How Do Rising Interest Rates Impact Property Prices And How To Prepare For It

February 2, 2022

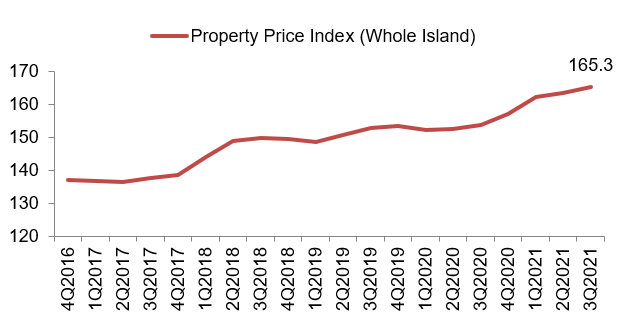

Unless you’ve been living under a rock, you’ve probably heard by now that 2021 saw the highest annual growth (10.6%) in around 10 years – beating the previous peak in 2013.

The rise in property prices has been attributed to a combination of various reasons. A spike in demand for ready-to-move-in homes as construction delays became widespread due to the pandemic. People are more willing to spend on property as they now are working from home and spending the majority of their time at home. And while Covid-19 has certainly impacted certain industries like travel, there were many others that boomed (online shopping and crypto) – so there was definitely a lot of money flowing into real estate.

Last but not least, record low-interest rates have allowed buyers to effectively increase their purchasing power, as interest rates have been depressed worldwide to support economic growth amidst the global pandemic.

But there are two factors that may slow the rise of prices in 2022: the recent cooling measures, and the impending plans to raise interest rates.

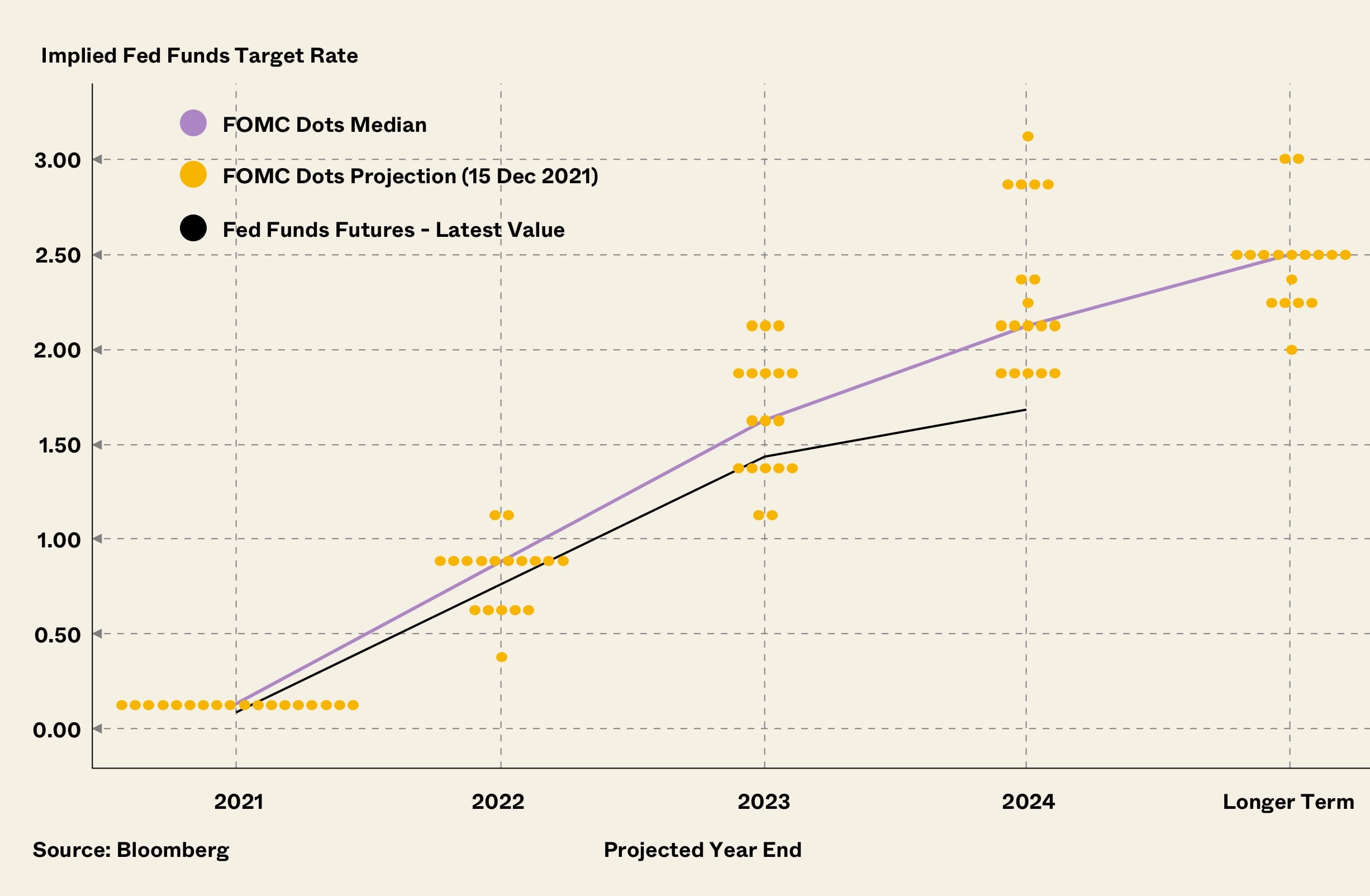

As you may very well know, the fate of Singapore’s interest rates is closely intertwined with the US interest rates. Thus, it is imperative to know that the Fed has plans to hike interest rates at least thrice in 2022, which will effectively end homebuyers’ paradise of accessing easy monies. For those currently repaying floating home loans, you can expect your interest rates to increase too.

So how should one go about financing his/her dream home and would the impending series of rate hikes have any effect on home prices moving forward? Read on to find out more!

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Key findings and tips

Our “READ” approach is summarised below to help you navigate through the rising interest rate environment, while you explore ways to finance your dream home. The first three points are more relevant for homebuyers who are keen to enter the market now or in the coming one to two years, while the last point suggests playing a “waiting” game before making a move.

- Relax, homebuyers will not face the brunt of interest rate hikes immediately as the pace of increase will be gradual, which provides time for prudent financial planning;

- Examine the loan packages to ensure they meet your needs (e.g. calculate the overall costs over the lifespan of the packages instead of the cost during the promotional period, look out for packages with capped maximum interest rates);

- Analyse the trade-offs between re-financing and re-pricing; and

- Defer your purchase for now if possible, and take clues from the STI Index which often leads the property price index (PPI), before making your move.

1) Relax, the impact from the rise in interest rate is transient

The rise in interest rate is inevitable to rein in rampant inflation in the US (39 year high of 7%). However, the full impact of interest rate hikes is likely to be felt in 2023, with some analysts predicting that the Fed’s series of hikes will only reach its peak shortly after 2023.

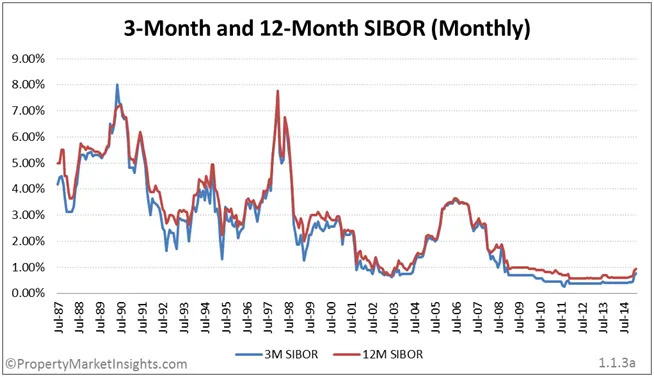

As such, homebuyers will still be able to enjoy the low (or not as low as before) interest rate environment and have time to shop around for the ideal loan package that suits their needs. In fact, looking at the historical trend of the SIBOR rates in Figure 1, there were only two instances when the rates were above 4% (i.e. once in 1990 and another in 1998), which lasted for barely a year each before the rates tapered off. This suggests the ephemeral nature of rate hikes, which offers some assurance and comfort to some of us who are concerned about rising mortgage costs.

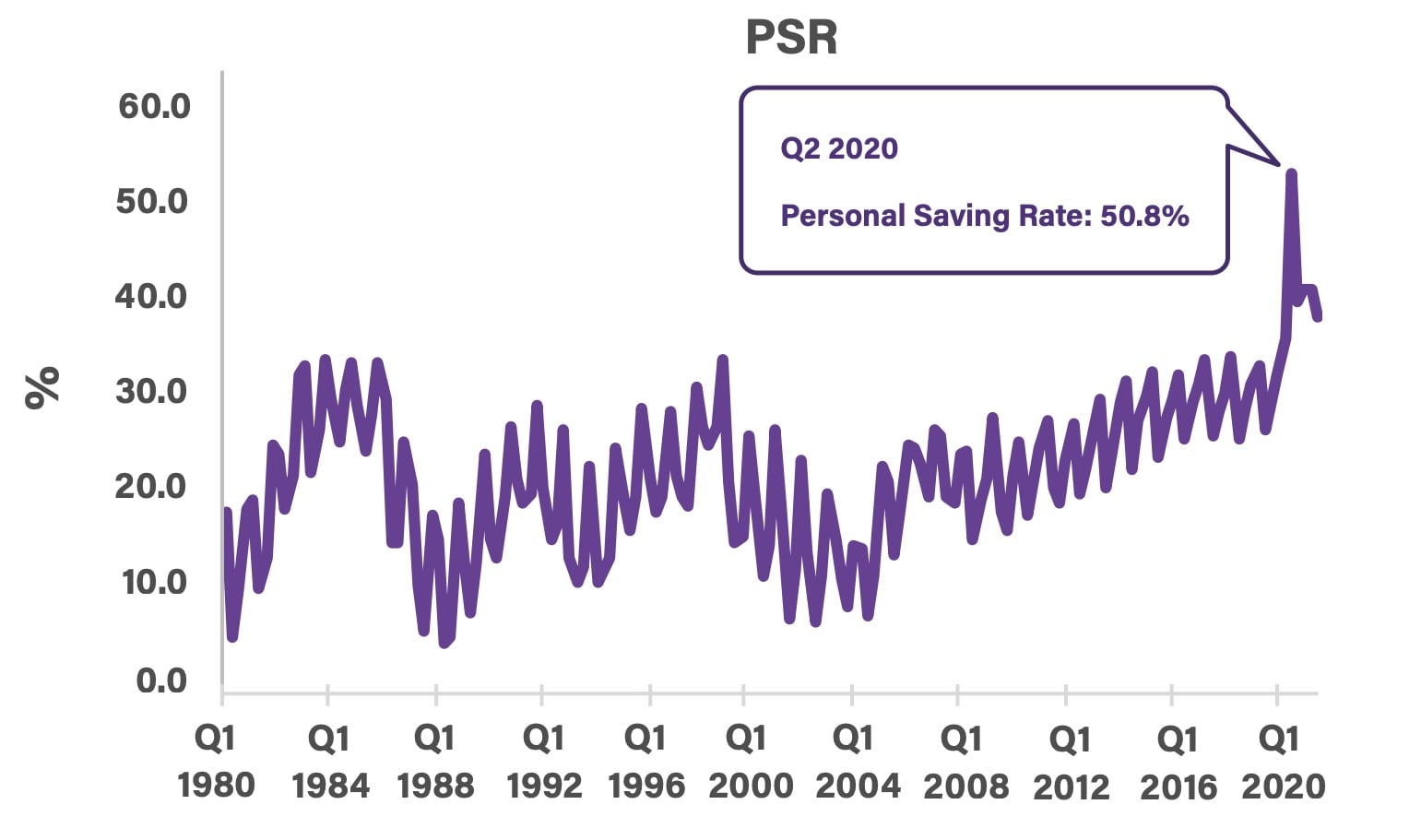

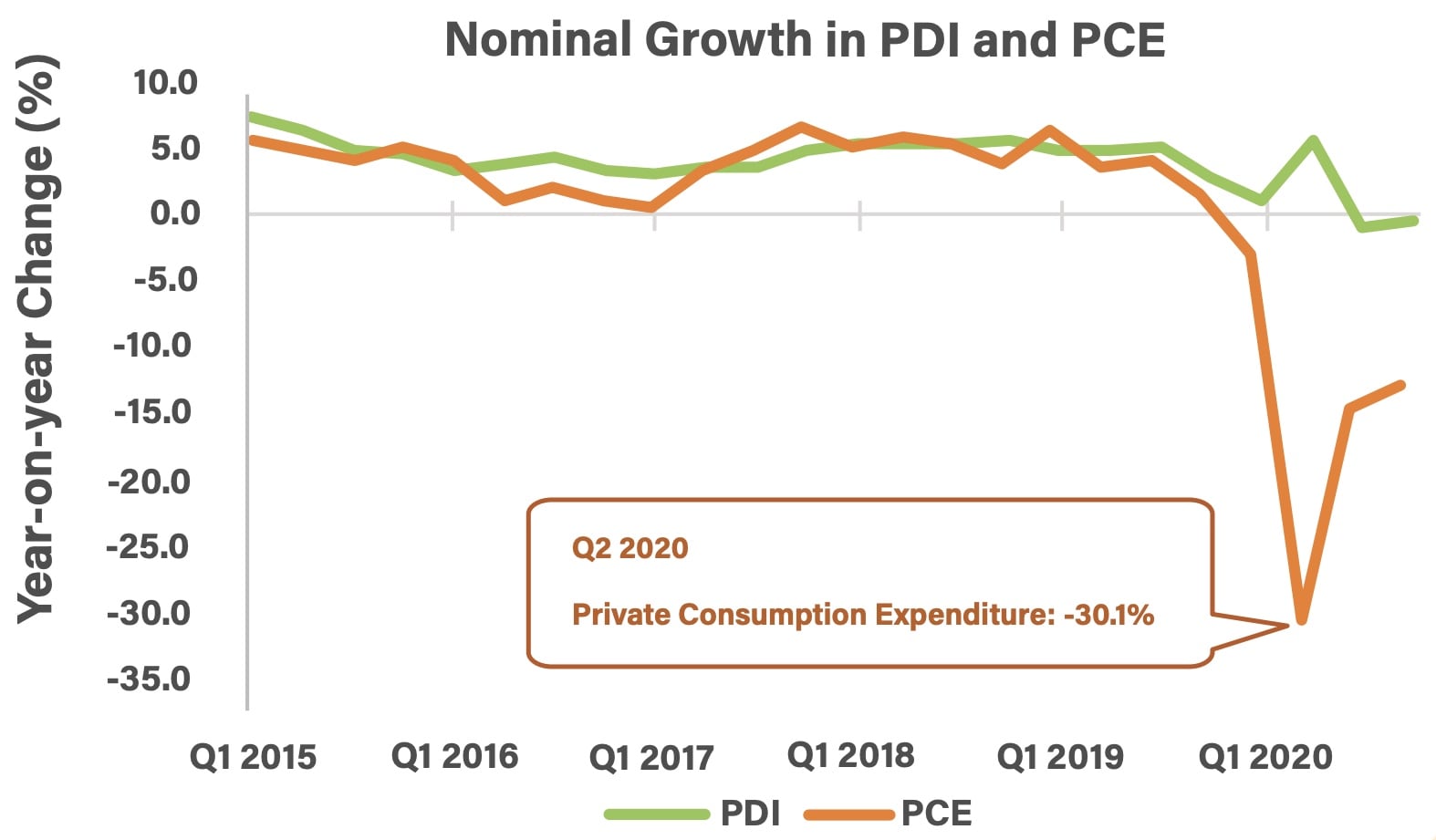

If you are still worried, take a look at our personal saving rate (“PSR”) and personal disposable income (“PDI”) vs private consumption expenditure (“PCE”) over the last 40 years in Figures 2 and 3, and you would see that Singaporeans are largely prudent financially, with rising income and savings. Granted, not every one of us can afford to scrimp and squirrel away a sizeable chunk of our income consistently. However, with our Government being “over-protective”, it may be tough to overstretch ourselves with the measures in place (e.g. lower total debt servicing ratio (“TDSR”), mortgage servicing ratio (“MSR”)) even if we want to.

Note: the sharp rise in PSR and steep fall in PCE in Q1 2020 were due to constraints in spending during Circuit Breaker and generous fiscal stimulus by the Government in response to the pandemic, respectively.).

Figure 2: PSR over last 40 years (source: Department of Statistics – Information Paper Series on Personal Disposable Income and Personal Saving)

2) Examine loan packages to ensure they meet your needs

Searching for an ideal home is arduous and finding an ideal loan package is no walk in the park either, especially when homebuyers are spoilt for choices with diverse offerings from various banks.

Regardless of which loan package you eventually set your eyes on, do consider the worst-case scenario and ensure that you would be able to service your mortgage in the short-to-medium term should unforeseen circumstances come into play. Sometimes, low promotional rates may be enticing, however, do compare it with the overall costs over the lifespan of the package since the rates may increase sharply after the promotional period.

Another tip is to be cognisant of packages that cap the maximum interest rates chargeable during the lock-in period (which is around a reasonable range of 1.4% to 2.0% for floating rate packages and 1.30% to 1.68% for fixed-rate packages in DBS’s context) depending on your loan tenure. With this, you will be able to kill two birds with one stone by taking advantage of the current decent interest rates, while hedging against the risk of interest rates rising later on.

Property Market CommentaryIs It Time To Refinance From An HDB Loan To A Bank Loan?

by Ryan J. Ong3) Analyse the trade-offs between re-financing and re-pricing

Currently, the TDSR is not applicable to the refinancing of owner-occupied residential mortgages. However, it is noteworthy to know that refinancing comes with its costs (e.g. legal and valuation fees. Along with early redemption fees, the total costs may erode or exceed savings from the lower interest rates.

An alternative is re-pricing, which essentially involves you working with the same mortgagee for the same loan, where the process will be faster with less paperwork and lower fees.

4) Fortune favours those with patience who are well-prepared

We often hear the adage “Past performance is not indicative of future results”. Yet, while “history does rhymes, even though it does not necessarily repeat itself”. This cannot be more apt for property prices.

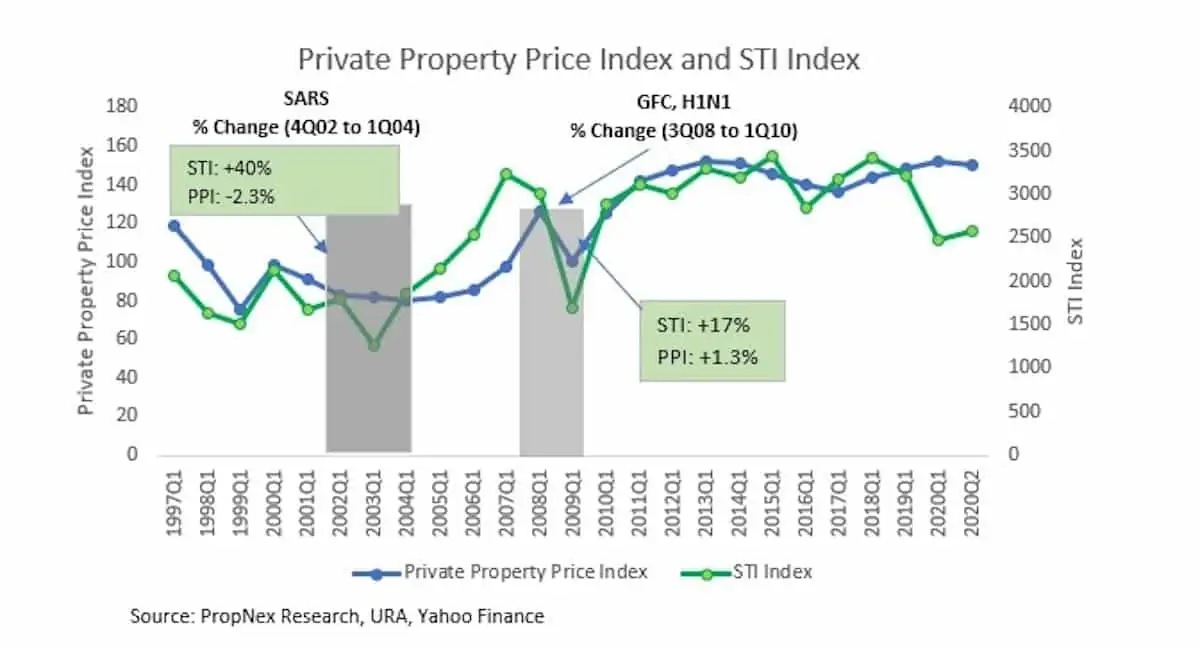

Figure 4 shows the positive correlation between the STI Index and the PPI, where the former leads the latter by about 1 to 2 quarters. If you recall in the earlier part of this article, the last time the interest rate went above 4% was in 1998. Sure enough, affordability became an issue for homebuyers back then when we saw property prices dropping for about 2 years before rebounding, which underscores the transient nature of rate hikes mentioned earlier. Hence, we may see a recurring trend moving forward as the Fed and the banks proceed with the rate hikes. An interesting observation was the fact that prices actually went up in 2006 and 2007 when the interest rates were about 3% (i.e. twice today’s rate), which is contrary to what most people might think.

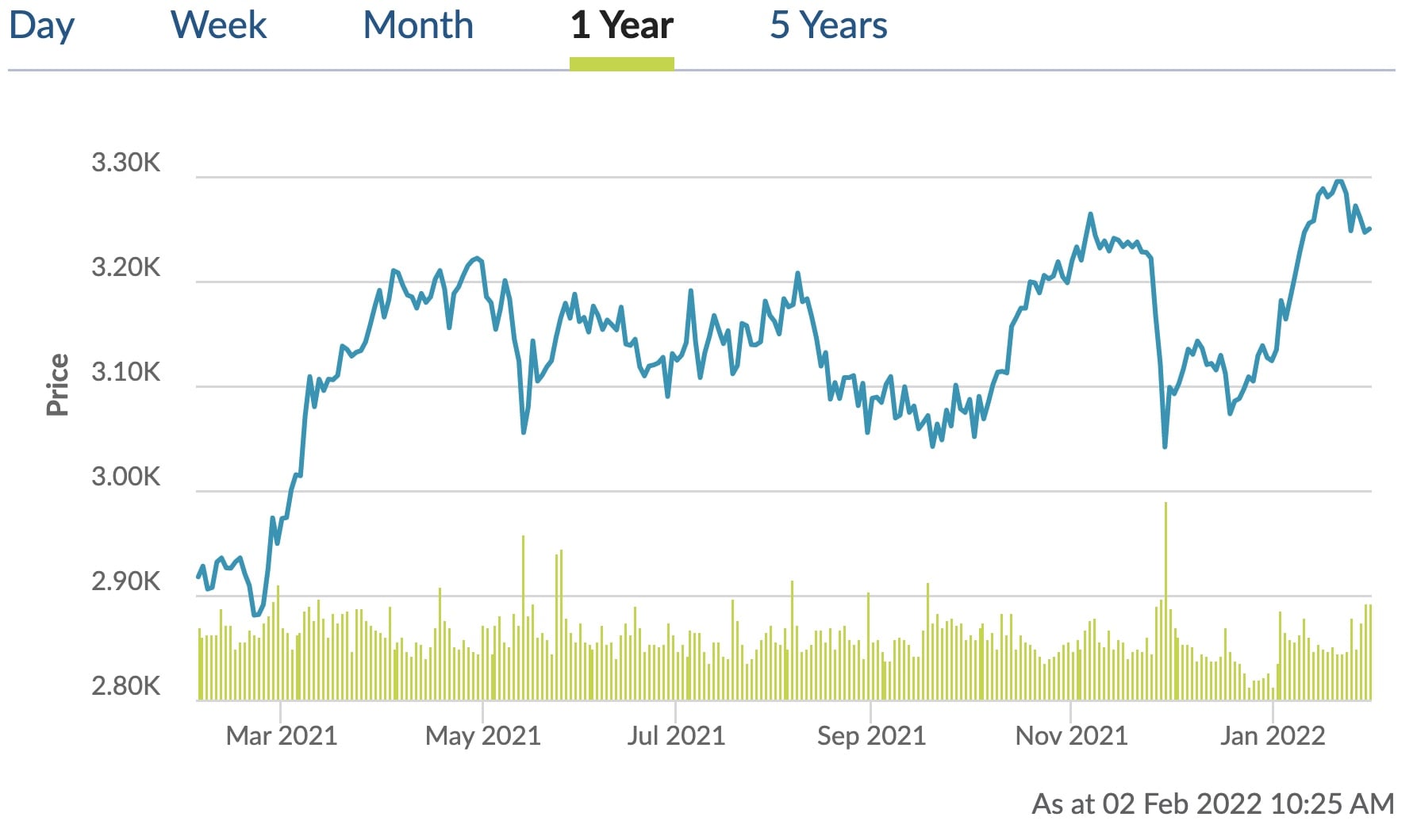

Figures 5 and 6 for both indices in the past year reinforce the positive correlation. The STI Index has registered a growth of 123 points or 3.93% since the beginning of 2022. It shows no sign of corrections yet although the US market has already retreated considerably in the past weeks. Thus, if the relationship continues to hold, we may still see a gradual rise in property prices for at least the first quarter of this year. Whether the STI will continue going north is anybody’s guess, although there is speculation on the ground that this is likely the case. Then again, analysts are usually bullish on the STI than to stick out like a sore thumb to predict that it will decline. Hence, do take a pinch of salt when you read them.

While we cannot predict the future, we can definitely prepare for it. As Warren Buffett once said, “Predicting rain doesn’t count. Building arks does.” Since properties are big-ticket items, rushing into a purchase and loan package (while interest rates are still low) should be seriously reconsidered. Instead, we should exercise patience and prepare ourselves for a variety of scenarios, so that we can capitalise on the opportunities when they present themselves.

Conclusion

In short, the impending rising interest rate should not be perceived as a harbinger of doom and gloom for the property market. In fact, we should embrace it as it is one way of curbing runaway prices and promoting financial prudence amongst consumers/mortgagors.

As shared earlier, interest rates do not stay constant. Hence, there are always opportunities for homebuyers to benefit from either the rates or prices, depending on whether the direction that they are moving is to our advantage. More importantly, it is better for homebuyers to be clear and realistic about their financial position and purchasing power, with some “stress testing” on their ability to commit to a purchase/mortgage repayment in unforeseen circumstances.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ian Tan

Ian is a property enthusiast who finds himself constantly learning about this art and uses data to educate himself on property investment. When not analysing property data, Ian can be found shooting hoops, eating healthily and reflecting on himself, so that he can continue pursuing his aspirations for as long as his mind and body allow.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments