How Much Income Do You Need To Get A Home Loan / Mortgage?

May 29, 2020

This is Part 3 of our 18-part first-time home buyer series. You may refer to the full table below:

Many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

First Time Home Buyer Guide

Financing

- Approval-in-Principle: Why It’s Your First Step for a Home Loan/Mortgage

- How Much Can You Borrow For A Home Loan / Mortgage?

- How Much Income Do You Need To Get A Home Loan / Mortgage?

- How To Read Your Credit Report For Your Home Loan / Mortgage

- Understanding SIBOR, Board Rate, And Fixed Deposit Home Loans

- How You Can Compare Home Loans And Get The Best Deal

Choosing The Right Condo

- Executive Condo Versus Private Condo

- Freehold Versus Leasehold Condos

- New Versus Resale Condos

- Large Versus Small Condo Developments

Choosing The Best Condo Unit In A Development

- How To Pick The Best Stack In A Development

- Key Questions To Ask About Condo Facilities

- Key Factors To Note About A Condo’s Location

- How To Read And Compare Floor Plans

- What To Look For In Condo Shoebox Units

- When Should You Consider A Dual-Key Unit?

- Key Questions To Ask At A Showflat

- Condo Purchase Timeline

This article was last updated on 7 July 2021.

Now that you understand how much you can borrow for your first property, it’s time to dig a little deeper to determine how much income you need in order to obtain that home loan.

Just because you can meet the minimum down payment, doesn’t mean the bank will give you a home loan. There are income requirements to get a mortgage, and some of these are specified by the Monetary Authority of Singapore (MAS). Here’s how much you need to earn to qualify for a home loan:

The absolute minimum requirements for private property buyers

Anyone looking to co-sign a home loan must be earning at least $24,000 per annum. Note that variable income sources, such as rental income or sales commissions, are subject to a haircut (see below), so you may need to earn more than this if you’re self-employed.

These requirements may also be raised for co-signers who are foreigners.

You cannot be older than 65 at the time of application, and the minimum age is 21.

The Total Debt Servicing Ratio (TDSR) framework

The TDSR framework curbs the size of your loan quantum (i.e. the amount you can borrow for your home loan), based on your income.

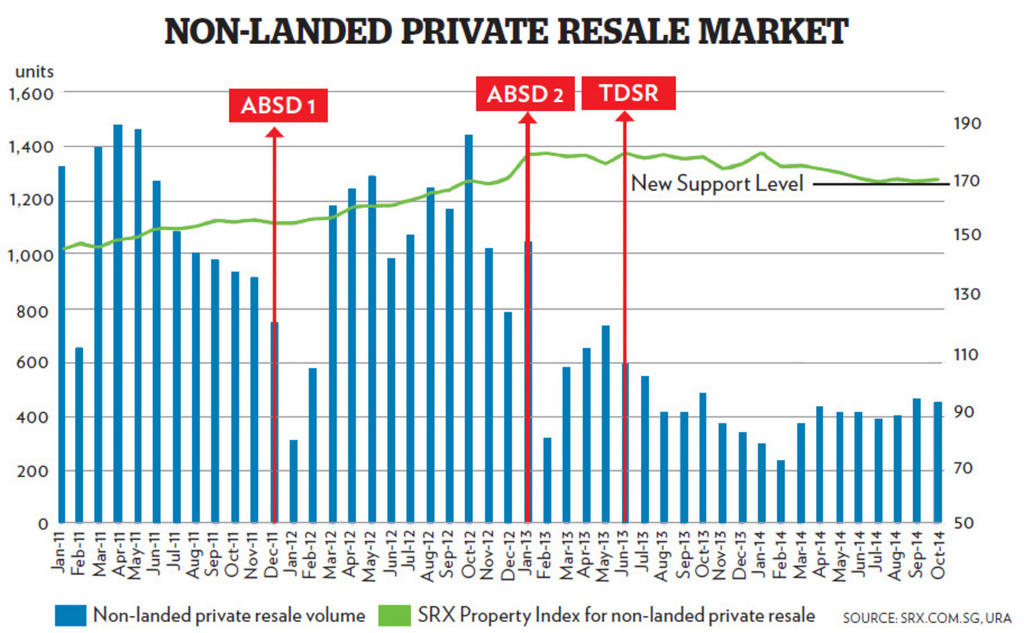

The TDSR is often mistakenly referred to as a “cooling measure”, but it wasn’t actually intended to be one; it’s a standardised approach to the way home loans are handled. It won’t go away even if the cooling measures were lifted tomorrow.

The TDSR restricts your monthly home loan repayment, plus your other outstanding debt obligations, to 60 per cent of your monthly income. For example, if you earn $7,000 a month, then your home loan repayment – plus any personal loans, car loans, student loans or others – cannot exceed $4,200 per month.

Just remember, your monthly debt includes all outstanding debt obligations:

- Property-related loans, including the loan being applied for.

- Car loans.

- Student loans.

- Renovation loans.

- Credit card loans.

- Any other secured or unsecured loans, including revolving loans.

Essentially, it was created to lower household debt and ensure some form of sustainability in the property market.

A note on Executive Condominiums (ECs) and the Mortgage Servicing Ratio (MSR)

ECs are subjected to another income requirement, called the MSR during the first Minimum Occupation Period (MOP). The MSR restricts your monthly home loan repayment – not inclusive of other debts – to 30 per cent of your monthly income.

So if you earn $7,000 a month, your MSR limit would be $2,100. Note that this is in addition to having to meet the TDSR (although if you can meet the MSR, you will usually be able to meet the TDSR; assuming your other debts are not too huge).

For fully private condos, there’s no MSR. You only need to worry about meeting the TDSR.

Determining the TDSR for Self-Employed Persons (SEPs), or people with variable income

Variable income can be derived from sources such as rental income, trust funds, sales commissions, stock dividends, and others. What’s acceptable as income – for the purposes of TDSR calculations – varies based on the lender. However, one thing they all have in common is that it cannot be a one-off source of income (e.g. winning the lottery, or getting severance pay from your last job).

If you have SEP status – such as if you’re a Private Hire Vehicle driver – your income counts as being variable.

In these cases, a haircut of 30 per cent is applied to your income, for the purposes of TDSR calculations. So if you were to earn $10,000 per month in variable income, you would count as earning only $7,000 per month.

If you have both a regular income and variable income, the haircut applies only to the variable component. So if you earn $7,000 per month, and receive $3,500 in rental income, you would count as earning ($7,000 + $2,450) = $9,450 per month.

Property Market CommentaryHere’s Why A Property Valuation Is A Big Deal When Getting Your Home Loan

by Ryan J. OngHow are the monthly loan repayments calculated for TDSR?

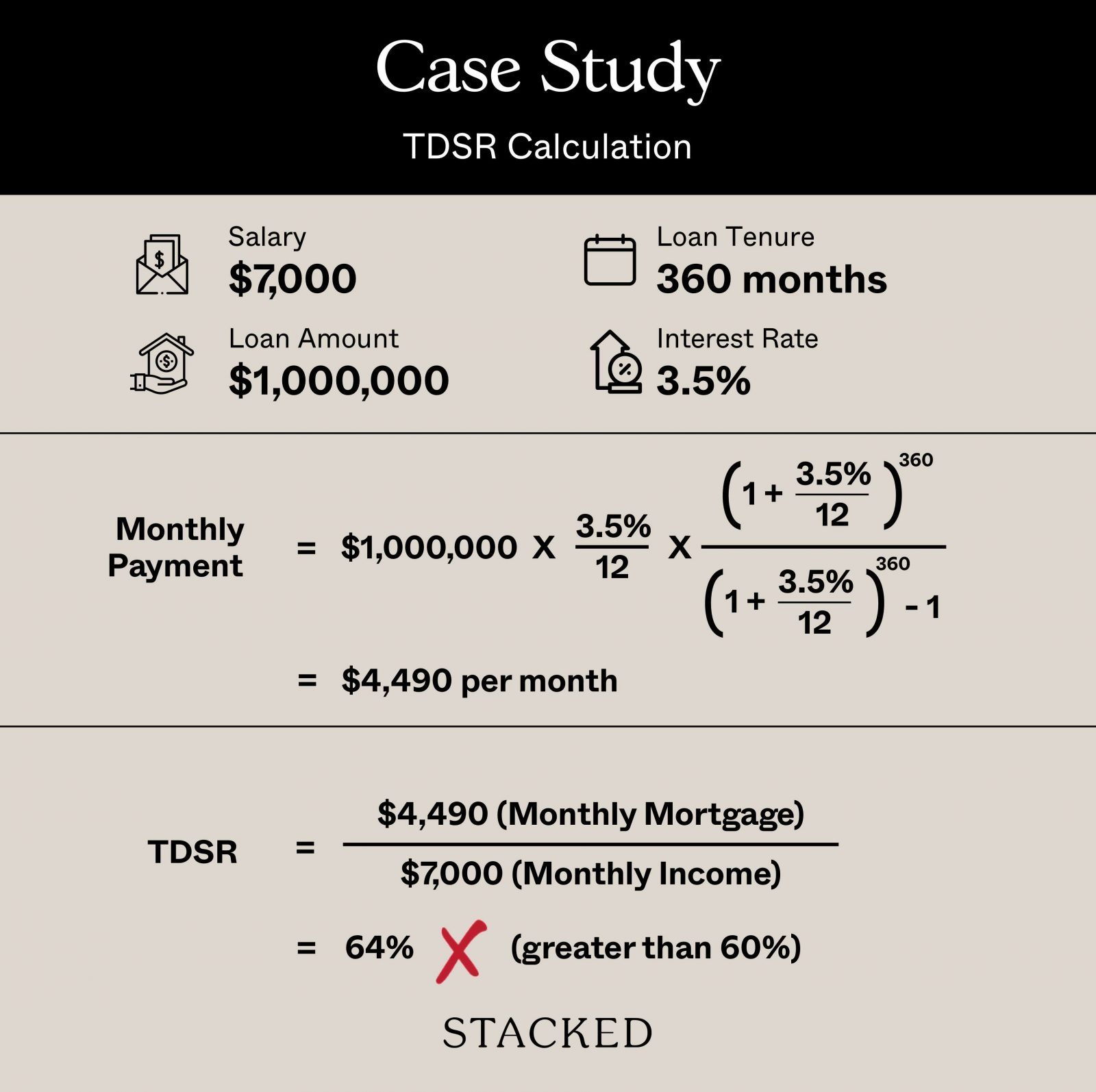

You can use an online mortgage calculator for an estimate, or get the bank to give you the specific numbers (there may be slight differences between banks). The main thing to note about TDSR is that the interest rate is always based on 3.5 per cent per annum, regardless of the actual interest rate.

For example, say you earn $7,000 per month (TDSR limit of $4,200), and want a loan of $1 million for 30 years. The actual interest rate is 1.3 per cent per annum. This comes to about $3,350 per month, which is within the limit.

However, the bank won’t apply 1.3 per cent as the interest rate. They will use 3.5 per cent for TDSR calculation purposes, which raises the monthly loan repayment to $4,490. As such, you’d fail to meet the TDSR framework.

The reason for applying 3.5 per cent as a standard rate is that home loan interest fluctuates; it’s a “stress test” that ensures you can service the loan even if the rates were to rise suddenly.

The impact of other debts on your TDSR

Say you earn $7,000 a month, but have various other debts that require you to pay $1,000 a month.

Your debt obligations effectively decrease the maximum possible size of your home loan repayment. For example, if your home loan repayment comes to $3,500 a month, you’d normally meet the TDSR limit of $4,200.

However, your home loan repayment plus your outstanding debts totals $4,500 in monthly repayments. This takes you past the TDSR limit, so you won’t qualify unless you pay down some of the debt.

In the case of debts with variable loan repayment amounts, such as credit cards, personal loans, and some lines of credit, the minimum required repayment is used for TDSR calculations.

For example, if you owe $5,000 on a credit card, and the minimum repayment is three per cent of the outstanding amount, the monthly repayment counts as being $150 for TDSR purposes.

For this reason, it’s advisable to avoid taking on large debts, such as car loans, in the 12 months preceding your home loan application.

The impact of your loan amount and loan tenure on TDSR

Your loan amount and loan tenure can increase or decrease your TDSR limit.

For example, a $1 million loan at the standardised 3.5 per cent interest rate comes to around $4,490 over 30 years; but this increases to just over $5,000 for a 25-year loan.

The longer the loan tenure, the lower the monthly repayments, and the more you’re likely to meet the TDSR.

Reducing your loan amount (e.g. by making a bigger down payment) will also lower your TDSR. In the above example, if you make a bigger down payment and borrow $800,000 instead of $1million, the monthly loan repayment falls to around $3,600 per month over a 30-year loan tenure.

You might want to read our previous section in this guide, on the maximum amount you can borrow.

Offering collateral to pass the TDSR requirement

If you can’t meet the TDSR requirement, you can sometimes put up additional collateral to secure the loan. Some examples of this include:

- A deposit of a certain amount, at the same bank you’re getting your loan from

- Your portfolio of stocks and bonds (not all banks accept this)

- Gold, silver, or other such commodities

- Other properties

Such arrangements are usually on a case-by-case basis, so don’t expect to get any brochures or offers specifying what you can put up as collateral.

Like the case for SEP, there will be a haircut, depending on whether the asset is pledged or unpledged.

| Eligible Financial Assets | Pledged for at least 4 years | Unpledged, or pledged for less than 4 years |

| Liquid Assets – Singapore dollars and coins, including deposits | Minimum 0% haircut | Minimum 70% haircut |

| Other Financial Assets | ||

| Foreign currency notes and coins, including deposits | Minimum 30% haircut | Minimum 70% haircut |

| Collective investment schemes | ||

| Business trusts | ||

| Debentures | ||

| Stocks | ||

| Structured deposits | ||

| Gold |

And in case we have to say it, the bank has a right to seize the collateral if you can’t service the home loan.

On average, most buyers will need a combined income of about $9,000 per month to buy a typical condo.

This is based on the median cost of a condo today, which is about $1.5 million. We also assume the maximum loan amount of $1.125 million, on 30-years loan tenure. As mentioned above, a 3.5 per cent interest rate is used to work out the monthly repayment (it’s roughly about $5,050 per month).

To comfortably afford a condo however, a combined income of about $12,600 or more is better. This will keep home loan repayments to about 40 per cent of your monthly income, leaving a healthy margin for savings and other investments.

However, this amount can vary significantly based on factors like self-employed income, debt, and other issues. If you’re having trouble securing a home loan, contact us on Facebook, so we can help you get to the bottom of it.

This is Part 3 of our Ultimate Guide to buying your first home. If you haven’t read Part 2, you can do so at the link!

Next up: Part 4 – How to read your credit score for a home loan / mortgage

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Property Advice We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

3 Comments

Great Article. Thanks for sharing this article.

The para on EC (within 10 yrs) is subjected to MSR is not true.

It’s only subjected to MSR within MOP according to MAS website?

https://www.mas.gov.sg/regulation/explainers/new-housing-loans/msr-and-tdsr-rules