The term ‘SSD’ is something we hear all the time.

That said, it’s also one of those terms that we don’t usually have a complete clue about till we find ourselves fidgeting nervously and nodding sheepishly in a conversation centered around this so-called terminator of ‘get-rich-quick’ house-flippers.

Now to be frank, SSD is quite a simple concept to master.

In this piece, we break the topic down into bite-sized digestible points.

More specifically, we’ll be delving into the history of Seller Stamp Duty – what it actually is, as well as how it can severely impact your transaction costs as a home seller.

We then conclude with how you can potentially avoid these additional costs that would otherwise be a massive unwanted cost.

Let’s hop to it.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A Brief History

Most of you will remember the ‘07/‘08 Global Financial Crisis and Singapore property market crash of ‘08/‘09 (for those who were too young to remember… congrats! You’ve now officially got your own tale to tell about the Covid-19 saga).

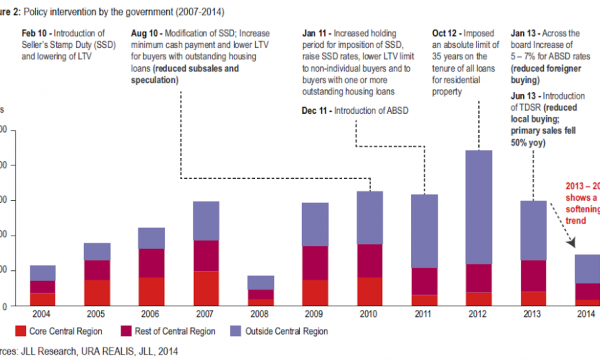

As we know, property market prices began to rocket as soon as economic sentiment returned post-crisis. Cooling measures were therefore introduced by the government in 2009 to ensure a smooth and sustainable property market recovery, while reducing price volatility and the likelihood of a property price bubble forming.

Seller Stamp Study – or SSD as we know it, was introduced on 20th February 2010. It was the first form of stamp duty that shaped the way for a slew of measures over the coming years.

Measures that included changes in loan-to-value (LTV) ratio requirements, Total Debt Service Ratio (TDSR) and of course, the infamous stamp duties (ABSD/SSD).

Well, what exactly is SSD?

In essence, SSD is the tax payable to the IRAS if you sell a property within the first 3 years of purchasing it.

The amount of Seller Stamp Duty payable is calculated off either the property’s selling price or estimated valuation at the point of sale – whichever is higher.

Like the other cooling measures, SSD rates have had several revisions over the years:

Introduction back in Feb 2010

SSD was payable on properties sold within a year of purchase, at up to 3% of the sales price.

30 August 2010

The SSD holding period increased from 1 to 3 years from date of purchase, with the following rates:

- Up to 3% for properties sold within the 1st year

- Up to 2% for 2 years

- Up to 1% for 3 years

14 January 2011

The SSD holding period was increased further to 4 years, with far higher tax rates:

- 16% for properties sold within the 1st year

- 12% for 2 years

- 8% for 3 years

- 4% for 4 years

As of 11 March 2017, the current SSD rates are as such:

| Holding Period | Rates |

| ≤1 Year | 12% |

| 1> Year and Up to 2 Years | 8% |

| 2> Years and Up to 3 Years | 4% |

| 3> Years | No SSD Payable |

So.. How does SSD Impact your Transactions?

To keep this digestible, here’s a (very) hypothetical scenario, featuring James and Johnson.

Scenario 1:

A while back on 1st Feb 2016, James bought himself a 4-bedder condo unit valued at $1.7mil.

8 months later, on 1st Dec 2017, James sold that unit for $1.85mil (Let’s just imagine that the area on which the development sat had a pot of gold that made it appreciate by $150k in under a year).

Scenario 2:

Likewise on 1st Feb 2016, Johnson also bought a 4-bedder unit in the same condo at $1.7mil.

The difference? Johnson sold it 20 months later (1 year 8 months), also for $1.85mil.

In comparison,

James’s SSD payable amounted to $210,000 ($1,750,000 x 12% SSD rate = $210,000),

While Johnson’s SSD payable was $140,000 ($1,750,000 x 8% SSD rate = $140,000).

Both units were bought and sold for the exact same prices respectively, and yet, Johnson paid far less in SSD simply because he waited one more year.

This goes to show how much of a difference waiting a single year can make in the amount of SSD payable when you sell your property.

I also hope that it clearly illustrates how Seller Stamp Duty works on a whole.

Property Market CommentarySingapore Cooling Measures – History of cooling measures since 2009

by Stanley Goh7 Ways you can Avoid Paying for SSD!

And so before we conclude, here are a couple of ways/scenarios that might come in handy when crossing the deathly SSD moat.

- Transferring flat within family

You can transfer or sell your flat to another member of your immediate family, (who must be either a Singapore citizen or PR) – without SSD charges.

However, this is only applicable to HDB units.

- Selling flat prior to Marriage

Let’s say you and your fiance are planning to tie the knot, and both of you each have a HDB flat of your own.

Upon marriage, HDB would require you to stay in a single flat as one ‘family unit’, meaning neither of your names can be listed in a separate flat.

Hence, one of you would have to sell off your respective flat – and in doing so, avoid any SSD rates.

- Selective En bloc Redevelopment Scheme (SERS)

SERS was implemented by HDB to maintain and upgrade flats in selected older estates. Unfortunately, it did mean that most SERS flat owners would have to vacate their units.

On the bright side, if you are/were a SERS flat owner, in addition to providing rehousing benefits, HDB will/would have compensated you based on the market valuation of your initial flat.

Same goes for condominium owners.

- Matrimonial proceedings

If an Order of Court (judicial separation, nullity of marriage, etc) requires you to sell your property to your spouse or either of your children, rest assured that the sale will be conducted SSD-free.

- Inheritance

If you already owned a HDB flat prior to acquiring another via inheritance, you will be required to sell one of the two off. This sale will also be conducted SSD-free.

- Bankruptcy

This should be near the tail-end on our list of ‘most unlikely scenarios’, but I’ll just include it nonetheless.

Upon declaring bankruptcy, you’ll be required to produce a receipt of approval from your Official Assignee (OA), afterwhich, you may dispose of your residential property tax-free.

- Winding up

Companies who undergo involuntary winding up proceedings (liquidation of the company and its assets) have to dispose of their properties.

The sales of these properties will also be tax-free.

Final Words

I’ll be the first to admit that I’m really not the biggest fan of losing my hard-earned money to taxes. And I’m sure that many of you feel the same way.

That said, paying for SSD is sometimes a necessary/lesser of two evils depending on our personal circumstances.

It sure beats holding on to that one property while you purchase a second (don’t forget about the ABSD charges!), and honestly, it could even be a minor monetary sacrifice in the long run if you’re getting that second property at a steal.

If, at the end of the day you don’t find yourself in any of the aforementioned scenarios to avoid paying SSD, it will ultimately come down to the numbers and figures.

Am I willing to lose this amount of tax money for this next step in my property journey that I am about to take?

It’s a question that only you can answer.

For more tips and tricks about Seller Stamp Duty, as well as the right way to calculate your tax losses and gains for the best possible returns, feel free to drop us an email at stories@stackedhomes.com!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Reuben Dhanaraj

Reuben is a digital nomad gone rogue. An avid traveler, photographer and public speaker, he now resides in Singapore where he has since found a new passion in generating creative and enriching content for Stacked. Outside of work, you’ll find him either relaxing in nature or retreated to his cozy man-cave in quiet contemplation.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments