I’m Single And Own A 1 Bedder Investment Condo In River Valley: Is It Better To Sell To Bigger Property Further Away Or A Resale HDB?

December 29, 2023

Hi,

It is me again. You have kindly given me valuable insights in 2021 and now being in a dilemma again, I decided to write to you.

I have been following private residential property news (including stacked homes) and I noticed that CCR price increase has been lagging. Now with the cooling measures and the money laundering issue, it makes matters worse (both rental and capital gain) and I am wondering whether I should continue to pay the high interest cost or just sell the small Irwell unit that I have.

As mentioned below, I have bought a 1 BR in Irwell and I am again thinking of selling it next year after May when SSD is no longer relevant (after 3 years). TOP is still a while away, in 2025. I bought it for investment but it seems like the outcome may not be so positive after all.

I am actually thinking of selling this to buy either a bigger Condo unit in OCR or even buy a HDB (at the same price, I could have gotten a bigger unit), however, I’m not sure if it is a wise choice. I am single and buying an HDB will also have limited choices.

Regards

Hi there,

Great to hear from you again.

As you mentioned, 2025 is still quite some time away so a lot can change then (for example, certain regulations that help boost sentiment in CCR property). Either way, you will have to wait till it is completed to see how prices are at that point in time, before deciding what is the next best move. If Irwell Hill Residences turns out to be even better in person when completed, prices could move higher than what you may expect!

Regardless, let’s start by looking at the price movements of non-landed private properties in the various regions over the last ten years.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Price trend of non-landed private properties

| Year | CCR Avg PSF (resale) | YoY | RCR Avg PSF (resale) | YoY | OCR Avg PSF (resale) | YoY |

| 2012 | $1,989 | – | $1,371 | – | $1,029 | – |

| 2013 | $2,054 | 3.27% | $1,509 | 10.07% | $1,055 | 2.53% |

| 2014 | $1,975 | -3.85% | $1,449 | -3.98% | $1,074 | 1.80% |

| 2015 | $1,972 | -0.15% | $1,383 | -4.55% | $1,078 | 0.37% |

| 2016 | $2,063 | 4.61% | $1,368 | -1.08% | $1,054 | -2.23% |

| 2017 | $2,059 | -0.19% | $1,437 | 5.04% | $1,072 | 1.71% |

| 2018 | $2,208 | 7.24% | $1,505 | 4.73% | $1,111 | 3.64% |

| 2019 | $2,278 | 3.17% | $1,520 | 1.00% | $1,099 | -1.08% |

| 2020 | $2,119 | -6.98% | $1,496 | -1.58% | $1,087 | -1.09% |

| 2021 | $2,111 | -0.38% | $1,568 | 4.81% | $1,167 | 7.36% |

| 2022 | $2,187 | 3.60% | $1,690 | 7.78% | $1,293 | 10.80% |

| Annualised | – | 0.95% | – | 2.11% | – | 2.31% |

As you’ve rightly observed, it’s evident from the above data that prices of non-landed private properties in the CCR haven’t shown as strong a performance compared to the other two regions.

Upon examining the figures more closely, it’s evident that prices in the CCR underwent a notable decline in 2020. While prices in other regions rebounded significantly in 2021, the CCR’s prices persisted in their downward trend until 2022. Though there was an uptick in prices starting that year, the rate of increase in the CCR was still relatively lower compared to other regions.

One plausible explanation could be attributed to the reduced presence of foreign investors during the pandemic. Given that a significant portion of foreign investors typically acquire properties in the CCR, the absence of this buyer pool inevitably impacts prices. Moreover, the adjustment of the ASBD rates in April 2023 has certainly had an effect on foreign investment interest. Sales of private non-landed properties, both new and resale, to foreigners declined to 1.8% of the total transactions in Q3 2023, marking the lowest quarterly percentage recorded since 1995.

On the other hand, properties in the RCR and OCR cater more for local buyers, ensuring a more consistent demand flow as these regions also attract a greater number of buyers looking for properties for their own stay purposes. Additionally, there was a higher number of new developments that were completed in recent years in the RCR and OCR as compared to the CCR, which could have contributed to the faster growth rates.

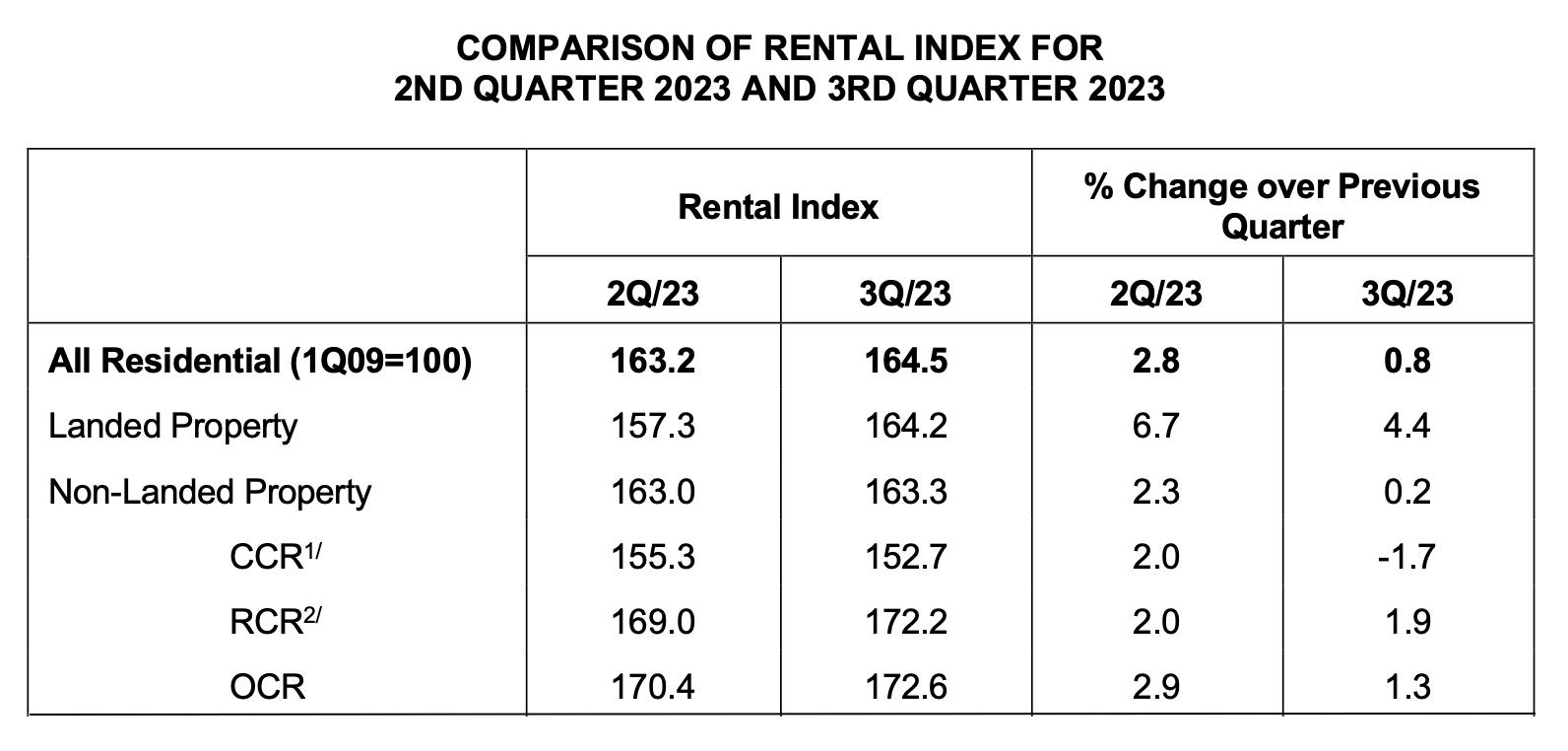

Regarding the rental market for private properties, recent trends indicate a moderation in prices. This shift might be attributed to some tenants choosing to rent HDBs instead, prompted by escalating rental costs. Also, it must be said, that the increased availability of newly completed projects has potentially contributed to curbing the growth in rental rates.

In the first three quarters of this year, the completion of 17,199 units was recorded, which is three times more than the corresponding period in 2022. Based on developers’ expected timelines, the final three months of the year are projected to see the completion of an additional 3,167 units. This will bring the total units completed in 2023 to an estimated 20,400 units, representing the highest annual figure since 2017.

Now let’s zoom in a little on the performance of 1-bedders.

How have 1-bedders in the CCR been performing?

1-bedders come in a range of different sizes but we will only be looking at units that are under 600 sq ft.

| Year | CCR Avg PSF (resale) | YoY | RCR Avg PSF (resale) | YoY | OCR Avg PSF (resale) | YoY |

| 2012 | $2,027 | – | $1,588 | – | $1,389 | – |

| 2013 | $2,017 | -0.49% | $1,638 | 3.15% | $1,433 | 3.17% |

| 2014 | $2,059 | 2.08% | $1,590 | -2.93% | $1,439 | 0.42% |

| 2015 | $2,032 | -1.31% | $1,530 | -3.77% | $1,383 | -3.89% |

| 2016 | $2,319 | 14.12% | $1,502 | -1.83% | $1,268 | -8.32% |

| 2017 | $2,254 | -2.80% | $1,517 | 1.00% | $1,275 | 0.55% |

| 2018 | $2,120 | -5.94% | $1,538 | 1.38% | $1,349 | 5.80% |

| 2019 | $2,311 | 9.01% | $1,508 | -1.95% | $1,336 | -0.96% |

| 2020 | $2,095 | -9.35% | $1,492 | -1.06% | $1,288 | -3.59% |

| 2021 | $2,011 | -4.01% | $1,579 | 5.83% | $1,363 | 5.82% |

| 2022 | $2,084 | 3.63% | $1,697 | 7.47% | $1,466 | 7.56% |

| Annualised | – | 0.28% | – | 0.67% | – | 0.54% |

Looking at the data above, it’s evident that, overall, 1-bedroom units have not exhibited the same level of performance compared to the collective growth rates of private properties. Among the three regions, the CCR stands out with the slowest annualised growth rate over the past decade and has shown greater price fluctuations.

One limitation of 1-bedroom apartments is that they typically appeal to investors who are attracted by the lower initial investment required. These investors, motivated primarily by profit, base their decisions on financial logic and tend to shift their investments to the most profitable opportunities. As a result, they might choose to sell their investment properties, even at a loss, if they identify more promising prospects. As such in such projects, a substantial number of owners are likely to be investors, a factor that could significantly influence the price dynamics of the development.

However, it’s worth noting that Irwell Hill Residences distinguishes itself from many other developments in District 9 due to its balanced unit mix, spanning from studio apartments to 5-bedroom layouts. Additionally, it boasts comprehensive condo amenities including a 50-metre lap pool, tennis court, a sizeable gym and clubhouse, among others. These factors may give it an edge over its competitors.

Should you hold on to Irwell Hill Residences?

Let us take a look at the costs incurred should you continue to hold on to your unit. Since we do not have your numbers, the following calculations will serve more as a reference point.

As the SSD period will be up next year, we will assume you purchased the unit in 2021. There were 111 1-bedroom transactions recorded in 2021 with an average price of $1,251,396. We will round this to $1,250,000 and assume this to be the purchase price. We will also presume that you took up the maximum loan of 75% with a 30 year tenure at 4% interest.

For calculation purposes, let’s say you continue to hold the property for another 5 years (2 more years to TOP, and then renting it out for 3 years at 3% rental yield). We will assume that the project is currently at the ceiling/roofing stage.

| Stage | % of purchase price | Disbursement amount | Monthly estimated payment | Monthly estimated interest | Monthly estimated principal | Duration | Total interest cost |

| Completion of foundation | 5% | $62,500 | $90 | $208 | $298 | 6-9 months (from launch) | $1,872 |

| Completion of reinforced concrete | 10% | $125,000 | $270 | $625 | $895 | 6-9 months | $5,625 |

| Completion of brick wall | 5% | $62,500 | $360 | $833 | $1,194 | 3-6 months | $4,998 |

| Completion of ceiling/roofing | 5% | $62,500 | $450 | $1,042 | $1,492 | 3-6 months | $6,252 |

| Completion of electrical wiring/plumbing | 5% | $62,500 | $540 | $1,250 | $1,790 | 3-6 months | $7,500 |

| Completion of roads/car parks/drainage | 5% | $62,500 | $630 | $1,458 | $2,089 | 3-6 months | $8,748 |

| Issuance of TOP | 25% | $312,500 | $1,081 | $2,500 | $3,581 | Usually a year before CSC | $30,000 |

| Certificate of Statutory Completion (CSC) | 15% | $187,500 | $1,351 | $3,125 | $4,476 | Monthly repayment until property is sold (36 months) | $112,500 |

*We used the longest duration at each stage for calculation purposes

Cost to hold Irwell Hill Residences

| Description | Amount |

| Interest expenses | $158,748 |

| Maintenance fees (assuming $325/month) | $11,700 |

| Property tax | $15,300 |

| Rental income | $112,500 |

| Agency fees (payable once every 2 years) | $6,750 |

| Total costs | $79,998 |

*Maintenance fees and property tax are only payable after TOP

To keep our calculations consistent, we will use the annualised growth rate of all private properties over the last 10 years at 2.21% to do a simple projection. However, as we have seen earlier, the growth rate of 1-bedders over the same time period is much lower.

Potential gains

| Time period | Price | Gains |

| Starting point | $1,250,000 | $0 |

| Year 1 | $1,277,625 | $27,625 |

| Year 2 | $1,305,861 | $55,861 |

| Year 3 | $1,334,720 | $84,720 |

| Year 4 | $1,364,217 | $114,217 |

| Year 5 | $1,394,367 | $144,367 |

Total gains if you were to hold on to Irwill Hill Residences for another 5 years: $144,367 – $79,998 = $64,369

Now let’s take a look at the potential costs and gains if you were to sell Irwell Hill Residences and purchase a condo or HDB.

Buying a resale condo

As we do not have your numbers, we will use $1.25M as your affordability. We are also making the assumption here that you will be selling Irwell Hill Residences at an amount where you’ll at least break even.

With a budget of $1.25M, these are some available units on the market with decent rental yields.

| Project | District | Tenure | TOP | Unit type | Size | Asking price | Avg rent (Jul-Sep) | Rental yield |

| Sol Acres | 23 | 99 years | 2019 | 2b2b | 732 | $1,088,888 | $3,638 | 4% |

| Parc Riviera | 05 | 99 years | 2019 | 2b1b | 603 | $1,150,000 | $4,018 | 4.2% |

| Kingsford Waterbay | 19 | 99 years | 2018 | 2b2b | 689 | $988,000 | $3,470 | 4.2% |

We picked out newer 2-bedroom units as younger projects generally tend to have better growth potential and there is also a larger buyer pool for this unit type since they cater to both investors and buyers looking for their own stay. However, these developments were picked out solely because they match these criteria and your budget, so we strongly encourage that you consult a property agent for further analysis.

In order for a fair comparison with Irwell Hill Residences, we will assume the hypothetical purchase of a resale property worth $1.25M with a 3% rental yield.

| Description | Amount |

| Purchase price | $1,250,000 |

| BSD | $34,600 |

| Loan required (assuming 75% LTV) | $937,500 |

Cost to purchase a resale condo and hold it for 4 years (we want to look at the same 5-year period as before and you’ll have to wait till next year before selling Irwell Hill Residences)

| Description | Amount |

| BSD | $34,600 |

| Interest expenses (assuming a 4% interest and a 30 year tenure) | $144,651 |

| Maintenance fees (assuming $325/month) | $15,600 |

| Property tax | $20,400 |

| Rental income (assuming $3,125/month) | $150,000 |

| Agency fees (payable once every 2 years) | $6,750 |

| Total costs | $72,001 |

Using the annualised growth rate of all private properties over the last 10 years at 2.21%, the potential gains in 4 years will be:

| Time period | Price | Gains |

| Starting point | $1,250,000 | $0 |

| Year 1 | $1,277,625 | $27,625 |

| Year 2 | $1,305,861 | $55,861 |

| Year 3 | $1,334,720 | $84,720 |

| Year 4 | $1,364,217 | $114,217 |

Total gains if you were to sell Irwill Hill Residences and purchase a resale condo: $114,217 – $72,001 = $42,216

Buying an HDB

It’s essential to note that if the choice is to purchase a resale HDB after selling Irwell Hill Residences, you’ll have to go through the 15-month wait-out period. We’re also assuming that you already meet the age requirement to buy an HDB which is to be at least 35 years of age.

When acquiring a resale HDB, single buyers face no restrictions regarding the flat type they can purchase. Limitations arise only if the decision is to opt for a BTO. However, purchasing a BTO involves a lengthy 30-month wait-out period along with a construction duration of 3 to 4 years. From an investment standpoint, this prolonged waiting period represents a significant loss of potential opportunities.

Another important aspect to consider when buying an HDB is the restriction on renting out the entire unit until it fulfils its Minimum Occupation Period (MOP). During these 5 years, the technical requirement is to reside in the unit, with the option to lease out only the surplus rooms. For instance, if a 4-room flat is purchased, only 2 bedrooms can be rented out.

Considering that the loan quantum for an HDB typically amounts to approximately half of that for a private property, let’s assume a budget of $625,000 for an HDB (half of $1.25M) as a basis.

| Towns | 3-Room | 4-Room | 5-Room |

| Ang Mo Kio | $385,000 | $538,000 | $725,500 |

| Bedok | $370,000 | $523,000 | $684,000 |

| Bishan | * | $715,000 | $929,000 |

| Bukit Batok | $385,000 | $595,000 | $758,000 |

| Bukit Merah | $439,500 | $860,000 | $928,000 |

| Bukit Panjang | $400,000 | $508,000 | $615,000 |

| Bukit Timah | * | * | * |

| Central | $470,000 | * | * |

| Choa Chu Kang | $391,500 | $500,000 | $579,000 |

| Clementi | $397,500 | $607,400 | * |

| Geylang | $330,000 | $610,000 | $750,000 |

| Hougang | $390,000 | $532,500 | $690,000 |

| Jurong East | $380,000 | $473,000 | $625,000 |

| Jurong West | $360,000 | $500,000 | $580,000 |

| Kallang/Whampoa | $385,000 | $790,400 | $907,900 |

| Marine Parade | * | * | * |

| Pasir Ris | * | $554,000 | $658,000 |

| Punggol | $470,000 | $600,000 | $677,500 |

| Queenstown | $389,400 | $928,000 | * |

| Sembawang | $447,500 | $556,900 | $580,000 |

| Sengkang | $465,000 | $558,000 | $630,000 |

| Serangoon | $420,000 | $575,000 | $731,500 |

| Tampines | $420,000 | $569,000 | $678,000 |

| Toa Payoh | $350,000 | $780,000 | $900,000 |

| Woodlands | $374,000 | $498,000 | $590,000 |

| Yishun | $385,000 | $500,000 | $650,000 |

Examining the third-quarter average prices of HDB flats across various towns, a budget of $625,000 does offer you a diverse selection of flats, subject to considerations such as unit size, location, and age.

Since you did not specify any preferences regarding location, let’s proceed by considering the purchase price set at $625,000. Additionally, we’ll hypothetically assume the acquisition of a 4-room flat, with a plan to lease out 2 bedrooms while awaiting the MOP. To err on the conservative side, let’s estimate a monthly rental rate of $800 for each bedroom.

| Description | Amount |

| Purchase price | $625,000 |

| BSD | $13,350 |

| Loan required (assuming 75% LTV) | $468,750 |

Cost to purchase a resale HDB and hold it for 3 years (looking at the same 5-year period as before – you’ll have to wait till next year before selling Irwell Hill Residences and also observe the 15-month wait out period)

| Description | Amount |

| BSD | $13,350 |

| Interest expenses (assuming a 3% interest and a 25 year tenure)* | $40,484 |

| Town Council service & conservancy fees (assuming $70/month) | $2,520 |

| Property tax | $6,912 |

| Rental income (assuming $1,600/month) | $57,600 |

| Agency fees (payable once every 2 years) | $1,728 |

| Total costs | $7,394 |

*This is if you were to take an HDB loan

We will use the annualised growth rate of HDBs over the last 10 years at 1.42%, to do a simple projection.

| Time period | Price | Gains |

| Starting point | $625,000 | $0 |

| Year 1 | $633,875 | $8,875 |

| Year 2 | $642,876 | $17,876 |

| Year 3 | $652,005 | $27,005 |

Total gains if you were to sell Irwill Hill Residences and purchase a resale HDB: $27,005 – $7,394 = $19,611

What should you do?

The whole premise of this question banks on the fact that Irwell Hill Residences would not appreciate as much condominiums in the OCR. For now, the concern is real as the Additional Buyers Stamp Duty (ABSD) continues to put a lid on investments – both locals and foreigners alike. But as said, this can change in the future given 2025 is still some time away.

While we kept this in mind, we relied on the same capital appreciation when making our comparison to better compare outcomes based on cost. Why?

This is because we cannot accurately predict how prices move. There is an inclination for 1-bedders in the CCR to continue seeing slower growth due to the reason highlighted above, but we think that focusing on cost is a better approach since there’s greater certainty there.

Here’s what the three pathways look like:

| Remain status quo | Sell Irwell Hill Residences and purchase a resale condo | Sell Irwell Hill Residences and purchase a resale HDB | |

| Costs incurred | $79,998 | $72,001 | $7,394 |

| Potential gains | $64,369 | $42,216 | $19,611 |

First, let’s look at the decision between keeping Irwell Hill Residences versus selling it and purchasing a resale condo in the Outside of Central Region.

In both scenarios, the costs incurred are similar – only around 10% off each other at a quantum difference of just $8,000. Considering this, as well as the lower appreciation chances of Irwell Hill Residences, we’re inclined to shift our investment into a bigger, 2-bedroom development elsewhere.

Doing this incurs a lower cost and owning a 2-bedroom unit means you could rent out individual rooms for higher yield or just stay in one and rent out the other as an option. A 2-bedroom unit is also more sought after since tenants can split the cost of the unit, making each bedroom cheaper than renting a whole unit by themselves. This is advantageous considering the high rental cost environment we’re in now.

Moreover, if you can secure a unit at a lower price but with a higher rental yield, the cost incurred will be lower since your loan quantum will be reduced, thereby lowering the interest expense and BSD, which are the two factors that contribute most to the total costs.

Finally, there’s the option of purchasing an HDB. Given that this property primarily serves as an investment, choosing a private property might prove more advantageous compared to an HDB due to the latter’s limited investment potential and regulated market. As much as we’re seeing more and more million-dollar flats today, the overall market still appreciates less than private residences.

While HDBs might offer better rental yields, it’s crucial to note the limitations, including the inability to rent out the entire unit until the Minimum Occupation Period (MOP) elapses and the mandatory 15-month wait-out before purchasing another unit.

For short-term investment goals, this might not be the most optimal choice as it restricts the property’s potential and timeframe for profit generation. We don’t know what your present housing arrangement is, but moving into an HDB with 2 other housemates may bring about privacy concerns you don’t have now, so this is something you should take into consideration too.

With some time still remaining before you’ve to make a decision, re-evaluating based on the potential unit value at Irwell Hill Residences and exploring the possibility of refinancing to a lower-interest loan package could be beneficial. If prices are rising, prolonging the property hold might be advantageous. Conversely, if the anticipated capital gains fall short, opting to sell and invest in a resale condo with better potential and rental yield could be a more suitable move.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

0 Comments