Avoid Homebuying Regrets: 9 Commonly Overlooked Things to Consider Before Buying a Home

June 19, 2023

There are some housing issues that you can quickly research online, and there are issues which you only learn to spot with experience (or some in-depth expert insight). Rather than cover the usual stuff like defects, checking on the neighbours, etc. which you already know, here are the obscure bits that most people miss. Check it out before you buy, or even before you take a home loan in 2023:

Table Of Contents

- 1. The dustbin chute being too near your unit is a noise issue

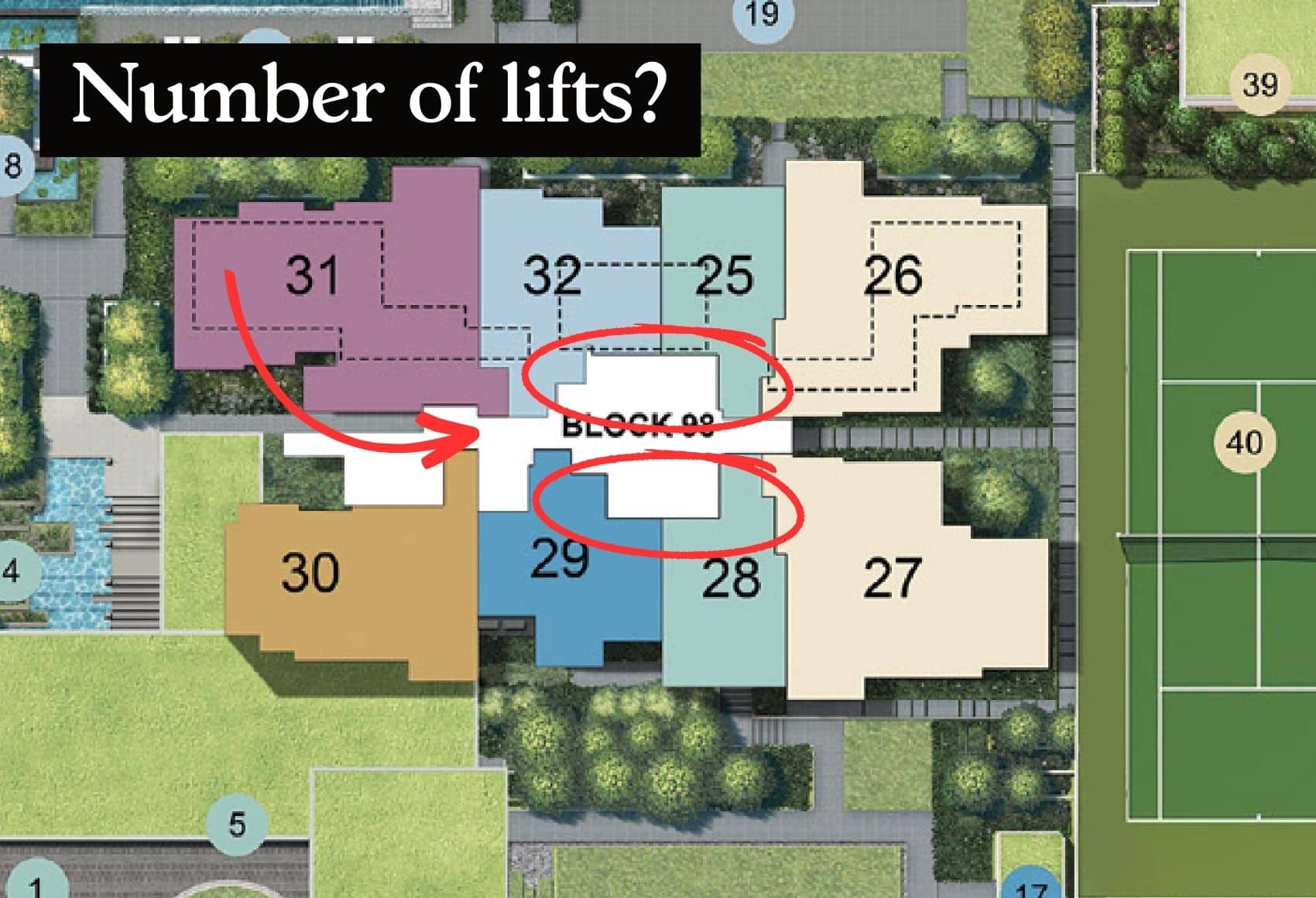

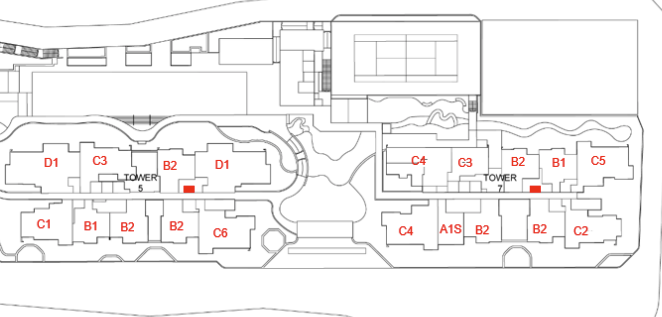

- 2. How many lifts are there serving the units on each floor

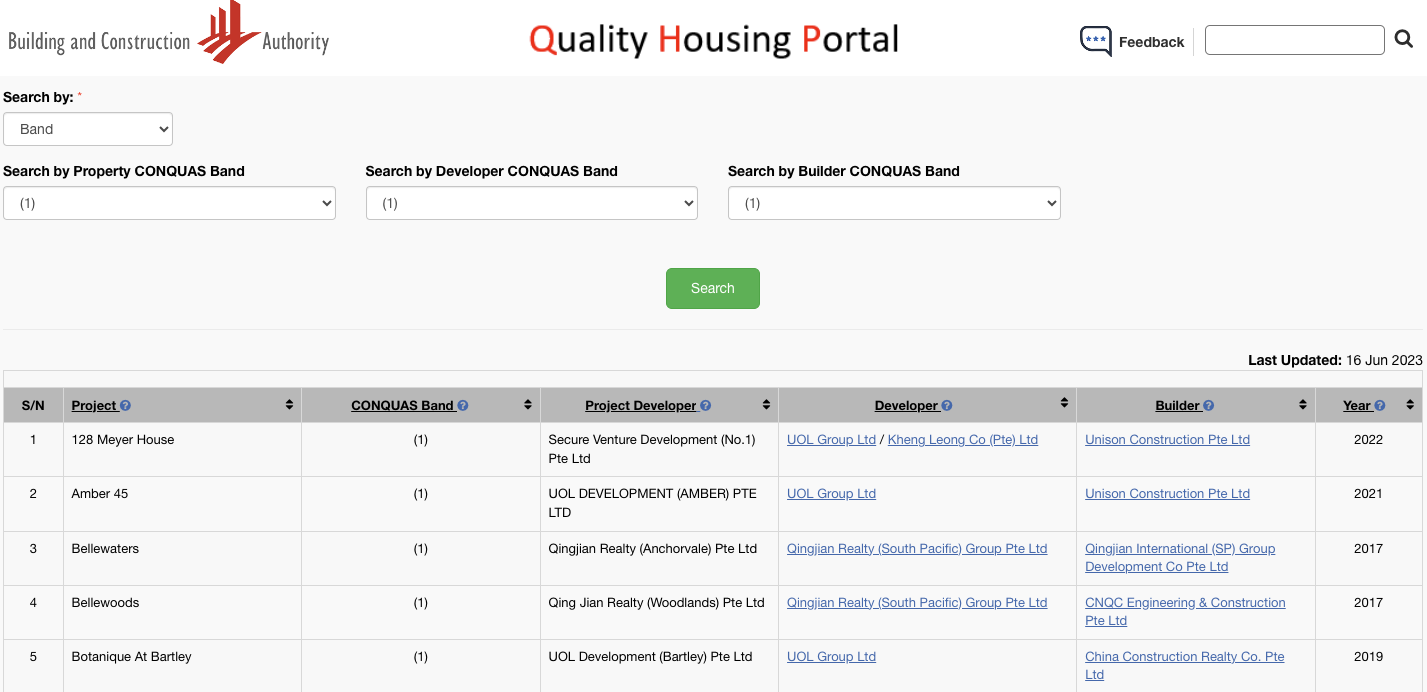

- 3. BCA’s developer banding matters more than you might expect

- 4. Deciding between a renovated vs non-renovated apartment

- 5. You can get “locked out” of facilities by a clique

- 6. A smaller condo may mean you have less say during the meetings

- 7. The “extra space” outside your front door is better for some units than others

- 8. There may be modifications to your resale unit that are illegal, or unrecorded

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. The dustbin chute being too near your unit is a noise issue

Most people don’t think of asking about this at the show flat, but it’s always worth finding out where the chutes are located.

Let’s be clear, this can be both a boon and a bane. Some people prefer having it right outside their unit, as it makes things very convenient to throw stuff.

However, this can also be an overlooked annoyance. This may not seem like a big deal at first if you’ve moved in early and not everyone has moved in yet. But many soon find that it’s a major noise disturbance, as you can hear footsteps and the chute clanking open and shut at all hours.

Sometimes people throw hard garbage, like glass or metal, and you’ll be treated to the banging and ringing sounds of the chute for a few minutes. Sometimes people do this at odd hours, like two or three in the morning – and it can be enough to wake the baby or any pets, even if you manage to sleep on.

2. How many lifts are there serving the units on each floor

This is another seemingly minor point that often gets overlooked, but waiting for the lift daily can build up to be a bigger annoyance than you might think. This is especially so for developments that are towering 30 to 40 stories high, and you may start to question if it’s worth it for the high views when you have to spend a couple of minutes daily waiting for the lifts.

So do ask at the show flat how many lifts there are available. For example, 2 lifts serving 30 floors of 10-12 units – that’s certainly not a ratio that would be very pleasant (even 3 lifts in this scenario might be pushing it).

3. BCA’s developer banding matters more than you might expect

It’s very hard for a layperson to gauge a developer’s capability. Even if you had the means to do so, the developer works through a series of other subcontractors. It’s possible that the developer is good, but that the sub-contractor is rubbish and the lowest bidder for the work.

That’s why you should check the BCA banding for both developers and builders (i.e., the general contractor). As far as possible, you want both to be well-rated.

If a developer has a bad reputation, odds are the real estate agency they work with will demand higher commissions. It’s not easy to sell a property when the developer has been labelled sub-par. As a buyer, you may bear the brunt of that higher commission.

As the banding system is quite new, we’ll need to monitor it for a while before we draw a definite conclusion; but you’d definitely want to use this before deciding on any new launch condo.

4. Deciding between a renovated vs non-renovated apartment

Many buyers have encountered this dilemma – do you opt for a unit that requires a ground-up renovation but is cheaper or one that is more expensive but is fully renovated?

Sometimes buyers can get blinded by the higher price and wanting to “save on costs”, it may seem like they are being more prudent to opt for the cheaper property. This can also be further obscured if it’s a new $psf high that they are paying.

But, there are a couple of pointers worth thinking about before you make the decision.

First, if you are on a stricter timeline to move in, can you afford the wait to renovate? If it’s your first time renovating a home, do take into account a sizeable buffer as any renovation project typically will have unforeseen delays. This could affect other things too, if you were renting previously, it may be tough to match the timelines.

Next, and more importantly, don’t forget that purchasing the more expensive home means that your renovation can essentially be funded by a bank loan. This is opposed to buying the cheaper unit, and having to pay for the renovation costs in cash.

5. You can get “locked out” of facilities by a clique

Sometimes we see this in some of the newer developments, such as having one tennis court for a 1,000+ unit condo; or a gym and BBQ pits that are clearly too limited for the number of residents.

You may think that, taking turns, you’ll eventually get your shot at the facilities; but some condo management teams are terrible at this. They’ll let cliques of friends make consecutive bookings of the same facility, so anyone not in the group is locked out completely.

Without pointing fingers, there are a few condos where a tennis gang, a rock-climbing gang, etc. all take turns booking the same facility, one after the other. A group of five or six people can effectively monopolise a whole facility for themselves.

Competent condo managers spot this and try to prevent it; but there are many who simply don’t care, and just let it happen.

6. A smaller condo may mean you have less say during the meetings

Be wary of boutique developments, where all the different owners are somehow related. There is the occasional project where, out of maybe 18 units, 10 of them are owned by people who are family relations (cousins, aunts, uncles, etc.)

In these small developments, the related members can form an ironclad management committee, where those outside the family have no say. If there’s a vote to push the large dumpsters next to your car, or to ban swimming and fitness instructors like your own, you’ll never get the votes to challenge them.

They may not even be family, but just a clique that has formed through long years of knowing each other.

Speak to other residents, or ask your property agent to speak to them, to find out if this is an issue.

7. The “extra space” outside your front door is better for some units than others

The total square footage may be the same, and you may be delighted at the “extra room” in front of the lift. But check if your unit is on the side of the wet riser (this is needed for firefighting).

You’re usually not allowed to block the wet riser, so this could mean you can’t place your shoe racks, umbrella stands, etc. near it. Unfairly, your neighbour might be able to do as they please with the space, if the riser is only on your side.

8. There may be modifications to your resale unit that are illegal, or unrecorded

This tends to happen with very old properties such as walk-ups; but it may happen with a newer condo too. Sometimes, the previous owner, or even the owner before them, had certain works done – works that by today’s standards are not allowed.

(Rules were more ambiguous in the ‘80s and ‘90s, and checks were less frequent).

You may find features like a mezzanine level, an attic space, or even makeshift electrical works; we have seen some old units where someone unqualified tried to move power outlets.

These pose safety concerns, and fixing them may require additional costs. It’s possible that authorities will check and crack down on you, requiring you to demolish an old mezzanine deck or fix bad wiring.

Be sure that everything in a unit is accounted for, especially if it’s an older home.

9. Finally, the bank loan with the long lock-in period may not be a bad deal

The lock-in period of your home loan prevents you from refinancing, until a certain time is up; this is usually three to five years.

But as compensation for the lack of flexibility, banks may lower the interest rates on these loan packages. This can turn them from otherwise bad deals into good ones.

For example: if you loathe refinancing, or don’t think interest rates will drop even in future, then it may be worth accepting the lock-in. You’re not going to refinance anyway, so it’s completely irrelevant that you’re locked in.

Accept the lock-in and you could end up with a cheaper loan, where the drawback is irrelevant.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments