently has a take up rate of 41.4% in the 11 months since launch.

44. Treasure @ Tampines

Treasure @ Tampines is a 99-year leasehold condo that was launched in March 2019. At a land cost of $970 million, the estimated break-even price will be around $1,113 PSF. It currently has a take up rate of 39.7% in the 11 months since launch.

45. The Essence

The Essence is a 99-year leasehold condo that was launched in March 2019. At a land cost of $27.4 million, the estimated break-even price will be around $1,076 PSF. It currently has a take up rate of 27.4% in the 11 months since launch.

46. Rezi 24

Rezi 24 is a freehold condo that was launched in March 2019. At a land cost of $60 million, the estimated break-even price will be around $1,276 PSF. It currently has a take up rate of 40% in the 11 months since launch.

47. Florence Residences

Florence Residences is a 99-year leasehold condo that was launched in March 2019. At a land cost of $629 million, the estimated break-even price will be around $1,303 PSF. It currently has a take up rate of 39.8% in the 11 months since launch.

48. Nyon

Nyon is a freehold condo that was launched in March 2019. At a land cost of $80 million, the estimated break-even price will be around $1,738 PSF. It currently has a take up rate of 22.8% in the 11 months since launch.

49. Boulevard 88

Boulevard 88 is a freehold condo that was launched in March. It currently has a take up rate of 57.8% in the 11 months since launch.

50. 1953

1953 is a freehold condo that was launched in March 2019. At a land cost of $53.2 million, the estimated break-even price will be around $1,436 PSF. It currently has a take up rate of 53.4% in the 11 months since launch.

51. Mayfair Gardens

Mayfair Gardens is a 99-year leasehold condo that was launched in April 2019. At a land cost of $188.76 million, the estimated break-even price will be around $1,762 PSF. It currently has a take up rate of 75.3% in the 10 months since launch.

52. Mayfair Modern

Mayfair Modern is a 99-year leasehold condo that was launched in April 2019. At a land cost of $174.24 million, the estimated break-even price will be around $1,762 PSF. It currently has a take up rate of 29.2% in the 10 months since launch.

53. Coastline Residences

Coastline Residences is a freehold condo that was launched in April 2019. At a land cost of $146.99 million, the estimated break-even price will be around $2,100 PSF. It currently has a take up rate of 19.4% in the 10 months since launch.

54. Wilshire Residences

Wilshire Residences is a freehold condo that was launched in April 2019. At a land cost of $98.8 million, the estimated break-even price will be around $2,004 PSF. It currently has a take up rate of 96.3% in the 3 years and 3 months since launch.

55. The Lilium

The Lilium is a freehold condo that was launched in May 2019. At a land cost of $84.01 million, the estimated break-even price will be around $1,589 PSF. It currently has a take up rate of 2.5% in the 9 months since launch.

56. The Gazania

The Gazania is a freehold condo that was launched in May 2019. At a land cost of $271 million, the estimated break-even price will be around $1,856 PSF. It currently has a take up rate of 9.6% in the 9 months since launch.

57. Jervois Prive

Jervois Prive is a freehold condo that was launched in May 2019. At a land cost of $52.9 million, the estimated break-even price will be around $2,171 PSF.

58. Juniper Hill

Juniper Hill is a freehold condo that was launched in May 2019. At a land cost of $180.65 million, the estimated break-even price will be around $2,444 PSF. It currently has a take up rate of 9.6% in the 9 months since launch.

59. Amber Park

Amber Park is a freehold condo that was launched in May 2019. At a land cost of $906.7 million, the estimated break-even price will be around $2,073 PSF. It currently has a take up rate of 32.4% in the 9 months since launch.

60. Parc Komo

Parc Komo is a freehold condo that was launched in May 2019. At a land cost of $248.8 million, the estimated break-even price will be around $1,356 PSF. It currently has a take up rate of 40.6% in the 9 months since launch.

61. Riviere

Riviere is a 99-year leasehold condo that was launched in May 2019. At a land cost of $955.4 million, the estimated break-even price will be around $2,321 PSF. It currently has a take up rate of 10.8% in the 9 months since launch.

62. Meyerhouse

Meyerhouse is a freehold condo that was launched in May 2019. At a land cost of $201.1 million, the estimated break-even price will be around $1,974 PSF. It currently has a take up rate of 8.9% in the 9 months since launch.

63. Olloi

Olloi is a freehold condo that was launched in May 2019. At a land cost of $37.6 million, the estimated break-even price will be around $1,466 PSF. It currently has a take up rate of 29.4% in the 9 months since launch.

64. The Hyde

The Hyde is a freehold condo that was launched in May 2019. At a land cost of $73.8 million, the estimated break-even price will be around $2,600 PSF. It currently has a take up rate of 12% in the 9 months since launch.

65. Lattice One

Lattice One is a freehold condo that was launched in June 2019. At a land cost of $25.74 million, the estimated break-even price will be around $1,173 PSF. It currently has a take up rate of 58.3% in the 8 months since launch.

66. Sky Everton

Sky Everton is a freehold condo that was launched in June 2019. At a land cost of $338 million, the estimated break-even price will be around $2,130 PSF. It currently has a take up rate of 71.8% in the 8 months since launch.

67. Sloane Residences

Sloane Residences is a freehold condo that was launched in June 2019. At a land cost of $80.5 million, the estimated break-even price will be around $2,188 PSF. It currently has a take up rate of 7.7% in the 8 months since launch.

68. View at Kismis

View at Kismis is a 99-year leasehold condo that was launched in July 2019. At a land cost of $102.75 million, the estimated break-even price will be around $1,319 PSF. It currently has a take up rate of 28% in the 7 months since launch.

69. One Pearl Bank

One Pearl Bank is a 99-year leasehold condo that was launched in July 2019. At a land cost of $929.4 million, the estimated break-even price will be around $2,191 PSF. It currently has a take up rate of 32.7% in the 7 months since launch.

70. Dunearn 386

Dunearn 386 is a freehold condo that was launched in July 2019. At a land cost of $36.3 million, the estimated break-even price will be around $1,907 PSF. It currently has a take up rate of 11.4% in the 7 months since launch.

71. Haus on Handy

Haus on Handy is a 99-year leasehold condo that was launched in July 2019. At a land cost of $212.2 million, the estimated break-even price will be around $2,310 PSF. It currently has a take up rate of 16.5% in the 7 months since launch.

72. Jervois Treasures

Jervois Treasures is a freehold condo that was launched in July 2019. At a land cost of $46.3 million, the estimated break-even price will be around $2,265 PSF. It currently has a take up rate of 2.8% in the 7 months since launch.

73. Parc Clematis

Parc Clematis is a 99-year leasehold condo that was launched in August 2019. At a land cost of $840.9 million, the estimated break-even price will be around $1,312 PSF. It currently has a take up rate of 36% in the 6 months since launch.

74. Uptown @ Farrer

Uptown @ Farrer is a 99-year leasehold condo that was launched in September 2019. At a land cost of $174.08 million, the estimated break-even price will be around $1,484 PSF. It currently has a take up rate of 19% in the 5 months since launch.

75. Cuscaden Reserve

Cuscaden Reserve is a 99-year leasehold condo that was launched in September 2019. At a land cost of $410 million, the estimated break-even price will be around $3,059 PSF. It currently has a take up rate of 2.1% in the 5 months since launch.

76. Avenue South Residence

Avenue South Residence is a 99-year leasehold condo that was launched in September 2019. At a land cost of $1.035 billion, the estimated break-even price will be around $1,641 PSF. It currently has a take up rate of 41.5% in the 5 months since launch.

View Avenue South Residence review

77. Meyer Mansion

Meyer Mansion is a freehold condo that was launched in September 2019. At a land cost of $319.88 million, the estimated break-even price will be around $1,873 PSF. It currently has a take up rate of 13% in the 5 months since launch.

78. The Antares

The Antares is a 99-year leasehold condo that was launched in September 2019. At a land cost of $223 million, the estimated break-even price will be around $1,608 PSF. It currently has a take up rate of 10.2% in the 5 months since launch.

79. RoyalGreen

RoyalGreen is a freehold condo that was launched in October 2019. At a land cost of $477.94 million, the estimated break-even price will be around $2,581 PSF. It currently has a take up rate of 17.2% in the 4 months since launch.

80. Midwood

Midwood is a 99-year leasehold condo that was launched in October 2019. At a land cost of $460 million, the estimated break-even price will be around $1,561 PSF. It currently has a take up rate of 3.7% in the 4 months since launch.

81. Midtown Bay

Midtown Bay is a 99-year leasehold condo that was launched in October 2019. At a land cost of $1.62 billion, the estimated break-even price will be around $2,291 PSF. It currently has a take up rate of 17.8% in the 4 months since launch.

82. Neu @ Novena

Neu @ Novena is a freehold condo that was launched in October 2019. At a land cost of $106 million, the estimated break-even price will be around $2,024 PSF. It currently has a take up rate of 74.7% in the 4 months since launch.

83. Parkwood Collection

Parkwood Collection is a 99-year leasehold condo that was launched in November 2019. At a land cost of $75.8 million, it currently has a take up rate of 5.7% in the 3 months since launch.

84. Urban Treasures

Urban Treasures is a freehold condo that was launched in November 2019. At a land cost of $220 million, the estimated break-even price will be around $1,619 PSF. It currently has a take up rate of 7.6% in the 3 months since launch.

85. The Iveria

The Iveria is a freehold condo that was launched in November 2019. At a land cost of $72 million, the estimated break-even price will be around $2,011 PSF. It currently has a take up rate of 25.5% in the 3 months since launch.

86. One Holland Village Residences

One Holland Village Residences is a 99-year leasehold condo that was launched in November 2019. At a land cost of $1.213 billion, the estimated break-even price will be around $2,498 PSF. It currently has a take up rate of 39.9% in the 3 months since launch.

View the One Holland Village Residences review

87. Sengkang Grand Residences

Sengkang Grand Residences is a 99-year leasehold condo that was launched in November 2019. At a land cost of $777.78 million, the estimated break-even price will be around $1,396 PSF. It currently has a take up rate of 34.6% in the 3 months since launch.

View the Sengkang Grand Residences review

88. Dairy Farm Residences

Dairy Farm Residences is a 99-year leasehold condo that was launched in November 2019. At a land cost of $368.8 million, the estimated break-even price will be around $1,355 PSF. It currently has a take up rate of 7.6% in the 3 months since launch.

89. Pullman Residences

Pullman Residences is a freehold condo that was launched in November 2019. At a land cost of $468 million, the estimated break-even price will be around $2,445 PSF. It currently has a take up rate of 2.1% in the 3 months since launch.

90. Van Holland

Van Holland is a freehold condo that was launched in January 2020. At a land cost of $120.43 million, the estimated break-even price will be around $2,216 PSF. It currently has a take up rate of 20% in the 1 month since launch.

91. Leedon Green

Leedon Green is a freehold condo that was launched in January 2020. At a land cost of $906.9 million, the estimated break-even price will be around $2,387 PSF. It currently has a take up rate of 5.2% in the 1 month since launch.

92. The Avenir

The Avenir is a freehold condo that was launched in January 2020. At a land cost of $980 million, the estimated break-even price will be around $2,406 PSF. It currently has a take up rate of 6.1% in the 1 month since launch.

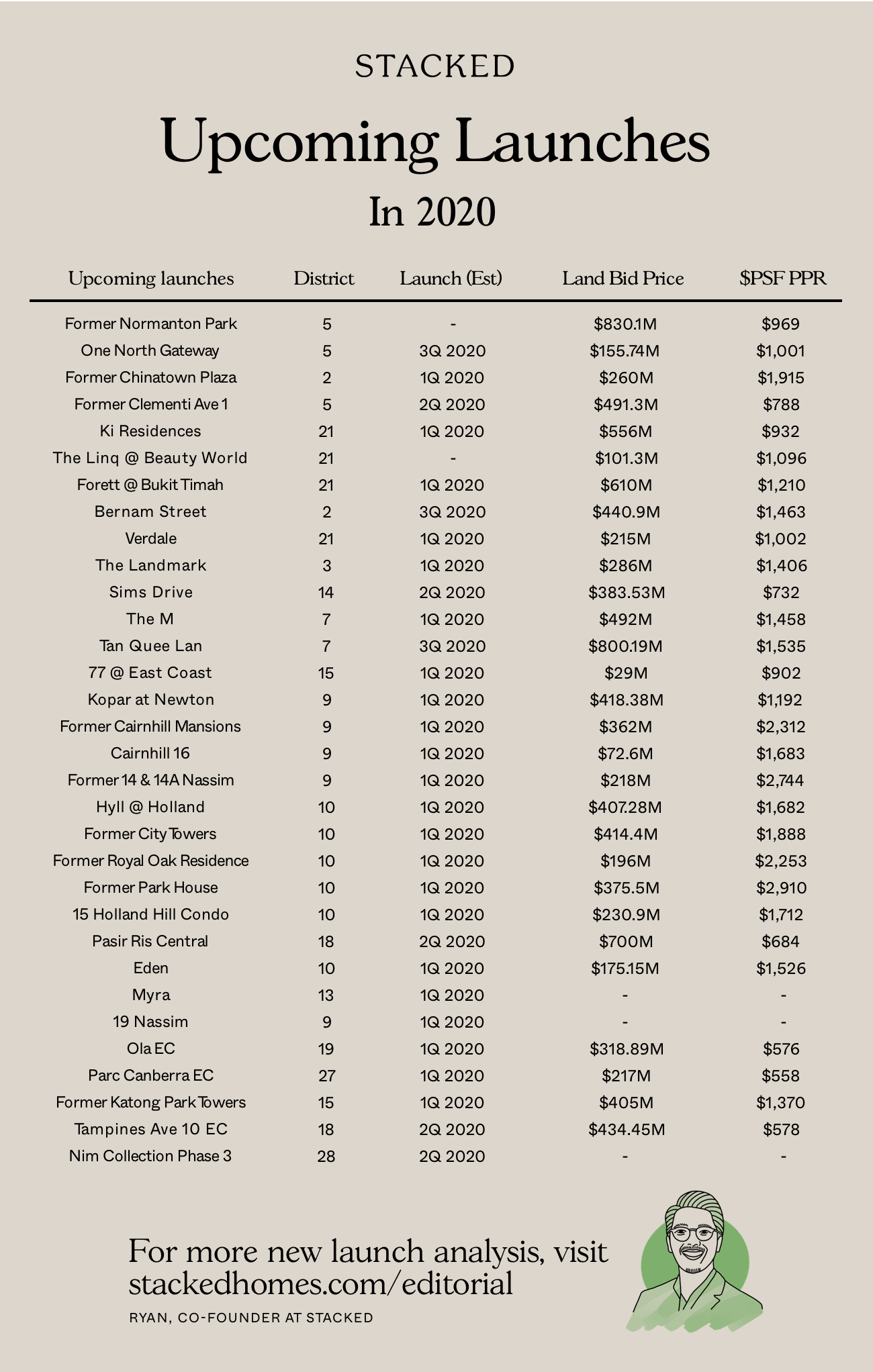

Bonus: Upcoming New Launches in 2020

Thanks for sharing this cheat sheet!

None of the figures in the worked example using Queens Peak makes sense, from the calculation of GFA using site area and GPR to the figures used in calculating est breakeven cost…