Hi,

I am currently a Singapore PR looking at the possibility to upgrade from HDB to a 3-bedroom condo for better capital appreciation and potentially beef up my retirement funds from the sale of the condo in the future. I’m a 40 year old single mum with a 9 year old and an elderly mum and am the sole breadwinner of the family.

I currently hold a 21 year old 4-room HDB at Tiong Bahru area with a price evaluation of 1 mil based on SRX X-value.

Would like to seek your opinion on the possible resale/new launch options if I were to look for a condo around D3, D10 or D11 area. This new place will be our home for the next 10 years due to schooling options around the vicinity.

I’m thinking of a new launch due to the progressive payment plan which is less burdensome on monthly cash layout for the first two years. However, I would still need to rent a place for at least 3 years (which I will be renting back at Tiong Bahru HDB for my child’s current schooling convenience) before the new launch is completed which is also another expense that I thought might be channelled to renovation if I were to get a resale (looking at older freehold at these areas too).

Appreciate your valuable inputs on this!

Thank you!

Hi there,

Thank you for reaching out with your question.

While a private property may be better from a capital gain standpoint, this becomes a lot more difficult to answer when you are the sole breadwinner of your family and you have both an elderly mum and child to take care of.

And as you noted, both resale and new launch condod come with their merits and drawbacks, which we’ll explore further in the article.

To begin, let’s take a look at your affordability.

Affordability

Selling

| Selling price | $1,000,000 |

| Outstanding loan | $380,000 |

| CPF used plus accrued interest | $200,000 |

| Sales proceeds | $420,000 |

Buying

| Maximum loan based on the age of 40 with a monthly income of $17K at 4.8% interest* | $1,055,852 (25-year tenure) |

| CPF | $200,000 |

| Cash | $620,000 |

| Total loan + CPF + cash | $1,875,852 |

| BSD based on $1,875,852 | $63,392 |

| Estimated affordability | $1,812,460 |

*We have also taken into account your monthly car loan repayment and credit card expenses

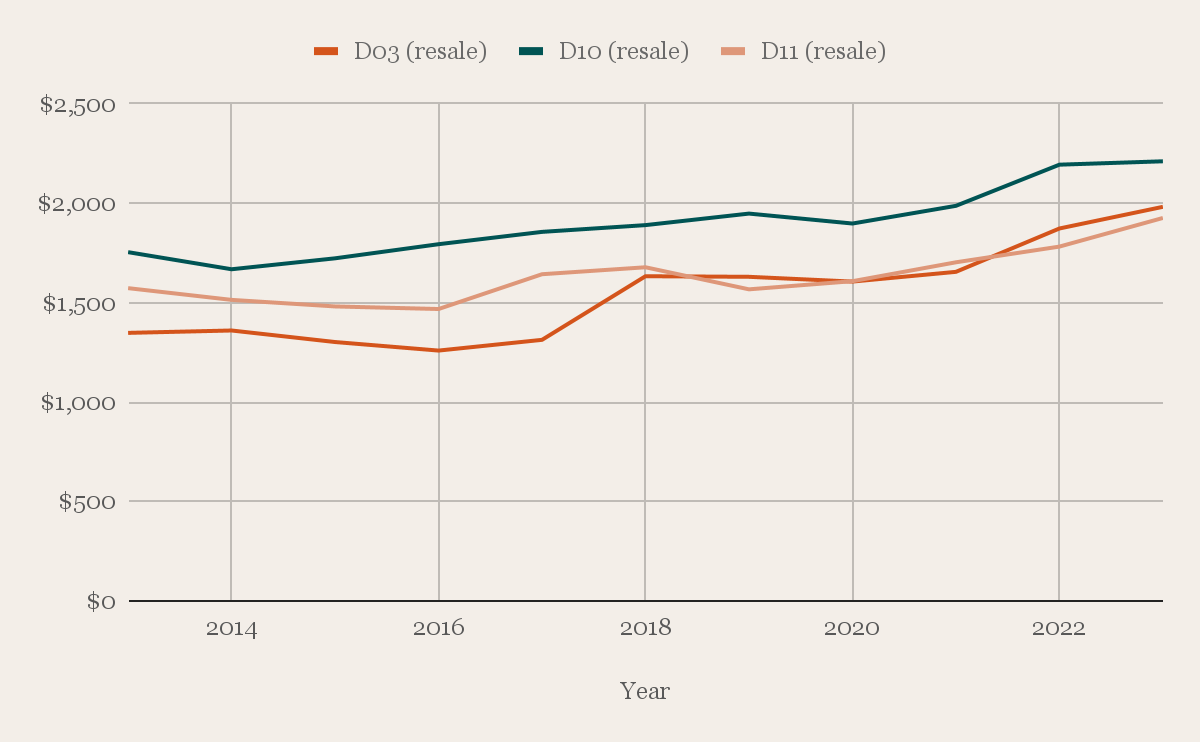

Now let’s take a look at the performance of condominiums in Districts 3, 10 and 11.

Performance of condos in D3, 10, 11

| Year | D3 (resale) | D10 (resale) | D11 (resale) |

| 2013 | $1,348 | $1,754 | $1,573 |

| 2014 | $1,360 | $1,668 | $1,514 |

| 2015 | $1,302 | $1,723 | $1,481 |

| 2016 | $1,259 | $1,794 | $1,468 |

| 2017 | $1,313 | $1,856 | $1,643 |

| 2018 | $1,633 | $1,890 | $1,678 |

| 2019 | $1,630 | $1,948 | $1,567 |

| 2020 | $1,606 | $1,898 | $1,608 |

| 2021 | $1,655 | $1,987 | $1,703 |

| 2022 | $1,873 | $2,194 | $1,782 |

| 2023 | $1,982 | $2,211 | $1,926 |

| Average | 4.24% | 2.42% | 2.19% |

Of the three districts, condominiums in District 3 have recorded the highest average growth rate over the past decade. During this period, both the Outside Central Region (OCR) and Rest of Central Region (RCR) outperformed the Core Central Region (CCR). This aligns with what we observe here, as D3 is in the RCR, while the other two districts are in the CCR. The higher growth rates in the OCR and RCR can likely be attributed to the government’s decentralisation efforts, as well as an increase in HDB upgraders (among other things). Additionally, the already elevated prices in prime districts offer less room for further appreciation. The CCR, which attracts a significant number of investors and foreign buyers, may also see prices held back by the latest hike in Additional Buyer’s Stamp Duty (ABSD) to 60% for foreigners and entities.

The debate between purchasing new launches versus resale properties is a long-standing one and ultimately depends on the individual property and your timing in terms of entry and exit. Each option has its pros and cons. Now, let’s examine how some of the newer properties in your preferred districts are performing compared to their older counterparts in the same area.

For newer developments, we’ll look at their initial launch to the present and compare this to the growth rate of older projects over the same period.

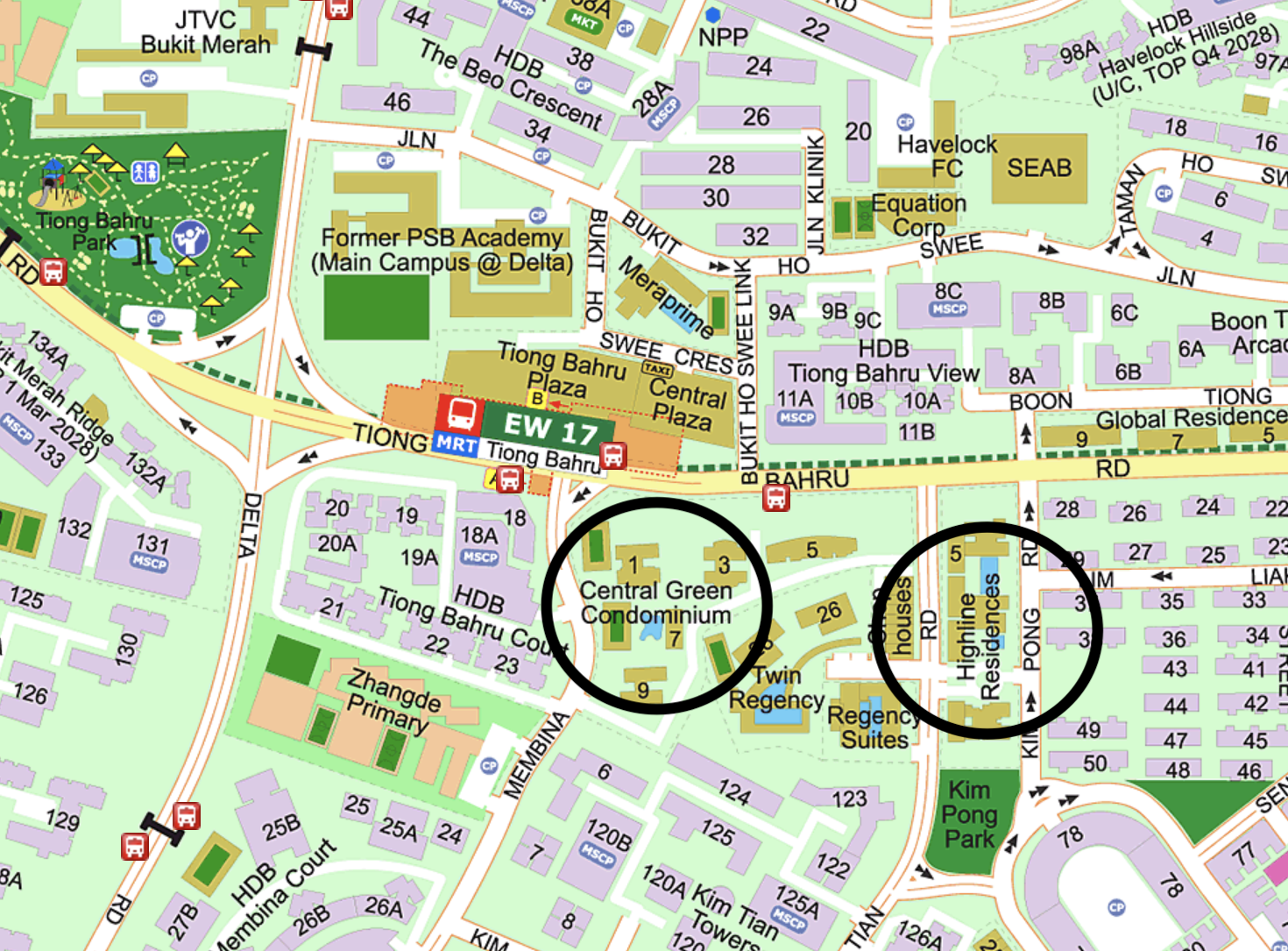

Tiong Bahru (D3)

| Project | Completion year | Tenure | No. of units |

| Central Green Condominium | 1995 | 99-year leasehold | 412 |

| Highline Residences | 2018 | 99-year leasehold | 500 |

| Year | Central Green Condominium | Highline Residences |

| 2014 | $1,273 | $1,856 |

| 2015 | $1,246 | $1,908 |

| 2016 | $1,246 | $1,796 |

| 2017 | $1,251 | $1,885 |

| 2018 | $1,412 | $1,968 |

| 2019 | $1,413 | $1,959 |

| 2020 | $1,412 | $1,912 |

| 2021 | $1,443 | $2,064 |

| 2022 | $1,479 | $2,192 |

| 2023 | $1,542 | $2,266 |

| Average | 2.15% | 2.24% |

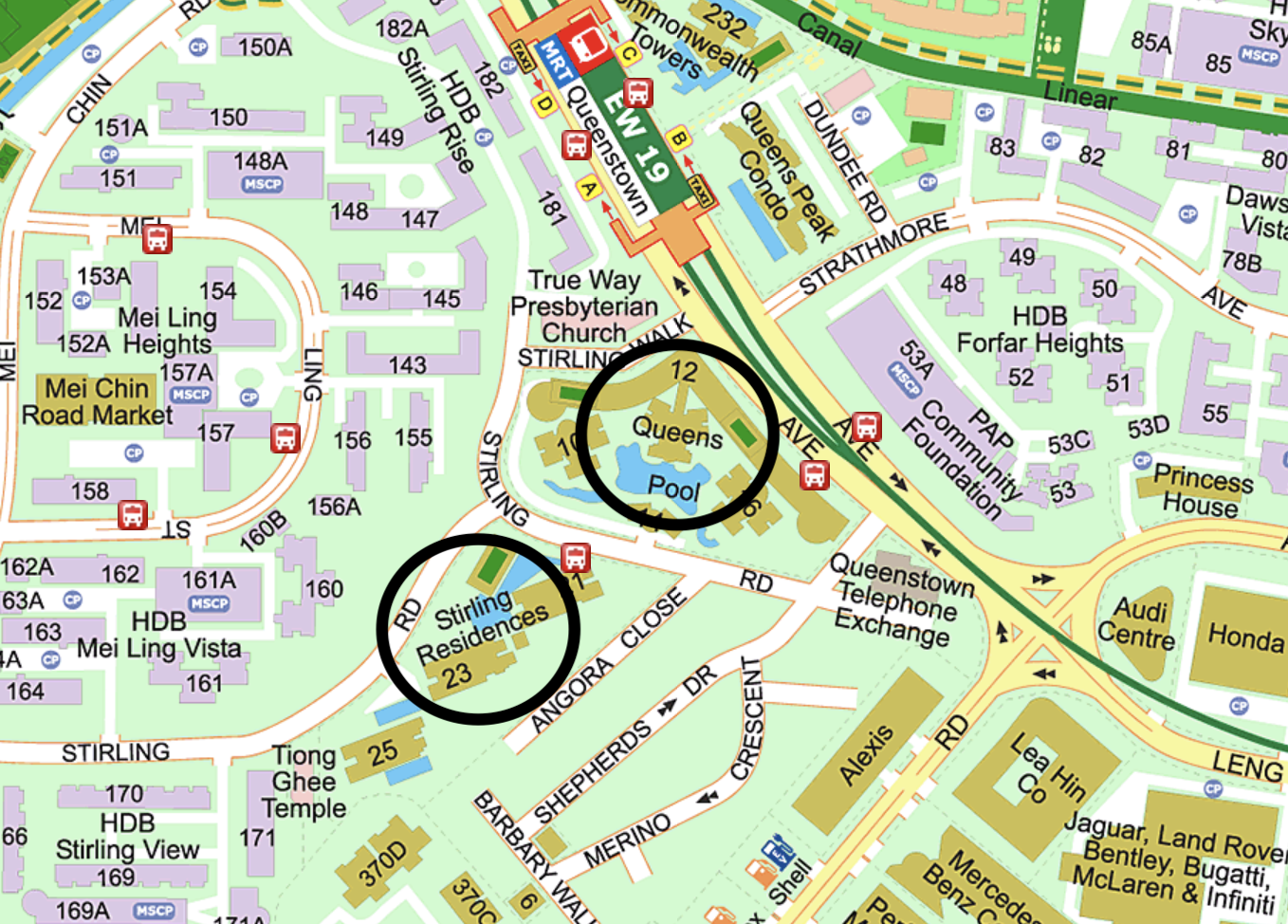

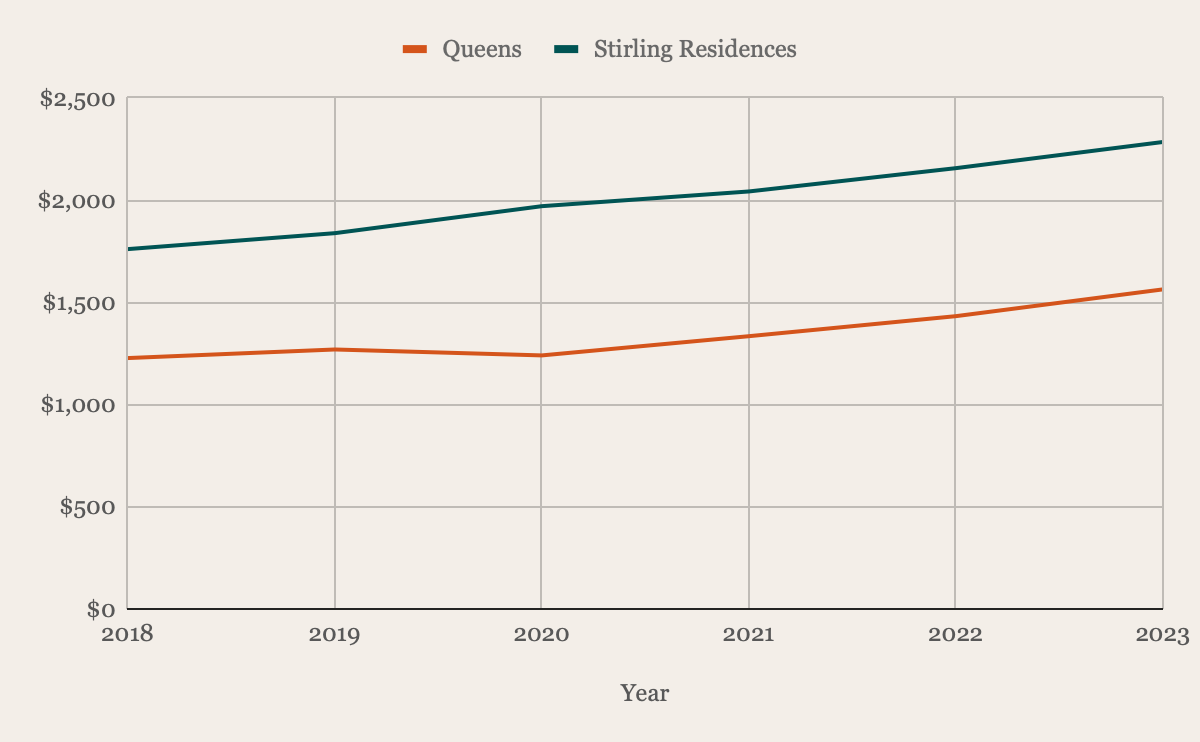

Queenstown (D03)

| Project | Completion year | Tenure | No. of units |

| Queens | 2002 | 99-year leasehold | 722 |

| Stirling Residences | 2022 | 99-year leasehold | 1259 |

| Year | Queens | Stirling Residences |

| 2018 | $1,227 | $1,760 |

| 2019 | $1,269 | $1,838 |

| 2020 | $1,240 | $1,970 |

| 2021 | $1,334 | $2,042 |

| 2022 | $1,432 | $2,156 |

| 2023 | $1,563 | $2,284 |

| Average | 4.96% | 5.35% |

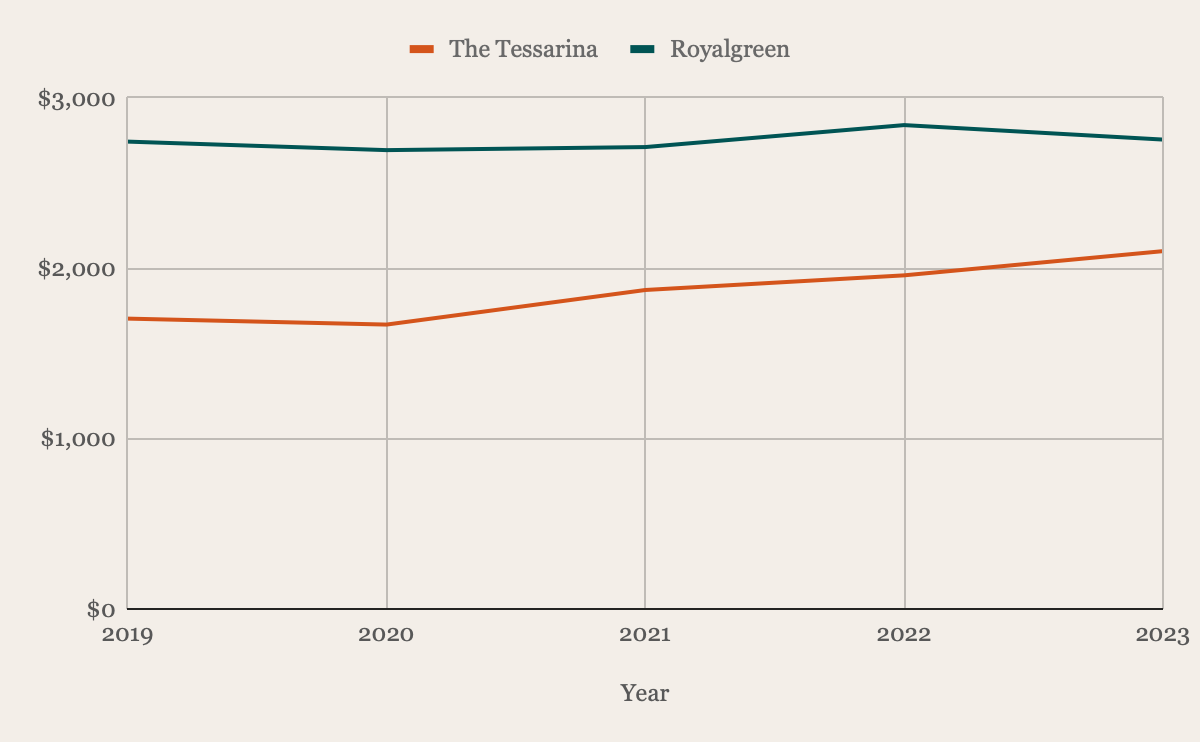

Bukit Timah (D10)

| Project | Completion year | Tenure | No. of units |

| The Tessarina | 2003 | Freehold | 443 |

| RoyalGreen | 2021 | Freehold | 285 |

| Year | The Tessarina | Royalgreen |

| 2019 | $1,704 | $2,743 |

| 2020 | $1,669 | $2,693 |

| 2021 | $1,872 | $2,711 |

| 2022 | $1,958 | $2,840 |

| 2023 | $2,100 | $2,755 |

| Average | 5.36% | 0.11% |

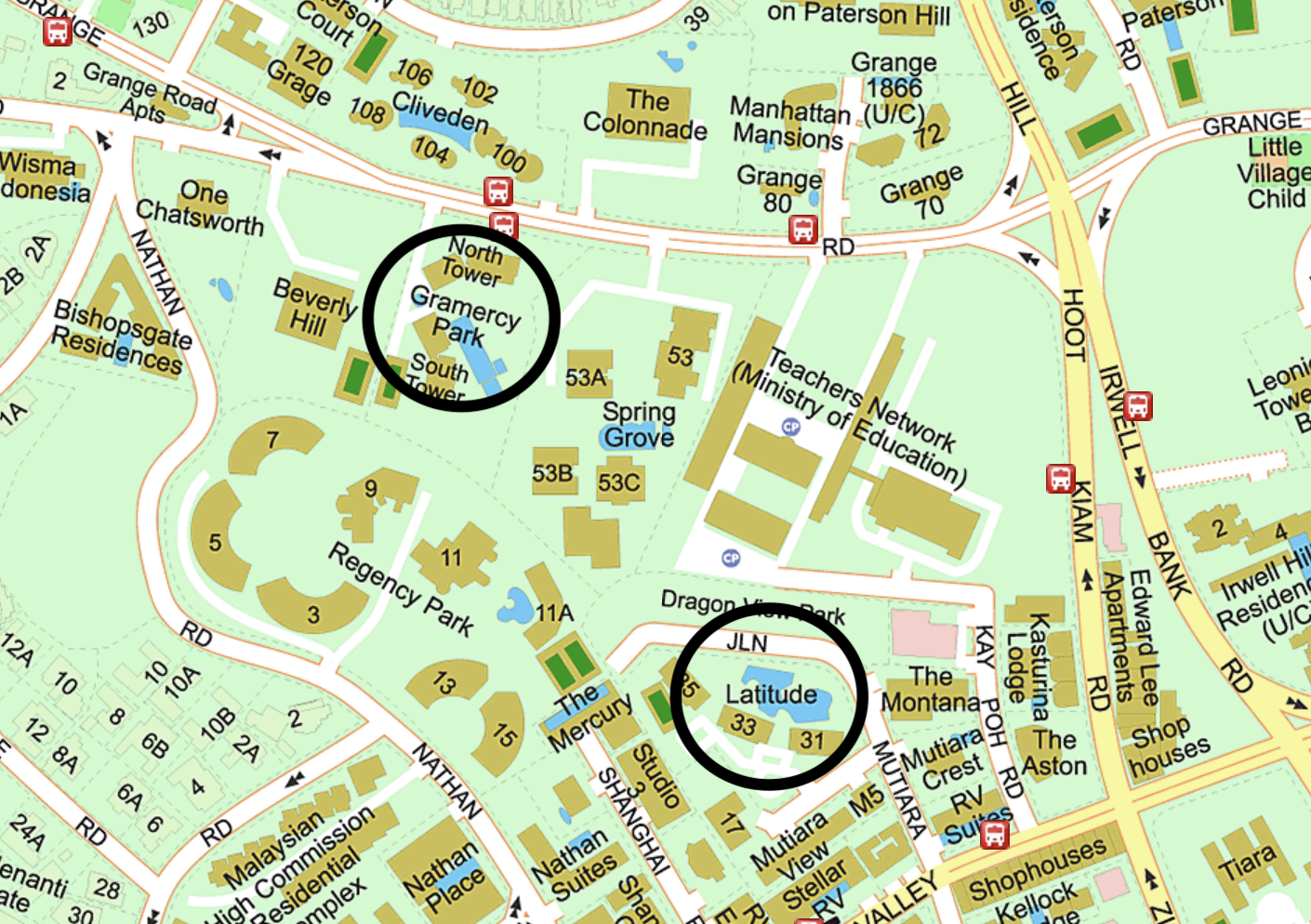

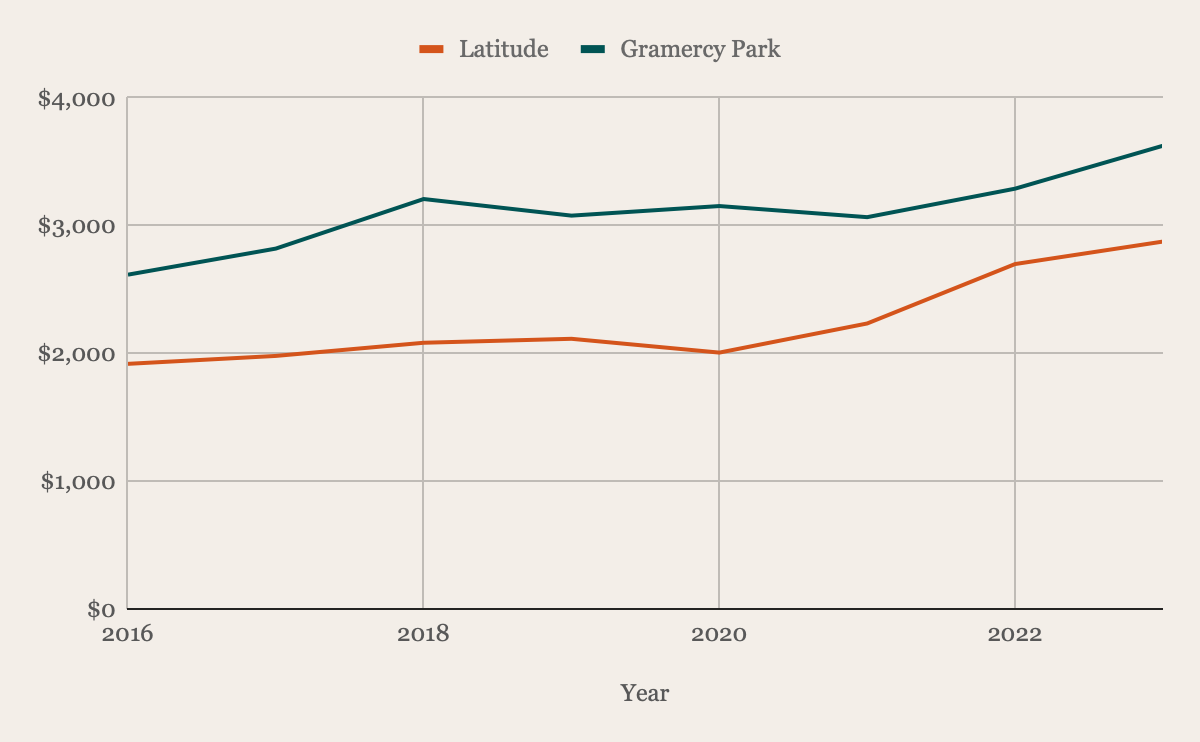

Tanglin (D10)

| Project | Completion year | Tenure | No. of units |

| Latitude | 2010 | Freehold | 217 |

| Gramercy Park | 2016 | Freehold | 174 |

| Year | Latitude | Gramercy Park |

| 2016 | $1,918 | $2,616 |

| 2017 | $1,980 | $2,820 |

| 2018 | $2,083 | $3,208 |

| 2019 | $2,114 | $3,078 |

| 2020 | $2,006 | $3,153 |

| 2021 | $2,234 | $3,066 |

| 2022 | $2,699 | $3,289 |

| 2023 | $2,875 | $3,625 |

| Average | 5.95% | 4.77% |

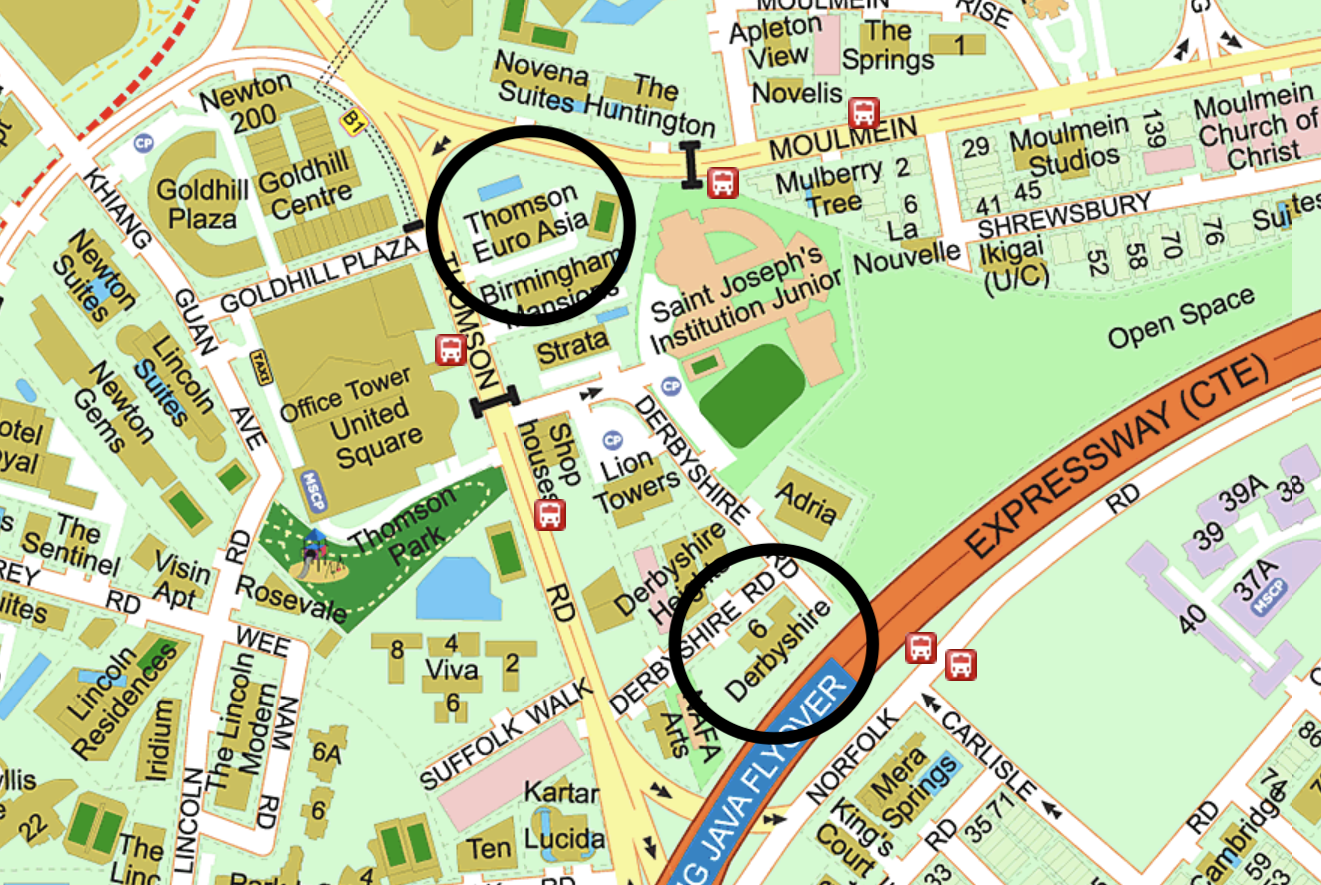

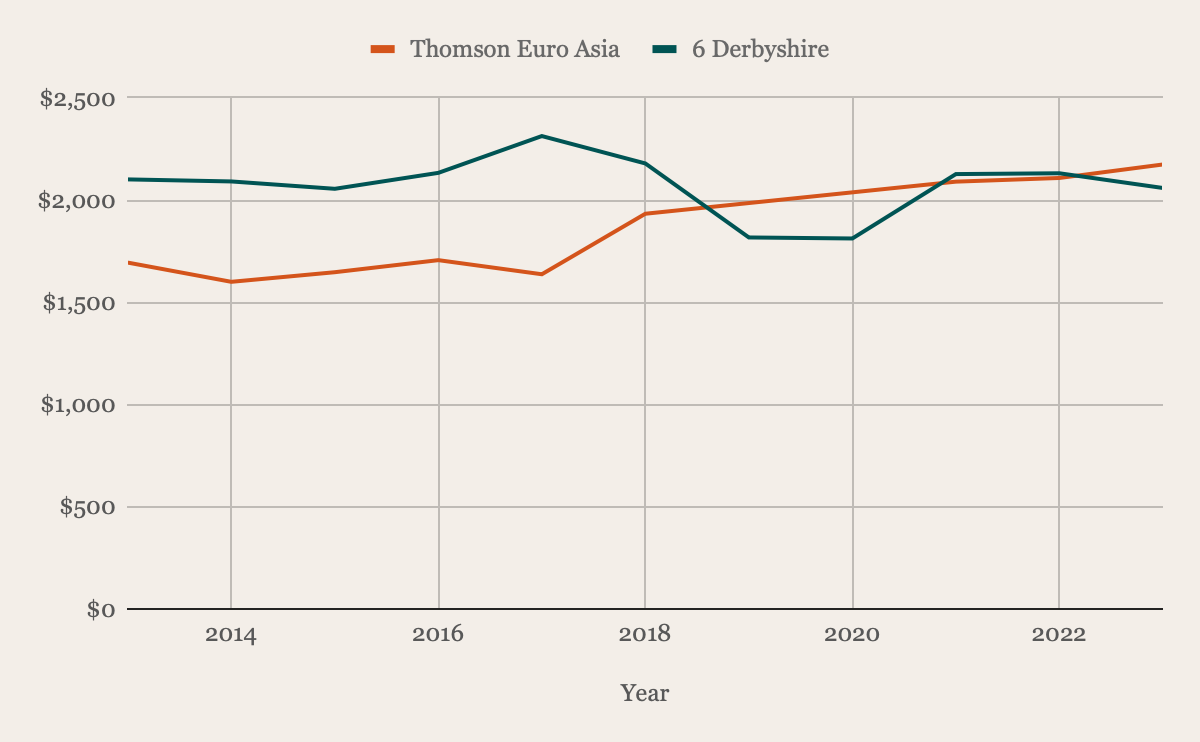

Novena (D11)

| Project | Completion year | Tenure | No. of units |

| Thomson Euro Asia | 2002 | Freehold | 163 |

| 6 Derbyshire | 2017 | Freehold | 168 |

| Year | Thomson Euro Asia | 6 Derbyshire |

| 2013 | $1,694 | $2,101 |

| 2014 | $1,600 | $2,091 |

| 2015 | $1,647 | $2,055 |

| 2016 | $1,706 | $2,133 |

| 2017 | $1,637 | $2,313 |

| 2018 | $1,933 | $2,179 |

| 2019 | – | $1,817 |

| 2020 | – | $1,812 |

| 2021 | $2,090 | $2,127 |

| 2022 | $2,108 | $2,131 |

| 2023 | $2,174 | $2,059 |

| Average | 2.53% | -0.20% |

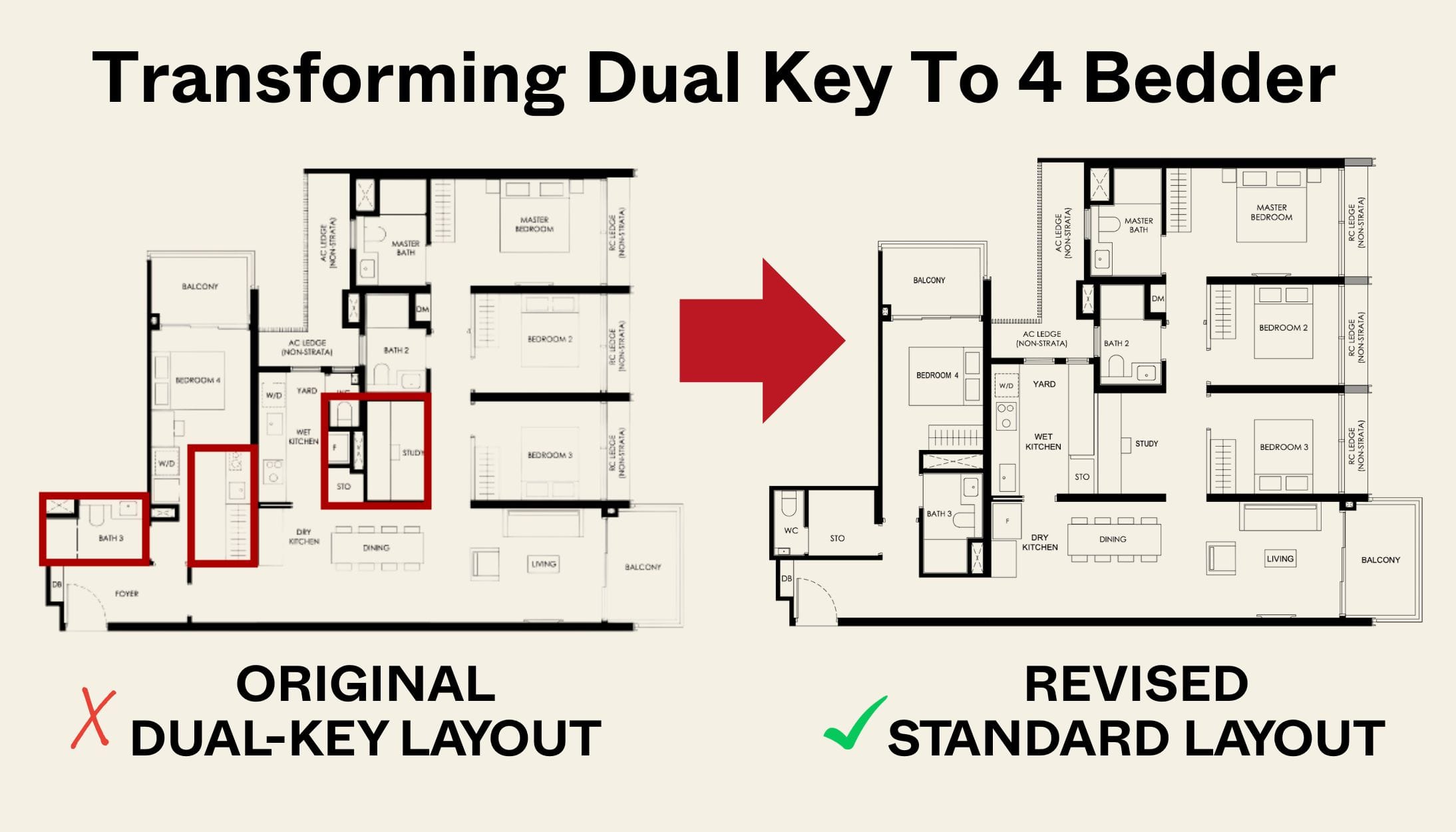

These examples illustrate that a new launch doesn’t always outperform a resale property (or neither can you conclusively say that a resale is better). The key factors that determine a property’s success still come down to price, location, development characteristics, and even smaller details like the unit layouts.

That being said, new launches do offer several distinct advantages. One benefit you’ve noted is the progressive payment scheme, which leads to lower monthly repayments during the construction phase. This helps to ease cash flow and reduces interest expenses over time. However, if you do not have alternative housing during the construction period, rental costs can add up significantly.

Another advantage is the developer’s pricing strategy, which typically increases as the project progresses. Early buyers may see paper gains as prices rise during the launch, benefiting from capital appreciation before the project is even completed. That said, this is not guaranteed, and price hikes don’t always materialise if demand is weaker than anticipated or if market conditions shift.

In contrast, resale properties come with their own set of perks. Although full monthly repayments begin as soon as the transaction is completed, you won’t have to wait 3-4 years for the property to be built. Moreover, with a resale unit, you get to physically inspect the property, its condition, and its surroundings, offering more certainty and clarity about what you’re purchasing.

Now let’s take a look at the potential cost incurred for the two pathways you’re considering.

Potential pathways

Buy a new launch

For calculation purposes, let’s assume you utilise your maximum budget of $1.8M. We’ll use the average rental price of $3,800 for a 4-room HDB in Bukit Merah. Given your 10-year timeframe, we will consider a rental period of 3.5 years while the project is under construction, followed by 6.5 years of occupancy in the property.

| Purchase price | $1,800,000 |

| BSD | $59,600 |

| CPF + cash | $820,000 |

| Loan required | $1,039,600 |

Progressive payment plan

Considering you have a significant amount of CPF and cash, these funds will be used to cover the monthly repayments during the initial stages. This calculation assumes an interest rate of 4% and a loan tenure of 25 years.

| Stage | % of purchase price | Disbursement amount | Monthly estimated interest | Monthly estimated principal | Monthly estimated repayment | Duration* | Total interest cost |

| Completion of foundation | 5% | $0 | $0 | $0 | $0 | 6-9 months (from launch) | $0 |

| Completion of reinforced concrete | 10% | $0 | $0 | $0 | $0 | 6-9 months | $0 |

| Completion of brick wall | 5% | $49,600 (3% loan disbursed) | $165 | $96 | $261 | 3-6 months | $990 |

| Completion of ceiling/roofing | 5% | $139,600 | $465 | $272 | $737 | 3-6 months | $2,790 |

| Completion of electrical wiring/plumbing | 5% | $229,600 | $765 | $447 | $1,212 | 3-6 months | $4,590 |

| Completion of roads/car parks/drainage | 5% | $319,600 | $1,065 | $622 | $1,687 | 3-6 months | $6,390 |

| Issuance of TOP | 25% | $769,600 | $2,565 | $1,497 | $4,062 | Usually a year before CSC | $15,390 |

| Certificate of Statutory Completion (CSC) | 15% | $1,039,600 | $3,465 | $2,022 | $5,487 | Monthly repayment until property is sold | $228,690 |

| Total interest paid in 10 years | $258,840 |

*We will assume the longest duration at every stage

Cost incurred

| BSD | $59,600 |

| Interest expense | $258,840 |

| Property tax | $18,720 |

| Maintenance fees (Assuming $350/month) | $27,300 |

| Rental expense | $159,600 |

| Renovation cost* | $30,000 |

| Total costs | $554,060 |

*Depends on the extent of work done

Buy a resale

Similarly, we will assume that you max out your budget at $1.8M and hold the property for 10 years.

| BSD | $59,600 |

| Interest expense | $360,739 |

| Property tax | $28,800 |

| Maintenance fees (Assuming $350/month) | $42,000 |

| Renovation cost* | $50,000 |

| Total costs | $541,139 |

*Depends on the extent of work done

What should you do?

Reviewing resale transactions from January this year to the present, with a budget of $1.8M, for units that are minimally 1,000 sq ft in D03, 10, and 11, here are some projects you could consider:

| Project | District | Tenure | Completion year |

| Allsworth Park | 10 | 999 years | 1985 |

| Dynasty Garden | 10 | Freehold | 1979 |

| Emerald Park | 3 | 99 years | 1993 |

| Harvest Mansions | 3 | 99 years | 1996 |

| Loft @ Nathan | 10 | Freehold | 2014 |

| M21 | 11 | Freehold | 2010 |

| Mon Jervois | 10 | 99 years | 2016 |

| River Place | 3 | 99 years | 1999 |

| Spring Grove | 10 | 99 years | 1996 |

| Stevens Loft | 10 | Freehold | 2003 |

| Tanglin Regency | 10 | 99 years | 1998 |

| Tanglin View | 3 | 99 years | 2001 |

We recommend consulting a property agent for a more detailed analysis of the potential developments.

Since you are a family of 3, we assume you’ll need at least three bedrooms or a 2-bedroom unit with a study. Unfortunately, within your budget, there are currently no new launches in your preferred districts that offer these unit types. Therefore, you may need to consider resale properties or explore options outside these areas.

When comparing the associated costs between a new launch and a resale property over a 10-year period, the difference is not particularly significant. As previously noted, resale properties can still appreciate in value – potentially as much as, or even more than, new launches if the right property is chosen.

If you are open to considering locations outside your preferred districts, you might think about purchasing a new launch elsewhere and moving in after your son graduates from primary school, especially since you would need to rent for three years regardless.

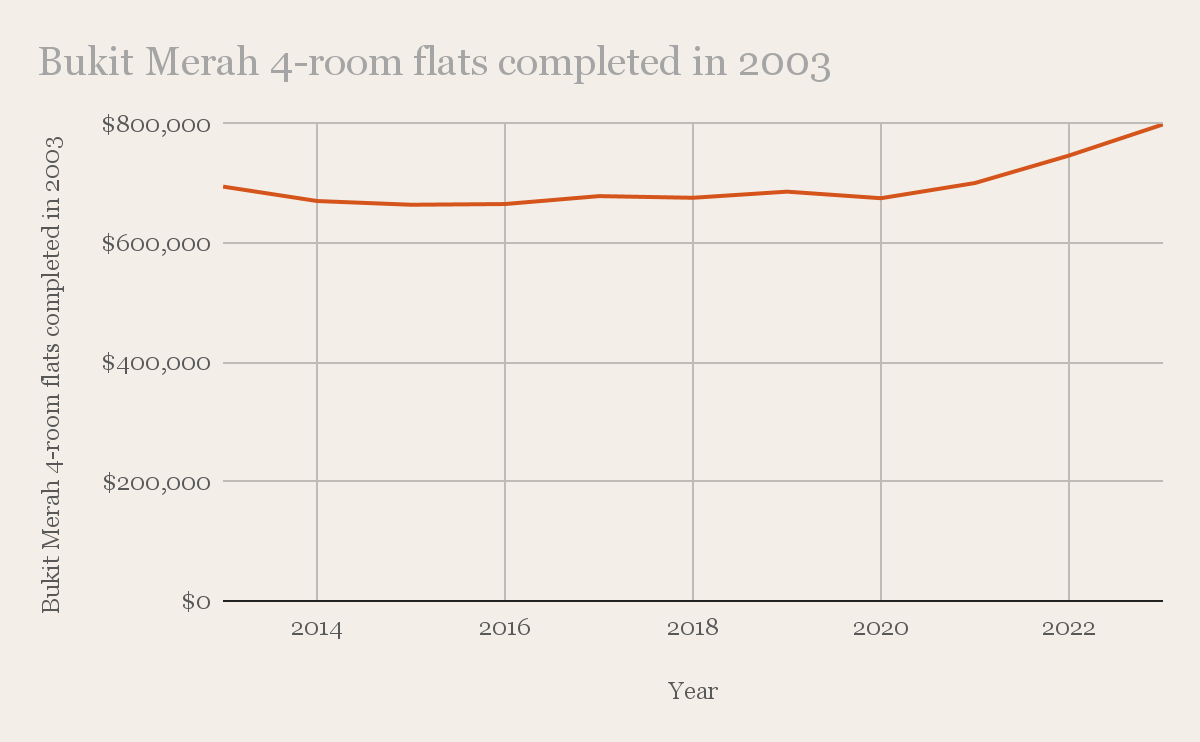

Given your lower outstanding loan, another option you might consider is maintaining the status quo, which would likely result in significantly lower costs. Let’s quickly review your current property’s performance. Since your flat is now 21 years old, we’ll focus on 4-room flats in Bukit Merah that were completed in 2003.

| Year | Bukit Merah 4-room flats completed in 2003 |

| 2013 | $694,733 |

| 2014 | $670,556 |

| 2015 | $664,295 |

| 2016 | $665,505 |

| 2017 | $678,792 |

| 2018 | $675,995 |

| 2019 | $686,274 |

| 2020 | $675,265 |

| 2021 | $700,725 |

| 2022 | $746,746 |

| 2023 | $798,990 |

| Average | 1.46% |

Costs incurred

| Interest expense (Assuming a remaining loan tenure of 20 years and 4% interest) | $123,768 |

| Property tax | $8,800 |

| Town council service & conservancy fees (Assuming $72/month) | $8,640 |

| Total costs | $141,208 |

Let’s compare the average annual growth rates required to break even in ten years for the 3 options.

| Potential pathway | Annual growth rate needed to breakeven |

| Buy a new launch | 3.08% |

| Buy a resale | 3.01% |

| Remain status quo | 1.41% |

Looking at the growth rates of the different property types over the past decade, the rates needed to break even appear achievable across all three options.

Being the sole breadwinner, it may be better to err on the side of caution and remain status quo. However, buying a private property gives you access to things like facilities and also the potential for greater appreciation. However, as you can see from the costs, the specific development you select will be crucial given it’s a large financial commitment – which ultimately might not be worth making the jump if you balance the risk/reward in your position.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Read next from Editor's Pick

Property Market Commentary The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

New Launch Condo Analysis This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

Landed Home Tours Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Overseas Property Investing Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Property Market Commentary 2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

Homeowner Stories Does The “Sell One, Buy Two” Strategy Still Work In 2025? 3 Real Stories From Singapore Homeowners

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?