How The Coronavirus Is Affecting Real Estate In Singapore

March 28, 2020

It has been a wild ride since we last wrote about the Coronavirus in February – so much has happened since then.

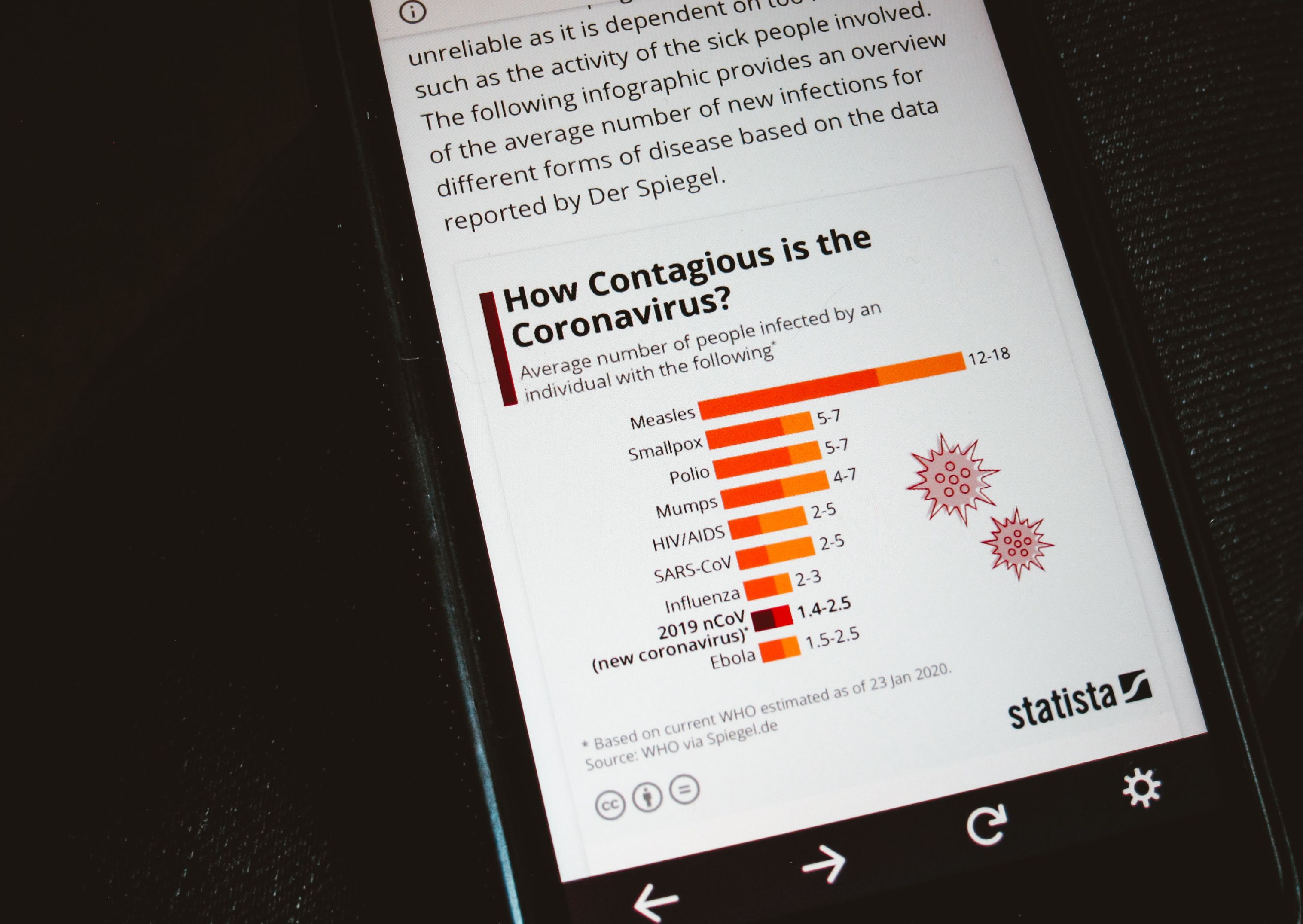

As of now, the spread of COVID-19 has worsened to a state that the World Health Organisation (WHO) declared it a pandemic on March 11. If you haven’t already grasped how serious the issue is at hand – in 2003 SARS wasn’t even considered significant enough to reach pandemic status.

At the time of writing, it has already claimed more than 24,000 lives and over 500,000 cases worldwide.

The COVID-19 pandemic is affecting everyone directly, with a third of the world now under lockdown – that’s nearly 3 billion people. Even if you were old enough to remember the SARS period, the measures then were nowhere close to the same as now – it is quite the unprecedented situation.

In Singapore itself, there have been 683 confirmed cases so far – with numbers expected to rise as more overseas Singaporeans return back home. On March 26, it was announced that an additional $48.4 billion will be put aside to combat the coronavirus – this was an additional major stimulus on top of the $6.4 billion that was previously announced.

So what now?

At risk of sounding like a general news site at the end of the day, let’s talk about what is currently happening in the real estate market and how the coronavirus has affected it.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How the Coronavirus might change things in the Singapore real estate market

Change in the way showrooms are viewed

With the current bans of gatherings of more than 10 people outside of work and school, it’s unsurprising that visits to showrooms would have to be regulated as well.

For those of you who’ve visited the M during its launch, it’s easy to see why this would have been a huge hotspot for another Coronavirus cluster.

So developers have been working with the Urban Redevelopment Authority (URA) to ensure that certain guidelines are kept.

The first – viewings are to be kept to groups of maximum 10 people and clients are to be kept one metre apart.

The second – temperature-taking and contact tracing.

You can expect the measures to be really stringent and followed to a T.

After all, no developer would want the “title” of the first showflat to be the cause of another Coronavirus hotspot – no one would want to visit thereafter!

Because of these new measures, most showflats will be switching to an appointment basis – so as to make it easier for them to adhere to the guidelines.

As an example, the Kopar at Newton launch was the first to have to deal with these new measures on their launch.

Viewings were all by appointment only, with only two groups of five (including the agent) allowed in the showflat at any point in time.

Thereafter, the sales would be conducted by balloting via live streaming.

While some people might find this a bore, we think that this might actually be a much better way to peruse a showflat!

There is no more jostling with the crowd – you can now take your time to go through the showflat in a relaxed manner – it just sounds like a calmer way of doing things.

New ways of selling real estate

Make no mistake, we’ve already started to see some of our clients postponing consultations or requesting to have conference/skype calls.

Some agents have also resorted to Facebook or Instagram Live to do broadcasts.

For the past few years, there has been much talk on how prop tech will change the real estate landscape.

3D virtual tours, video, virtual reality tours – these have all been bandied about at some point to be the game changers.

While they’ve all been adopted to some extent (particularly for overseas buyers), none have quite taken over the market like some have touted.

That said, there is a new virtual alternative that is gaining in popularity at the moment – it combines a 3D view with an agent in real-time.

In other words, from the client’s point of view it looks as if the agent has been integrated into the 3D model.

With all the measures and lockdowns in place, will this be the catalyst for one of these to become a defacto way of showing people around a property?

More from Stacked

Should We Buy An Old But Central HDB, Or A Newer One But Located Further Away?

Dear Stacked Homes,

Lower mortgage rates

The US Fed Reserve has lowered interest rates to near zero in an attempt to prop the US economy up.

It’s been the most dramatic move since the 2008 financial crisis, and even then there is speculation that wouldn’t be enough – they might even resort to a negative rate.

You might be wondering what the US Fed has got to do with you in Singapore, and how it even affects you.

But the truth is that it is mega relevant because interest rates like SIBOR and SOR are historically closely correlated with the US Fed rates.

Essentially, you can expect interest rates and home loans in Singapore to go down (net result: cheaper housing loans).

Slower construction

Another repercussion of the Coronavirus has been labour limitations and supply chain disruptions for construction.

With the curbs on work pass holders from China, Bangladesh workers here testing positive for COVID-19, and Malaysia’s partial lockdown, all these have had a major impact on the manpower available for the construction projects in Singapore.

Building materials have also been affected, especially those that came from China as the outbreak had resulted in major disruptions there. Construction materials from Europe too (Italy, Spain, and France) as these countries have struggled with containing the Coronavirus.

Another problem is the supply of prefabricated pre-finished volumetric construction (PPVC) modules – about 80% of these come from factories in Johor Bahru.

One example of a potentially delayed project is the Avenue South Residence, where construction was stuck at the fifth storey because of disrupted deliveries of building supplies from China.

As of now, there are a total of 44 PPVC projects, of which 35 are private residential and HDB.

With all these issues at hand, it’s only natural that there might be the possibility of project delays. More so if the pandemic rages on, we could see significant delays moving forward – which would have a further negative impact on the construction industry.

Which leads us to the next issue.

A major problem facing both the construction industry and property developers is the five-year Project Completion Period (PCP) deadline that is currently imposed on developers.

So if developers fail to build and sell all units from the time of the land purchase, they will be subject to ABSD of 25 per cent for land purchased from July 6, 2018.

Even before this crisis, it can be said that the ABSD ruling could be seen as an inequitable one – especially for large developments as needless to say, they would take a longer time to sell as compared to a small one.

Yet they are all subject to the same timeline.

So an extension to the ABSD deadline would definitely help – even if it was a temporary measure to tide through this period.

Moving forward

At the end of the day, the wild card at hand is the coronavirus – no one has a real clue of how long it will last.

The longer it goes on, the more likely of a major recession, which leads to unemployment – which then leads to low demand for housing.

But once everything blows over – there might be repercussions left in its wake.

For one, many people (and companies) are starting to realise that working from home can actually be a viable solution moving forward.

So this could have a major effect on corporate real estate in time to come.

Less commuting, less traffic jams, less pollution, less stress for employees – more time for family etc equals happy work life balance and maybe even better productivity overall.

On the company end of things, there is no need to expend cash on expensive office real estate – higher productivity and lower cost equals higher P&L for the company and shareholders.

Are there any other things that you feel might change once this is all over?

Do share in the comments below or reach out to us at stories@stackedhomes.com!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How has the COVID-19 pandemic changed property showings in Singapore?

Are virtual property tours becoming more common in Singapore due to COVID-19?

How does the US interest rate cut affect home loans in Singapore?

What impact has COVID-19 had on construction projects in Singapore?

Could the pandemic lead to changes in property development deadlines or regulations?

Druce Teo

Druce is one of the co-founders at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary Singapore’s Tallest HDB Yet: A 60-Storey Project Is Coming To Pearl’s Hill

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

2 Comments

Hi Druce,

What’s your sentiment on new project pricing, will the Developers price it lower to get buyers few from now till months down the road if the pandemic persists?

Thanks !

Hi Ong,

Yes if ABSD is not tweaked by then they might have to resort to that to move projects. Projects like Fourth Avenue Residences and Mayfair Modern have already just announced some discounts.