Can You Really Upgrade From A BTO To Landed Property Without Any Additional Cash?

April 3, 2023

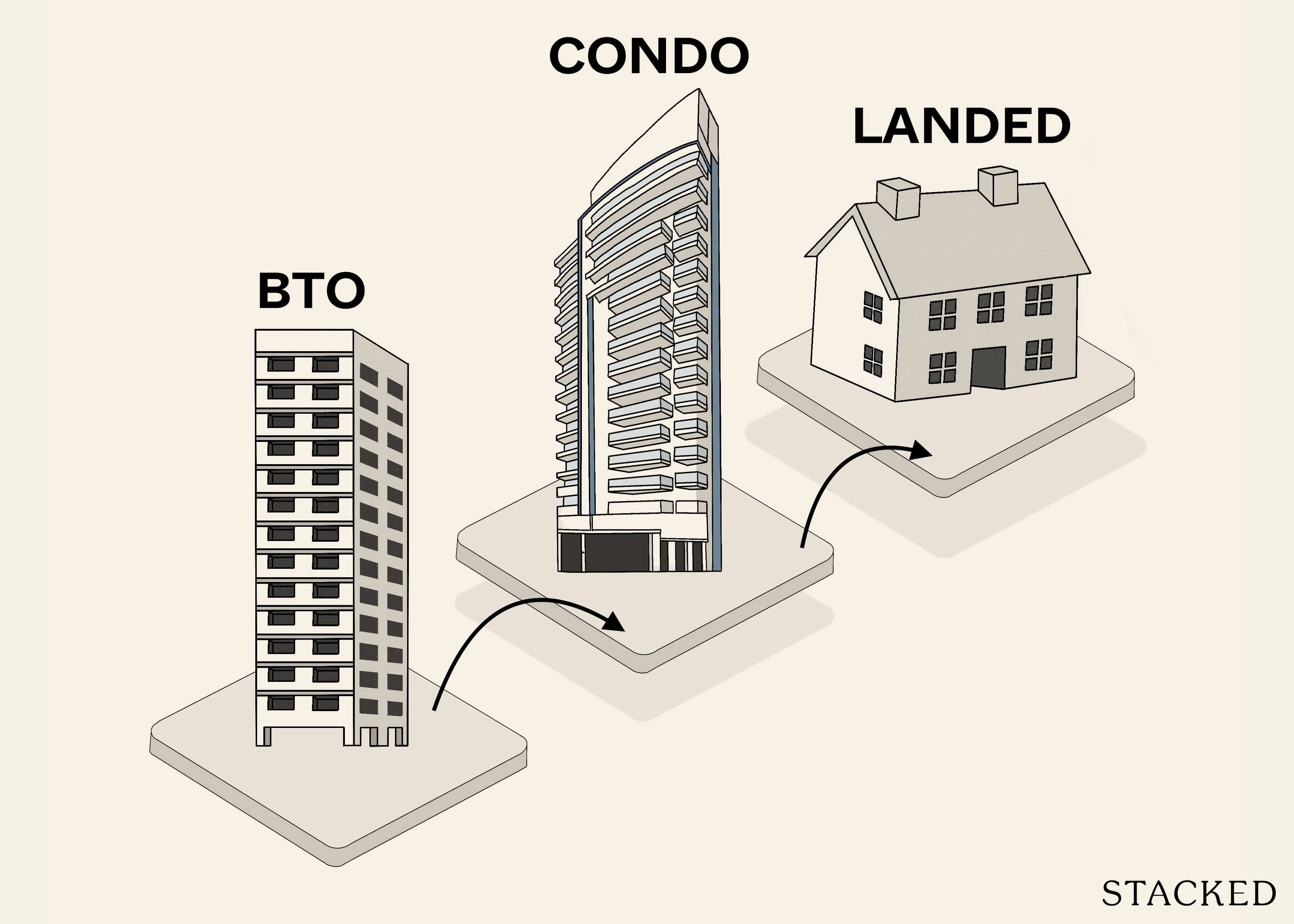

Property progression is often discussed, and just as often misunderstood, by many home buyers. We blame sales pitches over the years, which have over-simplified it as a way to “get rich with property” while going only into the skimpy details. To clarify things, we’re going to look at how property progression means different things to different people (as well as the much-overlooked risks):

Three different ways that property progression can work

Not everyone has the same end goal with their property. It’s important to decide the “route of progression,” based on the desired result:

- Progress to private housing, to eventually live off the resale gains

- Aim to own two or more properties, and live off rental income

- Property progression to benefit the next generation

Table Of Contents

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Progress to private housing, to eventually live off the resale gains

This is the most common approach, simply because it’s the most viable for many Singaporeans. This is how the progression works:

- Although resale flats are a preferred starting point*, let’s say we’re unable to manage the price just yet. We’ll start with a 4-room BTO flat in a non-mature estate. For our example, we will use Treelodge in Punggol, which would have cost around $231,000 when bought from HDB.

- About four years after balloting and getting the flat, we move in 2012. The MOP countdown begins from the key collection, so we’re able to sell by 2017. At this time, we can see that the typical resale price for a 4-room flat at Treelodge is $545,000. This leaves us with a profit of $314,000.

- With the sale proceeds from Treelodge, we then upgrade to an EC. Our choice will be Floravale EC. We can see the price for a three-bedder here is about $750,000, for which our flat profits ($314,000) can cover about 42 per cent of the price. It’s no issue to upgrade, as the minimum down payment is just 25 per cent.

- Fast forward another five years, and we’re ready to sell Floravale. The transacted prices at this time are around $1.2 million. Assuming we transact at about the same level, this leaves a net profit of $450,000.

- From this point, we have a wide number of options. Let’s aim higher and look at landed properties instead. Our situation is as follows:

| Description | Amount | Notes |

| Profit from both BTO and resale EC | $764,000 | $314K + $450K |

| Max price | $3,056,000 | |

| Loan | $2,292,000 | |

| Monthly Mortgage | $10,942 | |

| TDSR | $19,895 | The minimum combined income is well within median |

- This is sufficient for a modest, freehold landed property such as MacPherson Garden Estate, where we see prices at around $1.98 million. Notice that based on our situation above, the landed home now falls within the parameters of affordability:

| Description | Amount |

| Price | $1,980,000 |

| Loan | $1,216,000 |

| Monthly Mortgage | $5,805 |

| TDSR requirement | $10,555 |

As an alternative, we can consider private condos as well, which can also easily fall within the same $2 million range.

*Resale flats are preferred because MOP starts after key collection; so you can sell after the five-year MOP, whereas for BTO flats you need to wait for construction and then the MOP (around nine to 10 years in total). During this time, there is a risk that the price gap between flats and private housing will grow too large (see below).

**As of 2023, you need to wait 15 months after selling a private property to buy a resale flat, and 30 months before you can ballot for a BTO flat.

This sort of property progression is the most common because – in theory – it’s plausible even for middle-income families.

A significant advantage is that you don’t need to pay the Additional Buyers Stamp Duty (ABSD), or can claim ABSD remission if you meet the requirements.

Notice that your property count throughout the process remains at one (i.e., even if you buy a condo before selling your flat, it’s understood that you’ll sell your flat within six months of buying the condo, to claim ABSD remission – so you still keep to having just one property).

The downside to this approach is that it rests heavily on the resale value of each subsequent property. For example, your flat must sell for enough to fund the purchase of an EC, the EC must sell for enough to fund the condo, and – at the very end – you’re hoping the resale gains from your condo are enough to meet retirement goals.

This is further explained in the risks below.

Another potential downside is the emotional factor: some home buyers are tempted to abandon the plan when they become too attached to a particular property. For example, some buyers may find that – at the end of the road – they’re unwilling to surrender their condo for HDB living.

Some may find, even at the very beginning, that they’re unwilling to sell their flat and take on the higher mortgage of an EC or condo.

2. Aim to own two or more properties, and live off rental income

There are two variants of this. We’ll start with one of the popular versions, which is the “sell one, buy two” approach:

More from Stacked

How An Avid Baker Couple Created A Cosy HDB Home With A Dream Kitchen

Colin and his wife (@therollyjollyhome), like many couples, initially set their sights on applying for a BTO (Build-To-Order) flat. However,…

- In this example, we’ll begin with Fernvale Vista 1, a BTO 4-room flat in Sengkang. The average cost during the BTO launch was a mere $156,000 on average. Upon resale, however, prices were at $450,000, so we obtain a profit of $293,500.

- We then move to our next unit, a three-bedder EC at The Eden at Tampines. Prices upon purchase are close to $1 million, for which our Fernvale Vista profits can cover about one-third. We’re thus able to make the down payment, without even additional funds like CPF.

- When we resell The Eden at Tampines around five years later, prices are about $1.35 million. This is a profit of close to $350,000. Our total profits from our two properties are now about $643,500. This fuels our next purchase, where one spouse will buy an own-stay three-bedder, while another will buy a smaller unit to rent out.

- For our rental unit, we will pick Treasures @ G20. We’ll use 25 per cent of our $643,500 profits ($160,875) to buy this investment condo – at $530,000, we’re more than able to make the minimum down payment. At the same time, the low price point plus the good rental prospects in Geylang suggests a strong rental yield:

| Description | Amount |

| Treasures @ G20 Price | $530,000 |

| Less downpayment | $160,875 |

| Loan | $369,125 |

| Monthly Mortgage | $1,762 |

| TDSR | $3,204 |

- For our own-stay unit, we’ll pick The Madeira, with its transacted prices of about $970,000. This is in a city fringe location, so the price represents good value, and we can see it viable for one spouse to take on the full mortgage:

| Description | Amount | Notes |

| 1 person’s income | $8,000 | |

| 30% mortgage | $2,400 | Check what 30% of $8,000 is |

| Mortgage check | $2,387 | Instalment well within 30% |

| Max Loan | $500,000 | |

| Total Price | $982,625 |

And so, we end up with two properties: Treasures @ G20 is providing rental income, which helps to mitigate or cover the costs of The Madeira. Once it’s fully paid off, the rental income will be a continued cash generator.

Note that, because each spouse is the owner of one property, there is no ABSD paid on either.

This approach also allows provides a contingency: if you outlive your retirement savings, or face any kind of crisis, you can still sell one of the properties.

The downside here is the risk of the family bearing two mortgages, which we describe below. In addition, a higher income level is needed to execute this plan, as each spouse must qualify to take on a mortgage (as opposed to combining their income to buy a single condo unit).

Another possible variant is to just buy a condo after your MOP is up:

- Start with an HDB flat, almost always resale

- Save up aggressively for a coming upgrade

- After MOP, buy a condo while retaining the HDB flat

- Either live in the flat while renting out the condo or vice versa

Note that you can buy private property and still keep your HDB flat. You just need to wait till the five-year MOP is up, before buying your condo. You cannot, however, do it the other way around (i.e., you can’t buy a private property first, and then try to buy a flat and keep both).

With this approach, you can then live in the condo and rent out the flat, or vice versa. However, the downside is that you can’t escape paying the ABSD on the condo.

This approach is quite rare because you need to be rather affluent to buy a condo – and pay its ABSD – without needing to sell your flat for funds.

Usually, anyone who can afford this process earns too much to buy a BTO flat or EC (the income ceiling is $14,000 and $16,000 per month, respectively), or enjoyed a significant bump in income along the way.

3. Property progression to benefit the next generation

This is similar to method #1, but the difference is that you don’t sell private property at the end. Rather than right-sizing to a flat, you keep the condo and pass it to your children.

This decision isn’t usually made early on, but later when parents can see how their children are managing. If your children all end up with high-paying jobs and homes of their own, for instance, then you don’t need to keep the condo for them. You can just right-size and enjoy a bigger retirement income.

Conversely, if your children aren’t doing well, you may want to leave them a condo instead of a flat. Even if they don’t sell it, it will provide them with a higher rental income.

This approach can be tough for middle-income Singaporeans, who may struggle to meet retirement goals without the help of property assets.

What are the risks of property progression?

As always, there are risks involved that we have noted here.

This is partly where we come in, as you can reach out to Stacked to help plan your property picks and progression. It’s also where personal acumen comes in, as some home buyers have a knack for picking properties that sell better than expected (thus skipping a few steps; such as by heading straight for a private condo instead of an EC).

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Can I upgrade from a BTO flat to a landed property without extra cash?

What are the common property progression routes in Singapore?

Is it necessary to sell my flat before buying a private property?

What are the risks involved in upgrading from a HDB flat to private property?

Can I own multiple properties at the same time for income or inheritance purposes?

What should I consider before deciding on property progression plans?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

4 Comments

This simulation is unrealistic. It does not take into account interest rates, and assume owner pays up the loan fully within the mop.

Hmm.. Legitimate comments are deleted.

Just curious, the article does not take into account loan interest, remaining loan amount, renovation costs, taxes etc,