Here’s How You Should be Comparing New Condo Vs Resale Units

April 28, 2020

Reuben wrote a really intriguing piece the other day on cognitive biases and why they affect your property purchases.

Perhaps the thing that struck me most was the confirmation bias bit.

And it’s something that I am looking to touch on today.

You tend to prioritise information that confirms your beliefs, while discounting those that do not…

This is something that I see happening a lot.

And it is probably something that has pushed many people away from making the right property purchase for them.

What I’m speaking about is the endless debate between a new condo and a resale property.

In the past, many people used to compare properties by their PSF value.

But today, that really isn’t as relevant anymore.

Because it isn’t always about the “sky high” PSF, it’s about the final price that you will be paying.

The real question is, would you really be forking out extra cash for a newer unit?

You see, we often base our first impressions/decisions on whether a unit is suitable for us based on that initial PSF figure without even bothering about the (total) quantum of the unit.

What we often fail to bring into the picture however is that many of the new condo units are actually smaller than the older resale units.

Now if you were to actually compare their total quantum (i.e total price of the unit) from time to time, you might be surprised to find that many of the older and new condo units are almost similar in terms of its price!

Let me first explain the technicalities.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Can a new condo unit have the same/less quantum value as an older one?

Is it possible?

Well, it all comes down to the numbers.

As you know, units are growing smaller by the day – even to the point that the government has now stepped in to prevent the rise of these shoebox units from getting out of control.

Based on that, the overall quantum of a smaller/new condo (with a higher psf), when compared to a larger/older unit (with a lower psf) could logically fall under similar price ranges.

Of course, you do not get to enjoy the luxury of space as an owner of these smaller/newer units – nor have we yet factored in new launch unit renovation VS resale unit maintenance costs (amongst a number of other things).

But as you might have seen in Sean’s ‘Why we shouldn’t judge a property based on its high PSF’ piece a couple of months back, these newer/smaller units are forced to adopt more efficient layouts (ie. no bay windows, unnecessary planter space etc.) to appeal to increasingly savvy buyers.

Here are some cases (of larger tiered units) that illustrate my point on the similar quantum values across both newer and older units:

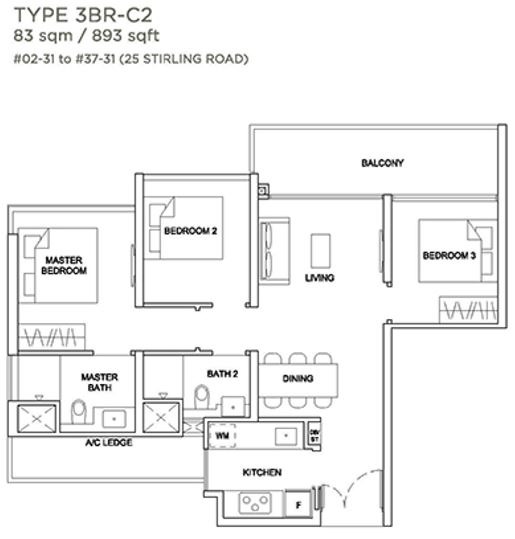

Case Study 1 – Stirling Residence Vs Queens

Let’s take a look at the Stirling Residences Vs Queens along Stirling Road.

| Stirling Residences (3-bedroom, #14-31) | Queens (3-bedroom, #15-17) | |

| TOP Year | 2022 | 2002 |

| PSF | $1,735 | $1,287 |

| Unit Size | 893 sqft | 1,195 sqft |

| Quantum | $1.55m | $1.538m |

The Queens condominium was built in 2002, and Stirling Residences comes on almost 20 years later.

Let’s see what that means in a nutshell.

- You’d expect more modern facilities as well as newer and cleaner grounds from Stirling Residences,

- New condo units don’t always turn out the way we anticipate them to be so a fully furnished Queens resale unit could be the ‘safer’ bet in that regard.

- New condo units tend to have higher monthly maintenance fees + minor renovation costs. Older resale units might require a heftier budget for upkeep.

(For more on the pros and cons of New Launch Vs Resale units, check this out)

Now the main reason we’re really here is to observe the price differences between the two unit types.

The particular Queens Condo unit we’re looking at has a $1,287 psf. At 1,195 square feet wide, that transitions to $1.538m quantum value.

The Stirling Residences unit on the other hand has a much higher $1,735 psf. But at 893 square feet wide, its quantum value transitions to $1.55m quantum value.

That’s a 0.8% ($12k) difference!

Let’s also have a look at their unit layouts.

Now let’s have a look at another example.

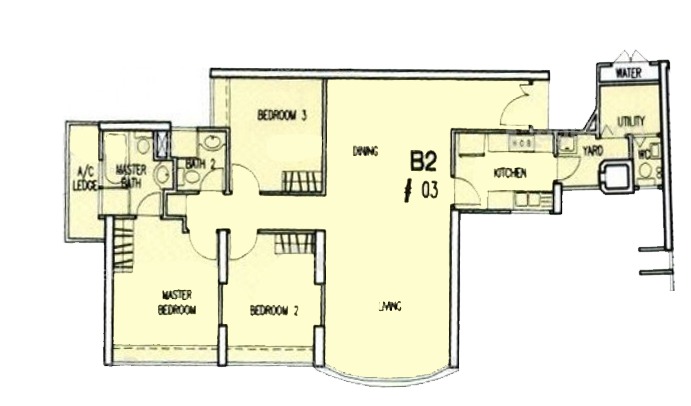

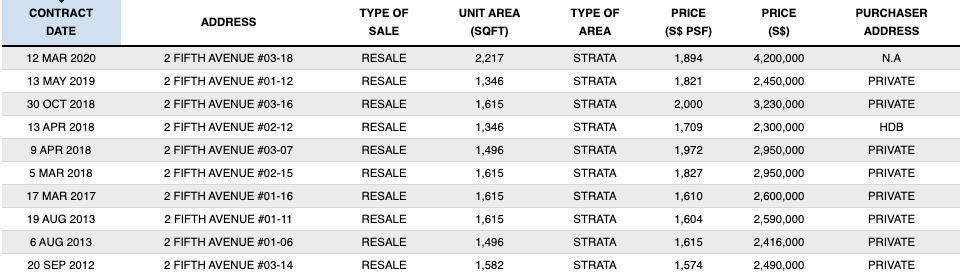

Case Study 2 – Fifth Avenue Vs RoyalGreen

| RoyalGreen (4-bedroom, #03-28) | Fifth Avenue (4-bedroom, #03-18) | |

| TOP Year | 2022 | 1998 |

| Unit Size | 1,432 sqft | 2,217 sqft |

| PSF | $2,805 | $1,894 |

| Quantum | $4.016m | $4.2m |

| Rental Yield (Average for Unit Tier) | N.A | 1.9% |

This time, we’re comparing RoyalGreen and Fifth Avenue.

New Launch Condo ReviewsRoyalGreen Review: Luxury Freehold Condo in Sixth Avenue

by Reuben DhanarajAs you can see, Fifth Avenue is RoyalGreen’s senior by almost 24 years.

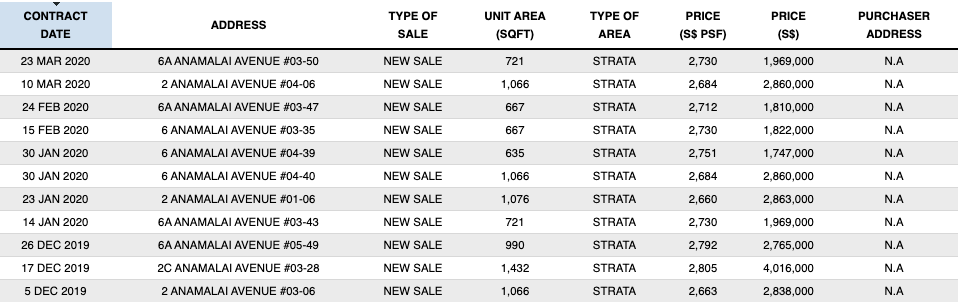

Now a 3rd storey (1,432sqft) 4-bedder unit at RoyalGreen went for $2,805psf in late 2019 for a total of $4.016million.

On the other hand, a similar 3rd storey (2,217sqft) 4-bedder unit over at Fifth Avenue went for almost a thousand psf less at $1,894psf early this year for a total of $4.2million.

Basically, the (much) older 4-bedroom unit over at Fifth Avenue actually cost $184k (or 4.4%) more than the 4-bedroom unit at Royal Green based on quantum value alone.

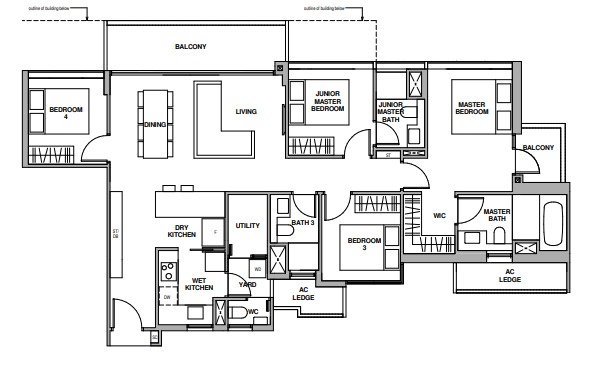

Let’s see how their unit layouts fare.

And so as you can see, the newer launch units can sometimes be even cheaper than the older units based on the size difference.

‘But Ryan…What if I really like my space?’

So you’ve seen how some of the new launch units can actually be cheaper than older more spacious units.

But living in smaller areas isn’t something that everyone can get used to. What if you really cannot ‘tahan’ these smaller units?

Well in that case, one option would be to either buy/rent a place with larger unit areas – and perhaps rent-out any newer units you might own/potentially own for rental yield.

Of course it isn’t always that easy.

What if… say, you really like a particular development – but it turns out that it has smaller-sized units than you would prefer?

Well, there has to be some workarounds right?

One way I can think of in this case is actually employing innovative interior designs.

Believe it or not, with many today’s smart/modern interior tricks, you could actually transform your ‘seemingly’ tight-fitting unit into an unexpected spacious pad.

Of course you wouldn’t expect a palace in its place, but good interior design will go a long way in expanding the spatial offerings in a unit – amongst many other things.

So at the end of the day…should I still use PSF value for my research?

Based on the examples we’ve seen today, I think it’s pretty obvious how unit sizes can vary between developments.

It’s therefore an important lesson as to why we should not base our judgements of a property’s price on its psf values alone. And no, not just because of varying unit sizes alone.

You see, most people like to use PSF values in their research/conversations because it resembles a ‘bite-sized’ measurement system.

And quite frankly, not everyone has the time/effort to hunt for the total unit size and then calculate the actual quantum value of every unit they come across.

So, they simply use the PSF values as a method of comparison as we have done over the past decades.

Now here’s the thing.

Back in the day, when condos in Singapore were all very much similar, comparing condos on their PSF values made sense because there were little differentiating factors that would undermine the accuracy of the PSF measurement system.

But because there are so many differences between condos these days; differences that impact the actual value of a unit (location, facility offerings etc.) – it means that you can no longer use a condo’s PSF as its sole source of value measurement.

So is the PSF value completely useless then?

Well, not entirely.

Besides serving as a (*very*) rough benchmark for research purposes, it can sometimes be used when comparing units in the same development.

For example – a high-floored unit with favourable sun/wind positions would naturally cost more than a similarly sized unit on the ground floor.

In cases such as these, comparing the units based on psf value makes sense because both the unit sizes and condo-type are already uniform.

And that’s why you see PSF values being mentioned all the time whenever you pop by a new condo showflat (don’t be fooled!!).

Final Word

Now if you are seriously considering buying/renting a place, then it is a must to consider both PSF and quantum values of not just your unit, but also those in and around your particular development.

You should also understand what your investment strategy/appetite involves.

Do you plan to buy a unit and rent it out for a period before selling it off for appreciation gains?

Are you planning to buy the unit solely for home ownership and possibly shared rental down the road?

Whatever your case, knowing about the importance of quantum values and how some of the newer units can be on the same price level or even be cheaper than older units is really just the beginning.

Other important factors like understanding rental demand/yields and the resale ability of your potential unit will also help you out in the long run.

If you’re interested in learning more about how you can find the most bang for your buck, and subsequently the most value from your home – feel free to send us an email at stories@stackedhomes.com.

At the end of the day, whatever your interest/motivation is for owning a house, remember that there will always be specific methods you can and should employ to achieve your goals with the maximum benefits.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan Ong

Ryan is part property consultant, part wordsmith, and a true numbers aficionado. Ryan's balanced approach to every transaction is as diverse as it is effective. Since starting his real estate journey in 2016, he has personally brokered over $250 million of properties. Beyond the professional sphere, you'll often find him cherishing moments with his beloved cats: Mia, Holly, Percy and Toto.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

0 Comments