Analysing Unprofitable Freehold Condos: 4 Reasons Why Starlight Suites Has Performed Poorly

August 17, 2023

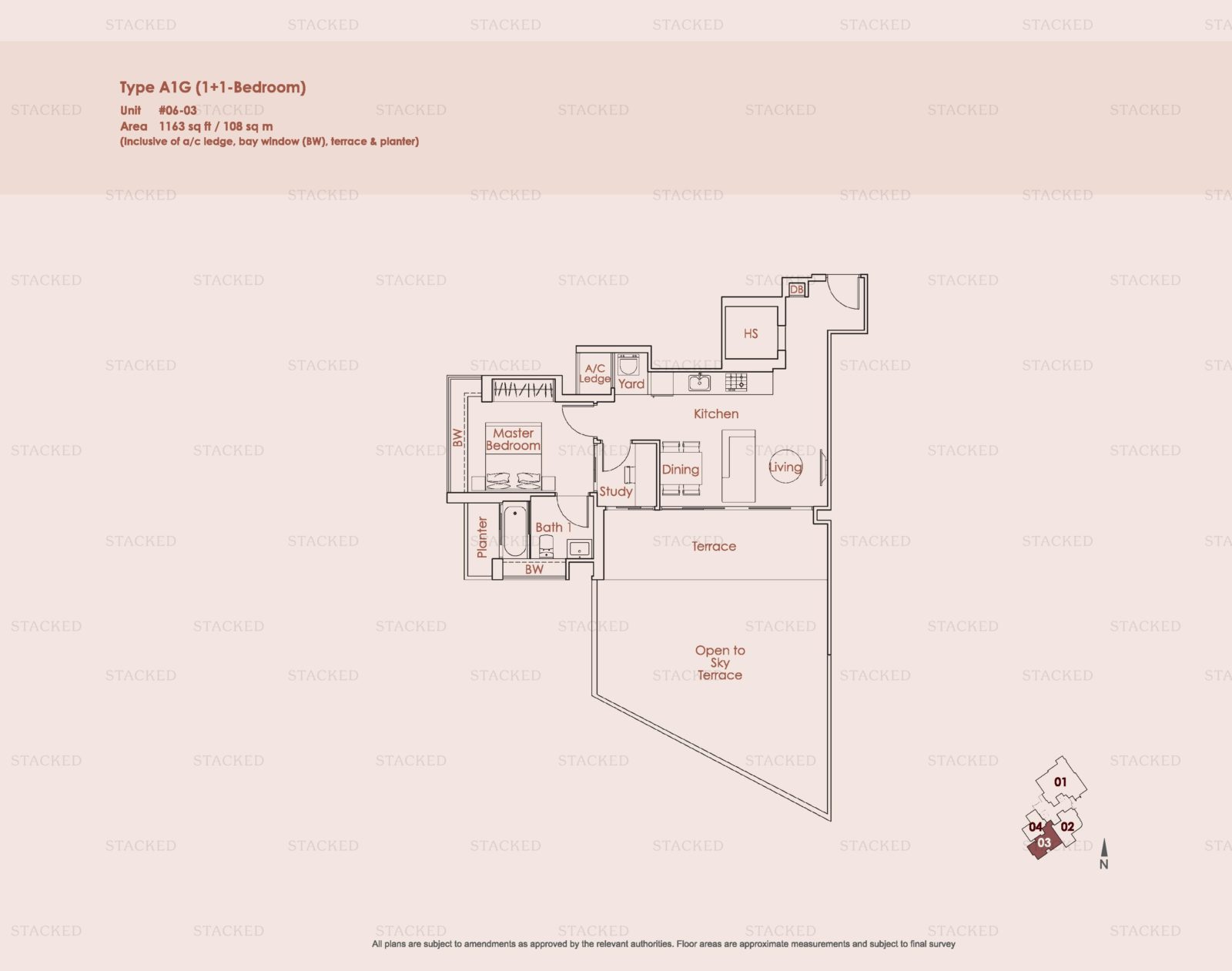

In July 2023, Starlight Suites set a record-low price since the condo was launched for sale in 2010 – $1,359 psf for a 1,163 sq. ft. unit. It’s not something you’d expect for a freehold luxury development in walking distance of Great World City, while being just shy of 10 years old in age. What could possibly be happening here? Is it the absolute deal of a lifetime, or a problem that sellers are struggling to offload? We took a closer look:

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How Much More Should You Really Pay for a Higher Floor or Sea View Condo?

“Hi Stacked, I’m looking at some condos including Amber Park, Coastline Residences, One Amber and Silversea. How much more is…

We took a closer look:

What and where is Starlight Suites?

Starlight Suites is a small (105-unit) freehold project located at River Valley Close, just across the road from River Valley Primary School. Its main highlights are being close to Robertson Walk as well as Great World City (it’s about a 10-to-13-minute walk, and the Great World MRT on the TEL is located there as well).

It’s a prime location to be sure; but Starlight Suites is still one of the bottom performers in District 9.

Completed in 2014, Starlight Suites has seen only two profitable transactions (and 23 losing transactions) in its history. While the latest two transactions are marked as resale, these were probably units that were sold from the bulk sale in 2016 as there were no transactions for these units prior. Starlight Suites also has the unfortunate title of the only freehold condo in the immediate area where prices have fallen lower than $2,000 psf.

The weak performance is partly due to the timing of Starlight Suite’s launch

Notice this unusual pattern of developer pricing, also visible on Square Foot Research:

The median price at launch appears to have started at around $2,076 psf in 2010, reaching around $2,408 psf by 2013. After this point, the remaining units didn’t seem to move.

The reason could be due to the dates of launch: 2011 was when ABSD was first introduced, and 2013 saw higher ABSD rates, with tightened loan limits. Note that the 2013 cooling measures were especially devastating, because at the time the market still thought of ABSD rates as temporary.

The developer resorted to a collective sale deal for 23 units, at a stunningly low $1,670 psf, which happened in 2016. This was to avoid extension charges from the Qualifying Certificate (QC).

(Under the QC, foreign developers must complete and sell all units in seven years, or pay extension charges).

This was one of the worst possible outcomes for the buyers: they had already bought just before a slew of cooling measures; but the developer’s fire sale further ground down the price.

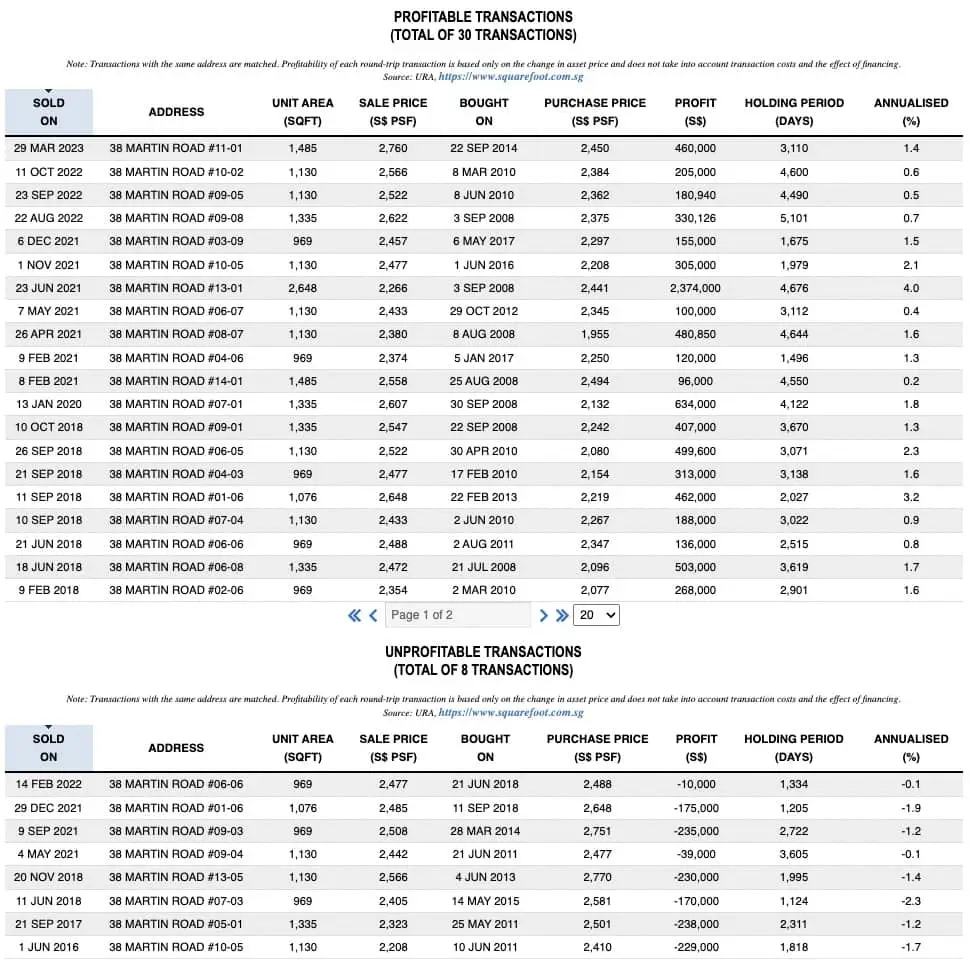

But let’s look at all the unprofitable transactions so far, to see what else we can find:

| Project Name | Transacted Price ($) | Area (SQFT) | Unit Price ($ PSF) | Bought On | Type of Sale | quantum | % | Sold On |

| STARLIGHT SUITES | $3,865,000 | 1862 | $2,076 | 8 May 2012 | New Sale | -$715,000 | -22.7% | 11/11/20 |

| STARLIGHT SUITES | $3,836,000 | 1862 | $2,060 | 23 Nov 2011 | New Sale | -$468,000 | -13.9% | 21/7/17 |

| STARLIGHT SUITES | $1,716,245 | 775 | $2,214 | 28 Jun 2013 | New Sale | -$336,245 | -24.4% | 23/4/19 |

| STARLIGHT SUITES | $2,198,752 | 1076 | $2,043 | 30 Aug 2010 | New Sale | -$278,752 | -14.5% | 29/5/17 |

| STARLIGHT SUITES | $2,178,308 | 1076 | $2,024 | 15 Sept 2010 | New Sale | -$228,308 | -11.7% | 20/11/17 |

| STARLIGHT SUITES | $2,269,323 | 1076 | $2,108 | 22 Aug 2011 | New Sale | -$219,323 | -10.7% | 5/7/19 |

| STARLIGHT SUITES | $1,850,000 | 850 | $2,176 | 20 Mar 2015 | New Sale | -$210,000 | -12.8% | 5/9/22 |

| STARLIGHT SUITES | $2,188,530 | 1076 | $2,033 | 16 Nov 2010 | New Sale | -$208,530 | -10.5% | 1/7/16 |

| STARLIGHT SUITES | $1,854,738 | 850 | $2,181 | 15 Jun 2015 | New Sale | -$194,738 | -11.7% | 14/9/22 |

| STARLIGHT SUITES | $3,900,000 | 1862 | $2,094 | 21 May 2019 | Resale | -$172,000 | -4.6% | 26/10/21 |

| STARLIGHT SUITES | $2,200,000 | 1076 | $2,044 | 4 May 2010 | New Sale | -$130,000 | -6.3% | 22/10/19 |

| STARLIGHT SUITES | $1,659,413 | 850 | $1,951 | 14 May 2010 | New Sale | -$129,413 | -8.5% | 17/6/16 |

| STARLIGHT SUITES | $1,320,000 | 560 | $2,358 | 25 Feb 2015 | New Sale | -$120,000 | -10.0% | 2/5/23 |

| STARLIGHT SUITES | $2,119,309 | 1076 | $1,969 | 16 Aug 2012 | New Sale | -$119,309 | -6.0% | 8/10/20 |

| STARLIGHT SUITES | $1,707,863 | 850 | $2,008 | 27 May 2010 | New Sale | -$107,863 | -6.7% | 8/2/21 |

| STARLIGHT SUITES | $1,655,375 | 850 | $1,947 | 14 May 2010 | New Sale | -$105,375 | -6.8% | 6/4/18 |

| STARLIGHT SUITES | $1,332,045 | 560 | $2,380 | 23 Nov 2011 | New Sale | -$102,045 | -8.3% | 6/6/23 |

| STARLIGHT SUITES | $1,580,000 | 775 | $2,039 | 9 Feb 2015 | New Sale | -$90,000 | -6.0% | 16/6/23 |

| STARLIGHT SUITES | $1,748,238 | 850 | $2,056 | 14 May 2010 | New Sale | -$68,238 | -4.1% | 25/1/21 |

| STARLIGHT SUITES | $1,290,000 | 560 | $2,305 | 25 May 2012 | New Sale | -$60,000 | -4.9% | 20/9/22 |

| STARLIGHT SUITES | $1,720,000 | 850 | $2,023 | 30 Oct 2015 | New Sale | -$50,000 | -3.0% | 10/1/22 |

| STARLIGHT SUITES | $1,550,000 | 775 | $2,000 | 10 Aug 2010 | New Sale | -$35,000 | -2.3% | 13/11/17 |

| STARLIGHT SUITES | $1,279,000 | 560 | $2,285 | 31 Oct 2011 | New Sale | -$29,000 | -2.3% | 11/4/18 |

| STARLIGHT SUITES | $1,243,000 | 560 | $2,221 | 25 Aug 2010 | New Sale | $7,000 | 0.6% | 13/10/17 |

| STARLIGHT SUITES | $1,540,000 | 775 | $1,987 | 30 Aug 2017 | Resale | $10,000 | 0.6% | 18/4/22 |

Naturally, the biggest losses quantum-wise go to the large unit that’s 1,862 sq ft in size. The biggest losers clocked a loss of $715,000 and $468,000 respectively. It’s not just the quantum that’s large here. In terms of annualised returns, both averaged over a 2% loss. Funnily enough, these were purchased in 2012 and 2011 respectively.

The biggest percentage loss at a whopping 24.4%, however, goes to the 775 sq. ft. unit. It was purchased at the peak of the market and sold about a year after the bottom of the property cycle. Talk about bad timing.

So a good part of the reason why Starlight Suites did badly was due to when it was launched – and buyers who expect to sell after TOP would find it quite disheartening that the market was slowing down.

Examining later purchases reveals a similar trend. Even those who bought during the down market in 2015 registered losses when selling in 2022. One buyer, who acquired a 1,862 sq. ft. unit near the market’s low, still faced losses when selling during the market’s resurgence. And this doesn’t even account for the Seller’s Stamp Duty!

Next, when we breakdown by the year, here’s how it matches up:

| Year | No. of unprofitable |

| 2010 | 9 |

| 2011 | 4 |

| 2012 | 3 |

| 2013 | 1 |

| 2015 | 5 |

| 2019 | 1 |

As you can see, most of the losses occurred in the first 3 years of the sale. There was a pause in purchases between 2013-2014 which explains the low numbers in these years, and purchases resumed again in 2015.

The transactions recorded between 2010 and 2016 were new sale transactions, indicating direct purchases from the developer. To grasp the extent of the development’s underperformance, imagine you’re a new launch buyer in 2010. If you were comparing Starlight Suites with nearby new launch competitors, these would likely be the prices you’d encounter:

New Sales Comparison (2010 only)

| Project Name | 1BR Avg ($) | 1BR Avg (PSF) | 2BR Avg ($) | 2BR Avg ($PSF) | 3BR Avg ($) | 3BR Avg ($PSF) |

| 8 RODYK | $1,366,000 | $1,894 | $2,530,000 | $1,851 | ||

| CENTENNIA SUITES | $2,435,987 | $1,968 | $3,520,490 | $1,972 | ||

| ESPADA | $1,282,381 | $2,492 | $1,864,741 | $2,586 | ||

| KILLINEY 118 | $1,360,500 | $2,385 | ||||

| MARTIN NO 38 | $2,528,758 | $2,359 | $7,160,000 | $2,334 | ||

| MARTIN PLACE RESIDENCES | ||||||

| RIVERIA GARDENS | $1,790,800 | $1,849 | $2,664,045 | $1,861 | ||

| SKYLINE 360 @ SAINT THOMAS WALK | $3,754,986 | $2,167 | ||||

| STARLIGHT SUITES | $1,498,374 | $2,081 | $2,191,928 | $2,036 | $3,867,000 | $2,077 |

| TWO8ONE STUDIO | $881,800 | $1,672 | ||||

| VIVACE | $874,243 | $2,057 | $1,400,207 | $2,048 |

At a glance, Starlight Suites emerges as the priciest new launch of its time. Its 1-bedroom units had an average transacted price of $1,498,374 — roughly 9.7% more than 8 Rodyk, another new launch in close proximity. However, its $PSF at $2,081 was notably lower than both Espada and Killiney 118.

A similar trend is observed with its 2-bedroom units. They offer a competitive quantum at $2,191,928, especially when benchmarked against Centennia Suites and even more so against Martin No. 38. Yet, its $PSF stands lower at $2,036 compared to Martin No 38’s towering $2,359 $PSF.

Despite Martin No. 38’s units demanding around 15.9% more in $PSF and having a greater quantum, the development has proven to be a more profitable venture for its buyers than Starlight Suites.

New Sale Premium Comparison

| Project | 1BR Quantum | 1BR $PSF | 2BR Quantum | 2BR $PSF | 3BR Quantum | 3BR $PSF |

| 8 RODYK | 9.7% | 9.9% | 52.8% | 12.2% | ||

| CENTENNIA SUITES | -10.0% | 3.5% | 9.8% | 5.3% | ||

| ESPADA | 16.8% | -16.5% | 17.5% | -21.2% | ||

| KILLINEY 118 | 10.1% | -12.7% | ||||

| MARTIN NO 38 | -13.3% | -13.7% | -46.0% | -11.0% | ||

| MARTIN PLACE RESIDENCES | ||||||

| RIVERIA GARDENS | 22.4% | 10.1% | 45.2% | 11.6% | ||

| SKYLINE 360 @ SAINT THOMAS WALK | 3.0% | -4.1% | ||||

| STARLIGHT SUITES | NA | NA | NA | NA | NA | NA |

| TWO8ONE STUDIO | 69.9% | 24.5% | ||||

| VIVACE | 71.4% | 1.2% | 56.5% | -0.6% |

A detailed examination reveals considerable premium gaps. Universally, Starlight Suites commanded a higher quantum, particularly for its 1-bedroom units. When it comes to the 3-bedroom category, Starlight Suites again surpassed the price of most new units sold in 2010. This might account for the significant losses observed for these 3-bedders. However, it’s worth noting that only a single 3-bedroom unit was transacted in 2010.

Resale Comparison In 2010

| Projects | 1BR Avg ($) | 1BR Avg (PSF) | 2BR Avg ($) | 2BR Avg ($PSF) | 3BR Avg ($) | 3BR Avg ($PSF) |

| 2 RVG | $1,050,000 | $1,524 | $1,456,556 | $1,611 | ||

| 336 RIVER VALLEY | $1,496,875 | $972 | ||||

| ASPEN HEIGHTS | $1,495,171 | $1,347 | $1,857,013 | $1,400 | ||

| CLAREMONT | $1,600,000 | $1,425 | ||||

| EURO-ASIA COURT | $1,325,625 | $1,244 | $1,620,000 | $1,194 | ||

| GAMBIER COURT | $1,610,000 | $1,084 | ||||

| LA CRYSTAL | $1,280,000 | $1,416 | $1,526,250 | $1,464 | ||

| LANGSTON VILLE | $1,153,333 | $1,227 | ||||

| MARTIN EDGE | $710,000 | $1,374 | ||||

| MIRAGE TOWER | $835,778 | $1,465 | $1,363,333 | $1,423 | $1,922,352 | $1,404 |

| OLEANAS RESIDENCE | $1,616,429 | $1,274 | ||||

| RESIDENCES AT 338A | $1,690,000 | $1,398 | ||||

| RIVERGATE | $2,084,224 | $2,011 | $2,920,827 | $1,877 | ||

| ROBERTSON 100 | $1,056,000 | $1,480 | $1,367,875 | $1,527 | $1,658,000 | $1,510 |

| ROBERTSON EDGE | $724,750 | $1,749 | ||||

| STARLIGHT SUITES (New Sales) | $1,498,374 | $2,081 | $2,191,928 | $2,036 | $3,867,000 | $2,077 |

| THE ABODE AT DEVONSHIRE | $1,718,333 | $1,589 | ||||

| THE BOTANIC ON LLOYD | $3,410,000 | $2,003 | ||||

| THE MORNINGSIDE | $2,238,600 | $1,300 | ||||

| THE PIER AT ROBERTSON | $1,275,333 | $1,804 | $2,049,928 | $1,912 | $2,930,000 | $1,640 |

| THE REGALIA | $1,736,267 | $1,367 | ||||

| TRIBECA | $978,000 | $1,893 | $2,416,667 | $1,764 | ||

| URBANA | $1,662,667 | $1,618 | ||||

| WATERMARK ROBERTSON QUAY | $1,572,504 | $1,623 | $2,427,113 | $1,533 | ||

| YONG AN PARK | $1,550,000 | $1,516 | $4,771,270 | $1,647 |

Examining the 3-bedroom unit at that period highlights the significant premium of Starlight Suites. Few developments at the time breached the $2,000 psf threshold. While it’s common for new launches to have a higher $PSF given the escalating land costs, there were still numerous competitive 3-bedroom units in the vicinity that were freehold, yet boasted a substantially lower quantum and $PSF. This gave Starlight Suites a less-than-competitive start, though it certainly wasn’t the only contributing factor.

So why else has this development done poorly?

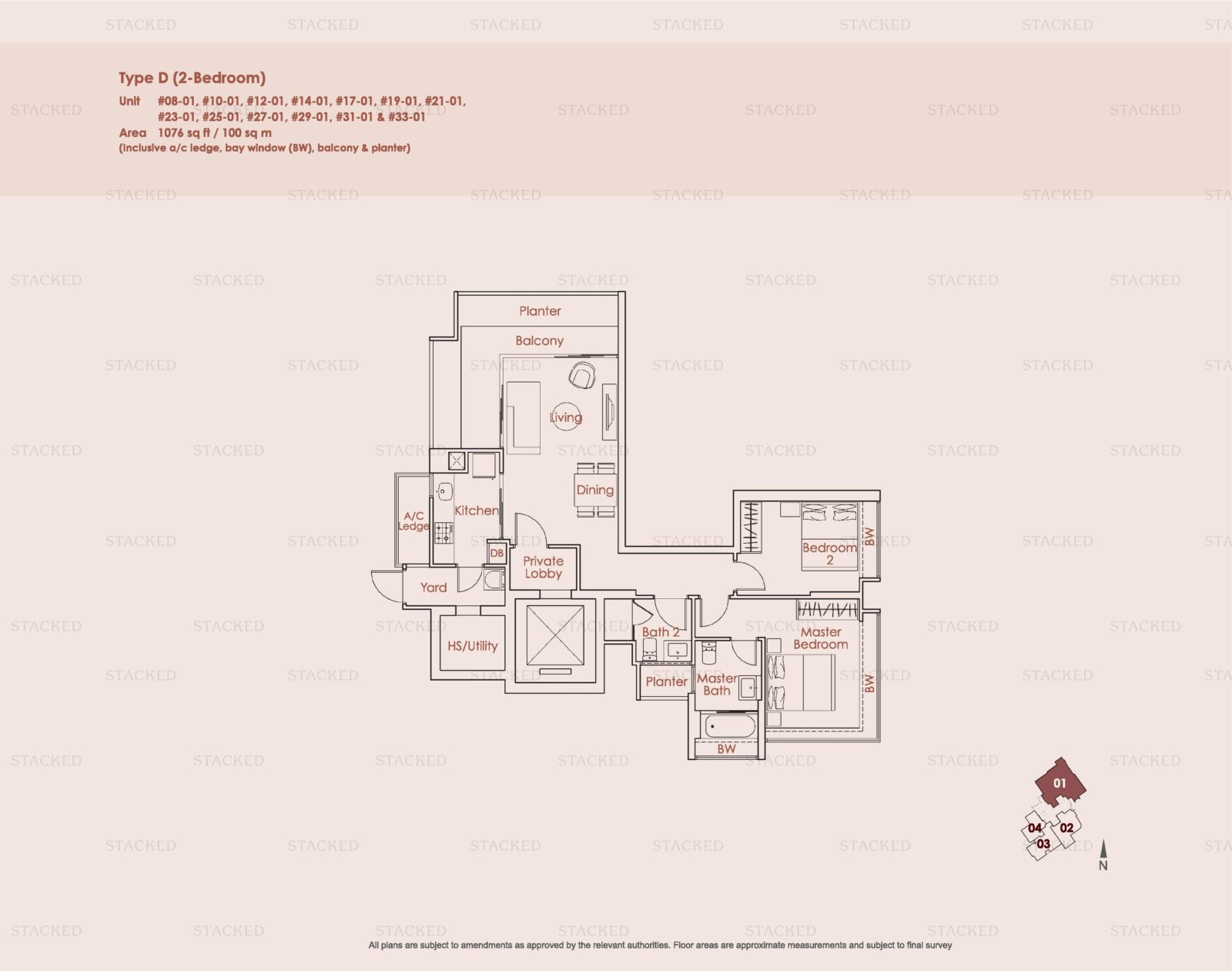

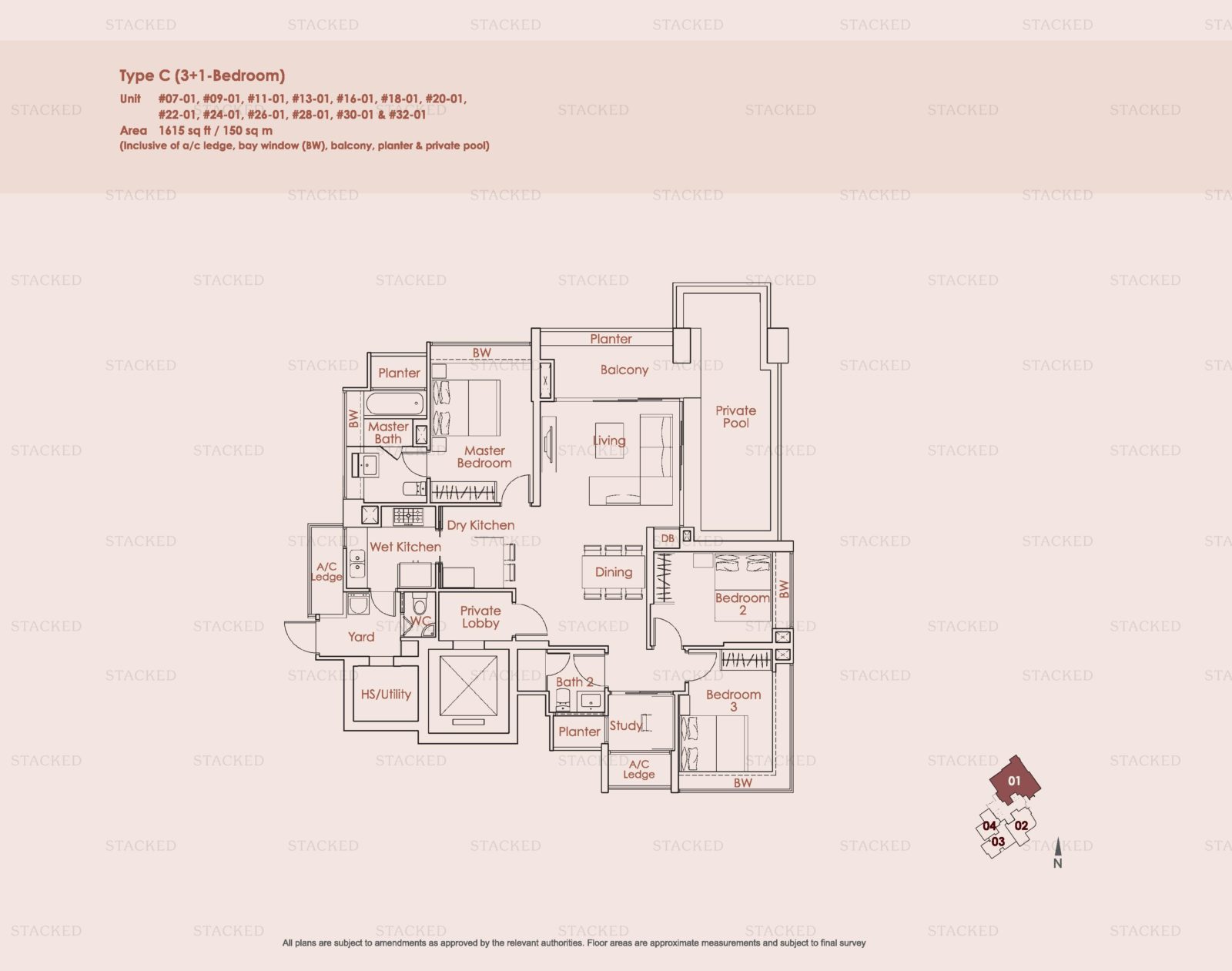

Aesthetically pleasing but inefficient layouts

The interior layouts are flashy, but often at the expense of efficiency.

The layouts of the two and three-bedder units are chock full of planter boxes and bay windows, which take up available living space. Some three-bedder layouts, for instance, have as many as three planter boxes and five bay windows. This means that while the units seem big on paper (1,076 sq. ft. for a 2 bedder is considerably well-sized), the actual unit will not seem as spacious in person. Take away the planter, balcony, bay windows, corridors, and you are left with an internal living space that doesn’t feel like its size.

Some units also have a private pool, which to some buyers is actually a drawback. Private pools attached to units tend to drive up maintenance costs, and they’re considered too small to contribute much. If your condo already has a proper-sized pool, do you really want to pay more for a second mini-pool that takes up your square footage?

We also note that the unit which sold for the record-low price had a “large open-air terrace,” which like private pools and large balconies, are often considered space-wasting features today.

Many of the units also seem to feature high ceilings with a lot of void space. It looks good, but do see this article on why that’s a mon6 Potential Money Wasters To Avoid When Buying Propertyey-waster.

Property Advice6 Potential Money Wasters To Avoid When Buying Property

by Ryan J. OngAll of this results in units that can look stunning in a design magazine or show flat, but which compromise on living space to do so. Overall, this means that these units attract a very niche audience, one that prioritises lifestyle over practicality.

Starlight Suites has to pack a lot into a single tower

A land space of 11,924 sqm. and a Gross Floor Area (GFA) of 50,404 sqm. is not a lot of room, even for just 105 units. All of this is packed into a single tower.

There is a pool, gym, and other basic facilities; but these are all situated vertically within the tower itself. This is going to feel hemmed in for families, with children having no significant play areas at the ground level.

The location aggravates this issue, as the area around Robertson Quay is already packed, and lacking in green spaces. You’ll have to travel out of the neighbourhood to find a green field for the children to run in.

The limited room also means no tennis court, by the way.

While it’s commendable that the architects and designers managed to squeeze so much into a single tower, it’s still not the level of facilities that one expects from a District 9 luxury property.

Too much better surrounding competition

Starlight Suites is surrounded by condos like The Avenir, Martin Place Residences, Martin Modern, and 8 Martin Residences. Having that many competitors nearby is already bad for landlords and sellers.

The problem is that, within this prime area, all the condos are among the cream of the crop when it comes to luxury. For a buyer at that price bracket, they have a lot of options to choose from – from more efficient units, to developments with better and more modern facilities. It’s hard for Starlight Suites to challenge them facilities-wise, because as we’ve mentioned, it’s rather bare-bones in that regard.

For buyers looking at this area now, at similar price points, there is stiff competition from newer condos that have come up recently like Martin Modern, etc.

| Projects | 1BR Avg ($) | 1BR Avg (PSF) | 2BR Avg ($) | 2BR Avg ($PSF) | 3BR Avg ($) | 3BR Avg ($PSF) |

| 8 SAINT THOMAS | $2,530,000 | $3,134 | ||||

| ASPEN HEIGHTS | $2,300,000 | $2,203 | $2,876,000 | $2,155 | ||

| ESPADA | $990,000 | $2,628 | ||||

| EURO-ASIA COURT | $2,260,000 | $2,121 | $2,750,000 | $2,028 | ||

| LA CRYSTAL | $1,862,500 | $2,060 | ||||

| LANGSTON VILLE | $1,803,444 | $1,915 | ||||

| MARTIN PLACE RESIDENCES | $2,900,000 | $2,495 | $3,623,750 | $2,551 | ||

| MARTIN MODERN | $2,315,000 | $2,623 | $2,906,800 | $2,873 | ||

| MIRAGE TOWER | $3,280,000 | $2,192 | ||||

| ONE DEVONSHIRE | $3,534,444 | $2,825 | ||||

| RESIDENCES @ KILLINEY | $2,470,000 | $2,342 | $3,600,000 | $2,406 | ||

| RIVERGATE | ||||||

| RIVERIA GARDENS | $2,375,000 | $2,452 | $3,373,333 | $2,356 | ||

| ROBERTSON 100 | $2,350,000 | $2,251 | ||||

| ROBERTSON BLUE | $4,500,000 | $2,417 | ||||

| ROBERTSON EDGE | $895,000 | $2,081 | ||||

| SKYLINE 360 @ SAINT THOMAS WALK | $5,700,000 | $2,674 | ||||

| ST THOMAS SUITES | ||||||

| STARLIGHT SUITES | $1,375,000 | $1,906 | $3,716,667 | $1,996 | ||

| THE BOUTIQ | ||||||

| THE INSPIRA | $2,180,000 | $2,315 | ||||

| THE MORNINGSIDE | ||||||

| THE PIER AT ROBERTSON | $1,538,000 | $2,342 | ||||

| THE QUAYSIDE | $2,298,000 | $1,750 | ||||

| THE WHARF RESIDENCE | $2,395,000 | $2,284 | ||||

| TRIBECA | $1,310,000 | $2,535 | $3,269,000 | $2,382 | ||

| UP@ROBERTSON QUAY | $1,080,000 | $2,333 | ||||

| VIVACE | $870,000 | $2,184 | ||||

| WATERFORD RESIDENCE | $2,466,163 | $1,767 | ||||

| WATERMARK ROBERTSON QUAY | $2,900,000 | $2,264 | ||||

| YONG AN PARK | $4,250,000 | $2,350 |

You can see how almost every resale condo has surpassed the $2,000 mark since 2010 when Starlight Suites sold its first unit. On the other hand, Starlight Suites has regressed. It started off selling at over $2,000 psf on average, but today, resale prices are close to but still below $2,000 psf on average.

The challenges are uphill; and we’re not surprised if the occasional owner decides to trim their losses and reinvest.

If there’s a takeaway from this, it’s to bear in mind that the property market is full of exceptions. Despite the repeated insistence that District 9 or 10 condos are in perpetual demand, and resistant to downturns, some outliers can always be found. When buying, review each property as a unique asset, that might not move in tandem with its particular segment or type.

For more trends and news in the Singapore property market, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale projects alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

0 Comments