Here’s Where The Future MRT Stations May Be

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

An educated prediction on future MRT lines

These are some interesting – and well-researched – speculations on MRT lines that we may see in future. Some of the future areas to think about, for me, are the Long Island project (off East Coast Beach) and the movement of Paya Lebar Airbase.

The former is going to require some form of additional transport (the discussions suggest an LRT line), while for Paya Lebar airport, the new neighbourhood spans some 800 hectares; that’s bound to require an extension of some existing railway lines, and some new MRT stations. So far though, there hasn’t been a peep on new stations in the area; understandable as it’s far in the future, but I’d keep an eye out. I do wonder if accessibility will be an issue for these two new areas.

That being said, the sheer number of new stations is going to be such that, in the next decade or two, I predict having an MRT station near your home will no longer be as big a deal. Rather, people will get picky about which train lines are near your home, with some lines being considered more “premium” than others. Buyers will probably also focus on having multiple train lines near their homes, so having just one MRT line nearby may not quite cut it anymore.

And don’t get me started about train lines to Changi Airport, or why there’s just one interchange at Tanah Merah. It’s high time we had multiple lines leading there since at the rate it’s growing, Changi Airport may as well declare itself its own country.

Now, for a current issue…

It seems the dominant opinion on rental vouchers is “too little.”

I’m referring to the $300 per month rental vouchers, which you can read more about here. These are meant to defray the cost of renting on the open market since HDB rental rates went berserk in the immediate aftermath of Covid. Those rates are starting to dip slightly, but tenants are reacting with the optimism of a chainsaw accident victim being told someone brought a bandaid.

A flat $300 may not have been the best idea, as some people are in tougher situations than others. If you’re a low-income household, say $5,000 a month, then I doubt a $300 voucher helps when rental rates of 3-room flats in Woodlands average $2,400 per month (as of end-January 2024)

I know that varying the voucher based on income will involve more paperwork; but it’s worth doing as it comes at a crucial and vulnerable point in people’s lives. The affected Singaporeans are at that precarious point of getting a first home, and are likely dealing with other factors such as the cost of marriage or a first child; this is a crucial turning point which justifies more help.

So whilst I think an across-the-board increase in rental vouchers may be a bit much, it might be reasonable to do it for families in lower income brackets.

It does also say something about how we view tenants

As a matter of personal opinion, I feel Singaporeans have been conditioned to disregard tenant issues. This is a natural effect of living in a country with a near 90-percent homeownership rate: unlike the US or EU, where locals are also dependent on rentals, we’re used to thinking of rental as being a problem for mainly foreigners.

More from Stacked

What The Future Of Singapore Real Estate Could Look Like: 6 Exciting Predictions

Let’s imagine for a second that you are in art class and the teacher gave you this description to create:

(And those foreigners are sometimes identified as affluent expatriates renting Orchard Road condos, who definitely don’t need help)

But because of this sweeping assumption, we tend to ignore Singaporeans escaping dysfunctional families, lifelong singles, those caught in financial distress, or even lower-income foreign workers (who, let’s face it, keep everything from construction to F&B businesses ticking, and have for decades).

It may be time to reconsider rental policies, especially given the impact they can have in black swan events like Covid. Besides the occasional Singaporean who needs rentals, we do have to consider how many industries are dependent on lower-wage foreign workers; we should address the erroneous assumption that they need us more than we need them.

Some part of this is due to an observation of New York City over the past two weeks (I’ve been abroad to my favourite haunt again), where rental rates have seen record highs of late. I probably don’t need to explain the social hardships involved here; Singaporeans are not any more immune to recent inflation, so you know how it feels. But one of the factors I noticed was diminishing business: fewer people eating out, fewer new shops opening, and a certain loss of “bustle” in the city; all factors that seem to boil down to high rent, and the associated costs of living it creates.

Again, I’m conscious our cities aren’t comparable, due to our abnormally high homeownership rates; but one shared factor is that high accommodation costs for foreign workers do hurt businesses, and make certain lifestyles less affordable.

Meanwhile in other property news…

- Two condos that cost $1.8 million, but with very different results. They’re even in close proximity. Here are the main lessons.

- Jalan Wangi is under the radar, and it’s one of the few places where landed homes in the $2 million range are still possible.

- Check out this art-deco home, which shows how much colour and energy you can pack into a 699 sq.ft. unit.

- Fake property listings still haven’t gone away in 2024, so keep an eye out.

Weekly Sales Roundup (11 March – 17 March)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ONE BERNAM | $3,685,000 | 1421 | $2,594 | 99 yrs (2019) |

| 19 NASSIM | $3,583,000 | 1055 | $3,397 | 99 yrs (2019) |

| LENTOR MANSION | $3,512,000 | 1507 | $2,331 | 99 yrs |

| THE LANDMARK | $3,336,083 | 1141 | $2,924 | 99 yrs (2020) |

| LENTOR HILLS RESIDENCES | $2,867,000 | 1356 | $2,114 | 99 yrs |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| LENTOR MANSION | $1,137,000 | 527 | $2,156 | 99 yrs |

| LENTORIA | $1,198,000 | 538 | $2,226 | 99 yrs |

| THE LAKEGARDEN RESIDENCES | $1,555,700 | 732 | $2,125 | 99 yrs |

| THE MYST | $1,558,000 | 678 | $2,297 | 99 yrs |

| HILLHAVEN | $1,582,785 | 797 | $1,987 | 99 yrs (2023) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CAIRNHILL PLAZA | $5,050,000 | 2820 | $1,791 | FH |

| THE TRIZON | $4,850,000 | 2314 | $2,096 | FH |

| ST REGIS RESIDENCES SINGAPORE | $3,868,000 | 1507 | $2,567 | 999 yrs (1995) |

| SOMMERVILLE PARK | $3,710,000 | 1948 | $1,904 | FH |

| THE SEA VIEW | $3,690,000 | 1410 | $2,617 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE INFLORA | $560,000 | 463 | $1,210 | 99 yrs (2012) |

| CAMBRIDGE VILLAGE | $700,000 | 452 | $1,548 | FH |

| THE VERVE | $733,000 | 441 | $1,661 | FH |

| THE PLAZA | $750,000 | 592 | $1,267 | 99 yrs (1968) |

| THE SANTORINI | $752,000 | 527 | $1,426 | 99 yrs (2013) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE TRIZON | $4,850,000 | 2314 | $2,096 | $1,804,800 | 14 Years |

| THE SEA VIEW | $3,690,000 | 1410 | $2,617 | $1,510,000 | 13 Years |

| LAGUNA PARK | $1,820,000 | 1615 | $1,127 | $1,380,000 | 25 Years |

| OASIS GARDEN | $2,235,000 | 1238 | $1,806 | $1,258,000 | 15 Years |

| CENTRAL GREEN CONDOMINIUM | $2,350,000 | 1346 | $1,747 | $1,230,000 | 28 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE CREST | $2,188,888 | 1292 | $1,695 | -$160,112 | 6 Year |

| ONE-NORTH RESIDENCES | $955,000 | 592 | $1,613 | -$25,000 | 12 Years |

| KINGSFORD . HILLVIEW PEAK | $765,000 | 517 | $1,481 | $15,000 | 9 Years |

| SEAHILL | $806,000 | 495 | $1,628 | $65,877 | 12 Years |

| THE VERVE | $733,000 | 441 | $1,661 | $81,000 | 6 Years |

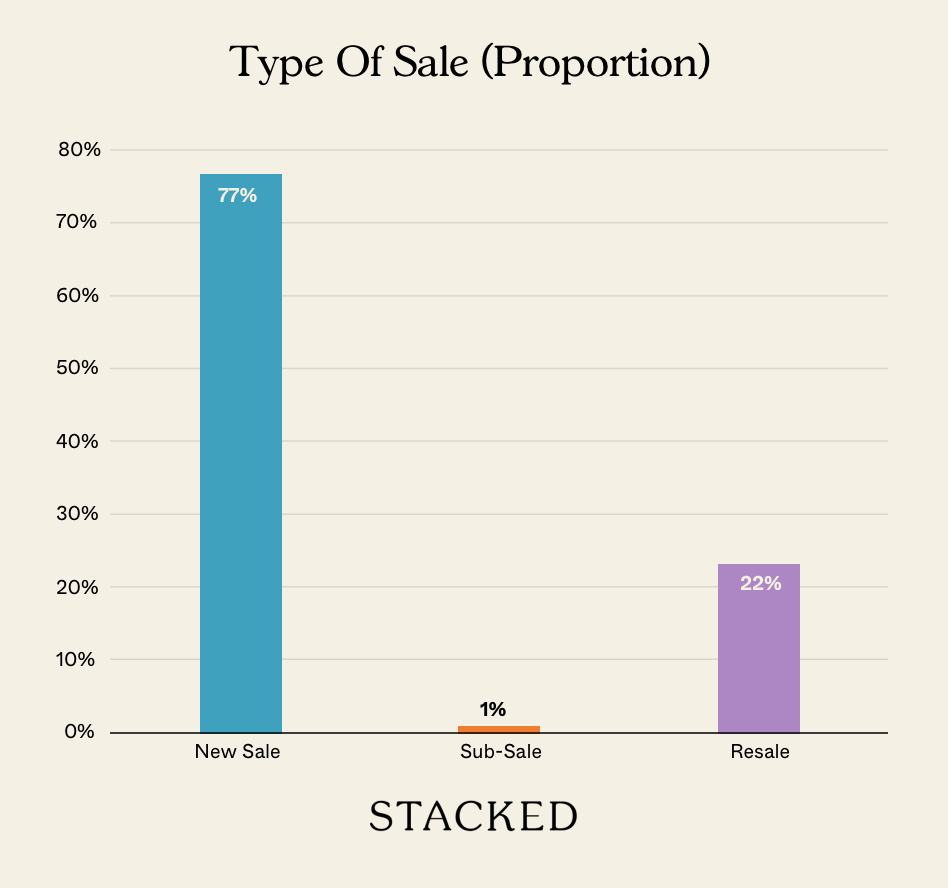

Transaction Breakdown

Follow us on Stacked for more news on the Singapore property market.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

Singapore Property News URA’s 2025 Draft Master Plan: 80,000 New Homes Across 10 Estates — Here’s What To Look Out For

Singapore Property News She Lost $590,000 On A Shop Space That Didn’t Exist: The Problem With Floor Plans In Singapore

Latest Posts

Pro Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest

Pro Similar Layout, Same District—But Over $500K Cheaper? We Compare New Launch Vs Resale Condos In District 5

New Launch Condo Analysis The First New Condo In Science Park After 40 Years: Is LyndenWoods Worth A Look? (Priced From $2,173 Psf)

Editor's Pick Why The Johor-Singapore Economic Zone Isn’t Just “Iskandar 2.0”

Pro Analysing Forest Woods Condo at Serangoon: Did This 2016 Project Hold Up Over Time?