Has BTO Supply Been Keeping Up With Application Rates? Here’s A Look At The Data

November 11, 2022

It was on April 2001 that the Built-To-Order (BTO) system was first launched, with the pilot scheme offering 2,500 new flats at 4 sites in Sengkang and Sembawang.

This was done to replace the old Registration for Flats System (RFS), which had a few issues:

- HDB had to build flats first, and then hope that there was enough demand to fill the flats

- Buyers were only able to select the broad geographical zone of their desired location, but the exact location and cost were only made known when they were invited to select their flats

- There was no way to know when the flats would be completed, and this invited further issues when flats were completed earlier but buyers weren’t adequately prepared with enough funds to pay for the downpayment.

But the real catalyst was because of the mid-1990s boom that led to HDB ramping up to build more flats, only to be stuck with 31,000 flats when the 1997 Asian Financial Crisis hit.

As such, the BTO system was introduced to only build if there is real demand (HDB will only begin construction if bookings exceed 70 per cent).

All that said, the situation is very different today.

Type “HDB is really ramping up the supply of housing” anywhere on the internet, and you’ll probably start a fight. With resale flat prices through the roof, and even non-mature BTO flats oversubscribed, it’s just tough for many to believe the demand is being catered to. This week we looked at some data on first-timer applications, as well as the number of BTO launch units, to see how well supply is keeping up:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The rise in first-timer applications vs. BTO launch units

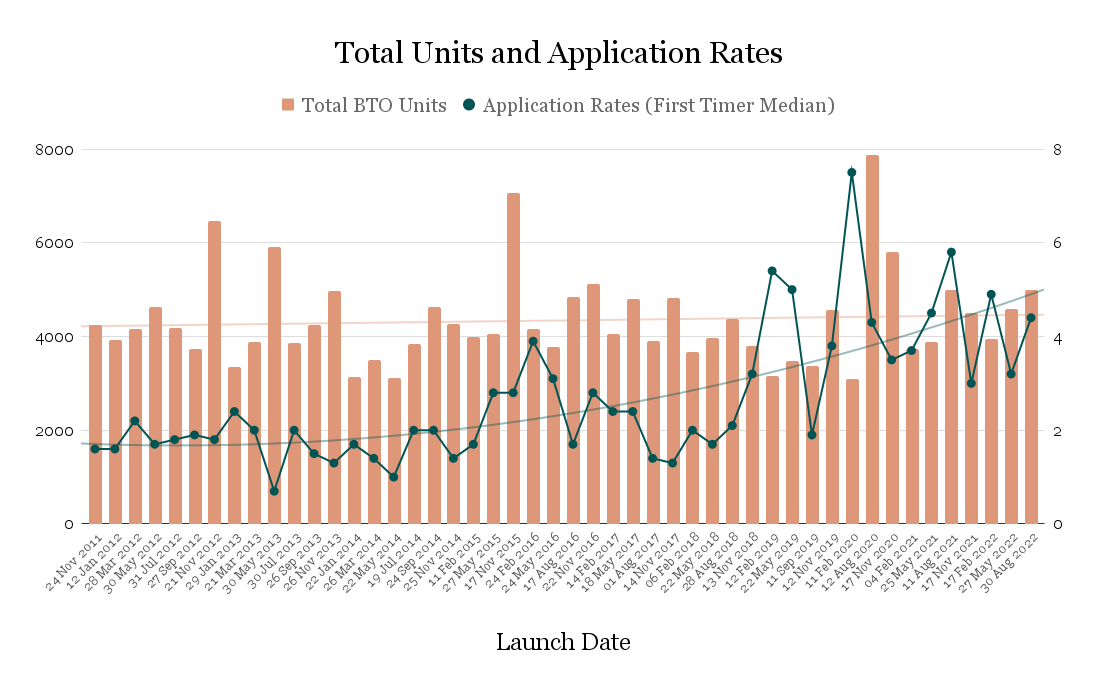

The following tracks the number of first-timer applications, against the number of BTO launch units, from November 2011 to August 2022:

We can see that overall, the number of BTO launch units hasn’t increased by a substantial number over a roughly 10-year period. At the same time, however, the number of first-timer applications seems to have climbed much quicker.

| Launch date | Application Rates (First Timer Median) |

| 24 Nov 2011 | 1.6 |

| 12 Jan 2012 | 1.6 |

| 28 Mar 2012 | 2.2 |

| 30 May 2012 | 1.7 |

| 31 Jul 2012 | 1.8 |

| 27 Sep 2012 | 1.9 |

| 21 Nov 2012 | 1.8 |

| 29 Jan 2013 | 2.4 |

| 21 Mar 2013 | 2 |

| 30 May 2013 | 0.7 |

| 30 Jul 2013 | 2 |

| 26 Sep 2013 | 1.5 |

| 26 Nov 2013 | 1.3 |

| 22 Jan 2014 | 1.7 |

| 26 Mar 2014 | 1.4 |

| 22 May 2014 | 1 |

| 19 Jul 2014 | 2 |

| 24 Sep 2014 | 2 |

| 25 Nov 2014 | 1.4 |

| 11 Feb 2015 | 1.7 |

| 27 May 2015 | 2.8 |

| 17 Nov 2015 | 2.8 |

| 24 Feb 2016 | 3.9 |

| 24 May 2016 | 3.1 |

| 17 Aug 2016 | 1.7 |

| 22 Nov 2016 | 2.8 |

| 14 Feb 2017 | 2.4 |

| 18 May 2017 | 2.4 |

| 01 Aug 2017 | 1.4 |

| 14 Nov 2017 | 1.3 |

| 06 Feb 2018 | 2 |

| 22 May 2018 | 1.7 |

| 28 Aug 2018 | 2.1 |

| 13 Nov 2018 | 3.2 |

| 12 Feb 2019 | 5.4 |

| 22 May 2019 | 5 |

| 11 Sep 2019 | 1.9 |

| 12 Nov 2019 | 3.8 |

| 11 Feb 2020 | 7.5 |

| 12 Aug 2020 | 4.3 |

| 17 Nov 2020 | 3.5 |

| 04 Feb 2021 | 3.7 |

| 25 May 2021 | 4.5 |

| 11 Aug 2021 | 5.8 |

| 17 Nov 2021 | 3 |

| 17 Feb 2022 | 4.9 |

| 27 May 2022 | 3.2 |

| 30 Aug 2022 | 4.4 |

The number of first-timer applications started to climb around 2015

From around 2015, the number of first-timer applications was already starting to outpace the first half of the decade. The median number of applications for May and November 2015 stood at around 2.8.

If we look before 2015, we can see only two months over a roughly five-year period where median first-timer application crossed the 2.0 mark: in March 2012, and January 2013.

In the next half of the decade, applications generally start mounting.

In February and May of 2019, first-timer applications reached 5.4 and 5, higher than any point between 2011 to February 2019. February 2020, which was before the Circuit Breaker (April 2020), saw first-timer application numbers of 7.5.

From that point on the application, numbers are much higher than the first half of the decade, for Covid-related reasons.

We can set aside the Covid years as an exceptional event

Demand for flats spiked after the Covid peak in 2020, and wouldn’t be too fair to fault HDB for this black swan event. Due to the sudden need for personal space, from Work From Home (WFH) and other such factors, demand for flats (both BTO and resale) rose by an uncharacteristic degree following the Circuit Breaker in April 2020.

HDB has responded to this quite swiftly, with a decision to ramp up production by 35 per cent in 2022/23. You won’t see this right away on the graph of course, as there’s a four-to-five-year construction time.

Dover forest, for instance, now has its western half set aside for ecological preservation, while part of it is being cleared for HDB flats. The Bayshore area, which is currently a bit of an inaccessible “ulu” area despite beach proximity, is also likely to hold a new HDB community (in a mix of public and private housing).

However, these projects will take time; and they may not salve the pain of first-time home buyers right now, who are struggling to find accommodation.

Even setting aside Covid-19, HDB production could perhaps have been higher

Applications seemed to already be rising about five years ago. Couple this with the construction time for our flats, and perhaps we should have started raising supply back then.

The issue here may not be HDB’s decision-making, but rather the Built To Order (BTO) system itself. This was instituted in 2001, to prevent building an excessive number of flats. The system requires that sufficient home buyers show an interest in a launch, before HDB starts construction.

However, the BTO system also limits HDB’s speed. If HDB could start building based on projected need, without going through the BTO process, we’d have more flats sooner – and new homeowners would be able to move in within a much shorter time.

It also introduces other far-reaching unintended consequences. For one, it really delays or even possibly disrupts family planning for younger couples. With the falling birth rate in Singapore, this could possibly be one of the major reasons why this is happening right now.

We understand the need for the BTO system in earlier years – but it’s now been two decades since it was devised. At this point, HDB probably has sufficient data and experience to project the number of new flats needed. They have exhibited this, for instance, in seizing the initiative and ramping up supply to cope with the aftermath of Covid. They’re effective, so why limit their flexibility with the BTO system? This essentially could be a form of a “cooling measure”, as it prevents the overflow of people from having to resort to buying a resale HDB flat and pushing the prices up.

Of course, it goes without saying that this has to be managed very carefully. Build too many BTO flats in anticipation of demand, and it could also result in falling housing prices. Perhaps there is also a worry for the future, when the older generation passes on – what happens when a big bulk of these older resale HDB flats do come on the market?

For more on the situation as it unfolds, follow us on Stacked. If you’re in need of a home in the meantime, check out our in-depth reviews of new and resale projects alike; or reach out to us for a direct consultation.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Has the demand for new flats in Singapore increased over the years?

Is the supply of new flats keeping up with application demand in Singapore?

Why did HDB decide to ramp up flat production after 2020?

Could the BTO system be limiting the speed of housing supply in Singapore?

What are some challenges associated with the current housing supply system in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

0 Comments