Buy 3-Room Flat Now, Own 2 Properties Later: 7 Reasons Why These Flats Are An Underrated Choice

September 9, 2022

Among Singaporeans, there’s an unspoken agreement that – if you buy an HDB flat – you should go for the largest flat type you can get. It’s not always just about having more space or for future family planning; it’s also due to the expectation that 3-room flats will perform worse than 5-room flats, or 5-room flats will perform worse than executive flats, and so forth. But given the rising property prices in 2022, it may be time to question some of these assumptions:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. A 3-room flat may help if you are looking to invest in a second property in the future

If you are planning to invest in a second property in the future, it’s good to get that right from the start if you want to avoid having to pay any Additional Buyer Stamp Duty (ABSD). Traditionally, if your first home is an HDB and you want to keep the HDB and buy a second property, you will have to incur the hefty 20% ABSD.

Now, if you want to avoid splashing out that sum, one way to do so is to adopt the Single Owner and Essential Occupier scheme. This is a very under-the-radar scheme where your spouse can be listed as an essential occupier instead of a co-owner. To qualify for this, you have to list one of the applicants as the single owner, and your spouse/fiance as the essential owner during the flat application.

This means that as the essential owner is not seen as a homeowner (and after the 5-year MOP is up) you will be considered to be a first-time homeowner when buying a private property. As such, you will be able to avoid the ABSD and also qualify for the higher loan quantum (75% of LTV), as compared to the maximum 55% limit for a second property loan if you hadn’t done so.

Before you jet off to do anything, there are some important cons that you need to know.

First, as an essential occupier, you can’t use your CPF to fund the purchase (meaning you can’t help your partner to pay off the flat, down payment or monthly instalments). Second, because only the single owner will be qualified to take on a mortgage, the assessable income will naturally be lower. Lastly, as the essential occupier isn’t seen as having legal ownership right – even if you have paid cash behind the scenes to help finance the unit, you will have no claims over the property in the event that things go south.

As such, do proceed with caution if this is your desired plan.

But if you do decide to go down this path, this is the reason why a 3-room HDB flat, and not something bigger will work for younger homeowners.

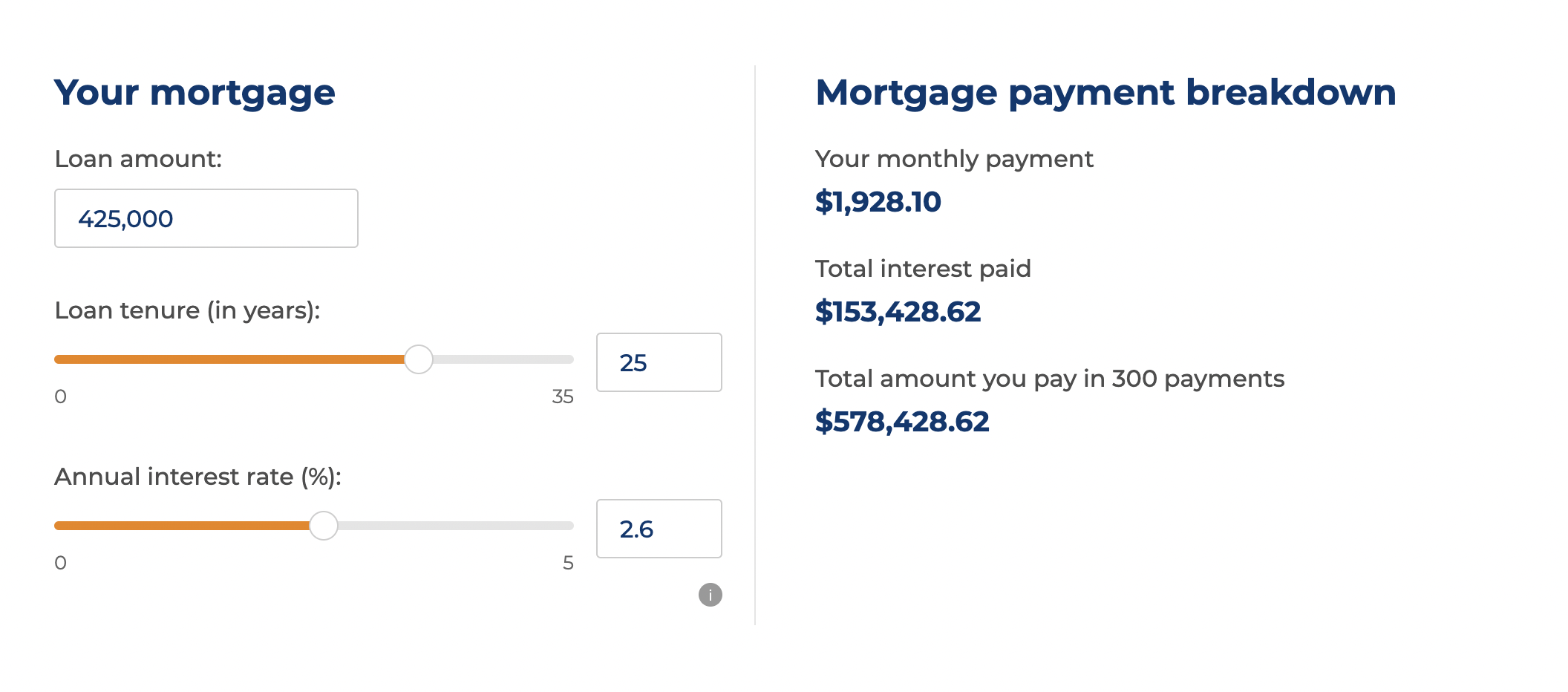

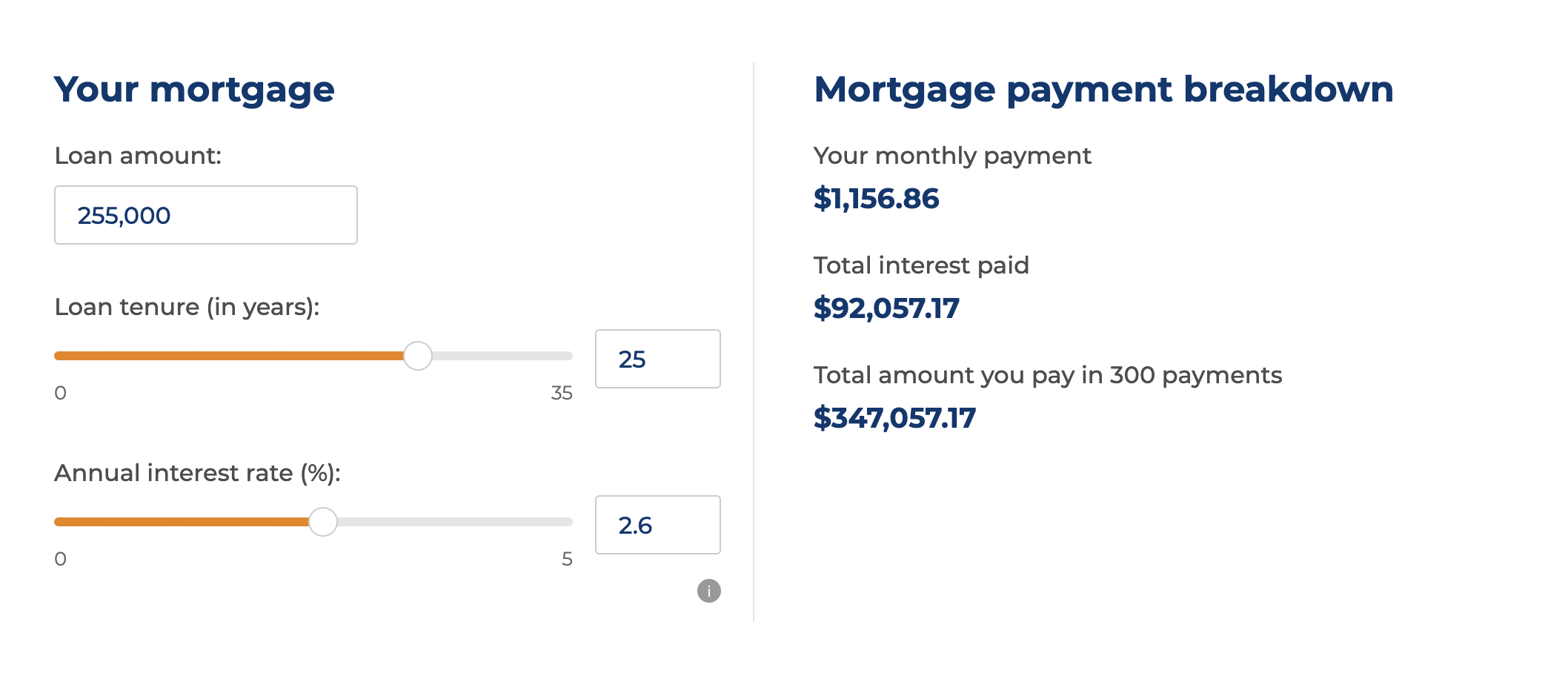

Here’s how the math works out if they decide to go by the Single Owner and Essential Occupier scheme:

Let’s say a couple makes $4,000 each and has a combined income of $8,000. So if they are deciding between a 4-room flat that costs $500,000 and a 3-room flat that costs $300,000, this is how it would work.

If you were to purchase the 4-room HDB flat at $500,000, the interest rate of $1,928 will exceed the 30% MSR limit of the $4,000 income. Compare this to the 3-room HDB flat at $300,000, the interest rate of $1,157 will come just under the MSR limit of $1,200.

We know this isn’t for everyone (there is a fair amount of trust involved), but when planned well this could really help with your future goals.

2. Smaller flats can mean you have more cash to invest elsewhere

Let’s consider a typical 4-room resale flat, purchased for around $485,000. For simplicity’s sake, we’ll assume the valuation and the asking price were an exact match.

Assuming an HDB loan of 85 per cent, for 25 years, this is a monthly repayment of $1,870.25.

If you were to opt for a smaller 3-room resale flat, you might pay about $380,000. Using the exact same loan, this comes to about $1,465.30 per month. This is a difference of around $405 per month, that could be invested elsewhere.

If that $405 per month were invested in something secure – even just your CPF Special Account at a guaranteed four per cent per annum – this comes to around $208,916. We doubt that’s worth the luxury of one extra bedroom.

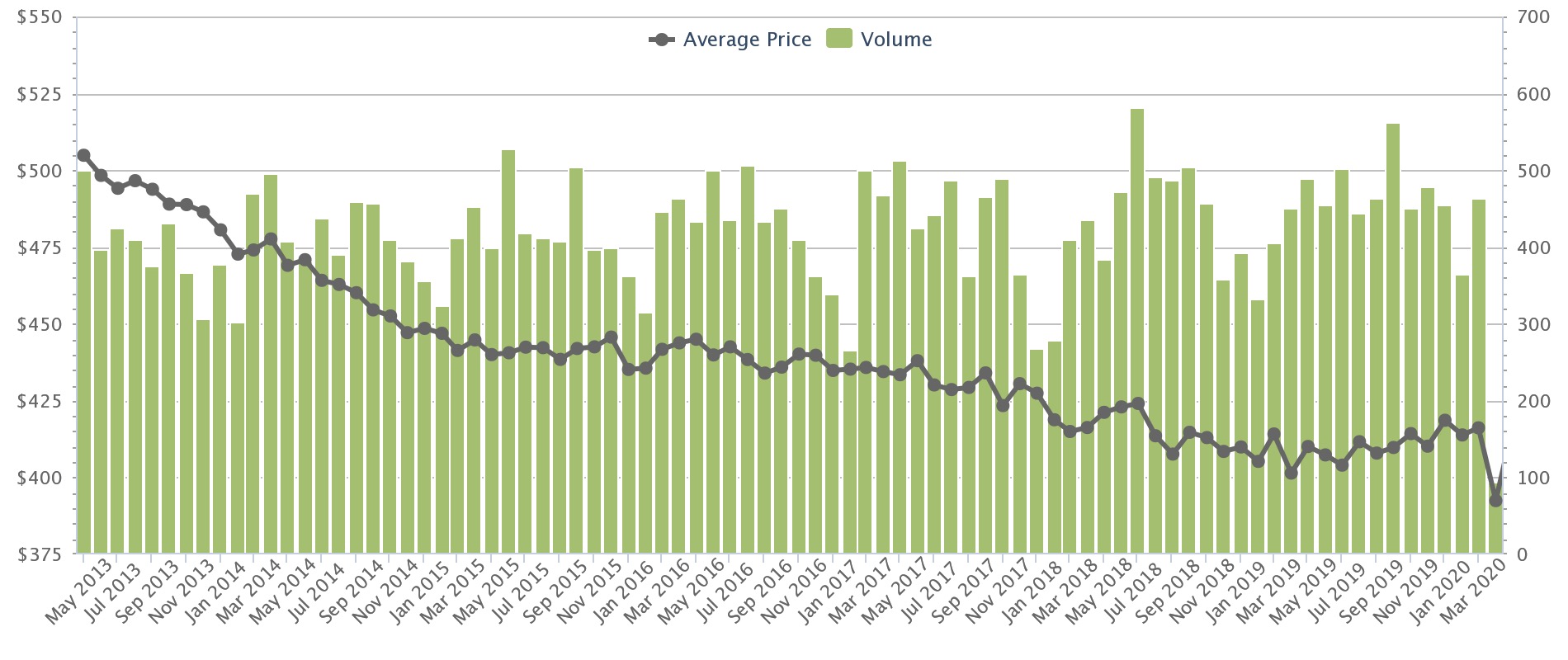

Of course, you could bank on the fact that a larger flat will appreciate so much better, that it will more than make up for this amount; but to that, we would remind you of what a single government policy tweak can do to resale flat prices.

This was what happened to resale flat prices for around seven straight years, after a quick tweak to control Cash Over Valuation (COV) in resale flats. Resale flat prices may be crazy due to the aftermath of Covid, but never forget how quickly the tide can turn.

Rather than bet the proverbial farm on the price movement of your flat, it might make sense to purchase a smaller flat as a home only and invest the rest in a balanced, well-diversified portfolio to reach financial targets.

3. A smaller flat means a smaller cash outlay

We’re not just referring to the down payment; we’re also talking about renovations and furnishing. This is doubly true for resale flats, where extensive renovation is more likely to be needed (unless you’re one of the rare people who are happy to live with the previous owners’ design choices).

Now if your aim is to upgrade after five years (or expand your family), you could be wasting quite a lot of money on the renovation portion. While costs differ greatly between home buyers, it’s quite typical for a 4-room flat to cost at least in the range of $30,000 to $50,000, after carpentry, flooring, putting in new furniture, etc.

More from Stacked

I Regret Getting A BTO: We Share 5 Uncommon Regrets Singaporeans Have

To many Singaporeans, a BTO flat is the default “first home.” If there are any complaints about this most affordable…

(This is the reason every bank sets the reno loan cap at $30,000, or six months of your income; experience has taught them how much most homeowners need).

A smaller cash outlay can also be a huge help if your goal is to upgrade later. The less of your CPF you use, the smaller your CPF refund when you sell the flat. This mitigates the risk of a negative cash sale, where you can’t make the minimum five per cent cash down for a private property.

And, of course, saving on renovations means you could have more cash in hand when it comes time to look for a condo.

Besides the smaller cash outlay, remember that a smaller flat can be quicker to renovate (depending on your chosen design features). If you need to move in urgently, you may want to consider a 3-room just to move in asap.

4. If you hate having a home loan, a smaller flat can mean you’re debt-free sooner

Note that it’s not always prudent to rush your home loan repayment. But that being said, some people just don’t like the sense of being in debt. In these cases, a smaller flat means you borrow less, and discharge your home loan sooner.

This can also mean significant cost savings. For example, an HDB loan for $400,000, over 25 years, means total interest repayments of around $144,403 by the end of 25 years.

But say you buy a smaller flat, and hence borrow just $300,000 – and because the loan quantum is smaller, you can also afford to drop the loan tenure to 20 years instead of five. The total interest paid would be around $85,407 by the end of the loan.

Note that the difference in the monthly loan repayment as well: you would pay around $1,815 per month for the $400,000 loan, but only around $1,604 for the smaller, shorter loan.

There was even a Singaporean couple who managed to pay off their $470,000 flat in just two years.

If all of this appeals to you, and you have a strict “no debt” lifestyle, then it may be emotionally comforting to pick the smaller flat and live debt-free sooner.

5. For BTO flats, you may be more likely to win the balloting attempt

Because most Singaporeans prefer bigger flats, the 5-room and 4-room units tend to quickly be oversubscribed. The competition for 3-room flats is usually less intense, so you have a better shot at winning the ballot.

As an example, consider the balloting for Dakota Crest (Geylang) in February 2022: the 4-room flat saw an application rate of 20.5, whilst the 3-room flats saw an application rate of just 4.8 for first-timers.

At King George’s Heights (Kallang/Whampoa) in the same exercise, 4-room flats had an application rate of 10.9, versus 3-room application rates of 2.8.

So, if it’s a priority to secure your BTO flat fast, you may want to consider the compromise of a smaller flat. This will get you started on your home ownership journey a lot sooner.

6. A smaller flat might mean you can afford a better location

Consider a hotspot like Serangoon and flats that are near NEX megamall (also where the Serangoon MRT station is located).

A check on current listings shows that a 4-room unit in Serangoon Central, within 400 metres, has an asking price of $780,000. Conversely, we can see 3-room flats at Lorong Lew Lian, which are also within 400 metres; and the apparent asking prices range from $390,000 to $430,000.

The price gaps between 3-room and 4-room units in the resale market can be startling; and sometimes, if you can’t seem to afford a desired location, the solution may just be to knock off one bedroom.

7. Remember that some benefits, such as GST offset vouchers, are based on the value of your home

To be precise, this is the Annual Value of your unit. Whenever the government gives out perks, like GST offset vouchers, discounts on conservancy fees, etc., the value of your housing is often a deciding factor. In general, homes with a lower estimated AV (almost always the smaller flats) will receive the larger share of the profits.

The amounts involved are not huge; but they are a small incentive not to pick the biggest flats, just because you can.

Finally, remember it’s not guaranteed that larger flats always appreciate better

There is no universal rule for this, that applies across all of Singapore. The degree to which bigger flats outperform small ones is more likely location-specific. The main downside of a 3-room HDB flat (other than the size), is the target pool when it comes to selling – there’s no question that the number of potential buyers will be a lot smaller.

Contact us at Stacked if you have a more specific query, and visit us for in-depth reviews of new and resale homes alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why might buying a 3-room flat be a good idea for future property investment?

How can choosing a smaller flat save money for homeowners?

What are the advantages of buying a smaller flat in terms of loan repayment?

Does choosing a 3-room flat improve chances of winning BTO balloting?

Can buying a smaller flat help me afford a better location?

Are there government benefits linked to the size of my flat?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

0 Comments