Here’s Why Some New Launch Condos Sell Better Than Others

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Bigger condo projects tend to sell better these days

News reports have a whole host of reasons why Lentor Mansion managed to sell 75 per cent of its units, despite slower sales of projects like The Arcady at Boon Keng or Hillhaven (both sold about a third of their units). Now we in the industry have a hardwired response to this sort of thing: and that’s to give you long-winded explanations on price, location, layout, etc.

But there is also an underrated reason, and I think it boils down to something simpler: show of hands all, who here has heard of Lentor Mansion? And who has heard of The Arcady or Hillhaven? Okay so I can’t actually see you, but I’m betting the majority have seen some kind of Lentor Mansion advertisement and know what it is, whilst the other two may as well be exotic European handbag brands or something.

And this may come down to an issue of size: Lentor Mansion is the bigger project here, and gets more marketing. To be clear, I’m not saying that’s the only reason a bigger project (by unit count at least) fares better – there are other factors like more land space, more facilities, generally lower maintenance costs, etc. But besides that, a large project is going to get more aggressive marketing from the developer.

Not only can the developer not afford to fail, there’s the simple fact that there are more units to move. Regardless of whether there are 20 units or 1,000+ units, developers are working on the same five-year time limit (although their ABSD rule has somewhat relaxed). So with a bigger resulting budget, developers of bigger condos are bound to spend more on print/bus ads, buy more online ads, invite more press visits, invest in a better showroom, etc.

They have the scale to really push the awareness of the project, and that in turn makes it easier for the property agents to push to their clients as well. It’s much easier when the prospect has heard of the development in some form, as compared to one that needs a completely new introduction.

Contrast that to smaller, or boutique condos: when there are 50 or fewer units, developers tend to leave it more to property agents. They leave it to realtors’ blogs, personal networks, fake “official” websites, and roadshows. And if sales aren’t happening, it’s grumbling about the agents’ being subpar.

The thing is, realtors act as individuals first and foremost – and when you do that, it’s like one of those amateur tug-of-war teams where no one is all pulling at the same time. Some of them may not even be pulling in the same direction.

Also, property agencies want a big win. New projects are where they make a large chunk of their money, and they would want to put more into it as they also want to get repeated business from the developer. As such, you’d see a greater emphasis on these projects from the agencies as there’s more effort put into marketing materials and sales kits for their agents. We’ve seen examples, where the marketing slides can go into the 100s, as compared to smaller developments where such material is hard to come by.

More from Stacked

Why Are Some Homeowners Being Advised To Take Lock-in Home Loans?

You’ve gone through all the terms and conditions, and you still can’t believe what the mortgage broker is telling you:…

Couple this with the natural advantages that larger developments have, and it may explain why bigger developments tend to see better launch day results, or sell out much faster. And given how expensive a certain property portal is becoming, plus a more cautious turn among buyers, this is definitely a playbook that we will be seeing more as consumers get more selective over their purchases.

Meanwhile, it looks like coffin homes may not be unique to Hong Kong

Some landlords have supposedly started to rent out utility rooms to tenants. Looking at the size of those things, I can’t help but feel it’s by definition taking advantage of someone – nobody but the most desperate or impoverished is going to live there by choice (and for the record, I think those tiny “rooms” provided to domestic helpers are a disgrace too).

These utility rooms are typically found in older, first generation executive flats or maisonettes. The others are from flats that underwent an upgrading programme between 1989 to the early ‘00s. These rooms are typically around 50 to 55 sq. ft., which is about the size of a small office cubicle.

And to be clear, it is illegal to rent out utility rooms to tenants. The problem is, who’s going to make a report?

The people forced to rent these often have no other options; and if they complain, they have as much to lose as the landlord. The landlord may get fined, but they’ll be back out on the street with no affordable accommodation. It’s pretty clear who wins in that scenario. So in a twisted way, the very nature of the tenant demographic is also what allows this to happen.

The best way to prevent this kind of thing isn’t just fines and threats to landlords (not that those should stop if they’re deserved), but more rental options or better controlled rental rates. People won’t roll over and accept a utility room if they can afford better options.

In other property news…

- Did you know there are HDB flats above 1,700 sq. ft., which would be like, 31 utility rooms put together? Here’s where you can find some.

- The price tags on those are too high? Here’s where to find the cheapest and biggest flats in 2024, starting from a more reasonable $690,000.

- There’s been a big price drop at Cuscaden Reserve, following its relaunch. Does that mean it’s now a huge bargain? Eh, it’s a bit more nuanced than that.

- Circular balconies (which tend to go with circular layouts): if you think these are cool, and you love that whole old-school flying saucer vibe, check out the rare condos that have them.

Weekly Sales Roundup

As Friday was a public holiday, there are no new transaction data for the week. Keep a look out for next week’s newsletter for the latest transaction update!

For more on the Singapore property scene, follow us on Stacked.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

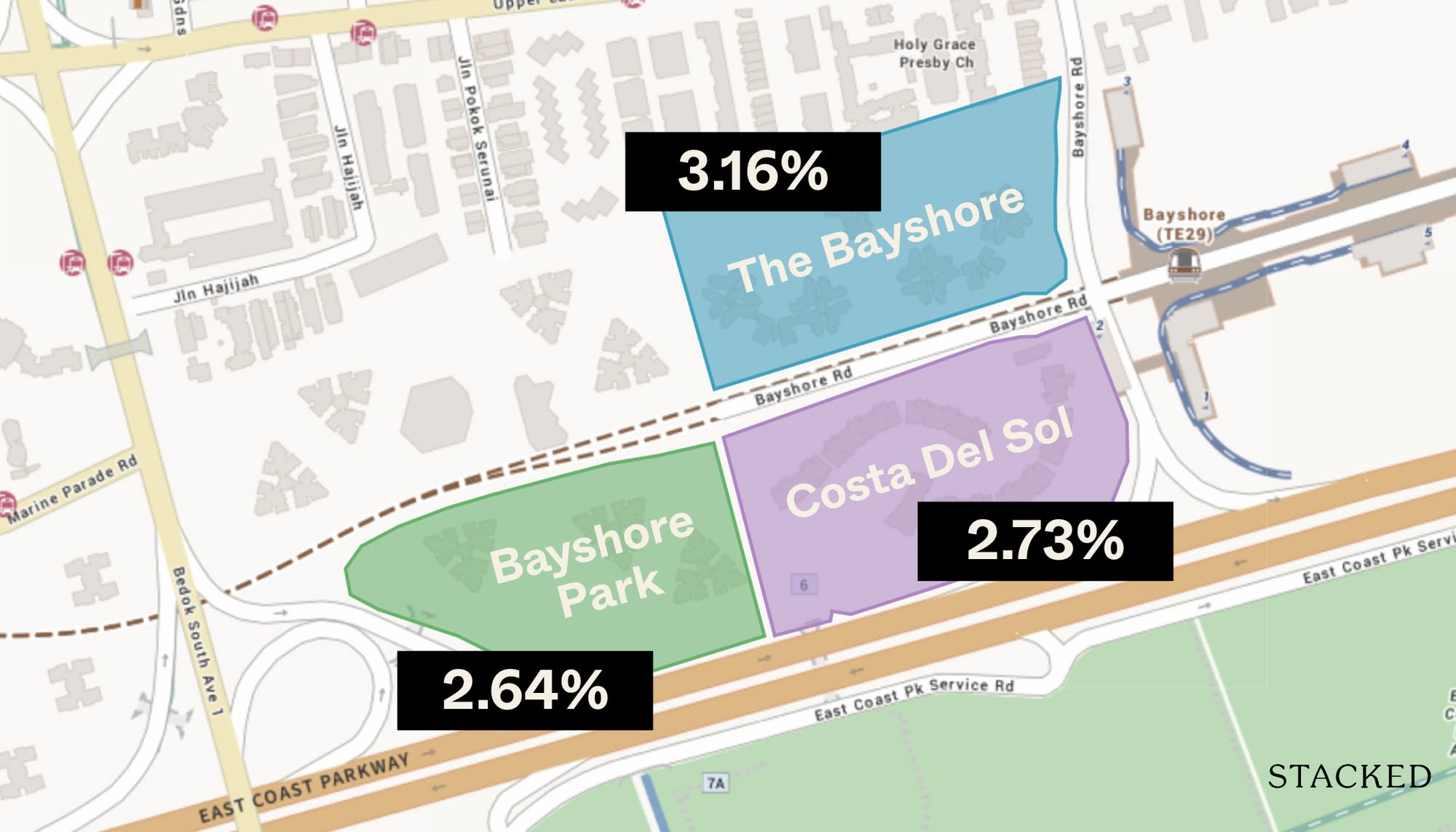

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

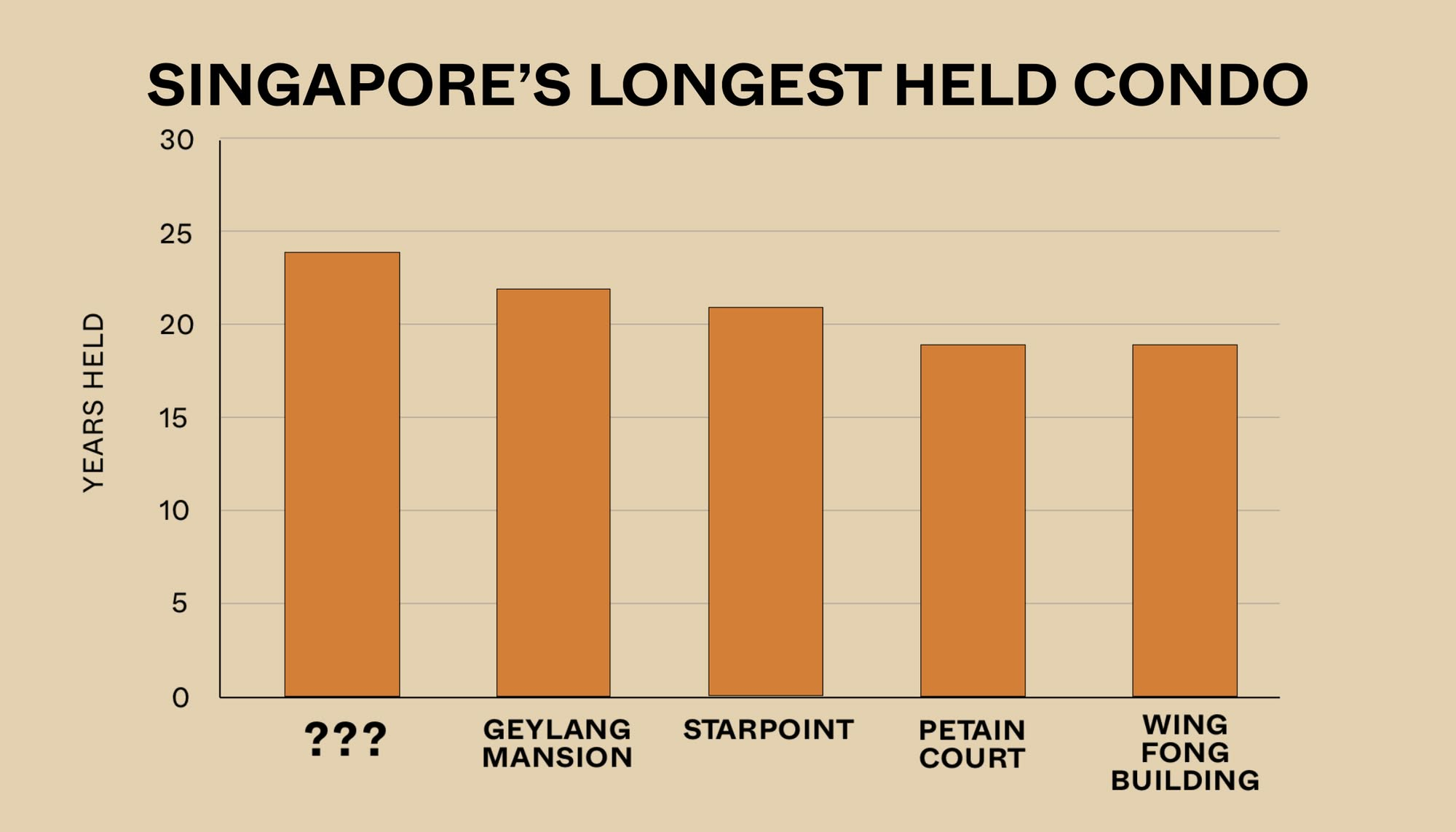

Editor's Pick The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

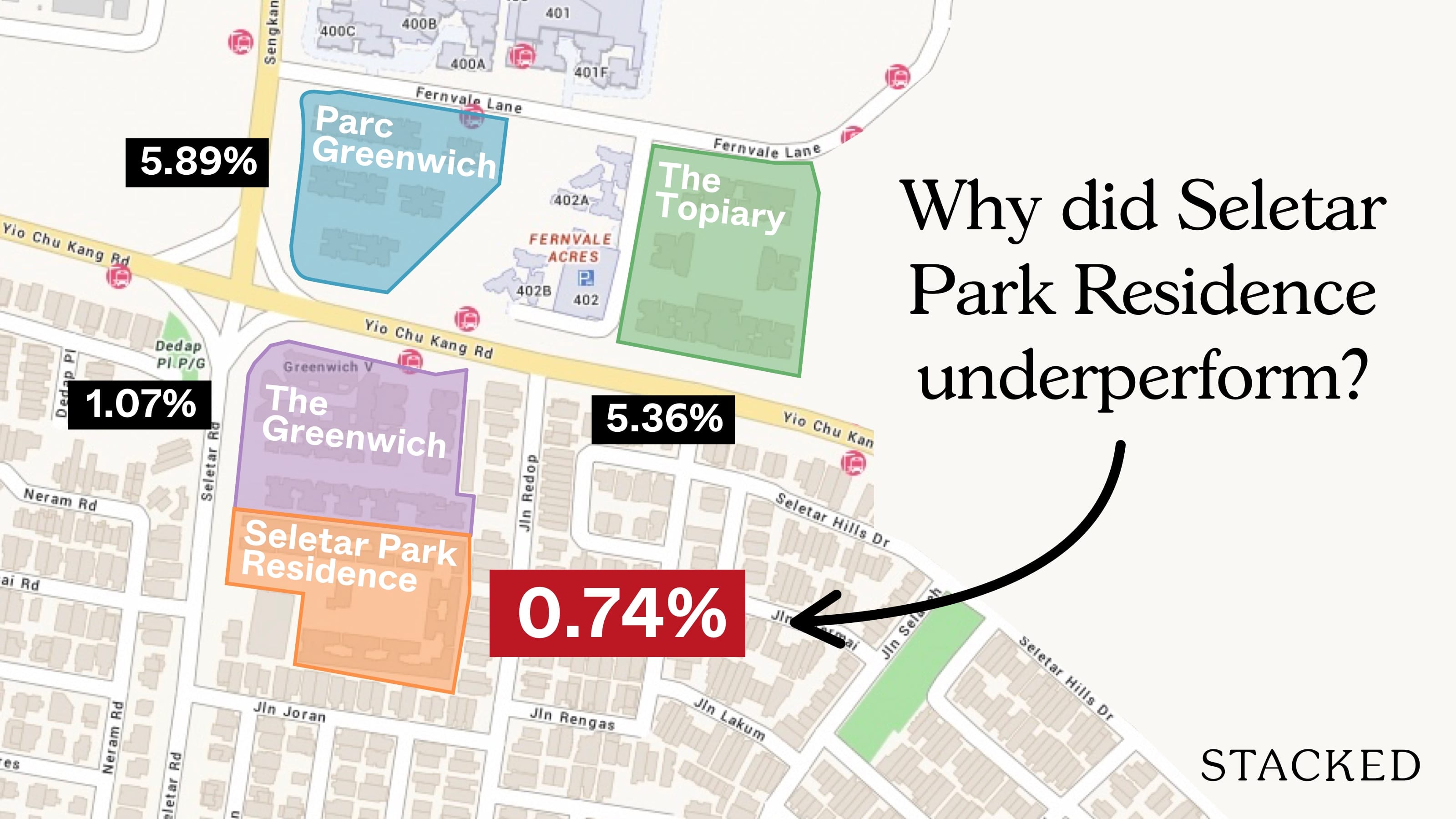

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

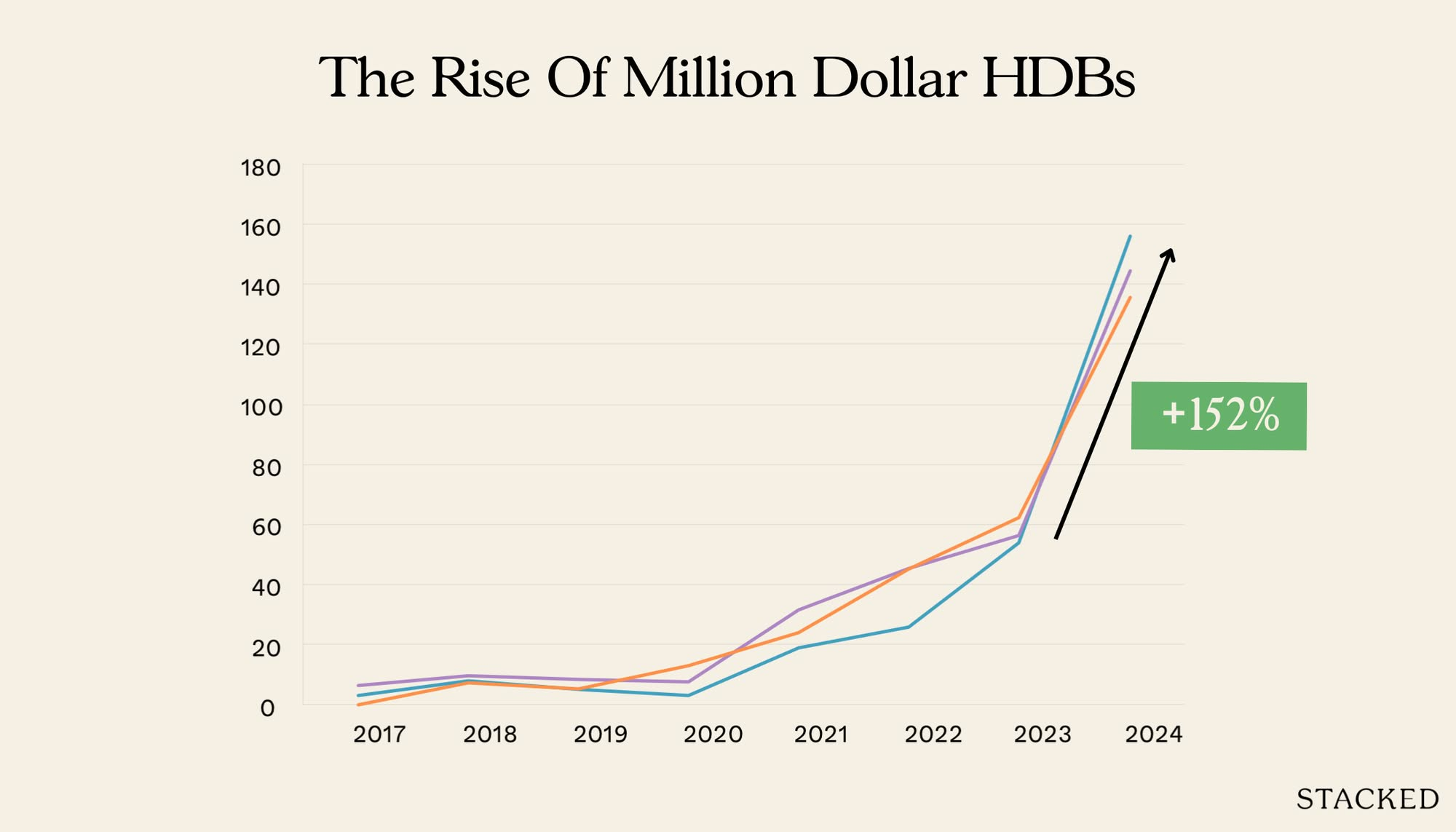

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden