Should You Take Up A Deferred Payment Scheme When Buying A Condo?

August 12, 2020

You’ve had your eye on that new launch condo for a long time; and now that it’s complete, you can even move in right after buying. Well, get ready to be introduced to the Deferred Payment Scheme (DPS) when you start enquiring about the price. As if the enthusiastic sales pitch wasn’t enough, now someone is telling you can skip payments for two whole years on top of it.

If it sounds too good to be true, that’s probably because you’re getting the simplified version. There’s a price for anything, especially if you don’t want to pay a home loan for two years. Here’s a look at whether the deferred payment scheme is the best deal for everyone:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What is a Deferred Payment Scheme anyway?

With some variations*, the deferred payment scheme allows a buyer to put down just 20 per cent of the property price, before being allowed to move into the unit or start renting it out. The buyers only need to pay the remaining 80 per cent after a period of 24 months.

Since 2007, DPS has only been allowed for a completed property (i.e. the development has received the Temporary Occupancy Permit and Certificate of Statutory Completion).

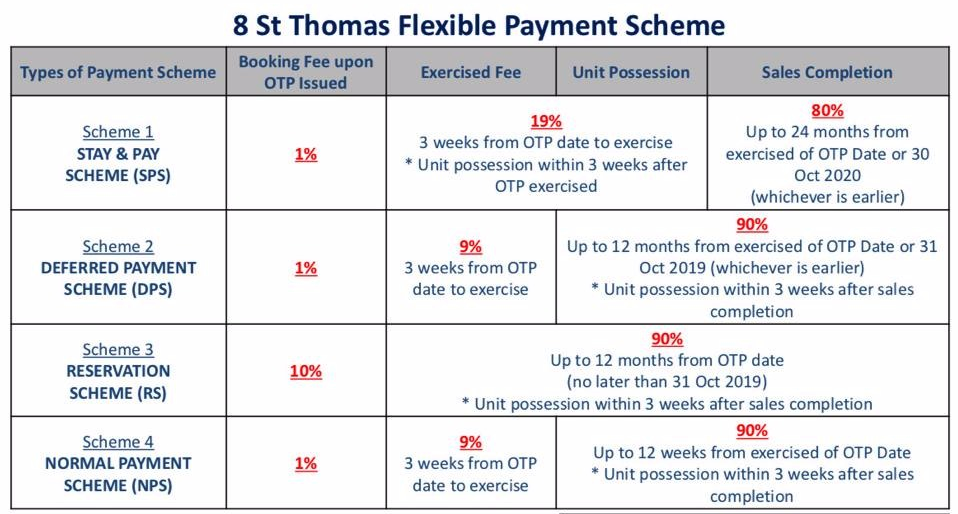

The scheme thus appears in the final phases of a new condo, when the project is built and the developer needs to move the remaining units. Marina One Residences, and 8 St Thomas for example, offers a deferred payment scheme for home buyers.

*There are variations where the deferred period is 12 months or 36 months, and the required deposit may differ.

Why is the Deferred Payment Scheme often marketed as a major bonus?

First, it means less capital is tied up in the property; you have two years to invest and grow the money elsewhere, before you need to start dealing with the home loan, interest rates, etc.

Second, the property can often be rented out during the two years, thus generating rental income without any home loan repayments. This could offset the initial cash outlay (e.g. if you generate $3,500 per month in rent, that’s $84,000 over a period of two years. That would be more than enough to offset the initial cash payment of about $75,000 on a $1.5 million condo unit).

Third, you have 24 months to settle any outstanding home loan. Under normal circumstances, if you buy a new property before settling your outstanding home loan, your maximum financing falls to 45 per cent or less of the new property’s value.

With the deferred payment scheme, you can buy your new property first, get 24 months to settle your outstanding home loan, and then apply for a new home loan at full financing.

Sometimes, stamp duties like the Additional Buyers Stamp Duty (ABSD), will only be payable after the 24-month deferment period (and if your previous home is sold by then – and it will probably be after two years – you won’t need to pay the ABSD). You may even escape maintenance fees and property taxes for the two years.

Editor's PickAdditional Buyer’s Stamp Duty (ABSD): A Comprehensive Guide

by Reuben DhanarajBut this isn’t always the case, as we’ll explain below.

This all sounds like it’s purely advantageous, but there’s always a catch

- You are paying more when you use the DPS

- Not all DPS schemes are the same

- Maximum financing is reduced

- Your financial situation may change two years later

1. You are paying more when you use the DPS

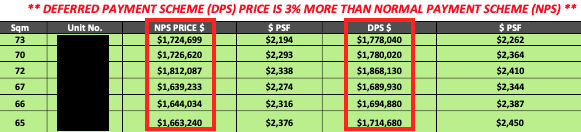

Almost invariably, we see prices go up when the DPS is used. This varies between projects, but it’s often to the tune of 10 per cent.

Because of this, DPS is a much bigger benefit to the financially savvy. If you know how to invest the savings over a 24-month period (e.g. trade stocks, buy the right REITs, and so forth), then the 10 per cent premium is nothing to you. You might even earn it back and more, by the time 24 months is up.

But if you don’t know how to do all that, well… you’re still getting benefits, such as being able to move in right away. But is that worth paying, say, $150,000 more on a $1.5 million condo?

There’s no one-size-fits-all answer to this, so reach out to us on Facebook to clarify your specific situation.

2. Not all DPS schemes are the same

Check the terms in the Option To Purchase (OTP). If the exercise date of the option is 21 days, then you’re going to have to pay stamp duties – like the Buyers Stamp Duty (BSD) and ABSD, within 14 days of the exercise date. This means you can’t avoid paying the ABSD, if you haven’t sold your previous property yet.

(You’re still able to apply for ABSD remission if you qualify, and sell your previous property within six months of completing the transaction).

Note that you’re also liable to pay property taxes and maintenance fees, along with all the usual obligations of a property owner. This is the type of DPS typically offered for Executive Condominiums (ECs).

If the exercise date is beyond 21 days (e.g. 24 months), this means you’re not truly the owner of the property during the given deferment period – the developer is just letting you stay there. Most genuine home owners prefer this, as it means you don’t have to pay the stamp duties (you haven’t bought the property yet).

You also don’t have to pay property taxes and maintenance fees, until you become the true owner two years later.

Investors may be less enthusiastic about this. Because they aren’t owners, they can’t rent out the unit during the two years. As such, they typically look for schemes where the developer also allows them to sublet the unit. This can be in the form of financial returns each month or an agreement that allows you to sublet the unit.

3. Maximum financing is reduced

With normal home loans, the maximum financing is 75 per cent of the property price for new condos. However, the Monetary Authority of Singapore (MAS) considers the DPS to be a benefit. This has to be subtracted from the purchase price, when the maximum loan amount is being considered.

The amount of this benefit is based on the Singapore Government Securities rate. For example, say you put down 20 per cent of the property, and get a DPS for 24 months.

Over the next 24 months, the benefit to you is counted as (the outstanding 80 per cent) x (Singapore Government Securities rate*). This amount is subtracted from the purchase price as a rebate.

For example, say the rebate comes up to $80,000. The price of the property is $1.5 million. The maximum you can borrow is 75 per cent of ($1.5 million – $80,000) = $1.065 million, instead of the usual $1.125 million.

This means a bigger down payment, when you obtain your home loan at the end of the two-year deferment.

Besides the rebate from the DPS itself, other related benefits – such as rental income if you’re allowed to sublet – may also reduce the maximum financing available.

A loan specialist can look over the terms of the DPS and tell you what is or isn’t a benefit, rebate, etc., so contact us if you need help with this.

*You can check the current rate on the MAS website.

4. Your financial situation may change two years later

If you’re not going to own the property due to the DPS (i.e. the OTP exercise date is 24 months later), you should only proceed if your financial situation is stable.

If your financial situation should change drastically within the next two years, there’s a chance you won’t qualify for a sufficient bank loan once the deferment period is up. The developer may impose penalties beyond keeping your deposit.

Besides the above, you should inquire as to why the units have remained unsold to the point of completion.

Units that are still unsold, upon the project’s completion, may be the ones which have worse views, less efficient floor plans, are further from the facilities, etc. This isn’t always the case – sometimes big developments just take longer to sell out – but it’s always worth being extra cautious.

After all, you’re paying around 10 per cent more for the unit due to the DPS.

Overall, the DPS can be a better deal for some homeowners, but it’s not an “automatic win” when picking properties

It definitely fits into the plans for some – those who’ve gotten a windfall from their en-bloc property, flexibility when upgrading (getting those timelines right can be really tough), and even waiting out on a possible change of regulation regarding the ABSD.

Ultimately though, don’t let the deferred payment scheme lure you into ignoring the fundamentals, when comparing properties. Just because you don’t have to pay for two years, that doesn’t override concerns like the facilities, amenities, future URA master plan developments, etc. You can follow Stacked to check out in-depth reviews that take these into consideration.

Above all, stick to the parameters of affordability. Don’t be lured into over-leveraging, just because you’re spared the first few years of the home loan.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

3 Comments

Thanks Ryan, your information is well researched and detailed. Greatly appreciate.

Which Condos provide DPS at the moment?