I Have A Monthly Income Of $10K: Should I Buy A Tiny 1-Bedder Condo Or An Old But Centrally-Located Resale HDB?

November 29, 2024

Hi team,

Thank you so much for providing great insight and articles over the years!

I am really hoping you could give me some advice on my current situation. I am torn between this 2

- to buy a resale flat under HDB family scheme

- to buy a really tiny studio / 1 bedder private house

My goal is eventually be able to stay in a bigger condo. But based on my saving thus far, I can only afford a 50 years remaining lease HDB at near Central Area such as TPY. Just wondering if this is a good choice if my goal is to sell and get private in future? My concern is that this HDB will depreciate and I will be worse off and should just directly get a private now.

My only drawback for option 2 is the high interest rate environment now as I am able to only pay the minimum down payment. Size is not a main determining factor for now.

Kindly refer to my details below:

For myself:

- Age – Late 20s

- Income – $10,000 gross

- Cash that you can put towards property – $150,000

Just to add more color, I’ll be buying the property myself under the family scheme for HDB so I’ll be the sole owner with my parents as occupant instead. We currently don’t have a HDB.

Thank you!

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there,

Happy to hear that our content has been helpful to you!

One of the key factors to consider when choosing the most suitable choice is your intended holding period. This is because in some central locations with a limited supply of HDB flats, older flats may retain their value reasonably well due to the demand-supply dynamics.

That said, if the flat’s remaining lease does not cover the youngest buyer until they reach 95 years old, the reduced housing loan eligibility and grants could shrink the potential buyer pool as the property ages. Similarly, 1-bedroom condos face a comparable challenge, as their primary market consists of singles, couples, and investors, which inherently limits the buyer pool.

We’ll start by examining your affordability before comparing the performance of the specific property types you’re considering. Hopefully, this will provide some insight to guide your decision-making process.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

Based on your age of 28 and monthly income of $10,0000, at a 4.8% interest, your maximum loan quantum is:

| For the purchase of an HDB | $523,563 (25-year tenure) |

| For the purchase of a private property | $1,048,287 (30-year tenure) |

Buying an HDB

| Maximum loan based on the age of 28 with a fixed monthly income of $10K at 4.8% interest | $523,563 |

| CPF | $53,000 |

| Cash | $150,000 |

| Total loan + CPF + cash | $726,563 |

| BSD based on $726,563 | $16,396 |

| Estimated affordability | $710,167 |

When purchasing a private property, although you qualify for a maximum loan of $1,048,287, based on the available CPF and cash for the 25% down payment and BSD, your estimated affordability is around $740,000.

With a clearer understanding of your budget, let’s explore some potential options.

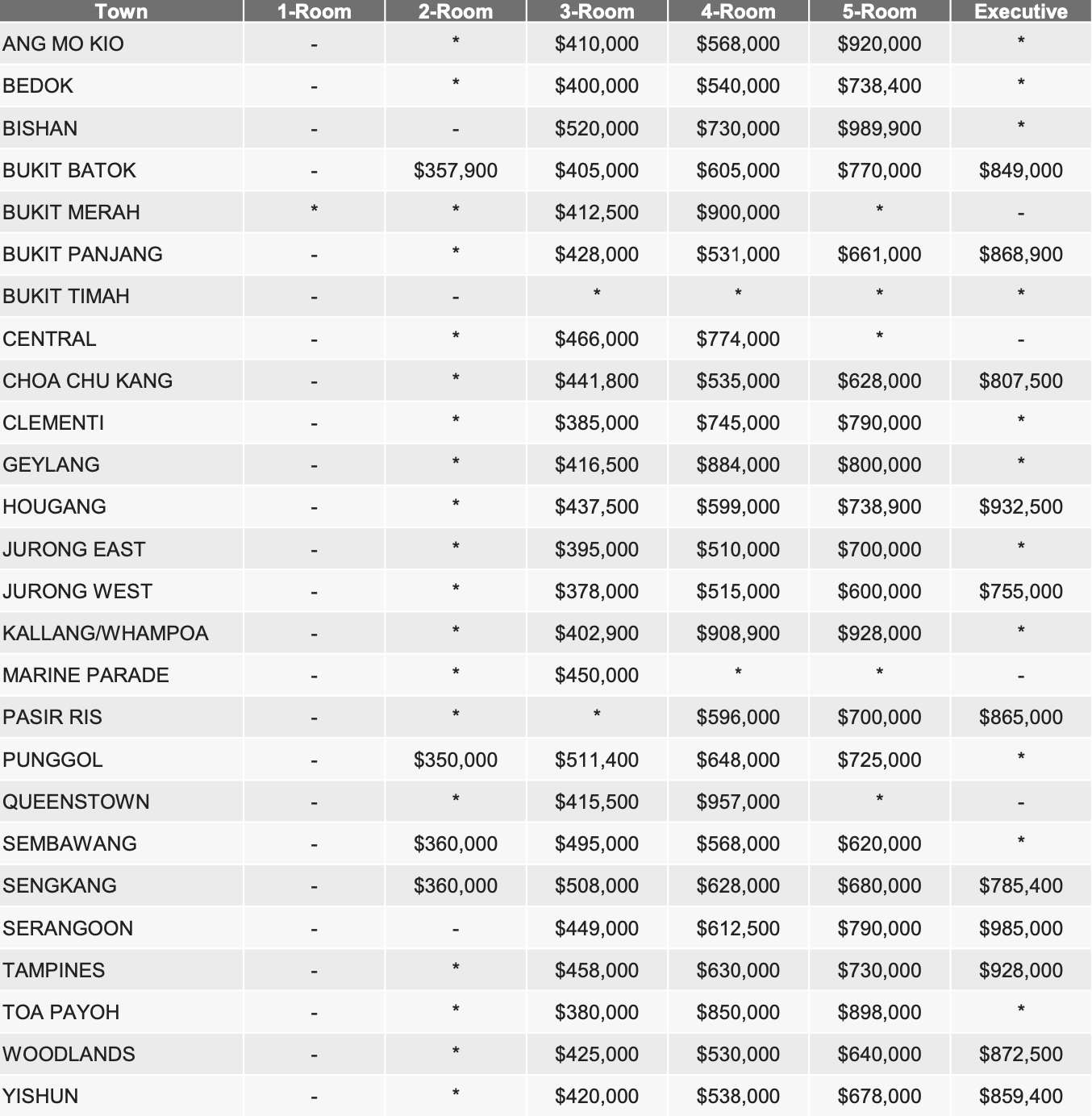

Source: HDB

If you’re considering a 4-room flat with a budget of around $710,000, you should be able to find a unit in most towns outside of the central region. If you’re looking for something more centrally located, then as you’ve mentioned, you might need to look at older flats. However, with just three people in your household, a 3-room flat could also be a good option, and in that case, you’d likely be able to find a younger unit in most towns.

Regarding private properties, based on resale transactions from January this year to the present, there are some 1-bedroom options. However, most of these are in freehold boutique developments, with the majority being under 600 sq ft.

Since you raised concerns about HDB depreciation, we can compare the growth rates of both older and newer HDB flats, as well as 1-bedroom condominiums over the past decade.

Performance of HDBs

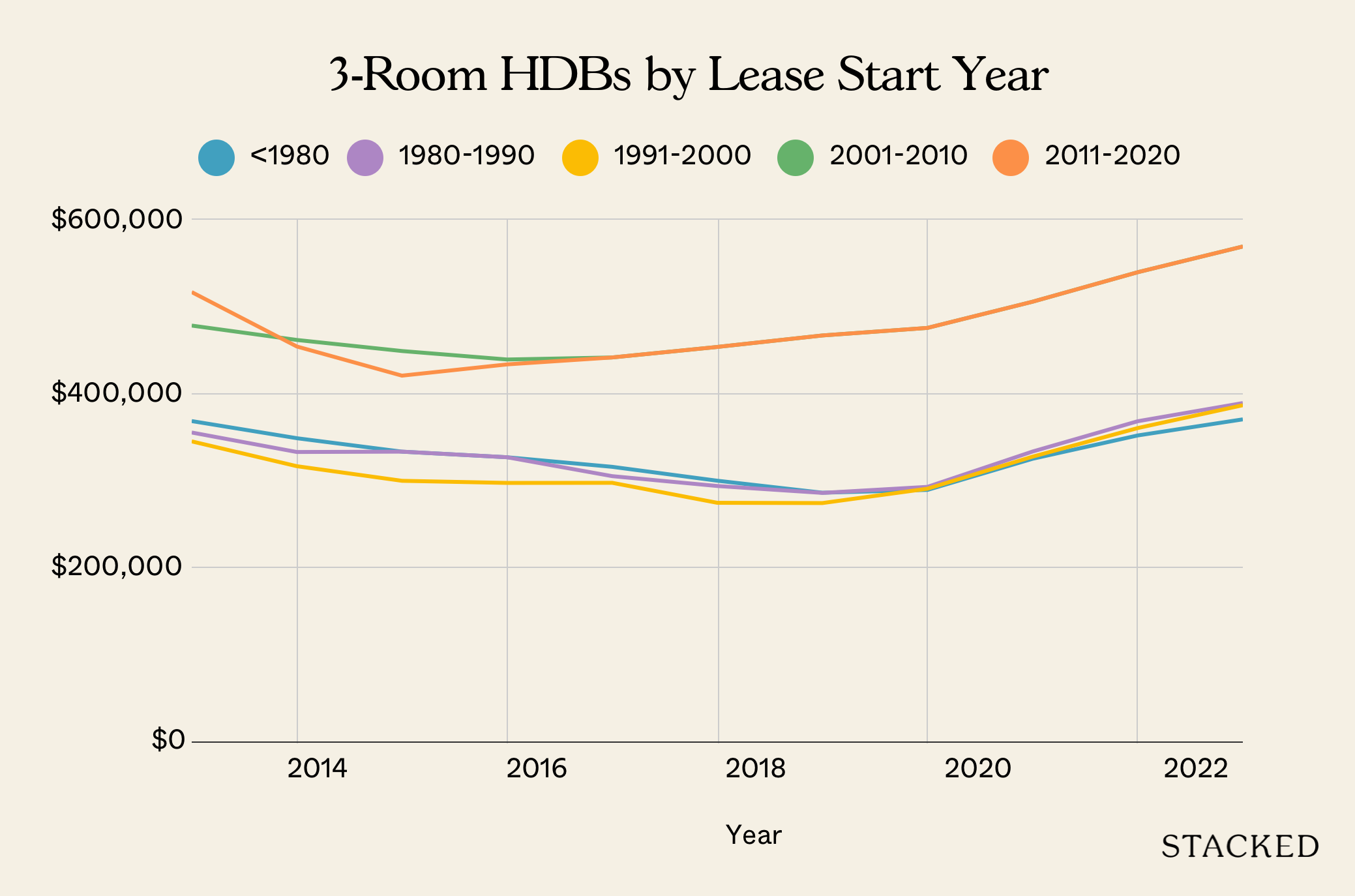

| Year | <1980 | 1980-1990 | 1991-2000 | 2001-2010 | 2011-2020 |

| 2013 | $367,391 | $354,310 | $344,180 | $476,685 | $515,000 |

| 2014 | $347,790 | $331,997 | $315,756 | $460,225 | $452,750 |

| 2015 | $332,404 | $332,404 | $299,042 | $447,550 | $419,368 |

| 2016 | $325,997 | $325,997 | $296,610 | $437,850 | $432,245 |

| 2017 | $315,031 | $304,365 | $296,745 | $440,192 | $440,192 |

| 2018 | $299,140 | $293,083 | $273,863 | $452,229 | $452,229 |

| 2019 | $285,393 | $285,190 | $273,559 | $465,364 | $465,364 |

| 2020 | $288,630 | $292,117 | $290,000 | $474,025 | $474,025 |

| 2021 | $324,256 | $332,559 | $326,686 | $504,001 | $504,001 |

| 2022 | $350,932 | $367,188 | $359,395 | $537,737 | $537,737 |

| 2023 | $369,350 | $388,025 | $385,544 | $567,194 | $567,194 |

| Average | 0.23% | 1.12% | 1.38% | 1.82% | 1.14% |

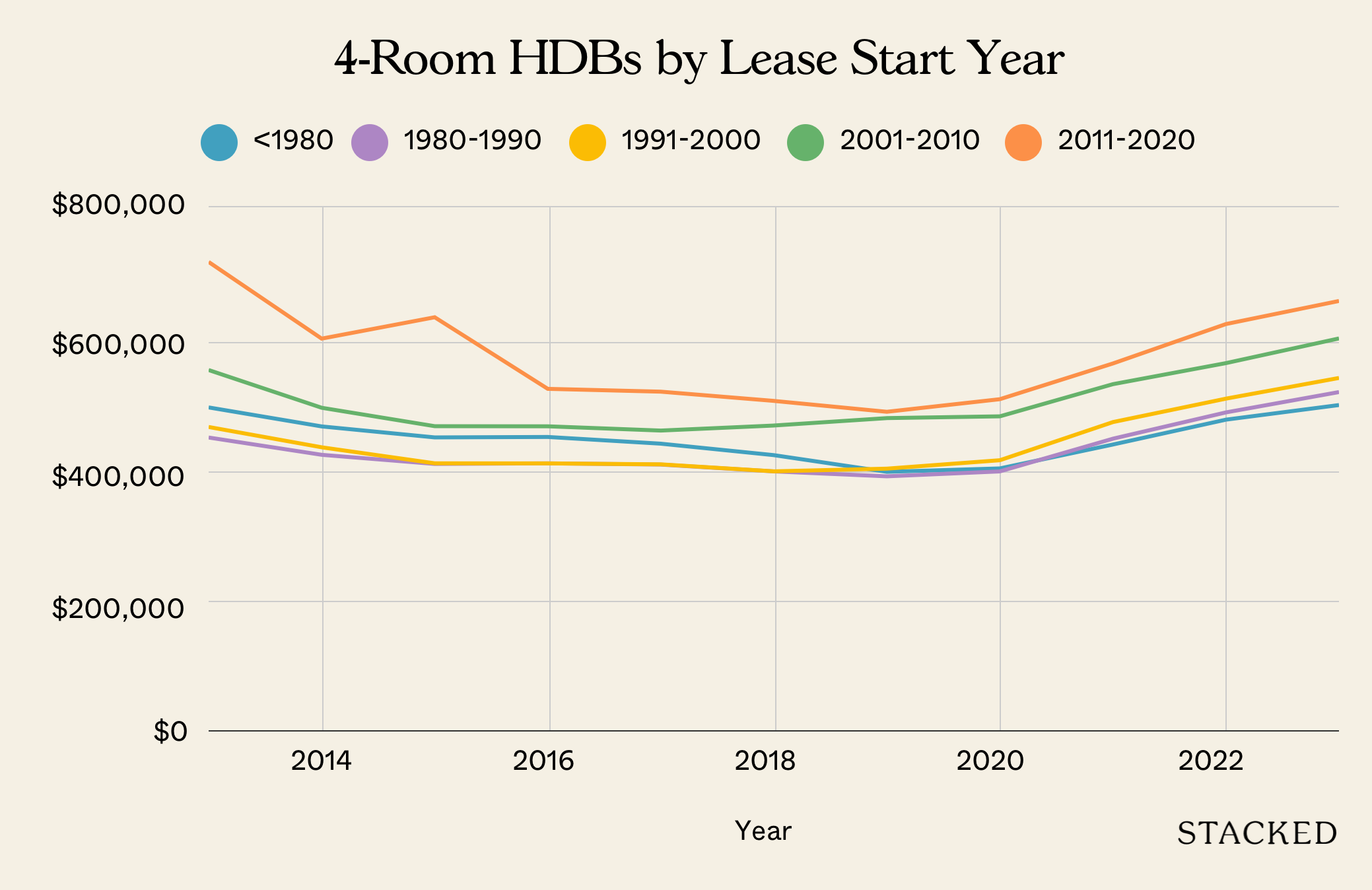

| Year | <1980 | 1980-1990 | 1991-2000 | 2001-2010 | 2011-2020 |

| 2013 | $492,629 | $446,701 | $462,800 | $549,676 | $714,594 |

| 2014 | $463,636 | $420,311 | $431,774 | $492,106 | $597,604 |

| 2015 | $446,856 | $406,395 | $407,349 | $463,986 | $630,236 |

| 2016 | $447,546 | $407,316 | $407,200 | $463,801 | $521,001 |

| 2017 | $437,304 | $405,437 | $405,751 | $457,305 | $516,668 |

| 2018 | $419,806 | $394,997 | $395,091 | $465,008 | $502,585 |

| 2019 | $394,352 | $387,466 | $399,178 | $476,328 | $485,959 |

| 2020 | $399,549 | $394,999 | $412,048 | $479,025 | $505,186 |

| 2021 | $436,013 | $444,896 | $470,236 | $528,091 | $559,683 |

| 2022 | $473,951 | $485,000 | $506,025 | $560,226 | $619,839 |

| 2023 | $496,252 | $516,058 | $537,604 | $597,883 | $655,080 |

| Average | 0.21% | 1.61% | 1.69% | 1.01% | -0.39% |

Over the past ten years, you can see that both 3-room and 4-room HDB flats completed before 1980 have experienced significantly slower growth compared to those built in more recent decades.

On the other hand, flats completed between 1980 and 2000 saw moderate growth, with the most significant price increases occurring during and after the pandemic. This surge can be attributed to a supply-demand imbalance, where the demand for HDB flats outpaced supply, pushing up prices even for older units. However, newer flats, particularly those built after 2000, have shown a much faster price recovery following the 2013 market downturn.

That said, age isn’t the only factor influencing price growth. Location and the availability of flats also play a critical role. Older flats located in areas with limited HDB supply tend to retain their value better than those in towns where new developments are continually being built. In these high-demand areas, even older flats can see more substantial price appreciation due to their scarcity.

Performance of 1-bedroom condos

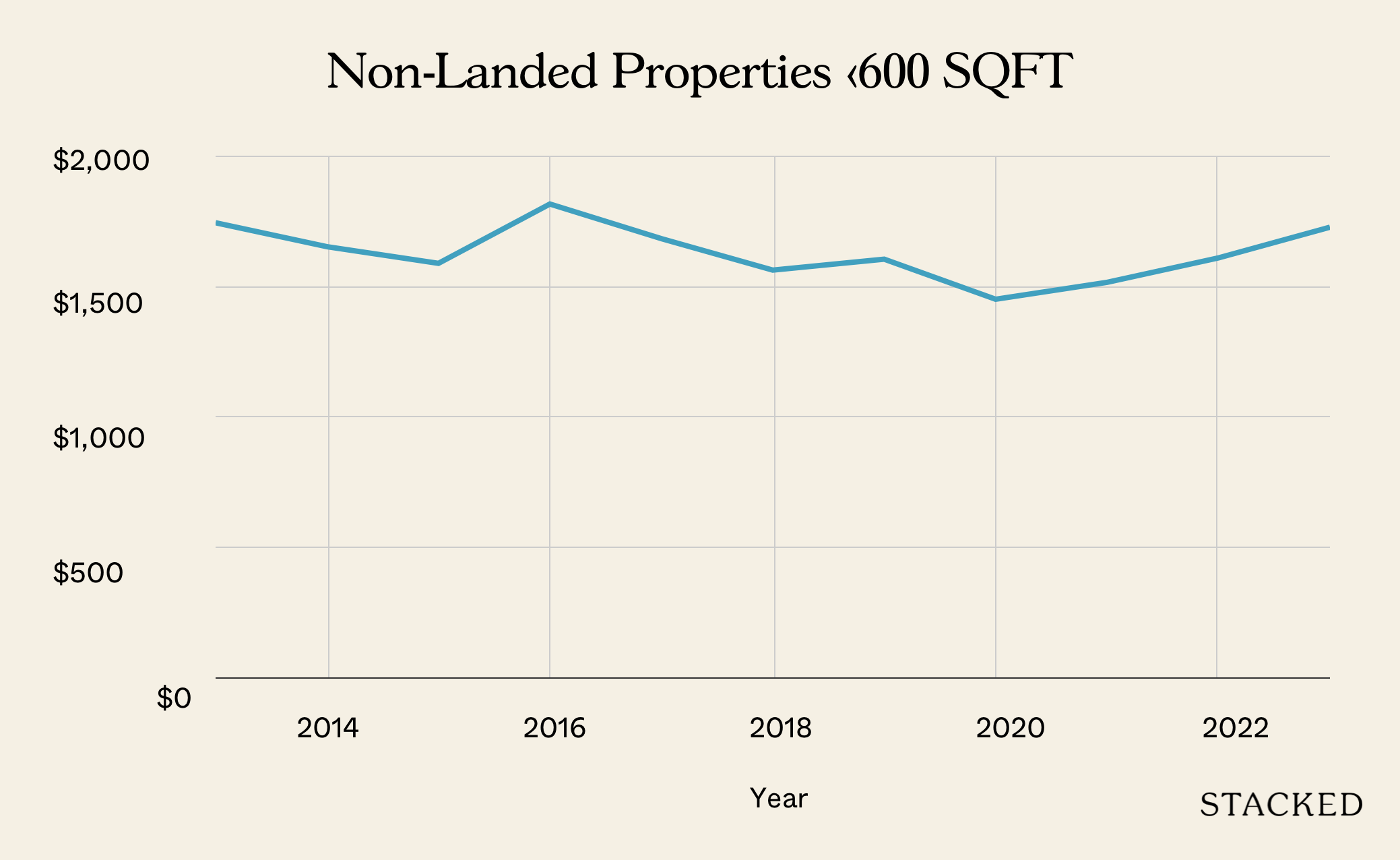

Here, we are looking at resale transactions for units under 600 sq ft.

| Year | Avg PSF |

| 2013 | $1,750 |

| 2014 | $1,658 |

| 2015 | $1,594 |

| 2016 | $1,822 |

| 2017 | $1,689 |

| 2018 | $1,568 |

| 2019 | $1,610 |

| 2020 | $1,456 |

| 2021 | $1,521 |

| 2022 | $1,615 |

| 2023 | $1,733 |

| Average | 0.18% |

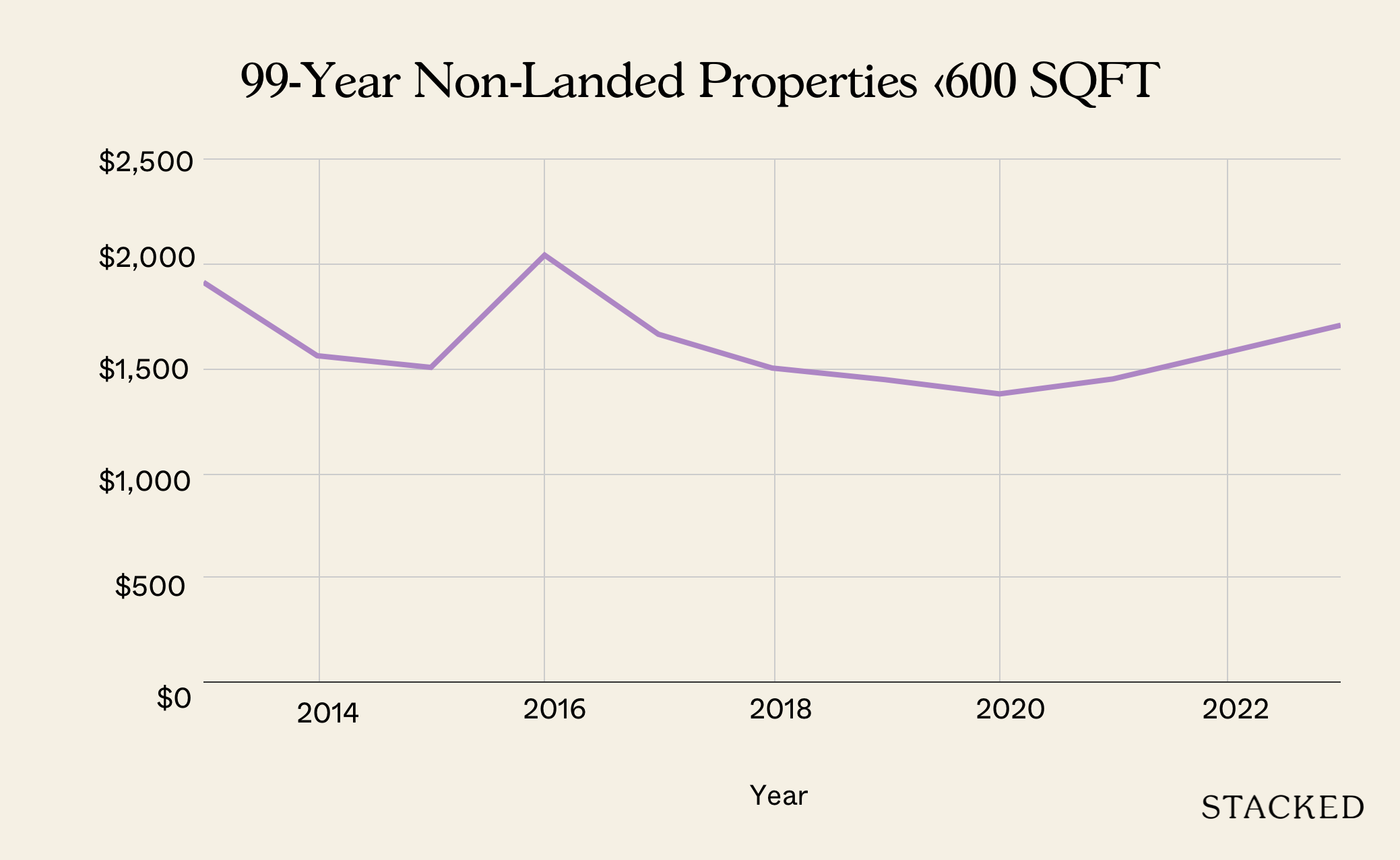

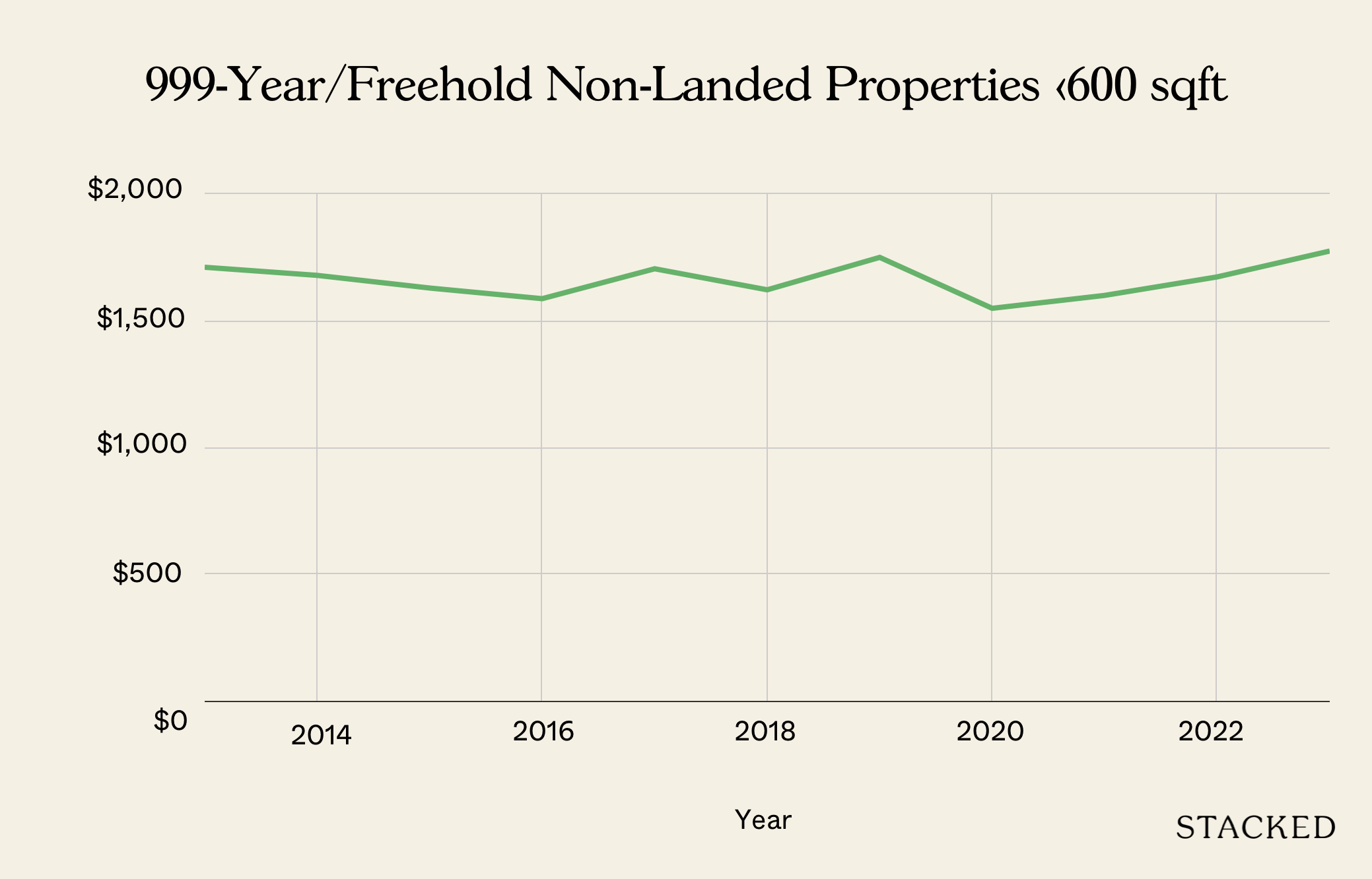

The data shows that the performance of these properties is relatively underwhelming compared to HDBs. Given that most of the units within your budget are in freehold boutique developments, let’s go further into the comparison between 99-year leasehold and 999-year/freehold properties.

| Year | Avg PSF (99y) |

| 2013 | $1,916 |

| 2014 | $1,564 |

| 2015 | $1,508 |

| 2016 | $2,046 |

| 2017 | $1,667 |

| 2018 | $1,505 |

| 2019 | $1,449 |

| 2020 | $1,381 |

| 2021 | $1,453 |

| 2022 | $1,581 |

| 2023 | $1,710 |

| Average | -0.08% |

| Year | Avg PSF (999y/freehold) |

| 2013 | $1,711 |

| 2014 | $1,679 |

| 2015 | $1,629 |

| 2016 | $1,587 |

| 2017 | $1,705 |

| 2018 | $1,622 |

| 2019 | $1,750 |

| 2020 | $1,549 |

| 2021 | $1,600 |

| 2022 | $1,673 |

| 2023 | $1,775 |

| Average | 0.55% |

One-bedroom units generally appeal to a niche market of single professionals, couples and investors seeking rental income, rather than families or long-term owner-occupiers. This limits their broad appeal and makes their prices more sensitive to market fluctuations.

Rental demand for one-bedroom units, while occasionally popular among singles and couples, is also less stable than for larger units. As investment properties, one-bedroom condos tend to have slower appreciation than their larger counterparts. Investors often focus on rental yield rather than long-term value, and since these units attract fewer owner-occupiers who typically drive sustained property value, their prices appreciate more modestly.

Let’s now take a look at the potential costs for the two pathways.

Potential costs

Buying an HDB

For calculation purposes, we will assume that you max out your budget of $710,000 and hold the property for 10 years.

| Purchase price | $710,000 |

| BSD | $15,900 |

| CPF + cash | $203,000 |

| Loan required | $522,900 |

| BSD | $15,900 |

| Interest expenses (Assuming a 25-year tenure and 4% interest) | $181,445 |

| Property tax | $5,320 |

| Town council service & conservancy fees (Assuming $70/month) | $8,400 |

| Total cost | $211,065 |

Buying a private property

Similarly, we will assume here that you max out your budget of $740,000 and hold the property for 10 years.

| Purchase price | $740,000 |

| BSD | $16,800 |

| CPF + cash | $203,000 |

| Loan required | $553,800 |

| BSD | $16,800 |

| Interest expenses (Assuming a 30-year tenure and 4% interest) | $199,777 |

| Property tax | $5,680 |

| Maintenance fees (Assuming $200/month) | $24,000 |

| Total cost | $246,257 |

What should you do?

Given that your affordability for both HDB flats and private properties is pretty similar, the cost difference between them is relatively small. However, depending on your desired location and unit size, you may find that HDB flats offer more options compared to private properties.

When comparing the historical performance of HDB flats and 1-bedroom condos, data shows that HDB flats across various ages have generally outperformed 1-bedroom condos in terms of appreciation over the past decade.

Your holding period is also an important consideration. Although HDB flats have outperformed 1-bedroom condos, much of this growth, especially in older HDB flats, occurred during and after the pandemic. As the market stabilises, the appreciation rate of older flats may not continue at the same pace. This is particularly relevant if you’re considering holding an older flat for an extended period, as future gains might be more modest.

If you plan to live in the property, an HDB flat might be more suitable, as it offers at least two bedrooms and more space for you and your family. Since you mentioned that size is not a determining factor, if your plan is to rent out the property, a 1-bedroom unit allows you to lease out the entire space immediately. This could potentially yield higher rental returns compared to an HDB flat, where you would typically only be able to rent out the additional bedroom(s).

Between the two options, purchasing an HDB appears to be the more favourable choice. If a 3-room flat meets your requirements, you could find a younger property in a central location within your budget. Alternatively, if you are open to areas outside the central region, you might afford a larger unit type, offering more space for your family. This gives you time to accrue more savings for a bigger condo unit in the future, rather than cutting it close to buy a 1-bedder condo right now.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

0 Comments