The Real Effect Of Loan Curbs On The Singapore Property Market: A Quick Look Back At History

October 18, 2022

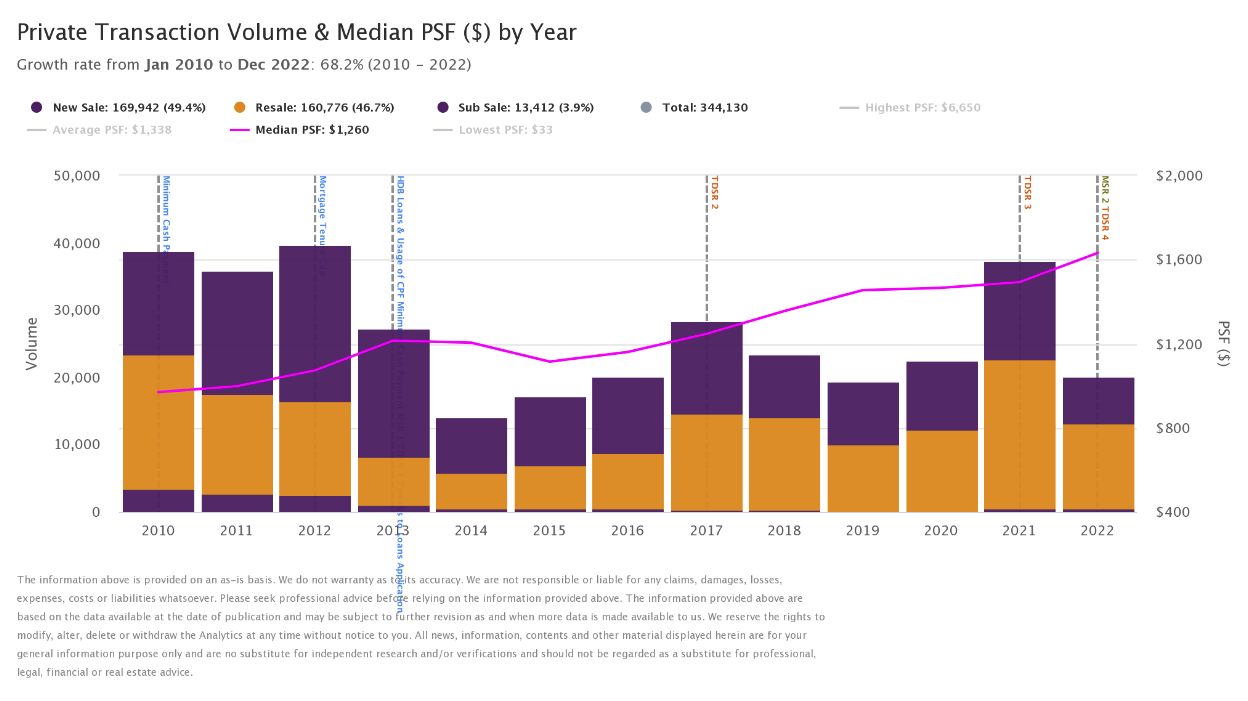

One of the most dreaded policy tweaks by MAS is loan curbs – restrictions on how much you can borrow. In almost every round of cooling measures, we’ve come to learn that nothing makes buyers shrink back more than a tightened Loan to Value (LTV) ratio, or a stricter Total Debt Servicing Ratio (TDSR). In today’s chart, we look at the effect this measure has had on the property market:

Table Of Contents

- A quick note on loan curbs versus cooling measures

- A rundown of the loan curbs above:

- It takes some time for the loan curbs to “bite” and drive down prices

- The last few rounds of loan curbs were less significant than their predecessors

- Loan curbs may lower prices, but they also bring refinancing risks

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A quick note on loan curbs versus cooling measures

Loan curbs tend to be rolled out with other cooling measures; but technically speaking, a loan curb is not a cooling measure. TDSR, for instance, is not a temporary measure to cool housing prices; it is a fundamental change in the loan process.

At this point, most market watchers have theorised that cooling measures aren’t temporary at all, and are here to stay. But with loan curbs, we know for sure that these aren’t part of temporary measures.

A rundown of the loan curbs above:

February 2010: The maximum LTV ratio for bank loans fell to 80 per cent. The LTV for HDB falls to 90 per cent.

Later on 30th August, LTV was further reduced to 75 per cent of the property price or valuation (whichever is lower), and the first five per cent of the property must be paid in cash (for private residences).

October 2012: The maximum loan tenure for residential property is set to 35 years. In addition, loans with a tenure of more than 30 years receive tighter LTV ratios.

January 2013: Loan restrictions are tightened even further, for buyers purchasing second or third homes, or who have loan tenures beyond 30 years.

The Mortgage Servicing Ratio (MSR) is introduced for HDB properties; this caps monthly loan repayment at 30 per cent of the borrower’s income.

July 2018: LTV ratios shrink from 80 to 75 per cent, for private bank loans.

December 2021: TDSR ratios are tightened, from 60 to 55 per cent. The LTV for HDB loans is reduced from 90 to 85 per cent.

September 2022: The LTV for HDB loans is reduced from 85 to 80 per cent. The floor rate – or the interest rate used to calculate the MSR and TDSR – is raised by 0.5 per cent (e.g., when determining your home loan repayment amount for TDSR purposes, the interest rate used is four per cent, regardless of the actual market rate).

Singapore Property NewsBiggest Winners And Losers Of The Latest Cooling Measures In 2022: How Does This Affect You?

by Ryan J. OngIt takes some time for the loan curbs to “bite” and drive down prices

Between 2010 to 2013, there were five rounds of loan curbs. Despite this, median prices climbed from $970 psf to $1,215 psf.

It was only around 2014 that prices and volume seemed to fall; and by that point that were other cooling measures contributing (such as the ABSD). After that, it took till around 2017 for prices to recover, climbing back to $1,247 psf.

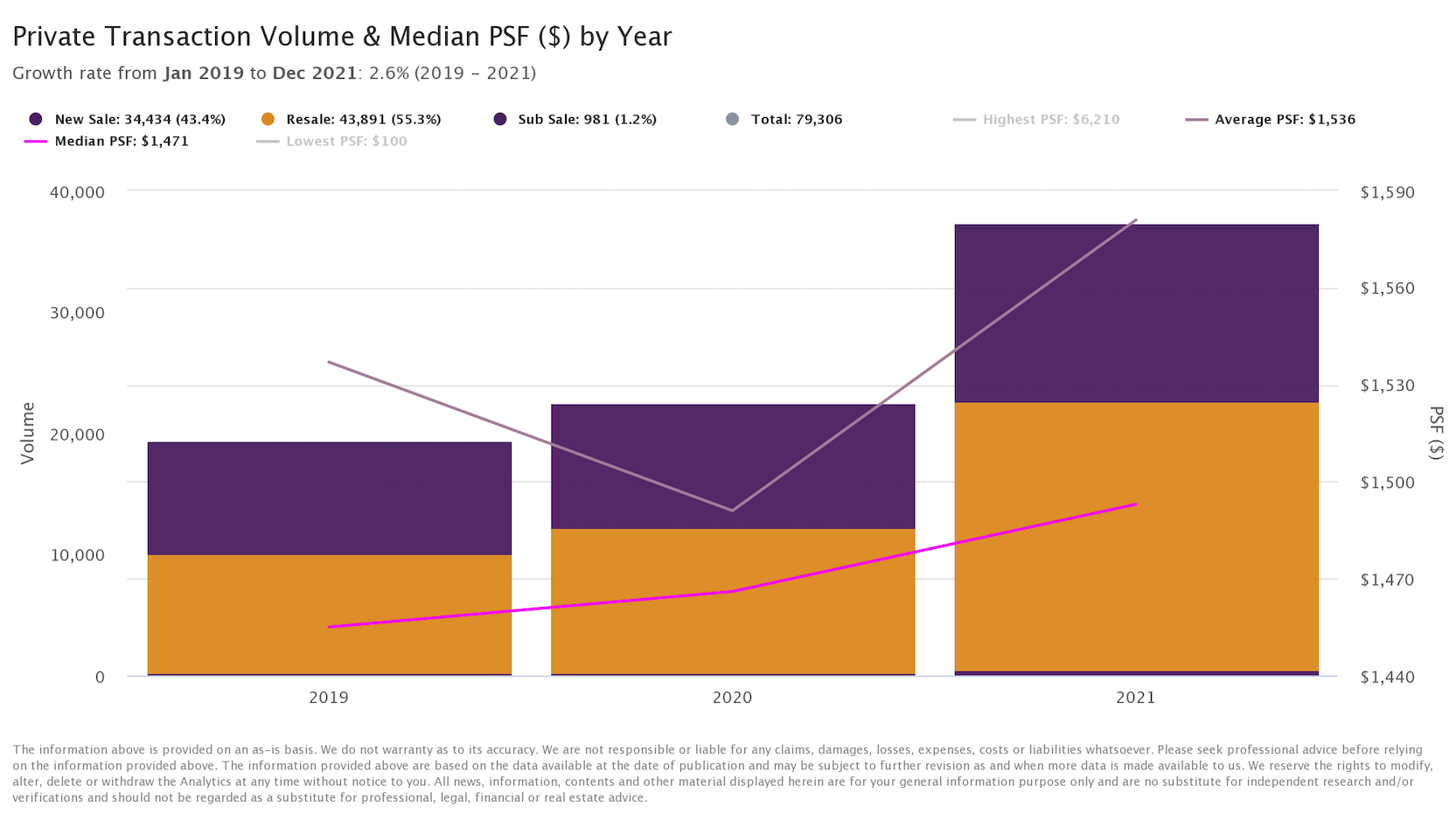

So even though we saw loan curbs in December and September this year, it’s unlikely that we’ll see a steep drop in home prices. As of end 2021, home prices averaged $1,493 psf; it remains to be seen if last year’s momentum can be maintained.

The last few rounds of loan curbs were less significant than their predecessors

The earliest loan curbs were far harsher – the most significant of them being the mandatory five per cent down payment in cash. The high cash outlay normalised the process of starting with an HDB, and then relying on sale proceeds to cover the cash down.

The latest cooling measures haven’t come close. Lowering the LTV on HDB loans, for instance, doesn’t affect most buyers: most Singaporeans already paid more than 20 per cent down for their HDB units.

For those buying private properties or bank loans, note that the LTV hasn’t budged: it’s still 25 per cent down payment.

The only effect of the latest cooling measures is to raise the projected monthly home loan repayments, for the purposes of MSR and TDSR qualifications. This may require some Singaporeans to fork out a higher down payment, but that’s not an issue if HDB upgraders are selling their flats at record prices.

Loan curbs may lower prices, but they also bring refinancing risks

In an overheated market like 2022, many will rally behind the idea of loan curbs (or anything that will lower prices).

But bear in mind that, with the new floor rate, many who could previously get home loans might now fail to do so – it’s possible that they qualified under the MSR and TDSR in 2012, for instance, but can’t do so in 2022.

This might trap some buyers into higher rates, as they can’t refinance. It may also have influenced the recent proposition to allow a one-time refinancing, from bank to HDB loans.

(Right now you can refinance from a bank to an HDB loan an HDB loan to a bank loan, but not the other way around).

Follow us on Stacked, and we’ll update you if we see the loan curbs start to bite. In the meantime, though, it’s best to save aggressively and plan for a smaller loan quantum than you expected.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How do loan curbs affect the Singapore property market?

What are some examples of past loan restrictions in Singapore?

Do loan curbs immediately lower property prices in Singapore?

Are recent loan curbs as strict as those in the past?

What are the risks of loan curbs for homeowners and buyers?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

2 Comments

There’s an error in the second last para – “Right now you can refinance from a bank loan to HDB loan but not the other way around”.

The opposite is true rather – you can refinance from an HDB loan to bank loan but not the other way around.