Shrinking HDB Sizes: How Much Have HDB Sizes Really Shrunk Over The Years?

August 21, 2023

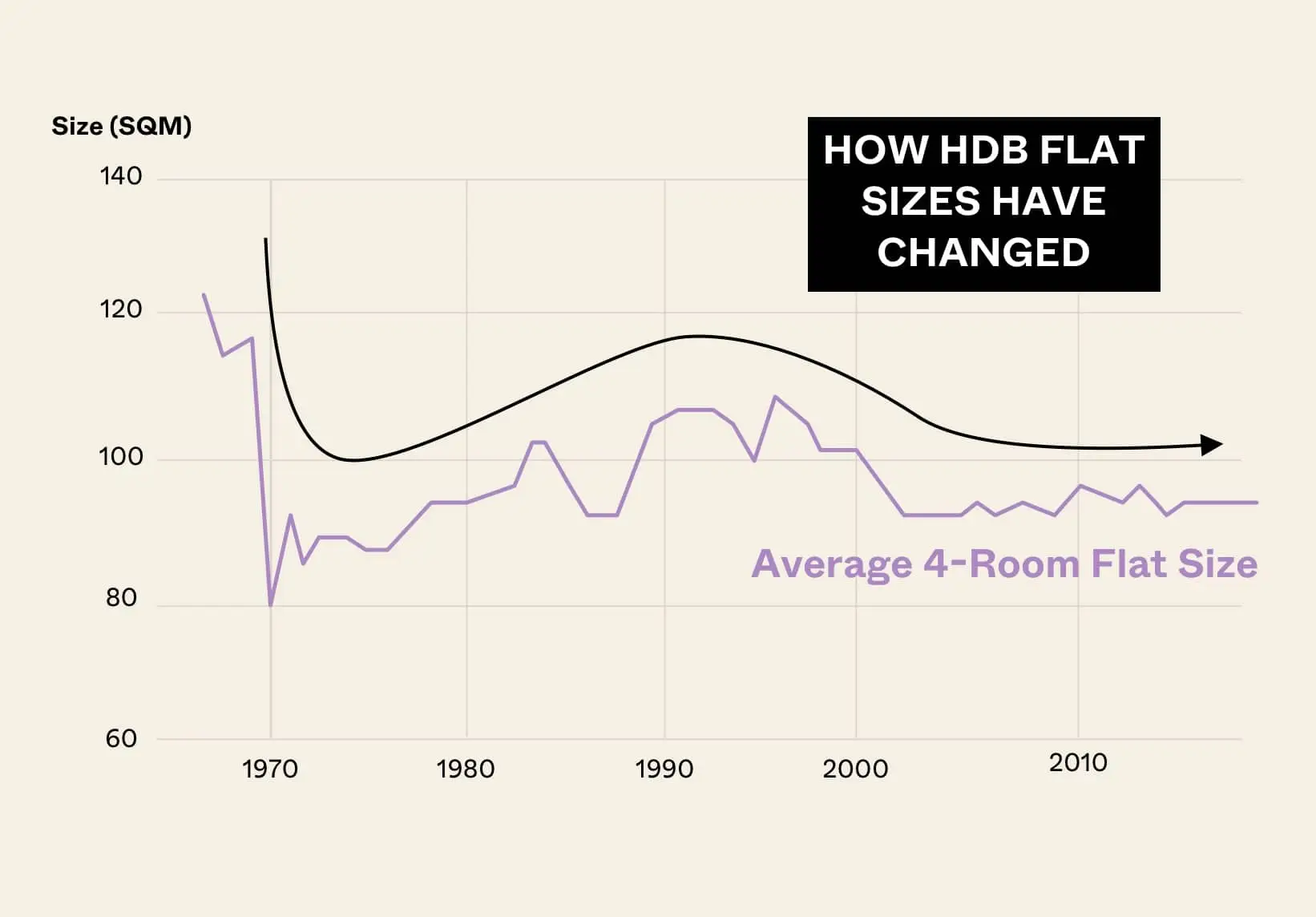

Along with many other property sites, it is probably the common consensus that only very old flats have a significant size difference. But it’s time to quantify that: how old is “very old”, and how much of a size difference truly exists? To find the answers, we plumbed the depths of available data, from the earliest flat leases to the present – and here’s what we managed to find:

Observations on changing flat sizes:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Except for 3-room flats, flats shrunk the most between the ‘70s to the ‘80s

If a flat’s size is a major factor for you, then you don’t just want flats built before 2000. Rather, you want the flats that date back to the 1970s, as the data shows that’s clearly when flats were at their biggest.

The exception to this, however, is 3-room flats. In fact, 3-room flats between the ‘80s and ‘90s tended to be bigger than their predecessors. 3-room flats peaked in size in 1993, when they averaged 74 sqm., versus 65 to 68 sqm. in the ‘70s or earlier.

As a loose rule of thumb, you can spot these ‘60s to ‘70s era flats by checking the car park. Most of them will not have a multi-storey car park, as these were built by HDB in later eras.

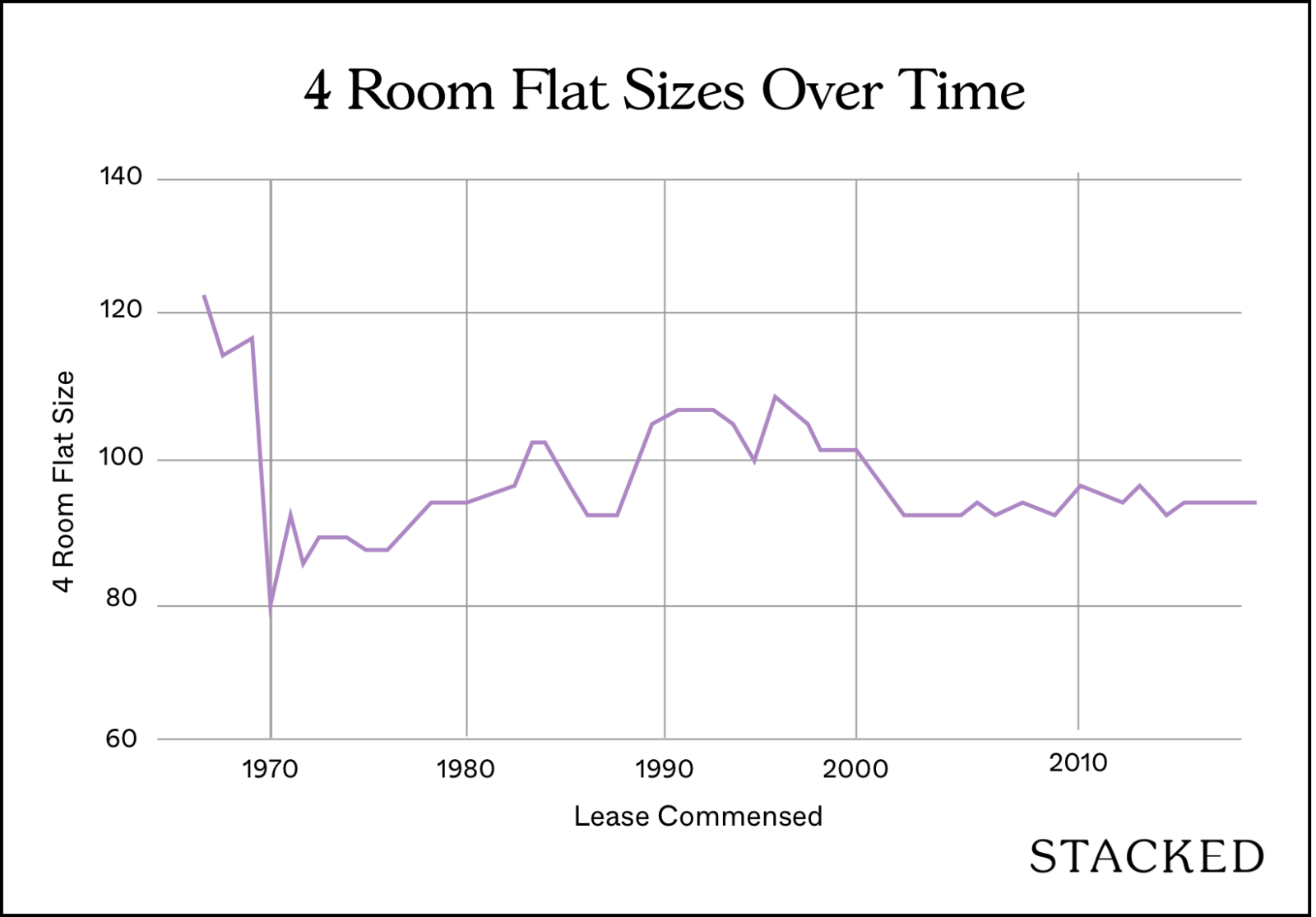

2. For 4-room flats, there was a significant size reduction between 1969 and 1970

Prior to 1970, there were a couple of HDBs in Queenstown and Bukit Merah classified as 4-room flats that were between 94 sqm up to 149 sqm. This explains the sharp drop in size. However, these have the “Adjoined Flat” model type, so it’s not accurate to describe them as 4-room in the traditional sense.

In the 1970s, 4-room flats coming out at 80 sqm wasn’t uncommon at all. Many flats in Bukit Merah and Queenstown saw flats coming in at around 80+ sqm. In fact, flats built in the 70s have smaller flat sizes than most 4-room flats built today. It was only towards the late 70s that we started bigger 4-room flats and this continued on to the 80s.

From the 80s, some 4-room flats even went up to 100+ sqm. For example, Tampines Street 11 have flats at 117 sqm which is bigger than most 5-room flats today. This explains the sharp increase in average sizes in the 80s.

The 90s continued seeing 4-room flats in the 100+ sqm as many flats were built in non-mature estates.

The 2000s then saw flats consistently averaging around the 90 sqm mark which is where we’re at today too.

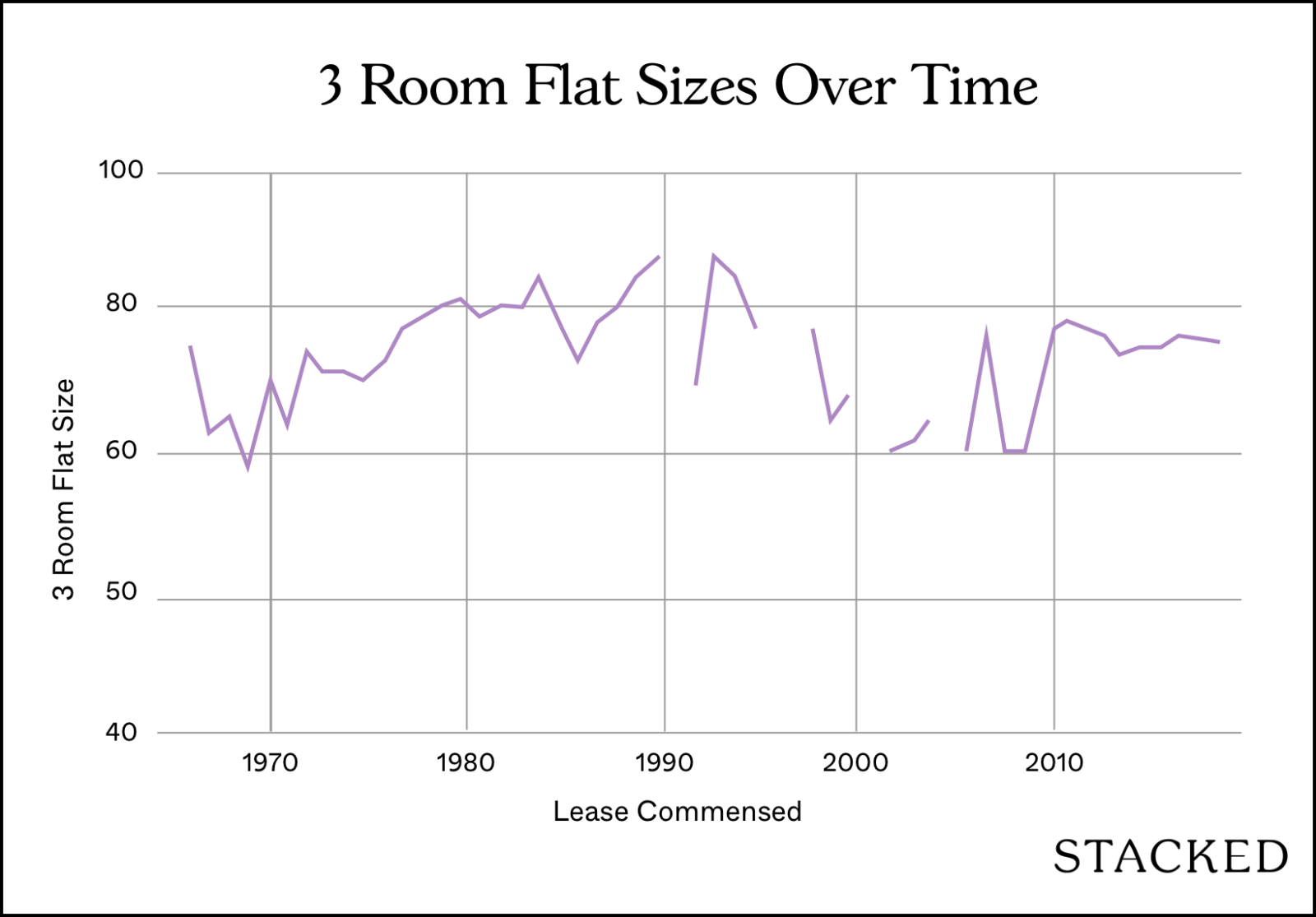

3. The “shrinking” phenomenon doesn’t seem to apply to 3-room flats

Perhaps it’s simply because 3-room flats are already small, and there’s no way to shrink them even further without becoming 2-rooms!

The average size of a 3-room flat back in 1966, among the earliest recorded flats, was 68 sqm. As of 2019, the average size of a 3-room flat was…still 68 sqm.

The largest 3-room flats were from 1993, when they averaged 74 sqm; but this difference is not very significant.

So if you’re buying a 3-room flat, you may as well discard the notion that “older is bigger,” as it won’t be true for your flat size. Just focus on getting something newer and with less lease decay.

Property Market CommentaryBuy 3-Room Flat Now, Own 2 Properties Later: 7 Reasons Why These Flats Are An Underrated Choice

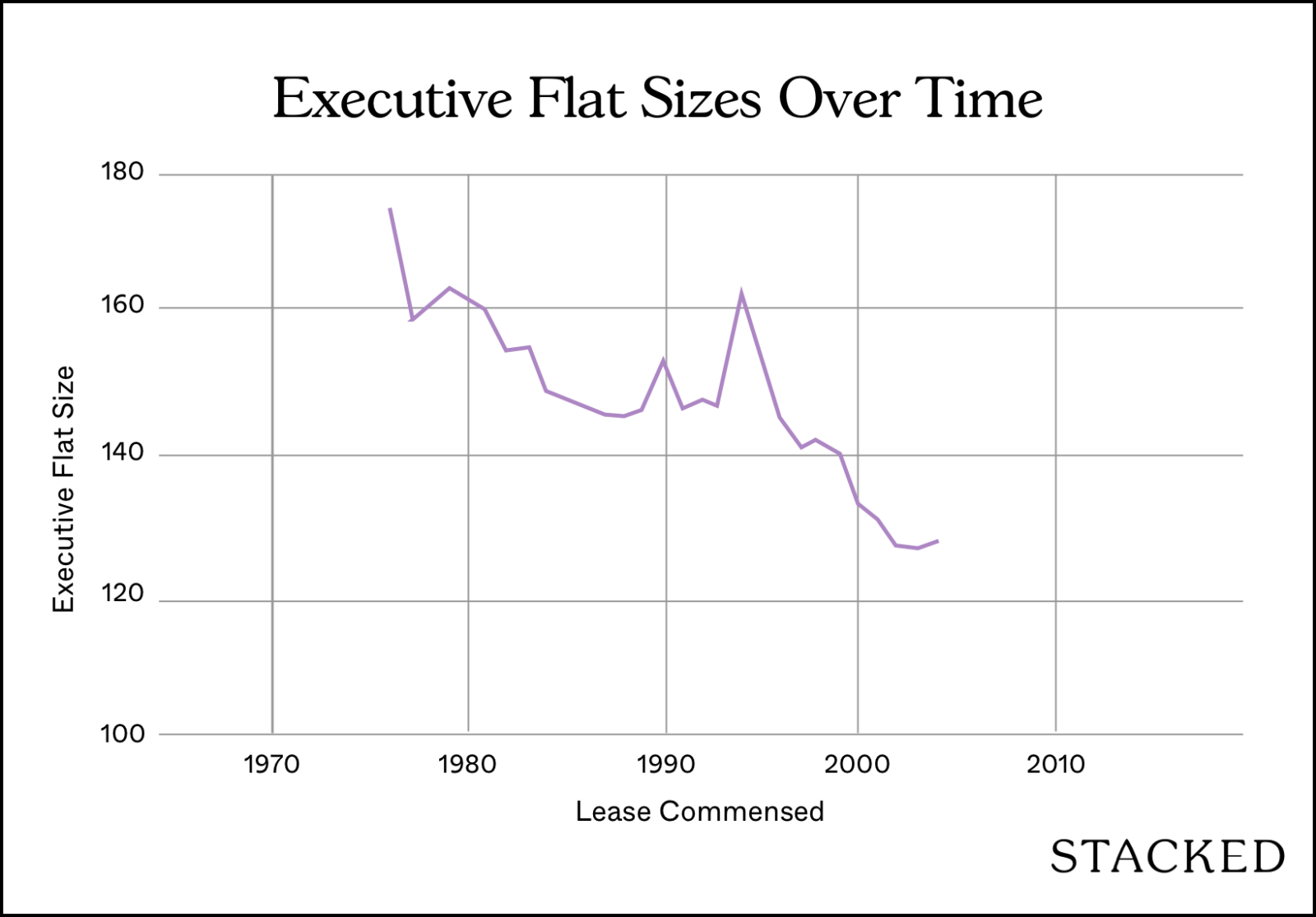

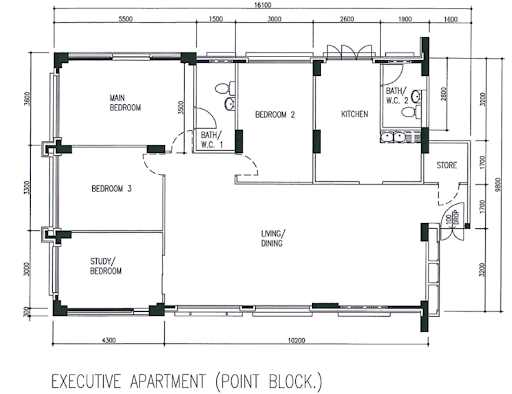

by Ryan J. Ong4. Executive flats have shrunk the most overall

When it comes to executive flats, older really is bigger. These have gone from a huge 176 sqm back in 1976, to about 128 sqm. in 2004.

This means the latest executive flats may be smaller than 5-room flats built in 1973 or earlier. It also means that executive flats built in 1976 may be the most prized, among those who need space more than remaining lease; that year saw the highest average size for executive units, at 176 sqm.

There might be a pressing need to reconsider building larger flats, especially when considering its potential impact on family planning. For families contemplating having three or more children, the lease concerns associated with older, spacious executive flats could be a more significant deterrent than we might think.

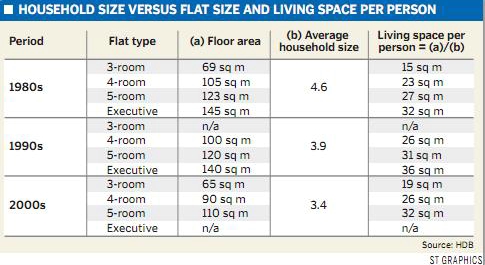

There’s another perspective though, which is to look at the amount of space per resident

This was an opinion brought up by HDB some years ago: the idea is that, while flat sizes have shrunk, so has the number of residents sharing a unit (i.e., there is more square footage available per person, even if the total size has been reduced).

If we look at Singapore’s shrinking population, and the growing number of people who stay single for much longer, this could be a valid point. Perhaps when most Singaporean households shrink down to just two or three people (quite plausible given ageing and low birth rates), we won’t really feel the need for such large flats anymore.

However, this argument presents a classic chicken and egg conundrum. Could the reduced size of HDB flats also inadvertently have a small part to play in the low birth rates in Singapore? By framing the narrative that modern flats are designed for smaller families, we inadvertently suggest a lack of infrastructure to support larger families, which could deter individuals from considering having more children.

Moreover, while this perspective may seem theoretically sound, it often clashes with the tangible experiences of homeowners. We know many angry home buyers who will point out their small kitchens or tiny bedrooms, and explain that it’s not okay for quality of life, regardless of some policymaker’s theories of square footage per person.

For more on the situation as it progresses, and news on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Have HDB flats really gotten smaller over the years?

Which types of HDB flats have seen the most size reduction?

Did 3-room flats also get smaller over the years?

When did the biggest size reductions occur for HDB flats?

Are only old flats smaller, or have newer flats also shrunk?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

2 Comments

Felt that the small size of flats now have played some part in the low fertility rates we are facing. In a 90s 4 room flat, 2 kids can comfortably sleep in one room with space for wardrobe and a table. In the current room of a bto, only 1 kid can sleep squeezing in a wardrobe. Max of 2 kids for a 4 rm or 5 rm per family.

My wife and i went to visit friends in their new Punggol-area BTO 3-room HDB flat. My wife currently owns a 5-room HDB flat. We were astounded at how cramped the flat is; and, much worse (at least from my perspective), the fact that the flat is surrounded within 200 metres or less by other HDB flats or the MRT station, makes me feel like i am in China, where “homes” are like prison camps. Although I’m a Singapore PR and have lived in and visited Singapore since 2003, i am unafraid to share this opinion: the reason Singaporeans are crowded like cattle in HDB Estates is not because Singapore is “rich and affluent” but simply because government Ministers and other “royalty” will never live in such conditions, which are “unsuitable” for them and their many helpers and large families.