Can Young Singaporean Home Buyers Survive The 2021 Property Market?

May 4, 2021

Singapore’s property market is booming, with resale flat prices at eight-year-highs, and private home prices rising for four straight quarters. Coupled with job worries over Covid-19, and construction delays, all of this poses a problem for young, first-time home buyers. The hard truth is that, despite the volatile economy, home prices aren’t falling; and sellers have sufficient holding power to demand high prices.

Here’s a look at the issues facing young home buyers:

- Prices are rising in almost all property segments

- Condo prices supported by a slew of HDB upgraders

- The return of Cash Over Valuation (COV), with rising prices for resale flats

- Affordable new homes are often too small for families

- Construction delays coupled with rising rental rates

1. Prices are rising in almost all segments

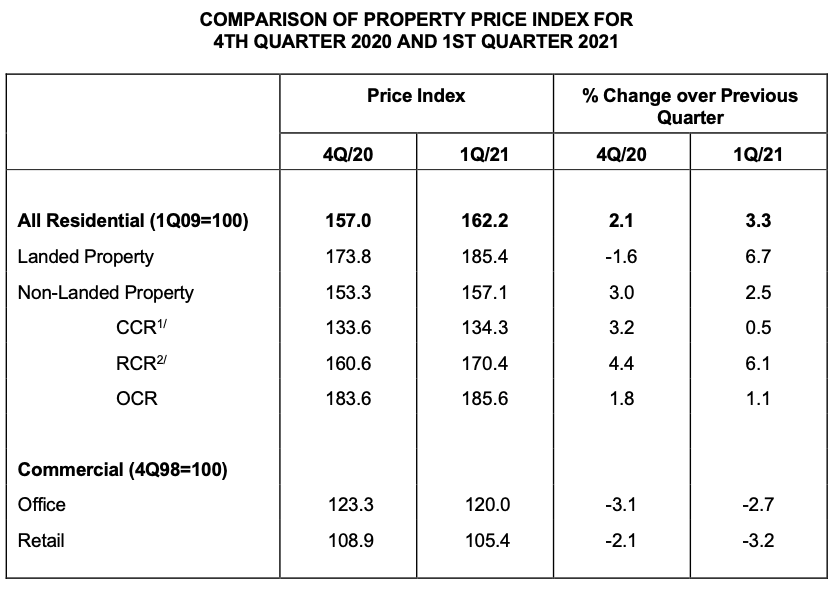

While the CCR and OCR recorded modest increases, it’s the RCR (where most of the younger buyers would be looking at) that has established the biggest increase for non-landed property.

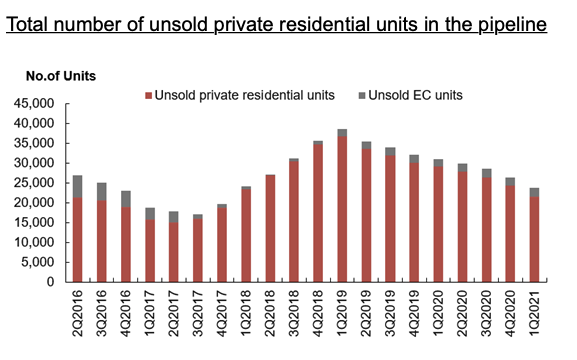

Looking at the supply of private residential units, you can see that the figure has come down to approximately 21,000 to 22,000 unsold units – a far cry from the peak in Q1 2019.

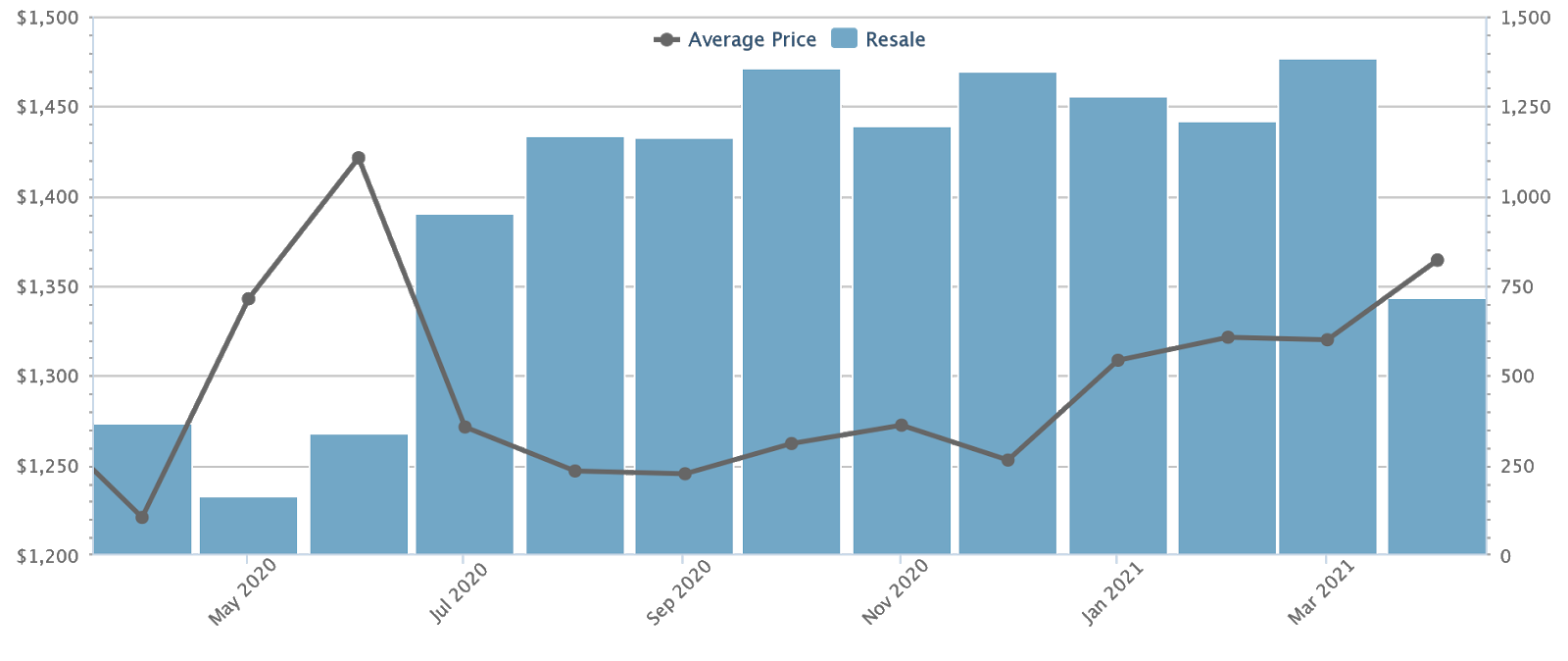

If we were to look at resale condos, it is much of the same story.

Resale condos have fallen from their last high in June 2020, but have been rising again over the past half of the year. They’re now at $1,364 psf, up from $1,221 psf at the same time last year.

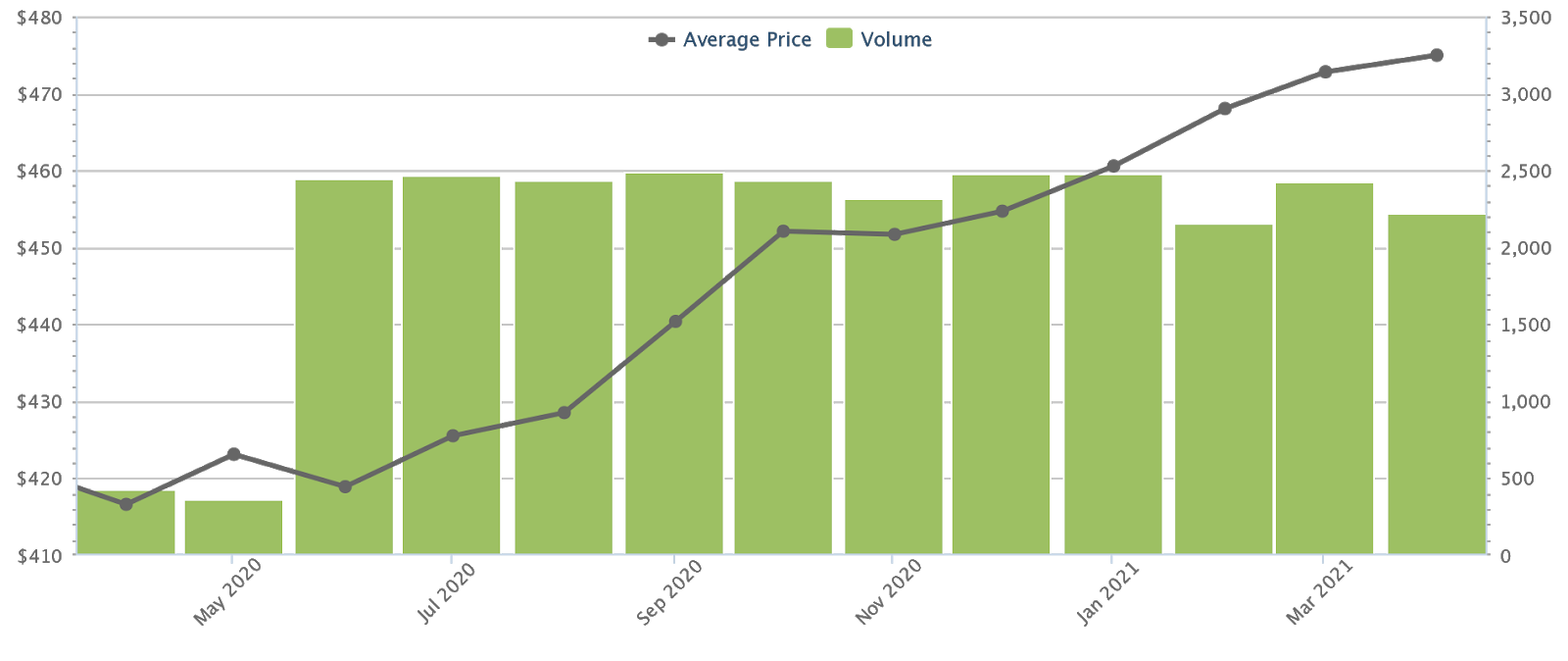

HDB resale flats have seen their most meteoric rise, undoing around seven years of falling prices over the course of 2020 to the present. They now average $475 psf, up from $417 psf a year ago.

It seems that everywhere a new home buyer looks, prices have soared from the pre-pandemic period. Those counting on developer discounts or desperate sellers, due to Covid-19, have more or less seen their plans backfire; a “wait-and-see” approach from the start of 2020 would result in paying more in the current context.

2. Condo prices supported by a slew of HDB upgraders

HDB upgraders currently dominate the Singapore property market, with 50,000+ flats reaching their Minimum Occupation Period (MOP) in 2020 or 2021. By comparison, the number of flats reaching MOP per year, between 2010 and 2018, was just around 9,000.

One of the realtors we spoke to, who declined to be named, cautioned that:

“The main problem for new buyers is the price being supported by upgraders. Because those who have just sold their flat, especially a five-year old flat that is in high demand, are flush with cash; they can afford the down payment to go private. They can even afford to take a smaller loan, to meet the TDSR*, which normally they may not qualify for. This is why you see new launch prices are not falling even with Covid.”

At the same time, HDB upgraders appear to have no shortage of willing buyers, willing to meet their price (see below). As such, a long of younger, first-time home buyers are going to feel priced out.

*The Total Debt Servicing Ratio (TDSR) caps your monthly loan repayment to 60 per cent of your monthly income. If you cannot meet the TDSR, you can – assuming you have the cash – make a bigger down payment to reduce the repayment amount. See our guide to home loans for a detailed explanation.

3. The return of Cash-Over-Valuation (COV), with rising prices for resale flats

Due to construction delays (see below), or the unavailability of BTO flats in certain areas, young home buyers may sometimes opt for a resale flat first. This also opens up the possibility for a wider range of grants.

However, there’s a double-whammy that they’ll run into.

The first is the rising resale flat prices, which are at their highest in almost eight years. Analysts and realtors that we spoke to pointed out two reasons, that won’t be going away soon:

The first is the better support for buying old flats, due to a policy change in 2019. The government has allowed more liberal use of CPF when purchasing older resale flats, so long as the lease can last till the youngest buyer is 95 years-old. Gone are previous restrictions, such as older flats needing more than 30 years left on the lease (you can now use your CPF so long as there’s 20 years or less on the lease).

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

I’ve Lived In Braddell View For 14 Years: What It’s Like To Live In Singapore’s Largest Residential Site

Braddell might not be the first estate that comes to mind when you think of popular family-friendly spots, but maybe…

This has raised the prices of even older resale flats, while the prices of newer resale flats (e.g., those that are just five-years old) are already high. Realtors explained that newer resale flats see much strong demand, as buyers can move in immediately but the lease decay is negligible.

As such, whether a resale flat is five-years old or even 40-years old, new home buyers are confronted by higher prices than previous years.

The other issue is the return of Cash Over Valuation (COV). While HDB no longer reveals COV data (this helps to keep it under control), realtors have reported seeing COV rates creep back, with rates of $20,000 to $30,000 appearing even in non-mature towns.

Property Market CommentaryCan We Expect Cash Over Valuation (COV) To Keep Climbing For HDB Flats?

by Ryan J. OngCOV is the portion of the cost that’s above the actual flat valuation. E.g., if your flat price is $370,000, but the valuation is $350,000, then there’s a COV of $20,000. This portion is not covered by an HDB loan or bank loan, so buyers must have sufficient funds to pay it alone. For first-time home buyers on a tight budget, COV could have a serious impact on immediate affordability.

4. Affordable new homes are often too small for families

To keep homes palatable despite rising price per-square-foot, we’ve seen a trend of developers building smaller units. We have, for example, pointed out several new launch condos that are priced under $1.4 million.

However, we hear common complaints that these new condo units are stifling for families. Many units under the $1.4 million mark tend to be around 800 to 900 sq. ft. By comparison, most 4-room flats are about 968 sq. ft.

Young home buyers expecting to have children, or who are living with their parents, may find themselves priced out of the living spaces they need. This leaves them with either BTO flats (with construction delays and availability issues), or resale flats (also with rising prices, and possible COV). It’s a typical rock-and-a-hard-place scenario.

5. Construction delays coupled with rising rental rates

For young home buyers, temporary accommodation can be a challenge. Most of them don’t want to wait two years before moving in with their spouse (potentially three or four years, in the case of BTO flats).

This presents yet another expensive problem:

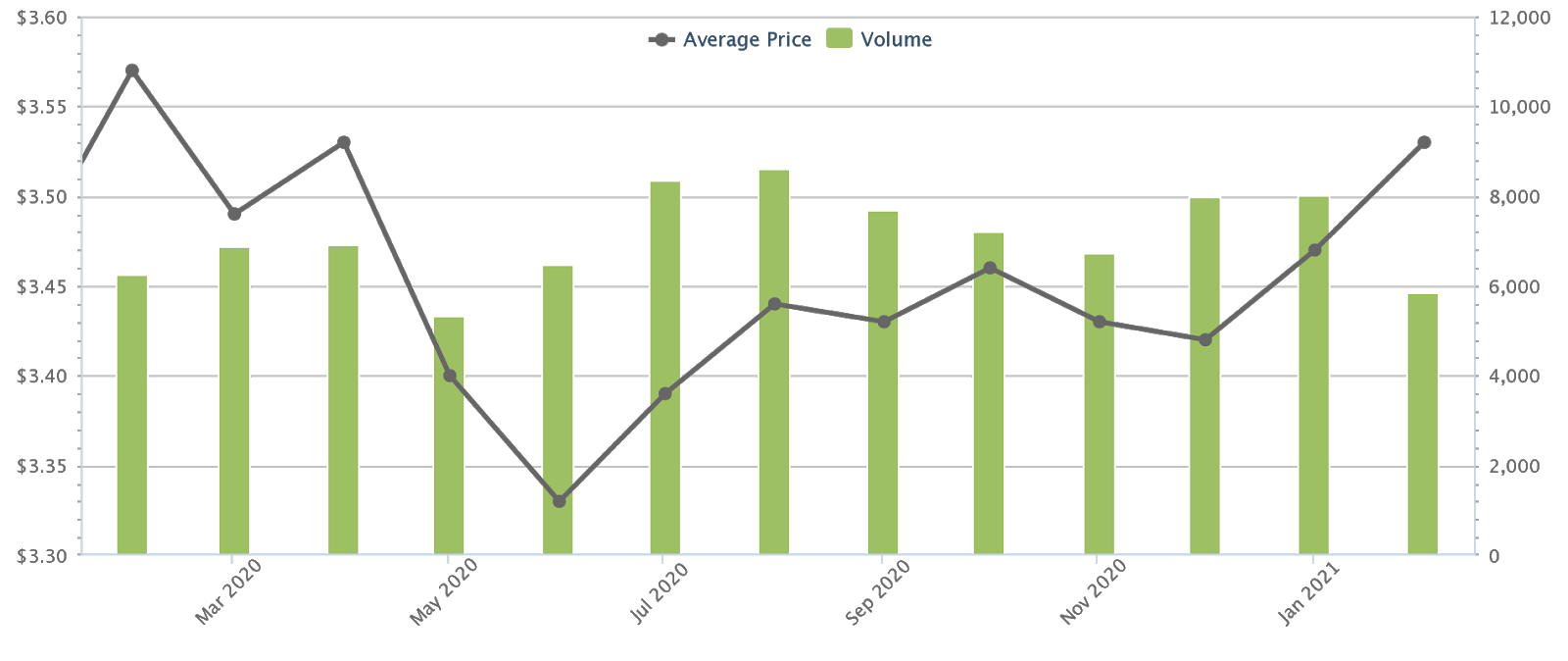

For those looking to rent out a condo, the period of low rental rates came and went in a flash. Condo rental rates plunged to $3.33 psf, in June 2020; but have since climbed back up to $3.53 psf. This is expected to rise even further by end-2021, with the return of foreign tenants (assuming Covid-19 restrictions lift), and possibly more local tenants awaiting construction of their delayed condos / flats.

Young home buyers who opt for new construction will have to budget accordingly (or rent a cheaper HDB flat / stay with their parents).

The best hope for young, first-time home buyers is new cooling measures; but this is speculative.

At the current rate, the property market seems to be headed for potential new cooling measures. In the event that happens, there may be a price dip which offers young home buyers a much-needed break. But it’s speculative to assume this will happen, or that prices will drop even if it does.

At this volatile time, it’s best if genuine home buyers stop trying to outguess the market, and simply move on to properties that meet affordability. The last batch that tried to “wait-and-see” to get lower prices have seen how the opposite can happen, despite a global pandemic. That should give a good sense as to how accurate predictions can get (i.e., not very).

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are property prices in Singapore still rising for young buyers in 2021?

Why are condo prices supported by HDB upgraders in Singapore?

What is Cash Over Valuation (COV) and how does it affect home buyers?

Are new homes in Singapore suitable for families in 2021?

How do construction delays and rising rental rates impact young home buyers?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

0 Comments